Indian Polity

Uttarakhand's UCC Draft Report

For Prelims: Uniform Civil Code (UCC), Fundamental Rights, Directive Principles of State Policy

For Mains: Challenges in Implementation of Uniform Civil Code.

Why in News?

Recently, the Uniform Civil Code (UCC) draft report was approved by the Uttarakhand Cabinet and is likely to be tabled in the state assembly on 6th February 2024, as a bill for enactment.

- The UCC drafting committee was led by retired Supreme Court judge Ranjana Prakash Desai.

- The UCC is a proposed set of common laws for all residents of Uttarakhand, regardless of their religion, caste, or gender.

Note

- Article 162 of the Indian Constitution indicates that the executive power of a State extends to matters with respect to which the Legislature of the State has power to make laws. In view of the provisions of Entry 5 of the Concurrent List of the Seventh Schedule, the constitution of a Committee to introduce and implement Uniform Civil Code (UCC) per se cannot be challenged as ultra vires.

- Entry 5 of the Concurrent List deals with “marriage and divorce; infants and minors; adoption; wills, intestacy, and succession; joint family and partition; all matters in respect of which parties in judicial proceedings were immediately before the commencement of this Constitution subject to their personal law.

- This implies that the state government of Uttarakhand can enact UCC within its territory.

What are the Key Highlights of Uttarakhand's UCC Draft Report?

- The UCC aims to replace distinct personal laws of every religion, focusing on marriage, divorce, adoption, and inheritance, guided by Article 44 of the Constitution.

- Article 44 of the Indian Constitution is a Directive Principle of State Policy (DPSP). It states that the state should try to establish a uniform civil code for all citizens throughout India.

- This code would be a single set of personal laws that would apply to all citizens, regardless of religion.

- Some of the key proposals put forth by the committee include the prohibition of polygamy, nikah halala, iddat (a mandatory period of waiting to be observed by women following the dissolution of a Muslim marriage), triple talaq, and child marriage, uniform age for girls' marriage across all religions, and mandatory registration of live-in relationships.

- The draft UCC aims to focus on gender equality by treating men and women equally in matters such as inheritance and marriage.

- The Code is also likely to extend an equal property share to Muslim women against the existing 25% share accorded under Muslim personal laws.

- The minimum age for marriage for men and women is set to remain the same,18 years for women and 21 years for men.

- Scheduled tribes (STs) have been exempted from the purview of the bill. The tribal population in the state, which is around 3%, had been voicing its dissent against UCC in the wake of the special status accorded to them.

What are the Concerns Regarding the UCC Draft Report for Uttarakhand?

- The UCC draft report may infringe upon the fundamental rights of religious freedom and personal liberty guaranteed by the Constitution of India.

- Some critics argue that the UCC draft report does not respect the diversity and pluralism of India, and imposes a uniform code that may not suit the customs and practices of different communities.

- The UCC draft report may affect the rights and interests of the STs of Uttarakhand.

- Some activists claim that the UCC draft report does not adequately address the issues and aspirations of the STs, and may erode their cultural identity and autonomy.

What is the Uniform Civil Code?

- About:

- The UCC is mentioned in Article 44 of the Constitution as part of the Directive Principles of State Policy, that the state should work to establish a uniform civil code for all citizens across India.

- However, the Constitution's framers left it to the government's discretion to implement the UCC.

- Goa is the only state in India with a UCC, following the Portuguese Civil Code of 1867.

- The UCC is mentioned in Article 44 of the Constitution as part of the Directive Principles of State Policy, that the state should work to establish a uniform civil code for all citizens across India.

- Supreme Court of India Stance on UCC:

- Mohd. Ahmed Khan vs Shah Bano Begum Case,1985:

- The Court observed that “it is a matter of regret that Article 44 has remained a dead letter” and called for its implementation.

- Such a demand was reiterated in subsequent cases such as Sarla Mudgal v. Union of India, 1995, and John Vallamattom v. Union of India, 2003.

- Jose Paulo Coutinho v. Maria Luiza Valentina Pereira Case, 2019:

- The Court hailed Goa as a “shining example” where “the uniform civil code is applicable to all, regardless of religion except while protecting certain limited rights” and accordingly urged for its pan-India implementation.

- Mohd. Ahmed Khan vs Shah Bano Begum Case,1985:

- Law Commission's Stance:

- In 2018, the 21st Law Commission headed by former Supreme Court judge Justice Balbir Singh Chauhan submitted a consultation paper on “Reforms of family law” wherein it observed that the “formulation of a Uniform Civil Code is neither necessary nor desirable at this stage”.

- It underscored that secularism should coexist with the prevailing plurality in the country. It however recommended that discriminatory practices and stereotypes within existing personal laws should be amended.

- Acknowledging the lapse of more than three years since the issuance of the initial consultation paper. In 2022, the 22nd Law Commission headed by Justice (Retd) Rituraj Awasthi, issued a notification seeking opinions from various stakeholders, including the public and religious organisations, on the UCC.

- In 2018, the 21st Law Commission headed by former Supreme Court judge Justice Balbir Singh Chauhan submitted a consultation paper on “Reforms of family law” wherein it observed that the “formulation of a Uniform Civil Code is neither necessary nor desirable at this stage”.

Read More: Just (Uniform) Civil Code.

Legal Insight: Uniform Civil Code

UPSC Civil Services Examination Previous Year’s Question (PYQs)

Prelims

Q1. Consider the following provisions under the Directive Principles of State Policy as enshrined in the Constitution of India: (2012)

- Securing for citizens of India a uniform civil code

- Organising village Panchayats

- Promoting cottage industries in rural areas

- Securing for all the workers reasonable leisure and cultural opportunities

Which of the above are the Gandhian Principles that are reflected in the Directive Principles of State Policy?

(a) 1, 2 and 4 only

(b) 2 and 3 only

(c) 1, 3 and 4 only

(d) 1, 2, 3 and 4

Ans: (b)

Q2. A legislation that confers on the executive or administrative authority an unguided and uncontrolled discretionary power in the matter of the application of law violates which one of the following Articles of the Constitution of India?

(a) Article 14

(b) Article 28

(c) Article 32

(d) Article 44

Ans: (a)

Mains

Q. Discuss the possible factors that inhibit India from enacting for its citizens a uniform civil code as provided for in the Directive Principles of State Policy. (2015)

Economy

Interim Budget 2024-2025

For Prelims: Capital expenditure, Fiscal deficit, Direct & Indirect taxes, Lakhpati Didis, NaMo Bharat, Nano-DAP, Cervical Cancer Vaccination, Rooftop solarization, PM-SVANidhi, Mudra Yojana, Fasal Bima Yojana, Coal gasification, Ayushman Bharat, Oilseeds, Multidimensional poverty, Order of Distribution of Government Investment Across Various Sectors.

For Mains: Major Development Plans in Interim Budget 2024-2025

Why in News?

Recently, the Interim Budget 2024-25 was tabled in the parliament. It envisions 'Viksit Bharat' by 2047, with all-round, all-pervasive, and all-inclusive development.

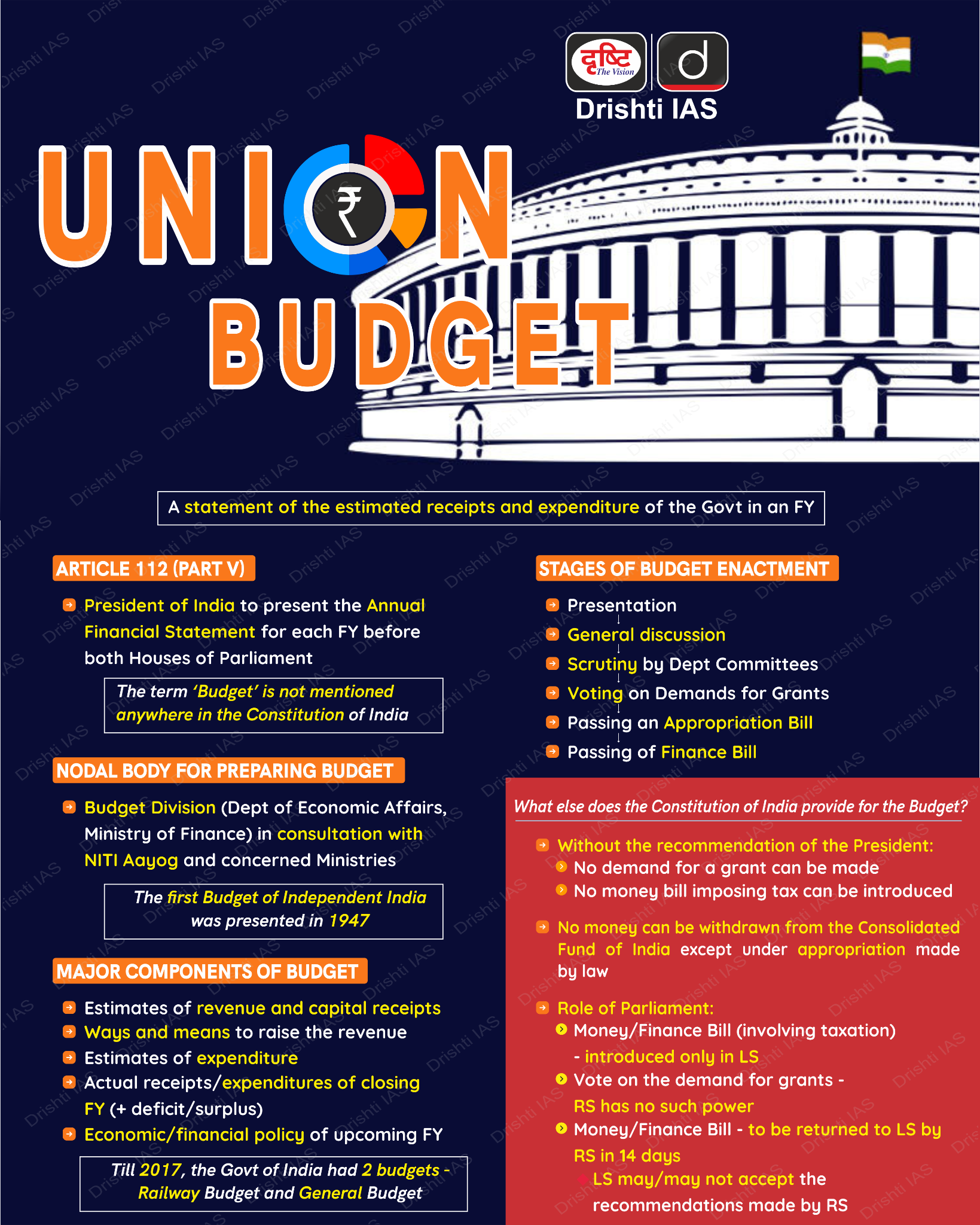

What is an Interim Budget?

- An Interim Budget is presented by a government that is going through a transition period or is in its last year in office ahead of general elections.

- The purpose of the interim budget is to ensure the continuity of government expenditure and essential services until the new government can present a full-fledged budget after taking office.

What is the Difference Between Interim Budget and Vote on Account?

| Feature | Interim Budget | Vote on Account |

| Constitutional Provision | Article 112 | Article 116 |

| Purpose | Financial Statement presented by the government ahead of general elections. |

To meet essential government expenditures for a limited period until the budget is approved. |

| Duration of Expenditure | Covers a specific period, usually a few months until a new government is formed and a full budget is presented. | It is generally granted for two months for an amount equivalent to one-sixth of the total estimation. |

| Policy changes | Can propose changes in the tax regime | Cannot change the tax regime under any circumstances |

| Impact on Governance | Provides continuity in governance during the transition period between two governments. | Ensures the smooth functioning of the government and public services until the regular budget is approved. |

What are the Major Highlights of the Interim Budget 2024-25?

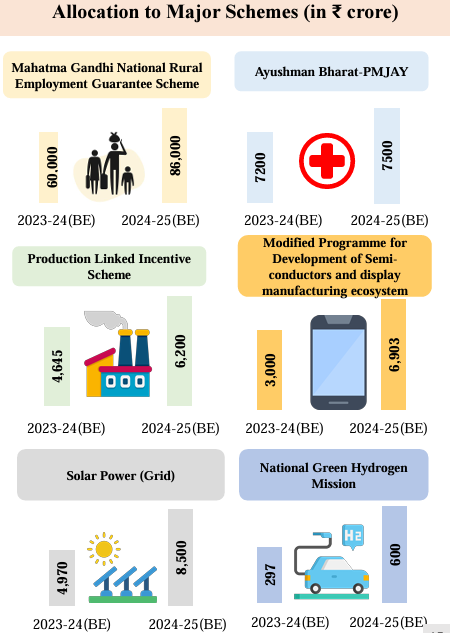

- Capital Expenditure: An 11.1% increase in the capital expenditure outlay for 2024-2025 was announced.

- The capital expenditure is set at Rs 11,11,111 crore, constituting 3.4% of the GDP.

- Economic Growth Projections: The GDP growth for FY 2023-24 real GDP growth is projected at 7.3%, aligning with the RBI's revised growth projection.

- The International Monetary Fund upgraded India's growth projection to 6.3% for FY 2023-24. It also anticipates India becoming the third-largest economy in 2027.

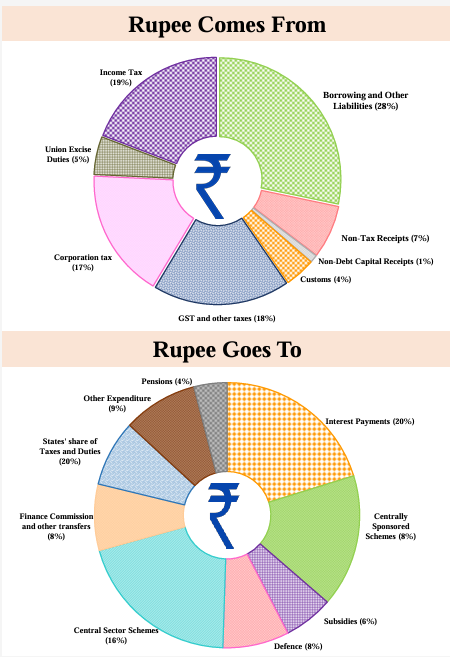

- Revenue and Expenditure Estimates (2024-25):

- Total Receipts: Estimated at Rs 30.80 lakh crore, excluding borrowings.

- Total Expenditure: Projected at Rs 47.66 lakh crore.

- Tax Receipts: Estimated at Rs 26.02 lakh crore.

- GST Collections: Reached ₹1.65 lakh crore in December 2023, crossing the ₹1.6 lakh crore benchmark for the seventh time.

- Fiscal Deficit and Market Borrowing: Fiscal deficit is estimated at 5.1% of GDP in 2024-25, aligning with the goal of reducing it below 4.5% by 2025-26 (announced in budget 2021-22).

- Gross and net market borrowings through dated securities in 2024-25 are estimated at Rs 14.13 and 11.75 lakh crore, respectively.

- Taxation: The Interim Budget maintains the existing rates for direct and indirect taxes, including import duties.

- For Corporate Taxes: 22% for existing domestic companies, 15% for certain new manufacturing companies.

- No tax liability for taxpayers with income up to ₹7 lakh under the new tax regime.

- Certain tax benefits for Start-Ups and investments extended by one year up to March 31, 2025.

- Priorities: Emphasizing the focus on the Poor, Women, Youth and Farmer.

- Poor: Successful movement of 25 crore people out of multidimensional poverty.

- Credit assistance was provided to 78 lakh street vendors under PM-SVANidhi.

- Women: Disbursement of 30 crore Mudra Yojana loans to women entrepreneurs.

- 43% of female enrolment in STEM courses.

- Assistance to 1 crore women through 83 lakh SHGs, fostering 'Lakhpati Didis.'

- 28% increase in female enrolment in higher education over a decade.

- Youth: Training of 1.4 crore youth under the Skill India Mission.

- Fostering entrepreneurial aspirations with 43 crore loans sanctioned under PM Mudra Yojana.

- Farmers: Direct financial assistance was provided to 11.8 crore farmers under PM-KISAN.

- Crop insurance extended to 4 crore farmers through Fasal Bima Yojana.

- Integration of 1,361 mandis under eNAM for streamlined agricultural trade.

- Poor: Successful movement of 25 crore people out of multidimensional poverty.

- Major Development Plans:

- Infrastructure:

- Railways: Three major economic railway corridor programmes will be implemented- energy, mineral & cement corridors, port connectivity corridors, and high traffic density corridors.

- Forty thousand normal rail bogies will be converted to Vande Bharat standards for enhanced safety, convenience, and passenger comfort.

- Aviation: Expansion of existing airports and comprehensive development of new airports under the UDAN scheme.

- Urban Transport: Promotion of urban transformation via Metro rail and NaMo Bharat.

- Railways: Three major economic railway corridor programmes will be implemented- energy, mineral & cement corridors, port connectivity corridors, and high traffic density corridors.

- Clean Energy Sector:

- Viability gap funding for wind energy

- It will help in harnessing offshore wind energy potential, aiming for an initial capacity of 1 gigawatt.

- Establishment of coal gasification and liquefaction capacity of 100 million tonnes by 2030.

- Phased mandatory blending of CNG, PNG and compressed biogas

- Financial assistance for procurement of biomass aggregation machinery

- Rooftop solarization: 1 crore households will be enabled to obtain up to 300 units of free electricity per month

- Strengthening e-vehicle ecosystem by supporting manufacturing and charging

- New scheme of biomanufacturing and bio-foundry to be launched to support environment friendly alternatives

- Viability gap funding for wind energy

- Housing Sector: Government plans to subsidize the construction of 30 million affordable houses in rural areas.

- Housing for Middle Class scheme to be launched to promote middle class to buy/built their own houses

- Healthcare Sector: Encouraging Cervical Cancer Vaccination for girls (9-14 years).

- U-WIN platform for immunization efforts of Mission Indradhanush to be rolled out.

- Expanding the Ayushman Bharat scheme to include all ASHA workers, Anganwadi workers, and helpers.

- Agricultural Sector: Encouraging the use of 'Nano DAP' for various crops across all agro-climatic zones.

- Formulating policies to support dairy farmers and combat Foot and Mouth Disease.

- Strategizing for AtmaNirbharta (self-reliance) in oilseeds, covering research, procurement, value addition, and crop insurance.

- Nano-DAP (Di-ammonium Phosphate) is a nanotechnology-based agri-input developed by the Indian Farmers Fertilizer Cooperative Limited (IFFCO). It helps in correcting the Nitrogen & Phosphorus deficiencies in standing crops.

- Fishery Sector: Establishing a new department, 'Matsya Sampada,' to address the needs of fishermen.

- For States Capex: The continuation of the fifty-year interest-free loan scheme for capital expenditure to states was announced.

- A total outlay of Rs 1.3 lakh crore, with a provision of Rs 75,000 crore for fifty-year interest-free loans to support state-led reforms.

- Special attention will be paid to the eastern region to make it a powerful driver of India's growth.

- Others:

- Establishment of a corpus of Rs 1 lakh crore with a fifty-year interest-free loan to encourage research and innovation in sunrise domains.

- Also, aiming to boost private sector participation in research and innovation.

- To address rapid population growth and demographic shifts, the government will form a high-powered committee.

- The committee will provide comprehensive recommendations aligned with the goal of 'Viksit Bharat.'

- Establishment of a corpus of Rs 1 lakh crore with a fifty-year interest-free loan to encourage research and innovation in sunrise domains.

- Infrastructure:

|

|

What are the Funds Related to the Budget in India?

- Consolidated Fund of India: Article 266 (1) of the Constitution consolidates all revenues, loans, and loan repayments received by the Union Government into a single fund known as the Consolidated Fund of India.

- Withdrawal needs parliament permission (except for Charged Expenditure like Judges’ salaries).

- Public Account of India: Under Article 266 (2), it includes incoming money from provident fund, small savings, postal deposit etc.

- Government acts similar to a banker transferring funds from here to there so parliament permission is not necessary.

- Contingency Fund of India: It is established under the Contingency Fund of India Act, 1950 and operates as an imprest in accordance with Article 267(1).

- It serves the purpose of offering advances to the government for unforeseen expenditures during the fiscal year, pending authorization by Parliament.

- Funds withdrawn from the Contingency Fund are replenished upon parliamentary approval through Supplementary Demands for Grants.

UPSC Civil Services Examination, Previous Year Question:

Prelims:

Q. What is the difference between “vote-on-account” and “Interim Budget”? (2011)

- The provision of a “vote-on-account” is used by a regular Government while an “interim budget” is a provision used by a caretaker Government.

- A “vote-on-account” only deals with the expenditure in Government’s budget, while an “interim budget” includes both expenditures and receipts.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Q. When the annual Union Budget is not passed by the Lok Sabha, (2011)

(a) the Budget is modified and presented again

(b) the Budget is referred to the Rajya Sabha for suggestions

(c) the Union Finance Minister is asked to resign

(d) the Prime Minister submits the resignation of Council of Ministers

Ans: (d)

Q. In the Union Budget 2011-12, a full exemption from the basic customs duty was extended to the bio-based asphalt (bioasphalt). What is the importance of this material? (2011)

- Unlike traditional asphalt, bio-asphalt is not based on fossil fuels.

- Bioasphalt can be made from non-renewable resources.

- Bioasphalt can be made from organic waste materials.

- It is eco-friendly to use bioasphalt for surfacing of the roads.

Which of the statements given above are correct?

(a) 1, 2 and 3 only

(b) 1, 3 and 4 only

(c) 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (b)

Q. Along with the Budget, the Finance Minister also places other documents before the Parliament which include ‘The Macro Economic Framework Statement’. The aforesaid document is presented because this is mandated by (2020)

(a) Long standing parliamentary convention

(b) Article 112 and Article 110(1) of the Constitution of India

(c) Article 113 of the Constitution of India

(d) Provisions of the Fiscal Responsibility and Budget Management Act, 2003

Ans: (d)

Q. With reference to the Union Government, consider the following statements: (2015)

- The Department of Revenue is responsible for the preparation of the Union Budget that is presented to the Parliament.

- No amount can be withdrawn from the Consolidated Fund of India without the authorization from the Parliament of India.

- All the disbursements made from Public Account also need the authorization from the Parliament of India.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 2 only

(d) 1, 2 and 3

Ans: (c)

Q. Which of the following are the methods of Parliamentary control over public finance in India? (2012)

- Placing Annual Financial Statement before the Parliament

- Withdrawal of moneys from Consolidated Fund of India only after passing the Appropriation Bill

- Provisions of supplementary grants and vote-on account

- A periodic or at least a mid-year review of programme of the Government against macroeconomic forecasts and expenditure by a Parliamentary Budget Office

- Introducing Finance Bill in the Parliament

Select the correct answer using the codes given below:

(a) 1, 2, 3 and 5 only

(b) 1, 2 and 4 only

(c) 3, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (a)

Q. Which one of the following is responsible for the preparation and presentation of Union Budget to the Parliament? (2010)

(a) Department of Revenue

(b) Department of Economic Affairs

(c) Department of Financial Services

(d) Department of Expenditure

Ans: (b)

Q. There has been a persistent deficit budget year after year. Which action/actions of the following can be taken by the Government to reduce the deficit? (2016)

- Reducing revenue expenditure

- Introducing new welfare schemes

- Rationalizing subsidies

- Reducing import duty

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2, 3 and 4

Ans: (c)

Mains:

Q. Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. (2021)

Q, The public expenditure management is a challenge to the Government of India in the context of budget-making during the post-liberalization period. (2019)

Q. How have the recommendations of the 14th Finance Commission of India enabled the States to improve their fiscal position? (2021)

Q. What were the reasons for the introduction of Fiscal Responsibility and Budget Management (FRBM) Act, 2003? Discuss critically its salient features and their effectiveness. (2013)

Agriculture

Economics of the Food System Transformation

For Prelims: Food and Agriculture Organisation (FAO), GDP (Gross Domestic Product), Malnutrition.

For Mains: The Economics of the Food System Transformation.

Why in News?

Recently, the Food System Economics Commission has published a report titled-” The Economics of the Food System Transformation”, highlighting that a sustainable transformation of existing food systems is urgently required at an estimated total cost of USD 500 billion per year.

- THe Food System Economics Commission (FSEC) is a private consortium of scientists across nationalities and academic fields, aimed at identifying the challenges to food system security and the policy changes required to overcome them.

What are the Food Systems?

- According to the Food and Agriculture Organisation (FAO), food systems encompass the entire range of actors involved in:

- Production, aggregation, processing, distribution, consumption and disposal of food products that originate from agriculture, forestry or fisheries, and parts of the broader economic, societal and natural environments in which they are embedded.

What are the Key Highlights of the Report?

- Current Costs and Impacts:

- Globally, current food systems cost significantly more than they contribute to development. A sustainable transformation of existing food systems is urgently required at an estimated total cost of $500 billion per year.

- This cost is equivalent to only 0.2–0.4% of global GDP (Gross Domestic Product) and is small relative to the multi-trillion dollar benefits it could bring.

- Globally, current food systems cost significantly more than they contribute to development. A sustainable transformation of existing food systems is urgently required at an estimated total cost of $500 billion per year.

- Current Food System Challenges:

- The current global food system is characterised by hidden environmental, health, and social costs exceeding 10 trillion USD in 2020.

- If current trends persist, over 640 million individuals (including 121 million children) could suffer from Hunger and Malnutrition by 2050.

- Food System to Drive Global Greenhouse Gas:

- Under the existing scenario, food systems will continue to drive a third of global Greenhouse Gas (GHG) emissions, which will contribute to 2.7 degrees Celsius of warming by the end of the century compared to pre-industrial periods.

- Food production will become increasingly vulnerable to climate change, with the likelihood of extreme events dramatically increasing.

- Pathways to 2050:

- The report contrasts two pathways up to 2050: Current Trends (CT) and Food System Transformation (FST).

- The CT pathway shows continued food insecurity, obesity increase, and negative environmental impacts by 2050.

- Transforming food systems can contribute significantly to economies and address health and climate challenges.

- Global convergence towards healthy diets could contribute as much as 70% of the total economic benefits of pursuing the FST pathway.

- Food systems under FST could become net carbon sinks by 2040, helping limit global warming to below 1.5°C.

- Positive developments include extensive reforestation, reducing extreme weather events, protecting land, halving nitrogen surplus, and reversing biodiversity loss.

- The report contrasts two pathways up to 2050: Current Trends (CT) and Food System Transformation (FST).

- Recommendations:

- Lifting financing constraints for lower-income countries is crucial to unlocking the global benefits of transforming food systems.

- Policymakers are urged to face the food system challenge, make necessary changes, and reap short- and long-term benefits globally.

- The report emphasises the need for comprehensive and sustainable pathways for the transformation of food systems.

How can we make the Global Food System More Sustainable?

- Reduce Food Waste:

- Encourage and support the adoption of circular food systems, where surplus food is efficiently redistributed to those in need.

- Develop and implement policies that incentivize businesses and consumers to minimize food waste.

- Optimize Food Production Processes:

- Promote and invest in smart farming practices that utilise technology to monitor and optimize growing conditions.

- Encourage the adoption of sustainable agriculture techniques such as hydroponic and vertical farming.

- Support research and development of crop varieties that are resilient to environmental challenges, reducing the need for excessive resource input.

- Promote Sustainable Agricultural Practices:

- Advocate for the use of regenerative agriculture, which focuses on soil health and ecosystem restoration.

- Implement precision farming techniques to reduce overuse of fertilizers, pesticides, and water.

- Support farmers in transitioning to more sustainable and organic farming methods.

- Encourage Sustainable Consumption:

- Promote a shift towards plant-based diets, which generally have a lower environmental impact than diets rich in animal products.

- Educate consumers about the environmental and social impacts of their food choices.

- Support local and sustainable food markets to encourage the consumption of locally produced goods.

- Invest in Research and Innovation:

- Allocate resources to research and development efforts aimed at creating more sustainable agricultural practices and technologies.

- Support initiatives that focus on climate-resilient crops and innovative solutions to address emerging challenges in the food system.

- Empower Local Communities:

- Support community-led initiatives for sustainable agriculture and food production.

- Provide training and resources to farmers, especially smallholders, to adopt sustainable practices.

- Ensure that local communities have a voice in decision-making processes related to food production and distribution.

UPSC Civil Services Examination Previous Year Questions (PYQs)

Prelims

Q. What are the significances of a practical approach to sugarcane production known as ‘Sustainable Sugarcane Initiative’? (2014)

- Seed cost is very low in this compared to the conventional method of cultivation.

- Drip irrigation can be practiced very effectively in this.

- There is no application of chemical/inorganic fertilizers at all in this.

- The scope for intercropping is more in this compared to the conventional method of cultivation.

Select the correct answer using the code given below:

(a) 1 and 3 only

(b) 1, 2 and 4 only

(c) 2, 3 and 4 only

(d) 1, 2, 3 and 4

Ans: (b)

Mains:

Q. How far is Integrated Farming System (IFS) helpful in sustaining agricultural production? (2019)

Q. What are the reformative steps taken by the Government to make the food grain distribution system more effective? (2019)

Economy

China's Shifting Economic Landscape

For Prelims: Deflation, Reasons for China's Economic Downfall, Largest Greenhouse gas Emitter, Decoupling, South China Sea, Uighurs in Xinjiang, India Semiconductor Mission, IMEC corridor, International Solar Alliance.

For Mains: Major Factors Contributing to Economic Challenges in China, India’s Transition Amid the Economic Turmoil in China.

Source: TOI

Why in News?

China's economy faced significant challenges in 2023, registering one of its slowest growth rates in over three decades as it was battered by a crippling property crisis, sluggish consumption, shifting demographic trends and global turmoil.

What are the Major Factors Contributing to Economic Challenges in China?

- Economic Status: China's National Bureau of Statistics (NBS) reported a 5.2% growth in GDP, reaching 126 trillion yuan in 2023.

- Despite exceeding the target and outperforming the 3% recorded in 2022, this growth represents the slowest performance since 1990, excluding pandemic years.

- Deflation for three consecutive months added to the economic headwinds.

- Factors Contributing to Economic Challenges:

- Lack of Jobs for Youth: More than 1 in 5 people between 16 and 24 were unemployed in May 2023 highlighting challenges in job creation for the youth.

- The working-age population between 15 to 59 years, which is seen as being productive in an economy, has now fallen to 61% of the total population.

- Demographic Trends: China's population has been declining since 2016, reflecting a falling Total Fertility Rate (TFR) and challenges in overcoming the legacy of the one-child policy.

- Despite policy changes allowing up to 3 children, demographic trends have not reversed.

- Unsteady Real Estate Market: The real estate market, traditionally a significant contributor to China's economy, faces financial challenges with major firms like Evergrande and Country Garden experiencing difficulties.

- Lack of Jobs for Youth: More than 1 in 5 people between 16 and 24 were unemployed in May 2023 highlighting challenges in job creation for the youth.

What are the Other Challenges Related to China in Global Context?

- Environmental degradation: China is the world's largest source of greenhouse gas emissions. Air pollution is responsible for about 2 million deaths in China per year (WHO).

- Tense Relations with the United States: The ongoing trade war, competition for technological dominance, and differences in values create significant tension between China and the US, impacting the global balance of power.

- The US and its allies are increasingly decoupling from China in key technological areas, like semiconductors.

- South China Sea Disputes: China's territorial claims in the South China Sea are contested by several countries, raising concerns about regional stability and freedom of navigation.

- Human Rights Concerns: China has faced international scrutiny and criticism regarding human rights issues, particularly concerning the treatment of ethnic minorities such as the Uighurs in Xinjiang.

How India is Transitioning Amid the Economic Turmoil in China?

- Demographic Advantage: India's working-age population is projected to constitute 68.9% of the total population by 2030, in stark contrast to China's ageing population.

- Evolving Manufacturing and Transportation Landscape: Initiatives such as the India Semiconductor Mission and dedicated industrial corridors like the Delhi-Mumbai Industrial Corridor are bolstering infrastructure and drawing investments to India.

- Foxconn, a major Apple supplier, is relocating a substantial portion of iPhone production from China to India.

- Business-Friendly Environment: Programs like Make in India and the production-linked incentive scheme offer crucial support for businesses.

- The PLI scheme for electronics has successfully lured major players such as Samsung, Pegatron, Rising Star, and Wistron.

- Thriving Domestic Market: As the world's fifth-largest economy (by nominal GDP), India presents significant opportunities for locally manufactured goods, attracting multinational corporations to integrate India into their production processes.

- H&M, for instance, sources from Indian garment manufacturers.

- Emphasis on Sustainability and ESG: With a goal to achieve 50% renewable energy capacity by 2030, India is attracting companies committed to green manufacturing.

- Tesla, for example, plans to enter the Indian electric vehicle market in 2024.

- Global Recognition and Dependability: India's membership in the IMEC corridor and its leadership in the International Solar Alliance are enhancing its trade appeal and global reputation as a reliable investment destination.

What are the Challenges Hindering India’s Progress?

- Infrastructure Constraints: Despite ongoing improvement, India's infrastructure, including power grids, logistics networks, and transportation systems, lags behind China's, potentially hindering manufacturing competitiveness and attracting investment.

- Skilled Workforce Shortage: While demographics offer a large working-age population, a significant portion lacks the specific skills (Skill India Report: Only 5% Indians formally skilled) required for high-value manufacturing, necessitating heavy investment in upskilling and vocational training.

- Lack of Desired Ease of Doing Business: While initiatives like Make in India aim to improve, India still ranks lower than China in global ease of doing business rankings, requiring further measures to simplify processes and reduce red tape.

- Lack of R&D Push: Despite advancements, India continues to trail in research and development capabilities, allocating only 0.6-0.7% of its GDP to R&D, in stark contrast to China's 2.56% investment.

Way Forward

- Upskill the Workforce: India needs to focus on vocational training and skilling programs aligned with industry needs, creating a readily available pool of qualified workers for high-value manufacturing.

- Streamline Regulations and Bureaucracy: Implementing reforms to simplify procedures, reducing red tape, and expediting business approvals can enhance India's ease of doing business.

- Boost Innovation and Technology: Increasing R&D investments, foster collaboration between academia and industry, and promoting entrepreneurship can cultivate a robust innovation ecosystem in India.

- Diplomatic Dialogue and Conflict Resolution: India can take advantage of this time to engage in constructive diplomatic dialogue with China to address outstanding border issues and foster better relations on various fronts, including trade, economic partnerships, and cultural exchanges, benefiting both nations and the broader global community.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. “Belt and Road Initiative” is sometimes mentioned in the news in the context of the affairs of : (2016)

(a) African Union

(b) Brazil

(c) European Union

(d) China

Ans: D

Q. Consider the following statements:

- India has more arable area than China.

- The proportion of irrigated area is more in India as compared to China.

- The average productivity per hectare in Indian agriculture is higher than that in China.

How many of the above statements are correct?

(a) Only one

(b) Only two

(c) All three

(d) None

Ans: B

Mains

Q. The China-Pakistan Economic Corridor (CPEC) is viewed as a cardinal subset of China’s larger ‘One Belt One Road’ initiative. Give a brief description of CPEC and enumerate the reasons why India has distanced itself from the same. (2018)

Q. “China is using its economic relations and positive trade surplus as tools to develop potential military power status in Asia”. In the light of this statement, discuss its impact on India as her neighbour. (2017)

Internal Security

National Terrorism Data Fusion & Analysis Centre

For Prelims: National Investigation Agency (NIA), National Terrorism Data Fusion & Analysis Centre (NTDFAC), Crime and Criminal Tracking Network & Systems (CCTNS).

For Mains: National Terrorism Data Fusion & Analysis Centre, Role of external state and non-state actors in creating challenges to internal security.

Why in News?

Recently, the National Investigation Agency (NIA) has developed the National Terrorism Data Fusion & Analysis Centre (NTDFAC), which makes the government collect and compile information on terrorists and their associates from various sources.

- The NIA has for the first time collected details of all terrorists including those from Indian Mujahideen and Lashkar-e-Taiba as well as Khalistani militant groups.

What is the National Terrorism Data Fusion & Analysis Centre?

- About:

- The NTDFAC has been modelled along the lines of the Global Terrorism Database (GTD) of the US.

- The GTD is managed by the National Consortium for the Study of Terrorism and Responses to Terrorism (START), based at the University of Maryland in the United States.

- The GTD is a publicly accessible database that collects and analyzes data on terrorist incidents globally. It provides detailed information on various aspects of each incident, including the date, location, weapons used, tactics employed, targets, and the number of casualties.

- It will serve as a centralized database and analysis centre for information related to terrorism and terrorists operating in the country.

- In 2023, the Ministry of Home Affairs had asked all state police forces and anti-terror agencies to adopt an approach to prevent the formation of new terrorist groups.

- The NTDFAC has been modelled along the lines of the Global Terrorism Database (GTD) of the US.

- Key Features:

- Comprehensive Database: This includes case histories, fingerprints, videos, pictures, and social media profiles, providing a comprehensive overview of individuals involved in terrorist activities.

- Automated Fingerprint Identification System (AFIS): The NTDFAC incorporates the National Automated Fingerprint Identification System (NAFIS), which holds over 92 lakh fingerprint records.

- This allows for the quick and accurate identification of individuals based on fingerprint data.

- Face Recognition System: It is equipped with a face recognition system, enabling the scanning of pictures of suspects from CCTV footage. This technology aids in the identification and tracking of individuals involved in terrorist activities.

- Support for State Police Forces: The NTDFAC not only assists NIA officers but also supports state police forces in identifying details of suspects.

- State police forces can access the centralised server to gather information on terrorists operating in their jurisdictions.

What is the National Automated Fingerprint Identification System (NAFIS)?

- About:

- Conceptualized and managed by the National Crime Records Bureau (NCRB), it is a country-wide searchable database of crime- and criminal-related fingerprints.

- The web-based application functions as a central information repository by consolidating fingerprint data from all states and Union Territories.

- Key Features:

- Web-Based Application: The system operates as a web-based application, allowing law enforcement agencies to access and manage fingerprint data in real-time on a 24x7 basis.

- Unique Identifier: NAFIS assigns a unique 10-digit National Fingerprint Number (NFN) to each person arrested for a crime.

- This unique ID can be used for the person’s lifetime, and different crimes registered under different FIRs will be linked to the same NFN.

- Integration with CCTNS: NAFIS is connected to the Crime and Criminal Tracking Network & Systems (CCTNS) database at the backend, providing a unique identifier for every arrested person in the CCTNS.

- Real-Time Data Upload and Retrieval: The system enables law enforcement agencies to upload, trace, and retrieve fingerprint data in real time, enhancing the efficiency of criminal identification processes.

- Replacement for Previous Systems: NAFIS is the latest iteration in a series of automated fingerprint identification systems in India. It replaces the previous system, FACTS 5.0, which was considered to have "outlived its shelf life."

What is the National Investigation Agency (NIA)?

- About:

- The NIA is the Central Counter-Terrorism Law Enforcement Agency of India mandated to investigate all the offences affecting the sovereignty, security and integrity of India. It includes:

- Friendly relations with foreign states.

- Against atomic and nuclear facilities.

- Smuggling of arms, drugs and fake Indian currency and infiltration from across the borders.

- The offences under the statutory laws enacted to implement international treaties, agreements, conventions and resolutions of the United Nations, its agencies and other international organisations.

- It was constituted under the National Investigation Agency (NIA) Act, 2008.

- The agency is empowered to deal with the investigation of terror related crimes across states without special permission from the states under written proclamation from the Ministry of Home Affairs.

- Headquarters: New Delhi

- The NIA is the Central Counter-Terrorism Law Enforcement Agency of India mandated to investigate all the offences affecting the sovereignty, security and integrity of India. It includes:

- Origin:

- In the wake of the 26/11 Mumbai terror attack in November 2008, which shocked the entire world, the then United Progressive Alliance government decided to establish the NIA.

- Jurisdiction:

- The law under which the agency operates extends to the whole of India and also applies to Indian citizens outside the country.

- Persons in the service of the government wherever they are posted.

- Persons on ships and aircraft registered in India wherever they may be.

- Persons who commit a scheduled offence beyond India against the Indian citizen or affecting the interest of India.

What are Scheduled Offences?

- The schedule to the Act specifies a list of offences which are to be investigated and prosecuted by the NIA.

- The list includes:

- Explosive Substances Act

- Atomic Energy Act

- Unlawful Activities (Prevention) Act

- Anti-Hijacking Act

- Suppression of Unlawful Acts against Safety of Civil Aviation Act

- SAARC Convention (Suppression of Terrorism) Act

- Suppression of Unlawful Acts Against Safety of Maritime Navigation and Fixed Platforms on Continental Shelf Act

- Weapons of Mass Destruction and their Delivery Systems (Prohibition of Unlawful Activities) Act

- Any other relevant offences under the Indian Penal Code, Arms Act and the Information Technology Act.

- Narcotic Drugs and Psychotropic Substances Act

UPSC Civil Services Examination, Previous Year Question (PYQ)

Mains

Q. The scourge of terrorism is a grave challenge to national security. What solutions do you suggest to curb this growing menace? What are the major sources of terrorist funding? (2017)

Q. Analyse the multidimensional challenges posed by external state and non-state actors, to the internal security of India. Also discuss measures required to be taken to combat these threats. (2021)

Rapid Fire

Exercise Vayu Shakti- 2024

The Indian Air Force will be conducting Exercise Vayu Shakti-24 on 17th February 2024 at the Pokhran Air to Ground Range, near Jaisalmer.

- Exercise Vayu Shakti is set to deliver a compelling display of the Indian Air Force's offensive and defensive prowess, seamlessly operating both day and night.

- Additionally, the exercise will highlight collaborative manoeuvres with the Indian Army, showcasing their joint operational capabilities.

- The exercise will showcase IAF's prowess in precision, long-range weapon delivery, and effective operations from various air bases, including special missions with transport, helicopter fleets, Garuds, and Indian Army elements.

- This year, 121 aircraft, including Tejas, Prachand, Dhruv, Rafale, Mirage-2000, Sukhoi-30 MKI, Jaguar, Hawk, C-130J, Chinook, Apache, and Mi-17, will participate in the exercise, showcasing the capabilities of indigenous Surface to Air Weapon systems Akash and Samar in tracking and shooting down intruding aircraft.

Read more: EXERCISE VAYUSHAKTI

Rapid Fire

Dusted Apollo Butterfly

Recently, the Dusted Apollo (Parnassius stenosemus), a rare high-altitude butterfly, was sighted and photographed for the first time in Himachal Pradesh's Chamba.

- The Dusted Apollo butterfly was discovered in 1890 and its distribution range extends from Ladakh to West Nepal, flying between 3,500 to 4,800 meters in the inner Himalayas.

- It is a member of the snow Apollo genus (Parnassius) of the swallowtail family.

- The Dusted Apollo species closely resembles Ladakh Banded Apollo (Parnnasius stoliczkanus) but the discal band (band on a butterfly's wing) on the upper fore wing in dusted Apollo is complete and extends from costa to vein one while this discal band is incomplete and extends only up to vein four in Ladakh Banded Apollo.

- The sighting also included another rare species, Regal Apollo (Parnnasius charltonius), which is protected under Schedule II of the Wildlife Protection Act, 1972.

Rapid Fire

Kalaripayattu

Haryana youth made significant strides in embracing Kalaripayattu, securing the second position, just after Kerala at the Khelo India Youth Games 2023.

- Kalari Payat (Kalaripayattu) meaning 'Battleground' or 'Gymnasium'- (Kalari), 'Method' or 'Art' - (Payatt), also known as Kalari, is an Indian martial art that originated in Kerala during the 3rd century BC to the 2nd century AD. It is now practised in Kerala and in some parts of Tamil Nadu.

- It is considered one of the oldest and most scientific martial arts in the world, with a history spanning over 3,000 years.

- Kalaripayattu, a personal combat training system includes exercises to develop sharp reflexes for unarmed combat and skilful fighting using sticks, daggers, knives, spears, swords, shields, etc.

Read more: 6th Edition of Khelo India Youth Games, Martial Art Forms in India

Rapid Fire

NITISH Device

The Bihar State Disaster Management Authority has launched the Novel Initiative Technological Intervention for Safety of Humanlives (NITISH) device, an innovative pendant-shaped technology designed to provide timely alerts to farmers and the public, specifically targeting lightning, floods, heatwaves, and coldwaves.

- The initiative was triggered by recurring deaths among farmers due to lightning and flash floods, emphasizing the device's role in saving lives.

- The NITISH Device is introduced in collaboration with the Indian Institute of Technology (IIT), Patna.

- The device is connected to the Bihar Meteorological Service Centre, ensuring real-time and accurate weather-related alerts.

- The NITISH device will sound an alert to its users half an hour before lightning or flooding.

- The pendant will get charged from body heat. The device will sound an alert in three ways: it will send voice messages; its colour will change from green to red; and the device will keep warming till its user switches it off.

- Considering the challenges faced by farmers, the device is waterproof, ensuring durability and functionality in various weather conditions.

Read more: Emergency Alert System