Governance

Tax Devolution

For Prelims: Tax Devolution, Finance Commission, Article 280(3)(a), Million-Plus Cities Challenge Fund, Fiscal Federalism.

For Mains: Tax Devolution its significance and its Constitutional Mandates.

Why in News?

Recently, the Union government has released the 3rd Installment of Tax Devolution to state governments amounting to Rs 1,18,280 crore in June 2023, as against the normal monthly devolution of Rs 59,140 crore.

- It will enable states to speed up capital spending, finance their development/ welfare related expenditure and also to make available resources for priority projects/ schemes.

- Uttar Pradesh received the highest (Rs 21,218 crore) followed by Bihar (Rs 11,897 crore), Madhya Pradesh, West Bengal and Rajasthan.

What is Tax Devolution?

- About:

- Tax devolution refers to the distribution of tax revenues between the central government and the state governments. It is a constitutional mechanism established to allocate the proceeds of certain taxes among the Union and the states in a fair and equitable manner.

- Article 280(3)(a) of the Constitution of India mandates that the Finance Commission (FC) has the responsibility to make recommendations regarding the division of the net proceeds of taxes between the Union and the states.

- Key Recommendations of 15th Finance Commission:

- Share of States in Central Taxes (Vertical Devolution):

- The share of states in the central taxes for the 2021-26 period is recommended to be 41%, same as that for 2020-21.

- This is less than the 42% share recommended by the 14th Finance Commission for 2015-20 period.

- The adjustment of 1% is to provide for the newly formed union territories of Jammu and Kashmir, and Ladakh from the resources of the centre.

- The share of states in the central taxes for the 2021-26 period is recommended to be 41%, same as that for 2020-21.

- Horizontal Devolution (Allocation Between the States):

- For horizontal devolution, it has suggested 12.5% weightage to demographic performance, 45% to income, 15% each to population and area, 10% to forest and ecology and 2.5% to tax and fiscal efforts.

- Revenue Deficit Grants to States:

- Revenue Deficit is defined as the difference between revenue or current expenditure and revenue receipts, that includes tax and non-tax.

- It has recommended post-devolution revenue deficit grants amounting to about Rs. 3 trillion over the five-year period ending FY26.

- Performance Based Incentives and Grants to States: These grants revolve around four main themes.

- The first is the social sector, where it has focused on health and education.

- Second is the rural economy, where it has focused on agriculture and the maintenance of rural roads.

- The rural economy plays a significant role in the country as it encompasses two-thirds of the country's population, 70% of the total workforce and 46% of national income.

- Third, governance and administrative reforms under which it has recommended grants for judiciary, statistics and aspirational districts and blocks.

- Fourth, it has developed a performance-based incentive system for the power sector, which is not linked to grants but provides an important, additional borrowing window for States.

- Grants to Local Governments:

- Along with grants for municipal services and local government bodies, it includes performance-based grants for incubation of new cities and health grants to local governments.

- In grants for Urban local bodies, basic grants are proposed only for cities/towns having a population of less than a million. For Million-Plus cities, 100% of the grants are performance-linked through the Million-Plus Cities Challenge Fund (MCF).

- MCF amount is linked to the performance of these cities in improving their air quality and meeting the service level benchmarks for urban drinking water supply, sanitation and solid waste management.

- Share of States in Central Taxes (Vertical Devolution):

What is the Role of the FC in Maintaining Fiscal Federalism?

- Distribution of Tax Proceeds:

- The Finance Commission recommends the distribution of the net proceeds of taxes between the Union government and the state governments.

- This ensures a fair and equitable sharing of tax revenues, taking into account the fiscal capacities and needs of the states.

- Allocation of Taxes Among States:

- The Finance Commission determines the principles and quantum of grants-in-aid to states that require financial assistance.

- It assesses the financial needs of states and recommends measures to allocate funds from the consolidated funds of the states.

- Augmenting Resources of Local Governments:

- The Finance Commission suggests measures to augment the consolidated fund of a state in order to supplement the resources of Panchayats and Municipalities in that state.

- Cooperative Federalism:

- The Finance Commission's functioning is characterized by extensive consultations with all levels of governments, promoting the principle of cooperative federalism.

- It engages in consultations with the central government, state governments, and other stakeholders to gather inputs and ensure a participatory approach in decision-making.

- Public Spending and Fiscal Stability:

- The recommendations of the Finance Commission are aimed at improving the quality of public spending and promoting fiscal stability.

- By evaluating the financial position of the Union and state governments, the Commission provides guidance on fiscal management, resource allocation, and expenditure priorities.

What is the 15th Finance Commission?

- The Finance Commission is a constitutional body that determines the method and formula for distributing the tax proceeds between the Centre and states, and among the states as per the constitutional arrangement and present requirements.

- Under Article 280 of the Constitution, the President of India is required to constitute a Finance Commission at an interval of five years or earlier.

- The 15th Finance Commission was constituted by the President of India in November 2017, under the chairmanship of NK Singh.

- Its recommendations will cover a period of five years from the year 2021-22 to 2025-26.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Consider the following: (2023)

- Demographic performance

- Forest and ecology

- Governance reforms

- Stable government

- Tax and fiscal efforts

For the horizontal tax devolution, the Fifteenth Finance Commission used how many of the above as criteria other than population area and income distance?

(a) Only two

(b) Only three

(c) Only four

(d) All five

Ans: (b)

Mains

Q. Discuss the recommendations of the 13th Finance Commission which have been a departure from

the previous commissions for strengthening the local government finances. (2013)

Ethics

Neurotechnology and Ethics

For Prelims: United Nations Educational, Scientific and Cultural Organization, Neurotechnology, Deep Brain Stimulation, Sustainable development, Parkinson's disease

For Mains: Ethical Concerns Related to Neurotechnology

Why in News?

The United Nations Educational, Scientific and Cultural Organization (UNESCO) is organising an international conference in Paris, France to address the ethical implications of neurotech devices that collect brain-wave data.

- This conference aims to establish a global ethical framework to ensure individual freedom of thought, privacy, and protection of human rights.

- With the growing potential of neurotechnology to address neurological problems, concerns have been raised regarding its impact on personal identity and privacy.

What is Neurotechnology?

- Neurotechnology is defined as the assembly of methods and instruments that enable a direct connection of technical components with the nervous system. These technical components are electrodes, computers, or intelligent prostheses.

- They are meant to either record signals from the brain and “translate” them into technical control commands, or to manipulate brain activity by applying electrical or optical stimuli.

- From bioelectronic medicine that improves the quality of life to brain imaging that revolutionizes our conception of human consciousness, this technology has helped us to address many challenges.

- Neurotechnology encompasses all technologies developed to understand the brain, visualise its processes and even control, repair or improve its functions.

What are the Ethical Concerns Related to Neurotechnology?

- Privacy Issues: The use of neurotechnology can potentially reveal highly personal and sensitive information about an individual's thoughts, emotions, and mental states.

- Combined with artificial intelligence, its resulting potential can easily become a threat to notions of human dignity, freedom of thought, autonomy, (mental) privacy and well-being.

- Cognitive Enhancement and Inequality: Neurotechnologies aimed at enhancing cognitive abilities raise concerns about fairness and equality.

- If these technologies become available only to a privileged few or exacerbate existing social inequalities, it could lead to an unfair advantage for certain individuals or groups, creating a "cognitive divide" in society.

- Psychological and Emotional Impact: The ability to manipulate or access brain activity raises ethical concerns regarding the psychological and emotional impact on individuals.

- For example, deep brain stimulation or neurofeedback techniques may have unintended consequences or side effects on an individual's mental well-being, personal identity, or autonomy.

What is Deep Brain Stimulation (DBS)?

- It is a neurosurgical procedure that involves the implantation of a medical device called a neurostimulator, which delivers electrical impulses to specific regions of the brain.

- DBS works by altering the electrical signals in targeted brain regions, effectively "resetting" or normalising the neural activity

- DBS is primarily used to treat neurological conditions such as Parkinson's disease, essential tremor, dystonia, and some cases of epilepsy and obsessive-compulsive disorder (OCD).

- Parkinson’s disease is a chronic, degenerative neurological disorder that affects the central nervous system.

How can the Ethical Concerns Surrounding Neurotechnology be Resolved?

- Informed Consent: Ensuring that patients have a comprehensive understanding of the risks, benefits, and potential outcomes of neurological interventions is crucial.

- Healthcare providers should engage in transparent and thorough discussions with patients, providing them with the information necessary to make informed decisions about their treatment options.

- Ethical Review Boards: Establishing independent and multidisciplinary ethical review boards can help evaluate the ethical implications of neurology research and interventions.

- These boards should consist of healthcare professionals, ethicists, legal experts, and patient advocates who can assess the potential benefits, risks, and ethical implications of proposed interventions.

- Maintaining Privacy and Confidentiality: Safeguarding patient privacy and confidentiality is of utmost importance in neurology.

- With the advancement of technologies like brain-computer interfaces and deep brain stimulation, it is crucial to implement robust privacy protocols and ensure that patients' sensitive information is protected.

- Equity and Access: Ethical concerns can arise when access to neurological treatments and interventions is limited by factors such as cost, geographic location, or social disparities.

- Efforts should be made to promote equity and ensure that these interventions are accessible to all individuals who can benefit from them, regardless of socioeconomic status.

What is UNESCO?

- About:

- UNESCO is a specialised agency of the United Nations (UN). It seeks to build peace through international cooperation in Education, the Sciences and Culture.

- Its Headquarter is in Paris, France.

- UNESCO is a specialised agency of the United Nations (UN). It seeks to build peace through international cooperation in Education, the Sciences and Culture.

- Members:

- The Organization has 193 Members and 12 Associate Members.

- UNESCO has announced that the United States intends to rejoin the organisation and settle over USD 600 million in outstanding dues

- Membership of the United Nations carries with it the right to membership of UNESCO.

- States that are not members of the United Nations may be admitted to UNESCO, upon recommendation of the Executive Board, by a two-thirds majority vote of the General Conference.

- The Organization has 193 Members and 12 Associate Members.

- Objectives:

- Attaining quality education for all and lifelong learning

- Mobilising science knowledge and policy for sustainable development

- Addressing emerging social and ethical challenges

- Fostering cultural diversity, intercultural dialogue and a culture of peace

- Building inclusive knowledge societies through information and communication

- Focuses on global priority areas - “Africa” and “Gender Equality”.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. What are the aims and objectives of the McBride Commission of the UNESCO? What is India’s position on these? (2016)

Governance

Governor’s Role in State Legislature

For Prelims: Governor, Article 153, Punchhi Commission, Judicial review, President, Supreme Court, Nabam Rebia and Bamang Felix v Dy.Speaker Case, Purushothaman Nambudiri v State of Kerala.

For Mains: Constitutional Provisions Related to the Governor, SC’s stance and Recommendations of Commissions regarding the Governor's Power to Withhold Assent to Bills.

Why in News?

Issues have recently emerged in several Indian states regarding the interaction between Chief Ministers and Governors concerning the passing of bills. Chief Ministers have expressed concerns that Governors have delayed acting on bills presented for their assent.

- This situation raises important questions about the functioning of a democracy and the potential consequences of hindering the legislative process.

What are Constitutional Provisions Related to the Governor?

- Article 153 says that there shall be a Governor for each State. One person can be appointed as Governor for two or more States.

- The Governor is appointed by the President by warrant under his hand and seal and holds office under the pleasure of the President (Article 155 and 156).

- Article 161 states that the governor has the power to grant pardons, reprieves, etc.

- The Supreme Court stated that the sovereign power of a Governor to pardon a prisoner is actually exercised in consensus with the State government and not the Governor on his own.

- The advice of the government binds the Head of the State.

- Article 163 states that there is a council of ministers headed by the Chief Minister to aid and advise the Governor in the exercise of his functions, except some conditions for discretion.

- Discretionary powers include:

- Appointment of a chief minister when no party has a clear majority in the state legislative assembly

- In times of no-confidence motions

- In case of failure of constitutional machinery in the State(Article 356)

- Discretionary powers include:

- Article 200:

- Article 200 of the Indian Constitution outlines the process for a Bill passed by the Legislative Assembly of a State to be presented to the Governor for assent, who may either assent, withhold assent or reserve the Bill for consideration by the President.

- The Governor may also return the Bill with a message requesting reconsideration by the House or Houses.

- In the case of Purushothaman Nambudiri v State of Kerala, the Supreme Court ruled that a bill pending the Governor's assent does not lapse upon the dissolution of the House.

- The Court inferred from the absence of a time limit in Articles 200 and 201 that the framers did not intend for bills awaiting the Governor's assent to be at risk of lapsing.

- In the case of Purushothaman Nambudiri v State of Kerala, the Supreme Court ruled that a bill pending the Governor's assent does not lapse upon the dissolution of the House.

- The second provision of Article 200 grants the Governor the discretion to refer a bill to the President if they believe its passage would infringe upon the powers of the High Court. The procedure for presidential assent is outlined in Article 201.

- In the Shamsher Singh case, the Court held that the Governor's power to reserve bills for the President's consideration is an instance of discretionary authority.

- Article 201:

- It states that when a Bill is reserved for the consideration of the President, the President may assent to or withhold assent from the Bill.

- The President may also direct the Governor to return the Bill to the House or Houses of the Legislature of the State for reconsideration.

- Article 361:

- Under Article 361 of the Constitution, the Governor has complete immunity from court proceedings for any act done in the exercise of their powers.

What are the Recent Instances of Governor Withholding Assent to Bills in India?

- In April 2020, the Chhattisgarh Governor withheld assent to a Bill passed by the State Assembly in 2019 that sought to amend Section 8(5) of Chhattisgarh Lokayukta Act, 2001.

- In September 2021, the Tamil Nadu Assembly passed a Bill seeking exemption for students from the state from the National Eligibility cum Entrance Test (NEET) required for undergraduate medical college admissions. The Governor reserved the Bill for the assent of the President after considerable delay.

- In February 2023, the Kerala Governor signed into law five bills passed by the Assembly, but withheld assent to the remaining six bills, including the Kerala Lokayukta (Amendment) Bill, the Kerala University (Amendment) Bill etc.

- The Governor said he had reservations about the constitutionality and legality of these bills.

What is the SC’s Stance and Recommendations of Commissions regarding the Governor's Power to Withhold Assent to Bills?

- SC Stance: The Supreme Court’s judgement in Nabam Rebia and Bamang Felix vs Dy.Speaker clarified that the Governor's discretion under Article 200 is limited to deciding whether a bill should be reserved for the President's consideration.

- The Court also underscored that Article 163(2) must be read in conjunction with Article 163(1), suggesting that only matters expressly permitting the Governor to act autonomously are beyond the purview of judicial challenge.

- Therefore, withholding assent to a bill indefinitely is unconstitutional, and a Governor's action or inaction in this regard can be subject to judicial review.

- Punchhi Commission (2010): It recommended that it is necessary to prescribe a time limit within which the Governor should take the decision whether to grant assent or to reserve it for consideration of the President.

- National Commission to Review the Working of the Constitution (NCRWC): It laid down a time-limit of four months within which the Governor should take a decision whether to grant assent or reserve it for the consideration of the President.

- It had also suggested the removal of the power of Governor, as provided in Article 200, to withhold assent for a piece of legislation and reserve a Bill for the consideration of the President except in cases as stipulated in the Constitution.

UPSC Civil Services Examination, Previous Year Questions (PYQ)

Prelims

Q. Which of the following are the discretionary powers given to the Governor of a State? (2014)

- Sending a report to the President of India for imposing the President’s rule

- Appointing the Ministers

- Reserving certain bills passed by the State Legislature for consideration of the President of India

- Making the rules to conduct the business of the State Government

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 1 and 3 only

(c) 2, 3 and 4 only

(d) 1, 2, 3 and 4

Ans: (b)

Mains

Q. Whether the Supreme Court Judgment (July 2018) can settle the political tussle between the Lt. Governor and elected government of Delhi? Examine. (2018)

Q. Discuss the essential conditions for exercise of the legislative powers by the Governor. Discuss the legality of re-promulgation of ordinances by the Governor without placing them before the Legislature. (2022)

Indian Economy

RBI’s Regulation for UCBs

For Prelims: Urban Co-operative Banks (UCBs), Reserve Bank India (RBI), Priority Sector Lending (PSL), Ministry of Cooperation, Multi-State Cooperative Societies Act, 2002, Banking Regulations Act, 1949, Banking Laws (Co-operative Societies) Act, 1955, Supervisory action Framework (SAF).

For Mains: Issues faced by Cooperatives banks in India, the revival of UCBs on the line of PSBs, need of Cooperatives banks to boost the cooperative culture in Agriculture.

Why in News?

To strengthen 1,514 urban co-operative banks, the Reserve Bank India has notified four key measures, including giving them two years more to meet the priority sector lending targets.

What are the Key Measures taken by RBI?

- Four Key Measures:

- Allowing UCBs to open new branches without prior approval from RBI, up to 10% (maximum 5 branches) of the number of branches in the previous financial year.

- Allowing UCBs to do One-Time Settlement at par with commercial banks.

- Extending the timeline for UCBs to achieve Priority Sector Lending (PSL) targets by two years, up to March 31, 2026.

- The excess deposits, if any, after clearing the shortfall of PSL during FY 2022-23 will also be refunded to the UCB.

- Notifying a nodal officer for closer coordination and focused interaction between RBI and the cooperative sector.

- Possible Effects:

- These initiatives will further strengthen the UCBs, which work in urban areas and were facing hardships in achieving PSL targets.

- The Ministry of Cooperation is committed to strengthening cooperatives and treating them at par with other forms of economic entities.

What is Cooperatives Banks in India?

- It is an institution established on a cooperative basis to deal with the ordinary banking business. Cooperative banks are founded by collecting funds through shares, accepting deposits, and granting loans.

- They are Cooperative credit societies where members from a community group together to extend loans to each other, at favorable terms.

- They are registered under the Cooperative Societies Act of the State concerned or the Multi-State Cooperative Societies Act, 2002.

- The Co-operative banks are governed by the,

- Banking Regulations Act, 1949.

- Banking Laws (Co-operative Societies) Act, 1955.

- They are broadly divided into Urban and Rural cooperative banks.

What are Urban Cooperative banks (UCB)?

- The term Urban Cooperative Banks (UCBs) is not formally defined but refers to primary cooperative banks located in urban and semi-urban areas.

- The Urban Cooperative Banks (UCBs), the Primary Agricultural Credit Societies (PACS), Regional Rural Banks (RRBs), and Local Area Banks (LABs) could be considered as differentiated banks as they operate in localized areas.

- Till 1996, these banks were allowed to lend money only for non-agricultural purposes. This distinction does not hold today.

- These banks were traditionally centred on communities and local workgroups as they essentially lent to small borrowers and businesses. Today, their scope of operations has widened considerably.

What are Recent Developments?

- In January 2020, the RBI revised the Supervisory action Framework (SAF) for UCBs.

- In June 2020, the Central government approved an Ordinance to bring all urban and multi-state cooperative banks under the direct supervision of RBI.

- In 2022 RBI has announced 4 tier regulatory framework for categorization of UCBs

- Tier 1 with all unit UCBs and salary earner’s UCBs (irrespective of deposit size) and all other UCBs having deposits up to Rs 100 crore.

- Tier 2 with UCBs of deposits between Rs 100 crore and Rs 1,000 crore,

- Tier 3 with UCBs of deposits between Rs 1,000 crore and Rs 10,000 crore and

- Tier 4 with UCBs of deposits more than Rs 10,000 crore.

UPSC Previous Year Question (PYQ)

Prelims:

Q. With reference to ‘Urban Cooperative Banks’ in India, consider the following statements: (2021)

- They are supervised and regulated by local boards set up by the State Governments.

- They can issue equity shares and preference shares.

- They were brought under the purview of the Banking Regulation Act, 1949 through an Amendment in 1966.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Mains:

Q. The concept of cooperative federalism has been increasingly emphasized in recent years. Highlight the drawbacks in the existing structure and the extent to which cooperative federalism would answer the shortcomings.(2015)

Q. “In the villagesitself no formof credit organization will be suitable exceptthe cooperative society.” – All India Rural Credit Survey. Discuss this statement in the background of agricultural finance in India. What constraints and challenges do financial institutions supplying agricultural finance face? How can technology be used to better reach and serve rural clients? (2014)

Important Facts For Prelims

India's First Dimethyl Ether Fuelled Tractor

Why in News?

Recently, India’s first 100% Dimethyl Ether (DME) fuelled tractor/ vehicle for on- and off-road applications has been developed by IIT Kanpur that exhibited higher thermal efficiency and lower emissions than the baseline diesel engine.

- The research received support from the Science and Engineering Research Board (SERB), a part of the Department of Science and Technology (DST).

- The project aligned with the 'Methanol Economy' program of NITI Ayog, aiming to reduce India's oil import bill and greenhouse gas emissions.

What are the Key Points Related to DME Fuel?

- About:

- DME is a synthetically produced alternative fuel that can be directly used in specially designed compression ignition diesel engines for various purposes.

- DME is a renewable alternative to crude oil.

- Several countries, including Japan, USA, China, Sweden, Denmark, and Korea, are already using DME to power their vehicles.

- Properties:

- Under normal atmospheric conditions, DME is a colourless gas.

- DME exhibits comparable calorific value and similarity of its thermal efficiency to traditional fuels; It is a clean-burning fuel with low emission and low particulate matter.

- Uses:

- It is used extensively in the chemical industry and as solvent, fuel, and refrigerant.

- It has already been used as an ozone-friendly aerosol propellant to replace ozone-destroying chlorofluorocarbons (CFCs).

- It is an essential intermediate for producing valuable chemicals such as lower olefins, dimethyl sulfate, and methyl acetate.

- Significance:

- Environmental Benefits:

- The DME-fuelled engine exhibited remarkably low particulate and soot emissions, almost eliminating smoke generation.

- This was achieved without the need for expensive exhaust gas after-treatment devices or advanced engine technologies.

- The DME technology offers a viable and eco-friendly alternative for conventional diesel engines in agriculture and transport sectors.

- DME as a Renewable Alternative:

- India heavily relies on crude oil imports to meet its energy demands across various sectors.

- DME presents a renewable alternative fuel option that can be produced domestically.

- India heavily relies on crude oil imports to meet its energy demands across various sectors.

- Reinforcing Methanol Economy Programe:

- Converting domestic coal reserves, low-value agricultural biomass waste, and municipal solid waste into methanol and DME can contribute to achieving these goals.

- Converting domestic coal reserves, low-value agricultural biomass waste, and municipal solid waste into methanol and DME can contribute to achieving these goals.

- Environmental Benefits:

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. Which one of the following Union Ministries is implementing the Biodiesel Mission (as Nodal Ministry)? (2008)

(a) Ministry of Agriculture

(b) Ministry of Science and Technology

(c) Ministry of New and Renewable Energy

(d) Ministry of Rural Development

Ans: (d)

Exp:

- The Ministry of Rural Development (MoRD) was involved to act as a Nodal Ministry for launching the National Mission on Biodiesel with special focus on plantation of Jatropha.

- Jatropha is a plant of Latin American origin, which is now widespread throughout arid and semi-arid tropical regions of the world.

- The plant is well known among the Africans, Asians and Latin American countries as having many uses, particularly in providing renewable energy, controlling erosion, improving soil and reducing poverty.

- Biodiesel is an alternative fuel similar to conventional or ‘fossil’ diesel. Biodiesel can be produced from straight vegetable oil, animal oil/fats, tallow and waste cooking oil.

- The process of converting these oils into Biodiesel is called transesterification. Biodiesel is environmentally friendly as it is carbon neutral.

- Therefore, option (d) is the correct answer

Important Facts For Prelims

Interlocking System in Indian Railways

Why in News?

An investigation is underway to determine the cause of a devastating train crash in Odisha's Balasore district. The incident has raised concerns about the electronic track management system used by the railways.

- The Indian Railway Minister has highlighted a change in the electronic interlocking as the primary factor leading to the accident.

What is an Interlocking System in Indian Railways?

- About:

- Interlocking System refers to a crucial safety mechanism used to control train movements and ensure safe operations at railway stations and junctions.

- It is a complex network of signals, points (switches), and track circuits that work together to prevent conflicting movements and collisions.

- Electronic Interlocking (EI): It employs computer-based systems and electronic equipment to control signals, points, and level-crossing gates.

- Unlike conventional relay interlocking systems, EI utilises software and electronic components to manage the interlocking logic.

- EI ensures the synchronisation of all elements to facilitate uninterrupted train movement.

- As of 2022, 2,888 stations in India were equipped with an electronic interlocking system — comprising 45.5% of the Indian Railways network.

- Interlocking System refers to a crucial safety mechanism used to control train movements and ensure safe operations at railway stations and junctions.

Indian Railways Network

- The Indian Railways is the world's fourth-largest railway network, carrying an average of eight billion passengers annually.

- The network spans over 68,000 km and encompasses more than 7,000 stations, with a running track of 1,02,831 km.

- As of March 31, 2022, the total track length, including sidings, yards, and crossings, stands at 1,28,305 km.

- Components of Electronic Interlocking:

- Signal: Signals use light indicators to direct trains to stop (red), proceed (green), or exercise caution (yellow) based on the track's status ahead.

- Point: Points are movable sections of tracks that enable trains to change lines by guiding the wheels towards a straight or diverging path.

- Electric point machines lock and unlock point switches in the desired position.

- Track Circuit: Electrical circuits installed on tracks detect the presence of a train between two points, determining the safety of train movement.

- Additional Components: Electronic systems, communication devices, and other equipment control signalling components and are housed in relay rooms with dual-lock access control.

- A data logger records all system activities, serving as a record similar to an aircraft's black box.

- Functionality of the System:

- Command Reception and Route Setting: The electronic interlocking system receives commands from operators or automated control systems following which information is collected from the yard and processed to set a safe route for trains to follow.

- Alignment and Interlocking: Once the route is determined, the system aligns the necessary track switches (points) and interlocks signalling devices at appropriate positions to establish the desired route.

- Signal for Train Proceeding: Trains are given signals to proceed based on the track's direction and the absence of obstructions on diverging tracks.

- This ensures that trains can safely and smoothly navigate through the network.

- Collision Prevention: The system utilises track circuits to detect the presence of trains.

- By monitoring these circuits, the system prevents multiple trains from running on the same block or conflicting paths, thus minimising the risk of collisions.

- Point Locking: Points (switches) remain locked in position until certain conditions are met, such as the train crossing a specific section of the track or the signal to proceed being withdrawn.

- This ensures that the points are correctly aligned and secure for train movements.

- Failure Indication: In the event of a failure or malfunction, the system alerts operators or maintenance personnel.

- One common method is the use of a red light signal, indicating that the system has detected an issue and the route ahead is not clear or safe.

- This prompts appropriate actions to be taken to resolve the problem and ensure safe operation.

Important Facts For Prelims

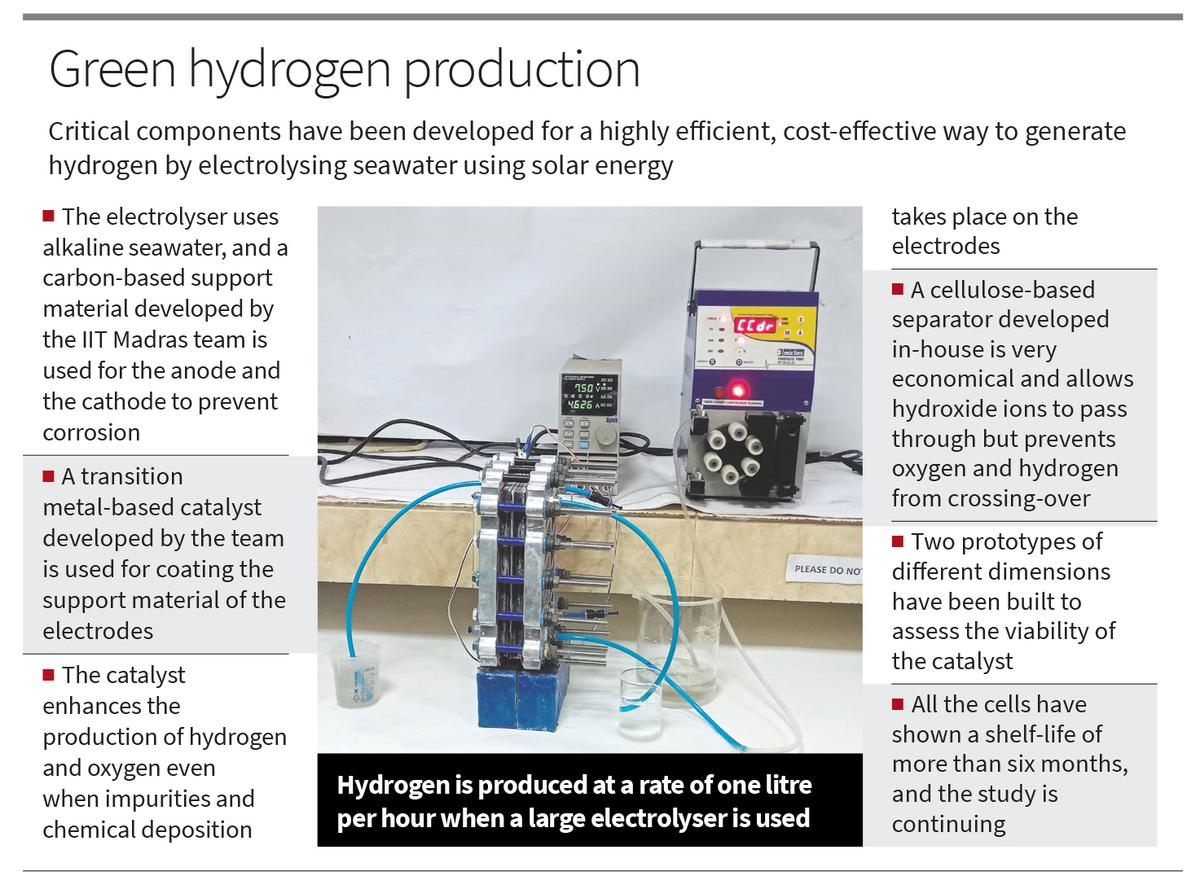

Alkaline Seawater Electrolyzer for Hydrogen Generation

Why in News?

Recently, Researchers from IIT-Madras have developed Alkaline Seawater Electrolyzer to Generate Hydrogen, addressing the challenges related with the existing Water Electrolyzer Technology.

- Alkaline water electrolyzer technology is energy-intensive, requires an expensive oxide-polymer separator, and uses fresh water for electrolysis. This invention has addressed each of these challenges by developing simple, scalable and cost-effective alternatives that are highly efficient in splitting seawater and generating hydrogen.

What are the Key Features of the Invention?

- Carbon Based Support Catalyst:

- In an Alkaline Water electrolyzer, two reactions occur at the anode and cathode. At the cathode, water splits into H+ and hydroxide ions. The H+ ions become hydrogen, while the hydroxide ions pass through a separator and form oxygen at the anode.

- However, when seawater is used, there are challenges. The anode forms hypochlorite, which corrodes the electrode support material and competes with oxygen production. The cathode gets impurities that slow down hydrogen production.

- To solve these issues, the electrodes have a special support material coated with a catalyst. Instead of using metals that corrode seawater, a carbon-based material is used.

- This support material, found in both the anode and cathode, is coated with the catalyst. The catalyst enables improved production of hydrogen and oxygen simultaneously.

- Cellulose-Based Separator:

- Usually, an expensive zirconium oxide-based material is used to separate the anode and cathode in alkaline electrolysis.

- However, the researchers have used a Cellulose-Based Separator. This separator allows hydroxide ions to pass from the cathode to the anode while minimizing the crossover of hydrogen and oxygen.

- This separator is highly resistant to degradation when exposed to seawater. This is an important quality for long-term performance and durability.

What is the Significance of this Invention?

- This invention addresses the limitations of current technologies and paves the way for scalable and sustainable hydrogen production, contributing to a greener and more sustainable future.

What are the Reasons to Develop Green Hydrogen?

- Reducing Greenhouse Gas Emissions:

- The main goal of green hydrogen is to reduce harmful greenhouse gas emissions, which are a major cause of climate change.

- Unlike traditional fuels, green hydrogen produced from renewable sources emits no greenhouse gases, making it an eco-friendly and sustainable energy option.

- Energy Security and Independence:

- By shifting towards renewable energy sources like green hydrogen, countries can become more self-reliant and less vulnerable to price fluctuations and supply disruptions associated with finite fossil fuels. This enhances energy security and independence.

- Decarbonizing Difficult-to-Decarbonize Sectors:

- Green hydrogen has great potential to replace fossil fuels in sectors that are challenging to decarbonize, such as heavy industry and aviation. These sectors contribute significantly to global emissions, and adopting green hydrogen can help reduce their carbon footprint.

- Technological Advancements:

- The advancement of green hydrogen technology drives innovation in various fields. Developing the infrastructure for production, storage, and distribution of green hydrogen requires new technologies, materials, and systems. This stimulates progress and breakthroughs in related industries.

UPSC Civil Services Examination, Previous Year Questions (PYQ)

Q1. Consider the following heavy industries: (2023)

- Fertilizer plants

- Oil refineries

- Steel plants

Green hydrogen is expected to play a significant role in decarbonizing how many of the above industries?

(a) Only one

(b) Only two

(c) All three

(d) None

Ans: (c)

Q2. With reference to green hydrogen, consider the following statements: (2023)

- It can be used directly as a fuel for internal combustion.

- It can be blended with natural gas and used as fuel for heat or power generation.

- It can be used in the hydrogen fuel cell to run vehicles.

How many of the above statements are correct?

(a) Only one

(b) Only two

(c) All three

(d) None

Ans: (c)

Rapid Fire

Rapid Fire Current Affairs

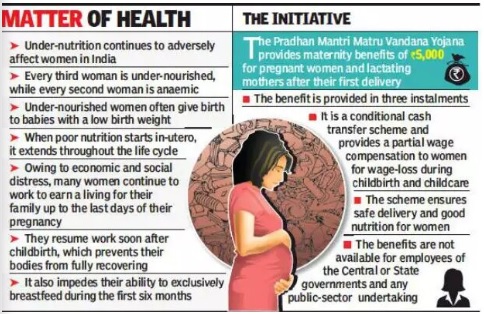

Pradhan Mantri Matru Vandana Yojana As a ‘Godh Bharai' Ceremony

The Prime Minister of India has lauded the new initiative of celebrating Pradhan Mantri Matru Vandana Yojana as a ‘Godh Bharai' ceremony in Dausa, Rajasthan. The pregnant women gather for this celebration, where they are provided with Poshan Kits to promote the health of their babies. In Rajasthan alone, approximately 3.5 lakh women have benefited from this scheme in the year 2022-23. Godh Bharai' is a traditional Indian ceremony to celebrate the impending arrival of a baby, often referred to as a baby shower.

Pradhan Mantri Matru Vandana Yojana is a maternity benefit program in India that provides financial assistance to pregnant and lactating women for their healthcare and nutrition needs. It is a centrally sponsored scheme being executed by the Ministry of Women and Child Development.

Read more: Pradhan Mantri Matru Vandana Yojana

Living at High Altitudes: Challenges and Adaptations

Living at high altitudes presents unique challenges and adaptations for the inhabitants of these regions. The village of Karzok in Ladakh stands as the highest settlement in India, situated at an elevation of 4,570 meters above sea level. Similarly, Komic in Himachal Pradesh also boast altitudes exceeding 4,500 meters. On a global scale, approximately 6.4 million individuals, which accounts for nearly 0.1% of the world's population, reside at elevations surpassing 4,000 metres. Many of these individuals have called the high-altitude plains of the Andes in South America and Tibet in Asia home for over ten millennia. However, people accustomed to lower altitudes often struggle with the cold, reduced atmospheric pressure, and diminished oxygen levels found at such heights.

Life in high-altitude regions presents unique challenges for its inhabitants. The economic outlook is often hindered by limited opportunities, especially in agriculture due to the need for terracing and irrigation challenges. However, activities such as livestock grazing and mining provide alternative sources of income.

Physiological adaptations, including increased basal metabolic rate and enhanced lung capacities, allow high-altitude residents to thrive in low-oxygen environments. High-altitude natives, such as the Quechua people of South America, known for their deep chests, display higher forced vital capacity (FVC) than their counterparts who grew up closer to sea level.

Despite the difficulties, living at high altitudes may have compensatory benefits for overall health and fitness. A study conducted in the Kinnaur district of Himachal Pradesh revealed that individuals in the 70-74 age group exhibited an average blood pressure of 120/80, highlighting the potential positive effects of the difficult living conditions on overall fitness.

Read more: Importance of Ladakh

Ex Ekuverin

The 12th edition of the joint military exercise "Ex Ekuverin" between the Indian Army and the Maldives National Defence Force commenced at Chaubatia, Uttarakhand from 11 to 24 June 2023.

This bilateral annual exercise, alternately conducted in India and Maldives, aims to enhance interoperability in Counter Insurgency/Counter Terrorism Operations under the UN mandate and conduct joint Humanitarian Assistance and Disaster Relief operations.

The Maldives is an archipelago located in the Indian Ocean, southwest of Sri Lanka.It consists of a chain of almost 1200 small coral islands that are grouped into clusters of atolls. The capital and largest city of the Maldives is Malé. The majority of the population follows Islam. The official language of the Maldives is Dhivehi. English is also widely spoken, especially in the tourist areas.

Captagon Pills Crisis

Recently, reports suggested that the Islamic State (IS) and Syrian fighters widely consumed Captagon to increase alertness and suppress appetite during their gruelling battles. Captagon, a potent amphetamine-type drug, is known for its highly addictive nature and is primarily manufactured in Syria. These pills act as stimulants on the central nervous system, providing users with increased energy, improved focus, extended wakefulness, and a sense of euphoria.

Originally developed in the 1960s, the genuine Captagon medication, which shares the same brand name, contained fenetylline, a synthetic drug belonging to the phenethylamine family, which also includes amphetamines. However, this authentic version was banned in the 1980s.