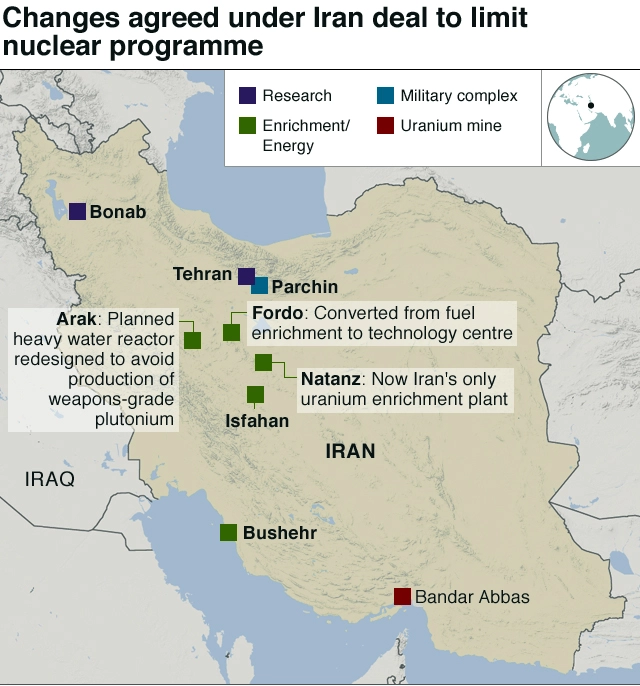

Restoration of JCPOA

For Prelims: Joint Comprehensive Plan of Action (JCPOA), International Atomic Energy Agency (IAEA).

For Mains: Timeline & Background of JCPOA, Impacts on India of Restoration of JCPOA.

Why in News?

Recently, the US has restored sanctions waivers to Iran to allow international nuclear cooperation projects, as indirect American-Iranian talks on reviving the 2015 international nuclear deal with Iran enter the final stretch.

- The waiver allows other countries and companies to participate in Iran’s civilian nuclear programme without triggering US sanctions on them, in the name of promoting safety and non-proliferation.

- The waivers were revoked by the United States in 2019 and 2020 under former President Donald Trump, who pulled out of the nuclear agreement. The agreement is formally called the Joint Comprehensive Plan of Action (JCPOA).

What is the Timeline & Background of JCPOA?

- The JCPOA was the result of prolonged negotiations from 2013 and 2015 between Iran and P5+1 (China, France, Germany, Russia, the United Kingdom, the United States).

- It happened due to the backchannel talks between the US (President Barack Obama) and Iran, quietly brokered by Oman, in an attempt to repair the accumulated mistrust since the 1979 Islamic revolution.

- Islamic Revolution, also called Iranian Revolution, popular uprising in Iran in 1978–79 that resulted in the toppling of the monarchy on 11th February, 1979, and led to the establishment of an Islamic republic.

- The JCPOA obliged Iran to accept constraints on its uranium enrichment program verified by an intrusive inspection regime in return for a partial lifting of economic sanctions.

- However, faced with a hostile Republican Senate, President Obama was unable to get the nuclear deal ratified but implemented it on the basis of periodic Executive Orders to keep sanction waivers going.

- When Donald Trump became president, he withdrew from the deal and called it a “horrible, one-sided deal that should have never, ever been made”.

- The US decision was criticized by all other parties to the JCPOA (including the European allies) because Iran was in compliance with its obligations, as certified by the International Atomic Energy Agency (IAEA).

- Tensions rose as the US pushed ahead with its unilateral sanctions, widening its scope to cover nearly all Iranian banks connected to the global financial system, industries related to metallurgy, energy, and shipping, individuals related to the defence, intelligence, and nuclear establishments.

- For the first year after the US withdrawal, Iran’s response was muted as the E-3 (France, Germany, the U.K.) and the European Union (EU) promised to find ways to mitigate the US decision.

- The E-3’s promised relief Instrument in Support of Trade Exchanges (INSTEX), created in 2019 to facilitate limited trade with Iran.

- However, by May 2019, Iran’s strategic patience ran out as the anticipated economic relief from the E-3/EU failed to materialize.

- As the sanctions began to hurt, Iran shifted to a strategy of ‘maximum resistance’.

What will be the Impacts on India of Restoration of JCPOA?

- Restoration of JCPOA may ease many restrictions over the Iranian regime, which may directly or indirectly help India. This can be reflected in the following examples:

- Boost to Regional Connectivity: Removing sanctions may revive India’s interest in the Chabahar Project, Bandar Abbas port, and other plans for regional connectivity.

- This would further help India to neutralize the Chinese presence in Gwadar port, Pakistan.

- Apart from Chabahar, India’s interest in the International North-South Transit Corridor (INSTC), which runs through Iran, which will improve connectivity with five Central Asian republics, may also get a boost.

- Energy Security: Due to the pressure linked to the US’ Countering America’s Adversaries Through Sanctions Act (CAATSA), India has to bring down oil imports to zero.

- Restoration of ties between the US and Iran will help India to procure cheap Iranian oil and aid in energy security.

Patent Waiver Plan for Vaccines

For Prelims: World Trade Organisation (WTO) , Trade-Related Aspects of Intellectual Property Rights (TRIPS), Doha Declaration.

For Mains: Patent Waiver, Covid-19, Intellectual Property Rights.

Why in News?

Recently, the Geneva Health Files, a Switzerland-based newsletter portal, revealed that a small group of World Trade Organisation (WTO) members were discussing to exclude drug manufacturers in India and China from prospective waivers to Intellectual Property Rights obligations under Trade-Related Aspects of Intellectual Property Rights (TRIPS).

- In 2020, India and South Africa had proposed a waiver from the implementation and application of certain provisions of the TRIPS Agreement (waiving IP rights like patents, copyright, and trademarks) for prevention, containment or treatment of Covid-19.

What is the TRIPS Agreement & its Relationship with Indian Patent Law?

- The TRIPS agreement was negotiated in 1995 at the WTO, it requires all its signatory countries to enact domestic law.

- It guarantees minimum standards of IP protection.

- Such legal consistency enables innovators to monetise their intellectual property in multiple countries.

- In 2001, the WTO signed the Doha Declaration, which clarified that in a public health emergency, governments could compel companies to license their patents to manufacturers, even if they did not think the offered price was acceptable.

- This provision, commonly referred to as “compulsory licensing”, was already built into the TRIPS Agreement and the Doha declaration only clarified its usage.

- Under Section 92 of the 1970 Indian Patents Act, the central government has the power to allow compulsory licenses to be issued at any time in case of a national emergency or circumstances of extreme urgency.

What is the Need for Invoking Compulsory Licensing?

- Plugging Shortage of Vaccine: The richest countries have cornered about 80% of vaccine supplies so far.

- While India needs to supplement its output to ensure that a population of over 900 million which is above 18 years of age gets about 1.8 billion doses at the earliest.

- Thus, compulsory licensing can be used to augment the supply of drugs and other therapeutics.

- Nudging Voluntary Licensing: An assertive posture on compulsory licences would also have the advantage of forcing several pharmaceutical companies to offer licences voluntarily.

- Leading By Example: Licensing Covaxin widely would enable India to live up to its reputation of being the ‘pharmacy of the world’ and also put pressure on developed countries to transfer their vaccine technology to developing countries.

- Thus, the government should not only transfer Covaxin’s technology to domestic pharmaceutical companies, to boost national supplies, but also offer it to foreign corporations.

- By unlocking its vaccine technical know-how to the world, India would demonstrate its resolve to walk the talk on the TRIPS waiver.

- Favourable Regulatory Environment: A commitment to supply vaccines to India requires trust in the country’s regulatory and institutional environment, which the government must strive to instil through dependable commitments.

- Such confidence, combined with the expedited process for vaccine approval, can help India quickly overcome its supply shortage.

Why are the Issues With TRIPS Waiver?

- Complex Intellectual Property Mechanism: The process of vaccine development and manufacturing has several steps, and involves a complex intellectual property mechanism.

- Different types of IP rights apply to different steps and there is no one kind of IP that could unlock the secret to manufacturing a vaccine.

- The expertise to manufacture it may be protected as a trade secret, and the data from clinical trials to test vaccine safety and efficacy may be protected by copyright.

- Complex Manufacturing Mechanism: Manufacturers will need to design the process for manufacturing the vaccines, source necessary raw materials, build production facilities, and conduct clinical trials to get regulatory approvals.

- The manufacturing process itself has different steps, some of which may be subcontracted to other parties.

- Thus, a patent waiver alone does not empower manufacturers to start vaccine production immediately.

Content Regulatory Powers of the I&B Ministry

For Prelims: Content Regulation, IT Rules, 2021, Over the Top platforms, Social Media, Press, Central Board of Film Certification, Cable TV Network Rules, 1994, Press Council of India, Article 19.

For mains: Government Policies & Interventions, Scientific Innovations & Discoveries, Issues Arising Out of Design & Implementation of Policies, IT & Computers, Content Regulation in India.

Why in News?

Recently, the Information and Broadcasting Ministry (I&B) informed a Malayalam-language news channel that its broadcast licence had been cancelled.

- The cancellation order cited a Home Ministry order that had denied security clearance to the channel.

Which Sectors Can the I&B Ministry Regulate Content?

- Until 2021, it had the powers to regulate content across all sectors — TV channels, newspapers and magazines, movies in theatres and on TV, and the radio — barring the internet.

- In February, 2021, the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021, extended its regulatory powers over internet content too, especially on digital news platforms and Over the Top (" OTT ") platforms.

What Kind of Powers Does it Have?

- Films Related:

- For example, the Central Board of Film Certification (CBFC) has a mandate to give any film that will be played in a theatre, a rating indicating the kind of audience it is suitable for.

- In practice, however, the CBFC has often suggested changes or cuts to a film before giving it a certification. While it isn’t the CBFC’s mandate to censor a film, it can withhold giving a rating unless the filmmaker agrees to its suggestions.

- For example, the Central Board of Film Certification (CBFC) has a mandate to give any film that will be played in a theatre, a rating indicating the kind of audience it is suitable for.

- TV Channels & OTT Related:

- When it comes to TV channels, the government last year came up with a three-tier grievance redressal structure for viewers to raise concerns, if any.

- A viewer can successively approach the channel, then a self-regulatory body of the industry, and finally the I&B Ministry, which can issue a show cause notice to the channel, and then refer the issue to an Inter-Ministerial Committee (IMC).

- For content on OTT platforms too, there is a similar structure.

- The ministry also has the Electronic Media Monitoring Cell, which tracks channels for any violations of the programming and advertising codes mentioned in the Cable TV Network Rules, 1994.

- Violation can lead to revocation of a channel’s uplinking licence (for sending content to a satellite) or downlinking licence (for broadcasting to viewers through an intermediary). It is these licences of MediaOne (Malayalam-language news channel) that the government revoked.

- When it comes to TV channels, the government last year came up with a three-tier grievance redressal structure for viewers to raise concerns, if any.

- Print Media and Website Related:

- In print, based on the recommendations of the Press Council of India, the government can suspend its advertising to a publication.

- And last year’s IT rules allowed the I&B Ministry to issue orders to ban websites based on their content.

What Kind of Content is Not Allowed?

- There are no specific laws on content allowed or prohibited in print and electronic media, radio, films or OTT platforms.

- The content on any of these platforms has to follow the free speech rules of the country. Article 19(1) of the Constitution, while protecting freedom of speech, also lists certain “reasonable restrictions” including content related to:

- The security of the state

- Friendly relationship with foreign states

- Public order

- Decency

- Morality etc.

- Action can be taken if any of these restrictions is violated.

Do Other Agencies Play a Role?

- There is no direct involvement, as the powers to regulate content rest only with the I&B Ministry. However, the ministry relies on inputs from other ministries, as well as intelligence agencies.

- For Example: In the recent case the licences were revoked because the Home Ministry had denied it security clearance, which is essential as part of the policy.

- There is also a new mechanism the I&B Ministry adopts: It has used emergency powers it has under the new IT Rules to block certain YouTube channels and social media accounts based on inputs from intelligence agencies.

- The recourse available to anyone whose channel or account has been banned would be to go to the courts.

Sovereign Green Bonds

For Prelims: Features of Sovereign green bonds, Major Announcements in Budget 2022.

For Mains: Net-zero carbon emissions by 2070, Sovereign green bonds.

Why in News?

Recently, the Finance Minister in the Budget 2022 announced that the government proposes to issue sovereign green bonds to mobilise resources for green infrastructure.

- The proceeds will be deployed in public sector projects which help in reducing the carbon intensity of the economy.

- The announcement is in sync with India’s commitment to achieving net-zero carbon emissions by 2070.

What are Green Bonds?

- Green bonds are issued by companies, countries and multilateral organisations to exclusively fund projects that have positive environmental or climate benefits and provide investors with fixed income payments.

- The projects can include renewable energy, clean transportation and green buildings, among others.

- Proceeds from these bonds are earmarked for green projects. This is unlike standard bonds, the proceeds of which can be utilised for various purposes at the discretion of the issuer.

- The international green bond market has seen cumulative issuance worth more than USD 1 trillion since market inception in 2007.

- By the end of 2020, 24 national governments had issued Sovereign Green, Social and Sustainability bonds totalling a cumulative USD 111 billion dollars, according to the London-based Climate Bonds Initiative.

What is the Significance of Sovereign Guarantee to Green Bonds?

- Sovereign green issuance sends a powerful signal of intent around climate action and sustainable development to governments and regulators.

- It will catalyze domestic market development and provides impetus to institutional investors.

- It will provide benchmark pricing, liquidity and a demonstration effect for local issuers, helping to support the growth of a local market.

- With the IEA’s World Energy Outlook 2021, estimating that 70% of the additional USD 4 trillion spending to reach net-zero is required in emerging/developing economies, sovereign issuance can help kickstart these large inflows of capital.

What are Other Measures on Climate Action announced in the Budget?

- The budget included several measures on climate action such as:

- Battery swapping policy.

- Additional allocation under the PLI scheme for manufacturing high efficiency solar modules.

- The government is introducing a new bill that aims to provide a regulatory framework for Carbon Trading in India to encourage penetration of renewables in the energy mix.

Way Forward

- Following the French Model: India can follow the example of France which as part of the budgeting process, assigns a green coefficient to each budget line according to how green the expenditure is relative to the six environmental priorities of the European Union (climate change mitigation, climate change adaptation, water management, circular economy, pollution, and biodiversity).

- Harmonising Standards: One of the foremost requirements is to harmonise international and domestic guidelines and standards for green bonds to develop a robust green bond market.

- Homogeneity is also required in terms of what constitutes green investments, as varied taxonomies would be antithetical to a cross-border green bond market.

- Leveraging Private Sector: Appropriate capacity building efforts for issuers in emerging markets to spread knowledge on the benefits and related processes and procedures pertaining to green bonds would help in addressing the institutional barriers to entry into this market.

Parvatmala Scheme

For Prelims: Parvatmala Scheme, Ropeway.

For Mains: Significance of Parvatmala Scheme and Benefits of Ropeways.

Why in News?

Recently, the Union Finance Minister in the Union Budget for 2022-23 announced National Ropeways Development Programme – “Parvatmala” to improve connectivity in hilly areas.

What is the Scheme?

- The scheme will be taken up on PPP (Public Private Partnership) mode, which will be a preferred ecologically sustainable alternative in place of conventional roads in difficult hilly areas.

- The idea is to improve connectivity and convenience for commuters, besides promoting tourism.

- This may also cover congested urban areas, where conventional mass transit systems are not feasible.

- The scheme is being presently started in regions like Uttarakhand, Himachal Pradesh, Manipur, Jammu & Kashmir and the other North Eastern states.

- The Finance Minister announced that contracts for 8 ropeway projects for a length of 60 km would be awarded in 2022-23.

Who is the Nodal Ministry?

- The Ministry of Road Transport and Highways (MORTH) will have responsibility for development of ropeway and alternative mobility solutions technology, as well as construction, research, and policy in this area.

- In February 2021, the Government of India (Allocation of Business) Rules 1961 was amended, which enabled the MORTH to also look after the development of Ropeways and Alternate Mobility Solutions.

- The move will give a boost to the sector by setting up a regulatory regime.

- The MORTH has so far been responsible for development of Highways and regulating the road transport sector across the country.

What is the Significance?

- Economical mode of transportation:

- Given that ropeway projects are built in a straight line over a hilly terrain, it also results in lower land acquisition costs.

- Hence, despite having a higher cost of construction per km than roadways, ropeway projects’ construction cost may happen to be more economical than roadways.

- Faster mode of transportation:

- Owing to the aerial mode of transportation, ropeways have an advantage over roadway projects where ropeways can be built in a straight line, over a hilly terrain.

- Environmentally friendly:

- Low dust emissions. Material containers can be designed so as to rule out any soiling of the environment.

- Last mile connectivity:

- Ropeway projects adopting 3S (a kind of cable car system) or equivalent technologies can transport 6000-8000 passengers per hour.

What are the Benefits of Ropeways?

- Ideal for difficult / challenging / sensitive terrain:

- Long rope spans: The system crosses obstacles like rivers, buildings, ravines, or roads without a problem.

- Ropes guided over towers: Low space requirements on the ground, and no barrier for humans or animals.

- Economy:

- Ropeway having multiple cars propelled by a single power-plant and drive mechanism.

- This reduces both construction and maintenance costs.

- The use of a single operator for an entire ropeway is a further saving, in labor cost.

- On level ground, the cost of ropeways is competitive with narrow-gauge railroads, in the mountains the ropeway is far superior.

- Flexible:

- Transport of different materials - A ropeway allows for the simultaneous transport of different types of material.

- Ability to handle large slopes:

- Ropeways and cableways (cable cranes) can handle large slopes and large differences in elevation.

- Where a road or railroad needs switchbacks or tunnels, a ropeway travels straight up and down the fall line. The old cliff railways in England and ski resort ropeways in the mountains take advantage of this feature.

- Low footprint:

- The fact that only narrow-based vertical supports are needed at intervals, leaving the rest of the ground free, makes it possible for ropeways to be constructed in built-up areas and in places where there is intense competition for land use.

India’s Solar Sector

For Prelims: Schemes and programmes for Achieving Renewable Energy Target.

For Mains: India's achievements in renewable energy sector, India's renewables energy targets, challenges and initiatives taken to achieve it.

Why in News?

The centre is set to come up with rules to pool solar tariffs and is also aiming to increase bundling of renewable energy in existing thermal Power Purchase Agreements (PPAs) to boost the procurement of renewable energy.

- The government is aiming to boost installed renewable energy capacity to 500 GW (GigaWatts) by 2030.

- A Power Purchase Agreement (PPA), or electricity power agreement, is a contract between two parties, one which generates electricity (power generating companies (gencos)) and one which is looking to purchase electricity (Discoms).

What is the Issue?

- Solar tariffs have fallen consistently over the past decade to a low of under Rs 2 per unit (1 unit = 1 kWh) in December 2020 due to the falling price of solar panels and lower financing cost.

- The trend of lower solar tariffs has led to many many players waiting on tariffs to fall further instead of entering into long term power procurement agreements.

How can this Step be Helpful?

- A move to pool tariffs could help speed up procurement of solar power by addressing concerns among discoms of losing out on lower solar tariffs in the future.

- The government is planning to pool all solar power procurement in a given period and ask that all buyers pay an average of all the tariffs that are contracted in a pooling period.

- The government’s step to bundle about 10,000 MW of Renewable energy based power with fossil fuel based power over the next 4-5 year would also help lower total cost of power procurement for certain discoms.

- There are a number of old thermal power projects that are unviable because of high variable costs and don’t get dispatched in merit order and that discoms are forced to pay fixed costs due to requirements under existing PPAs.

- The centre had in November 2021 issued guidelines which permitted thermal generation companies to supply power to customers from their renewable energy projects under the existing Power Purchase Agreements (PPAs) for coal-based electricity with gains from the bundling of renewable energy to be shared between generators and (discoms) on a 50:50 basis.

What is the Current state of India’s Solar Sector?

- About:

- The country’s installed Renewable Energy (RE) capacity stands at 150.54 GW (solar: 48.55 GW, wind: 40.03 GW, Small hydro Power: 4.83, Bio-power: 10.62, Large Hydro: 46.51 GW) as on 30th Nov. 2021 while its nuclear energy based installed electricity capacity stands at 6.78 GW.

- India has the 4th largest wind power capacity in the world.

- This brings the total non-fossil based installed energy capacity to 157.32 GW which is 40.1% of the total installed electricity capacity of 392.01 GW.

- Push to RE in the Budget 2022-23:

- About:

- To facilitate domestic manufacturing for the ambitious goal of 280 GW of installed solar capacity by 2030, an additional allocation of 19,500 crore for Production Linked Incentive for manufacture of high efficiency modules will be made.

- Issues:

- Budget estimate for the Union Ministry of New and Renewable Energy (MNRE) for 2022-23 showed that the investment in Solar Energy Corporation of India (SECI) has been nearly halved — to less than Rs 1,000 crores from over Rs 1,800 crore.

- SECI is the only Public Sector Undertaking of the Union government working on solar energy and is currently responsible for the development of the entire renewable energy sector.

- A primary issue with the manufacturing of solar PhotoVoltaic (PV) modules in India over the years has been a lack of quality.

- This could have been addressed by enhancing research and development related to technological aspects of fully integrated manufacturing units from polysilicon to solar PV modules.

- However, any separate allocation for such R&D has not been announced.

- Budget estimate for the Union Ministry of New and Renewable Energy (MNRE) for 2022-23 showed that the investment in Solar Energy Corporation of India (SECI) has been nearly halved — to less than Rs 1,000 crores from over Rs 1,800 crore.

- About:

- Related Initiatives:

Way Forward

- Identification of Areas: Renewable resources specially wind cannot be set up everywhere, they require specific location.

- Identification of these specific locations, integrating them with the main grid and distribution of powers, a combination of these three is what will take India forward.

- Exploration: More storage solutions need to be explored.

- Agriculture Subsidy: Agricultural subsidy should be rectified in order to ensure that only the required amount of energy is consumed.

- Hydrogen Fuel Cell Based Vehicles and Electric Vehicles: These are the most suitable options when it comes to shifting towards renewable sources of energy, that’s where we need to work upon.

Need to Boost Labour Income and Consumption Expenditure

For Prelims: Important macroeconomic indicators of the Indian economy, Government Budgeting.

For Mains: Fiscal Consolidation Approach in the Budget 2022.

Why in News?

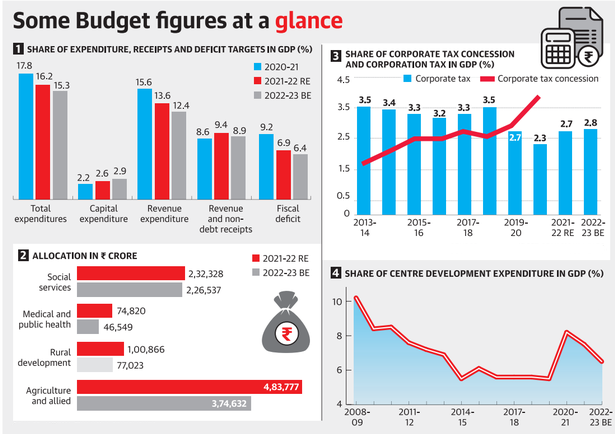

The Union Budget 2022-23 has projected a fiscal deficit of 6.4% of nominal GDP, a narrowing from the 6.9% assumed in the revised estimates for the current fiscal year ending on 31st March, 2022.

- In simple words, a fiscal deficit is a shortfall in a government's income compared with its spending.

- Nominal GDP is GDP (Gross Domestic Product) evaluated at current market prices. It includes all of the changes in market prices that have occurred during the current year due to inflation or deflation.

What was the Economic Context to this year’s Budget Formulation?

- Reduction in Labour Income and Consumption Expenditure:

- Though every economic crisis involves sharp reduction in output growth rate, the specificity of the present crisis in India lies in the sharper reduction in labour income as compared to profits.

- The consequent reduction in income share of labour was associated with a sharp fall in consumption-GDP ratio as well as absolute value of consumption expenditure during the pandemic.

- The four components of Gross Domestic Product (GDP) are personal consumption, business investment, government spending, and net exports.

- The consequent reduction in income share of labour was associated with a sharp fall in consumption-GDP ratio as well as absolute value of consumption expenditure during the pandemic.

- Though every economic crisis involves sharp reduction in output growth rate, the specificity of the present crisis in India lies in the sharper reduction in labour income as compared to profits.

- Structural Challenge:

- It is pertaining to addressing the structural constraints of the Indian economy that restricted growth even during the pre-pandemic period.

What are the Key Shortcomings in the Budget-22 in this Regard?

- Revenue Expenditure:

- The share of revenue and non-debt receipts in GDP has remained more or less unchanged, the objective of fiscal consolidation has been sought to be achieved primarily by reducing the expenditure-GDP ratio.

- Fiscal consolidation refers to the ways and means of narrowing the fiscal deficit.

- Hence, the brunt of this expenditure compression fell on revenue expenditure.

- Expenditure on the payment of wages and salaries, subsidies or interest payments would be typically classified as revenue expenditure.

- The share of revenue and non-debt receipts in GDP has remained more or less unchanged, the objective of fiscal consolidation has been sought to be achieved primarily by reducing the expenditure-GDP ratio.

- Effect on Income and Livelihood of Labour:

- Since the bulk of the revenue expenditure comprises food subsidies and current expenses in social and economic services, reduction in the allocation for revenue expenditure has been associated with fall in several key expenditure that affect the income and livelihood of labour.

- For example, allocation for both agriculture and allied activities and rural development registered a sharp decline in nominal absolute terms in 2022-23 as compared to 2021-22.

- Similarly, in the midst of the ongoing pandemic, total nominal expenditure on medical and public health registered a sharp fall in 2022-23 as compared to 2021-22. Such expenditure compression has been associated with the overall fall in the allocation for total social sector expenditure.

- Since the bulk of the revenue expenditure comprises food subsidies and current expenses in social and economic services, reduction in the allocation for revenue expenditure has been associated with fall in several key expenditure that affect the income and livelihood of labour.

- Low Corporate Tax Ratio:

- Despite sharp increase in profits during the pandemic, the corporate tax-GDP ratio has continued to remain below the 2018-19 level due to tax concessions. Despite the objective of fiscal consolidation, the corporate tax ratio continues to remain low and restrict revenue receipts.

What are the Implications for Development Spending?

- The objective of fiscal consolidation along with the inability to increase revenue receipts has posed a constraint on development expenditure.

- Developmental expenditure refers to the expenditure of the government which helps in economic development by increasing production and real income of the country.

- With non-development expenditure comprising of interest payments, administrative expenditure and various other components which are typically rigid downward, the brunt of expenditure compression has fallen on development expenditure.

- The reduction in the allocation for development expenditure ratio for 2022-23 reflects reduction in the allocation for food subsidies, national rural employment guarantee program, expenditure in agriculture, rural development and social sector.

What is the Concern from a Macroeconomic Perspective?

- Impact on the Recovery of Labour Income and Consumption Expenditure:

- Reduction in the allocation for development expenditure would have adverse impact on labour income and consumption expenditure.

- The positive impact of higher capital expenditure on the recovery process would be largely curtailed by the adverse impact of more than proportionate fall in revenue expenditure.

- Reduction in the allocation for development expenditure would have adverse impact on labour income and consumption expenditure.

- Dependent on External Factor for Economic Revival:

- Given the fiscal consolidation strategy of the Government, the prospect and extent of economic revival at the present remains heavily dependent on external demand.

- Despite the brief recovery in exports in the last few quarters, the possibility of sustained economic recovery relying exclusively on the export channel appears to be bleak at the present as different countries have already started pursuing fiscal consolidation at the dictate of the IMF (International Monetary Fund).

Way Forward

- In an economy where growth is largely consumption-driven, it is important that income reaches the hands of the lower and the middle-income groups. This extra money in the hands of the lower and middle incomes groups will reach into the consumption channel, spurring consumption-driven growth.

- India’s policy response needs to be ‘Keynesian’ — greater wealth taxation to channel resources towards social goals. This needs to be complemented by economic empowerment at the grassroots level by revitalising social security schemes targeted at income generation for lower income groups.

Microbes in Plastic Clean-up: Bioremediation

Why in News?

A team of Argentine scientists is using microorganisms native to Antarctica to explore the idea of cleaning up pollution from fuels and, potentially, plastics in the pristine expanses of the white continent.

- The continent is protected by a 1961 Madrid Protocol that stipulates it must be kept in a pristine state.

- Over 300 million tons of plastic are produced every year for use in a wide variety of applications. At least 14 million tons of plastic end up in the ocean every year, and plastic makes up 80% of all marine debris found from surface waters to deep-sea sediments.

How was the Research carried out on Microbes?

- The researchers collected samples of plastic from the Antarctic seas and studied to see if the microorganisms are eating the plastics or simply using them as rafts.

- The team carried out bioremediation tasks.

- The team helped the microbes with nitrogen, humidity and aeration to optimize their conditions.

- This work uses the potential of native microorganisms - bacteria and fungi that inhabit the Antarctic soil, even when it is contaminated - and make these microorganisms eat the hydrocarbons.

- The tiny microbes munch through the waste, creating a naturally occurring cleaning system for pollution caused by diesel that is used as a source of electricity and heat for research bases in the frozen Antarctic.

- The research on how the microbes could help with plastic waste could have potential for wider environmental issues.

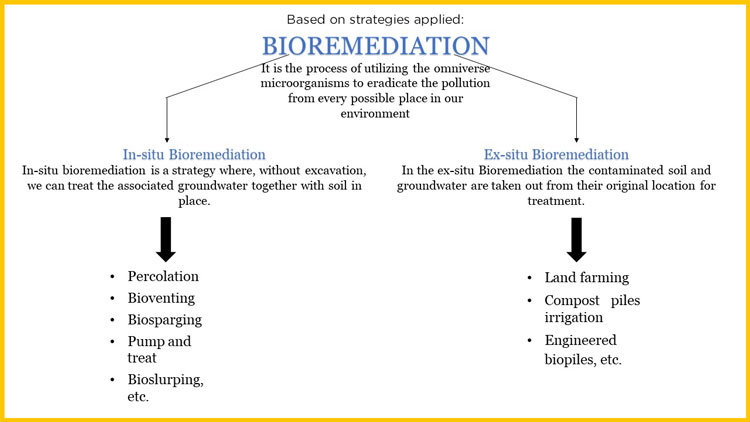

What is Bioremediation?

- It is a branch of biotechnology that employs the use of living organisms, like microbes and bacteria, in the removal of contaminants, pollutants, and toxins from soil, water, and other environments.

- Bioremediation is used to clean up oil spills or contaminated groundwater.

- Bioremediation may be done "in situ"–at the site of the contamination–or "ex situ"–away from the site.

What are the Benefits of Bioremediation?

- By relying solely on natural processes, it minimizes damage to ecosystems.

- Bioremediation often takes place underground, where amendments and microbes can be pumped in order to clean up contaminants in groundwater and soil.

- Consequently, bioremediation does not disrupt nearby communities as much as other cleanup methodologies.

- “Amendments” to the environment, such as molasses, vegetable oil, or simple air optimize conditions for microbes to flourish, thereby accelerating the completion of the bioremediation process.

- The bioremediation process creates relatively few harmful byproducts (mainly due to the fact that contaminants and pollutants are converted into water and harmless gases like carbon dioxide).

- Bioremediation is cheaper than most cleanup methods because it does not require substantial equipment or labor.

Powerthon-2022

Why in News?

Recently, the Ministry of Power has launched Powerthon-2022.

What is Powerthon-2022?

- It is a hackathon competition under RDSS (Revamped Distribution Sector Scheme) to find technology driven solutions to solve the complex problems in power distribution.

- The hackathon will see participation from startups, Technology Solution Providers (TSPs), educational and research institutions, equipment manufacturers and state power utilities and other power entities.

- The nine themes for the hackathon are -- demand/load forecasting, AT&C (Aggregate Technical and Commercial) loss reduction, energy theft detection, prediction of DT (Distribution Transformer) failure, asset inspection, vegetation management, consumer experience enhancement, renewable energy integration and power purchase optimisation.

What is RDSS?

- It was approved by the Cabinet Committee on Economic Affairs in July 2021 to improve the operational efficiencies and financial sustainability of discoms (excluding Private Sector DISCOMs).

- It provides conditional financial assistance to strengthen the supply infrastructure of discoms (power distribution companies).

- All the existing power sector reforms schemes such as Integrated Power Development Scheme, Deen Dayal Upadhyaya Gram Jyoti Yojana, and Pradhan Mantri Sahaj Bijli Har Ghar Yojana will be merged into this umbrella program.

- The scheme will be available till 2025-26.

- RDSS is a Reform-based and Result-linked Scheme and the key objectives of RDSS are Reducing AT&C losses to 12-15%, eliminating the cost-revenue gap by 2024-25 and improving the quality & reliability of the power supply.

What are the other Schemes related to the Power Sector?

- Pradhan Mantri Sahaj Bijli Har Ghar Yojana (Saubhagya).

- Integrated Power Development Scheme (IPDS).

- Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY).

- GARV (Grameen Vidyutikaran) App.

- Ujwal Discom Assurance Yojana (UDAY).

- ‘4 Es’ in the Revised Tariff Policy.

Wayanad Wildlife Sanctuary

Why in News?

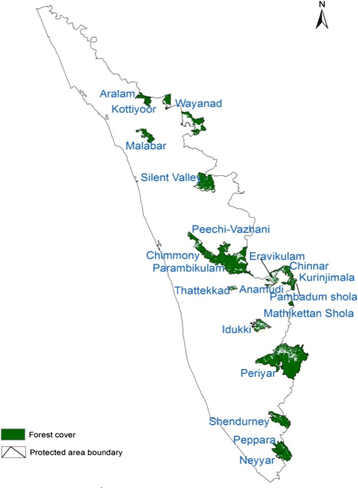

With the onset of summer, the seasonal migration of wild animals has begun from the adjacent wildlife sanctuaries in Karnataka and Tamil Nadu to the Wayanad Wildlife Sanctuary (WWS) in Kerala.

- The sanctuary is a haven for wild animals during summer owing to the easy availability of fodder and water throughout the year.

Where is the Wayanad Wildlife Sanctuary Located?

- Located in Kerala, Wayanad Wildlife Sanctuary (WWS) is an integral part of the Nilgiri Biosphere Reserve. It was established in 1973.

- Nilgiri Biosphere Reserve was the first from India to be included in the UNESCO designated World Network of Biosphere Reserves (designated in 2012).

- Other wildlife parks within the Reserve are: Mudumalai Wildlife Sanctuary, Bandipur National Park, Nagarhole National Park, Mukurthi National Park and Silent Valley.

- Spread over 344.44 sq km, Wayanad Wildlife Sanctuary is contiguous to the tiger reserves of Nagerhole and Bandipur of Karnataka and Mudumalai of Tamil Nadu.

- Kabini river (a tributary of the Cauvery river) flows through the sanctuary.

- The forest types include South Indian Moist Deciduous forests, West coast semi-evergreen forests and plantations of teak, eucalyptus and Grewelia.

- Elephant, Gaur, Tiger, Panther, Sambar, Spotted deer, Wild boar, Sloth bear, Nilgiri langur, Bonnet macaque, Common langur, Malabar giant squirrel etc are the major mammals.