Indian Economy

Rooftop Solar in India's Energy Sector

For Prelims: India's rooftop solar (RTS), India's energy sector, photovoltaic panels Council on Energy, Environment and Water (CEEW), Ministry of New and Renewable Energy (MNRE), fossil fuels and energy imports, PM Surya Ghar Muft Bijli Yojana, UN Sustainable Development Goals.

For Mains: Significance of Rooftop Solar in India's Energy Sector.

Why in News?

As of March 2024, India's total installed rooftop solar (RTS) capacity stood at 11.87 gigawatts (GW), with a notable increase of 2.99 GW in installed capacity during 2023-2024. This highlights the substantial transformative potential of RTS within India's energy sector.

What is the Rooftop Solar Programme?

- About:

-

The government introduced the Rooftop Solar Programme in 2014 to promote rooftop solar installation.

-

The original target was 40 GW installed capacity (out of 100 GW by 2030) by 2022 but the goal was not met by 2022, the deadline was extended to 2026.

- Rooftop solar panels are photovoltaic panels installed on the roof of a building and connected to the main power supply unit.

-

- Objective:

- To promote grid-connected solar rooftop systems on residential buildings.

- Historical Context:

- This program was launched as part of the Jawaharlal Nehru National Solar Mission in 2010, the Initial target was 20 GW of solar energy by 2022 then the revised target was 100 GW by 2022, including 40 GW from RTS.

- Key Initiatives under Rooftop Solar:

- SUPRABHA (Sustainable Partnership for RTS Acceleration in Bharat).

- SRISTI (Sustainable Rooftop Implementation for Solar Transfiguration of India).

- Implementation and State Performance:

- Centrally driven by the Ministry of New and Renewable Energy (MNRE) and executed through state nodal agencies and power distribution companies.

- Top performers States: Gujarat, Maharashtra, Rajasthan.

- Moderate performers: Kerala, Tamil Nadu, Karnataka.

- Underperformers: Uttar Pradesh, Bihar, Jharkhand.

- Centrally driven by the Ministry of New and Renewable Energy (MNRE) and executed through state nodal agencies and power distribution companies.

What is the Significance of the Rooftop Solar Programme?

- Decentralised Energy Production: It reduces dependency on centralized power grids and enhances energy security and resilience by installing rooftop solar panels in targeted households.

-

Economic Advantages: It lowers electricity bills for consumers, creates jobs in the solar industry, and reduces the need for expensive grid infrastructure upgrades.

- Energy Independence: It empowers consumers to become 'prosumers' (producers and consumers) and reduces reliance on fossil fuels and energy imports.

- Rural Electrification and Energy Diversification: It provides power to remote areas not connected to the main grid, improves the quality of life in underserved communities, and contributes to a more diverse and stable energy mix.

- Sustainable Development: It aligns with UN Sustainable Development Goals (SDG 7) and supports India's commitment to renewable energy and climate action.

What is India’s Current Solar Capacity?

- India's Rooftop Solar Capacity:

- India's total installed rooftop solar capacity is reported to be approximately 11.87 GW, with Gujarat leading the table followed by Maharashtra, as of March 2024.

- The overall RTS potential of India is approximately 796 GW.

- According to a Council on Energy, Environment and Water (CEEW) report, only 20% of rooftop solar installations are currently in residential sectors, with the majority concentrated in commercial and industrial sectors.

- The CEEW report projects that India's 250 million households have the potential to collectively install up to 637 GW of rooftop solar capacity, which could potentially fulfil one-third of the country's residential electricity demand.

- India's total installed rooftop solar capacity is reported to be approximately 11.87 GW, with Gujarat leading the table followed by Maharashtra, as of March 2024.

- Total Installed Capacity:

- Regarding total solar capacity, the Ministry of New and Renewable Energy states that India had achieved approximately 73.31 GW by December 2023, with Rajasthan leading at 18.7 GW and Gujarat following at 10.5 GW.

Note

- Modhera, India’s first solar-powered village, is in Gujarat and has 1,300 RTS systems of 1 kW each.

What is PM Surya Ghar Muft Bijli Yojana?

- About:

-

The PM Surya Ghar Muft Bijli Yojana is a scheme aimed at providing RTS systems in 1 crore households.

-

Under this initiative, participating households can receive 300 units of electricity free every month.

-

The scheme targets residential consumers with systems up to 3 kW capacity, covering a majority of households in India.

-

- Registration and Installation:

- To initiate the installation, interested residents must register on the national rooftop solar portal and select a vendor from the provided list.

- Eligibility requires a valid electricity connection and no prior subsidy availed for solar panels.

- Financial Setup:

- The scheme is financed with a central allocation of Rs 75,021 crore, primarily distributed as direct subsidies to consumers.

- It also includes provisions for payment security in renewable energy service company models and supports innovative projects.

- Key Benefits:

- It includes free electricity, reduced electricity bills, payback periods ranging from three to seven years, lower costs for the government, increased adoption of renewable energy, and decreased carbon emissions.

What are the Other Government Initiatives to Harness Solar Energy?

- FDI in Renewable Energy: Permitting up to 100% FDI under the automatic route for renewable energy projects.

- One Sun, One World, One Grid

- Pradhan Mantri Sahaj Bijli Har Ghar Yojana (SAUBHAGYA)

- Green Energy Corridor (GEC)

-

National Smart Grid Mission (NSGM) and Smart Meter National Programme

What are the Different Challenges and Way Forward Related to RTS?

| Challenges | Way Forward |

|

|

|

|

|

|

|

|

|

Drishti Mains Questions: Q. What are the primary challenges associated with rooftop solar installation and What need to be done to address them? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. With reference to the Indian Renewable Energy Development Agency Limited (IREDA), which of the following statements is/are correct? (2015)

- It is a Public Limited Government Company.

- It is a Non-Banking Financial Company.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)

Mains

Q. “Access to affordable, reliable, sustainable and modern energy is the sine qua non to achieve Sustainable Development Goals (SDGs)”.Comment on the progress made in India in this regard. (2018)

International Relations

Russian Consignment to India via INSTC

For Prelims: Central Asia, Baltic, Chabahar Port, JCPOA, INSTC.

For mains: International North–South Transport Corridor, Significance, Potential and Challenges.

Why in News?

Recently, Russia has sent two trains carrying coal to India through the International North-South Transport Corridor (INSTC) for the first time.

- The consignment will travel over 7,200km from St. Petersburg, Russia to Mumbai port via Bandar Abbas port of Iran.

What is the International North-South Transport Corridor (INSTC)?

- About:

- INSTC is a 7,200-kilometer Multimode Transit Route linking the Indian Ocean and the Persian Gulf to the Caspian Sea via Iran and onward to northern Europe via St. Petersburg in Russia.

- It connects ship, rail, and road routes for moving cargo between India, Iran, Azerbaijan, Russia, Central Asia, and Europe.

- Origin:

- It was launched on 12th September 2000 in St. Petersburg, by a trilateral agreement signed by Iran, Russia and India at the Euro-Asian Conference on Transport in 2000 for promoting transportation cooperation among the Member States.

- Ratification:

- Since then, INSTC membership has expanded to include 10 more countries (total 13)-Azerbaijan, Armenia, Kazakhstan, Kyrgyzstan, Tajikistan, Turkey, Ukraine, Syria, Belarus, and Oman.

- Routes and Modes:

- Central Corridor: It begins from the Jawaharlal Nehru Port in Mumbai and connects to the Bandar Abbas port (Iran) on the Strait of Hormuz. It then passes through the Iranian territory via Nowshahr, Amirabad, and Bandar-e-Anzali, runs along the Caspian Sea to reach the Olya and Astrakhan Ports in Russia.

- Western Corridor: It connects the railway network of Azerbaijan to that of Iran via the cross-border nodal points of Astara (Azerbaijan) and Astara (Iran) and further to Jawaharlal Nehru port in India via sea route.

- Eastern Corridor: It connects Russia to India through the Central Asian countries of Kazakhstan, Uzbekistan, and Turkmenistan.

What is the Significance of INSTC for India?

- Diversification of Trade Routes:

- INSTC allows India to bypass chokepoints like the Strait of Hormuz and the Red Sea (Suez Canal route), making its trade more secure.

- The Israel-Hamas conflict and the Houthi attacks on ships in the southern Red Sea have highlighted the significance of having alternative trade routes.

- Through this India can bypass Pakistan and unstable Afghanistan to reach Central Asia.

- Enhanced Connectivity with Central Asia:

-

It connects India to markets in Russia, the Caucasus, and Eastern Europe, facilitating trade, energy cooperation, defense, counterterrorism, and cultural exchanges with Central Asian Republics through initiatives like “Connect Central Asia”.

- The INSTC significantly reduces transit time by 20 days and freight costs by 30% compared to the Suez Canal route.

-

- Energy Security:

- The INSTC facilitates India's access to energy resources in Russia and Central Asia and can reduce reliance on the Middle East.

- Since the Russia-Ukraine war, imports of metallurgical coal from Russia have tripled, and are expected to grow amid declining imports from Australia.

- Strengthening Ties with Iran and Afghanistan:

-

India has invested in the Chabahar Port in Iran's Sistan-Balochistan province and signed an agreement for the INSTC, aiming to facilitate trade with Central Asian countries.

-

Chabahar Port is essential for India, Iran, and Afghanistan as it offers direct sea access and trade opportunities in the region.

-

What are the Challenges Related to Full Utilization of INSTC?

- Limited International Funding: Unlike China's Belt and Road Initiative (BRI) with its dedicated funding institutions, INSTC lacks significant financial funding from major institutions like the World Bank and Asian Development Bank.

- US Sanctions on Iran: The harsh sanctions imposed on Iran after the US's withdrawal from the JCPOA (Joint Comprehensive Plan of Action) in 2018 resulted in many global companies withdrawing from infrastructure projects in Iran.

- Security Concerns in Central Asia: The presence of terrorist organizations like the Islamic State (IS) in Central Asia poses a significant security threat along the corridor which can deter investment and smooth operation of the route.

- Differential Tariffs and Customs: Disparities in customs regulations and tariff structures across member states create complexities and delays for cargo movement.

- Uneven Infrastructure Development: The corridor utilizes various modes of transport (ship, rail, road). Uneven infrastructure development across member states, particularly underdeveloped rail networks in Iran, creates bottlenecks and hinders the seamless movement of goods.

- There is a lack of a joint work plan for developing the corridor and its business ecosystem.

Way Forward

- Proactive Approach: A proactive approach, particularly by founding members India and Russia, is crucial for the success of INSTC.

- This could involve joint marketing efforts, infrastructure development initiatives, and diplomatic efforts to address political hurdles.

- Financing Gap: Infrastructure development and corridor maintenance require substantial investment.

- Private sector participation should be encouraged by mitigating risks through improved security and political stability in the region.

- Streamlining Customs and Tariffs: Implementing a harmonized customs regime and implementing mutual recognition agreements would simplify procedures and expedite cargo movement.

Conclusion

The INSTC corridor has the potential to create a strong trade connection between India, Russia, Iran and Baltic and Scandinavian countries. It could boost economies, improve relations between involved countries, and counter China's influence in Central Asia. However, there are challenges like bureaucracy and regional conflicts that need to be addressed for INSTC to be successful.

|

Drishti Mains Question: What is the geopolitical and geoeconomic importance of the International North-South Transport Corridor (INSTC) for India? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. What is the importance of developing Chabahar Port by India? (2017)

(a) India’s trade with African countries will enormously increase.

(b) India’s relations with oil-producing Arab countries will be strengthened.

(c) India will not depend on Pakistan for access to Afghanistan and Central Asia.

(d) Pakistan will facilitate and protect the installation of a gas pipeline between Iraq and India.

Ans: (c)

Mains

Q. In what ways would the ongoing U.S-Iran Nuclear Pact Controversy affect the national interest of India? How should India respond to this situation? (2018)

Q. The question of India’s Energy Security constitutes the most important part of India’s economic progress. Analyse India’s energy policy cooperation with West Asian countries. (2017)

Indian Heritage & Culture

Evolution of Music System

For Prelims:Sama Veda, Hindustani and Karnatak (Carnatic) music, ,Muslim rulers in North India, Bhakti Movement, ragas and talas, saptaswaras, Gharanas', Thaat', Khayal, Thumri, and Tarana

For Mains: Indian Music System, Evolution and Development.

Why in News?

A recent study revealed chimps' ability to dance in tune with rhythmic music suggesting an evolutionary link in our sense of rhythm. Archaeological evidence, including a 40,000-year-old flute made from animal bone, provides insights into the origins of human musical expression.

What are the Findings of the Recent Study?

- Origin of Music in Humans: According to this study, humans likely began singing after the development of speech during the Old Stone Age, approximately 2.5 million years ago.

- Evidence suggests that the ability to play musical instruments emerged around 40,000 years ago, exemplified by the discovery of a flute made from animal bone with seven holes.

- Musical Notations: In India, musical notes ('sa, re, ga, ma, pa, da, ni') are believed to have originated during Vedic times (1500-600 BCE), forming the basis of Indian classical music traditions.

- Musical notation systems were established independently in Europe and the Middle East around the 9th century BCE, using spaced notations ('do, re, mi, fa, sol, la, ti').

- Evolution of the Indian Music System: Indian music evolved in the ancient, medieval and modern periods.

How Indian Music Evolved in the Ancient Period?

- Origins in the Sama Veda: The roots of Indian music stretch back to the Sama Veda, where slokas were harmonized with music.

- Narada Muni introduced the art of music to humanity and imparted knowledge of Naada Brahma, the cosmic sound that permeates the universe.

- Development of Vedic Music: Initially centred around single notes, Vedic music progressively incorporated two and then three notes.

- This evolution culminated in the establishment of the seven basic notes (sapta swaras) that form the basis of Indian classical music.

- Vedic hymns were integral to religious rituals such as yagas and yagnas, where they were sung and danced to the accompaniment of string and percussion instruments.

- Early Tamil Contributions: Scholars like Ilango Adigal and Mahendra Verma contributed significantly to the musical ideas in ancient Tamil culture, documented in texts such as Silappadi Kaaram and Kudumiyamalai inscriptions.

- Ancient Tamil treatises, like Karunamrita Sagara, provided insights into ragas represented by various 'pans' and the understanding of sthayi (octave), srutis, and swara sthanas.

How Indian Music Evolved in the Medieval Period?

- Unified Musical System: Up until the 13th century, India maintained a cohesive musical system grounded in fundamental principles such as saptaswaras (seven notes), octaves, and sruti (microtones).

- Introduction of Terms: Haripala coined the terms Hindustani and Carnatic music, marking the distinction between northern and southern musical traditions

- Impact of Muslim Rule: With the arrival of Muslim rulers in North India, Indian music assimilated influences from Arabian and Persian musical systems. This interaction broadened the scope of Indian musical expression.

- Regional Stability and Flourishing: While North India experienced cultural exchanges, South India remained relatively insulated, fostering the uninterrupted growth of classical music supported by temples and Hindu monarchs.

- The Emergence of Distinct Systems: Hindustani and Carnatic music evolved as distinct systems, each rooted in Vedic principles yet exhibiting unique regional flavours and stylistic nuances.

- Influence of Bhakti Movement: The 7th century onwards saw the rise of numerous saint singers and religious poets across India, including Purandara Dasa in Karnataka, who systematised talas (rhythmic cycles) and contributed significantly to devotional song compositions.

- During this era, classifications of ragas became clearer, laying the foundation for the melodic structure that defines Indian classical music.

- Expansion and Refinement: This era witnessed significant growth in the quality and quantity of musical forms, including Ragas, Talas (rhythmic cycles), and musical instruments.

- Emergence of Musical Forms: Composition forms such as Khayal, Thumri, and Tarana gained prominence during this period, contributing to the diverse repertoire of Hindustani classical music.

- Gharanas: Distinct musical traditions known as gharanas, such as Agra, Gwalior, Jaipur, Kirana, and Lucknow, flourished during this period, each contributing unique stylistic elements to Hindustani music.

How Indian Music Evolved in the Modern Period?

- Legendary Musicians: Renowned musicians like Ustad Alladia Khan, Pt. Omkarnath Thakur, Pt. Vishnu Digambar Paluskar and Ustad Bade Gulam Alikhan emerged as icons of 20th-century Hindustani music, enriching the tradition with their mastery and innovations.

- Preservation through Notation: The advent of notation systems ensured the preservation and accessibility of musical compositions across generations, safeguarding invaluable musical heritage.

- Systematization of Hindustani Ragas: Pandit Vishnu Narayan Bhatkhande played a pivotal role in systematising Hindustani Ragas under the 'Thaat' system, laying a structured foundation for musical education and performance.

- Scholarly Compositions: Numerous scholarly musical forms such as Kritis, Swarajatis, Varna, Pada, Tillana, Jawali, and Ragamalikas were composed.

- These compositions drew inspiration from ancient prabandhas while evolving in musical and lyrical sophistication.

Read more:

|

Drishti Mains Questions: Discuss the evolution of the Indian music system from traditional roots in classical music to its contemporary forms, and discuss the factors that have influenced its transformation over the centuries. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q. A community of People Called Manganniyars is Well-Known for their (2014)

(a) Martial arts in North -East India

(b) Musical tradition in North -West India

(c) Classical vocal music in south india

(d) Pietra dura tradition in central India

Ans:(b)

Mains:

Q.1 What are the groups into which musical instruments in India have traditionally been classified? (2012)

Indian Economy

Trends in Remittances Inflow

For Prelims: World Bank, Remittances, Foreign exchange, Organisation for Economic Co-operation and Development, Gulf Cooperation Council, National Payments Corporation of India.

For Mains: Remittance Trends Across the Globe, Factors Affecting Remittance Flows to India, Measures to Boost Remittance Inflow.

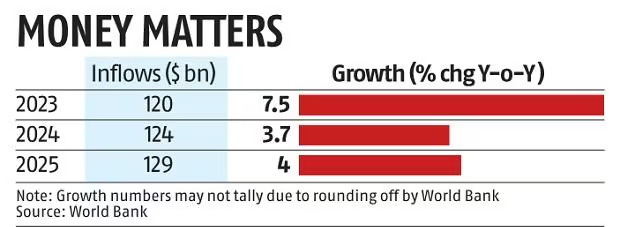

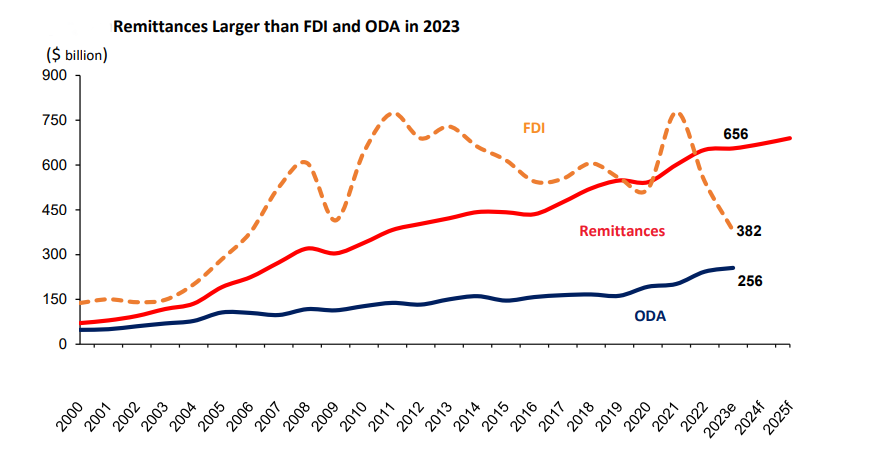

Why in News?

According to the latest report by the World Bank, the growth in remittances to India is likely to halve in 2024 compared to 2023.

- This slowdown is attributed to "reduced outflows from GCC (Gulf Cooperation Council) countries, amid declining oil prices and production cuts.

What are Remittances?

- About:

- Remittances are the funds or goods that migrants send back to their families in their home country to provide financial support.

- They are an important source of income and foreign exchange for many developing countries, especially those in South Asia.

- Remittances can help reduce poverty, improve living standards, support education and health care, and stimulate economic activity.

- India sent out 18.7 million emigrants in 2023.

- Remittances are the funds or goods that migrants send back to their families in their home country to provide financial support.

-

Growth of Remittances:

- Remittances Inflows in Countries:

- In 2023, India topped in remittances inflow list, followed by Mexico (USD 66 billion), China (USD 50 billion), the Philippines (USD 39 billion), and Pakistan (USD 27 billion).

- India's foreign assets increased more than liabilities in 2023-24 according to RBI data.

Migration Trends

- In 2023, there were approximately 302.1 million international migrants globally, according to World Bank data.

- Economic migrants constituted an estimated 252 million of the total international migrants.

- Refugees and asylum seekers numbered around 50.3 million in 2023, according to the United Nations High Commissioner for Refugees (UNHCR).

What are the Factors Affecting Remittance Flows to India?

- Top Sources of Remittances for India:

- Around 36% of total remittance flows to India are sent by high-skilled Indian migrants residing in 3 high-income countries like the United States, the United Kingdom, and Singapore.

- The post-pandemic recovery led to a tight labour market in these regions, resulting in wage hikes that boosted remittances.

- Among the other high-income destinations for Indian migrants, such as the Gulf Cooperation Council (GCC) countries, UAE accounted for 18% of India's remittance flows, while Saudi Arabia, Kuwait, Oman, and Qatar collectively accounted for 11%.

- Around 36% of total remittance flows to India are sent by high-skilled Indian migrants residing in 3 high-income countries like the United States, the United Kingdom, and Singapore.

- Reason for Consistent Remittance Inflow:

-

Strong Economic Conditions:

- In developed economies like the US, UK, and Singapore, lower inflation and strong labour markets have benefited skilled Indian professionals, resulting in increased remittance inflows to India.

- High employment growth and a general decrease in inflation in Europe contributed to the increase in remittances worldwide.

- Diversified Migrant Pool:

-

India's migrant pool is no longer concentrated solely on high-income countries. A significant portion resides in the Gulf Cooperation Council (GCC), offering a buffer during economic downturns in either region.

- Favorable economic conditions in GCC, including high energy prices and curbed food price inflation have positively impacted employment and incomes for Indian migrants, especially those in less-skilled sectors.

- India and the United Arab Emirates (UAE) signed a pact in 2023 to establish a Local Currency Settlement System (LCSS) to promote the use of the Indian rupee (INR) and UAE Dirham (AED) for cross-border transactions further boosting remittance flows.

-

- Improved Remittance Channels:

- Initiatives like Unified Payment Interface (UPI) have enabled real-time fund transfers, allowing remittances to be sent and received instantly.

- The National Payments Corporation of India (NPCI) has allowed NRIs to use UPI in several countries including Singapore, Australia, Canada, Hong Kong, Oman, Qatar, USA, Saudi Arabia, United Arab Emirates, and the United Kingdom, Sri Lanka, Bhutan, Mauritius, France, Nepal.

-

How can Remittance Inflow in India be Increased?

- Boosting Financial Inclusion: World Bank data indicates only 80% of Indians have bank accounts. Expanding formal financial services, especially in rural areas can facilitate easier remittance transfers through a wider network of bank branches, ATMs, and digital platforms.

-

Reducing Remittance Costs: As per World Bank data, India has high remittance costs (5-6%).

- Introducing competition between remittance service providers and promoting digital channels can lower transaction costs, while government incentives for formal channels can boost adoption.

- Enhancing Remittance Infrastructure: Upgrading payment systems and leveraging new technologies like blockchain can streamline the remittance process.

-

The Reserve Bank of India's Centralized Payment System such as Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) is a step towards this goal.

-

-

Targeted Diaspora Engagement: Increased government engagement with the Indian diaspora through programs like Pravasi Bharatiya Divas and the Know India Programme can strengthen connections.

-

Offering attractive investment options and tax breaks, as suggested by the International Monetary Fund (IMF) data can incentivize higher remittance inflows.

-

-

Promoting Economic Stability:

- Implementing sound macroeconomic policies, improving the ease of doing business, and addressing corruption is crucial for diaspora confidence which can create a more attractive environment for remittance flows .

|

Drishti Mains Question: Analyze the factors influencing remittance inflows to India and discuss the policy measures that can be implemented to enhance their contribution to the Indian economy. |

UPSC Civil Services Examination, Previous Year Questions

Q1. Which of the following constitute Capital Account? (2013)

- Foreign Loans

- Foreign Direct Investment

- Private Remittances

- Portfolio Investment

Select the correct answer using the codes given below:

(a) 1, 2 and 3

(b) 1, 2 and 4

(c) 2, 3 and 4

(d) 1, 3 and 4

Ans: (b)

Q2. With reference to digital payments, consider the following statements: (2018)

- BHIM app allows the user to transfer money to anyone with a UPI-enabled bank account.

- While a chip-pin debit card has four factors of authentication, BHIM app has only two factors of authentication.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Q3. Which of the following is a most likely consequence of implementing the ‘Unified Payments Interface (UPI)’? (2017)

(a) Mobile wallets will not be necessary for online payments.

(b) Digital currency will totally replace the physical currency in about two decades.

(c) FDI inflows will drastically increase.

(d) Direct transfer of subsidies to poor people will become very effective.

Ans: (a)

Mains

Q. ‘Indian diaspora has a decisive role to play in the politics and economy of America and European Countries’. Comment with examples. (2020)

Important Facts For Prelims

Joint Sitting of Parliament and Leader of House

Why in News?

The President of India recently addressed the joint sitting of both houses of Parliament. It was the first time he addressed the newly elected 18th Loksabha.

What is the Joint Sitting of Parliament?

- About:

- A joint sitting involves both houses of Parliament (Lok Sabha and Rajya Sabha) meeting together.

- Types of Joint Sittings in the Constitution:

- There are two main types of joint sittings in the Indian parliamentary system.

- First is the presidential address under Article 87 and

- Second is the resolution of legislative deadlocks under Article 108.

- Article 87 of the Indian Constitution outlines when the President addresses both Houses of Parliament.

- The President addresses the Rajya Sabha and Lok Sabha at the beginning of the first session after each general election.

- The President also addresses both Houses at the beginning of the first session of each year.

- The Constitution (First Amendment) Act of 1951 modified Article 87 as follows: In clause (1), the phrase "every session" was replaced with "the first session after each general election to the House of the People and at the commencement of the first session of each year.

- Significance of Joint Sitting:

-

They provide an opportunity for the President to outline the government's policy priorities and legislative agenda.

-

The address after general elections is particularly significant as it often reflects the mandate and priorities of the newly elected government.

-

- Article 108 of the Constitution can be called in the following scenarios:

- when a bill is passed by one house but rejected or not returned by the other.

- When the President returns a bill for reconsideration.

- When more than six months have elapsed from the date of the

- receipt of the bill by the other House without the bill being

- passed by it.

- Key provisions for Joint Sittings:

- Chaired by the Lok Sabha Speaker

- Follows Lok Sabha rules of procedure.

- A quorum is one-tenth of the total members from both houses

- Used as a last resort to resolve legislative deadlocks.

- Exceptions to Joint Sittings: The two exceptions are:

- There are two main types of joint sittings in the Indian parliamentary system.

Note:

- Only three bills have been passed through joint sittings since 1950:

- Dowry Prohibition Bill, 1960

-

Banking Service Commission (Repeal) Bill, 1977

-

Prevention of Terrorism Bill, 2002

Who is the Leader of the House (LOH)?

- Current LOH in Rajya Sabha:

- On the opening day of the Rajya Sabha's 264th session, Health Minister Jagat Prakash Nadda was officially appointed as the Leader of the House in the Rajya Sabha.

- Legal Backing:

- The term Leader of the House is officially defined in the Rules of Procedure for both the Lok Sabha and the Rajya Sabha.

- Appointment Process:

- He is a minister and a member of the Rajya Sabha and is nominated by the prime minister to function as such.

- Additionally, the Leader of the House has the authority to appoint a Deputy Leader of the House.

- In the United States, a comparable position is known as the 'majority leader.'

-

Responsibilities:

- Conducts the overall process, especially debates and discussions

- Maintains harmony among members

- Upholds the respect of the Rajya Sabha

- Maintains standard proceedings during parliamentary debates

- LOH in Lok Sabha:

- In the Lok Sabha, the Leader of the House is typically the Prime Minister if they are a house member. If not, it's a Minister who is a member and is nominated by the Prime Minister for this role.

- By convention, the Prime Minister is always the Leader of the Lok Sabha.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Which of the following is/are the exclusive power(s) of Lok Sabha? (2022)

- To ratify the declaration of Emergency.

- To pass a motion of no-confidence against the Council of Ministers.

- To impeach the President of India.

Select the correct answer using the code given below:

(a) 1 and 2

(b) 2 only

(c) 1 and 3

(d) 3 only

Ans: B

Important Facts For Prelims

India to Import at Concessional Duty

Why in News?

Recently, India has allowed limited imports of corn, crude sunflower oil, refined rapeseed oil, and milk powder under the Tariff-Rate Quota (TRQ).

- This has been taken with the effort to control the rising food inflation.

Tariff-Rate Quota (TRQ)

- It is a trade policy tool that allows a set amount of a specific good to be imported at a reduced tariff rate, while quantities above this threshold are subject to a higher tariff.

- This is used to balance protecting domestic industries with the need to meet demand through imports.

What is India's Position in Vegetable Oil and Milk Market?

- India’s Position in Vegetable Oils:

- India is the world's largest importer of vegetable oils such as palm oil, soya oil and sunflower oil, fulfilling almost two-thirds of its needs through imports.

- Palm oil accounts for 40% of India's vegetable oil consumption, with over two-third of it imported from Indonesia and Malaysia.

- In 2021, India unveiled the National Mission on Edible Oil-Oil Palm to boost India’s domestic palm oil production.

- Sunflower oil and Soybean oil are imported from Russia, Ukraine, Argentina, and Brazil.

- Top 5 producers of Edible Oil: China, India, the United States, Indonesia and Brazil.

- Palm oil accounts for 40% of India's vegetable oil consumption, with over two-third of it imported from Indonesia and Malaysia.

- India is the world's largest importer of vegetable oils such as palm oil, soya oil and sunflower oil, fulfilling almost two-thirds of its needs through imports.

- Milk Production:

- India is the top producer of milk contributing around 24.64% of the world's total milk production in 2021-22 as per Food and Agriculture Organisation’s (FAO) data.

- The National Dairy Development Board (NDDB) reported a significant 58% increase in milk production from 2014-15 to 2022-23, with the total production reaching 230.58

million tonnes.

- The National Dairy Development Board (NDDB) reported a significant 58% increase in milk production from 2014-15 to 2022-23, with the total production reaching 230.58

- India is the top producer of milk contributing around 24.64% of the world's total milk production in 2021-22 as per Food and Agriculture Organisation’s (FAO) data.

- Corn:

- India ranks fourth globally in corn cultivation area and seventh largest producer, contributing around 2% to global corn output.

- Corn production estimates for 2023-24 indicate a yield of approximately 33.5 million metric tons.

- Top 3 Producers of Corn: US, China and Brazil.

What is Concessional Duty?

- About:

- It is a tariff, or tax, imposed on imported goods, but at a lower rate than the standard duty.

- Reasons for Imposition:

- Reduced Import Costs: By lowering the duty, the government aims to make importing certain goods cheaper. This can benefit consumers by making those goods more

affordable domestically. - Control Prices: It can help regulate domestic prices, especially when dealing with essential commodities.

- Encourage Specific Industries: Reduced duties on raw materials or equipment can incentivize domestic production in certain industries.

- Strengthen Trade Relations: Offering concessional duties can be a way to build stronger trade partnerships with other countries.

- Reduced Import Costs: By lowering the duty, the government aims to make importing certain goods cheaper. This can benefit consumers by making those goods more

- Temporary Measure: These are often implemented as temporary measures to address specific situations, like high domestic prices or shortages. Once the situation

improves, the duty may be raised back to the standard rate.

UPSC Civil Services Examination, Previous Year Questions (PYQ)

Prelims

Q1. Consider the following statements: (2018)

- The quantity of imported edible oils is more than the domestic production of edible oils in the last five years.

- The Government does not impose any customs duty on all the imported edible oils as a special case.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Rapid Fire

Cohabitation

Recent opinion polls for the French legislative elections suggest the possibility of a cohabitation in the French Parliament.

- Cohabitation is a situation where the President and the Prime Minister (leader of the National Assembly) come from different political parties.

- This occurs when the President's party does not have a majority in the National Assembly, leading to the appointment of a Prime Minister from the opposition party or coalition.

- In this power-sharing arrangement, the President handles foreign policy and defense, while the Prime Minister focuses on domestic policy and day-to-

day governance. - It requires cooperation and compromise between the two leaders to ensure effective governance.

- It has occurred 3 times in the French Fifth Republic since 1958.

- The French Fifth Republic refers to the current republican system of government in France, established by Charles de Gaulle in 1958, replacing the former parliamentary Fourth Republic.

- France is a semi-presidential, double-headed executive, representative parliamentary democracy, with clearly defined roles for the President and the Prime Minister.

Rapid Fire

High Speed Expendable Aerial Target ‘ABHYAS’

Recently, Defence Research and Development Organisation (DRDO) has completed developmental trials of the High Speed Expendable Aerial Target (HEAT) 'ABHYAS'.

- The trials took place at the Integrated Test Range (ITR), Odisha.

- ABHYAS is a HEAT being developed at Aeronautical Development Establishment (ADE) of DRDO.

- It is designed to provide a realistic threat scenario for practicing the use of weapon systems.

- Abhyas is made for autonomous flight with the assistance of an autopilot.

- It is equipped with systems like RCS (Radar Cross Section), Visual, and IR (Infrared) augmentation, a laptop-based ground control system, pre-flight checks, and data recording for post-flight analysis to support weapon practice.

- An expendable aerial target is a low-cost, replaceable drone or Unmanned Aerial Vehicles (UAVs) that is used to simulate aerial threats and enable

military training, testing, and evaluation activities.

Rapid Fire

GST on Employee Stock Option Plan (ESOP)

Recently, Central Board of Indirect Taxes & Customs (CBIC) mandated that no Goods and Services Tax (GST) will be levied on Employee Stock Option Plan (ESOP) issued by Indian subsidiries of Multi-National Companies (MNCs).

- Based on recommendations by GST Council, CBIC has mandated that, subject to some conditions, Employee Stock Option Plan (ESOP), Employee Stock Purchase Plan (ESPP), Restricted Stock Unit (RSU) issued by foreign firms will not attract GST.

- ESOP is an employee benefit plan that gives workers ownership interest in the company in the form of shares of stocks.

- ESPP is a plan where employees can purchase company stock directly at a discounted price.

- RSU is a plan where employees get incentives from equity stocks in the future (only after vesting period).

- This will benefit the likes of Google, Microsoft, Oracle, and Walmart, as well as a large number of tech companies and other MNCs whose Indian

employees were getting the benefit from ESOP plans. - CBIC which is a part of the Department of Revenue under the Ministry of Finance deals with the tasks of formulation of policy concerning levy and collection of customs, central excise duties, Central GST (CGST) and Integrated GST (IGST).

Read More: Goods and Services Tax (GST)

Rapid Fire

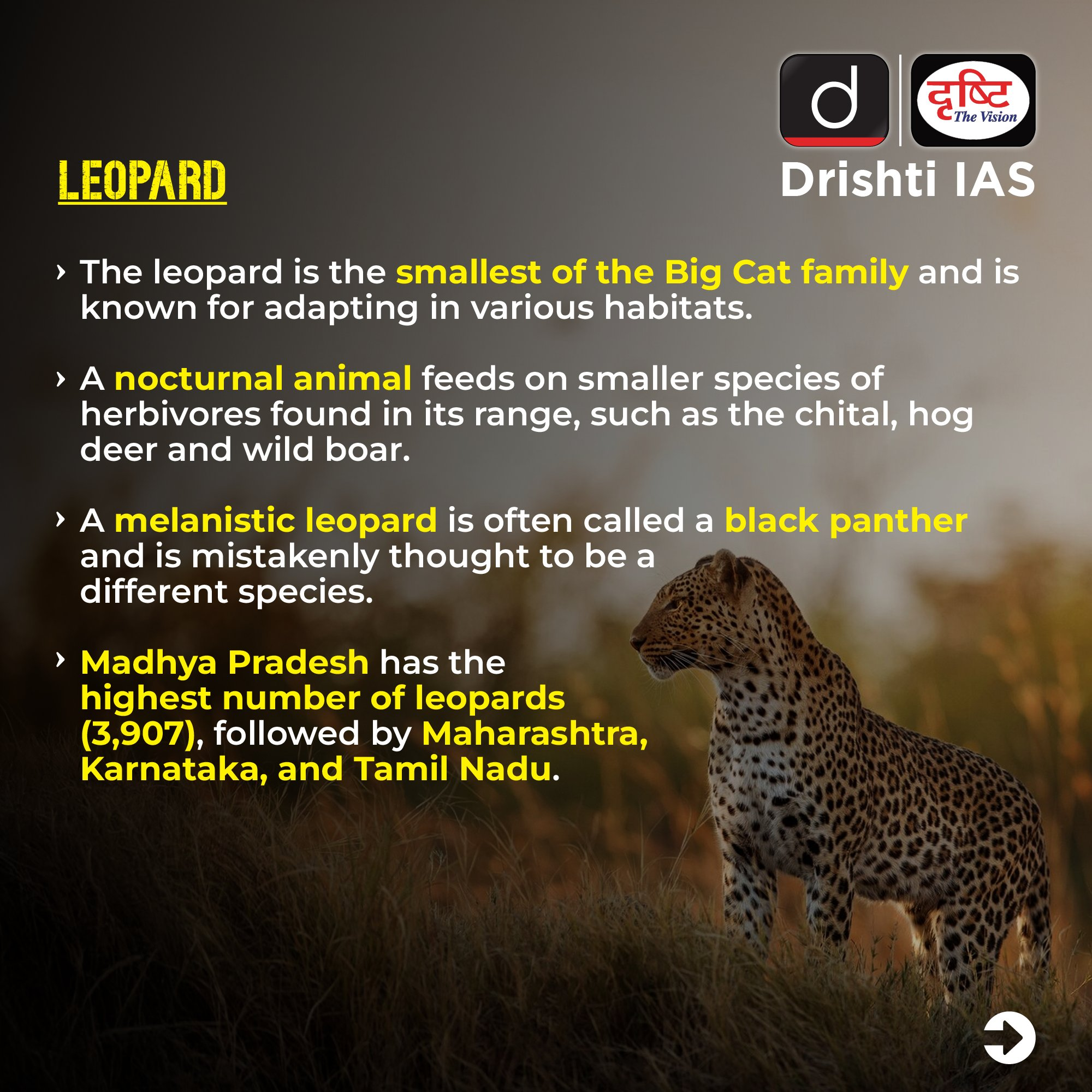

India’s Largest Leopard Safari

Recently, India's largest leopard safari has been inaugrated at Bannerghatta Biological Park (BBP) in Bengaluru, Karnataka.

- The leopard safari at BBP covers an area of 20 hectares. It features an undulating terrain with naturally occurring rocky formations and partially deciduous forests, and is currently home to 8 leopards.

- Bannerghatta Biological Park (BBP) was separated from Bannerghatta National Park (BNP) in 2004 and gained its status as a national park in 1974.

- It is home to free ranging leopards (Panthera Pardus).

- It has 4 sections: the zoo, the safari, the butterfly park, and the rescue center.

- The park also includes the valley of the Champakadhama hills within its boundaries.