Reform Linked Borrowing

Why in News

Indian states were able to borrow an extra Rs. 1.06 lakh crore in 2020-21 (FY21) due to the Reform Linked Borrowing window.

- This was announced to provide an additional leeway to states in order to cope with the adverse effects of Covid-19 pandemic on the economy.

Note

- Chapter II of Part XII of the Constitution of India deals with borrowing by the Central Government and State Governments.

- It comprises two provisions - Article 292 which covers borrowing by the Central Government and Article 293, which covers borrowing by State Governments.

- Article 293 (3) requires State Governments that are indebted to the Central Government to seek the consent of the Central Government before raising further borrowings.

Key Points

- About:

- This was a nudge, incentivising the States to adopt progressive policies to avail additional funds.

- In October 2020, the Central government had linked permission for additional borrowing of 1% of their GSDP (Gross State Domestic Product) to implementation of four critical reforms, which are:

- Implementation of One Nation One Ration Card System,

- Ease of doing business reform,

- Urban Local body/ utility reforms and

- Power Sector reforms.

- Under this reforms-linked borrowing window, states were to get access to funds of up to Rs 2.14 lakh crore on completion of all the four reforms.

- For states completing three of the four reforms, the Centre would provide additional funds assistance of Rs. 2,000 crore for capital expenditure.

- For FY 2021-22, the net borrowing ceiling for states has been fixed at 4% of the projected GSDP (about Rs 8.46 lakh crore), based on recommendations of the Fifteenth Finance Commission.

- One Nation One Ration Card System (ONORC) Reforms:

- This was aimed to ensure that the beneficiaries under the National Food Security Act (NFSA) and other welfare schemes, especially the migrant workers and their families, get ration from any Fair Price Shop (FPS) across the country.

- Other aims of the intended reform were to better target beneficiaries, elimination of bogus/ duplicate/ ineligible ration cards and thus enhance welfare and reduce leakage.

- For this, the reform conditions stipulated Aadhar Seeding of all Ration Cards, biometric authentication of beneficiaries and automation of all the FPS in the State.

- ‘Ease of Doing Business’ Reforms:

- It is to facilitate a better environment and seamless process for entrepreneurs and companies to operate.

- The reforms stipulated in this category are:

- Completion of first assessment of ‘District Level Business Reform Action Plan’.

- Elimination of the requirements of renewal of Registration certificates/approvals/licences obtained by businesses under various Acts.

- Implementation of a computerized central random inspection system under the Acts.

- Urban Local Body/ Utility Reforms:

- These reforms are aimed at financial strengthening of ULBs (Urban Local Bodies) in the States and to enable them to provide better public health and sanitation services to citizens.

- It required states to notify floor rates of property tax and of water and sewerage charges.This was in consonance with stamp duty guideline values for property transactions and current costs in urban areas.

- Power Sector Reforms:

- There are three parameters a state must meet under the power sector reforms - reduction in Aggregate Technical & Commercial (AT&C) losses, targeted reduction in Average Cost of Supply and Average Revenue Realisation (ACS-ARR) gap, and direct benefit transfer (DBT) of electricity subsidy to farmers.

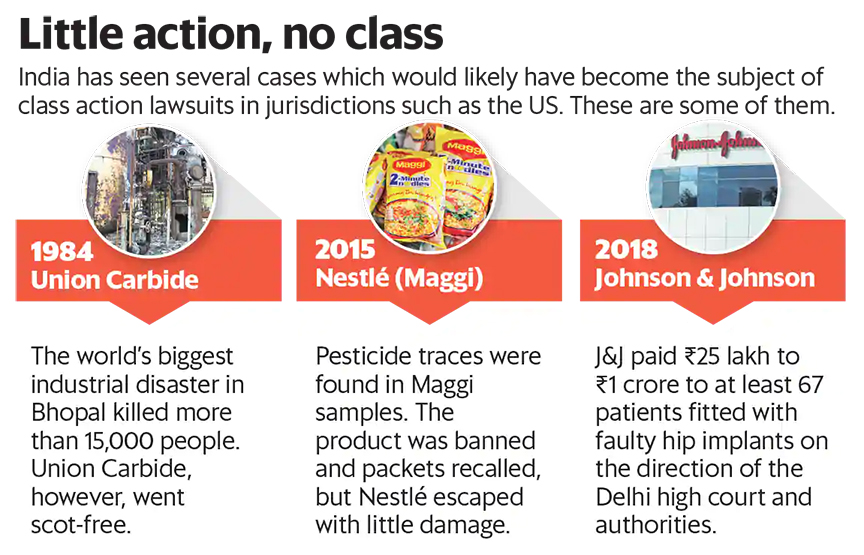

Class Action Suits

Why in News

Incidents such as the recent Oil and Natural Gas Corporation Limited (ONGC) barge disaster underline the absence of effective class action suits/lawsuits in India.

- 71 people were killed after Cyclone Tauktae damaged ONGC’s barge vessels off Bombay High.

Oil and Natural Gas Corporation Limited

- It is a Maharatna Public Sector Undertaking (PSU) of the Government of India.

- It was set up in 1995 and is under the Ministry of Petroleum and Natural Gas.

- It is the largest crude oil and natural gas company in India, contributing around 70% to Indian domestic production.

Key Points

- About:

- It is a case brought to court by a group representing a larger set of people, often in thousands, who have suffered the same loss. Such a group forms a class.

- It derives from representative litigation, to ensure justice to the ordinary individual against a powerful adversary.

- The accused in such cases usually are corporate entities or governments.

- Generally, in class action suits, the damages paid may be small at an individual level or may not even be quantifiable.

- The total damages calculated, however, could be large.

- The difference between public interest litigation (Article 32 or Article 226 of the Constitution) and class action suits is that unlike a class action suit, a public interest litigation cannot be filed against a private party.

- History of Class Action Suits:

- While class action suits have a history dating back to the 18th century, these were formally incorporated into law in the US in 1938 under the Federal Rules of Civil Procedure.

- It is a tool extensively used in the US where individuals or small communities, aggrieved by the actions of a large entity, come together to exercise legal options collectively.

- Over the years, class action has become so successful at curbing negligence, that it is now a part of US corporate and consumer laws, environmental litigation, etc.

- While class action suits have a history dating back to the 18th century, these were formally incorporated into law in the US in 1938 under the Federal Rules of Civil Procedure.

- Rules in India for Class Action Suits:

- Civil Procedure Code 1908 :

- The Code of Civil Procedure, 1908 is a procedural law related to the administration of civil proceedings in India.

- Rule 8 refers to representative suits, which is the closest to a classic class action suit in a civil context in India. It does not cover criminal proceedings.

- Companies Act 2013:

- Section 245 of it allows members or depositors of a company to initiate proceedings against the directors of the company in specific instances.

- There are threshold limits, requiring a minimum number of people or holders of issued share capital before such a suit can proceed.

- This type of suit is filed in the National Company Law Tribunal (NCLAT) currently.

- Competition Act 2002:

- Under Section 53(N), it allows a group of aggrieved persons to appear at the NCLAT in issues of anti-competitive practices.

- Consumer Protection Act 2019 (replaced the 1986 Act):

- The Supreme Court has held that in certain complaints under the Consumer Protection Act 1986, they can be considered as class action suits. (Rameshwar Prasad Shrivastava and Ors v Dwarkadhis Project Pvt Ltd and Ors 2018).

- Civil Procedure Code 1908 :

- Benefits:

- Reduced Burden:

- An immediate benefit is that the court has to hear only one case and not several. This reduces the chance of similar cases clogging the already overburdened courts.

- Helps the Weak:

- As not everyone has the means or time to pursue a legal case, a small group of people with funds or the ability to raise money can bring justice to other victims who may be disadvantaged.

- Affects Brand Image:

- Companies are reluctant to face such suits as it affects their brand image. They prefer settling such cases faster to minimize the damage to their reputation.

- An advantage for the accused parties, however, is that they have to deal with only one case.

- Reduced Burden:

- Challenges:

- Underdeveloped system of torts:

- Tort law has not developed sufficiently in India for a number of reasons, primarily due to the high cost and time-consuming nature of litigation.

- Lack of contingency fees:

- The rules of the Bar Council of India do not allow lawyers to charge contingency fees, i.e., a percentage of the damages claimants receive if they win a case.

- This disincentives lawyers from appearing in time-consuming cases that class action suits inevitably are.

- Lack of Third-party financing mechanisms for litigants:

- Since litigation costs are high, class action suits can be made easier by allowing external parties to fund or sponsor the cost of litigation.

- Some states like Maharashtra, Gujarat, Madhya Pradesh, and Karnataka have made changes in the Civil Procedure Code to allow this.

- Since litigation costs are high, class action suits can be made easier by allowing external parties to fund or sponsor the cost of litigation.

- Underdeveloped system of torts:

Way Forward

- India should move in the direction of such accountability, which is taken seriously in developed economies, and which makes them better abodes for employment and business.

- Lawyers should be incentivised for taking such cases, it will be a good first step in bringing class action suits into the mainstream.

- Class action suits are necessary if India is to improve its ease of doing business rankings, especially in disaster prevention and risk of life.

Electoral Trust Scheme, 2013

Why in News

For the first time, an electoral trust (under Electoral Trust Scheme, 2013) has declared donation through electoral bonds and hasn’t revealed the names of the political parties that received the money, citing anonymity guaranteed under the electoral bond scheme.

- According to the Association of Democratic Reforms (ADR), this “practice is against the spirit of the Electoral Trusts Scheme, 2013 and the Income Tax Rules, 1962 which make it mandatory for trusts to furnish each and every detail about the donor contributing to the trust.

- If Electoral trusts start adopting this precedent of donating through bonds, it will be a complete situation of unfair practices i.e. total anonymity, unchecked and unlimited funding, free flow of black money circulation, corruption, foreign funding, corporate donations and related conflict of interest etc.

Key Points

- About the Electoral Trust Scheme:

- Electoral Trust is a non-profit organization formed in India for orderly receiving of the contributions from any person.

- Electoral Trusts are relatively new in India and are part of the ever-growing electoral restructurings in the country.

- Electoral Trusts Scheme, 2013 was notified by the Central Board of Direct Taxes (CBDT).

- The provisions related to the electoral trust are under Income-tax Act, 1961 and Income tax rules-1962.

- Objective:

- It lays down a procedure for grant of approval to an electoral trust which will receive voluntary contributions and distribute the same to the political parties.

- A political party registered under section 29A of the Representation of the People Act, 1951 shall be an eligible political party and an electoral trust shall distribute funds only to the eligible political parties.

- Criteria for Approval of Trusts:

- An electoral trust shall be considered for approval if it fulfills following conditions, namely:-

- The company registered for the purposes of section 25 of the Companies Act, 1956.

- The object of the electoral trust shall not be to earn any profit or pass any direct or indirect benefit to its members or contributors.

- An electoral trust shall be considered for approval if it fulfills following conditions, namely:-

- Contributions to Electoral Trusts:

- Receive Voluntary Contributions From:

- An individual who is a citizen of India;

- A company which is registered in India; and

- A firm or Hindu undivided family or an Association of persons or a body of individuals, resident in India.

- Shall not accept contributions From-

- An individual who is not a citizen of India.

- Any other electoral trust which has been registered as a company under section 25 of the Companies Act, 1956 and approved as an electoral trust under the Electoral Trusts Scheme, 2013;

- A Government company as defined in section 2 of the Companies Act, 2013.

- A foreign source as defined in section 2 of the Foreign Contribution (Regulation) Act, 2010.

- An electoral trust can accept contributions only by cheque, demand draft or account transfer to the bank.

- Receive Voluntary Contributions From:

- Other Points:

- The electoral trust may spend up to 5% of the total contributions received in a year subject to an aggregate limit of Rs. 5 Lakh in the first year of incorporation and Rs. 3 Lakh in subsequent years.

- The trust obtains a receipt from the eligible political party indicating the name of the political party, its permanent account number etc.

- The trust shall keep and maintain such books of account and other documents in respect of its receipts, distributions and expenditure.

- The trust shall also maintain a list of persons from whom contributions have been received and to whom the same have been distributed.

- Significance of Scheme:

- Electoral Trusts are designed to bring in more transparency in the funds provided by corporate entities to the political parties for their election related expenses.

- The Election Commission had also circulated guidelines for submission of contribution reports of electoral trusts to submit an annual report containing details of contributions received by the electoral trusts and disbursed by them to political parties in the interest of transparency.

Electoral Bond

- Electoral Bond is a financial instrument for making donations to political parties.

- The bonds are issued in multiples of Rs. 1,000, Rs. 10,000, Rs. 1 lakh, Rs. 10 lakh and Rs. 1 crore without any maximum limit.

- State Bank of India is authorised to issue and encash these bonds, which are valid for fifteen days from the date of issuance.

- These bonds are redeemable in the designated account of a registered political party.

- The bonds are available for purchase by any person (who is a citizen of India or incorporated or established in India) for a period of ten days each in the months of January, April, July and October as may be specified by the Central Government.

- A person being an individual can buy bonds, either singly or jointly with other individuals.

- Donor’s name is not mentioned on the bond.

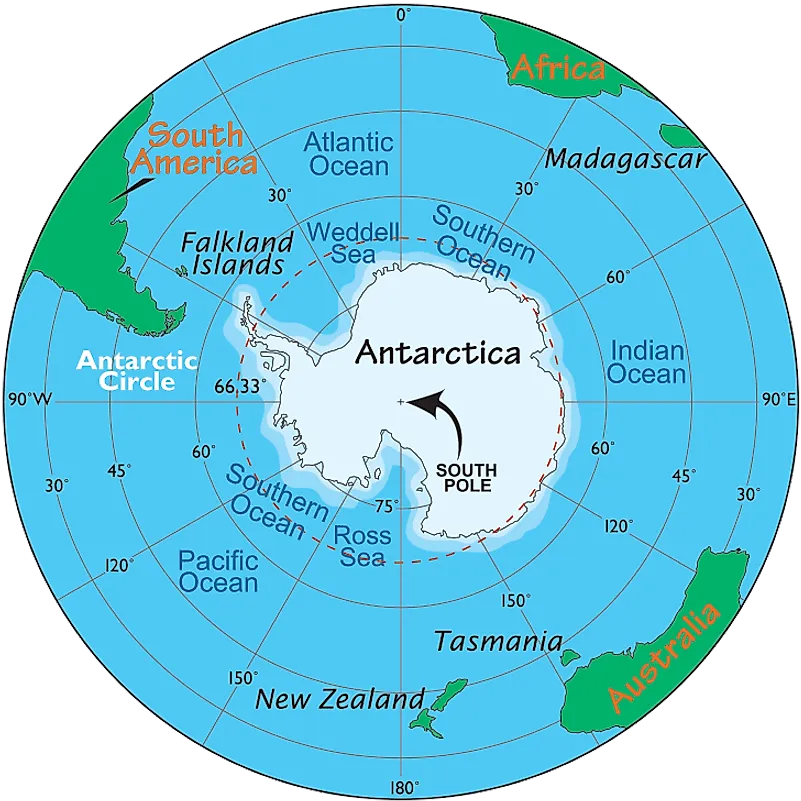

Antarctic Treaty

Why in News

Recently, the 60th anniversary of the Antarctic Treaty was celebrated.

- The Antarctic treaty remains the only example of a single treaty that governs a whole continent.

- It is also the foundation of a rules-based international order for a continent without a permanent population.

Key Points

- About:

- The Antarctic Treaty was signed between 12 countries in Washington on 1st December 1959 for making the Antarctic Continent a demilitarized zone to be preserved for scientific research only.

- The twelve original signatories are Argentina, Australia, Belgium, Chile, France, Japan, New Zealand, Norway, South Africa, the Union of Soviet Socialist Republics, the UK and the US.

- It entered into force in 1961 and has since been acceded by many other nations.

- Antarctica is defined as all of the land and ice shelves south of 60°S latitude.

- Recently, an enormous iceberg 'A-76' has calved from the western side of the Ronne Ice Shelf, lying in the Weddell Sea, in Antarctica.

- The Antarctic Treaty was signed between 12 countries in Washington on 1st December 1959 for making the Antarctic Continent a demilitarized zone to be preserved for scientific research only.

- Members:

- Currently it has 54 parties. India became a member of this treaty in 1983.

- Headquarters:

- Buenos Aires, Argentina.

- Major Provisions:

- Promoting the freedom of scientific research.

- Countries can use the continent only for peaceful purposes.

- Prohibition of military activities, nuclear tests and the disposal of radioactive waste.

- Neutralising territorial sovereignty, this means a limit was placed on making any new claim or enlargement of an existing claim.

- It put a freeze on any disputes between claimants over their territories on the continent.

- Dispute & Resolution:

- There have been tensions from time to time. Argentina and the UK, for instance, have overlapping claims to territory on the continent.

- However, a key reason why the treaty has been able to survive has been its ability to evolve through a number of additional conventions and other legal protocols.

- These have dealt with the conservation of marine living resources, prohibitions on mining, and the adoption of comprehensive environmental protection mechanisms.

- As disputes have arisen over the years, many have been addressed through the expansion of the treaty framework with these agreements. This framework is now referred to as the Antarctic Treaty System.

- Antarctic Treaty System:

- About:

- It is the whole complex of arrangements made for the purpose of regulating relations among states in the Antarctic.

- Its purpose is to ensure in the interests of all mankind that Antarctica shall continue forever to be used exclusively for peaceful purposes and shall not become the scene or object of international discord.

- It is a global achievement and has been a hallmark of international cooperation for more than 50 years.

- These agreements are legally binding and purpose-built for the unique geographical, environmental and political characteristics of the Antarctic and form a robust international governance framework for the region.

- Major International Agreements of the Treaty System:

- The 1959 Antarctic Treaty.

- The 1972 Convention for the Conservation of Antarctic Seals.

- The 1980 Convention on the Conservation of Antarctic Marine Living Resources.

- The 1991 Protocol on Environmental Protection to the Antarctic Treaty.

- About:

Indian Antarctic Programme

- About:

- It is a scientific research and exploration program under the National Centre for Antarctic and Ocean Research (NCPOR). It started in 1981 when the first Indian expedition to Antarctica was made.

- NCPOR is the nodal agency for planning, promotion, coordination and execution of the entire gamut of polar and southern ocean scientific research in the country as well as for the associated logistics activities.

- It was established in 1998.

- Dakshin Gangotri:

- Dakshin Gangotri was the first Indian scientific research base station established in Antarctica, as a part of the Indian Antarctic Program.

- It has weakened and become just a supply base.

- Maitri:

- Maitri is India’s second permanent research station in Antarctica. It was built and finished in 1989.

- Maitri is situated on the rocky mountainous region called Schirmacher Oasis. India also built a freshwater lake around Maitri known as Lake Priyadarshini.

- Bharti:

- Bharti, India’s latest research station operation since 2012. It has been constructed to help researchers work in safety despite the harsh weather.

- It is India’s first committed research facility and is located about 3000 km east of Maitri.

- Other Research Facilities:

- Sagar Nidhi:

- In 2008, India commissioned the Sagar Nidhi, for research.

- An ice-class vessel, it can cut through the thin ice of 40 cm depth and is the first Indian vessel to navigate Antarctic waters.

- Sagar Nidhi:

Way Forward

- While the Antarctic Treaty has been able to successfully respond to a range of challenges, circumstances are radically different in the 2020s compared to the 1950s. Antarctica is much more accessible, partly due to technology but also climate change.

- More countries now have substantive interests in the continent than the original 12. Some global resources are becoming scarce, especially oil.

- There is considerable speculation as to China’s interests in Antarctic resources, especially fisheries and minerals, and whether China may seek to exploit weaknesses in the treaty system to secure access to those resources.

- Therefore, all of the treaty signatories, but especially those with significant stakes in the continent, need to give the future of the treaty more attention.

G20 Labour and Employment Ministers’ Meeting

Why in News

Recently, the Union Minister for Labour and Employment has said that India is making collective efforts to reduce gender gaps in labour force participation.

- He was delivering the Ministerial Address on Declaration and Employment Working Group Priorities at G20 Labour and Employment Ministers’ Meeting.

G20

- It is an informal group of 19 countries and the European Union, with representatives of the International Monetary Fund and the World Bank.

- The G20 membership comprises a mix of the world’s largest advanced and emerging economies, representing about two-thirds of the world’s population, 85% of global gross domestic product, 80% of global investment and over 75% of global trade.

- Members: Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, United Kingdom, United States, and the European Union.

Key Points

- Issues Discussed:

- The Employment Working Group deliberated upon key issues, including women employment, social security and remote working.

- In 2014, G20 Leaders pledged in Brisbane to reduce the gap in labour force participation rates between men and women by 25% by 2025, with the aim of bringing 100 million women into the labour market, increasing global and inclusive growth, and reducing poverty and inequality.

- The Employment Working Group deliberated upon key issues, including women employment, social security and remote working.

- Initiatives Highlighted by India:

- Educational and Skilling Efforts:

- New National Education Policy, 2020:

- It aims for reforms in school and higher education systems.

- India is strengthening its educational and skilling efforts to ensure quality education from preschool to senior secondary stage.

- National Skill Development Mission:

- It aims to create convergence across sectors and States in terms of skill training activities.

- Pradhan Mantri Kaushal Vikas Yojana:

- It enables the youth to take up industry related skill training to assist them in securing better opportunities.

- Digital educational content has been made available on various e-learning platforms like DIKSHA, SWAYAM.

- New National Education Policy, 2020:

- For Employment Generation:

- Aatmanirbhar Bharat Rozgar Yojana:

- The government is paying up to 24% of wages towards EPF contributions for new employees as well as those who lost their jobs in the pandemic and are being re-employed.

- Aatmanirbhar Bharat Rozgar Yojana:

- To Ensure Women Participation:

- New Code on Wages, 2019:

- It will reduce gender-based discrimination in wages, recruitment and conditions of employment.

- Pradhan Mantri Mudra Yojana:

- It provides financial support to women entrepreneurs to start small enterprises.

- Collateral free loans worth Rs 9 lakh crore have been disbursed under this scheme.

- There are around 70% of women in this scheme.

- New Code on Social Security:

- It may now include even self-employed and all other classes of workforce into the folds of social security coverage.

- Others:

- Women can now work even during night hours and the duration of paid maternity leave has been increased from 12 weeks to 26 weeks.

- New Code on Wages, 2019:

- Educational and Skilling Efforts:

- G20 Roadmap Towards and Beyond the Brisbane Target:

- This has been developed for achieving equal opportunities and outcomes for women and men in the labour markets as well as societies in general.

- The G20 Roadmap Towards and Beyond the Brisbane Target has been set as:

- Increasing the quantity and quality of women’s employment.

- Ensuring equal opportunities and achieving better outcomes in the labour market.

- Promoting a more even distribution of women and men across sectors and occupations.

- Tackling the gender pay gap.

- Promoting a more balanced distribution of paid and unpaid work between women and men.

- Addressing discrimination and gender stereotypes in the labour market.

Labour Force Participation

- The labor force participation rate indicates the percentage of all people of working age who are employed or are actively seeking work.

- India continues to struggle to provide its women with equal opportunity.

- In 2019, before the Covid-19 pandemic, female labor force participation in India was 23.5%, according to ILO estimates.

- According to the Periodic Labour Force Survey, 2018-19, the female labour force participation rates (LFPR) among women aged above 15 years are as low as 26.4% in rural areas and 20.4% in urban areas in India.

Constraints in Female Labor Force Participation

- Stereotyping in Society: India’s societal norms are such that women are expected to take the responsibility of family care and childcare. This stereotype is a critical barrier to women’s labor force participation.

- Due to this, women are in constant conflict over-allotment of time for work and life is a war of attrition for them.

- Digital Divide: In India in 2019, internet users were 67% male and 33% female, and this gap is even bigger in rural areas.

- This divide can become a barrier for women to access critical education, health, and financial services, or to achieve success in activities or sectors that are becoming more digitized.

- Technological Disruption: Women hold most of the administrative and data-processing roles that artificial intelligence and other technologies threaten to usurp.

- As routine jobs become automated, the pressure on women will intensify and they will experience higher unemployment rates.

- Lack of Gender-Related Data: Globally, major gaps in gendered data and the lack of trend data make it hard to monitor progress.

- In India, too, significant gaps in data on the girl child prevent a systematic longitudinal assessment of the lives of girls.

- Impact of Covid-19: Owing to Covid-19, global female employment is 19% more at risk than male employment (ILO estimates).

Way Forward

- Work opportunities for women are restricted to a few sectors. Policies are needed to promote access to employment across the spectrum of sectors and occupations, investments in diversified sectors and upgrade to high-end activities, particularly in rural and semi-urban areas along with infrastructural support like transport, housing, sanitation facilities, lights and so on.

- Encouraging female entrepreneurship can promote a broader dynamic economy, elevate the economic role of women, and therefore distribute the benefits of growth more equitably.

World’s First Genetically Modified Rubber: Assam

Why in News

Recently, the world's first Genetically Modified (GM) rubber plant developed by Rubber Research Institute was planted in Assam.

- The rubber plant is the first of its kind developed exclusively for this region, and is expected to grow well under the climatic conditions of the mountainous northeastern region.

Rubber Board

- It is headquartered at Kottayam, Kerala, under the administration of the Ministry of Commerce and Industry.

- The Board is responsible for the development of the rubber industry in the country by assisting and encouraging research, development, extension and training activities related to rubber.

- Rubber Research Institute is under the Rubber Board.

Key Points

- About the GM Rubber:

- Genetic modification (GM) technology allows the transfer of genes for specific traits between species using laboratory techniques.

- The GM rubber has additional copies of the gene MnSOD, or manganese-containing superoxide dismutase, inserted in the plant, which is expected to tide over the severe cold conditions during winter in the northeast.

- The MnSOD gene has the ability to protect plants from the adverse effects of severe environmental stresses such as cold and drought.

- Need:

- Natural rubber is a native of warm humid Amazon forests and is not naturally suited for the colder conditions in the Northeast, which is one of the largest producers of rubber in India.

- Growth of young rubber plants remains suspended during the winter months, which are also characterised by progressive drying of the soil. This is the reason for the long immaturity period of this crop in the region.

- Natural Rubber:

- Commercial Plantation Crop: Rubber is made from the latex of a tree called Hevea Brasiliensis. Rubber is largely perceived as a strategic industrial raw material and accorded special status globally for defence, national security and industrial development.

- Conditions for Growth: It is an equatorial crop, but under special conditions, it is also grown in tropical and sub-tropical areas.

- Temperature: Above 25°C with moist and humid climate.

- Rainfall: More than 200 cm.

- Soil Type: Rich well drained alluvial soil.

- Cheap and adequate supply of skilled labour is needed for this plantation crop.

- Indian Scenario:

- The British established the first rubber plantation in India in 1902 on the banks of the river Periyar in Kerala.

- India is currently the sixth largest producer of NR in the world with one of the highest productivity (694,000 tonnes in 2017-18).

- Top Rubber Producing States: Kerala > Tamil Nadu > Karnataka.

- Government Initiatives: Rubber Plantation Development Scheme and Rubber Group Planting Scheme are examples of government led initiatives for rubber.

- 100% Foreign Direct Investment (FDI) in plantations of rubber, coffee, tea, cardamom, palm oil tree and olive oil tree.

- Major Producers Globally: Thailand, Indonesia, Malaysia, Vietnam, China and India.

- Major Consumers: China, India, USA, Japan, Thailand, Indonesia and Malaysia.

- India’s National Rubber Policy:

- The Department of Commerce brought out the National Rubber Policy in March 2019.

- The policy includes several provisions to support the Natural Rubber (NR) production sector and the entire rubber industry value chain.

- It covers new planting and replanting of rubber, support for growers, processing and marketing of natural rubber, labour shortage, grower forums, external trade, Centre-State integrated strategies, research, training, rubber product manufacturing and export, climate change concerns and carbon market.

- It is based on the short term and long term strategies identified by the Task Force constituted on the rubber sector for mitigating problems faced by rubber growers in the country.

- Developmental and research activities for supporting the NR sector for the welfare of growers are carried out through Rubber Board by implementing the scheme Sustainable and Inclusive Development of Natural Rubber Sector in the Medium Term Framework (MTF) (2017-18 to 2019-20).

- The developmental activities include financial and technical assistance for planting, supply of quality planting materials, support for grower forums, training and skill development programme.

Special Purpose Vehicle for Mission Karmayogi

Why in News

Recently, a three-member task force has been formed to help the government in bringing major bureaucratic reforms through its ambitious “Mission Karmayogi”.

Key Points

- About:

- The Centre has recently approved the ‘National Programme for Civil Services Capacity Building – Mission Karmayogi’ to effect a transformational shift from rule based training to role-based capacity development of all civil services in the country.

- The Programme also aims to enhance citizen experience for government services and improve availability of competent workforce.

- To effectively roll out this competency driven mission, a Special Purpose Vehicle (SPV), namely ‘Karmayogi Bharat’, would be set up as a not-for-profit company.

- It will be set up under section 8 of Companies Act, 2013 as a 100% government-owned entity.

- The SPV will be responsible to deliver and manage design, implement, enhance and manage a digital platform and infrastructure, manage and deliver competency assessment services, and manage governance of telemetry data and ensure provision of monitoring and evaluation.

- The task force shall submit its recommendations on organisational structure for the SPV aligning its vision, mission and functions.

- The Centre has recently approved the ‘National Programme for Civil Services Capacity Building – Mission Karmayogi’ to effect a transformational shift from rule based training to role-based capacity development of all civil services in the country.

- About Mission Karmayogi:

- Aim and Objectives:

- It is aimed at building a future-ready civil service with the right attitude, skills and knowledge, aligned to the vision of New India.

- It aims to prepare Indian civil servants for the future by making them more creative, constructive, imaginative, proactive, innovative, progressive, professional, energetic, transparent, and technology-enabled.

- Reason for Mission:

- At present bureaucracy is facing challenges like- Rule orientation, political interference, inefficiency with promotions, and generalist and specialist conflict.

- To change the status quo of civil services and bring about the long pending civil services reforms.

- Features of the scheme:

- Tech-Aided: The capacity building will be delivered through iGOT Karmayogi digital platform, with content drawn from global best practices.

- Coverage: The scheme will cover 46 lakh central government employees, at all levels, and involve an outlay of Rs. 510 crores over a five-year period.

- Shift from Rules to Roles: The programme will support a transition from “rules-based to roles-based” Human Resource Management (HRM) so that work allocations can be done by matching an official’s competencies to the requirements of the post.

- Integrated Initiative: Eventually, service matters such as confirmation after probation period, deployment, work assignments and notification of vacancies will all be integrated into the proposed framework.

- Aim and Objectives:

- Other Bureaucratic Reforms:

- The Government has ended the hegemony of the Indian Administrative Service (IAS), the apex bureaucratic cadre, with respect to appointments at the level of joint secretary (JS).

- Instead, appointments to posts have been drawn from other cadres also like the Indian Revenue Service, Indian Accounts and Audit Service and the Indian Economic Service.

- Similarly, the Union government has also encouraged lateral induction of personnel from the private sector.

- The Government has ended the hegemony of the Indian Administrative Service (IAS), the apex bureaucratic cadre, with respect to appointments at the level of joint secretary (JS).

RBI’s Proposals for Microfinance Institutions

Why in News

Recently, the Reserve Bank of India (RBI) proposed to lift the interest rate cap on Microfinance Institutions (MFIs), and said all micro loans should be regulated by a common set of guidelines irrespective of who gives them.

Key Points.png)

- Proposals:

- RBI has suggested a common definition of microfinance loans for all regulated entities.

- Microfinance loans should mean collateral-free loans to households with annual household income of Rs 1,25,000 and Rs 2,00,000 for rural and urban/semi urban areas, respectively.

- For this purpose, ‘household’ means a group of persons normally living together and taking food from a common kitchen.

- RBI has mooted capping the payment of interest and repayment of principal for all outstanding loan obligations of the household as a percentage of the household income, subject to a limit of maximum 50%.

- Non-banking Financial Company (NBFC)-MFIs, like any other NBFC, shall be guided by a board-approved policy and the fair practices code, whereby disclosure and transparency would be ensured.

- There would be no ceiling prescribed for the interest rate. There would be no collateral allowed for micro loans.

- There can be no prepayment penalty, while all entities have to permit the borrowers to repay weekly, fortnightly or monthly instalments as per their choice.

- Significance of Proposal:

- RBI has reposed faith in the maturity of the microfinance sector with this step.

- This is a forward-looking step where the responsibility is of the institution to fix a reasonable interest rate on transparent terms.

- MicroFinance Institution (MFI):

- Microfinance is a form of financial service which provides small loans and other financial services to poor and low-income households.

- Indian microfinance sector has witnessed phenomenal growth over the past two decades in terms of increase in both the number of institutions providing microfinance and the quantum of credit made available to the microfinance customers.

- Microcredit is delivered through a variety of institutional channels viz.,

- Scheduled commercial banks (SCBs) (including small finance banks (SFBs) and regional rural banks (RRBs))

- Cooperative banks,

- Non-banking financial companies (NBFCs)

- Microfinance institutions (MFIs) registered as NBFCs as well as in other forms.

- MFIs are financial companies that provide small loans to people who do not have any access to banking facilities.

- The definition of “small loans” varies between countries. In India, all loans that are below Rs. 1 lakh can be considered as microloans.

- Significance:

- It is an economic tool designed to promote financial inclusion which enables the poor and low-income households to come out of poverty, increase their income levels and improve overall living standards.

- It can facilitate achievement of national policies that target poverty reduction, women empowerment, assistance to vulnerable groups, and improvement in the standards of living.

Non-Banking Financial Company-Micro Finance Institution

- The NBFC-MFI is a non-deposit taking financial company.

- Conditions to qualify as NBFC-MFI:

- Minimum Net Owned Funds (NOF) of Rs. 5 crore.

- At least 85% of its Net Assets in the nature of Qualifying Assets.

- The Qualifying Assets are those assets which have a substantial period of time to be ready for its intended use or sale.

- The difference between an NBFC-MFI and other NBFC is that while other NBFCs can operate at a very high level, MFIs cater to only the smaller level of social strata, with need of smaller amounts as loans.

National Maritime Heritage Complex: Lothal

Why in News

The Ministry of Culture (MoC) and Ministry of Ports, Shipping and Waterways (MoPSW) signed a Memorandum of Understanding (MoU) for ‘Cooperation in Development of National Maritime Heritage Complex (NMHC)’ at Lothal, Gujarat.

Key Points

- About:

- NMHC will be developed in Lothal region of Gujarat.

- It would be developed as an international tourist destination, where the maritime heritage of India from ancient to modern times would be showcased.

- The idea is to create an edutainment (education with entertainment) approach for this destination that would be of great interest for the visitors.

- It is going to cover an area of 400 acres, with structures such as Heritage Theme Park, National Maritime Heritage Museum, Lighthouse Museum, Maritime Institute, eco-resorts, and more.

- There will also be many pavilions where all coastal states in India and union territories can showcase their artifacts and maritime heritage.

- The unique feature of NMHC is the recreation of ancient Lothal city, which is one of the prominent cities of the ancient Indus valley civilization.

- About Lothal:

- Lothal was one of the southernmost cities of the ancient Indus Valley Civilization located in Gujarat.

- Construction of the city began around 2400 BCE.

- According to the Archaeological Survey of India (ASI), Lothal had the world’s earliest known dock, which connected the city to an ancient course of the Sabarmati river on the trade route between Harappan cities in Sindh and the peninsula of Saurashtra.

- Lothal was a vital and thriving trade Centre in ancient times, with its trade of beads, gems, and valuable ornaments reaching the far corners of West Asia and Africa.

- The techniques and tools they pioneered for bead-making and in metallurgy have stood the test of time for over 4000 years.

- The Lothal site has been nominated as a UNESCO World Heritage Site, and its application is pending on the tentative list of UNESCO.

Indus Valley Civilization

- Also known as Harappan Civilization that flourished around 2,500 BC, in the western part of South Asia, in contemporary Pakistan and Western India.

- It was home to the largest of the four ancient urban civilizations of Egypt, Mesopotamia, India and China.

- It was basically an urban civilization and the people lived in well-planned and well-built towns, which were also the centers for trade.

- They had wide roads and a well-developed drainage system.

- The houses were made of baked bricks and had two or more storeys.

- The highly civilized Harappans knew the art of growing cereals, and wheat and barley constituted their staple food.

- By 1500 BC, the Harappan culture came to an end. Among various causes ascribed to the decay of Indus Valley Civilization are the recurrent floods and other natural causes like earthquakes, etc.

Peter Pan Syndrome

Why in News

Recently, a special court in Mumbai granted bail to an accused of sexually assaulting a minor as he was suffering from Peter Pan Syndrome (PPS).

- A syndrome is a combination of symptoms and signs that together represent a disease process.

Key Points

- About:

- PPS is a psychological condition that is used to describe an adult who is socially immature.

- People who develop similar behaviours of living life carefree, finding responsibilities challenging in adulthood, and basically never growing up suffer from PPS.

- The term was coined by psychologist Dan Kiley to explain the behaviour of such men who ‘refuse to grow’ and behave their age in 1983.

- Dan Kiley got the idea of PPS after noticing Peter Pan, a fictional character created by Scottish novelist James Matthew Barrie.

- Peter Pan was a care-free young boy, who never grew up.

- While the WHO (World Health Organization) does not recognise Peter Pan Syndrome as a health disorder, many experts believe it is a mental health condition that can affect one’s quality of life.

- Symptoms:

- PPS hasn’t officially been diagnosed as a health disorder, there are no clearly-defined symptoms or characteristics or even reasons which cause it.

- However, it could affect one’s daily routine, relationships, work ethic, and result in attitudinal changes.

- People Affected:

- It can affect anyone, irrespective of gender, race or culture. However, it appears to be more common among men.

- It affects people who do not want or feel unable to grow up, people with the body of an adult but the mind of a child.

- They don’t know how to or don’t want to stop being children and start being mothers or fathers.

- It is not currently considered a psychopathology. However, a large number of adults are presenting emotionally immature behaviors in Western society.

- Psychopathology is a term which refers to either the study of mental illness or mental distress or the manifestation of behaviours and experiences which may be indicative of mental illness or psychological impairment.

Wendy Syndrome

- The Psychologist who defined PPS also used the term Wendy Syndrome (WS) to describe women who act like mothers with their partners or people close to them.

- People suffering from WS are often seen making decisions, tidying up messes, and offering one-sided emotional support.