Biodiversity & Environment

Rise of India's Carbon Marketplace

This editorial is based on “Establishing a carbon market” which was published in The Hindu on 29/08/2024. The article highlights India's transition from energy efficiency targets under the PAT scheme to establishing its own carbon market, balancing climate goals with its development priorities, particularly in hard-to-abate industries like iron and steel.

For Prelims: Perform, Achieve, and Trade scheme, Nationally Determined Contributions, Carbon Credits, Carbon Taxes, World Bank’s State and Trends of Carbon Pricing 2024, Carbon Credits Trading Scheme, Electricity Conservation Act, 2001, Bureau of Energy Efficiency, International Monetary Fund, Carbon footprint, India's industrial sector, Carbon Border Adjustment Mechanism, World Economic Forum.

For Mains: Current Government Initiatives Related to the Carbon Market in India, Advantages of Implementing a Carbon Tax, Major Challenges Related to Carbon Taxation in India.

As the world's third-largest emitter, India faces the dual challenge of meeting its climate objectives while sustaining its developmental aspirations. The recent announcement by the Finance Minister to shift "hard to abate" industries from energy efficiency targets to emission targets marks a pivotal change in policy. This shift recognizes the limitations of the existing Perform, Achieve, and Trade (PAT) scheme, which has primarily focused on relative energy efficiency.

The move towards establishing an Indian Carbon Market offers a significant opportunity. Although India is not obligated to mandatory emission reductions under its Nationally Determined Contributions (NDCs), this step signals a strong commitment to exploring market-based solutions for curbing emissions. However, crafting a carbon market that effectively aligns with India's development priorities while ensuring substantial emission reductions will require strategic and nuanced planning.

What is the Carbon Market?

- About: Carbon markets are market-based mechanisms designed to reduce greenhouse gas emissions by creating a financial incentive for individuals and organizations to reduce their carbon footprint.

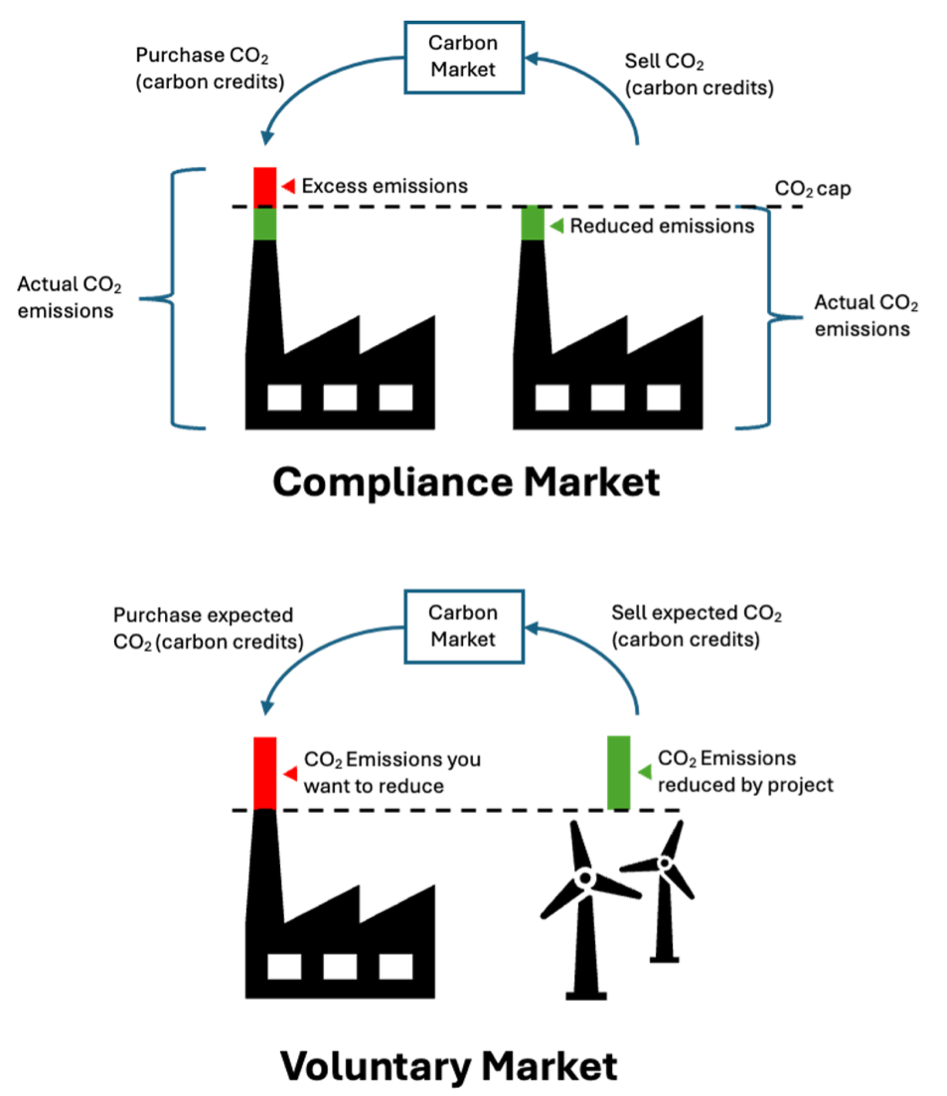

- They operate on the principle of cap-and-trade, where a government or regulatory body sets a cap on the total amount of greenhouse gas emissions allowed within a specific jurisdiction.

- Types of Carbon Markets:

- Compliance Markets: These markets are mandatory, requiring regulated entities to purchase carbon credits to offset their emissions. Often, these entities are large industrial polluters.

- Voluntary Markets: These markets are voluntary, allowing individuals, businesses, and organizations to purchase carbon credits to offset their emissions beyond regulatory requirements.

- India is a significant exporter of carbon credits into the decentralized voluntary market, with its credits worth between USD 200-300 billion per year and accounting for 17% of the global supply in 2022.

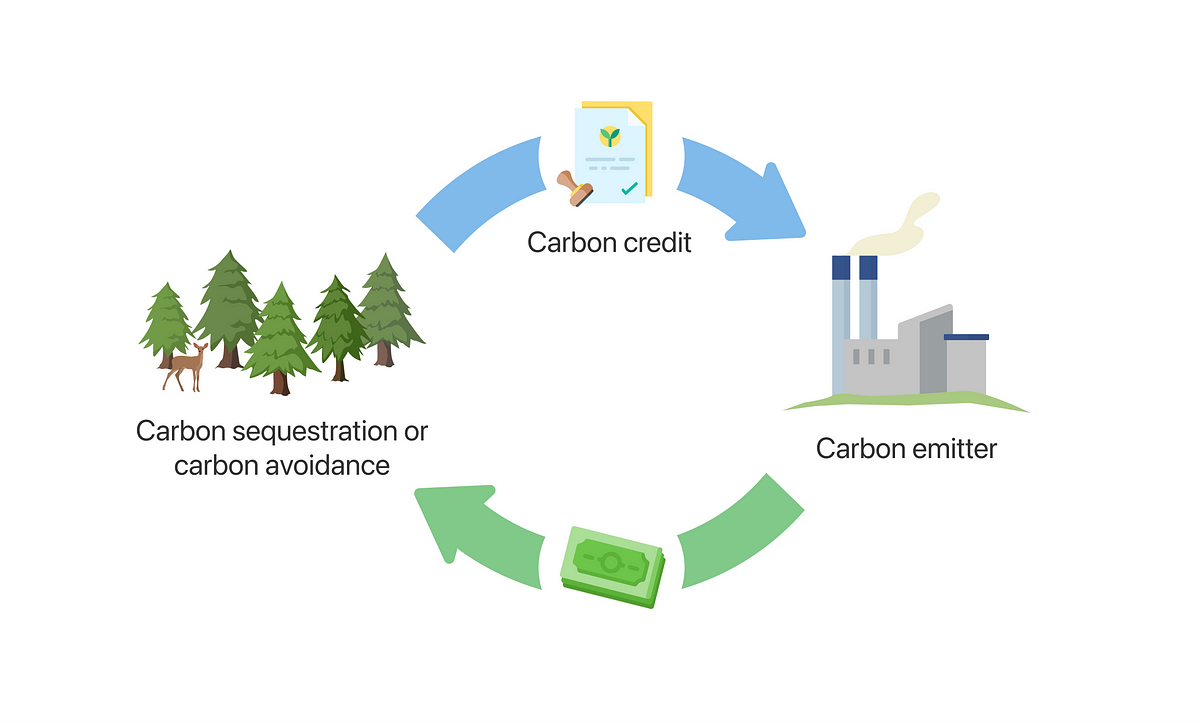

- Carbon Credits: They represent a reduction in greenhouse gas emissions that can be traded. One carbon credit equates to one ton of carbon dioxide equivalent (tCO2e) reduced or avoided.

- Carbon credits can be generated through various activities, such as:

- Implementing energy-efficient technologies, reducing waste, or transitioning to renewable energy sources.

- Preventing deforestation or promoting reforestation.

- Carbon credits can be generated through various activities, such as:

- Carbon Taxes: They are direct levy on the emission of greenhouse gases. This means that polluters pay a tax based on the amount of greenhouse gases they emit.

- Carbon taxes generate revenue for the government, which can be used to fund climate mitigation and adaptation projects or reduce other taxes.

- Global Trends in Carbon Markets: As of August 2023, 74 carbon pricing mechanisms have been identified worldwide, in either the form of carbon taxes or emissions trading schemes (ETS).

- In 2023, carbon pricing revenues reached a record USD 104 billion, according to the World Bank's annual “State and Trends of Carbon Pricing 2024” report.

What are the Current Government Initiatives Related to the Carbon Market in India?

- Carbon Credits Trading Scheme (CCTS): Building on the Electricity Conservation Act, 2001, and the Environment (Protection) Act, 1986, India launched the CCTS to reduce GHG emissions by trading carbon credit certificates.

- The compliance segment of CCTS will commence in 2025-26, allowing non-obligated entities to participate and trade carbon credit certificates (CCCs).

- Other Existing Schemes: The Perform, Achieve and Trade (PAT) scheme and the Renewable Energy Certificates (REC) system are existing market-based emission reduction schemes in India.

- Monitoring and Verification: The Bureau of Energy Efficiency (BEE) and the National Steering Committee for Indian Carbon Market (NSCICM) are responsible for ensuring the integrity of the carbon credits through rigorous monitoring, reporting, and verification processes.

What are the Advantages of Implementing a Carbon Tax?

- Incentivizing Green Innovation: A carbon tax creates a strong financial incentive for businesses to reduce their carbon footprint, spurring innovation in clean technologies.

- In India, where the renewable energy sector is growing rapidly, a carbon tax could accelerate this trend.

- For instance, after implementing a carbon tax, British Columbia saw a 6.1% reduction in emissions in sectors covered by the tax.

- In India, it would also account for an estimated 15% of CO2 reductions (compared with baseline levels) from G20 countries.

- Applied to India, this could lead to significant advancements in solar, wind, and energy storage technologies, potentially positioning India as a global leader in clean tech innovation.

- Revenue Generation for Climate Adaptation: Carbon taxes can generate substantial revenue for governments to invest in climate adaptation and mitigation efforts.

- In India, where climate change impacts are already severe, this could be crucial.

- The International Monetary Fund estimates that carbon taxes could raise typically 1–2% of GDP for a USD 35 a ton tax in 2030.

- This funding could be directed towards flood protection infrastructure, drought-resistant agriculture, and other critical adaptation measures, helping to safeguard India's most vulnerable populations against climate impacts.

- Improving Public Health: By reducing fossil fuel consumption, a carbon tax can significantly improve air quality and public health. This is particularly relevant for India, where air pollution is a major concern.

- As per the recent IMF Fiscal Monitor, a carbon tax of USD 50 per tonne of CO2 in just the G20 countries can prevent 6,00,000 premature air pollution deaths annually by 2030.

- The resulting reduction in healthcare costs and improved productivity could provide a substantial boost to India's economy, potentially offsetting the initial economic impact of the tax.

- Consumption Consciousness: Carbon taxes can play a crucial role in raising awareness about the carbon footprint of different products and services, thereby influencing consumer behavior.

- In India, where consumer awareness about climate change is growing but still limited, a carbon tax could serve as an educational tool.

- By making carbon-intensive products more expensive, it could nudge consumers towards more sustainable choices.

- This shift could have ripple effects across the economy, encouraging businesses to offer more low-carbon options and accelerating the overall transition to a sustainable economy.

What are the Major Challenges Related to Carbon Taxation in India?

- Economic Impact on Industries: Implementing a carbon tax could significantly impact India's industrial sector, particularly energy-intensive industries like steel, cement, and textiles.

- While it would incentivize cleaner production methods, it might also increase production costs in the short term.

- This could potentially affect India's global competitiveness in these sectors, necessitating careful policy design to balance environmental goals with economic growth.

- Regressive Nature-Burden on Lower-Income Groups: Carbon taxes can be regressive, disproportionately affecting lower-income groups who spend a larger proportion of their income on energy.

- Considering that India has the largest number of poor worldwide at 22.8 crore (Global MPI 2022), this is a critical concern.

- A poorly designed carbon tax could lead to increased energy and transportation costs, potentially exacerbating economic inequality.

- Limited Scope: According to the World Economic Forum, Carbon taxes, while effective in reducing CO2 emissions from fossil fuels, have a limited scope.

- They may not adequately address other significant greenhouse gases like methane, which is emitted in large quantities from agricultural activities.

- For instance, methane's warming potential is significantly higher than CO2, making it a major contributor to climate change.

- To comprehensively address greenhouse gas emissions, additional policies and regulations specifically targeting methane and other non-CO2 gasses are essential.

- The Informal Sector Conundrum: India's large informal sector, which accounts for about 90% of the workforce, poses significant challenges for carbon tax implementation.

- Tracking and taxing emissions from small, unregistered businesses is extremely difficult and could inadvertently exempt them from a carbon tax, potentially undermining its effectiveness and creating market distortions.

- Inter-State Disparities: India's federal structure adds another layer of complexity to carbon taxation.

- Different states have varying levels of industrialization, energy mix, and fiscal capacities.

- A uniform national carbon tax could disproportionately affect coal-producing states like Jharkhand and Chhattisgarh.

- Carbon Leakage: Carbon leakage, where emissions-intensive industries relocate to jurisdictions with laxer environmental regulations, is a significant concern.

- For India, which is striving to become a global manufacturing hub through initiatives like 'Make in India', this risk is particularly acute.

- International Trade Implications: As more countries implement carbon pricing mechanisms, India's exports could face challenges in markets with stricter environmental standards.

- The European Union's proposed Carbon Border Adjustment Mechanism, for instance, could significantly impact Indian exports.

- India's steel sector faces significant challenges due to the EU's carbon border tax, which could cost up to USD 8 billion in exports to the EU.

What Measures can India Adopt for Effective Establishment of Carbon Market?

- Phased Implementation-The Gradual Greening: India could adopt a phased approach to carbon taxation, starting with a low rate and gradually increasing it over time.

- This would allow industries to adapt and invest in cleaner technologies without sudden economic shocks.

- The government could announce a clear schedule of rate increases, providing certainty for businesses to plan their investments.

- Sectors could be brought under the tax regime in stages, beginning with the most carbon-intensive industries.

- This approach would also allow time for the development of supporting infrastructure and policies, such as green energy alternatives and energy efficiency programs.

- Border Carbon Adjustments- Leveling the Global Playing Field: To address carbon leakage concerns and protect domestic industries, India could consider implementing border carbon adjustments (BCAs).

- This would involve applying a carbon price to imported goods based on their embedded emissions, leveling the playing field for domestic producers.

- This measure would need to be carefully designed to comply with WTO rules and India's international trade commitments.

- Technology Transfer Incentives-Bridging the Innovation Gap: The carbon tax could be coupled with strong incentives for technology transfer and adoption of clean technologies, particularly for small and medium enterprises (SMEs).

- A portion of the tax revenue could fund a "Clean Tech Adoption Fund" providing low-interest loans or grants for green technology investments.

- Green Lanes for Carbon-Conscious Industries: Implement a tiered regulatory system that offers expedited approvals and incentives for industries demonstrating significant carbon reduction efforts.

- This "Green Lane" approach could include faster environmental clearances, priority in government tenders, and access to low-interest green financing.

- By creating tangible benefits for carbon-conscious businesses, India can accelerate the adoption of cleaner technologies across sectors.

- This measure balances economic growth with environmental responsibility, encouraging industries to voluntarily embrace carbon reduction without imposing blanket regulations.

- Carbon Credit Cooperative for SMEs: Establish a cooperative framework enabling small and medium enterprises (SMEs) to collectively participate in the carbon market.

- This system would allow smaller businesses to pool their emission reduction efforts, collectively generate carbon credits, and share the benefits.

- By lowering the barrier to entry for SMEs, India can broaden participation in the carbon market and drive innovation in emission reduction at the grassroots level.

- Carbon Tech Incubators for Homegrown Solutions: Launch a network of specialized incubators focused on developing indigenous carbon reduction technologies.

- These incubators would provide funding, mentorship, and testing facilities for startups working on innovative solutions in areas like carbon capture, energy efficiency, and renewable energy.

- By fostering a robust ecosystem of homegrown climate tech, India can reduce dependence on imported technologies and create solutions tailored to its unique environmental and economic context.

- Green Finance Revolution: India could establish a robust green finance ecosystem to support its carbon market.

- This could include green bonds, sustainability-linked loans, and climate risk insurance products.

- A national green investment bank could be created to catalyze private investment in low-carbon projects.

- Integration with Existing Schemes: India's new carbon market should be integrated with existing schemes like PAT and REC for policy coherence.

- This could involve creating conversion mechanisms between different types of credits.

- A common trading platform could be developed to enhance liquidity across schemes.

- Gradually, these schemes could be merged into a comprehensive national carbon market.

Conclusion

India is at a pivotal moment, where establishing a carbon market can effectively balance its climate goals with economic development. By strategically designing this market, integrating existing schemes, and encouraging innovation, India can position itself as a global leader in sustainable growth. As India moves towards a low-carbon future, now is the time to act decisively and lead the way in creating a resilient, climate-conscious economy.

|

Drishti Mains Question: Discuss the concept of carbon credits and analyze their potential role in combating climate change, with a special focus on India's approach and challenges in integrating carbon credits into its environmental policies. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Consider the following statements (2023)

Statement—I Carbon markets are likely to be one of the most widespread tools in the fight against climate change.

Statement—II Carbon markets transfer resources from the private sector to the State.

Which one of the following is correct in respect of the above statements?

(a) Both Statement—I and Statement—II are correct and Statement—II is the correct explanation for Statement—I

(b) Both Statement—I and Statement—II are correct and Statement—II is not the correct explanation for Statement—I

(c) Statement—I is correct but Statement—II is incorrect

(d) Statement—I is incorrect but Statement—II is correct

Ans: B

Q. The concept of carbon credit originated from which one of the following? (2009)

(a) Earth Summit, Rio de Janeiro

(b) Kyoto Protocol

(c) Montreal Protocol

(d) G-8 Summit, Heiligendamm

Ans: B