Parliament Passes Bills To Replace British-era Criminal Laws

For Prelims: Bharatiya Nyaya (Second) Sanhita, 2023, Bharatiya Nagarik Suraksha (Second) Sanhita, 2023, Bharatiya Sakshya (Second) Bill, 2023, Sedition, Parliamentary Standing Committee, Organized Crime, Sexual Offences Against Women.

For Mains: Major Provisions of Bharatiya Nyaya (Second) Sanhita, 2023, Bharatiya Nagarik Suraksha (Second) Sanhita, 2023, Bharatiya Sakshya (Second) Bill, 2023, Government Initiatives Related to Criminal Justice System.

Why in News?

The Parliament recently passed three pivotal Bills: Bharatiya Nyaya (Second) Sanhita, 2023; Bharatiya Nagarik Suraksha (Second) Sanhita, 2023; and Bharatiya Sakshya (Second) Bill, 2023.

- Following their introduction in August, 2023, the bills were referred to a 31-member Parliamentary Standing Committee.

What are the Major Provisions of Bharatiya Nyaya (Second) Sanhita, 2023?

The Bharatiya Nyaya Sanhita (Second) (BNS2) replaces the Indian Penal Code, 1860 and introduces significant alterations including:

- Retention and Incorporation of Offences: The BNS2 maintains existing IPC provisions on murder, assault, and causing hurt, while incorporating new offenses like organized crime, terrorism, and group-related grievous hurt or murder. It also adds community service as a form of punishment.

- Terrorism: Defined as acts threatening the nation's integrity or causing terror among the populace. Penalties range from death or life imprisonment to imprisonment with fines.

- Organized Crime: Includes offenses like kidnapping, extortion, financial scams, cybercrime, and more. Punishments vary from life imprisonment to death, with fines for those committing or attempting organized crime.

- Mob Lynching: BNS2 identifies murder or severe injury by five or more individuals on specific grounds (race, caste, etc.) as a punishable offence, carrying life imprisonment or death penalty.

- Sexual Offences Against Women: Retaining IPC sections on rape, voyeurism, and other violations, BNS2 raises the age threshold for gangrape victims from 16 to 18 years. Additionally, it criminalizes deceptive sexual acts or false promises.

- Sedition Revisions: BNS2 eliminates the sedition offense, replacing it with penalizing activities related to secession, armed rebellion, or actions endangering national sovereignty or unity through various means.

- However, critics argue that despite the sedition law's alteration from 'rajdroh' to 'deshdroh,' concerns remain over its essence and application.

- Death by Negligence: The BNSS elevates the punishment for causing death by negligence from two to five years under Section 304A of the IPC.

- However, it stipulates that doctors, if convicted, will still face the lower punishment of two years imprisonment.

- Supreme Court Compliance: Aligns with certain Supreme Court decisions by excluding adultery as an offense and introducing life imprisonment alongside the death penalty for murder or attempted murder by a life convict.

Criticism of BNS2

- Criminal Responsibility Age Discrepancy: The age of criminal responsibility remains at seven years, with potential extension to 12 years based on the accused's maturity. This may conflict with international convention recommendations.

- Inconsistencies in Child Offense Definitions: While the BNS2 defines a child as someone below 18, the age threshold for several offenses against children differs. For instance, the age requirement for offenses like rape and gangrape varies, creating inconsistency.

- Sedition Provisions and Sovereignty Concerns: While the BNS2 eliminates sedition as an offense, elements related to endangering India's sovereignty, unity, and integrity might retain aspects of sedition.

- Retention of IPC Provisions on Rape and Sexual Harassment: The BNS2 retains the provisions of the IPC on rape and sexual harassment. It does not consider recommendations of the Justice Verma Committee (2013) such as making the offence of rape gender neutral and including marital rape as an offence.

What are the Major Provisions of Bharatiya Nagarik Suraksha (Second) Sanhita, 2023?

The Bharatiya Nagarik Suraksha (Second) Sanhita, 2023 (BNSS2) replaces the Criminal Procedure Code, 1973 (CrPC) and introduces significant alterations including:

- Detention Conditions: The BNSS2 alters rules for undertrials, restricting release on personal bond for those accused in severe offenses, including life imprisonment cases and individuals facing multiple charges.

- Medical Examination: It broadens the scope of medical examinations, allowing any police officer (not just a sub-inspector) to request one, making the process more accessible.

- Forensic Investigation: Mandates forensic investigation for crimes punishable by at least seven years' imprisonment.

- It requires forensic experts to collect evidence at crime scenes, recording the process electronically. States lacking forensic facilities should utilize those in other states.

- Sample Collection: Extends the power to collect finger impressions and voice samples, even from individuals not under arrest, expanding beyond the CrPC's specimen signatures or handwriting orders.

- Timelines: The BNSS2 introduces strict timelines: medical reports for rape victims within 7 days, judgments within 30 days (extendable to 45), victim progress updates within 90 days, and charge framing within 60 days from the first hearing.

- Court Hierarchy: The CrPC organizes India's criminal courts hierarchically, from Magistrate’s Courts to the Supreme Court. It previously allowed cities with over a million people to have Metropolitan Magistrates, but the BNSS2 eliminates this distinction and the role of Metropolitan Magistrates.

Criticism of BNSS2

- Property Attachment from Crime Proceeds and Lack of Safeguards: The power to seize property from crime proceeds lacks the safeguards provided in the Prevention of Money Laundering Act, raising concerns about potential misuse or lack of oversight.

- Restrictions on Bail for Multiple Charges: While the CrPC allows bail for an accused detained for half the maximum imprisonment for an offense, the BNSS2 denies this facility for individuals facing multiple charges.

- This restriction, prevalent in cases involving multiple sections, may limit bail opportunities.

- Handcuff Use and Contradictory Supreme Court Directives: The BNSS2 permits the use of handcuffs in various cases, including organized crime, which contradicts directives laid down by the Supreme Court.

- Integration of Trial Procedure and Public Order Maintenance: The BNSS2 retains CrPC provisions related to the maintenance of public order. This raises questions about whether trial procedures and the maintenance of public order should be regulated under the same law or addressed separately.

What are the Major Provisions of Bharatiya Sakshya (Second) Bill, 2023?

The Bharatiya Sakshya (Second) Bill, 2023 (BSB2) replaces the Indian Evidence Act, 1872 (IEA). It retains most provisions of the IEA including those on confessions, relevancy of facts, and burden of proof. However, it introduces significant alterations including:

- Documentary Evidence:

- Definition Expansion: The BSB2 broadens the definition of documents to include electronic records alongside traditional writings, maps, and caricatures.

- Primary and Secondary Evidence: Primary evidence retains its status, encompassing original documents, electronic records, and video recordings.

- Oral and written admissions, along with testimony from a qualified individual examining the documents, are now considered secondary evidence.

- Oral Evidence: The BSB2 permits electronic provision of oral evidence, enabling witnesses, accused individuals, and victims to testify through electronic means.

- Admissibility of Electronic Records: Electronic or digital records are granted equivalent legal status as paper records.

- This includes information stored in semiconductor memory, smartphones, laptops, emails, server logs, locational evidence, and voicemails.

- Amended Explanation to Joint Trials: Joint trials encompass cases where one accused is absent or has not responded to an arrest warrant, now categorized as joint trials.

Criticism of BSB2

- Admissibility of Information from Accused in Custody: The BSB2 allows such information to be admissible if it was obtained when the accused was in police custody, but not if he was outside. The Law Commission recommended removing this distinction.

- Unincorporated Law Commission Recommendations: Several recommendations by the Law Commission, such as presuming police responsibility for injuries sustained by an accused in police custody, have not been included in the BSB2, despite their significance.

- Tampering of Electronic Records: The Supreme Court has recognised that electronic records may be tampered with.

- While the BSB2 provides for the admissibility of such records, there are no safeguards to prevent the tampering and contamination of such records during the investigation process.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Mains:

Q. We are witnessing increasing instances of sexual violence against women in the country. Despite existing legal provisions against it, the number of such incidences is on the rise. Suggest some innovative measures to tackle this menace. (2014)

Q. Mob violence is emerging as a serious law and order problem in India. By giving suitable examples, analyze the causes and consequences of such violence. (2015)

Illegal Sand Mining

For Prelims: Sand mining, Mines and Mineral Development and Regulation Act, 1957, Mines and Minerals (Development and Regulation) Amendment Act, 2023, Enforcement and Monitoring Guidelines for Sand Mining 2020, Manufactured sand (M-sand)

For Mains: Environmental and Socio-economic Impacts of Marine Sand Extraction, Sand Mining in India.

Why in News?

Recently, Bihar police arrested sand smugglers in a major crackdown against illegal sand mining.

- This operation, near the Sone River, signifies a significant step in the ongoing battle against powerful criminal syndicates involved in illicit sand mining activities.

What is Sand Mining?

- About:

- Sand mining is defined as the removal of primary natural sand and sand resources (mineral sands and aggregates) from the natural environment (terrestrial, riverine, coastal, or marine) for extracting valuable minerals, metals, crushed stone, sand and gravel for subsequent processing.

- This activity, driven by various factors, poses serious threats to ecosystems and communities.

- Source of Sand in India:

- Sustainable Sand Mining Management Guidelines (SSMMG) 2016 suggest that the source of sand in India are through

- River (riverbed and flood plain),

- Lakes and reservoirs,

- Agricultural fields,

- Coastal / marine sand,

- Palaeo-channels,

- Manufactured Sand (M-Sand).

- Sustainable Sand Mining Management Guidelines (SSMMG) 2016 suggest that the source of sand in India are through

- Factors Contributing to Illegal Sand Mining:

- Lack of Regulation and Enforcement:

- Inadequate regulatory frameworks and weak enforcement mechanisms contribute to the proliferation of illegal sand mining.

- High Demand for Construction Materials:

- The construction industry's hefty demand for sand fuels is illegal extraction, intensifying pressure on riverbeds and coastal areas due to the rising need for sand in construction projects.

- Rapid population growth and urbanization drive the need for construction, escalating the demand for sand.

- Corruption and Mafia Influence:

- Corrupt practices and the influence of organized sand mafias contribute to the continuation of illegal mining.

- Collusion between authorities and illegal operators undermines efforts to control and regulate the sand mining industry.

- Corrupt practices and the influence of organized sand mafias contribute to the continuation of illegal mining.

- Lack of Sustainable Alternatives:

- Limited adoption of sustainable alternatives like manufactured sand (M-sand) contributes to overreliance on riverbed sand.

- Inadequate promotion of eco-friendly alternatives maintains the demand for natural sand, exacerbating environmental consequences.

- Weak Environmental Impact Assessment (EIA) Implementation:

- Ineffective implementation of EIAs for sand mining activities allows for unauthorized extraction.

- Insufficient public awareness and monitoring mechanisms contribute to illegal mining activities going unnoticed.

- Lack of Regulation and Enforcement:

- Consequences of Sand Mining:

- Erosion and Habitat Disruption:

- The Geological Survey of India (GSI) notes that unregulated sand mining alters riverbeds, leading to increased erosion, changes in channel morphology, and disruption of aquatic habitats.

- Sand Mining leads to loss of stability in stream channels, threatening the survival of native species adapted to pre-mining habitat conditions.

- Flooding and Increased Sedimentation:

- Depletion of sand from river beds contributes to increased flooding and sedimentation in rivers and coastal areas.

- Altered flow patterns and sediment loads negatively impact aquatic ecosystems, affecting both flora and fauna.

- Groundwater Depletion:

- Deep pits formed due to sand mining can cause a drop in the groundwater table.

- This in turn affects local drinking water wells, leading to water scarcity in surrounding areas.

- Deep pits formed due to sand mining can cause a drop in the groundwater table.

- Biodiversity Loss:

- Habitat disruption and degradation arising from activities such as sand mining lead to the significant loss of biodiversity, adversely affecting both aquatic and riparian species. The destructive impact extends even to mangrove forests.

- Erosion and Habitat Disruption:

What are the Initiatives to Prevent Sand Mining in India?

- Mines and Mineral Development and Regulation Act, 1957 (MMDR Act):

- Sand is classified as a “minor mineral”, under The Mines and Minerals (Development and Regulations) Act, 1957 (MMDR Act) and administrative control over minor minerals vests with the State Governments.

- Section 3(e) of the MMDR Act aims to prevent illegal mining, with the government implementing laws to curb illicit practices.

- The Mines and Minerals (Development and Regulation) Amendment Act, 2023 was recently passed by the Parliament to amend the MMDR Act, 1957.

- 2006 Environment Impact Assessment (EIA):

- The Supreme Court of India mandated that approval is required for all sand mining collection activities, even in areas less than 5 hectares.

- This decision aimed to address the severe impact of sand mining on the ecosystem, affecting plants, animals, and rivers.

- Sustainable Sand Management Guidelines (SSMG) 2016:

- Issued by the Ministry of Environment, Forests, and Climate Change (MoEFCC), the main objectives of these guidelines include environmentally sustainable and socially responsible mining, conservation of the river equilibrium and its natural environment by protection and restoration of the ecological system, avoiding pollution of river water, and prevention of depletion of groundwater reserves.

- Enforcement and Monitoring Guidelines for Sand Mining 2020:

- The guidelines provide a uniform protocol for monitoring sand mining across India.

- The guidelines cover the identification of sand mineral sources, their dispatch, and their end-use.

- The guidelines also consider the use of new surveillance technologies, such as drones and night vision, to monitor the sand mining process.

- The guidelines provide a uniform protocol for monitoring sand mining across India.

Sone River

- The Sone River, a perennial river in central India, is the Ganges' 2nd-largest southern tributary.

- Originating near Amarkantak Hill in Chhattisgarh, it flows through Chhattisgarh, Madhya Pradesh, Uttar Pradesh, and Bihar, forming waterfalls at the Amarkantak plateau.

- It merges with the Ganges near Patna, Bihar.

- Tributaries include Ghaghar, Johilla, Chhoti Mahanadi, Banas, Gopad, Rihand, Kanhar, and North Koel River.

- Prominent dams include the Bansagar Dam in Madhya Pradesh and the Rihand Dam near Pipri in Uttar Pradesh.

UPSC Civil Services Examination Previous Year Question (PYQ)

Mains

Q. Coastal sand mining, whether legal or illegal, poses one of the biggest threats to our environment. Analyse the impact of sand mining along the Indian coasts, citing specific examples. (2019)

Housing for PVTGs

For Prelims: Pradhan Mantri Awas Yojana-Gramin, Particularly Vulnerable Tribal Groups, Pradhan Mantri Janjati Adivasi Nyaya Maha Abhiyan, Janjatiya Gaurav Divas

For Mains: Sustainable Livelihoods For PVTGs, Welfare schemes for vulnerable sections of the population

Why in News?

The Centre has initiated a comprehensive survey and registration process to identify eligible beneficiaries of the Pradhan Mantri Awas Yojana-Gramin (PMAY-G) among 75 Particularly Vulnerable Tribal Groups (PVTGs) across 18 states and Union Territories.

- The Ministry of Rural Development utilizes the Aawas+ app, its dedicated online application, to identify beneficiaries for the rural housing scheme.

- A total of 4.9 lakh houses are planned to be built for PVTGs under the Pradhan Mantri Janjati Adivasi Nyaya Maha Abhiyan (PM JANMAN).

What is Pradhan Mantri Janjati Adivasi Nyaya Maha Abhiyan (PM JANMAN)?

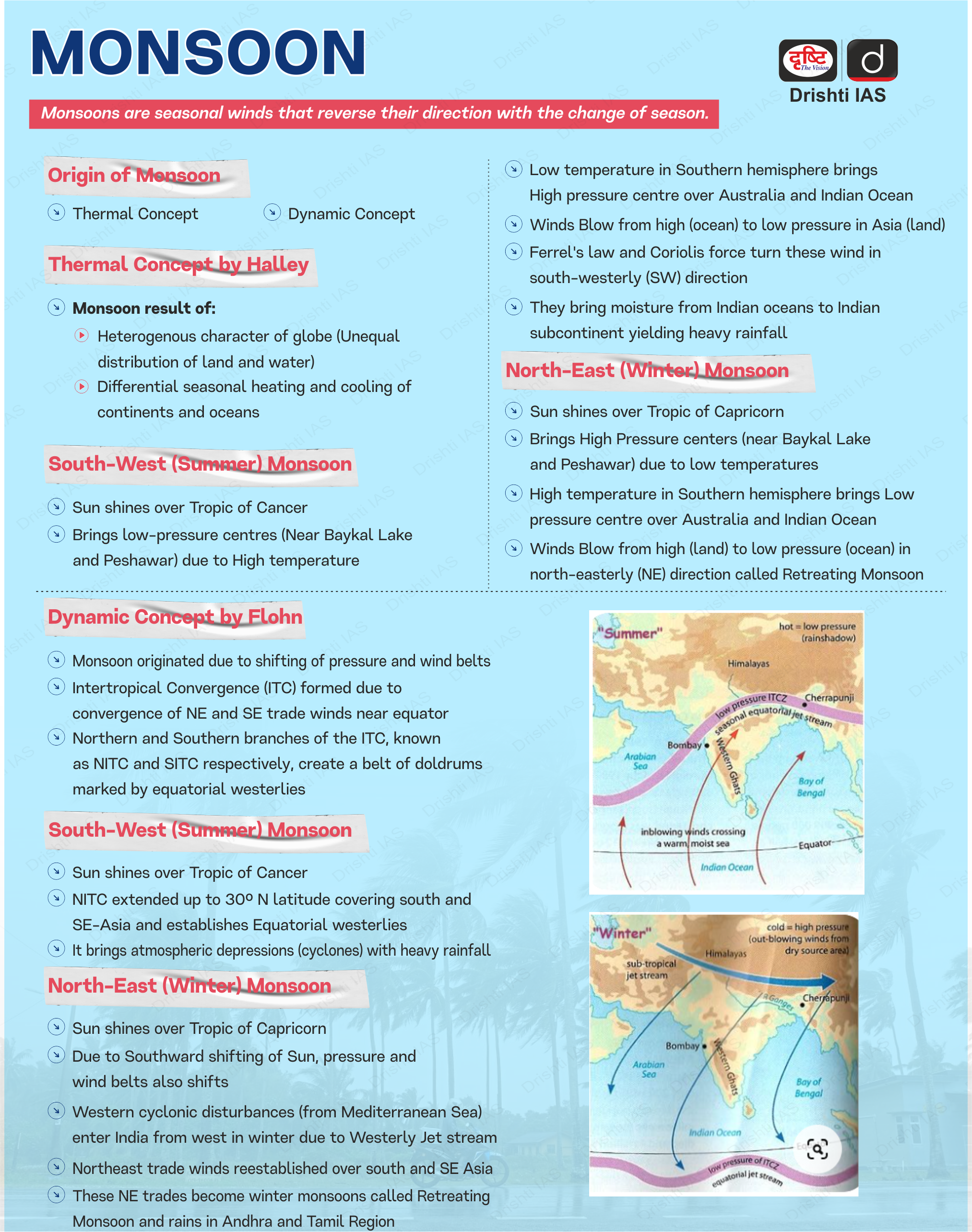

- PM JANMAN, led by the Ministry of Tribal Affairs, seeks to integrate tribal communities into the mainstream through a comprehensive scheme. In collaboration with states and PVTG communities, the initiative focuses on 11 key interventions across sectors, including housing, healthcare, education, and livelihood opportunities.

- The scheme will be overseen by 9 line Ministries, ensuring the implementation of existing schemes in villages inhabited by PVTGs.

- This initiative was announced by the Prime Minister on Janjatiya Gaurav Diwas 2023 (15th November).

What is Pradhan Mantri Awas Yojana- Gramin (PMAY-G)?

- About:

- It is a flagship program of the Central Government. It was launched on April 1, 2016, by the Ministry of Rural Development (MoRD).

- The scheme's goal is to provide affordable housing for the rural poor. This includes providing basic amenities and hygienic kitchens to those living in dilapidated and kutcha houses.

- The deadline for completion of 2.95 crore houses under PMAY-G is 31st March, 2024.

- Beneficiaries:

- People belonging to SCs/STs, PVTGs, freed bonded labourers and non-SC/ST categories, widows or next-of-kin of defence personnel killed in action, ex-servicemen and retired members of the paramilitary forces, disabled persons and minorities.

- Cost Sharing:

- The cost of unit assistance is shared between Central and State Governments in the ratio of 60:40 in plain areas and 90:10 for North Eastern and hilly states.

- Features:

- The unit cost for PMAY-G houses in PVTGs has been increased to Rs 2 lakh, compared to Rs 1.2 lakh in plain areas and Rs 1.30 lakh in hilly areas.

- PMAY-G beneficiaries can avail additional financial assistance of Rs 12,500 for toilet construction and 90 days of work under the National Rural Employment Guarantee Scheme(NREGS), taking the total benefit to Rs 2.39 lakh.

What are the PVTGs of India?

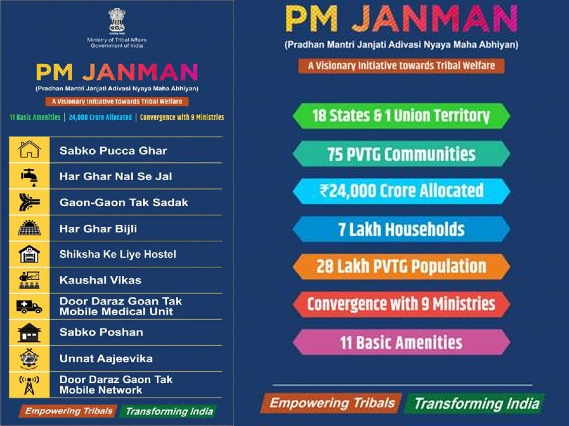

- Of the 75 PVTGs, the maximum 13 are in Odisha, followed by 12 in Andhra Pradesh

- Other Initiatives for PVTGs:

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q.1 Consider the following statements about Particularly Vulnerable Tribal Groups (PVTGs) in India: (2019)

- PVTGs reside in 18 States and one Union Territory.

- A stagnant or declining population is one of the criteria for determining PVTG status.

- There are 95 PVTGs officially notified in the country so far.

- Irular and Konda Reddi tribes are included in the list of PVTGs.

Which of the statements given above are correct?

(a) 1, 2 and 3

(b) 2, 3 and 4

(c) 1, 2 and 4

(d) 1, 3 and 4

Ans: C

Mains

Q. What are the two major legal initiatives by the State since Independence addressing discrimination against Scheduled Tribes (STs)? (2017)

Q. Why are the tribals in India referred to as ‘the Scheduled Tribes’? Indicate the major provisions enshrined in the Constitution of India for their upliftment. (2016)

FAME India Phase-II Scheme

For Prelims: Parliamentary Committee, FAME India Scheme Phase-II, Electric Mobility, National Electric Mobility Mission Plan, Vehicle Scrappage Policy.

For Mains: Government policies, EVs: Advantages, Challenges

Why in News?

The Parliamentary Standing Committee on Industry has recently put forth crucial recommendations regarding the extension and enhancement of the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India) Scheme Phase-II.

- The committee suggests extending the FAME India Phase-II Scheme's deadline by at least three more years to facilitate the transition momentum to electric mobility.

- The current deadline is March 31, 2024, with a budget allocation of Rs 10,000 crore.

What are the Committee Recommendations for Improvement?

- Restoration of Subsidy on Electric Two-Wheelers:

- The committee suggests restoring the subsidy on electric two-wheelers, which was reduced in June 2023.

- Government reduced the FAME-II subsidy for electric two-wheelers after June 1, 2023.

- The initial 40% incentive on ex-factory price was cut to 15%. Reduction in subsidies negatively impacted electric two-wheeler sales. Budget constraints cited as a reason for subsidy reallocation.

- Government reduced the FAME-II subsidy for electric two-wheelers after June 1, 2023.

- It also recommends projecting enhanced budget allocations, if required, to maintain the momentum and pace of electric vehicle penetration.

- The committee suggests restoring the subsidy on electric two-wheelers, which was reduced in June 2023.

- Inclusion of Private Electric Four-Wheelers:

- The ministry should increase the number of electric vehicles supported in the four-wheelers category and include private electric four-wheelers in the FAME-II Scheme, with a cap based on the cost and battery capacity of the vehicle.

- Supportive Government Frameworks:

- The committee emphasizes the need for supportive, transparent, and consistent government frameworks at national, state, and local levels to make India a global EV hub.

- It also recommends focusing on establishing dedicated manufacturing hubs and industrial parks for batteries, cells, and EV auto components.

- The committee emphasizes the need for supportive, transparent, and consistent government frameworks at national, state, and local levels to make India a global EV hub.

- Funding for BHEL and Charging Stations:

- More funds should be allocated to Bharat Heavy Electricals Limited (BHEL) to facilitate popularizing EV mobility.

- BHEL provided Engineering, Procurement, and Construction (EPC) solutions for EV charging stations. These include solar-based charging stations and battery energy storage systems.

- Additionally, public sector undertakings and government institutions should participate in installing charging stations on their premises.

- More funds should be allocated to Bharat Heavy Electricals Limited (BHEL) to facilitate popularizing EV mobility.

- Incentivizing Charging Station Installation:

- FAME-II should incentivise individual investors in charging stations. Women's self-help groups and cooperative societies should be assisted in opening and operating charging stations, with assured returns provided by the government from its funds.

What is the FAME India Scheme?

- Background:

- FAME India is a part of the National Electric Mobility Mission Plan.

- The scheme's main objective is to encourage the adoption of electric and hybrid vehicles by offering upfront incentives on purchase.

- The scheme covers Hybrid and electric technologies like Mild Hybrid, Strong Hybrid, Plug-in Hybrid and battery Electric Vehicles.

- Phase I:

- Started in 2015 and was completed on 31st March 2019, with an outlay of Rs 895 crore.

- The 1st phase of FAME The scheme had four focus areas namely, technology development, demand creation, pilot project, and charging infrastructure.

- Achievements:

- In the 1st phase of the scheme, about 2.78 lakh xEVs were supported with total demand incentives. In addition, 465 buses were sanctioned to various cities/states under this scheme.

- FAME India Phase-II:

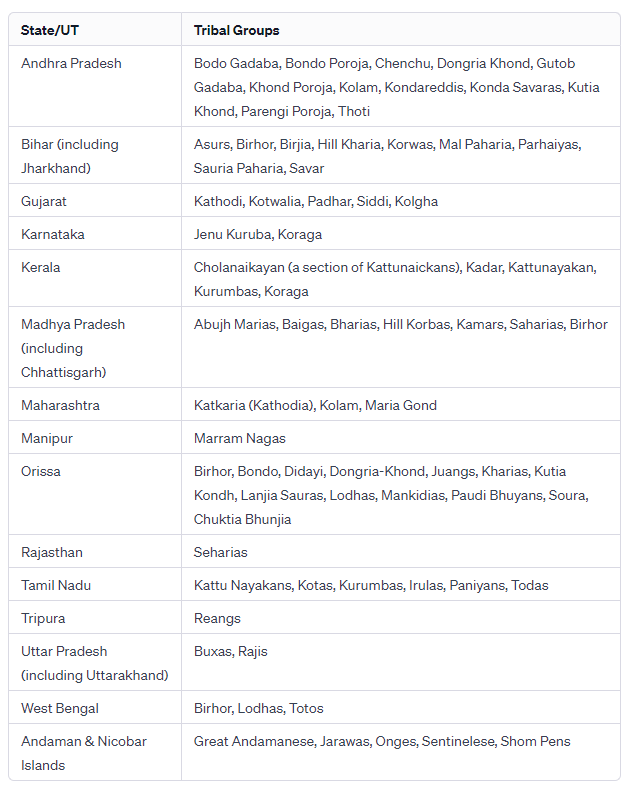

- The Ministry of Heavy Industries is implementing the scheme for five years, starting April 1, 2019, with a total budget of Rs. 10,000 crore.

- This phase mainly focuses on supporting the electrification of public & shared transportation and aims to support through demand incentive eBuses, e-3 Wheelers, e-4 Wheeler Passenger Cars and e-2 Wheelers.

- In addition, the creation of charging infrastructure is also supported under the Scheme.

- Achievements:

What are the Other Government Initiatives to Promote EV Adoption?

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains

Q. How is efficient and affordable urban mass transport key to the rapid economic development in India? (2019)

Tribunals

For Prelims: Tribunals, Supreme Court, High Court, Armed Forces Tribunal (AFT), Judge Advocate General, Article 226 of the Constitution.

For Mains: Tribunals, Statutory, regulatory, and various quasi-judicial bodies.

Why in News?

Recently, the Supreme Court (SC) in case Union of India (UoI) & Ors. v. AIR Commodore NK Sharma (2023), has clarified that Tribunals functioning under the strict parameters of their governing legislations cannot direct the government to make policy.

- The SC was dealing with a question on whether the Armed Forces Tribunal (AFT) could have directed the government to make a policy to fill up the post of the Judge Advocate General (Air).

What is the SC’s Ruling in UoI & Ors. v. AIR Commodore NK Sharma Case?

- Tribunals, including the Armed Forces Tribunal (AFT), do not have the authority to direct the government to formulate specific policies.

- The role of making policy is not within the domain of the judiciary, including quasi-judicial bodies like the AFT.

- Even though the AFT is vested with powers akin to a civil court, it lacks the authority of the Supreme Court or the High Courts. Additionally, the High Courts, exercising powers under Article 226 of the Constitution, cannot direct the government or its departments to create particular policies.

- Article 226 provides the High Courts the authority to bring a lawsuit against a government entity if any citizen’s rights and freedoms are violated. The High Court has broad powers to issue orders and writs to any person or authority under Article 226 of the Indian Constitution.

- The formulation or sanctioning of policies regarding the service of defense personnel or their regularization falls solely within the government's prerogative.

- A tribunal functioning within the confines of its governing legislation lacks the power to mandate the creation of a policy.

What is a Tribunal?

- About:

- Tribunal is a quasi-judicial institution that is set up to deal with problems such as resolving administrative or tax-related disputes. It performs a number of functions like adjudicating disputes, determining rights between contesting parties, making an administrative decision, reviewing an existing administrative decision and so forth.

- Constitutional Provisions:

- Tribunals were not part of the original constitution, it was incorporated in the Indian Constitution by 42nd Amendment Act, 1976.

- Article 323-A deals with Administrative Tribunals.

- Article 323-B deals with tribunals for other matters.

- Under Article 323 B, the Parliament and the state legislatures are authorized to provide for the establishment of tribunals for the adjudication of disputes relating to the following matters:

- Taxation

- Foreign exchange, import and export

- Industrial and labour

- Land reforms

- Ceiling on urban property

- Elections to Parliament and state legislatures

- Food stuff

- Rent and tenancy rights

- Articles 323 A and 323 B differ in the following three aspects:

- While Article 323 A contemplates the establishment of tribunals for public service matters only, Article 323 B contemplates the establishment of tribunals for certain other matters (mentioned above).

- While tribunals under Article 323 A can be established only by Parliament, tribunals under Article 323 B can be established both by Parliament and state legislatures with respect to matters falling within their legislative competence.

- Under Article 323 A, only one tribunal for the Centre and one for each state or two or more states may be established. There is no question of the hierarchy of tribunals, whereas under Article 323 B a hierarchy of tribunals may be created.

- Article 262: The Indian Constitution provides a role for the Central government in adjudicating conflicts surrounding inter-state rivers that arise among the state/regional governments.

- Tribunals were not part of the original constitution, it was incorporated in the Indian Constitution by 42nd Amendment Act, 1976.

What are the Different Tribunals in India?

- Administrative Tribunals:

- Administrative tribunals, instituted under the Administrative Tribunals Act, 1985, stem from Article 323 A of the Constitution. They serve as specialized quasi-judicial bodies tasked with adjudicating disputes and grievances concerning recruitment and terms of service for individuals in public posts under Union and State governance.

- These tribunals include the Central Administrative Tribunal (CAT), state-specific tribunals upon request, and joint tribunals for multiple states.

- Water Disputes Tribunal:

- The Parliament has enacted Inter-State River Water Disputes (ISRWD) Act, 1956 have formed various Water Disputes Tribunal for adjudication of disputes relating to waters of inter-State rivers and river valleys thereof.

- Standalone Tribunal: The Inter-State River Water Disputes (Amendment) Bill, 2019 is passed by Parliament for amending the existing ISRWD Act, 1956 to constitute a standalone Tribunal to remove with the need to set up a separate Tribunal for each water dispute which is invariably a time-consuming process.

- The Parliament has enacted Inter-State River Water Disputes (ISRWD) Act, 1956 have formed various Water Disputes Tribunal for adjudication of disputes relating to waters of inter-State rivers and river valleys thereof.

- Armed Forces Tribunal (AFT):

- It is a military tribunal in India. It was established under the Armed Forces Tribunal Act, 2007.

- It has provided the power for the adjudication or trial by AFT of disputes and complaints with respect to commission, appointments, enrolments and conditions of service in respect of persons subject to the Army Act, 1950, The Navy Act, 1957 and the Air Force Act, 1950.

- The Judicial Members are retired High Court Judges and Administrative Members are retired Members of the Armed Forces who have held the rank of Major General/ equivalent or above for a period of three years or more, Judge Advocate General (JAG), who have held the appointment for at least one year are also entitled to be appointed as the Administrative Member.

- National Green Tribunal (NGT):

- The National Green Tribunal (NGT), established by the National Green Tribunal Act 2010, is a body dedicated to swiftly resolving environmental disputes.

- Comprising judges and environmental specialists, it expedites cases involving nature conservation and damage compensation.

- Income Tax Appellate Tribunal:

- Section 252 of the Income Tax Act, 1961 provides that the Central Government shall constitute an Appellate Tribunal consisting of many Judicial Members and Accountant members as it thinks fit to exercise the powers and functions conferred on the Tribunal by the Act.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. The National Green Tribunal Act, 2010 was enacted in consonance with which of the following provisions of the Constitution of India? (2012)

- Right to healthy environment, construed as a part of Right to life under Article 21

- Provision of grants for raising the level of administration in the Scheduled Areas for the welfare of Scheduled Tribes under Article 275(1)

- Powers and functions of Gram Sabha as mentioned under Article 243(A)

Select the correct answer using the codes given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (a)

India Skills Report 2024

For Prelims: India Skills Report 2024, All India Council for Technical Education (AICTE), Confederation of Indian Industry and Association of Indian Universities, AI (Artificial Intelligence).

For Mains: India Skills Report 2024.

Why in News?

Recently, Wheebox in association with various agencies including All India Council for Technical Education (AICTE), Confederation of Indian Industry and Association of Indian Universities has published India Skills Report 2024, highlighting India’s skill landscape and the impact of AI (Artificial Intelligence) on the workforce

- Theme: Impact of AI on the Future of Work, Skilling & Mobility.

- The findings in this report are a result of the evaluation of 3.88 Lakhs candidates who took the Wheebox National Employability Test (WNET) across academic institutions in India.

Note

Wheebox is one of the leading firms in remote proctored assessments and consulting services, Headquartered in India and spread across GCC (Gulf Cooperation Council) Countries, Wheebox delivers millions of assessments for corporations, institutions and governments across the globe.

What are the Key Highlights of the India Skills Report 2024?

- AI Leadership and Talent Concentration:

- India holds a prominent global position in AI skill penetration and talent concentration, showcasing a strong base of AI professionals.

- As of August 2023, there were 4.16 lakh AI professionals, poised to meet the increasing demand expected to reach 1 million by 2026.

- India has a 60%-73% demand-supply gap in key roles such as ML engineer, data scientist, DevOps engineer, and data architect.

- Employability Trends:

- The overall young employability in India has shown improvement, reaching 51.25%. States like Haryana, Maharashtra, Andhra Pradesh, Uttar Pradesh,

- Kerala, and Telangana demonstrate a high concentration of highly employable youth.

- Haryana has the highest employable youth concentration with 76.47% of test takers in this region scoring 60% and above on the WNET.

- Age-Specific Employability:

- Different age groups display varying levels of employability. For instance, in the 22 to 25 years age range, states like Uttar Pradesh and Maharashtra stand out with high talent concentrations.

- Telangana has the highest concentration of employable talent in the age group of 18-21 with 85.45% found employable followed by Kerala 74.93% employable resources in this age group.

- Gujarat has the highest availability of employable resources in the age group of 26-29 with 78.24% in this age group found employable.

- CIties with Employable Talent:

- Among top cities with employable talent in the age group of 18-21, Pune came first with 80.82% of candidates found highly employable, followed by Bengaluru, and then Trivandrum.

- For employability in the age group of 22-25 among top cities, Lucknow comes first at 88.89%, followed by Mumbai and then Bengaluru.

- Most Preferred State to Work:

- Kerala is the most preferred state to work for both male and female employable talent, with Cochin being the most preferred area to work for female test takers.

- AI Integration in Learning:

- The integration of AI into learning science is seen as a key differentiator, enabling personalized, analytics-driven, and actionable insights. This integration is deemed essential for effective professional development.

- Industry Readiness:

- Companies are anticipated to invest more in upskilling initiatives, with a focus on early careers programs. The report foresees a significant portion of hiring being directed toward early career segments.

- Collaborative Efforts:

- The report emphasizes the need for collaborative efforts among government bodies, businesses, and educational institutions to address challenges and focus on inclusive upskilling initiatives to navigate the transformative journey catalyzed by AI.

What are India's Initiatives Related to Artificial Intelligence?

- INDIAai.

- Global Partnership on Artificial Intelligence (GPAI).

- US India Artificial Intelligence Initiative.

- Responsible Artificial Intelligence (AI) for Youth.

- Artificial Intelligence Research, Analytics and Knowledge Assimilation Platform.

What are the Government Initiatives Related to Skill Development?

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. With the present state of development, Artificial Intelligence can effectively do which of the following? (2020)

- Bring down electricity consumption in industrial units

- Create meaningful short stories and songs

- Disease diagnosis

- Text-to-Speech Conversion

- Wireless transmission of electrical energy

Select the correct answer using the code given below:

(a) 1, 2, 3 and 5 only

(b) 1, 3 and 4 only

(c) 2, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (b)

Mains

Q. What are the main socio-economic implications arising out of the development of IT industries in major cities of India? (2022)

Q. “The emergence of the Fourth Industrial Revolution (Digital Revolution) has initiated e-Governance as an integral part of government”. Discuss. (2020)

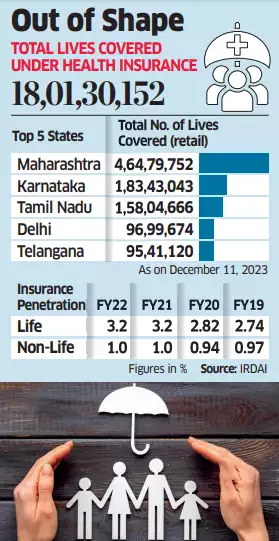

Regulator to Oversee Health Insurance

For Prelims: Regulator to Oversee Health Insurance, IRDAI Vision 2047, Health Insurance, Out of Pocket expenditure (OOPE).

For Mains: Regulator to Oversee Health Insurance.

Why in News?

The government is exploring setting up a health sector regulator that will bring private and government health insurance schemes under its purview to facilitate affordable insurance coverage for all.

What is the Need for Setting up a Health Sector Regulator?

- Lower Penetration:

- Under the IRDAI Vision 2047, the government aims to provide ‘Insurance for All by 2047’, which means that every citizen has appropriate life, health, and property insurance coverage and every enterprise is supported by appropriate insurance solutions.

- According to a report by the National Insurance Agency, over 400 million individuals, or about a third of the population, lack Health Insurance due to lower penetration, coverage inadequacy and rising healthcare costs.

- Unified Oversight:

- Bringing both private and government health insurance schemes under one regulator ensures standardized oversight.

- It streamlines regulations, policies, and procedures, creating a cohesive framework for the entire health insurance sector.

- Ensuring Fair Practices:

- A regulator helps ensure fair practices across the board. It can monitor premiums, claim settlements, and coverage criteria, preventing malpractices and ensuring that both private and government insurers operate transparently.

- Enhanced Accessibility:

- With a regulator in place, there's an opportunity to improve the accessibility of healthcare.

- Penetration of private insurance is increasing at a fast rate and along with government-run insurance, India aims to be covering 70% of the population soon.

- Affordability and Sustainability:

- By overseeing insurance schemes, the regulator can work toward maintaining the affordability of health insurance.

- It can help control costs, establish fair pricing structures, and prevent undue premium hikes, making insurance more sustainable in the long run.

- Quality Control:

- The regulator can set and enforce standards for healthcare services covered by insurance. This includes ensuring that empaneled hospitals meet certain quality benchmarks, fostering a higher quality of care for insured individuals.

What is Health Insurance?

- About Healthcare:

- Health insurance is a type of coverage that pays for medical expenses incurred by the insured individual.

- It works by providing financial protection to cover various healthcare costs, including hospitalization, doctor visits, surgeries, medications, and preventive care.

- Significance of Health Insurance:

- It is a mechanism of pooling the high level of Out of Pocket expenditure (OOPE) in India to provide greater financial protection against health shocks.

- Pre-payment through health insurance emerges as an important tool for risk-pooling and safeguarding against catastrophic (and often impoverishing) expenditure from health shocks.

- Moreover, pre-paid pooled funds can also improve the efficiency of healthcare provision.

- Issues related to Health Insurance:

- Life Status is unevenly Distributed: There has been a significant increase in life expectancy of people from 35 years to 65 years since Independence. But the status of life is unevenly distributed in different parts of the country. The health problems in India are still a cause of great concern.

- Low Government Expenditure: Low Government expenditure on health has constrained the capacity and quality of healthcare services in the public sector.

- It diverts the majority of individuals – about two-thirds – to seek treatment in the costlier private sector.

- Significant Population is missed: At least 30% of the population, or 40 crore individuals are devoid of any financial protection for health.

- Related Government Schemes:

- Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana (AB-PMJAY): It offers a sum insured of Rs. 5 lakh per family for secondary care (which doesn’t involve a super specialist) as well as tertiary care (which involves a super specialist).

- In 2019, the government had reconstituted the National Health Agency (NHA) as the National Health Authority (NHA), responsible for implementing Ayushman Bharat.

- The NHA has developed a national Health Claims Exchange (HCX) to enable the interoperability of health claims.

- Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana (AB-PMJAY): It offers a sum insured of Rs. 5 lakh per family for secondary care (which doesn’t involve a super specialist) as well as tertiary care (which involves a super specialist).

Note

The Insurance Regulatory and Development Authority of India (IRDAI) regulates insurers that provide health cover among other products.

Nematocyst a Cellular Weapon

Evolution has equipped certain aquatic animals with a potent defence mechanism known as the nematocyst.

- Nematocysts are specialized cells found in Cnidarians which include jellyfish, corals, sea anemones, and hydras that serve as potent weapons for hunting prey and defending against predators.

- Each nematocyst contains a capsule with a coiled, thread-like tubule and toxins capable of rapid ejection with an acceleration surpassing that of a bullet.

- Cnidarians contain cnidocytes which release nematocysts when triggered by potential prey. Nematocysts pierce prey's outer layer or inject toxins into its body.

- Toxins in nematocysts have paralytic (paralysis) or cytolytic(destroying cells) effects on the prey.

- Cnidarians use a combination of toxins for predatory or defensive purposes.

UNESCO’s 2023 Prix Versailles

Bengaluru's Kempegowda International Airport's Terminal 2 (T2) has recently garnered two prestigious recognitions at UNESCO's 2023 Prix Versailles.

- It has been marked as one of the 'World's most beautiful airports' and secured the coveted 'World special prize for an interior 2023.'

- Annually announced by UNESCO since 2015, the Prix Versailles awards honor exceptional accomplishments in global architecture and design.

- This prestigious recognition emphasizes the significance of thoughtful sustainability as a cultural catalyst, recognizing innovation, creativity, reflections of local heritage, ecological efficiency, and the promotion of social interaction.

Tax Relief Strategies for Sugar

The Union government is planning to revive tax remission benefits on sugar exports, which were placed in the ‘restricted’ category in mid-2022.

- The Remission of Duties and Taxes on Export Products (RoDTEP) scheme, which was launched in January 2021, aims to provide a mechanism for reimbursement of taxes, duties and levies that are incurred by the export entities in the process of manufacture and distribution of exported products.

- The RoDTEP Scheme is a Department of Commerce scheme (Ministry of Commerce & Industry), and it is being implemented by the Department of Revenue(Ministry of Finance).

- However, under this scheme, sugar exporters faced a tax query from the customs authorities, as it is a restricted commodity and is not eligible for export benefits.

- Industry challenges arose as sugar, previously under free export, sought RoDTEP benefits.

Read more: Scheme for Remission of Duties and Taxes on Exported Products

RBI’s State of the Economy Bulletin

The Reserve Bank of India (RBI) recently released its 'State of the Economy' Bulletin, providing crucial insights into the economic landscape.

- RBI anticipates a potential global reduction in interest rates in 2024, influenced by disinflation trends worldwide.

- Despite global headwinds, the Indian economy maintained its position as the fastest-growing major economy in 2023.

- RBI's Economic Activity Index (EAI) projects Gross Domestic Product (GDP) growth of 6.7% for Q3 2023-24.

- EAI is a “nowcast” that uses 27 high-frequency indicators to gauge growth and output. It tracks GDP dynamics.

- Consumer Price Index (CPI) inflation rose to 5.6% in November 2023, driven by food price spikes.

Read more: Reserve Bank of India (RBI)