Science & Technology

25th Anniversary of Pokhran-II

For Prelims: Pokhran-I, Pokhran-II, Non-Proliferation Treaty (NPT), National Technology Day, no first use policy

For Mains: Significance of Pokhran-II in shaping India's nuclear capabilities, India's nuclear doctrine and its implications for national security.

Why in News?

India recently celebrated the 25th anniversary of Pokhran-II on 11th May 2023 marking the successful nuclear bomb test explosions which became a significant milestone in its journey to become a nuclear power.

- May 11 is also celebrated as the National Technology Day to honour Indian scientists, engineers and technologists, who worked for the country's scientific and technological advancement and ensured the successful conduct of Pokhran tests.

What is Pokhran-II and India’s Journey as a Nuclear Power?

- Origin:

- In 1945, renowned physicist Homi J. Bhaba lobbied for the establishment of the Tata Institute of Fundamental Research (TIFR) in Bombay, dedicated to nuclear physics research.

- TIFR became India’s first research institution dedicated to the study of nuclear physics.

- Post-independence, Bhaba convinced the then PM Jawaharlal Nehru about the importance of nuclear energy and in 1954, the Department of Atomic Energy (DAE) was founded, with Bhabha as the director.

- The DAE operated autonomously, away from significant public scrutiny.

- In 1945, renowned physicist Homi J. Bhaba lobbied for the establishment of the Tata Institute of Fundamental Research (TIFR) in Bombay, dedicated to nuclear physics research.

- Reasons for India's Pursuit of Nuclear Weapons:

- India's pursuit of nuclear weapons was motivated by concerns over its sovereignty and security threats from China and Pakistan.

- The 1962 Sino-Indian War and China's nuclear test in 1964 heightened the need for India to safeguard its national security.

- The war with Pakistan in 1965, with Chinese support, further emphasized the need for self-sufficiency in defense capabilities.

- Pokhran- I:

- About:

- By the 1970s, India was capable of conducting a nuclear bomb test.

- Pokhran-I was India's first nuclear bomb test conducted on May 18, 1974, at the Pokhran Test Range in Rajasthan.

- It was code-named Smiling Buddha and officially described as a "peaceful nuclear explosion" with “few military implications”.

- India became the 6th country in the world to possess nuclear weapons capability after the US, Soviet Union, Britain, France and China.

- By the 1970s, India was capable of conducting a nuclear bomb test.

- Implications of Test:

- The tests faced near-universal condemnation and significant sanctions especially from US and Canada.

- It hindered India's progress in nuclear technology and slowed down its nuclear journey.

- Domestic political instability, such as the Emergency of 1975 and opposition to nuclear weapons also hindered progress.

- The tests faced near-universal condemnation and significant sanctions especially from US and Canada.

- After Pokhran-I:

- The 1980s saw a resurgence of interest in nuclear weapons development due to Pakistan's progress.

- India increased funding for its missile program and expanded its plutonium stockpiles.

- About:

- Pokhran-II:

- About:

- Pokhran-II refers to a sequence of five nuclear bomb test explosions conducted by India on between 11-13th May 1998 at Rajasthan's Pokhran desert.

- Code name - Operation Shakti, this event marked India's 2nd successful attempt.

- Significance:

- Pokhran-II cemented India's status as a nuclear power.

- It demonstrated India's ability to possess and deploy nuclear weapons, thus enhancing its deterrence capabilities.

- The Indian government led by Prime Minister Atal Bihari Vajpayee officially declared itself as a state possessing nuclear weapons following Pokhran-II.

- Implication:

- While the tests in 1998 also invited sanctions from some countries (like the US), the condemnation was far from universal like in 1974.

- In context of India’s fast-growing economy and market potential, India was able to stand its ground and thus cement its status as a dominant nation state.

- About:

- India's Nuclear Doctrine:

- India adopted a policy of credible minimum deterrence, stating that it would maintain a sufficient nuclear arsenal for deterrence purposes but would not engage in an arms race.

- In 2003, India officially came out with its nuclear doctrine that clearly elaborated on the 'no first use' policy.

- India's Current Nuclear Capability:

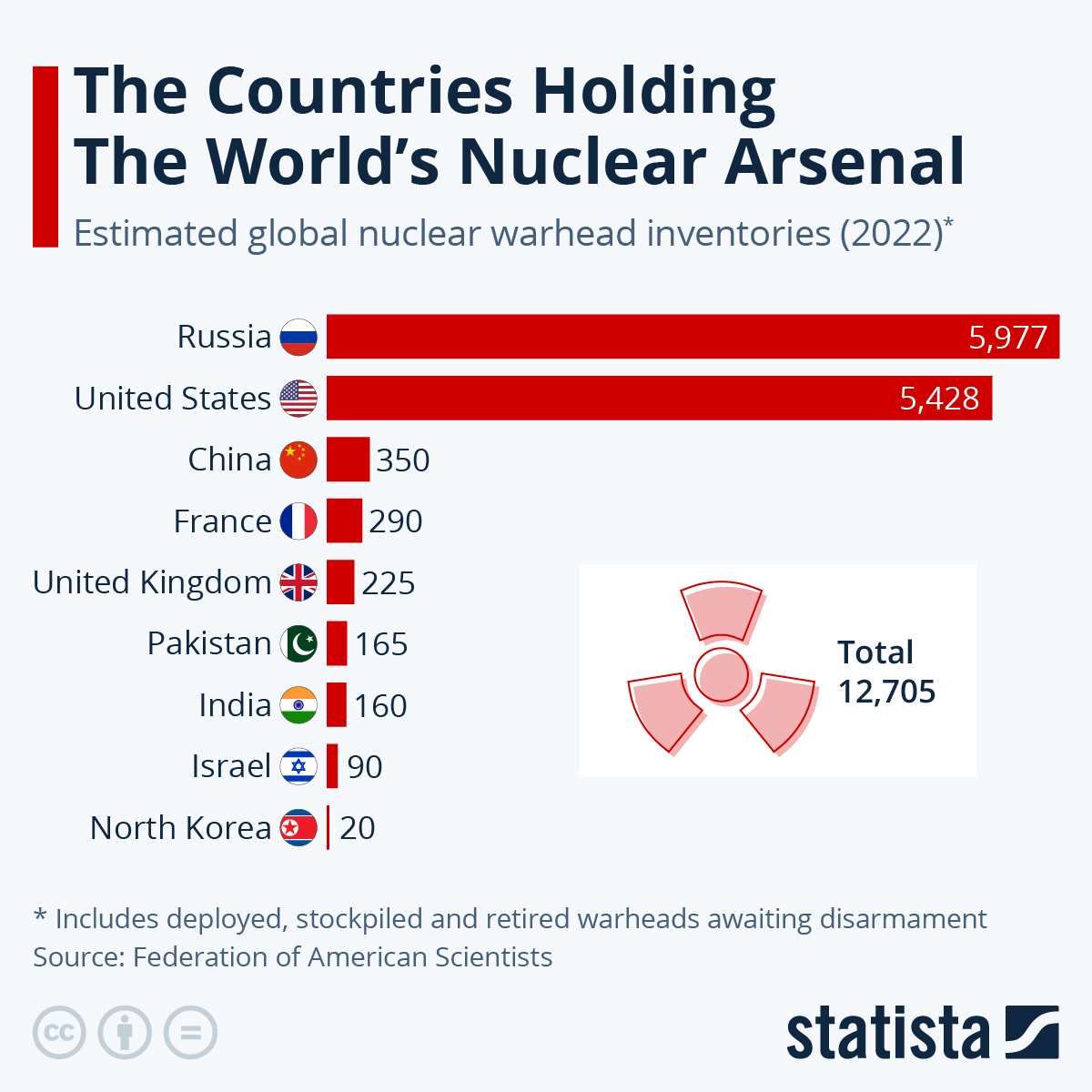

- India currently possesses approximately 160 nuclear warheads, according to the Federation of American Scientists (FAS).

- India has achieved an operational nuclear triad capability, allowing for the launch of nuclear weapons from land, air, and sea.

- The triad delivery systems include Agni, Prithvi, and K series ballistic missiles, fighter aircraft, and nuclear submarines.

What is India's Status on Various International Treaties about Nuclear Weapons?

- Non-Proliferation Treaty (NPT) 1968:

- India is not a signatory; it declined to accede to the NPT, citing concerns about the treaty's perceived discriminatory nature and lack of reciprocal obligations from nuclear weapons states.

- Comprehensive Nuclear-Test-Ban Treaty (CTBT):

- India has not signed the CTBT as it is a strong advocate for a time-bound disarmament commitment from nuclear weapon states (NWS) and may use the lack of a commitment as a reason to refrain from signing the CTBT.

- The Treaty on the Prohibition of Nuclear Weapons (TPNW):

- It entered into force on 22 January 2021 and India is not a member of this treaty.

- Nuclear Suppliers Group(NSG):

- India is not a member of the NSG.

- Wassenaar Arrangement:

- India joined the arrangement on December 2017 as its 42nd participating state.

UPSC Civil Services Examination Previous Year’s Question (PYQs)

Prelims

Q1. Consider the following countries: (2015)

- China.

- France

- India

- Israel

- Pakistan

Which among the above are Nuclear Weapons States as recognized by the Treaty on the Non-Proliferation of Nuclear Weapons, commonly known as Nuclear Non-Proliferation Treaty (NPT)?

(a) 1 and 2 only

(b) 1, 3, 4 and 5 only

(c) 2, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (a)

Q2. What is/are the consequence/consequences of a country becoming the member of the ‘Nuclear Suppliers Group’? (2018)

1. It will have access to the latest and most efficient nuclear technologies.

2. It automatically becomes a member of “The Treaty on the Non-Proliferation of Nuclear Weapons (NPT)”.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Mains

Q. With growing energy needs should India keep on expanding its nuclear energy programme? Discuss the facts and fears associated with nuclear energy. (2018)

Q. Give an account of the growth and development of nuclear science and technology in India. What is the advantage of fast breeder reactor programme in India? (2017)

Indian Economy

International Credit Card Spending Outside India under LRS

For Prelims: FEMA, Tax Collected at Source, Reserve Bank of India, Liberalised Remittance Scheme (LRS).

For Mains: Significance of Liberalised Remittance Scheme, FEMA

Why in News?

Recently, the Finance Ministry of India, in consultation with the Reserve Bank of India (RBI), has made significant amendments to the Foreign Exchange Management Act (FEMA), bringing international credit card spending outside India under the Liberalised Remittance Scheme (LRS).

- This comes in the backdrop of a surge in spending in overseas travel. Indians spent 12.51 billion USD on overseas travel between April-February of fiscal 2022-23, a rise of 104% compared to the same period of the last year.

- The inclusion enables the levy of the higher rate of Tax Collected at Source (TCS) as announced in the Budget for 2022-23 effective from 1stJuly 2023.

What are the Key Details and Implications?

- Inclusion of International Credit Card Spend in LRS:

- The amendment is expected to facilitate the monitoring of high-value overseas transactions but does not apply to payments for purchasing foreign goods/services from India.

- Omission of Rule 7 and Expansion of LRS:

- Previously, the usage of international credit cards for expenses during trips abroad was not covered under LRS.

- Rule 7 of the Foreign Exchange Management (Current Account Transaction) Rules, 2000, which excluded such spendings from LRS, has been omitted.

- This amendment allows international credit card transactions to be included in determining the overall LRS limit of 250,000 USD per person per financial year.

- Tax Implications:

- A TCS levy of 5% will be applicable on such transactions until 1stJuly 2023 (except for medical and education-linked sectors).

- After 1 stJuly 2023, the TCS rate will increase to 20% for credit card spends outside India.

- The new provisions will not apply on payments for 'education' and 'medical' purposes and do not impact changes in the use of international credit cards by residents while in India.

- The mechanism for levying TCS on overseas credit card spends is yet to be made functional, which poses compliance challenges for banks and financial institutions.

- Impact on Compliance and Refunds:

- Banks and financial institutions may experience an increased compliance burden due to these changes.

- Taxpayers can claim refunds on the TCS levy while filing tax returns, which could result in locked funds until refunds are initiated by the tax department.

What is Liberalised Remittance Scheme?

- About:

- This is the scheme of the Reserve Bank of India, introduced in the year 2004.

- Under the scheme, all resident individuals, including minors, are allowed to freely remit up to USD 2,50,000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both.

- Not Eligible:

- The Scheme is not available to corporations, partnership firms, Hindu Undivided Family (HUF), Trusts etc.

- Though there are no restrictions on the frequency of remittances under LRS, once a remittance is made for an amount up to USD 2,50,000 during the financial year, a resident individual would not be eligible to make any further remittances under this scheme.

- Remitted Money can be used for:

- Expenses related to travelling (private or for business), medical treatment, study, gifts and donations, maintenance of close relatives and so on.

- Investment in shares, debt instruments, and buy immovable properties in the overseas market.

- Individuals can also open, maintain and hold foreign currency accounts with banks outside India for carrying out transactions permitted under the scheme.

- Prohibited Transactions:

- Any purpose specifically prohibited under Schedule-I (like the purchase of lottery tickets, proscribed magazines, etc.) or any item restricted under Schedule II of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

- Trading in foreign exchange abroad.

- Capital account remittances, directly or indirectly, to countries identified by the Financial Action Task Force (FATF) as “non- cooperative countries and territories”, from time to time.

- Remittances directly or indirectly to those individuals and entities identified as posing a significant risk of committing acts of terrorism as advised separately by the Reserve Bank to the banks.

- Requirements:

- It is mandatory for the resident individual to provide his/her Permanent Account Number (PAN) for all transactions under LRS made through Authorized Persons.

What is Tax Collected at Source?

- TCS is the tax payable by a seller, which he collects from the buyer at the time of sale of certain goods or services.

- TCS is governed by Section 206C of the Income-tax Act, which specifies the goods or services on which TCS is applicable and the rates of TCS.

- Some of the goods or services on which TCS is applicable are liquor, timber, tendu leaves, scrap, minerals, motor vehicles, parking lot, toll plaza, mining and quarrying, foreign remittance under LRS, etc.

- The seller must have a Tax Collection Account Number (TAN) to collect and deposit TCS with the tax authorities.

- The seller must issue a TCS certificate to the buyer within a specified time limit, showing the amount of tax collected and deposited.

- The buyer can claim credit for the amount of TCS deducted from his income while filing his income tax return.

What is Foreign Exchange Management Act, 1999?

- The legal framework for the administration of foreign exchange transactions in India is provided by the Foreign Exchange Management Act, 1999.

- Under the FEMA, which came into force with effect from 1st June 2000, all transactions involving foreign exchange have been classified either as capital or current account transactions.

- Current Account Transactions:

- All transactions undertaken by a resident that do not alter his / her assets or liabilities, including contingent liabilities, outside India are current account transactions.

- Example: payment in connection with foreign trade, expenses in connection with foreign travel, education etc.

- Capital Account Transactions:

- It includes those transactions which are undertaken by a resident of India such that his/her assets or liabilities outside India are altered (either increased or decreased).

- Example: investment in foreign securities, acquisition of immovable property outside India etc.

- Current Account Transactions:

Governance

India’s Pharmaceutical Industry

For Prelims: India's pharmaceutical industry, World Health Organization (WHO), Central Drugs Standard Control Organisation (CDSCO), Intellectual Property Rights (IPR) laws, Production Linked Incentive (PLI) Scheme.

For Mains: Status of India's Pharmaceutical Industry, Major Challenges with India’s Pharma Sector.

Why in News?

India's pharmaceutical industry, renowned as the largest manufacturer of generic medicines globally, has faced significant challenges related to product quality and safety.

- Recent incidents of contaminated medicines and substandard drugs have raised concerns about the regulatory framework and the industry's commitment to ensuring high-quality pharmaceutical products.

What are the Incidents Highlighting Quality Control Failures?

- In January 2020, 12 children in Jammu died after consuming contaminated medicine, that was found to contain diethylene glycol, which led to kidney poisoning.

- In March 2021, Nycup syrup was found to have lower levels of active ingredients.

- In October 2022, the World Health Organization (WHO) released a medical product alert, which are said to be linked to acute kidney injury in children and 66 deaths in the small West African nation of Gambia.

- Four products from India-based Maiden Pharmaceuticals had been found to be contaminated with unacceptable amounts of diethylene glycol and ethylene glycol, both toxic to humans.

- In December 2022, the Central Drugs Standard Control Organisation (CDSCO) initiated a probe in connection with the death of 18 children in Uzbekistan allegedly linked to a cough syrup manufactured by Indian firm Marion Biotech.

- Recently, US Centers for Disease Control and Prevention (CDC) and the Food and Drug Administration (USFDA) raised concerns over a drug-resistant bacteria strain allegedly linked to eye drops imported from India.

- Recent regulatory inspections revealed that 48 drugs failed to meet quality standards.

- 3% of drugs used for common conditions like hypertension, allergies, and bacterial infections were found to be substandard.

What is the Status of India's Pharmaceutical Industry?

- About:

- India is the largest manufacturer of generic medicines globally. Its pharmaceutical industry plays a crucial role in global healthcare, providing affordable generic medicines that impact the lives of the global poor.

- It is currently valued at USD 50 Bn being a major exporter of Pharmaceuticals, with over 200+ countries served by Indian pharma exports.

- It is expected to reach USD 65 Bn by 2024 and to USD 130 Bn by 2030.

- Major Challenges with India’s Pharma Sector:

- Violation of IPR Rules:

- Indian pharmaceutical companies have faced allegations of violating Intellectual Property Rights (IPR) laws, resulting in legal disputes with multinational pharmaceutical companies.

- One such case involved Swiss pharmaceutical company Roche and Indian drug manufacturer Cipla in 2014.

- Roche accused Cipla of infringing on its patent for the cancer drug Tarceva by producing a generic version of the drug. The dispute escalated, leading to a court battle between the two companies.

- In 2016, the Delhi HC ruled in favor of Roche, affirming that Cipla had indeed violated Roche's patent rights. As a consequence, Cipla was ordered to pay damages to Roche.

- Pricing and Affordability: India is known for its generic drug manufacturing capabilities, which have contributed to affordable healthcare globally.

- However, the pricing of pharmaceuticals within India remains a significant concern. Balancing the need for affordable medicines with the profitability of pharmaceutical companies is a delicate task.

- Healthcare Infrastructure and Access: Despite India's strong pharmaceutical industry, access to healthcare remains a challenge for a significant portion of the population.

- Issues such as inadequate healthcare infrastructure, uneven distribution of healthcare facilities, and low health insurance coverage pose barriers to accessing medicines.

- Violation of IPR Rules:

- Related Government Initiatives:

What Steps Can be Taken to Reform India’s Pharma Sector?

- Legislative Changes and Centralised Database:

- Drugs and Cosmetics Act (1940) needs to be amended and the establishment of a centralised drugs database can enhance surveillance and ensure effective regulation across all manufacturers.

- India has 36 regional drug regulators; consolidating them into a single entity can reduce the risk of regulatory capture and influence networks.

- Also, implementing common quality standards across all states is necessary to ensure consistent product quality.

- Encouraging Certification:

- Encouraging more pharmaceutical manufacturing units to obtain WHO's Good Manufacturing Practice certification can elevate industry-wide quality standards.

- Transparency, Credibility, and Accountability:

- The regulator and the industry must collaborate to enhance India's drug regulatory regime, making it transparent, credible, and aligned with global standards.

- Public disclosure of drug application reviews and inspection records, violation history can ensure accountability.

- The cancellation of manufacturing licences for 18 pharma companies by the Drugs Controller General of India (DGCI) is a positive step.

- However, more comprehensive measures are required to address the root causes of quality issues.

- The regulator and the industry must collaborate to enhance India's drug regulatory regime, making it transparent, credible, and aligned with global standards.

- Focus on Sustainable Manufacturing Practices:

- Emphasising sustainable manufacturing practices, including green chemistry, waste reduction, and energy efficiency, can enhance the sector's environmental sustainability while reducing costs.

- Adopting environmentally friendly practices can also contribute to a positive brand image and attract environmentally conscious consumers.

- Emphasising sustainable manufacturing practices, including green chemistry, waste reduction, and energy efficiency, can enhance the sector's environmental sustainability while reducing costs.

UPSC Civil Services Examination, Previous Year Question (PYQ):

Mains:

Q. How is the Government of India protecting traditional knowledge of medicine from patenting by pharmaceutical companies? (2019)

Social Justice

Self Help Group Kudumbashree

For Prelims: Self Help Group, Kudumbashree, Poverty Eradication, NABARD, Local Self Governemtns, Ujjawala Yojna.

For Mains: Role of Self-Help group in Women Empowerment and Poverty Alleviation.

Why in News?

Recently, the President of India has inaugurated the 25th anniversary celebrations of Kudumbashree, the largest Self-Help Group (SHG) network in the country.

- The president also released a handbook called "chuvadu" (meaning footsteps) that outlined ideas for the future of the movement and highlighted its achievements so far.

What is Kudumbashree?

- About:

- Kudumbashree was established in 1997 in Kerala, aiming at eradicating poverty and empowering women following the recommendations of a government-appointed task force.

- The mission was launched with the support of the Government of India and NABARD (National Bank for Agriculture and Rural Development).

- Kudumbashree meaning 'prosperity of the family' in the Malayalam language and therefore focuses on poverty alleviation and women empowerment, promoting democratic leadership and provides support structures within the "Kudumbashree family."

- Kudumbashree was established in 1997 in Kerala, aiming at eradicating poverty and empowering women following the recommendations of a government-appointed task force.

- Operation: The mission operates through a Three-Tier structure consisting of,

- Neighbourhood Groups (NHGs) at the primary level

- Area Development Societies (ADS) at the ward level

- Community Development Societies (CDS) at the local government level.

- This structure forms a large network of Self-Help Groups.

- Goal:

- The goal of Kudumbashree is to eliminate absolute poverty within a specific timeframe of 10 years, with the active involvement of local self-governments.

- Through its mission and self-help group approach, Kudumbashree aims to uplift families and empower women to improve their socio-economic status and overall well-being.

- Significance:

- It has empowered women, generated employment, alleviated poverty, and initiated various social initiatives.

- It has become Kerala's biggest social capital, and its members have become elected representatives in local government bodies.

- During a severe flood that occurred in Kerala five years ago, Kudumbashree, the self-help group network, donated Rs 7 crore to the Chief Minister's distress relief fund.

- They contributed more money than tech giants like Google and Apple and even surpassed the contribution of the Bill and Melinda Gates Foundation.

- Many of the Kudumbashree workers themselves were victims of the flood, but they still wanted to help others by contributing to the relief fund.

What is a Self-Help Group?

- About:

- Self-Help Groups (SHGs) are informal associations of people who choose to come together to find ways to improve their living conditions.

- It can be defined as a self-governed, peer-controlled information group of people with similar socio-economic backgrounds and having a desire to collectively perform a common purpose.

- SHG relies on the notion of “Self Help” to encourage self-employment and poverty alleviation.

- Objectives:

- To build the functional capacity of the poor and the marginalized in the field of employment and income generating activities.

- To resolve conflicts through collective leadership and mutual discussion.

- To provide collateral free loan with terms decided by the group at the market driven rates.

- To work as a collective guarantee system for members who propose to borrow from organised sources.

- The poor collect their savings and save it in banks. In return they receive easy access to loans with a small rate of interest to start their micro unit enterprise.

What is the Role of SHGs in Women Empowerment and Fighting Poverty?

- Economic Empowerment:

- SHGs provide women in rural areas with an opportunity to create independent sources of income. Women can utilize their skills and talents to start their own businesses and become financially self-reliant.

- Access to capital through SHGs enables women to invest in their ventures and expand their economic activities.

- Overcoming Social Barriers:

- SHGs play a crucial role in challenging regressive social norms and empowering women to take on decision-making roles.

- Through participation in SHGs, women gain confidence, assertiveness, and leadership skills, which help them challenge gender stereotypes.

- Empowered women actively participate in local governance (e.g., gram sabha) and even contest elections.

- Improved Socio-economic Status:

- Formation of SHGs leads to a multiplier effect in improving women's status in society and within their families.

- Women experience enhanced socio-economic conditions, including better access to education, healthcare, and resources.

- SHGs contribute to women's self-esteem and confidence by providing them with a platform to voice their opinions and contribute to decision-making processes.

- Access to Financial Services:

- SHG-Bank linkage programs, pioneered by organizations like NABARD, facilitate easier access to credit for SHGs.

- Priority Sector Lending norms and assured returns incentivize banks to lend to SHGs.

- This reduces women's dependence on traditional moneylenders and non-institutional sources, leading to fairer and more affordable financial services.

- Alternative Employment Opportunities:

- SHGs provide support for setting up micro-enterprises, offering women alternatives to agriculture-based livelihoods.

- Women can establish personalized businesses such as tailoring, grocery shops, and repair services, diversifying their income sources.

What are the Initiatives Related to Women Empowerment and Poverty Alleviation?

- Ujjawala Yojna

- Swadhar Greh

- Pradhan Mantri Matru Vandana Yojana

- Pradhan Mantri Mahila Shakti Kendra Scheme

- Mahila e-haat

- Mahila Bank

- Mahila Coir Yojana

- Women Entrepreneurship Platform (WEP)

- Support to Training and Employment Programme for Women (STEP) Scheme

UPSC Civil Services Examination Previous Year’s Question (PYQs)

Q. Can the vicious cycle of gender inequality, poverty and malnutrition be broken through microfinancing of women SHGs? Explain with examples. (2021)

Governance

Supreme Court Upholds Laws Allowing Jallikattu

For Prelims: Jallikattu, SC, Prevention of Cruelty to Animals Act, 1960, Pongal

For Mains: Argument in Favour and Against Practicing Jallikattu.

Why in News?

Recently, the Supreme Court (SC) has upheld amendments made by Tamil Nadu, Karnataka and Maharashtra to the Prevention of Cruelty to Animals Act, 1960, to allow the traditional bull-taming sports of Jallikattu , Kambala (Karnataka) and bullock-cart racing.

- The case involves a challenge to the Tamil Nadu amendment allowing jallikattu, based on the argument that it goes against the central law prohibiting cruelty to animals.

What is the Court’s Judgement?

- The SC held that the state amendments (Prevention of Cruelty to Animals (Tamil Nadu Amendment) Act of 2017 and Prevention of Cruelty to Animals (Conduct of Jallikattu) Rules of 2017) did not violate the Constitution and the Supreme Court’s 2014 ruling banning Jallikattu.

- The court said the Amendment Act “substantially reduced pain and cruelty” to the participating animals.

- The judgment holds that the 2017 Amendment Act and Rules on Jallikattu are in time with Entry 17 (prevention of cruelty to animals) of the Concurrent List, Article 51A(g) (compassion to loving creatures) of the Constitution.

- The Supreme Court banned Jallikattu through a judgment in May 2014 in the Animal Welfare Board of India vs A. Nagaraja case on the grounds of cruelty to animals.

- The court said the Act was also not “relatable” to Article 48 of the Constitution which deals with the duty of the State to “organise agriculture and animal husbandry”.

- It also stated that any violation of the law in the name of cultural tradition would be punishable.

- The court decided that determining Jallikattu's cultural heritage status is best left to the State's legislative assembly and not a court of law.

What is Jallikattu?

- About:

- Jallikattu is a traditional sport that is popular in Tamil Nadu.

- The sport involves releasing a wild bull into a crowd of people, and the participants attempt to grab the bull's hump and ride it for as long as possible or attempt to bring it under control.

- It is celebrated in the month of January, during the Tamil harvest festival, Pongal.

- Arguments in Favour of Practice:

- Jallikattu is considered both a religious and cultural event in Tamil Nadu, celebrated by people regardless of their caste or creed.

- The State government argues that instead of completely banning this centuries-old practice, it can be regulated and reformed as society progresses.

- They believe that prohibiting jallikattu would be seen as an attack on the culture and sentiments of the community.

- The government asserts that jallikattu plays a role in conserving a valuable indigenous breed of livestock and that the event itself does not go against principles of compassion and humanity.

- They emphasize that the significance of jallikattu is being taught in high school curricula to ensure its preservation for future generations.

- Arguments in Opposition:

- It is argued that all living beings, including animals, possess inherent liberty, as recognized by the Constitution.

- Jallikattu has resulted in deaths and injuries to both humans and bulls in various districts of the State.

- It has been observed that tamers often act aggressively towards the bulls, causing them extreme cruelty.

- Critics compared jallikattu to practices like sati and dowry, which were once considered part of culture but were abolished through legislation.

Note: Kambala is a traditional buffalo race in paddy fields filled with slush and mud which generally takes place in coastal Karnataka (Udupi and Dakshina Kannada) from November to March.

What is the Prevention of Cruelty to Animals Act, 1960?

- The legislative intent of the Act is to “prevent the infliction of unnecessary pain or suffering on animals”.

- The Animal Welfare Board of India (AWBI) was established in 1962 under Section 4 of the Act.

- This Act provides for punishment for causing unnecessary cruelty and suffering to animals. The Act defines animals and different forms of animals.

- Discusses different forms of cruelty, exceptions, and killing of a suffering animal in case any cruelty has been committed against it, so as to relieve it from further suffering.

- Provides the guidelines relating to experimentation on animals for scientific purposes.

- The Act enshrines the provisions relating to the exhibition of the performing animals, and offences committed against the performing animals.

- This Act provides for the limitation period of 3 months beyond which no prosecution shall lie for any offences under this Act.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Consider the following statements: (2014)

- Animal Welfare Board of India is established under the Environment (Protection) Act, 1986.

- National Tiger Conservation Authority is a statutory body.

- National Ganga River Basin Authority is chaired by the Prime Minister.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 2 only

(d) 1, 2 and 3

Ans: (b)

Mains

Q. What are the challenges to our cultural practices in the name of Secularism? (2019)

Important Facts For Prelims

ECL Based Loan Loss Provisioning Framework

Why in News?

Lenders in India have approached the Reserve Bank of India (RBI) seeking a one-year extension for the implementation of the Expected Credit Loss (ECL)-based loan loss provisioning framework.

- Earlier in January 2023, the RBI came out with a draft guidelines proposing adoption of expected credit loss approach for credit impairment.

What is ECL-based Loan Loss Provisioning Framework?

- Background:

- The RBI had previously proposed the adoption of the ECL approach for credit impairment, and banks were given a one-year period for implementation once the final guidelines are released.

- While the final guidelines are yet to be announced, it is expected that they may be notified by FY2024 for implementation starting from April 1, 2025.

- The Indian Banks Association (IBA) has requested the RBI to grant an additional year for lenders to prepare for the implementation of the ECL norms.

- The RBI had previously proposed the adoption of the ECL approach for credit impairment, and banks were given a one-year period for implementation once the final guidelines are released.

- About ECL Framework:

- In the expected credit loss framework, banks are mandated to forecast anticipated credit losses through forward-looking estimations, rather than waiting for credit losses to materialise before making corresponding provisions for those losses.

- Banks will be required to classify financial assets (primarily loans, including irrevocable loan commitments, and investments classified as held-to-maturity or available-for-sale) into three categories: Stage 1, Stage 2, and Stage 3, based on the assessed credit losses at the time of recognition and subsequent reporting dates.

- Provisioning will be made accordingly for each category.

- Banks will be required to classify financial assets (primarily loans, including irrevocable loan commitments, and investments classified as held-to-maturity or available-for-sale) into three categories: Stage 1, Stage 2, and Stage 3, based on the assessed credit losses at the time of recognition and subsequent reporting dates.

- In the expected credit loss framework, banks are mandated to forecast anticipated credit losses through forward-looking estimations, rather than waiting for credit losses to materialise before making corresponding provisions for those losses.

- ECL vs IL Model:

- This new approach replaces the current "incurred loss (IL)" model, which delays loan loss provisioning, potentially increasing credit risk for banks.

- A key drawback in the IL model was that usually banks made provisions with a significant delay after the borrower may have started facing financial difficulties, thereby increasing their credit risk. This led to systemic issues.

- Furthermore, the delayed recognition of loan losses resulted in an overstatement of banks' income, combined with dividend payouts, which further eroded their capital base.

- Transitional Arrangement:

- To prevent a capital shock, the RBI has proposed a transitional arrangement for the introduction of ECL norms.

- This phased implementation will help banks absorb any additional provisions without adversely impacting their profitability.

- To prevent a capital shock, the RBI has proposed a transitional arrangement for the introduction of ECL norms.

What is Loan Loss Provisioning?

- It is a regulatory requirement enforced by the RBI, to ensure the financial stability of banks and protect the interests of depositors.

- It refers to the practice followed by banks and financial institutions to set aside a portion of their earnings as a provision to cover potential losses arising from non-performing assets (NPAs) or bad loans.

- RBI defines NPAs in India as any advance or loan that is overdue for more than 90 days.

- It helps banks to accurately reflect the true value of their loan portfolios and assess their overall risk exposure.

- Adequate provisioning also enhances the transparency of a bank's financial statements and provides a more accurate picture of its financial health to stakeholders.

What is the Indian Bank Association?

- Indian Bank Association (IBA) is a voluntary association of banks in India. It was formed on 26th September 1946 with the objective of promoting and coordinating the interests of the Indian banking industry.

- The members comprise of:

- Public Sector Banks.

- Private Sector Banks.

- Foreign Banks having offices in India.

- Co-operative Banks.

- Regional Rural Banks.

- All India Financial Institution.

Rapid Fire

Rapid Fire Current Affairs

Greater Flamingo

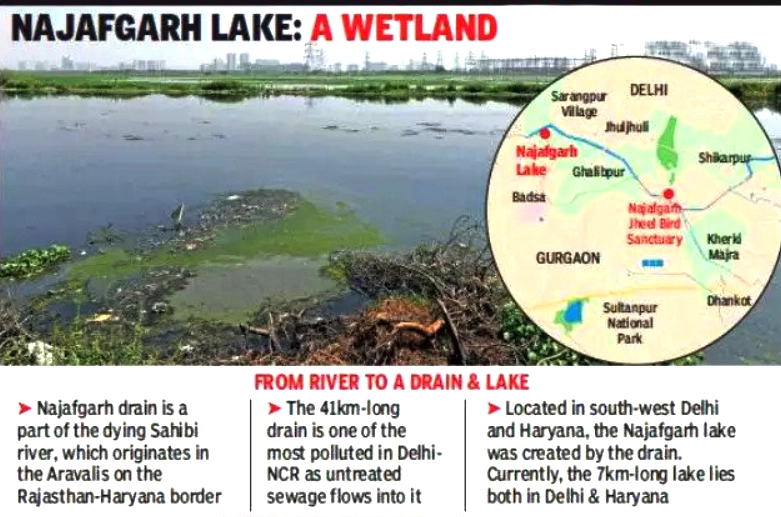

Recently, a greater flamingo was rescued from Najafgarh wetland, bordering Haryana.

Greater flamingo (Phoenicopterus roseus) is the state bird of Gujarat. They are found in the middle east, including Iran, Turkey, Dubai, Oman, and Afghanistan. They are also common in south and southwest Asia. They are mainly found in shallow waters of lagoons, lakes, estuaries, and muddy beaches. Of the six species of flamingos in the world, two are found in India: the tallest of them, the greater flamingo and the smallest one, the lesser flamingo (Phoeniconaias minor). They are taller, with black-tipped light pinkish beaks, yellowish eyes and pinkish-white body colour.

In the IUCN Red List of Threatened Species, they are categorized as "least concern (LC)".

Read More: Najafgarh wetland, Greater Flamingo

Production-Linked Incentive Scheme

The Indian government is offering a modified production-linked incentive (PLI) scheme for electric vehicles (EVs) and advanced chemistry cell batteries to attract investments from companies, including Tesla. This modification is not exclusive to Tesla but follows a similar approach taken with telecom products and IT Hardware PLI schemes. The finalization of the modified PLI scheme will determine the specifics of the incentives and structure for participating companies.

The PLI scheme is a crucial component of the 'AatmaNirbhar Bharat Abhiyan' (Self-Reliant India) initiative. It aims to boost domestic manufacturing and create global champions in strategic sectors. Under the scheme, companies receive incentives based on incremental sales from products manufactured in India compared to a base year. The PLI scheme also encourages foreign companies to establish manufacturing units in India. The Union Budget 2021-22 allocated INR 1.97 lakh crores for the PLI schemes, covering 14 sectors such as mobile manufacturing, medical devices, automobiles, pharmaceuticals, specialty steel, telecom products, electronic products, white goods, food products, textile products, solar PV modules, advanced chemistry cell batteries, and drones. These sectors were selected based on their potential for generating revenue and employment. The PLI scheme plays a vital role in transforming India into a global manufacturing hub and promoting self-reliance.

Read more: Enhanced Production Linked Incentive for IT Hardware

Link Between Climate & Covid-19

The World Meteorological Organisation (WMO) expert group concluded that cooler and drier climates may have facilitated Covid-19 transmission, but evidence does not support a significant role for weather conditions in the virus's spread.

The final report states that "high-quality" research studies show a negative association between temperature and Covid-19 transmission, suggesting that lower temperatures may promote the virus's spread. Similarly, humidity is also correlated with Covid-19 transmission, indicating that drier conditions likely facilitate transmission.

The WMO is an intergovernmental organization with a membership of 192 Member States and Territories. It originated from the International Meteorological Organization (IMO), which was established after the 1873 Vienna International Meteorological Congress. WMO is headquartered in Geneva, Switzerland. India is a member of WMO since 1949.

Read More: World Meterological Organisation (WMO), Covid-19 and India

Baobab Tree

The High Court of Madhya Pradesh has directed the state government to stop cutting down Baobab trees in the Dhar district of MP. This decision came after tribal communities protested against the removal of these trees.

The court has ordered the state to ensure that "not a single Baobab tree is cut for any purpose whatsoever by any authority until further orders of this court". The district has around 1,000 Baobabs, some of which are centuries old, and are of heritage and historical value. The trees have been placed under the Biological Diversity Act, 2002, meaning permission for commercial use must be taken from the state biodiversity board.

Baobabs are deciduous trees ranging in height from 5 to 20 meters. They are native to Africa but were likely brought to this corner by African soldiers between the 10th and 17th century. It is known as the ‘World Tree in Africa’. Baobab trees can live for more than a thousand years and provide food, livestock fodder, medicinal compounds, and raw materials.

Read More: Baobab Tree

Heatwaves

A study by the World Weather Attribution (WWA) found that the intense and humid heatwave that happened in April, impacting areas like east and north India, Bangladesh, Laos, and Thailand, was made much more likely by climate change. The chances of such a heatwave occurring increased by at least 30 times.

Humid heatwaves are analysed using the heat index which is a combination of heightened temperatures and relative humidity levels. It provides a better understanding of the impact of a heatwave on the human body.

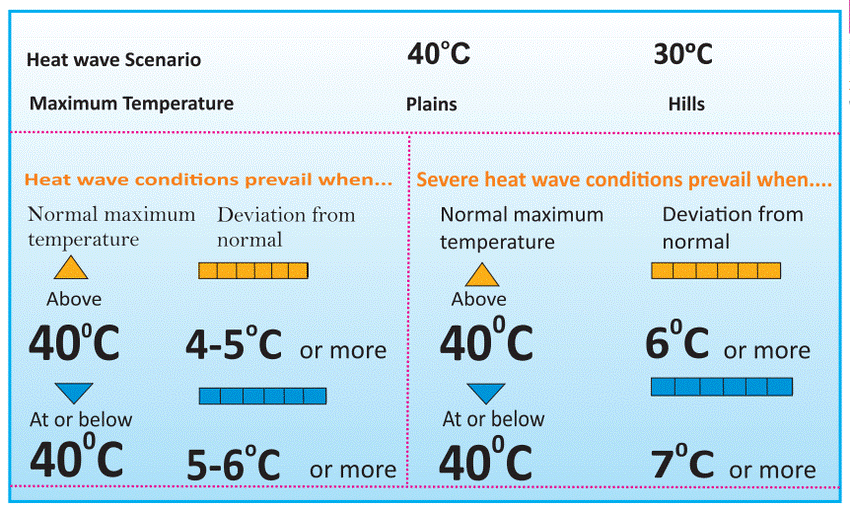

As per the Indian Meteorological Department (IMD) criteria, heatwave need not be considered till the maximum temperature of a station reaches at least 40°C for Plains and at-least 30°C for Hilly regions. If the normal maximum temperature of a station is less than or equal to 40°C, then an increase of 5°C to 6°C from the normal temperature is considered to be heat wave condition. Further, an increase of 7°C or more from the normal temperature is considered a severe heat wave condition.

WWA is a global association of climate scientists who study the role played by human-induced climate change in the occurrence, frequency and intensity of extreme weather events such as heatwaves, droughts, cold spells, extreme rainfall, floods and storms.

Read More: Climate Change, Heatwaves