Indian Economy

Fiscal Policies and Economic Resilience

This editorial is based on “Marathon, Not Sprint” which was published in Indian Express on 01/02/2024. The article discusses that despite global uncertainties, India continues to be the fastest-growing major economy, maintaining stability in key economic indicators such as the current account deficit, currency, and inflation.

For Prelims: Retail Inflation, Reserve Bank of India, Monetary Policy, Gross Domestic Product (GDP), International Monetary Fund, Monetary Policy Committee, Wholesale Price Index (WPI), Consumer Price Index, Core Inflation, Headline Inflation, Disinflation, National Statistical Office (NSO), Periodic Labour Force Survey (PLFS), Fiscal Policy

For Mains: Impact of Inflation on the growth and development of Economy and its potential relationship with creation of employment opportunities.

Economic policies, specifically fiscal policy, have played a key role in shaping the post-pandemic growth recovery. The fiscal policy transitioned from a focus on welfare during the pandemic towards a public investment-driven growth strategy to accelerate a buildup in infrastructure. This was achieved while staying on the glide path of a reducing fiscal deficit/gross domestic product (GDP) ratio.

The first advance GDP estimates from the National Statistical Office (NSO) indicate that the Indian economy will grow 7.3% this fiscal year, faster than the Economic Survey’s prediction of 6.5% made in January 2023. In this context, the Interim Budget presented recently needs to accommodate various issues left unaddressed to maintain the forecast growth momentum.

Interim Budget

- Interim Budget is a statement that comprises detailed documentation of every expense that the government will incur and every penny that the government will make in the coming few months until the new government comes into power. It also includes income and expenses, made in the previous fiscal year.

- It is different from the regular budget on the following aspects:

- The interim budget includes documentation of expenses until the upcoming elections are held, whereas a regular budget includes estimates of expenditure for the full year.

- Also generally, major policy changes are not announced in the interim budget.

- An outgoing government presents only an interim Budget or seeks a vote on account.

- An Interim Budget is not the same as a 'Vote on Account'. While a 'Vote on Account' deals only with the expenditure side of the government's budget, an Interim Budget is a complete set of accounts, including both expenditure and receipts.

What is the Current Scenario of India’s Growth Trajectory?

- Government's Investment Strategy: Investment has outpaced GDP growth, reaching 34.9% this year. However, there is a call for the government to moderate budgetary support to capital spending to achieve the targeted fiscal deficit of 4.5% of GDP by 2025-26.

- Fiscal Consolidation in Election Year: Achieving fiscal consolidation in an election year is crucial for the government. The review document of the Ministry of Finance expects close to 7% growth next fiscal, with potential for India to become a $7 trillion economy by the end of the decade.

- Healthy Medium-Term Forecasts: Healthy medium-term growth prospects are also reflected in the forecasts of multilateral agencies. GDP growth is expected to moderate to 6.4% next fiscal, before accelerating thereafter, due to slowing global growth and tighter financial conditions globally and at home.

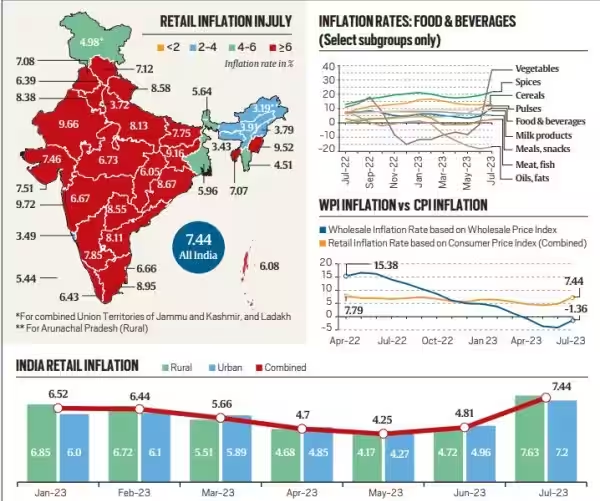

- Inflationary Concerns: Unlike advanced countries, core inflation has corrected quickly in India to 3.8% and Fuel inflation is at -1%.

- India’s headline inflation is yet to be brought under control, solely due to high food inflation. The underperformance of the agriculture and rural economy, coupled with high food inflation, can be worrisome.

- Climate Change and Economic Impacts: Year 2023 marked the highest annual temperature in recorded history, reminding the escalating climate risk. India is among the most climatically vulnerable countries.

- The Ministry of Finance’s review emphasises the need for research, development, and measures to adapt to climate change without compromising economic growth.

- Monsoon: While the overall rainfall was 6% below the expected during the monsoon season (due to 36% deficit rains in August, 2023), the spatial distribution is quite even. Out of 36 states/UTs, 29 received normal/above-normal rains.

- The SBI Monsoon Impact Index, which considers the spatial distribution, has a value of 89.5 in 2023, faring much better than the full season index value of 60.2 in 2022 (a better monsoon implies better agricultural productivity).

- Continuous Thrust on Capital Expenditure: During the first five months of the year 2023, the capital expenditure of the states as a percentage of the budgeted target was at 25%, while the Centre’s was at 37%, which was higher than the previous years and reflecting renewed capital generation.

- New Company Registrations: The robust new companies’ registration depicts strong growth intentions. Around 93,000 companies were registered in the first half of 2023-24 as compared to 59,000 five years back.

- It is interesting to note that the average daily registration of new companies increased to 622 in 2023-24 (an increase of 58%) from 395 in 2018-19.

- Reclassified India's Exchange Rate Regime: The International Monetary Fund (IMF) has classified India's exchange rate regime, labelling it a "stabilised arrangement" instead of "floating," indicating a shift in the perception of how India manages its currency.

- In a stabilised arrangement, the government fixes the exchange rate, whereas in a floating exchange rate system, it is determined by the demand and supply forces in the foreign exchange market.

- Declining Current Account Deficit (CAD): India’s CAD declined to 1% of GDP in the second quarter of 2023, down from 1.1% in the preceding quarter, and 3.8% in 2022.

- The CAD decreased to USD 8.3 billion in the September quarter of 2023-24 against a deficit of USD 9.2 billion in the preceding three months, according to the Reserve Bank of India (RBI) data.

- In the second quarter of 2022-23, the current account balance recorded a deficit of USD 30.9 billion.

What are the Major Challenges for the Indian Economy in 2024?

- Global Economic Integration: India's growth is not solely determined by domestic factors but is also influenced by global developments. Rising geopolitical events, therefore, could be a threat to India's growth.

- Increased geoeconomic fragmentation and the slowdown of hyper-globalisation are likely to result in further friend-shoring and onshoring, which are already having repercussions on global trade and, subsequently, on global growth.

- Energy Security vs Transition: A complex trade-off exists between energy security and economic growth versus the ongoing energy transition. This issue, surrounding geopolitical, technological, fiscal, economic, and social dimensions, requires careful consideration.

- Policy actions taken by individual countries in pursuit of energy goals can have spillover effects on other economies.

- Artificial Intelligence (AI) Challenges: The rise of AI also poses a huge challenge, especially in the services sector, as highlighted in an IMF paper and also highlighted in the report of Chief Economic Advisor (CEA) of India.

- This was mentioned in the IMF paper estimating that 40% of global employment is exposed to AI, with the benefits of complementarity operating beside the risks of displacement.

- Rising Inflation: Another major challenge that the government faces is the impact of rising inflation on the broader economy.

- Inflation affects growth by changing the labour supply and demand, and thus reducing aggregate employment in the sector that is subject to increasing returns. The reduction in the level of employment will reduce the marginal productivity of capital.

- Requirement of Skilled Workforce: Ensuring the availability of a talented and appropriately skilled workforce to the industry, age-appropriate learning outcomes in schools at all levels and a healthy and fit population are important policy priorities in the coming years will remain a challenge. A healthy, educated and skilled population augments the economically productive workforce.

- While the employable percentage of final-year and pre-final-year students increased from 33.9% in 2014 to 51.3% in 2024," as per the findings of the Wheebox National Employability Test, there is still much that needs to be done.

- Geopolitical Tensions: Maintaining high exports will not be easy in the current times for the country because of persisting geopolitical tensions, including recent events in the Red Sea, that further aggravated slower growth in global trade in 2023.

- Iran-backed militant group Houthis’ attack on shipments in the Red Sea have forced many nations, including India, to divert their cargo away from the troubled routes to longer and costlier ones.

- Some estimates stated India’s exports could be lower by USD 30 billion in the ongoing fiscal due to the crisis in the Red Sea.

What are the Reforms Required for Robust Economic Growth in 2024?

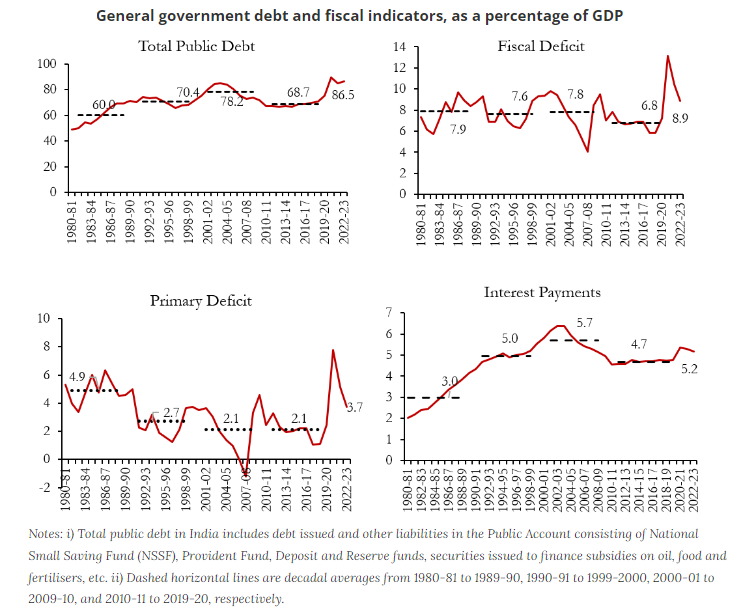

- Moving Towards Fiscal Consolidation: India’s general government debt to GDP ratio was at 82% of GDP in 2022-23, with interest payments at around 17% of the total expenditure. This leaves limited scope for more productive government spending. Hence, it is very important that the government continues to focus on fiscal consolidation and move towards a sustainable debt trajectory.

- Robust direct tax collections and higher dividend transfers from the RBI and public sector undertakings are likely to compensate for lower divestment this year.

- With healthy tax buoyancy, a budgeted fiscal deficit target of 5.3% for 2024-25 is expected as the government moves forward on the glide path of achieving a fiscal deficit of 4.5 % for 2025-26.

- Continuing Focus on Capital Expenditure (Capex): Given the strong multiplier effect of capex on growth, the focus on capex must continue in the forthcoming years. It is expected of the capex to grow by 10% to around Rs 11 trillion, with a continued focus on infrastructure.

- Post the pandemic, the government has increasingly used capex as a means of propelling growth. The government capex to GDP ratio is budgeted to increase to 3.4 % in 2023-24.

- The government in the last two years has also budgeted for interest-free loans amounting to Rs 2.3 trillion to state governments for capex.

- Need to Spur Consumption: The revival in consumption has been relatively weak and appears to be skewed towards the upper-income category. While GDP is estimated to grow by 7.3% in FY24 (as per advance estimates), consumption growth is estimated at only 4.4%.

- A revival in domestic demand becomes even more critical given the poor external demand scenario. Even while being cognisant of the fiscal limitations, there is a need to come up with measures to spur consumption demand.

- For instance, a small cut in excise duty on petrol/diesel by Rs 2-3/litre will provide some fillip to consumption and help contain inflation, without significantly disturbing the fiscal mathematics.

- Increased Spending on Human Capital: For many European countries, government spending on social services is more than one-fifth of GDP. Given that a large part of India’s population is dependent on the government for these services, it is critical to increase the spending on these services.

- India is in a unique position of enjoying a large working-age population at a time when most economies are struggling with an ageing population. However, for the economy to enjoy the demographic dividend, the government must invest in human capital.

- This requires a significantly higher expenditure on health, education and skilling so that the working-age population is equipped to be meaningfully employed.

- Focus on Agriculture and the Rural Sector: Rural India is home to 65% of the country’s population and has a large dependence on the agriculture sector. India’s agriculture productivity in terms of Gross Value Added (GVA) is a third of that in China and around 1% of that in the US. Measures to improve productivity in the sector will help improve rural incomes.

- This could be done through the adoption of the latest technology and by boosting rural infrastructure. Appropriate skilling of the rural workforce and enabling them to move to the manufacturing and services sectors will also help to reduce the large reliance of the rural workforce on the farm sector.

- Focus on Contemporary Issues: The need to create an enabling environment for businesses to thrive, the focus on environment-related issues, and the upliftment of the marginalised section of society are some other issues that must be provided adequate focus.

- This is the time to focus on the quality of growth to ensure that it is equitable, sustainable and green.

Conclusion

The first advance GDP estimates project a robust growth of 7.3% in the Indian economy, surpassing earlier predictions despite global uncertainties. The government's fiscal policies, transitioning from pandemic-focused welfare to public investment, have enhanced economic capacity, reflected in increased investment.

However, there's a need to moderate budgetary support to capital spending for fiscal consolidation. Managing food inflation, adapting to climate change, and maintaining macroeconomic fundamentals are vital for sustained growth, presenting policymakers with a challenging yet imperative task.

|

Drishti Mains Question: Discuss the role of fiscal policy in enhancing economic resilience, considering its evolution post-pandemic and the challenges posed by global uncertainties. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q. Consider the following statements: (2018)

- The Fiscal Responsibility and Budget Management (FRBM) Review Committee Report has recommended a debt to GDP ratio of 60% for the general (combined) government by 2023, comprising 40% for the Central Government and 20% for the State Governments.

- The Central Government has domestic liabilities of 21% of GDP as compared to that of 49% of GDP of the State Governments.

- As per the Constitution of India, it is mandatory for a State to take the Central Government’s consent for raising any loan if the former owes any outstanding liabilities to the latter.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Mains:

Q.1 Public expenditure management is a challenge to the Government of India in the context of budget-making during the post-liberalization period. Clarify it. (2019)

Q.2 Normally countries shift from agriculture to industry and then later to services, but India shifted directly from agriculture to services. What are the reasons for the huge growth of services vis-a-vis the industry in the country? Can India become a developed country without a strong industrial base? (2014)