Governance

Mitigating and Aggravating Circumstances in Death Penalty

For Prelims: CBI, Bachan Singh vs. State of Punjab Case, 1980, Supreme Court, Law Commission, Bharatiya Nyay Sanhita, 2023, Bhartiya Nagrik Suraksha Sanhita, 2023, UAPA, 1967, NDPS Act, 1985.

For Mains: Mitigating and aggravating circumstances in death penalty, Evolution of death penalty in India, Role of judiciary and law commission on death penalty.

Why in News?

A Kolkata court sentenced a convict to life imprisonment for the rape and murder of a doctor at RG Kar Medical College and Hospital, despite the CBI's strong argument for the death penalty.

- In Bachan Singh vs. State of Punjab Case, 1980, the Supreme Court (SC) upheld the death penalty as constitutional but should be awarded in the "rarest of rare" cases after considering both aggravating and mitigating circumstances.

What are Aggravating and Mitigating Circumstances?

- About: Aggravating (increasing) and mitigating (reducing) circumstances are factors courts consider when deciding the severity of a sentence, especially in the death penalty.

- Aggravating circumstances could tilt the court towards the death penalty, while mitigating circumstances could lead it away from the death penalty.

- Guiding Factors: The SC did not provide specific aggravating and mitigating circumstances for determining when the death penalty should be applied but provided a non-exhaustive list of guiding factors.

- Aggravating Circumstances:

- If the murder is pre-planned, calculated, and involves extreme brutality.

- If the murder involves “exceptional depravity”

- If the accused is found guilty of murdering a public servant, police officer, or armed forces member while on duty or for performing their lawful duties.

- Mitigating Circumstances:

- Whether the accused was experiencing extreme mental or emotional disturbance at the time of the offence.

- Age of the accused; they would not be given death if they are very young or very old.

- Probability of the accused posing a continued threat to society.

- Probability of reforming the accused.

- If the accused was acting on the directions of another person.

- If the accused believed their actions were morally justified.

- If the accused suffers mentally and is unable to appreciate the criminality of their actions.

- Aggravating Circumstances:

How Aggravating and Mitigating Circumstances Evolved After the Bachan Singh Case?

- Age of the Accused: In cases like Ramnaresh vs. State of Chhattisgarh Case, 2012 and Ramesh vs. State of Rajasthan Case, 2011, SC considered the accused's age (below 30) a strong mitigating factor, believing in their potential for reform.

- In Shankar Kisanrao Khade vs. State of Maharashtra Case, 2013, the SC highlighted the subjective nature of sentencing by distinguishing cases where age was a mitigating factor.

- The 262nd Law Commission Report 2015 noted that age as a mitigating factor has been used very inconsistently.

- In Shankar Kisanrao Khade vs. State of Maharashtra Case, 2013, the SC highlighted the subjective nature of sentencing by distinguishing cases where age was a mitigating factor.

- Nature of the Offence: In Machhi Singh vs. State of Punjab Case, 1983, the SC held that death could be given in cases where the “collective conscience” of society is so shocked that the judiciary is expected to impose the death penalty.

- It marked a shift toward emphasizing the nature of the crime over the circumstances of the criminal and the possibility of reform.

- Possibility of Reform: In Santosh Bariyar vs State of Maharashtra Case, 2009, the SC stated that the court must provide clear evidence explaining why the convict is unfit for reform or rehabilitation.

- The 262nd Law Commission Report 2015 called the evidence requirement in Bariyar "essential" for objectivity in sentencing.

- Stage of the Trial: In Bachan Singh, the SC ruled that courts must hold a separate trial after conviction to allow a “real, effective and meaningful hearing” on why the death sentence should not be imposed.

- In Dattaraya vs. State of Maharashtra Case, 2020, the court ruled that the lack of a proper hearing was a valid reason to commute the death sentence to life imprisonment.

What is the Death Penalty?

- About: The death penalty, also referred to as capital punishment, is the most severe form of punishment in the Indian judicial system as it cannot be reversed after execution like other kinds of punishment.

- It involves the state's execution of an individual as a penalty for serious offenses.

- Legal Framework: The death penalty in India is governed by provisions in the Bharatiya Nyay Sanhita, 2023, Bhartiya Nagrik Suraksha Sanhita, 2023, and other special laws

- The BNS prescribes the death penalty for crimes such as rape causing death (Section 66), gang rape of minors (Section 70(2)), serial rape (Section 71), and others.

- Offenses punishable by death include murder (Section 302), terrorism (UAPA, 1967), and certain drug trafficking offenses under the NDPS Act, 1985.

What are SC Rulings on the Death Penalty?

- Jagmohan Singh Case, 1972: The SC upheld the constitutionality of capital punishment, ruling that it could be imposed if due process was followed and constitutional provisions were not violated.

- Shatrughan Chauhan Case, 2014: The SC ruled that prolonged delays in execution of the death penalty could be a valid ground for commuting the sentence to life imprisonment.

- Manoj vs State of Maharashtra Case, 2022: The SC mandated a thorough investigation into the convict's mitigating circumstances and emphasized a balanced approach to sentencing, considering both aggravating and mitigating factors.

- Suo Motu Writ on Death Penalty, 2022: In a suo motu writ, the SC referred the issue of granting the convict a "meaningful opportunity" to argue against the death sentence to a larger five-judge bench for a fair hearing.

What is the Law Commission Stand on Death Penalty?

- 35th Report, 1967: In 1967, the Law Commission’s 35th Report strongly supported the death penalty.

- 187th Report, 2003: In 2003, the Law Commission’s 187th Report acknowledged the procedural flaws in sentencing though it did not advocate abolition.

- 262nd Report, 2015: In 2015, the Law Commission’s 262nd Report called for doing away with the death penalty for all crimes except terrorism and related offences.

Status of the Death Penalty Around the World

- As of 2022, 55 countries had the death penalty, with 9 reserving it for the most serious crimes like multiple killings or war crimes.

- The United States and Japan are the only advanced industrial democracies that still practice capital punishment.

- As of 2022, 112 countries have completely abolished the death penalty, up from 48 in 1991.

- In 2022, Kazakhstan, Papua New Guinea, Sierra Leone, and the Central African Republic abolished the death penalty, while Equatorial Guinea and Zambia limited it to the most serious crimes.

- The five countries responsible for 91% of these executions were China, Iran, Pakistan, Sudan, and the United States.

Conclusion

The Supreme Court’s rulings on the death penalty have evolved to incorporate both the severity of crimes and the possibility of reform, with significant focus on fairness in sentencing. The Court has emphasized a balanced approach, considering both aggravating and mitigating factors, and has advocated for procedural safeguards to prevent arbitrary applications.

|

Drishti Mains Question: Analyze the evolution of the Supreme Court’s stance on the death penalty in India. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Mains

Q. Instances of the President's delay in commuting death sentences has come under public debate as denial of justice. Should there be a time limit specified for the President to accept/reject such petitions? Analyse. (2014)

Indian Society

Decline in India’s Total Fertility Rate

For Prelims: Total Fertility Rate, Internal migration, National Family Health Survey, Dependency ratio, Middle-income trap, In vitro fertilization, Surrogacy, Saksham Anganwadi and Poshan 2.0, Replacement Level

For Mains: Demographic Transition and Population Growth in India, Impacts of Declining Fertility Rates, Government Policies for Population Control and Reproductive Health, Aging Population and Economic Sustainability

Why in News?

The Global Burden of Diseases, Injuries, and Risk Factors Study (GBD) 2021 has revealed a steep decline in India’s Total Fertility Rate (TFR) over the decades.

- This raises concerns about socio-economic and political repercussions, particularly in southern states.

What are the Key Findings of the Study?

- India’s Fertility Trends: India’s TFR dropped from 6.18 in the 1950s to 1.9 in 2021, below the replacement level of 2.1.

- By 2100, the TFR in India is projected to fall further to 1.04 (barely one child per woman).

- Regional Variations in India: Southern states like Kerala, Tamil Nadu, and Karnataka achieved replacement-level fertility earlier than northern states.

- By 2036, Kerala’s aged population is expected to surpass children (23%). High labor wages, quality of life, and internal migration are expected to bring migrant labor to 60 lakh by 2030 (about one-sixth of the State’s population).

- The demographic shift was driven by high literacy, women’s empowerment, and advances in social and health sectors.

- Reasons for Fertility Decline:

- Socio-Economic and Cultural Factors: India has one of the oldest birth control/family planning programs, but factors like female literacy, workforce participation, and women’s empowerment have had a greater influence on fertility decline.

- Changing attitudes toward marriage and reproduction, including delays or avoidance of marriage and motherhood, played a significant role.

- Health and Migration Issues: Increasing cases of infertility in both men and women contribute to the decline.

- The availability and social acceptance of abortions have likely contributed to the falling fertility rates.

- More young people are moving abroad for education and jobs, settling there, which reduces fertility rates in India.

- Socio-Economic and Cultural Factors: India has one of the oldest birth control/family planning programs, but factors like female literacy, workforce participation, and women’s empowerment have had a greater influence on fertility decline.

Total Fertility Rate and Replacement Level

- Total Fertility Rate (TFR): The TFR is the average number of children a group of women would have by the end of their reproductive years (ages 15 to 49) if they followed the current fertility rates throughout their lives, assuming no mortality. It is expressed as children per woman.

- As per the National Family Health Survey (NFHS-5) (2019-21), the TFR has declined to 2.0 children per woman from 2.2 children per woman (NFHS- 4 (2015-16).

- Replacement Level: A TFR of 2.1 is considered the replacement level, where each generation replaces itself without significant population growth or decline.

- A TFR lower than 2.1, however, can lead to negative population growth, potentially causing long-term demographic challenges, including an ageing population

What are the Consequences of Low Fertility Rates?

- Aging Populations: With fewer births and longer life expectancy, the population is aging rapidly.

- India currently has 149 million people aged 60 years or above, comprising 10.5% of the total population. By 2050, this number is expected to surge to 347 million, or 20.8% of the population.

- Economic Impact: A shrinking young workforce and a growing elderly population lead to higher dependency ratios and strain social welfare and healthcare systems.

- The rising costs of pensions and elder care will burden both governments and families.

- Unlike developed nations that experienced population ageing with higher per capita incomes, India faces the challenge of ageing without the same economic luxury.

- India risks getting caught in the middle-income trap if its economy cannot sustain rapid growth.

- Impact on Labour Market: The decline in fertility could reduce the size of the workforce, negatively impacting productivity.

Global Approaches in Tackling Declining Fertility Levels

- Germany: Liberal labor laws, parental leave, and benefits have seen success in increasing birth rates.

- Denmark: Offers state-funded in vitro fertilization (IVF) treatments for women below 40 years of age.

- Russia and Poland: Russia provides one-time financial incentives for families with more children, and Poland offers cash payments for families with multiple children.

Way Forward

- Policy Adjustments: India can emulate Germany and Denmark by adopting flexible labor policies, and parental benefits to improve work-life balance, and contribute to increasing fertility rates by supporting working parents.

- Raising a child costs Rs. 30 lakhs to Rs. 1.2 crores, deterring many middle-class families. To address this, make education affordable, upgrade public institutions with digital and practical learning to avoid skill mismatch, offer subsidies, and tax benefits.

- Policymakers must ensure economic growth while supporting an ageing population, or the demographic dividend could turn into a disaster.

- Focus on Health and Nutrition: Addressing nutritional needs and healthcare for mothers and children through the Saksham Anganwadi and Poshan 2.0 schemes, along with promoting childcare institutions for well-being, and prenatal trauma support, is crucial.

- Expanding initiatives like Telangana's distribution of pregnancy kits to support maternal health can aid in improving fertility rates across India.

- Reproductive Support: Provide affordable IVF and promote Surrogacy to increase child ratios without impacting career advancements.

|

Drishti Mains Question: Analyze the impact of declining fertility rates on India’s socio-economic structure. What policy measures can be implemented to reverse this trend? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q1. ‘’Empowering women is the key to control the population growth.’’ Discuss. (2019)

Q2. Critically examine the effect of globalization on the aged population in India. (2013)

Q3. Discuss the main objectives of Population Education and point out the measures to achieve them in India in detail. (2021)

Governance

Delays in MGNREGA Wages

For Prelims: Aadhaar Payment Bridge System (APBS), Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) scheme, National Electronic Fund Management System (NEFMS),

For Mains: Issue of Delayed Payment under MGNREGA Scheme, Challenges Related to MGNREGA Scheme, Way Forward and Solutions to Strengthen MGNREGA Scheme.

Why in News?

A recent study in the Indian Journal of Labour Economics (IJLE), revealed that the union government owes Rs 39 crore in delayed wages to Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) workers.

- The study analyzed 31.36 million wage transactions in 2021-22 and found that the Aadhaar-Based Payment System (ABPS) and caste-based wage distribution, instead of improving payment speed, have caused delays.

What are the Key Findings Related to the MGNREGA Wages?

- Inefficiency of ABPS: Only 43% of MGNREGA workers were eligible for ABPS when it became mandatory in January 2024.

- The unaccounted delay compensation caused by ABPS could amount to Rs 400 crore nationwide, contrary to the government's claim of streamlining payments and improving transparency.

- Inadequate Funds: The reason for delayed payments are primarily due to inadequate funds released by the central government.

- In FY 2021-22, only 29% of payments were processed within the mandated 7-day period

- Budget Allocation Shortfall: The study highlights critical underfunding of MGNREGA, with budget allocation in FY 2021-22 at just 0.41% of Gross Domestic Product (GDP), well below the required level to meet rural employment demand.

- During the Covid-pandemic year 2020-21, it was only 0.56%, which further declined to 0.2% in FY 2023-24 and FY 2024-25.

- Researchers suggest that to meet the full work demand, the budget should be at least 4 times higher i.e. around 1.2% to 1.5% of GDP.

- Caste-Based Wage Payments and Inequities: The caste-based wage segregation, introduced in 2021, which categorized payments into Scheduled Caste (SC), Scheduled Tribes (ST), and 'Other' categories led to delayed payments for 'Other' caste workers compared to SC and ST workers.

- Only 33% of 'Other' caste payments were processed within 7 days, compared to 42% for STs and 47% for SCs.

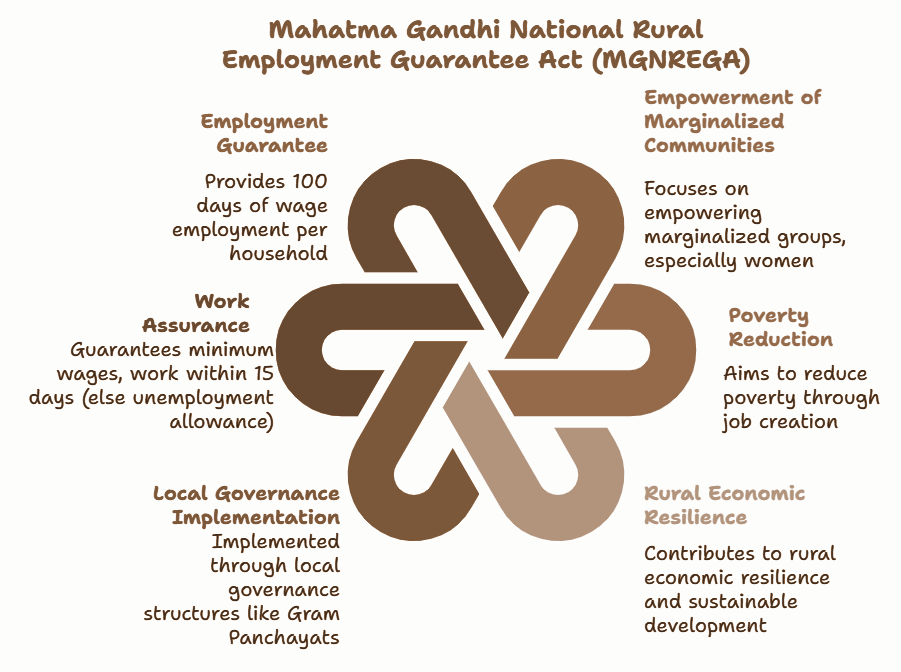

What is MGNREGA Act?

- About:

- The MGNREGA is a Centrally Sponsored Scheme for social security aimed at providing guaranteed rural employment in India.

- It was enacted in 2005 under the Ministry of Rural Development as nodal ministry.

- Purpose: To provide at least 100 days of guaranteed wage employment to registered adult rural households willing to undertake unskilled manual work.

- Coverage: The scheme extends across the entire country, excluding districts with 100% urban populations.

- Demand-Driven Framework: Employment is provided on demand; if not granted within 15 days, workers are entitled to an unemployment allowance, which is one-fourth of the minimum wage for the first 30 days and half of the minimum wage thereafter.

- Decentralized Planning: The scheme emphasizes grassroots planning, with at least 50% of work executed by Gram Panchayats based on Gram Sabha recommendations.

- Fund Sharing: The Central Government covers 100% of unskilled labor costs and 75% of material costs, while State Governments contribute 25% of material costs, ensuring cooperative federalism in implementation.

- Wage Payment Mechanism: Wages are linked to state-specific Minimum Wage rates and paid directly to workers' bank or Aadhaar-linked accounts for transparency.

- Compensation for delayed payments is provided at 0.05% of unpaid wages per day, starting from the 16th day after the muster roll closure.

- Accident Compensation: Workers injured on the job are eligible for compensation, with ex-gratia payments for families in case of death or permanent disability.

- At least one-third of MGNREGA beneficiaries must be women, ensuring equal access to wages and work opportunities.

Key Latest Data on MGNREGA

- Budget 2024-25:

- MGNREGA Allocation: The MGNREGA budget increased from Rs 33,000 crore in FY 2013-14 to Rs 86,000 crore in FY 2024-25.

- Wage Rate Increase: The minimum average wage rate saw a 7% increase in FY 2024-25.

- Economic Survey 2023-24:

- Women Participation: Women's participation in MGNREGA rose from 54.8% in FY 2019-20 to 58.9% in FY 2023-24.

- Geotagging & Transparency: MGNREGA ensures 99.9% payment accuracy through the National Electronic Management System, with geotagging of assets.

What Steps Should be Taken For Strengthening MGNREGA Scheme?

- Adequate Budget Allocation: The government must increase MGNREGA's budget allocation to ensure timely wage payments, meet the growing demand for rural employment, and protect the dignity and livelihood of workers.

- Review and Improve Digital Systems: The government should review and improve digital systems like ABPS, addressing technical barriers, enhancing infrastructure, and ensuring accessibility and user-friendliness, especially for rural workers.

- Strengthen Accountability Mechanisms: The government must take responsibility for delays, ensure compensation in line with MGNREGA provisions, and improve reporting, monitoring, and grievance redress systems to ensure timely wage disbursements.

- Future Reforms: Future reforms should ensure efficient, transparent, and equitable wage distribution, avoiding caste-based inequalities and ensuring fair treatment for all workers.

|

Drishti Mains Question: Discuss the objectives and challenges of the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA). What measures can be taken to address its challenges and enhance its effectiveness? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. Among the following who are eligible to benefit from the “Mahatma Gandhi National Rural Employment Guarantee Act”? (2011)

(a) Adult members of only the scheduled caste and scheduled tribe households

(b) Adult members of below poverty line (BPL) households

(c) Adult members of households of all backward communities

(d) Adult members of any household

Ans: (d)

Important Facts For Prelims

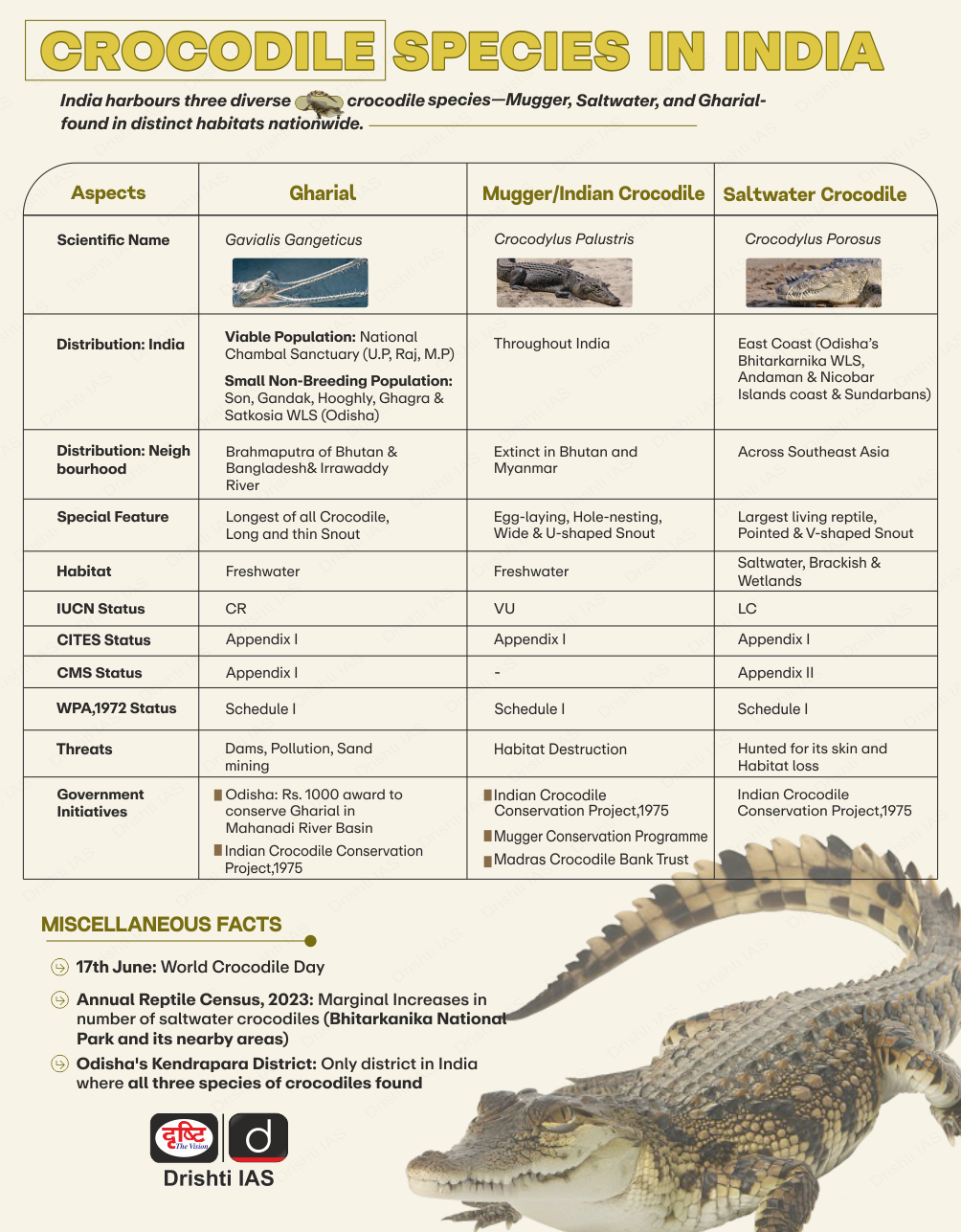

Reptile Census at Bhitarkanika National Park

Why in News?

The annual reptile census at Bhitarkanika National Park (BNP) has revealed that saltwater crocodiles in BNP stands at 1,826 in 2025, including 18 albino crocodiles (rare white crocodiles).

Note: The census was conducted using the Timestamp Camera App to record video with time watermarks and GPS, improving accuracy and minimizing human error.

What is the Crocodile Conservation Project?

- About: It was started in 1975 at Bhitarkanika National Park, Odisha, to protect and conserve the population of three endangered species of crocodiles i.e., Mugger, Gharial, and Saltwater Crocodile.

- Goals: It was started to increase the population so that 5 to 6 crocodiles could be sighted per kilometer of water.

- Objectives:

- Protection: To protect the remaining populations of crocodiles in their natural habitats by creating sanctuaries.

- Rebuilding Populations: Using a 'grow and release' or 'rear and release' approach through egg collection, incubation, rearing, release and monitoring.

- Personnel Training: Training personnel at project sites and the Central Crocodile Breeding and Management Institute, Hyderabad.

- Implementation: The project was initiated with assistance from the United Nations Development Programme (UNDP) and Food and Agriculture Organization (FAO).

- Important crocodile conservation sanctuaries include:

- Bhitarkanika National Park (Odisha) for saltwater crocodiles.

- National Chambal Sanctuary (spanning Madhya Pradesh, Rajasthan, and Uttar Pradesh) for gharials.

- Achievement: Since the 1975 launch of the Crocodile Conservation Project, the saltwater crocodile population has steadily risen.

- The crocodile breeding program in the park was stopped in 2024 due to population saturation, but eggs are still collected annually and bred for tourists.

What are Key Facts About BNP?

- About: Located in Odisha, BNP is India's 2nd largest mangrove ecosystem, after the Sunderbans.

- Recognized as a Ramsar Site, it is a significant wetland of international importance.

- Ecosystem: BNP comprises a network of creeks and canals, fed by waters from the Brahmani, Baitarani, Dhamra, and Patasala rivers, creating a unique ecosystem.

- Proximity to the Bay of Bengal enriches the soil with salts, supporting tropical and subtropical intertidal vegetation.

- Fauna: It is home to the largest congregation of saltwater crocodiles in India. Other notable species include water monitor lizards, pythons, and hyenas.

- Key Features:

- Gahirmatha Beach: Located in BNP, it is the largest nesting site for Olive Ridley Sea Turtles.

- Bagagahana (Heronry): Near the Surajpore creek, thousands of birds nest and perform aerial acrobatics before mating, creating an impressive spectacle.

UPSC Civil Services Examination Previous Year Question:

Prelims

Q. If you want to see gharials in their natural habitat, which one of the following is the best place to visit? (2017)

(a) Bhitarkanika Mangroves

(b) Chambal River

(c) Pulicat Lake

(d) Deepor Beel

Ans: (b)

Q. Consider the following pairs: (2010)

Protected area Well-known for

- Bhitarkanika, Orissa: Salt Water Crocodile

- Desert National Park, Rajasthan: Great Indian Bustard

- Eravikulam, Kerala : Hoolak Gibbon

Which of the pairs given above is/are correctly matched?

(a) 1 only

(b) 1 and 2 only

(c) 2 only

(d) 1, 2 and 3

Ans: (b)

Important Facts For Prelims

Open Market Sale Scheme (Domestic) Policy

Why in News?

The Ministry of Consumer Affairs, Food & Public Distribution announced key revisions to the Open Market Sale Scheme (Domestic) (OMSS(D)) policy for 2024-25. These changes aim to improve food security and support ethanol production in India.

What is the Open Market Sale Scheme (Domestic) Policy?

- About: The OMSS involves the periodic sale of surplus food grains (wheat and rice) from the central pool managed by the Food Corporation of India (FCI).

- The grains are sold to dealers, bulk consumers, and retail chains through e-auctions at prices set by the Ministry of Consumer Affairs, Food & Public Distribution.

- The scheme helps curb inflation and stabilize food grain prices meeting the needs of the Targeted Public Distribution System (TPDS) and Other Welfare Schemes.

- Eligible Buyers: Wheat is sold to Processors, Atta Chalkis, and Flour Millers, while rice is sold to traders.

- States can also procure food grains through the OMSS, beyond their National Food Security Act (NFSA), 2013 allocation, without participating in auctions.

- Auction Process: Bidders can participate through e-auctions, with a minimum of 10 metric ton (MT) and a maximum of 100 MT for wheat and a minimum of 10 MT and maximum of 1000 MT for rice.

- Revisions to the OMSS(D): The Centre reduced the reserve price of FCI rice under OMSS by Rs 550 to Rs 2,250 per quintal for states and ethanol producers to boost sales, support ethanol production, and enhance food security.

Food Corporation of India (FCI)

- Establishment: The FCI is a statutory body established under the Food Corporation’s Act, 1964.

- Key Roles:

- National Food Security Act (NFSA): FCI procures grains to fulfill NFSA, 2013 requirements and distributes them at Central Issue Prices to economically vulnerable sections.

- Public Distribution System (PDS): Delivers food grains to State Governments and agencies for distribution through Fair Price Shops.

- Promotes nutritional security through the distribution of fortified rice.

- Market Interventions: Stabilizes food prices and mitigates inflation through procurement and OMSS (Open Market Sale Scheme).

- Provides a safety net for farmers by ensuring Minimum Support Prices (MSP).

- Headquarters: Headquartered in New Delhi, FCI operates through a nationwide network with Zonal, Regional, and District Offices.

- Reforms By FCI:

- Direct Benefit Transfer (DBT): Implemented the “One Nation, One MSP” policy for transparent farmer payments.

- Digital Procurement: Computerized food grain procurement nationwide for faster and transparent operations.

- Modernized Storage: Transitioned from traditional storage to scientifically managed depots and silos.

- Integrated Supply Chain Management: Streamlined operations through the ANNA DARPAN portal.

- AI-Based Grain Analysis: Introduced Automatic Grain Analyzers for transparent procurement.

- Digital Quality Labs: Linked quality control labs with centralized dashboards for real-time data.

- Storage and Transit Loss Reduction: Reduced storage loss from 0.17% in 2013-14 to a net gain of 0.22% by 2023-24 and Cut transit losses from 0.46% to 0.16% over the same period.

- Decentralized Procurement (DCP): Increased state participation in DCP for both rice and wheat.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q1. With reference to the provisions made under the National Food Security Act, 2013, consider the following statements: (2018)

- The families coming under the category of ‘below poverty line (BPL)’ only are eligible to receive subsidised food grains.

- The eldest woman in a household, of age 18 years or above, shall be the head of the household for the purpose of issuance of a ration card.

- Pregnant women and lactating mothers are entitled to a ‘take-home ration’ of 1600 calories per day during pregnancy and for six months thereafter.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 3 only

Ans: (b)

Important Facts For Prelims

CBDT Issues New Guidelines for PPT under DTAAs

Why in News?

The Central Board of Direct Taxes (CBDT) has introduced new guidelines for applying the Principal Purpose Test (PPT) under India’s Double Tax Avoidance Agreements (DTAAs), aiming to prevent tax avoidance.

- These guidelines apply prospectively, with specific exemptions for treaties with Cyprus, Mauritius, and Singapore due to grandfathering provisions.

What is the Principal Purpose Test (PPT)?

- Principal Purpose Test: The PPT is part of international tax rules aimed at preventing misuse of tax treaties.

- Under the Base Erosion and Profit Shifting (BEPS) framework, the PPT checks whether a business arrangement is genuinely commercial or created mainly to avoid taxes.

- If the primary purpose is tax-saving, treaty benefits can be denied.

- Under the Base Erosion and Profit Shifting (BEPS) framework, the PPT checks whether a business arrangement is genuinely commercial or created mainly to avoid taxes.

- New Guidelines:

- Applicability of PPT: The PPT provisions will apply prospectively, meaning past investments, particularly those before 1st April 2017, will remain unaffected and not face retrospective scrutiny.

- Grandfathering Provisions: Treaties with Singapore, Mauritius, and Cyprus are excluded from PPT due to specific bilateral commitments.

- Investments made under these treaties before specific dates will follow the original treaty provisions.

- Reference to Global Standards: The new guidelines encourage tax authorities to refer to international tax frameworks, including the BEPS Action Plan 6 and the UN Model Tax Convention, when applying the PPT provisions.

What are Double Tax Avoidance Agreements (DTAAs)?

- About: DTAA is a treaty between two countries that helps taxpayers avoid double taxation.

- For example, an NRI earning dividends from investments in India would typically face taxes in both India and the US. However, with a DTAA, they are taxed in only one country based on the agreement's terms.

- This helps NRIs avoid hefty taxes in two nations and reduces tax evasion.

- DTAAs cover various income types, including business profits, dividends, interest, royalties, and capital gains.

- Each agreement specifies which country can tax certain income, usually granting the primary right to the country of origin while allowing the residence country to tax at a reduced rate.

- For example, an NRI earning dividends from investments in India would typically face taxes in both India and the US. However, with a DTAA, they are taxed in only one country based on the agreement's terms.

- India and DTAAs: India has signed 94 DTAAs with countries including Australia, France, Germany, Japan, Mauritius, the USA, and the UK.

Base Erosion and Profit Shifting (BEPS) Framework

- The BEPS framework, an initiative led by the Organisation for Economic Co-operation and Development (OECD) with the backing of the G20, seeks to address global tax avoidance strategies employed by multinational corporations.

- BEPS refers to strategies where multinationals minimize tax by shifting profits to low-tax regions or creating payments that can be subtracted from taxable income, like royalties.

- BEPS Framework established in 2016, it unites 147 countries (including India) to tackle tax avoidance. The framework consists of two key pillars:

- Pillar One: Reallocation of profits to countries with consumer presence.

- Pillar Two: Global Minimum Corporate Tax (GMCT) of 15% for MNEs.

- BEPS Action 6 tackles treaty shopping and sets minimum standards for the BEPS Inclusive Framework members.

- It provides rules to prevent treaty abuse and guides jurisdictions on tax policy considerations before entering into tax agreements.

UN Model Tax Convention

- It provides a framework for negotiating bilateral tax treaties. It aims to avoid double taxation and prevent tax evasion, with a focus on developing countries.

- It offers guidelines on taxing rights between countries and standardizes rules for income taxation, helping nations resolve cross-border tax issues.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. With reference to India’s decision to levy an equalization tax of 6% on online advertisement services offered by non-resident entities, which of the following statements is/are correct? (2018)

- It is introduced as a part of the Income Tax Act.

- Non-resident entities that offer advertisement services in India can claim a tax credit in their home country under the “Double Taxation Avoidance Agreements”.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)

Rapid Fire

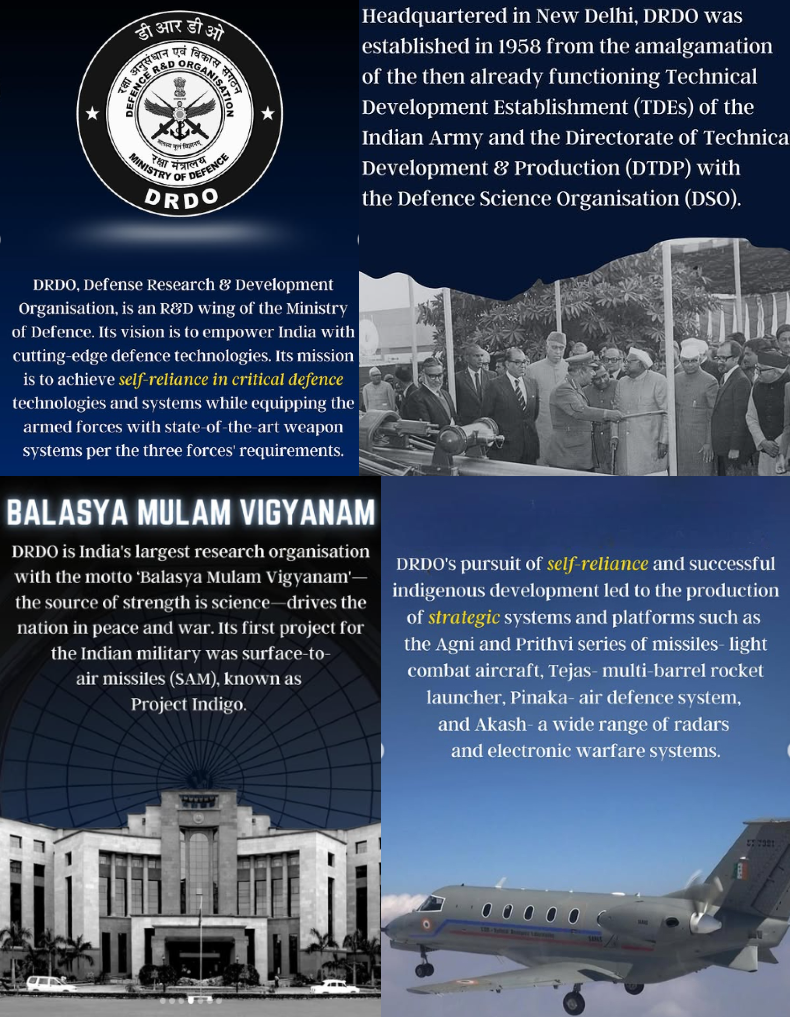

DRDO's Scramjet Test Boosts Hypersonic Missile Development

The Defence Research and Development Organisation (DRDO) has successfully conducted a Supersonic Combustion Ramjet (Scramjet) engine ground test, advancing India's hypersonic missile tech.

- Scramjet Engine: A scramjet engine (Air-breathing engines) is an advanced ramjet that uses supersonic airflow for combustion, enabling faster speeds. It uses liquid hydrogen and liquid oxygen for thrust, offering better fuel efficiency.

- Unlike a turbojet engine, ramjets and scramjets have no moving parts, consisting only of an inlet, combustor (with fuel injector and flame holder), and a nozzle.

- Scramjets are key to hypersonic vehicles to handle airflows at speeds above the speed of sound, offer maneuverability, and strategic advantage.

- Achievements of DRDO: Ground test achieved stable combustion in the scramjet engine, and developed indigenous endothermic scramjet fuel for improved cooling and ignition.

- A Thermal Barrier Coating was also developed to withstand extreme temperatures.

- Hypersonic Missiles: Traveling at speeds greater than Mach 5 (over 5,400 km/h), bypass air defences with high-speed, high-impact strikes.

- Global Race for Hypersonic Missiles: The US, Russia, and China are advancing hypersonic tech.

- In 2021, China tested a nuclear-capable hypersonic glide vehicle that circled the globe before speeding towards its target.

Read more: Defence Research and Development Organisation, Air Breathing Engines

Rapid Fire

SC Bose Aapda Prabandhan Puraskar 2025 to INCOIS

The Indian National Centre for Ocean Information Services (INCOIS) has been awarded the Subhash Chandra Bose Aapda Prabandhan Puraskar 2025 in the Institutional Category for its outstanding work in disaster management.

- It is awarded annually on 23rd January, Netaji Subhash Chandra Bose's birth anniversary, with Rs 51 lakh for institutions and Rs 5 lakh for individuals.

- About INCOIS: It was established in 1999 in Hyderabad, Telangana and specializes in ocean-related disaster management, particularly tsunami early warnings.

- It operates the Indian Tsunami Early Warning Centre (ITEWC), providing alerts within 10 minutes to India and 28 Indian Ocean countries.

- It is recognized by UNESCO as a Top Tsunami Service Provider.

- It functions under the Ministry of Earth Sciences (MoES) and a unit of the Earth System Science Organization (ESSO), New Delhi.

- It has developed Search and Rescue Aided Tool (SARAT) for locating individuals or objects lost at sea, and created the SynOPS visualization platform for real-time data integration.

- INCOIS is a permanent member of the Indian delegation to the Intergovernmental Oceanographic Commission (IOC) of UNESCO.

Read More: Indian National Centre for Ocean Information Services, Legacy of SC Bose

Rapid Fire

15th National Voters' Day 2025

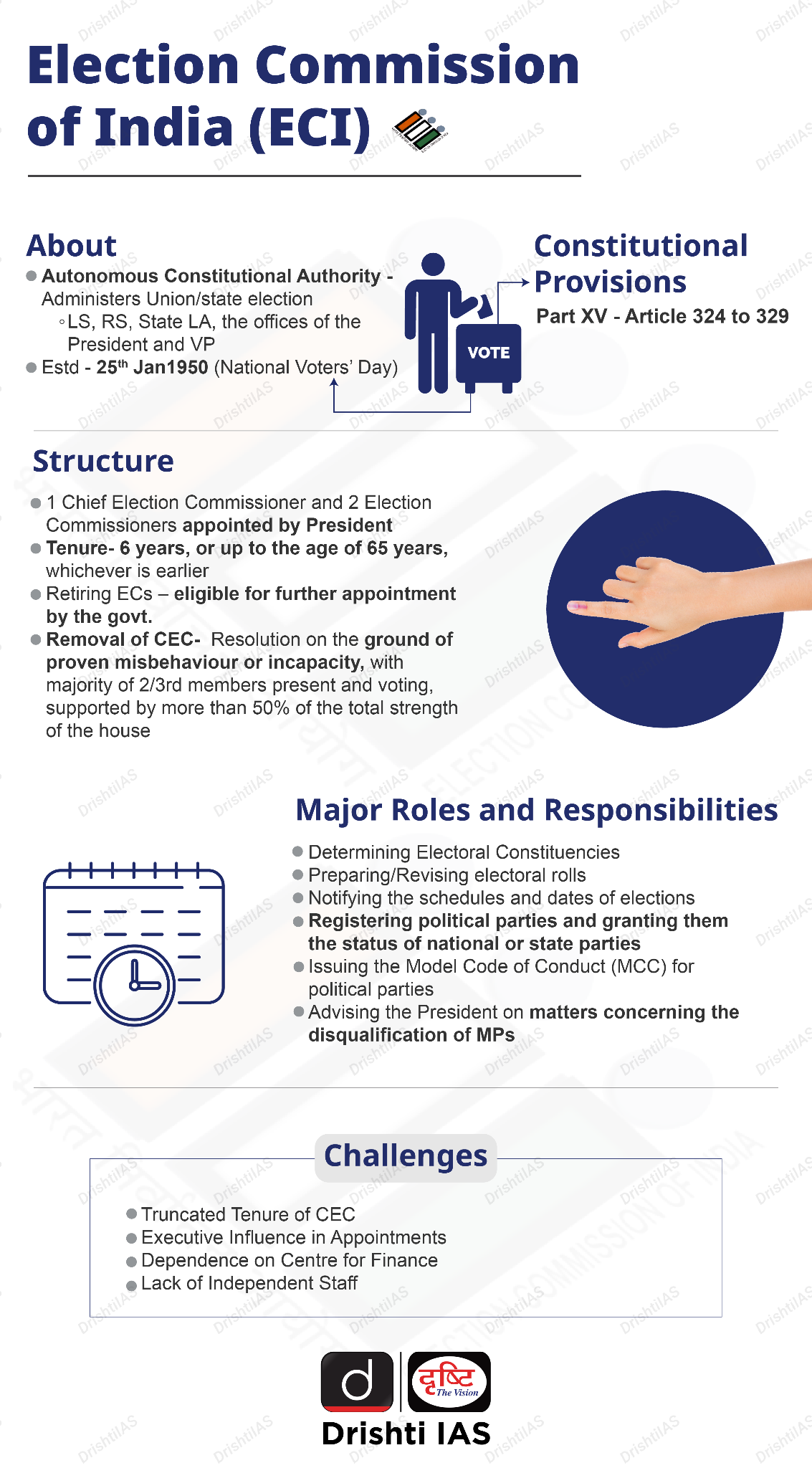

The 15th National Voters' Day (NVD) on 25th January 2025, marks 75 years of the Election Commission of India (ECI) and follows the successful 2024 Lok Sabha Elections, the world's largest democratic exercise.

- Significance of NVD: Celebrated annually on 25th January since 2011 to commemorate the establishment of the ECI on 25th January 1950, a day before India became a Republic.

- Aims to promote voter awareness, inspire participation, and honor new voters.

- Theme for 2025: “Nothing Like Voting, I Vote for Sure” to emphasize the importance of voting and pride in electoral participation.

- Electorate Milestone: India’s voter base nears the 100 crore mark, with 99.1 crore registered voters, including 21.7 crore young electors (18-29 age group) and an improved Electoral Gender Ratio (from 948 in 2024 to 954 in 2025).

- Highlights of the 15th NVD: The President of India will present the Best Electoral Practices Awards.

- The Best Electoral Practice Award acknowledges excellence in election management, with awards for District Election Officers, Superintendents of Police, and states demonstrating exceptional performance.

- The ECI Coffee Table Book "India Votes 2024: A Saga of Democracy" and the publication "Belief in the Ballot: Human Stories Shaping India’s 2024 Elections" will be presented to the President.

Read more: Strengthening India's Electoral Democracy

Rapid Fire

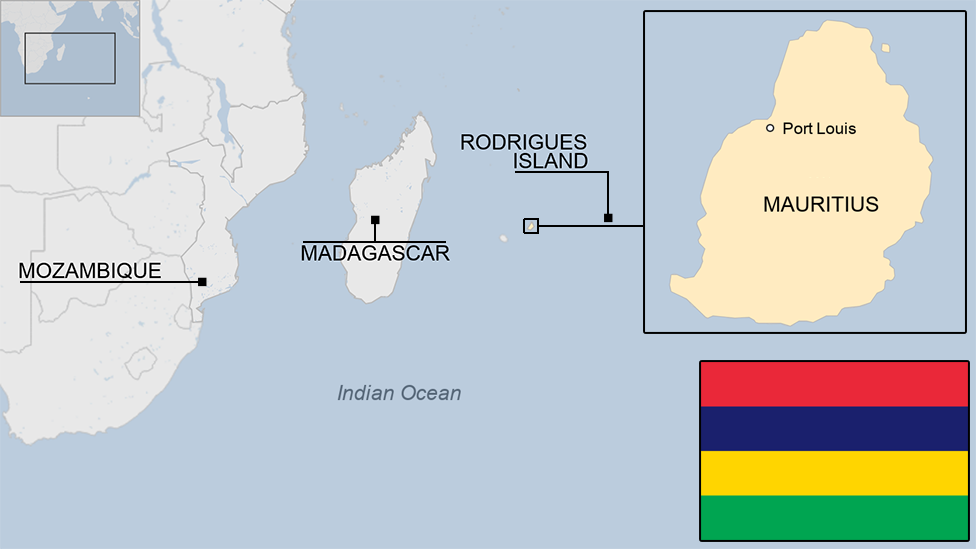

Mauritius Hydrographic Survey

The Indian Navy has successfully completed a hydrographic survey of 25,000 square nautical miles of Mauritius.

- Hydrographic Survey: INS Sarvekshak completed the hydrographic survey (mapping the ocean floor and sub-surface features), providing Mauritius with nautical charts to enhance its maritime infrastructure, resource management, and coastal planning.

- This event underscores the enduring partnership between India and Mauritius in fostering maritime development and regional cooperation.

- The Indian Navy regularly assists countries with hydrographic surveys of their Exclusive Economic Zones (EEZs) as part of the Security and Growth for All in the Region (SAGAR) initiative.

- India has increased capacity-building assistance to littoral states in the Indian Ocean. On World Hydrography Day (21st June annually), the Indian Navy highlighted conducting hydrographic surveys with friendly nations, covering 89,000 sq. km and producing 96 charts in five years.

- India-Mauritius Defence Cooperation: Includes joint coastal radar surveillance and the Mauritius operates two Advanced Light Helicopters (ALH)-MkIII and one Dornier Do-228 aircraft, built by Hindustan Aeronautics Limited (HAL).

- Mauritius has an International Liaison Officer at the Indian Navy’s Information Fusion Centre for Indian Ocean Region in Gurugram, India.

- INS Sarvekshak: It is an hydrographic survey ship, based at Kochi, is equipped with advanced survey tools and has conducted surveys in Sri Lanka, Seychelles, and Tanzania.

Read more: India-Mauritius Joint Trade Committee