Indian Polity

Proportional Representation

For Prelims: Representation of the People Act, 1951, Election Commission of India, General Financial Rules, National and State Parties, First-Past-The-Post (FPTP) electoral system, Proportional Representation (PR) electoral system, Proportional Representation (PR) By Single Transferable Vote (STV).

For Mains: Shifting from FPTP to Proportional Representation Electoral System, Consequences and Advantages of Proportional Representation.

Why in News?

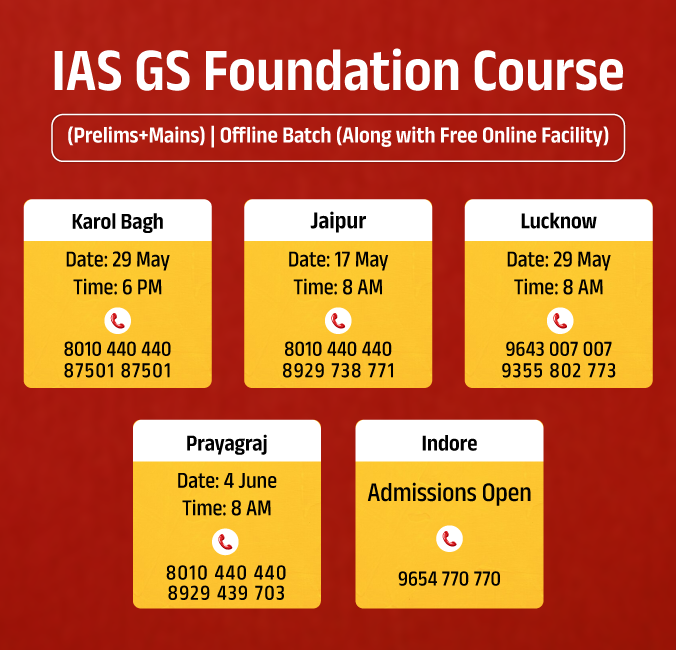

Recently, there is a growing consensus among a broad cross-section of citizens and political parties in India that the current First-Past-The-Post (FPTP) electoral system must be replaced with a Proportional Representation (PR) electoral system as one viable alternative.

What is the First-Past-The-Post (FPTP) Electoral System?

- About:

- It is an electoral system in which voters cast a vote for a single candidate, and the candidate with the most votes wins the election.

- Also known as the simple majority system or plurality system.

- One of the simplest and oldest electoral systems, used in countries such as the UK, the US, Canada, and India.

- It is an electoral system in which voters cast a vote for a single candidate, and the candidate with the most votes wins the election.

- Features:

- Voters are presented with a list of candidates nominated by different political parties or running as independents.

- Voters choose one candidate by marking their ballot paper or electronic voting machine.

- The candidate who receives the most votes in a constituency is declared the winner.

- The winner does not need to get a majority (more than 50%) of the votes, but only a plurality (the largest number) of the votes.

- This system frequently leads to disproportionate outcomes when selecting members of an assembly, like a Parliament, as political parties may not receive representation in line with their proportion of the overall vote.

- Advantages:

- Simplicity: It is a straightforward system that is easy for voters to understand and for officials to administer. This makes it cost-effective and efficient.

- Clear and Decisive Winners: It provides results with a definitive winner, which can contribute to stability and credibility in the electoral system.

- Accountability: Candidates in elections directly represent constituents, allowing for better accountability compared to Proportional Representation systems where candidates may not be as well known.

- Candidate Selection: It allows voters to choose between parties and specific candidates, while the PR system requires voters to select a party and the representatives are elected based on party lists.

- Coalition-Building: It encourages different social groups to unite locally, promoting broader unity and preventing fragmentation into numerous community-based parties.

What is Proportional Representation (PR) Systems?

- About:

- It is an electoral system where the political parties get representation (number of seats) in the legislature in proportion to the share of votes they get in the elections.

- Features:

- It fairly represents political parties based on their share of the vote.

- It ensures that every vote counts towards allocating seats in Parliament or other elected bodies.

- Types:

-

Single Transferable Vote (STV):

- It allows a voter to rank his/her candidate in order of preference, i.e., by providing backup references and casting only one vote.

- Proportional Representation (PR) By Single Transferable Vote (STV) enables voters to choose the most preferred candidate of the party and vote for independent candidates.

- The President of India is elected through the PR system with a STV, where a secret ballot system is used to elect the President.

- The electoral college, which consists of the Legislative Assemblies of the States, Council of States, and members of Rajya Sabha and Lok Sabha, elects the Indian president through a PR system utilizing an STV.

- Party-List PR:

- Here voters vote for the party (and not individual candidates) and then the parties get seats in proportion to their vote share.

- There is usually a minimum threshold of 3-5% vote share for a party to be eligible for a seat.

- Mixed-Member Proportional Representation (MMP):

- It is a system that aims to achieve a balance between stability and proportionate representation in a country's political system.

- Under this system, one candidate is elected through the First-Past-the-Post (FPTP) system from each territorial constituency. In addition to these representatives, there are also additional seats allocated to various parties based on their percentage of votes nationwide.

- This allows for a more diverse representation in government while still maintaining the stability of having individual representatives from specific geographical areas.

- New Zealand, South Korea, and Germany are examples of countries where MMP is operational.

-

- Advantages:

-

Ensures Every Vote Counts:

- In PR every vote is counted towards allocating seats in Parliament. This means that voters have a greater sense of participation in the democratic process.

- Diverse and Representative Government:

- Smaller parties and minority groups are more likely to be represented under a PR system, which can lead to a more diverse range of perspectives and ideas in Parliament.

- Reduces Gerrymandering:

- PR systems are less susceptible to gerrymandering, as distribution of seats is determined by the proportion of votes a party receives rather than by manipulating district boundaries.

- As a result, parties cannot unfairly manipulate the electoral map to their advantage, as is sometimes seen in systems with arbitrary constituency boundaries.

-

- Disadvantages:

- Unstable Governments: PR can lead to unstable governments as smaller parties and minority groups are more likely to be represented which can be difficult to form stable coalitions and govern effectively.

- More Complex: PR systems can be more complex than FPTP systems, making them more difficult for voters to understand and for governments to implement.

- Expensive: PR systems are expensive to operate, as a significant amount of resources and funds are required to conduct elections.

- Neglection of Local Needs: PR can lead to leaders prioritising party agendas over local needs, as multiple representatives share a constituency.

- This diffusion of accountability may result in selfish political behaviour and neglect of specific constituency concerns.

Why there is Need to Shift From FPTP System to the PR System?

- Over or Under Representation: The FPTP system may lead to over or under representation of political parties (in terms of seats they win) when compared to their vote-share they get.

- Eg: In the first three elections after independence, the Congress party won close to 75% of seats in the then Lok Sabha with just 45-47% vote share.

- In the 2019 Lok Sabha Elections, Bharatiya Janata Party (BJP) received just 37.36% of the vote and won 55% of the seats in Lok Sabha.

- Lack of Representation for Minority Groups: In a 2-party FPTP system, a party with a small percentage of votes may not win any seats which can result in a significant portion of the population being unrepresented in the government.

- Countries like the UK and Canada also use FPTP, but their Member of Parliaments (MPs) have more accountability to their local constituencies.

- Strategic Voting: Voters may feel pressure to vote for a candidate they do not truly support to prevent a candidate they dislike from winning the election. This can lead to a situation where voters feel like they are not truly expressing their preferences.

- Disadvantage for Smaller Parties: Smaller parties struggle to win in the FPTP system and often have to align with national parties, undermining local self-government and federalism.

Other Alternative Electoral Systems

- Ranked Voting Systems: These are systems that allow voters to rank candidates in order of preference, rather than choosing one candidate.

- Score Voting Systems: These are systems that allow voters to score candidates on a numerical scale, rather than choosing one candidate or ranking them.

International Practices

- Presidential democracies (like Brazil and Argentina), as well as parliamentary democracies (like South Africa, the Netherlands, Belgium, Spain, Germany, and New Zealand), have different proportional representation (PR) systems.

- In Germany, the Mixed Member Proportional Representation (MMPR) system is used (50% of the 598 seats in the Bundestag are filled from constituencies under FPTP system, and the remaining 50% are filled by apportioning them amongst parties securing at least 5% of the votes).

- In New Zealand, 60% of the total 120 seats in the House of Representatives are filled through the FPTP system from territorial constituencies, while the remaining 40% are allotted to parties securing at least 5% of the votes.

Way Forward

- Recommendation of Law Commission:

- The Law Commission in its 170th report (1999) recommended the introduction of the Mixed Member Proportional Representation (MMPR) system on an experimental basis.

- The report suggested that 25% of Lok Sabha seats may be filled through a PR system by increasing the strength of the Lok Sabha.

- It recommended considering the entire nation as one unit for PR based on vote share, or alternatively, considering it at the state/UT level, given India's federal polity.

- The Law Commission in its 170th report (1999) recommended the introduction of the Mixed Member Proportional Representation (MMPR) system on an experimental basis.

- Upcoming Delimitation Exercise:

- The upcoming delimitation exercise, which redraws constituencies based on population shifts could pose disadvantage to states with slower population growth. This could violate the very principles of federalism and lead to resentment in states losing representation.

- Thus, we need a mechanism that ensures fair representation for all states, regardless of population growth. This mechanism could involve:

- Taking into account the current levels of representation of each state can help to create a fairer balance.

- Investigating alternative systems like the Mixed Member Proportional Representation (MMPR) could be beneficial.

- Recommendation for MMPR system:

- To ensure a more equitable distribution of power, the MMPR system could be implemented for the additional seats or at least a quarter of the existing seats in each state/UT.

- This would empower southern, northeastern, and smaller northern states by giving them a stronger voice in Parliament, even with an increase in total seats.

Conclusion

As India continues to evolve as a democracy, exploring electoral reforms like proportional representation and mixed member proportional representation can potentially lead to a more balanced and fair system.

Implementing these changes thoughtfully, considering India’s unique federal and diverse nature, could enhance the democratic process and ensure that every vote really counts.

|

Drishti Mains Question: Evaluate the First Past the Post (FPTP) electoral system in the context of India's diverse political landscape. Discuss the potential benefits and challenges of adopting a Mixed Member Proportional Representation (MMPR) system. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Consider the following statements: (2017)

- The Election Commission of India is a five-member body.

- The Union Ministry of Home Affairs decides the election schedule for the conduct of both general elections and bye-elections.

- Election Commission resolves the disputes relating to splits/mergers of recognised political parties.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 2 and 3 only

(d) 3 only

Ans: (d)

Mains

Q. Discuss the role of the Election Commission of India in the light of the evolution of the Model Code of Conduct. (2022)

Q. To enhance the quality of democracy in India the Election Commission of India has proposed electoral reforms in 2016. What are the suggested reforms and how far are they significant to make democracy successful? (2017)

Indian Economy

Aspirational Goals of RBI

For Prelims: RBI, Capital Account, INR Internationalisation, Capital Account Convertibility, Non-resident Deposits, Indian MNCs and Global Brands, Digital Payment System, UPI, RTGS, NEFT, Central Bank Digital Currency (e-Rupee), Globalisation, GIFT City, Monetary Policy Framework, Climate Change Initiatives, Rupee Masala Bonds

For Mains: Challenges in Capital Account Liberalisation and INR Internationalisation

Why in News?

Recently, the Reserve Bank of India (RBI) has outlined several aspirational goals in preparation for India's fast-growing economy, aiming to be "future-ready" by the time it reaches its centenary year, RBI@100.

What are the Aspirational Goals of RBI?

- Capital Account Liberalisation and INR Internationalisation:

- Capital Account Convertibility: Proposed full capital account convertibility, allowing free conversion between the rupee and foreign currencies for capital transactions.

- Internationalisation of the Rupee: Enabling non-residents to use the rupee for cross-border transactions and enhancing rupee account accessibility for persons outside India.

- Calibrated Interest-Bearing Non-Resident Deposits: Adopting a careful approach toward interest-bearing deposits for non-residents.

- Promotion of Indian MNCs and Global Brands: Supporting overseas investments by Indian multinational corporations.

- Digital Payment System Universalisation:

- Domestic and Global Expansion: Expanding the use of India's digital payment systems (UPI, RTGS, NEFT) domestically and internationally, and linking payment systems with other countries.

- The starting point can be integrating Indian payment systems with those of other countries.

- Central Bank Digital Currency (e-Rupee): Phased implementation of the e-Rupee.

- Domestic and Global Expansion: Expanding the use of India's digital payment systems (UPI, RTGS, NEFT) domestically and internationally, and linking payment systems with other countries.

- Globalisation of India’s Financial Sector:

- Domestic Banking Expansion: Aligning banking sector growth with national economic growth.

- Top Global Banks: Aiming to position 3-5 Indian banks among the top 100 global banks in terms of size and operations and positioning the Reserve Bank as a model central bank of the global south.

- Support for GIFT City: Assisting the International Financial Services Centres Authority (IFSCA) in making GIFT City a leading international financial hub.

- Monetary Policy Framework Review:

- Balancing Act: Addressing the balance between price stability and economic growth from an Emerging Market Economy perspective.

- Policy Communication: Refining monetary policy communication and addressing spillovers from debt overhang in important economies.

- Climate Change Initiatives: Providing guidance for stress testing asset portfolios, strengthening payment systems against climate risks, and proposing disclosure norms and a government taxonomy for climate risks.

-

Short and Medium-Term Measures:

- Trade Arrangements: Standardizing approaches for bilateral and multilateral trade invoicing, settlement, and payment in rupee and local currencies.

- Financial Market Strengthening: Fostering a global rupee market and recalibrating the foreign portfolio investor regime.

- Rupee Masala Bonds: Reviewing taxes on rupee masala bonds.

- Global Bond Indices: Including Indian Government Bonds in global bond indices.

Steps Towards Internationalisation of Rupees

- Developments in the GIFT City

- Asian Clearing Union (ACU), a regional payment arrangement facilitates the settlement of trade transactions among its member countries on a multilateral basis. The ACU currently has 13 member countries. India is a member of ACU.

- In March 2023, the RBI put in place the mechanism for rupee trade settlement with as many as 18 countries.

- Banks from these countries have been allowed to open Special Vostro Rupee Accounts (SVRAs) for settling payments in Indian Rupees.

- In July 2022, the RBI issued a circular on “International Trade Settlement in Indian Rupees”.

- RBI enabled external commercial borrowings in Rupees as per the (especially Masala Bonds).

Narasimham Committee

- Dr Manmohan Singh set up Narasimham Committee in 1991 to analyse India’s banking sector and recommend reforms. It was followed by the 1998 Committee which is known as the Narasimham Committee II.

- Narasimham Committee- I Recommendations:

- A 4-tier hierarchy for the Indian banking system with 3 or 4 major public sector banks at the top and rural development banks for agricultural activities at the bottom.

- A quasi-autonomous body under RBI for supervising banks and financial institutions.

- Reduction in statutory liquidity ratio

- Reaching of 8% capital adequacy ratio

- Setting up Asset Reconstruction fund

- Narasimham Committee- II Recommendations:

- Stronger banking system: The Committee recommended the merger of major public sector banks to boost international trade. However, the Committee warned against merging stronger banks with weaker banks.

- Reform in the role of RBI: The Committee also recommended reforms in the role of the RBI in the banking sector. The Committee felt that RBI being the regulator, it should not have ownership in any bank.

- NPAs: The Committee wanted the banks to reduce their NPAs to 3% by 2002. It also recommended the formation of Asset Reconstruction Funds or Asset Reconstruction Companies.

- Foreign banks: It also proposed to raise the minimum start-up capital to USD 25 million for foreign banks from USD 10 million.

Tarapore Committee

- The RBI had appointed the Tarapore committee in 1997. The committee was formed with the objective of progressive liberalisation of capital account transactions.

- It suggested that full convertibility should be achieved in three phases and the process should be subject to fulfilment of certain crucial preconditions and signposts.

- Prior RBI approval dispensed with for foreign direct and portfolio investment and disinvestments

- Banks and FIs allowed to play in local and overseas gold markets

- FIIs, NRIs, non resident banks allowed into the forward exchange markets

- Financial institutions allowed to be full fledged authorised dealers.

What are the Challenges in Achieving the Aspirational Goals of RBI?

- Triffin Dilemma: It describes the conflict between a country's domestic monetary policy goals and its role as an international reserve currency issuer.

- The Triffin dilemma could manifest as a conflict between maintaining stability in India's domestic economy and meeting the global demand for the Rupee.

- Exchange Rate Volatility: Opening up the currency to international markets can increase volatility in its exchange rate, especially in the initial stages. Fluctuations can impact trade and investments, affecting economic stability.

- Impact on Export: The Rupee’s internationalisation will leads to increased demand for the currency in global markets, which may make Indian exports costly.

- Limited International Demand: The daily average share for the rupee in the global forex market is only around 1.6%, while India’s share of global goods trade is ~2%. The challenge lies in increasing share of Indian products in the competitive global market.

- Convertibility Concern: The absence of full convertibility of INR for capital transactions will restrict its widespread use in international trade and finance.

- Cybersecurity Threats: Digital payment systems are vulnerable to cyberattacks, which can lead to fraud and loss of money. Building trust requires robust security measures to protect user data and ensure the safety of transactions.

- High Non-Performing Assets (NPAs): Indian banks, particularly public sector ones, struggle with a high percentage of non-performing assets (loans unlikely to be repaid) making them less likely to absorb shock in case of global financial crisis.

What are the Steps Needed to Reach the Aspirational Goals?

- Convertible of Rupee: As per the recommendation of Tarapore committee, the goal should be of full convertibility by 2060, letting financial investments move freely between India and abroad.

- This would allow foreign investors to easily buy and sell the rupee, enhancing its liquidity and making it more attractive. Tobin Tax can be used as a safeguard measure by RBI against currency speculation.

- Reforms Suggested by Tarapore Committee:

- It had listed several preconditions such as fiscal consolidation, inflation control, low level of non-performing assets, low current account deficit and strengthening of financial markets for achieving capital account liberalisation.

- Strong Fiscal Management: Such as reducing fiscal deficits lower than 3.5%, reducing gross Inflation rate to 3%-5%, and reducing gross banking non-performing assets to less than 5%.

- Liberalised Scheme for Personal Remittance: The introduction of a more liberal scheme for personal remittances to facilitate easier transactions for individuals dealing with foreign exchange.

- Pursue a Deeper Bond Market: Enabling foreign investors and Indian trade partners to have more investment options in rupees, enabling its international use apart from developing the corporate bond market in India.

- Increase Rupee in International Trade: Optimising the trade settlement formalities for rupee import/export transactions would go a long way. For example rupee swap agreements with various countries, payment of Russian oil in Indian rupee etc.

- Globalisation of India’s Financial Sector: Encourage domestic banking expansion through licensing reforms and incentivise branch network expansion. Support Indian banks in enhancing their global presence through strategic partnerships and acquisitions.

- For example, similar to the support provided to Khanij Bidesh India Ltd support could be provided to banks for acquisition, merger and collaboration with foreign banking institutions.

- Monetary Policy Framework Review: Conduct a comprehensive review of the monetary policy framework to ensure it aligns with the goals of price stability and economic growth.

- Enhance transparency and clarity in monetary policy communication to manage market expectations effectively. For example releasing of meeting minutes.

- Climate Change Initiatives: Issue guidelines for stress testing of asset portfolios to assess climate change risks. Work with financial institutions to develop resilience measures against climate-related risks in payment systems. Propose disclosure norms for climate risk reporting and contribute to the development of a standardised government taxonomy.

|

Drishti Mains Question: Q. Discuss the key challenges faced by the Reserve Bank of India in its efforts to internationalise the Indian rupee. What measures can be taken to overcome these challenges? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Convertibility of rupee implies (2015)

(a) being able to convert rupee notes into gold

(b) allowing the value of rupee to be fixed by market forces

(c) freely permitting the conversion of rupee to other currencies and vice versa

(d) developing an international market for currencies in India

Ans: (c)

Q. With reference to Balance of Payments, which of the following constitutes/constitute the Current Account? (2014)

- Balance of trade

- Foreign assets

- Balance of invisibles

- Special Drawing Rights

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3

(c) 1 and 3

(d) 1, 2 and 4

Ans: (c)

Mains:

Q. Implementation of Information and Communication Technology (ICT) based Projects/ Programmes usually suffers in terms of certain vital factors. Identify these factors, and suggest measures for their effective implementation. (2019)

Economy

UN Report on Global Debt Crisis

For Prelims: Global Debt Trends and Implications, Debt, Recession, Gross Domestic Product (GDP), International Monetary Fund (IMF).

For Mains: Global Debt Trends and Implications.

Why in News?

Recently, a report released by the UN Trade and Development (UNCTAD) titled "A World of Debt 2024: A Growing Burden to Global Prosperity," has revealed an unprecedented global debt crisis in the world.

- Approximately 3.3 billion people currently live in countries where the payment of interest on debts surpasses the expenditure on either education or health.

What is Global Debt?

- About: Debt is an amount of money one borrows and has to pay back later.

- Global Debt refers to the total outstanding amount owed by governments, businesses, and individuals across the world.

- It encompasses both public and private debt.

- Global Debt refers to the total outstanding amount owed by governments, businesses, and individuals across the world.

- Composition of Global Debt:

- Public Debt: This is the money owed by governments to domestic and foreign creditors.

- It is typically financed through issuing bonds, treasury bills, or loans from international organisations.

- Private Debt: This is the money owed by businesses and individuals to banks, lenders, and other financial institutions.

- It includes mortgages, corporate bonds, student loans, and credit card debt.

- Public Debt: This is the money owed by governments to domestic and foreign creditors.

What are the Key Highlights of the Report?

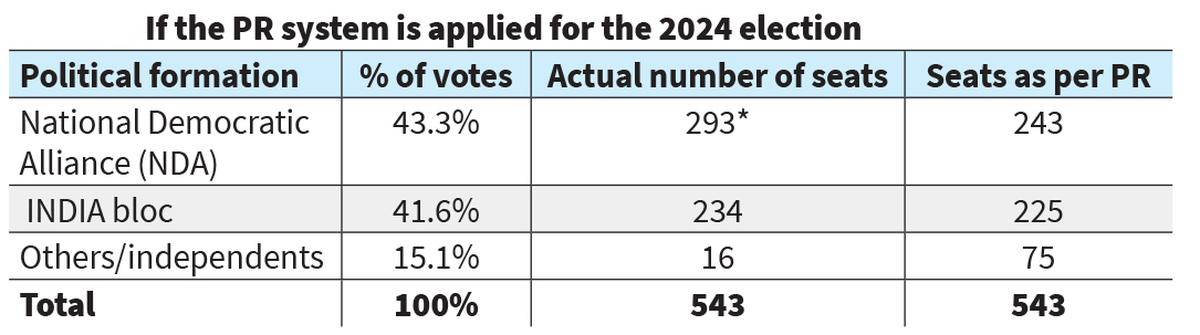

- Rapid Increase in Public Debt:

- Institute of International Finance (a global association of financial institutions) has estimated that global debt (including borrowings of households, businesses and governments) has reached USD 315 trillion in 2024, which is 3 times the global Gross Domestic Product (GDP).

- Global public debt is rising rapidly, due to a combination of recent crises (such as Covid-19, rising food and energy prices, climate change, etc.) and a sluggish global economy (slowing growth of economy, rising bank interest rates etc).

- Net interest payments on public debt reached USD 847 billion in 2023 in developing countries, a 26% increase compared to 2021.

- Institute of International Finance (a global association of financial institutions) has estimated that global debt (including borrowings of households, businesses and governments) has reached USD 315 trillion in 2024, which is 3 times the global Gross Domestic Product (GDP).

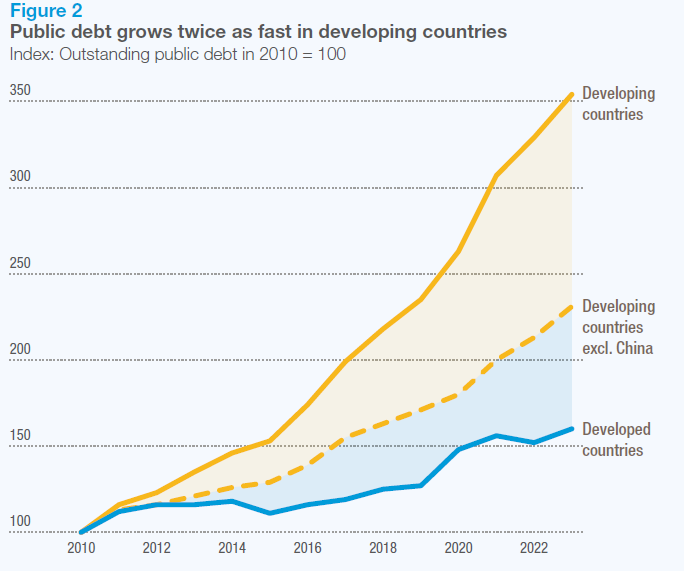

- Regional Disparity in Debt Growth:

- Public debt in developing countries is rising at twice the rate of that in developed countries.

- It reached USD 29 trillion (30% of the global total) in 2023, increasing from 16% in 2010.

- Africa's debt burden is growing faster than its economy leading to a rise in the debt-to-GDP ratio.

- The number of African countries with debt-to-GDP ratios above 60% has increased from 6 to 27 between 2013 and 2023.

- This is due to unforeseen global issues impacting their expansion and reduced domestic income as a result of a slow economy.

- Public debt in developing countries is rising at twice the rate of that in developed countries.

- Higher Debt Servicing Share of Income & Impact on Climate Initiatives:

- Roughly 50% of developing countries are now dedicating a minimum of 8% of their government revenues to servicing their debts, a number that has increased twofold in the last ten years.

- Currently, developing nations are spending a greater portion of their GDP on paying off interest (2.4%) than on climate efforts (2.1%).

- Their ability to address climate change is being constrained by debt. In order to meet the targets of the Paris Agreement, there is a requirement to raise climate investments to 6.9% by 2030.

- 3 Shifts in Official Development Assistance (ODA):

- ODA is government aid aimed at promoting economic development and welfare in developing countries.

- Repaying loans has become more difficult for developing countries, due to recent changes made in nature of foreign aid such as:

- Decreasing Overall Aid: ODA has been decreasing for two years in a row, dropping to USD 164 billion in 2022.

- More Loans and Less Grants: The proportion of aid given as loans is increasing, rising from 28% in 2012 to 34% in 2022. This creates debt burdens for developing countries.

- Less Help with Existing Debt: Funds for dealing with debt, like debt relief and restructuring, have dropped significantly from USD 4.1 billion in 2012 to just USD 300 million in 2022. This makes it harder for them to deal with their current borrowing and could limit their ability to access future loans.

What are the Initiatives Related to Solving Debt Crisis?

- Heavily Indebted Poor Countries (HIPC) Initiative:

- The IMF and World Bank's initiative tackles debt crises in the world's poorest countries. It recognises their struggle to repay debts without sacrificing crucial investments. By offering debt relief, the program frees up resources.

- This allows these nations to invest in healthcare, education, and poverty reduction, promoting long-term economic growth and social progress.

- The IMF and World Bank's initiative tackles debt crises in the world's poorest countries. It recognises their struggle to repay debts without sacrificing crucial investments. By offering debt relief, the program frees up resources.

- Debt Management and Financial Analysis System (DMFAS) Programme:

- UNCTAD's DMFAS program helps developing countries manage debt responsibly. It provides training and technical support to improve their borrowing practices, including tools for recording debt, assessing risks, and negotiating effectively.

- This program promotes sustainable debt management so these countries can borrow for development without creating future crises.

- UNCTAD's DMFAS program helps developing countries manage debt responsibly. It provides training and technical support to improve their borrowing practices, including tools for recording debt, assessing risks, and negotiating effectively.

- Global Sovereign Debt Roundtable (GSDR):

- The roundtable is co-chaired by the IMF, World Bank and G20 presidency, which aims to address debt challenges comprehensively. It brings together debtor countries and creditors with the objective of fostering a greater common understanding among key stakeholders on issues related to debt sustainability, debt restructuring challenges, and potential solutions.

What Measures should be taken to Address the Global Debt Crisis?

- Inclusive Governance, Transparency and Accountability:

- The World Bank's 2022 International Debt Statistics report highlights a concerning rise in public debt, particularly for low-income countries, thus increased participation for these nations in decision-making processes is essential.

- The UN Office for Sustainable Development emphasises that financial transparency and accountability are crucial for preventing debt crises.

- Contingency Financing:

- The IMF performs a vital role in providing emergency financial support.

- A 2019 IMF Report titled "Three Steps to Avert a Debt Crisis" proposed measures like increased access to Special Drawing Rights (SDRs) to bolster developing countries' reserves during emergencies.

- Managing Unsustainable Debt (Managing Debt Challenges):

- Existing frameworks for debt restructuring, such as the G20 Common Framework for Debt Treatment should be improved.

- In addition, including automatic provisions for suspending debt payments for countries facing crises would offer essential flexibility to help them stabilize their economies.

- Scaling up Sustainable Financing:

- Multilateral Development Banks (MDBs) need to be transformed to play a more prominent role in long-term financing for Sustainable Development Goals (SDGs).

- Attracting private investment towards sustainable projects like clean energy is also crucial. Fulfilling existing commitments for aid and climate finance, particularly for developing countries, is essential for facilitating this transition.

G20 Common Framework for Debt Treatment

- It is an initiative established in 2020, endorsed by the G20, in collaboration with the Paris Club to provide structural support to Low-Income Countries (LICs) facing unsustainable debt burdens.

- This framework aims to offer a coordinated and comprehensive approach to tackling the severe debt challenges faced by LICs, which have been worsened by the Covid-19 pandemic.

|

Drishti Mains Question: Q. Discuss the key factors contributing to the escalating global debt crisis and evaluate the possible measures that can be undertaken by both developed and developing economies to manage this crisis effectively. |

Governance

Agnipath Scheme

For Prelims: Compensation to Agniveer, Agnipath scheme, Seva Nidhi, Three services (Army, Navy and Airforce), Armed Forces Battle Casualty Fund.

For Mains: Significance, Criticisms of Agnipath Scheme, Government Policies & Interventions

Why in News?

The ruling-party government’s ambitious Agnipath scheme, announced in June 2022, has been facing opposition from various political parties and Armed Forces veterans.

- Ongoing concerns highlight the scheme’s impact on military recruitment and the welfare of soldiers.

What is Agnipath Scheme?

- About:

- The term "Agniveer" translates to "Fire-Warriors" and is a new military rank.

- It is a scheme of recruiting army personnel below officer ranks such as soldiers, airmen, and sailors who are not commissioned officers to the Indian Armed Forces.

- They are recruited for a period of 4 years, after which, upto 25% of these recruits (called Agniveers), can join the services on a permanent commission (another 15 years), subject to merit and organisational requirements.

- At present, all sailors, airmen, and soldiers, except the technical cadre of the medical branch, are recruited to the services under this scheme.

- Eligibility Criteria:

- Candidates between the age of 17.5 years to 23 years are eligible to apply (the upper age limit was increased from 21).

- Girls under the given age limit are open for the agnipath entry, while there is no such reservation for women under this scheme.

- Pay & Benefits:

- Death on Duty: The family gets a combined sum of Rs 1 crore, which includes both the Seva Nidhi package and the soldier's unserved salary.

- Disability: An Agniveer can receive compensation up to Rs 44 lakh depending on the severity of the disability. This amount is provided only if the disability is caused by or worsened due to military service.

- Pensions: Agniveers won't receive a regular pension after their 4-year service, unlike soldiers in the traditional system.

- Only the 25% who get selected for permanent commission will be eligible for a pension.

- Goal of Agnipath:

- This scheme is designed to keep the armed forces young and bring down the number of permanent soldiers in the military, leading to a significant reduction in the government's pension spending on defense forces.

Why was the Agnipath Scheme Introduced?

- Younger, Fitter Force: The government believes Agnipath will create a more agile fighting force due to the emphasis on younger recruits, translating to faster response times and better adaptation on the battlefield.

- The average age in the Armed Forces, currently 32 years, will be reduced to 26 years with Agnipath's implementation.

- Reduce Pension Bill: It also aims to lessen the burden of the ever-growing defense pension bill. The Parliamentary Standing Committee on Defence report in 2022 projected the Indian Armed Forces' pension bill to reach a staggering Rs 2.5 lakh crore by 2025.

- Agnipath, with its shorter service duration for most recruits, could potentially help manage this expenditure.

- Technological Integration: The scheme aims to leverage the tech-savviness of younger recruits to better integrate emerging technologies into the Armed Forces.

- Skilled Workforce for Civilian Sector: The government envisions Agniveers transitioning to the civilian workforce with valuable skills and discipline gained during their service.

- This could potentially contribute to a more skilled national workforce and economic growth.

- More Employment Opportunities: It will increase employment opportunities and because of the skills and experience acquired during the four-year service such soldiers will get employment in various fields.

Similar Programmes in Other Nations

- Voluntary Tour of Duty: Depending on the requirements of the military and the branch of service, tours of voluntary duty in the US can last anywhere from 6 to 9 months to a full year.

- Required Military Service (Conscription): Israel, Norway, North Korea, Singapore and Sweden are among the nations that use this practice.

What are the Issues Associated with Agnipath Scheme?

- Lack of Retirement Benefits: The scheme provides a one-time payment of Rs 11.71 lakh on completion of 4-year tenure, but no gratuity or pension.

- This has caused widespread discontent among aspirants who were seeking job security and pension benefits.

- Short Service Duration: The 4-year term is seen as inadequate, with concerns that recruits may lack the same motivation and training as permanent soldiers.

- Also, this duration is insufficient to train and skill soldiers in the long term as it may lead to skill and experience deficit in armed forces.

- Age Limit Issues: The current upper age limit of 23 years has excluded many youth who could not apply due to lack of recruitment during the pandemic.

- Unemployment Concerns: With limited permanent absorption (only 25%), the scheme is seen as exacerbating the already high youth unemployment in the country.

- This comes amidst wider economic challenges like rising inflation and inequalities.

- Perceived Political Motives: Experts believe the scheme was rushed through without adequate consultation, possibly as a political move ahead of elections. The lack of endorsement from defense forces also raises doubts.

- Pension Bill Reduction: The scheme is seen as a way for the government to reduce its rising defense pension expenditure, prioritizing financial savings over long-term force building.

Way Forward

- Raising the Age Limit and Permanent Retention Quota: There should be a longer service period to 7-8 years for Agniveers.

- Also, the entry age for technical roles should be increased to 23 years, and regular service retention rate for Agniveers should be increased from current 25% to 60-70%.

- Enhanced Entitlements and Benefits: Agniveers should be provided with a contributory pension scheme, generous gratuity, and ex-gratia for disability during training.

- They should be offered opportunities in other security forces, veteran status, and preference for government jobs, with a transparent, merit-based system for retaining Agniveers.

- Implement Robust Skilling and Resettlement Programs: A comprehensive skilling and resettlement programs should be developed in collaboration with the private sector and government agencies to facilitate a smooth transition for Agniveers into civilian life.

- A legislation should also be made that mandates the compulsory absorption of Agniveers by private employers and corporations.

- Raising Educational Standards: The educational requirements for Agniveers to should be raised from 10 to 10+2 and a more rigorous national entrance exam should be implemented.

Conclusion

The Agnipath scheme in India is a major reform in defense policy that changes the recruitment process for armed forces. Initial implementation shows positive signs in the motivation, intelligence, and physical standards of Agniveers recruited under the scheme. Human element is deemed more important than technological advancements in military operations, highlighting the need for character development and psychological well-being of Agniveers to align with unit pride and cohesion.

|

Drishti Mains Question: Discuss the significance and challenges of the Agniveer Scheme introduced by the Indian government for recruitment in the armed forces. What measures can ensure its success? |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. Department of Border Management is a Department of which one of the following Union Ministries? (2008)

(a) Ministry of Defence

(b) Ministry of Home Affairs

(c) Ministry of Shipping, Road Transport and Highways

(d) Ministry of Environment and Forests

Ans: (b)

Mains

Q1: Analyse the multidimensional challenges posed by external state and non-state actors, to the internal security of India. Also discuss measures required to be taken to combat these threats. (2021)

Important Facts For Prelims

Greater Adjutant Stork

Why in News?

The Greater Adjutant Stork, locally known as ‘Garuda’ once commonly found in southern Asia and mainland southeast Asia, is now restricted to a small area Assam in India.

- This large bird is known for its distinct appearance, with a long neck, large bill, and a prominent gular pouch.

What are the Key Facts about Greater Adjutant Stork?

- Scientific Name: Leptoptilos dubius

- Genus: It is a member of the stork family, Ciconiidae. There are about 20 species in the family. They are long-necked large birds.

- Habitat: There are only 3 known breeding grounds, one in Cambodia and two in India (Assam and Bihar).

- In India, they are found with the largest colony located in Assam and a smaller one around Bhagalpur.

- In Assam, their habitat is primarily in the Brahmaputra valley, specifically in the districts of Guwahati, Morigaon, and Nagaon.

- Protection Status:

- IUCN Red List: Endangered

-

Wildlife (Protection) Act 1972: Schedule IV

- Diet:

- Principally carnivorous, feeding on fish, frogs, snakes, other reptiles, eels, birds, offal and carrion.

- It shares the habit of scavenging with vultures.

- Significance:

-

Religious Icon:

- They are considered the mount of Vishnu, one of Hinduism’s prime deities.

- Some worship the bird and call it “Garuda Maharaj” (Lord Garuda) or “Guru Garuda” (Great Teacher Garuda).

- Helpful for Farmers:

- They help farmers by killing rats and other farm pests.

-

What are the Threats and Conservation Efforts Related to Greater Adjutant Storks?

- Threats:

-

Habitat Loss: Urbanization is destroying wetlands, which are essential for these storks to forage for food. Many are now forced to rely on garbage dumps, which is not a healthy long-term solution.

- Eg: Garbage dumping site near the Deepor Beel Wildlife Sanctuary (Ramsar site).

- Encroachment and drainage projects are destroying crucial wetland ecosystems.

- For example, In Guwahati, private landowners are cutting down roosting trees (which they need for nesting), further squeezing their habitat.

- Seasonal Challenges: The breeding season (October-February) coincides with abundant fish and prey availability in wetlands.

- During the non-breeding season, these storks rely on urban waste disposal sites for food.

- Human Disturbance: Local communities often drive the birds away due to the strong odor of their droppings and the presence of rotting meat brought to feed their hatchlings.

-

-

Conservation Efforts:

-

Working with the Locals: In Assam, local communities play a significant role in the conservation of Hargila. Conservationists have engaged villagers, particularly women, in protecting nesting sites and raising awareness about the importance of these birds.

-

Protection of Nesting Sites: Efforts have been made to protect and restore nesting sites by planting trees and safeguarding existing ones where the storks nest. Community-based organizations are working to monitor and protect these sites from disturbances.

-

Awareness Campaigns: Educational programs and awareness campaigns are being conducted to change public perception and encourage coexistence with these storks.

-

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. ‘Invasive Species Specialist Group’ (that develops Global Invasive Species Database) belongs to which one of the following organizations?(2023)

(a) The International Union for Conservation of Nature

(b) The United Nations Environment Programme

(c) The United Nations World Commission for Environment and Development

(d) The World Wide Fund for Nature

Ans: (a)

Q. Other than poaching, what are the possible reasons for the decline in the population of Ganges River Dolphins? (2014)

- Construction of dams and barrages on rivers

- Increase in the population of crocodiles in rivers

- Getting trapped in fishing nets accidentally

- Use of synthetic fertilizers and other agricultural chemicals in crop-fields in the vicinity of rivers.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1, 3 and 4 only

(d) 1, 2, 3 and 4

Ans: (c)

Important Facts For Prelims

Indian House Crows

Why in News?

Recently the Kenyan government has announced an action plan to eliminate a million Indian House Crows (Corvus splendens) by the end of 2024.

- This decision stems from the birds' significant negative impact on local ecosystems and their nuisance to the public, particularly in the Kenyan coastal region.

What is the Kenyan Government Action Plan?

- Invasive Species Issue: The Indian House Crow is described as an invasive alien species from India and parts of Asia, introduced to East Africa via shipping activities.

- Ecological Impact: The crows prey on endangered local bird species, destroy nests, and eat eggs and chicks, leading to a decline in indigenous bird populations.

- This decline disrupts the ecosystem, allowing pests and insects to proliferate, further harming the environment.

- Historical Effort: A similar effort in Kenya over 20 years ago managed to reduce their numbers temporarily.

- Government and Community Response: An action plan to combat the crow menace includes mechanical and targeted methods for culling the birds, and use of licensed poison for population control.

What are the Key Facts About Indian House Crows?

- Species: Corvus splendens

- Common names: Indian house crow, house crow, Indian crow, grey-necked crow, Ceylon crow, Colombo crow

- Family: Corvidae

- Taxonomy: The nominate race of Corvus splendens (C. splendens) exists in India, Nepal and Bangladesh and has a grey neck collar.

- Conservation Status:

- IUCN Status: Least Concerned

- Wildlife Protection Act: Schedule II

Key Points About Kenya

- Kenya is located in East Africa. Its terrain rises from a low coastal plain on the Indian Ocean to mountains and plateaus at its centre.

- Kenya shares common borders with five countries namely: Tanzania in the South, Uganda in the West, South Sudan in the North West, Ethiopia in the North and Somalia in the East

- Kenya's is located between the Indian Ocean and Lake Victoria.

- Lake Turkana, the world's largest desert lake, is part of the Omo-Turkana basin, which stretches into four countries: Ethiopia, Kenya, South Sudan and Uganda.

- UN-Habitat maintains its headquarters at the United Nations Office in Nairobi, Kenya.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Consider the following statements: (2019)

- Some species of turtles are herbivores.

- Some species of fish are herbivores.

- Some species of marine mammals are herbivores.

- Some species of snakes are viviparous.

Which of the statements given above are correct?

(a) 1 and 3 only

(b) 2, 3 and 4 only

(c) 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (d)

Q. Which one of the following is the national aquatic animal of India? (2015)

(a) Saltwater crocodile

(b) Olive ridley turtle

(c) Gangetic dolphin

(d) Gharial

Ans: (c)

Rapid Fire

Syndicated Loan

Recently, a private Non-Banking Financial Company (NBFC) announced that it has raised USD 425 million and EURO 40 million through a syndicated loan.

- It is a three-year external commercial borrowing facility structured as a social loan that would be used to empower small entrepreneurs and vulnerable groups across India.

- A syndicated loan is financing offered by a syndicate made up of a group of lenders that work together to provide funds for a borrower.

- The borrower can be a corporation, a large project, or a sovereign government.

- Syndicated loans involve large amounts of money, spreading the risk among several financial institutions to reduce the impact if the borrower fails to repay.

- External Commercial Borrowings (ECBs) denote Indian companies borrowing funds from foreign sources, such as loans, bonds, or financial instruments, to finance business expansion, asset acquisition, or existing debt repayment.

Read more: External Commercial Borrowings (ECBs), Non-Banking Financial Company (NBFC)

Rapid Fire

Skilling Potential of Tourism

The Ministry of Tourism has been implementing the Hunar se Rozgar Scheme (skill to employment) since 2006 and it needs to relaxation in bureaucratic norms to boost participation.

Hunar se Rozgar Scheme:

- The Hunar se Rozgar scheme has significant potential to skill and employ youth in the tourism sector.

- The primary goal of the scheme is to offer short-term vocational training to non-literate, semi-literate, and educated unemployed youth aged 18-28 years to improve their skills and employability.

- It enables less-educated youth to pursue formal employment after brief training.

- This scheme gives economic importance to tourism and the potential to promote cultural heritage.

- The scheme primarily attracts participants from northern states.

Rapid Fire

Cryonics

Recently, Southern Cryonics (a company in Australia) announced that it has successfully frozen its first client, with the hope of bringing him back to life in the future.

- The first patient was an 80-year-old man, who died in May 2024 at a hospital in Sydney.

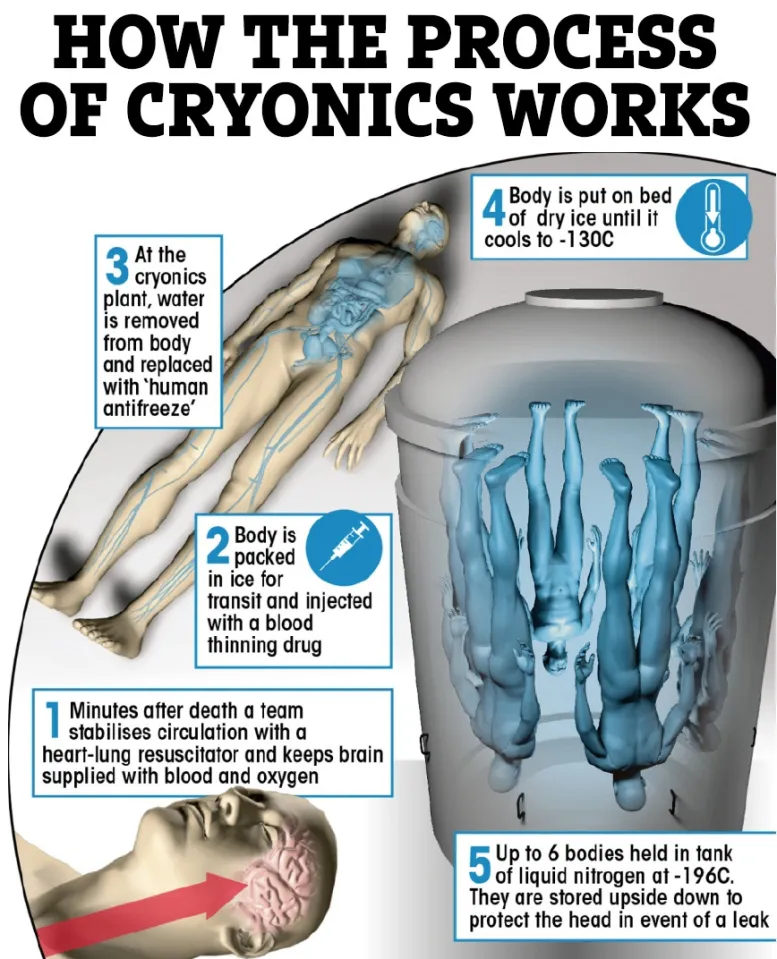

- Cryonics involves keeping the human body at cryogenic temperatures (-196°C) in the hopes that one day, medical science will be able to repair the molecular damage caused by ageing and disease and bring the patient back to full health.

- The process involves initially cooling the man's body to 6 degrees Celsius with ice, using a heart-lung bypass machine to circulate a preserving solution and lower the temperature.

- Further, the body is wrapped in a special sleeping bag and packed in dry ice to reach -80 degrees Celsius, and then gradually lowering the temperature to -200 degrees Celsius in a cooling chamber before placing in a pod and storing it upside down in a specialised tank.

- However, the concern lies in the scientific and ethical aspects of reviving a whole human body, along with the extended timeframe required for such advancements.

Rapid Fire

Leader of Opposition

Recently, the Congress Working Committee (CWC) has unanimously adopted a resolution to select the Leader of the Opposition (LoP) in the 18th Lok Sabha.

Leader of the Opposition (LOP):

- The leader of the largest opposition party having not less than one-tenth seats of the total strength of the Lok Sabha is recognised as the leader of the Opposition.

- He will be a member of crucial committees such as Public Accounts (Chairman), Public Undertakings, Estimates and also a member of several Joint Parliamentary Committees.

- He is entitled to be a member of various selection committees responsible for appointing heads of statutory bodies like the Central Vigilance Commission, the Central Information Commission, the CBI, the NHRC, and the Lokpal.

- He provides constructive criticism of the government policies and to provide an alternative government.

- The leader of Opposition in both the Houses were accorded statutory recognition under the Salaries and Allowances of Leader of Opposition in Parliament Act, 1977 and are entitled to the salary, allowances and other facilities equivalent to that of a cabinet minister.

- The office of the leader of the opposition is not mentioned in the Constitution.