Indian Economy

Scaling Up the Startup Ecosystem

This editorial is based on “UAE galvanising start-ups” which was published in The Hindu Business Line on 05/12/2024. The article brings into picture the emergence of India’s startup ecosystem as a global leader, with over 140,000 startups and 111 unicorns, supported by the UAE’s $20 billion investment. However, it highlights the need to address challenges in funding, regulation, and innovation to sustain growth.

For Prelims: India's startup ecosystem, Startup India, Standup India,Fast-moving consumer goods, Artificial Intelligence Reserve Bank of India, Corporate Venture Capital, Atal Innovation Mission,Fund of Funds for Startups,National Research Foundation ,SAMRIDH (Startup Accelerator of MeitY for Product Innovation, Development, and Growth).

For Mains: Current Growth Drivers of India’s Startup Ecosystem, Key Issues Related to India’s Startup Ecosystem.

India's startup ecosystem has emerged as a global powerhouse, with over 140,000 recognized startups and 111 unicorns driving technological innovation across diverse sectors. The UAE has become a critical strategic partner, with significant investments exceeding $20 billion and providing crucial support for Indian entrepreneurs seeking international expansion. More than 30% of Dubai's startups are founded by Indians, demonstrating the deep entrepreneurial synergy between the two nations. However, India needs to work more to enhance its startup culture, addressing challenges in funding, regulatory frameworks, and sustained innovation to maintain its competitive edge.

What are the Current Growth Drivers of India’s Startup Ecosystem?

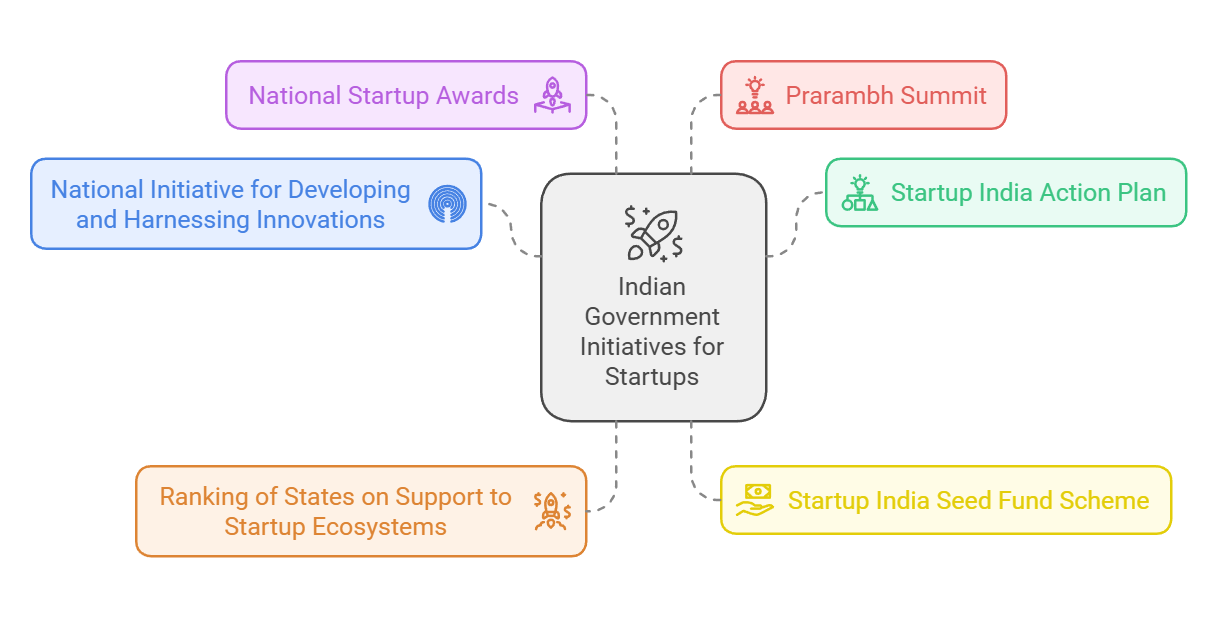

- Government Initiatives and Policy Support: The Indian government has implemented policies like Startup India, Standup India, offering tax exemptions, funding, and support for incubators, which have significantly boosted entrepreneurial activity.

- As of June 2023, over 100,000 startups have been recognized under this initiative, reflecting its widespread impact.

- Expanding Digital Infrastructure: The proliferation of smartphones and affordable internet has expanded digital access, enabling startups to reach a broader customer base.

- India is now the second-biggest manufacturing hub for mobile phones due to heavy investment from original equipment manufacturers and original design

- Also, India has more than 820 million active internet users at present, facilitating the growth of digital businesses.

- Growing Investment Ecosystem: A surge in venture capital and private equity investments has provided startups with essential funding.

- Between 2014 and H1 2024, the Indian startup ecosystem attracted over $150 billion in investments, with ecommerce, fintech, and enterprise tech leading the charge, contributing to 52% of the total funding

- Programs like Google’s Launchpad and Microsoft for Startups offer funding, mentorship, and market access.

- Evolving Consumer Market: A growing middle class with increasing disposable income has created a robust domestic market for new products and services.

- India's fast-moving consumer goods (FMCG) sector grew 5.7% by value and 4.1% by volume in the July-September 2024 driven by rural demand.

- Projections indicate that India's affluent segment will reach 100 million by 2027, offering substantial opportunities for startups.

- Supportive Regulatory Environment: Recent regulatory reforms have streamlined business operations. The Reserve Bank of India (RBI) has streamlined the compliance process for foreign companies undergoing a “reverse flip” merger with their Indian subsidiaries, cutting the timeline from 12-18 months to just 3-4 months.

- This move boosts efficiency and encourages startups to list in India.

- Thriving Incubation and Acceleration Programs: Institutions like IIM Bangalore's NSRCEL provide mentorship, funding, and resources, nurturing early-stage startups and fostering innovation.

- Programs such as the Women Entrepreneurship Program have been instrumental in supporting dive

- Rise of Deep-Tech and AI Startups: The demand for cutting-edge technologies like Artificial Intelligence, Machine Learning, and IoT is fueling the growth of deep-tech startups.

- India has emerged as a top contender in Artificial Intelligence (AI) readiness, ranking among the top 10 globally, as per the Boston Consulting Group's (BCG) report.

- According to Nasscom, India's deeptech sector is buzzing with over 3,000 startups and a 53% growth rate over the past decade.

- Expansion of D2C (Direct-to-Consumer) Models: The direct-to-consumer model has gained traction, with startups bypassing intermediaries to connect with consumers digitally.

- The Indian D2C market is expected to reach $100 billion by 2025. The increasing adoption of e-commerce platforms and personalized marketing tools is propelling this trend.

- Rise of Tier-2 and Tier-3 City Entrepreneurship: Entrepreneurship is no longer confined to metropolitan cities; smaller cities are emerging as startup hubs.

- Initiatives like the Atal Innovation Mission are enabling entrepreneurs in Tier-2 and Tier-3 cities through incubators and funding.

- Over 50% of startups recognized by the DPIIT in 2023 originated from non-metro regions, showcasing this decentralized growth.

- Digital Payments Revolution and FinTech Boom: The adoption of UPI and the growth of digital payments have transformed the fintech landscape, creating opportunities for startups.

- Over 11 Billion UPI transactions were done in October 2023 alone, fostering startups like PhonePe and Razorpay to scale rapidly.

- The Indian fintech market touted as the fintech hub globally is estimated to reach assets under management (AUM) of $1 trillion by 2030, up 10-fold from its 2021 size of roughly $100 billion.

- Fostering Sustainability and Green Startups: Sustainability-focused startups are gaining traction, fueled by government commitments like India’s Net Zero 2070 target.

- Startups like ElectricPe and Zypp Electric are leveraging EV and clean energy markets. The UNDP Accelerator Labs in India have further nurtured green innovation.

- Emergence of Corporate Venture Capital (CVC): Large corporations are investing in startups via Corporate Venture Capital, offering not just funding but also market expertise.

- Companies like Reliance, Tata, and Infosys have active CVC arms. This integration provides startups with the resources to scale and innovate.

- Cultural Shift Toward Entrepreneurship: A growing cultural shift in India views startups as aspirational career choices, with risk-taking becoming more socially acceptable.

- Media programs like Shark Tank India and startup success stories have popularized entrepreneurship.

- Surveys reveal that 77% of Indian youth expressed an interest in starting their own ventures.

What are the Key Issues Related to India’s Startup Ecosystem?

- Tightening Liquidity and Funding Challenges: India’s startup ecosystem faces a stark reduction in funding, highlighting a shift toward cautious investment practices globally.

- The reduced risk appetite among investors is prioritizing profitability over growth, constraining startups dependent on external capital for scaling.

- Indian startups have reported around 73% decline in funding in 2023 as compared to 2022 startups are grappling with stagnation amid rising operational costs.

- Policy Volatility and Taxation Woes: Frequent changes in taxation policies and regulatory ambiguity undermine investor confidence and operational ease for startups.

- The imposition of the Angel Tax on foreign investors in 2023, while aiming to curb money laundering, deterred legitimate foreign investments in early-stage startups.

- Despite initiatives like Startup India, the majority of Indian startups still spend a major chunk of their resources on navigating compliance, limiting their focus on innovation.

- Talent Retention and Skill Mismatch: While India produces a large volume of skilled graduates annually, startups face difficulties in retaining top talent due to global opportunities and domestic salary disparities.

- The allure of stable jobs abroad or in established MNCs has worsened the "brain drain" in critical areas like AI and machine learning.

- Between 2015 and 2022,1.3 million Indians left the country, many of whom were highly educated professionals creating a talent vacuum for Indian startups aiming to innovate.

- Overdependence on Urban Markets: Startups largely focus on urban-centric business models, neglecting the vast potential in rural India.

- This overdependence restricts their scalability and misses out on a market comprising over 65% of India’s population and startups still struggle to penetrate rural areas due to logistical and infrastructural challenges.

- Market Saturation and Fragmentation in Key Sectors: Certain industries, such as edtech and fintech, are reaching saturation points, leading to intense competition and declining margins.

- The fall of major players, showcases how overexpansion and unregulated competition have destabilized these sectors.

- Such saturation has resulted in layoffs and funding crunches, creating a ripple effect across the ecosystem.

- Insufficient Collaboration Between Academia and Startups: India’s academic institutions remain underutilized as engines of innovation for startups.

- Unlike Silicon Valley, where academia drives commercialization, Indian startups rarely collaborate with research institutions for cutting-edge technologies.

- A 2019 report suggests that out of 500 odd industrial clusters across India, 30-35% do not have any research institute or university in their vicinity.

- Digital Divide and Infrastructure Gaps: Despite the proliferation of digital tools, startups are hindered by inconsistent infrastructure, particularly in rural areas.

- The absence of high-speed internet in rural regions limits access to untapped markets, slowing the growth of sectors like agritech.

- A 2022 report revealed that almost 60% of the rural population is still not actively using the internet, startups struggle to deliver scalable, tech-driven solutions to underserved populations.

- Lack of Focus on Sustainability and ESG Alignment: Startups are increasingly scrutinized for failing to align with Environmental, Social, and Governance (ESG) standards, leading to reputational risks and regulatory challenges.

- Food delivery platforms like Swiggy and Zomato faced backlash for over-reliance on plastics.

- As India pushes for a circular economy and net-zero commitments, startups failing to adopt sustainable practices risk losing market trust and funding.

- Rising Protectionism and Global Competition: India’s startups are increasingly facing challenges from global rivals in sectors like fintech, gaming, and e-commerce, where international players dominate.

- At the same time, local protectionist policies, such as mandatory data localization, create compliance hurdles for startups aiming for global scalability.

- For instance, while Indian startups have struggled with compliance costs, global competitors like Amazon have continued aggressive market expansion in India.

What Steps can be Taken to Strengthen India's Startup Ecosystem?

- Streamlining Regulatory and Compliance Processes: Simplifying startup registration, taxation, and compliance procedures is crucial to reduce bureaucratic inefficiencies.

- A unified, time-bound single-window clearance system can address delays and ambiguities.

- For example, expanding the scope of the Ease of Doing Business Reforms 2.0, combined with reducing compliance costs under DPIIT’s Startup India initiative, can save startups hundreds of operational hours annually and promote faster scaling.

- Expanding Access to Funding Mechanisms: India should promote sector-specific venture funds and broaden the scope of the Fund of Funds for Startups (FFS) program.

- Introducing innovative funding models like revenue-based financing for early-stage startups can reduce the burden of equity dilution.

- Scaling up the SIDBI Startup Fund and linking it to emerging sectors like green energy and deep-tech can bridge funding gaps effectively.

- Enhancing Collaboration Between Academia and Startups: Structured industry-academia collaboration can drive innovation, particularly in deep-tech and biotech startups.

- Setting up innovation zones in universities under the National Research Foundation (NRF) can provide startups with access to cutting-edge research and technical expertise.

- These zones should focus on converting research into commercially viable technologies, creating intellectual property hubs.

- Strengthening Rural Digital Infrastructure: Expanding the BharatNet program to ensure 100% rural broadband coverage is key to unlocking the rural startup ecosystem.

- Startups in agritech, edtech, and e-commerce can thrive with enhanced internet penetration.

- Partnering with private players for last-mile connectivity under public-private partnership (PPP) models can ensure faster execution and reduce costs, fostering rural inclusivity.

- Promoting Sustainability-Centric Startups: Incentivizing green startups through tax benefits and subsidies can align the ecosystem with India’s climate goals.

- Linking sustainability initiatives like the National Green Hydrogen Mission and renewable energy subsidies to startups in EVs, clean tech, and waste management can accelerate innovation in this sector.

- For example, grants for battery recycling startups can align environmental goals with startup development.

- Improving Access to Global Markets: Encouraging startups to expand globally through government-supported export schemes can increase their market size.

- Programs like MADE (Mentoring, Access, Development, and Export) should be initiated to include funding for participation in international expos and trade missions.

- Partnering with chambers of commerce globally can also help Indian startups build cross-border networks.

- Tackling High Customer Acquisition Costs (CAC): To reduce CAC, the government can promote digital public infrastructure like ONDC (Open Network for Digital Commerce) to create a level playing field.

- ONDC can enable smaller startups to leverage shared resources and reduce dependence on heavy marketing spends.

- Additionally, incentives for startups leveraging data analytics for customer retention can lower churn rates, improving profitability.

- Fostering Women-Led Startups: Targeted initiatives to encourage women entrepreneurs, such as preferential credit under the Stand-Up India scheme, can address gender disparities.

- Expanding mentorship networks specifically for women founders and providing subsidized coworking spaces can create a more inclusive startup environment.

- Leveraging Digital Public Goods (DPGs): Startups can use India’s robust digital infrastructure, such as DigiLocker, to develop scalable solutions.

- Promoting open-source APIs for startups to build on top of these platforms can drive innovation.

- For example, fintech startups can utilize Account Aggregator Frameworks to create personalized financial products, reducing the time to market and enhancing efficiency.

- Building Robust Mentorship Networks: Creating national and regional mentorship networks can address the knowledge gap among founders.

- Programs like SAMRIDH (Startup Accelerator of MeitY for Product Innovation, Development, and Growth) can be expanded to provide sector-specific mentorship.

- Pairing successful entrepreneurs with early-stage startups through structured government-led programs can fast-track their learning curve.

- Reforming Labor Laws to Support Gig Economy Startups: Labor reforms to accommodate gig and platform workers can enhance the ecosystem's sustainability.

- Creating social security frameworks and health benefits for gig workers under programs like Code on Social Security, 2020 can reduce workforce volatility.

- This would particularly benefit startups in sectors like food delivery, ride-hailing, and logistics.

- Promoting Cross-Border Collaborations in Emerging Sectors: Fostering international collaborations in areas like AI, blockchain, and clean energy can position Indian startups at the forefront of global innovation.

- Bilateral agreements with countries like the US and Japan, focused on startup exchange programs, can enable knowledge transfer.

- Integrating these with Startup India International Summits can enhance India’s global startup footprint.

Conclusion:

India's startup ecosystem has demonstrated remarkable growth and global potential, driven by government policies, expanding digital infrastructure, and an evolving investment landscape. However, challenges like funding shortages, policy volatility, and talent retention remain significant obstacles. To strengthen this ecosystem, India must streamline regulatory processes, improve rural digital infrastructure and foster academia-startup collaboration.

|

Drishti Mains Question: India’s startup ecosystem has gained global recognition, yet challenges like funding gaps, regulatory hurdles, and limited innovation scaling persist. Discuss. |

UPSC Previous Year Question (PYQ)

Q. What does venture capital mean? (2014)

(a) A short-term capital provided to industries

(b) A long-term start-up capital provided to new entrepreneurs

(c) Funds provided to industries at times of incurring losses

(d) Funds provided for replacement and renovation of industries

Ans: (b)