Governance

Road Accidents in India-2022

For Prelims: Motor Vehicles Amendment Act, 2019, Road Accidents in India-2022, Ministry of Road Transport and Highways, United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), National Highways and Expressways.

For Mains: Road Accidents in India-2022, Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Why in News?

Recently, the Ministry of Road Transport and Highways has published a Report titled- ‘Road Accidents in India-2022', shedding light on the concerning trends in road accidents and fatalities.

- The report is based on the data/information received from police departments of States/UTs on calendar year basis in standardized formats as provided by the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) under the Asia Pacific Road Accident Data (APRAD) base project.

- APRAD is a software tool developed specifically for the UNESCAP and its member countries to help member countries in the Asia-Pacific region develop, update, maintain, and manage road accident databases.

What are the Key Highlights of the Report?

- Number of Road Accidents:

- In 2022, a total of 4,61,312 road accidents occurred in India, leading to 1,68,491 fatalities and 4,43,366 people injured.

- These figures represent an 11.9% year-on-year increase in accidents, a 9.4% rise in fatalities, and a substantial 15.3% surge in the number of people injured compared to the previous year.

- In 2022, a total of 4,61,312 road accidents occurred in India, leading to 1,68,491 fatalities and 4,43,366 people injured.

- Road Accident Distribution:

- 32.9% of accidents took place on National Highways and Expressways, 23.1% on State Highways, and the remaining 43.9% on other roads.

- 36.2% of fatalities occurred on National Highways, 24.3% on State Highways, and 39.4% on other roads.

- Demographic Impact:

- Young adults in the age group of 18 - 45 years accounted for 66.5% of the victims in 2022.

- Additionally, people in the working age group of 18 – 60 years constituted 83.4% of the total road accident fatalities.

- Rural vs. Urban Accidents:

- About 68% of road accident deaths occurred in rural areas, with urban areas contributing 32% to the total accident deaths in the country.

- Vehicle Categories:

- Two-wheelers, for the second consecutive year, accounted for the highest share in both total accidents and fatalities in 2022.

- Light vehicles, including cars, jeeps, and taxis, ranked a distant second.

- Road-User Categories:

- Among road-user categories, two-wheeler riders had the highest share in total fatalities, representing 44.5% of persons killed in road accidents in 2022.

- Pedestrian road-users were the second-largest group, with 19.5% of fatalities.

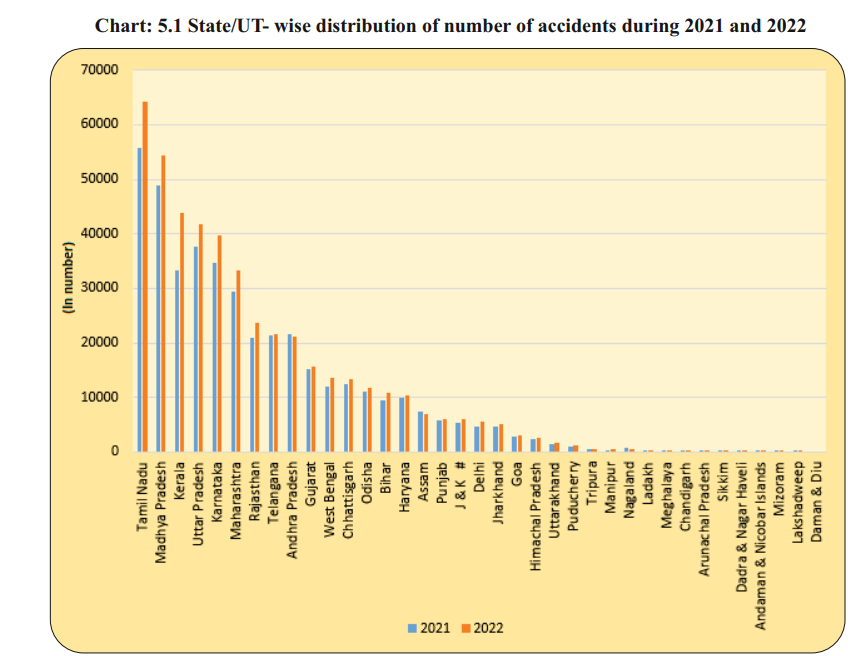

- State-Specific Data:

- Tamil Nadu recorded the highest number of road accidents in 2022, with 13.9% of the total accidents, followed by Madhya Pradesh with 11.8%.

- Uttar Pradesh had the highest number of fatalities due to road accidents (13.4%), followed by Tamil Nadu (10.6%). Understanding state-specific trends is essential for targeted interventions.

- International Comparison:

- India has the highest number of total persons killed due to road accidents, followed by China and the United States.

- Venezuela has the highest rate of persons killed per 1,00,000 population.

What is the Status of the Indian Road Network?

- India's road density at 1,926.02 per 1,000 sq.km of area in 2018-19 was higher than that of many developed countries though surfaced/paved road constituting 64.7 % of the total road length is comparatively lower than that of developed countries.

- National Highways constituted 2.09% of the total road length of the country in 2019.

- The balance road networks comprise of State Highways (2.9%), District Roads (9.6%), Rural Roads (7.1%), Urban Roads (8.5%) and Project Roads (5.4%).

What are the Road Accident Mitigation Measures Taken by the Ministry of Road Transport and Highways?

- Education Measures:

- To create effective public awareness about road safety, the Ministry undertakes various publicity measures and awareness campaigns through social media, electronic media and print media.

- Further, Ministry implements a scheme to provide financial assistance to various agencies for administering Road Safety Advocacy.

- Engineering Measures:

- Road safety has been made an integral part of road design at planning stage. Road Safety Audit (RSA) of all highway projects has been made mandatory at all stages.

- The Ministry has notified the mandatory provision of an airbag for the passenger seated on the front seat of a vehicle, next to the driver.

- Enforcement Measures:

- The Motor Vehicles (Amendment) Act, 2019.

- Electronic Monitoring and Enforcement of Road Safety rules (specify the detailed provisions for placement of electronic enforcement devices (speed camera, body wearable camera, dashboard camera, etc)).

What are the Initiatives Related to Road Safety?

- Global:

- Brasilia Declaration on Road Safety (2015):

- The declaration was signed at the second Global High-Level Conference on Road Safety held in Brazil. India is a signatory to the Declaration.

- The countries plan to achieve Sustainable Development Goal 3.6 i.e., to halve the number of global deaths and injuries from road traffic accidents by 2030.

- Decade of Action for Road Safety 2021-2030:

- The UN General Assembly adopted resolution "Improving global road safety " with the ambitious target of preventing at least 50% of road traffic deaths and injuries by 2030.

- The Global Plan aligns with the Stockholm Declaration, by emphasizing the importance of a holistic approach to road safety.

- The International Road Assessment Programme (iRAP) :

- It is a registered charity dedicated to saving lives through safer roads.

- Brasilia Declaration on Road Safety (2015):

- India:

- Motor Vehicles Amendment Act, 2019:

- The Act hikes the penalties for traffic violations, defective vehicles, juvenile driving, etc.

- It provides for a Motor Vehicle Accident Fund, which would provide compulsory insurance cover to all road users in India for certain types of accidents.

- It also provides for a National Road Safety Board, to be created by the Central Government.

- The Carriage by Road Act, 2007:

- The Act provides for the regulation of common carriers, limiting their liability and declaration of the value of goods delivered to them to determine their liability for loss of, or damage to, such goods occasioned by the negligence or criminal acts of themselves, their servants or agents and for matters connected therewith or incidental thereto.

- The Control of National Highways (Land and Traffic) Act, 2000:

- The Act provides for the control of land within the National Highways, right of way and traffic moving on the National Highways and also for removal of unauthorized occupation thereon.

- National Highways Authority of India Act, 1998:

- The Act provides for the constitution of an authority for the development, maintenance and management of NHs and for matters connected therewith or incidental thereto.

- Motor Vehicles Amendment Act, 2019:

Biodiversity & Environment

WJC Report Links Wildlife Trafficking to Organized Crime

For Prelims: Money Laundering and the Illegal Wildlife Trade, Illegal Sand Mining, Organized Crime, Pangolin, Rhino Poaching

For Mains: Organized crime and Wildlife Trafficking, Sand Mining, Wildlife Conservation,

Why in News?

The Wildlife Justice Commission (WJC), a nonprofit organization dedicated to combating organized crime, has released a new report titled Convergence of Wildlife Crime with Other Forms of Organised Crime: A 2023 Review.

- It is a follow-up to the first report published in 2021, which mentioned 12 case studies linking wildlife trafficking with human trafficking, fraud, migrant smuggling, illicit drugs, corruption and money laundering.

- The report also reveals the environmental crime of illegal sand mining for the first time.

What are the Key Highlights of the Report?

- Convergence of Wildlife Crime and Organized Crime:

- The report uncovers strong connections between wildlife trafficking and various forms of organized crime.

- These connections include protection rackets, extortion, murder, money laundering, illicit drugs, tax evasion, and corruption.

- The report uncovers strong connections between wildlife trafficking and various forms of organized crime.

- Illegal Sand Mining:

- For the first time, the report identifies illegal sand mining as an environmental crime.

- Sand, a raw material and second-most-used resource in the world is used to make concrete, asphalt and glass.

- About 40-50 billion tonnes of sand resources are exploited each year, but their extraction is managed and governed poorly in many countries,

- The Report sheds light on the adverse impacts of unregulated sand extraction, which is a crucial raw material globally.

- Environmental Impact of Sand Mining:

- Indiscriminate sand mining leads to erosion, negatively affecting communities and their livelihoods.

- It has dire consequences for aquifers, storm surge protection, deltas, freshwater and marine fisheries, land use, and biodiversity.

- Involvement of Violent Sand Mafias:

- The report emphasizes that illegal sand-mining operations are often organized and operated by violent sand mafias.

- The report recognizes instances of individuals, including journalists, activists, and government officials, who were killed for opposing illegal sand mining.

- These incidents were reported not only in India but also in other countries, including Indonesia, Kenya, Gambia, South Africa, and Mexico.

- For the first time, the report identifies illegal sand mining as an environmental crime.

- Case Studies:

- In addition to the 12 case studies from 2021, the report puts on record three cases from Southeast Asia, Africa and Central America.

- The first case study illustrated the diversion of commodities such as pangolin scales, illegal sand mining, protection rackets and elephant ivory in Southeast Asia and Africa.

- The Second case from Africa involved an embedded convergence between corruption, rhino poaching and money laundering.

- The third study from Central America represented transactional convergence between drug trafficking networks and seafood businesses involving sea cucumber and sharks closely linked to the smuggling of illicit drugs, money laundering, tax evasion and corruption.

- In addition to the 12 case studies from 2021, the report puts on record three cases from Southeast Asia, Africa and Central America.

- Guiding Law Enforcement and Policymakers:

- The report highlights the growing seriousness of wildlife trafficking, which has become a highly profitable and serious criminal activity.

- Crime convergence should be further studied and integrated as part of the approach to tackle wildlife crime and organized crime more broadly.

- The paper aims to provide typologies and strategies that can inform and support law enforcement and policymakers in their efforts to address transnational organized crime more effectively.

- The report highlights the growing seriousness of wildlife trafficking, which has become a highly profitable and serious criminal activity.

Organized Crime

- About:

- Organized Crime activities refer to actions carried out jointly or severally by members of a gang or syndicate, with the intent of obtaining pecuniary or other advantages.

- Types of Organized Crime:

- Organized gang criminality, Racketeering, Syndicate Crime, Drug trafficking, Cybercrime, Human trafficking, Money laundering, Violence, People smuggling, Extortion, Counterfeiting.

- They operate covertly, exploiting gaps in law enforcement and regulations.

- Legal Position In India on Organized Crime:

- India does not have a specific law to deal with organized crime at the national level. The existing laws, such as the National Security Act,1980, and the Narcotic Drugs and Psychotropic Substances Act, 1985 are inadequate as they target individuals and not criminal groups or enterprises.

- States, such as Gujarat (Gujarat Control of Organised Crime Act, 2015), Karnataka (Karnataka Control of Organised Crime Act, 2000), and Uttar Pradesh (Uttar Pradesh Control of Organised Crime Act, 2017), have enacted their laws to combat organized crime.

- India is also a party to several international conventions and treaties, these include:

Mains Value Addition

Contributions of Himmata Ram Bhambhu in tackling Wildlife Crime

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. Consider the following statements in respect of Trade Related Analysis of Fauna and Flora in Commerce (TRAFFIC): (2017)

- TRAFFIC is a bureau under United Nations Environment Programme (UNEP).

- The mission of TRAFFIC is to ensure that trade in wild plants and animals is not a threat to the conservation of nature.

Which of the above statements is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Exp:

- Trade Related Analysis of Fauna and Flora in Commerce (TRAFFIC), the wildlife trade monitoring network, is a joint program of World Wide Fund for Nature (WWF) and IUCN – the International Union for Conservation of Nature. It was founded in 1976. It is not a bureau under UNEP. Hence, statement 1 is not correct.

- TRAFFIC works to ensure that trade in wild plants and animals is not a threat to the conservation of nature. Hence, statement 2 is correct.

- TRAFFIC focuses on leveraging resources, expertise and awareness of the latest globally urgent species trade issues such as tiger parts, elephant ivory and rhino horn. Large scale commercial trade in commodities like timber and fisheries products is also addressed and linked to work on developing rapid results and policy improvements. Therefore, option (b) is the correct answer.

Mains

Q. Coastal sand mining, whether legal or illegal, poses one of the biggest threats to our environment. Analyze the impact of sand mining along the Indian coasts, citing specific examples. (2019)

Social Justice

Surrogacy Law

For Prelims: Surrogacy Law, Surrogacy (Regulation) Act 2021, Altruistic surrogacy, Commercial Surrogacy, Article 21 of the constitution.

For Mains: Surrogacy Law and Associated Challenges, Mechanisms, laws, institutions and Bodies constituted for the protection and betterment of these vulnerable sections.

Why in News?

Recently, the Delhi High Court has questioned the association of marital status with eligibility for surrogacy under the Surrogacy (Regulation) Act 2021.

- The petitioner challenged Section 2(1)(s) of the Surrogacy Act, which limits the right to avail surrogacy to Indian widows or female divorcees between the ages of 35 and 45.

- The petitioner's plea also challenges the regulation that compels a single woman (widow or divorcee) to utilize her own eggs for surrogacy. Due to her age, using her own gametes is medically inadvisable, and she seeks a donor for female gametes.

What is Surrogacy?

- About:

- Surrogacy is an arrangement in which a woman (the surrogate) agrees to carry and give birth to a child on behalf of another person or couple (the intended parent/s).

- A surrogate, sometimes also called a gestational carrier, is a woman who conceives, carries and gives birth to a child for another person or couple (intended parent/s).

- Altruistic Surrogacy:

- It involves no monetary compensation to the surrogate mother other than the medical expenses and insurance coverage during the pregnancy.

- Commercial Surrogacy:

- It includes surrogacy or its related procedures undertaken for a monetary benefit or reward (in cash or kind) exceeding the basic medical expenses and insurance coverage.

What is the Surrogacy (Regulation) Act, 2021?

- Provisions:

- Under the Surrogacy (Regulation) Act, 2021, a woman who is a widow or a divorcee between the age of 35 to 45 years or a couple, defined as a legally married woman and man, can avail of surrogacy if they have a medical condition necessitating this option.

- The intended couple shall be a legally married Indian man and woman, the man shall be between the ages of 26-55 years and the woman shall be between the ages of 25-50 years, and shall not have any previous biological, adopted, or surrogate child.

- It also bans commercial surrogacy, which is punishable with a jail term of 10 years and a fine of up to Rs 10 lakhs.

- The law allows only altruistic surrogacy where no money exchanges hands and where a surrogate mother is genetically related to those seeking a child.

- Under the Surrogacy (Regulation) Act, 2021, a woman who is a widow or a divorcee between the age of 35 to 45 years or a couple, defined as a legally married woman and man, can avail of surrogacy if they have a medical condition necessitating this option.

- Challenges:

- Exploitation of the Surrogate and the Child: The banning of commercial surrogacy moves from the rights-based approach to a needs-based approach, thus removing the women’s autonomy to make their own reproductive decisions and right to parenthood. One could argue that the state must stop the exploitation of poor women under surrogacy and protect the child’s right to be born. However, the current Act fails to balance these two interests.

- Reinforces Patriarchal Norms: The Act reinforces traditional patriarchal norms of our society that attributes no economic value to women’s work and, directly affecting the fundamental rights of the women to reproduce under Article 21 of the constitution.

- Emotional Complications: In altruistic surrogacy, a friend or relative as a surrogate mother may lead to emotional complications not only for the intending parents but also for the surrogate child as there is great deal of risking the relationship in the course of surrogacy period and post birth.

- Altruistic surrogacy also limits the option of the intending couple in choosing a surrogate mother as very limited relatives will be ready to undergo the process.

- No Third-Party Involvement: In an altruistic surrogacy, there is no third-party involvement. A third-party involvement ensures that the intended couple will bear and support the medical and other miscellaneous expenses during the surrogacy process.

- Overall, a third party helps both the intended couple and the surrogate mother navigate through the complex process, which may not be possible in the case of altruistic surrogacy.

- Some Exclusion from Availing Surrogacy Services:

- There is exclusion of unmarried women, single men, live-in partners, and same-sex couples from availing surrogacy services.

- This amounts to discrimination based on marital status, gender, and sexual orientation, and denies them the right to form a family of their choice.

What are the Recent Changes Made by the Supreme Court?

- A government notification in March 2023 amended the law, banning the use of donor gametes.

- It said “intending couples” must use their own gametes for surrogacy.

- The petition was filed in the Supreme Court challenging the amendment as a violation of a woman’s right to parenthood.

- The Court interpreted the requirement for the child to be "genetically related" as being related to the husband.

- The Court emphasized that the law permitting gestational surrogacy is "woman-centric," meaning that the decision to have a surrogate child is based on the woman's inability to become a mother due to her medical or congenital condition.

- The Court clarified that when Rule 14(a) of the Surrogacy Rules Applies, which lists medical or congenital conditions that allow a woman to opt for Gestational Surrogacy, the child must be related to the intended couple, especially the husband.

- Gestational surrogacy is a process where one person, who did not provide the egg used in conception, carries a fetus through pregnancy and gives birth to a baby for another person or couple.

- The Supreme Court stayed the operation of Rule 7 of the Surrogacy (Regulation) Act, 2021, to allow the woman suffering from the Mayer-Rokitansky-Küster-Hauser (MRKH) Syndrome —a rare congenital disorder that affects the female reproductive system — to undergo surrogacy using a donor egg.

- Rule 7 of the Surrogacy Act bans use of donor eggs for the procedure.

Way Forward

By focusing on inclusivity, ethics, and medical advancements, India can establish a robust legal framework for surrogacy that respects individuals' rights, ensures the well-being of all parties involved, and supports those seeking to start families through assisted reproductive technologies.

Internal Security

President Terminates Services of an Indian Army Major

For Prelims: President, Strategic Forces Command, Article 310, Army Act 1950, Military Intelligence (MI) Directorate, Directorate General of Military Intelligence (DGMI), Pakistan Intelligence Operative (PIO)

For Mains: Implications of disloyal attitude of security forces on nations’ internal security and sovereignty.

Why in News?

The President of India has dismissed an Indian Army Major stationed in a Strategic Forces Command (SFC) unit due to their involvement in serious national security breaches, as determined by an Army inquiry.

- The President utilized her authority under the Army Act, 1950, along with Article 310 of the Constitution and other relevant powers, to promptly terminate his services.

What are the Ethical Concerns Involved in Army Major’s Actions and Subsequent Dismissal?

- Ethical Violations and National Security Concerns:

- An Army inquiry, initiated in March 2022, revealed lapses and ethical violations by the Major, including the sharing of classified information, suspicious financial transactions, and connections with a Pakistani intelligence operative via social media.

- The Major's possession of secret documents on electronic devices was also against Army regulations. These actions raised significant ethical concerns and posed a threat to national security.

- An Army inquiry, initiated in March 2022, revealed lapses and ethical violations by the Major, including the sharing of classified information, suspicious financial transactions, and connections with a Pakistani intelligence operative via social media.

- Presidential Authority and Legal Basis:

- President in accordance with the powers conferred by Section 18 of the Army Act, 1950, and other relevant enabling powers, issued orders to terminate the services of the Major immediately.

- This action demonstrates the exercise of executive authority within the framework of established legal provisions. It underscores the commitment to uphold ethical standards and maintain the integrity of the military.

- Broader Implications and Ongoing Investigations:

- The termination orders highlight the importance of ethical conduct, integrity, and national security in the armed forces.

- It is noteworthy that the Army has taken disciplinary action against a Brigadier and a Lieutenant Colonel for social media policy violations related to their membership in this group which drives the importance of Code of Conduct.

- This case emphasizes the Army's vigilance and proactiveness in addressing potential breaches of security and lack of Devotion-To-Duty.

- Ongoing efforts to safeguard classified military information and counter- intelligence concerns remain a critical focus for the military, not the least of which is setting high moral standards and adherence to fundamental duties as per the constitution.

What are Articles 309, 310 and 311 of the Constitution of India Related to Civil Services?

- Part XIV of the Constitution of India deals with Services under The Union and The State.

- Article 309 empowers the Parliament and the State legislature to regulate the recruitment, and conditions of service of persons appointed, to public services and posts in connection with the affairs of the Union or of any State respectively.

- According to Article 310, except for the provisions provided by the Constitution, a civil servant of the Union works at the pleasure of the President and a civil servant under a State works at the pleasure of the Governor of that State (English doctrine of Pleasure).

- But this power of the Government is not absolute.

- Article 311:

- Article 311 (1) says that no government employee either of an all India service or a state government shall be dismissed or removed by an authority subordinate to the own that appointed him/her.

- Article 311 (2) says that no civil servant shall be dismissed or removed or reduced in rank except after an inquiry in which s/he has been informed of the charges and given a reasonable opportunity of being heard in respect of those charges.

- Exceptions to Article 311 (2):

- 2 (a) - Where a person is dismissed or removed or reduced in rank on the ground of conduct which has led to his conviction on a criminal charge; or

- 2 (b) - Where the authority empowered to dismiss or remove a person or to reduce him in rank is satisfied that for some reason, to be recorded by that authority in writing, it is not reasonably practicable to hold such inquiry; or

- 2 (c) - Where the President or the Governor, as the case may be, is satisfied that in the interest of the security of the State, it is not expedient to hold such inquiry.

What are Some of the Important Provisions of the Army Act, 1950?

- Enlistment and Terms of Service:

- It specifies the procedures for enlisting and the terms of service for army personnel, including conditions of recruitment, training, and retirement.

- Discipline and Conduct: The Army Act provides a detailed framework for maintaining discipline within the army. It outlines various offenses and penalties for misconduct, such as insubordination, desertion, disobedience, and conduct unbecoming of a soldier.

- It specifies the procedures for enlisting and the terms of service for army personnel, including conditions of recruitment, training, and retirement.

- Court-Martial:

- The Act establishes the legal framework for convening courts-martial to try military personnel accused of offenses. It defines different types of courts-martial, such as General Court-Martial (GCM), District Court-Martial (DCM), and Summary General Court-Martial (SGCM).

- Legal Rights of Accused: The Act outlines the legal rights and safeguards for individuals facing court-martial, including the right to legal representation, the right to remain silent, and the right to appeal.

- The Act establishes the legal framework for convening courts-martial to try military personnel accused of offenses. It defines different types of courts-martial, such as General Court-Martial (GCM), District Court-Martial (DCM), and Summary General Court-Martial (SGCM).

- Detention:

- The Act allows for the detention of military personnel in certain circumstances, such as when they are considered a threat to the security or discipline of the army.

- Service Tribunals: The Armed Forces Tribunal Act 2007 establishes the Armed Forces Tribunal, a specialized judicial body to hear appeals and petitions related to military matters.

- The Act allows for the detention of military personnel in certain circumstances, such as when they are considered a threat to the security or discipline of the army.

- Miscellaneous Provisions: The Act contains various miscellaneous provisions, including those related to the protection of witnesses, the appointment of Judge Advocates, and the rules for administering oaths.

Strategic Forces Command

- There are 2 tri-service commands, Strategic Forces Command (SFC) and Andaman and Nicobar Command (ANC), which is headed by rotation by officers from the 3 Services.

- The SFC (Strategic Forces Command), looks after the delivery and operational control of the country’s nuclear assets. It was created in 2003, but because it has no specific geographic responsibility and a designated role, it is not an integrated theatre command but an integrated functional command.

UPSC Civil Services Examination Previous Year Questions

Q. With reference to the election of the President of India, consider the following statements: (2018)

- The value of the vote of each MLA varies from State to State.

- The value of the vote of MPs of the Lok Sabha is more than the value of the vote of MPs of the Rajya Sabha.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Q2. Consider the following statements: (2022)

- A bill amending the Constitution requires a prior recommendation of the President of India.

- When a Constitution Amendment Bill is presented to the President of India, it is obligatory for the President of India to give his/her assent.

- A Constitution Amendment Bill must be passed by both the Lok Sabha and the Rajya Sabha by a special majority and there is no provision for joint sitting.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Indian Economy

OECD Report Highlights Taxation of Indian Farmers

For Prelims: Organisation for Economic Co-operation and Development (OECD), Market Price Support (MPS)

For Mains: Impact of Government Procurement & Distribution, Government Policies and Initiatives

Why in News?

The latest report titled Agricultural Policy Monitoring and Evaluation 2023 by the Organisation for Economic Co-operation and Development (OECD) has shed light on the implicit taxation of Indian farmers in 2022.

- According to a report Indian farmers were taxed USD 169 billion in 2022.

What are the Key Highlights of the Report?

- India's Negative MPS Dominance:

- In 2022, India's negative Market Price Support (MPS) accounted for over 80% of such taxes globally among 54 countries analyzed in the OECD report.

- Total implicit taxation for farmers across the 54 countries was approximately USD 200 billion. The implicit taxation imposed on Indian farmers reached a staggering USD 169 billion, making India a major player in this scenario.

- In 2022, India's negative Market Price Support (MPS) accounted for over 80% of such taxes globally among 54 countries analyzed in the OECD report.

Market Price Support (MPS)

- It is defined as the "annual monetary value of gross transfers from consumers and taxpayers to agricultural producers" due to policy measures that create a price gap between domestic and international markets.

- It is the measure of benefits or losses experienced by farmers when domestic prices deviate from world prices.

- Offset Attempts in Emerging Economies:

- Many emerging economies with negative MPS managed to offset it through budgetary support.

- However, in India’s case, different budgetary transfers to farmers in the form of large subsidies for variable input use, such as fertilizers, electricity, and irrigation water, Pradhan Mantri Kisan Samman Nidhi (PM-KISAN), did not offset the price-depressing effect of domestic marketing regulations and trade policy measures.

- Many emerging economies with negative MPS managed to offset it through budgetary support.

- Impact on Indian Farmers:

- While budgetary transfers constituted 11% of gross farm receipts, the negative MPS amounted to 27.5% for different commodities.

- This discrepancy resulted in an overall negative net support of 15% of gross farm receipts, a concerning situation for Indian farmers.

- While budgetary transfers constituted 11% of gross farm receipts, the negative MPS amounted to 27.5% for different commodities.

- Export Policies in 2022:

- In 2022, India introduced export bans, duties, and permits on several commodities, primarily as a response to the war in Ukraine and the 2022 heatwave.

- These policies aimed to prevent fluctuations in domestic prices but, in doing so, lowered farmers' receipts.

- Commodities affected by these export policies included various types of rice, wheat, sugar, onions, and related products, such as wheat flour.

- Export restrictions directly affected India's reliability as a supplier and exacerbated the persistent challenge of low farm incomes.

- These policies not only impacted domestic markets but also the country's position as a global agricultural producer.

- In 2022, India introduced export bans, duties, and permits on several commodities, primarily as a response to the war in Ukraine and the 2022 heatwave.

- Global Perspective:

- The OECD report highlighted that producer support to the agriculture sector across 54 countries averaged USD 851 billion annually during 2020-2022, a substantial increase attributed to responses to the Covid-19 pandemic, inflationary pressures, and the Ukraine war fallout.

- Potential for Distortion:

- Two-thirds of the positive support to producers across the 54 countries was in forms considered to be 'potentially most distorting' to production and trade.

- These forms include payments based on output and unconstrained use of variable inputs, which can lead to inefficiency and lack of targeted support.

- International Disparities:

- Emerging economies had potentially more distorting policies, generating both positive support to producers (10% of gross farm receipts) and implicit taxation (6% of gross farm receipts) during 2020-2022.

- In contrast, OECD countries had a lower level of potentially distorting policies but did not implicitly tax producers.

What are India’s Initiatives Related to Farmers?

- The Pradhan Mantri Kisan Samman Nidhi (PM-KISAN)

- Kisan Credit Cards (KCC)

- Mission Organic Value Chain Development for North Eastern Region (MOVCDNER)

- National Mission on Sustainable Agriculture

- Paramparagat Krishi Vikas Yojana (PKVY)

- Sub-mission on AgroForestry (SMAF)

- Rashtriya Krishi Vikas Yojana

- AgriStack

- Digital Agriculture Mission

What is the Organization for Economic Co-operation and Development (OECD)?

- About:

- The OECD is an intergovernmental economic organization, founded to stimulate economic progress and world trade.

- Most OECD members are high-income economies with a very high Human Development Index (HDI) and are regarded as developed countries.

- Foundation:

- It was founded in 1961 with its Headquarters at Paris, France and total membership is 38 countries.

- The most recent countries to join the OECD were Colombia, in April 2020, and Costa Rica, in May 2021.

- India is not a member, but a key economic partner.

- Reports and Indices by OECD:

- Government at a Glance.

- OECD Better Life Index.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. In India, which of the following can be considered as public investment in agriculture? (2020)

- Fixing Minimum Support Price for agricultural produce of all crops

- Computerization of Primary Agricultural Credit Societies

- Social Capital development

- Free electricity supply to farmers

- Waiver of agricultural loans by the banking system

- Setting up of cold storage facilities by the governments

Select the correct answer using the code given below:

(a) 1, 2 and 5 only

(b) 1, 3, and 4 and 5 only

(c) 2, 3 and 6 only

(d) 1, 2, 3, 4, 5 and 6

Ans:C

Q. What is/are the advantage/advantages of implementing the 'National Agriculture Market' scheme? (2017)

- It is a pan-India electronic trading portal for agricultural commodities.

- It provides the farmers access to nationwide market, with prices commensurate with the quality of their produce.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither1 nor 2

Ans: C

Mains

Q. What are the main constraints in transport and marketing of agricultural produce in India? (2020)

Important Facts For Prelims

India-Bangladesh Jointly Inaugurated Major Development Projects

Why in News?

Recently, the Indian Prime Minister and Prime Minister of Bangladesh co-inaugurated three significant Indian-assisted development projects.

What are the Key Projects Inaugurated?

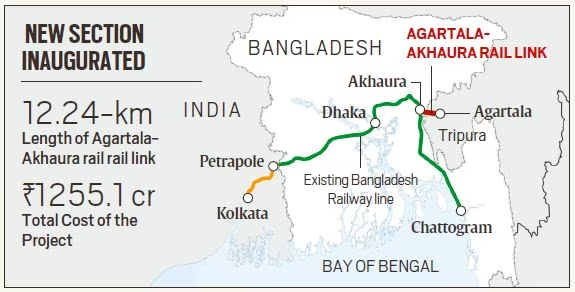

- Akhaura-Agartala Cross-Border Rail Link:

- Executed under India's grant assistance of Rs 392.52 crore to Bangladesh. Spans 12.24 km, comprising a 6.78 km Dual Gauge rail line in Bangladesh and 5.46 km in Tripura.

- Khulna-Mongla Port Rail Line:

- Implemented under India's concessional Line of Credit with a total cost of USD 388.92 million.

- Involves constructing approximately 65 km of broad gauge rail route connecting Mongla Port with Khulna's existing rail network.

- Maitree Super Thermal Power Project:

- Carried out under an Indian Concessional Financing Scheme loan of USD 1.6 billion.

- Houses a 1320 MW (2x660) Super Thermal Power Plant in Rampal, Khulna Division of Bangladesh.

- Led by Bangladesh-India Friendship Power Company (Private) Limited, a joint venture between India's NTPC Ltd and Bangladesh Power Development Board (BPDB).

- Significance of the Projects:

- Connectivity Enhancement: Strengthening cross-border connectivity through rail links, fostering trade and people-to-people ties.

- Energy Security: Significant contribution towards meeting energy needs and ensuring long-term energy security.

- Bilateral Relations: Reinforcing the strong bond between India and Bangladesh, showcasing collaborative efforts for mutual prosperity and development in line with India's Neighborhood First policy'.

What are the Other Key Bilateral Developments Between India and Bangladesh?

- India-Bangladesh Friendship Pipeline

- Ganga Waters Treaty and The Kushiyara River Treaty

- Joint Exercises - Army (Exercise Sampriti) and Navy (Exercise Bongosagar)

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. With reference to river Teesta, consider the following statements: (2017)

- The source of river Teesta is the same as that of Brahmaputra but it flows through Sikkim.

- River Rangeet originates in Sikkim and it is a tributary of river Teesta.

- River Teesta flows into Bay of Bengal on the border of India and Bangladesh.

Which of the statements given above is/are correct?

(a) 1 and 3 only

(b) 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (b)

Important Facts For Prelims

Kozhikode and Gwalior in UNESCO Creative Cities Network

Why in News?

Recently, the United Nations Educational, Scientific and Cultural Organization (UNESCO) announced the addition of 55 new cities to its Creative Cities Network (UCCN). Among the new entrants, two Indian cities made their mark: Kozhikode in Kerala as the ‘City of Literature’ and Gwalior in Madhya Pradesh as the ‘City of Music’.

Note

- Other Indian cities in the UCCN include Jaipur: Crafts and Folk Arts (2015), Varanasi: Creative City of Music (2015), Chennai: Creative City of Music (2017), Mumbai: Film (2019), Hyderabad: Gastronomy (2019), and Srinagar: Crafts and Folk Art (2021).

What is the Significance of Kozhikode and Gwalior?

- Kozhikode as City of Literature:

- Kozhikode is the first city in India to receive the prestigious title of ‘City of Literature’ by UNESCO.

- The city has a long history of hosting various literary events, such as the Kerala Literature Festival, which is one of the largest literary gatherings in Asia.

- This acknowledgement reinforces the city's role as a hub for intellectual exchange and literary discussions.

- Kozhikode carried the distinction of being home to over 500 libraries.

- The city is also home to many renowned writers, including S. K. Pottekkatt (the most celebrated writer of the city), Thikkodiyan and P. Valsala Sanjayan, along with poets, scholars, and publishers who have contributed to the diversity and vibrancy of Malayalam literature and culture.

- Gwalior as the City of Music:

- Gwalior is the second city in India to be designated as the ‘City of Music’ by UNESCO, after Varanasi in 2015.

- The city is widely regarded as the birthplace of Tansen, one of the greatest musicians and composers in Indian history, who was also one of the ‘Navratnas’ (nine jewels) in the court of Emperor Akbar.

- The city is also the origin of the Gwalior Gharana, the oldest and most influential school of Hindustani classical music.

- The city hosts one of the biggest annual music festivals in India, the Tansen Sangeet Samaroh, which attracts thousands of music lovers and artists from across the country and abroad.

UNESCO Creative Cities Network (UCCN)

- It was created in 2004.

- It aims to “promote cooperation among cities which recognize creativity as a strategic factor in their urban development”.

- Sustainable Development Goal 11 aims for Sustainable Cities and Communities.

- The network covers seven creative fields: crafts and folk arts, media arts, film, design, gastronomy, literature and music.

Important Facts For Prelims

India's Widening Tax Base

Why in News?

The recent release of income tax returns statistics by the Income Tax Department, spanning assessment years from 2019-20 to 2021-22, offers insights into changing tax compliance patterns.

- The data unveils a transformation in the profile of taxpayers, particularly a movement towards higher-income brackets, while highlighting persistent challenges in ensuring all eligible taxpayers file their returns.

What is an Income Tax Return?

- Income Tax:

- Income tax is a tax charged on the annual income of an individual or business earned in a financial year.

- The Income Tax system in India is governed by The Income Tax Act, 1961 and it is a direct tax.

- Income tax is a tax charged on the annual income of an individual or business earned in a financial year.

- Income Tax Return:

- It is a designated document used to convey details about an individual's earnings in a financial year and the taxes paid on that income to the Income-tax Department.

- This form also facilitates the carrying forward of losses and enables individuals to claim refunds from the income tax department.

- It is a designated document used to convey details about an individual's earnings in a financial year and the taxes paid on that income to the Income-tax Department.

What are the Major Takeaways from Recent Income Tax Returns Statistics?

- Overall Tax Filings:

- In the assessment year(AY) 2021-22 (financial year 2020-21), a total of 6.75 crore taxpayers submitted income tax returns, marking a 5.6% increase from the previous year's 6.39 crore filings.

- However, approximately 2.1 crore taxpayers paid taxes but did not file returns.

- In the assessment year(AY) 2021-22 (financial year 2020-21), a total of 6.75 crore taxpayers submitted income tax returns, marking a 5.6% increase from the previous year's 6.39 crore filings.

- Evolution of Taxpayer Base:

- The number of taxpayers has progressively increased in recent years: from 5.87 crore in AY 2018-19 to 6.75 crore in AY 2021-22.

- However, the percentage of taxpayers paying nil tax has also risen from 40.3% in AY 2018-19 to 66% in AY 2021-22.

- Income Trends:

- The department highlighted a migration of individual taxpayers towards higher income brackets over the years.

- According to the Central Board of Direct Taxes (CBDT), the proportionate contribution of income from the top 1% earners decreased, while the share from the bottom 25% increased over the years.

- Criticism:

- Critics highlight a widening wealth gap between the ultra-rich and the middle class in India, as the top 1% of income earners saw their income share rise from 17% to 23% from 2013-14 to 2021-22.

- Meanwhile, the income growth for the bottom 25% lagged, leading to a decline in their real income when adjusted for inflation.

- This income gap raises concerns about economic fairness and the struggles of the middle class in achieving sustainable financial progress.

Note

The assessment year is the period during which the income earned in a particular financial year is assessed or evaluated for tax purposes. It is the year immediately following the financial year for which the income is being assessed.

What is the Central Board of Direct Taxes?

- The Central Board of Direct Taxes is a statutory authority functioning under the Central Board of Revenue Act, 1963.

- It operates within the Department of Revenue Ministry of Finance.

- It plays a dual role by contributing crucial insights for shaping direct tax policies and strategies in India, while simultaneously overseeing the implementation and execution of direct tax regulations via the Income Tax Department.

- It is led by a Chairman and consists of six members.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Which one of the following effects of creation of black money in India has been the main cause of worry to the Government of India? (2021)

(a) Diversion of resources to the purchase of real estate and investment in luxury housing.

(b) Investment in unproductive activities and purchase of precious stones, jewellery, gold, etc.

(c) Large donations to political parties and growth of regionalism.

(d) Loss of revenue to the State Exchequer due to tax evasion.

Ans: (d)

Rapid Fire

Rapid Fire Current Affairs

Foundation Day of Indian States

The Foundation Day of the eight states and five union territories, namely Punjab, Chandigarh, Haryana, Andhra Pradesh, Chhattisgarh, Karnataka, Kerala, Madhya Pradesh, Tamil Nadu, Andaman and Nicobar Islands, Delhi, Lakshadweep and Puducherry was celebrated on 1st of November. The Foundation Day programme was organized as part of the 'Ek Bharat Shreshtha Bharat' initiative of Government of India.

- It was stressed that the foundation of four dharma peethas by Adi Shankaracharya in different corners of the country united the nation from Kashmir to Kanyakumari through the bonds of shared culture.

- Formation Years:

- 1956: Tamil Nadu, Andhra Pradesh, Madhya Pradesh, Karnataka, Kerala

- 1966: Haryana was carved out of Punjab

- 2000: Chhattisgarh

Read More: North-Eastern States Reorganisation Act, 1971 , Jammu and Kashmir Reorganisation Act, 2019, Statehood Demand

GST Collections Rise to ₹1.72 Lakh Crore

In October, India's Goods and Service Tax (GST) revenues surged, reaching the second-highest monthly collection of ₹1.72 lakh crore in 10 months.

- GST levies on imports of goods rose 13.9% in October, which is faster than the growth from domestic transactions.

- The average gross monthly GST collection in the FY 2023-24 now stands at ₹1.66 lakh crore and is 11% more than that in the same period in the previous financial year.

- The spate of notices to tax evaders and anti-evasion drives have led to substantial collections.

- The total revenue of Centre and the States in the month of October 2023 after regular settlement is ₹72,934 crore for CGST and ₹ 74,785 crore for SGST.

Read More: Goods and Service Tax Council, GST Appellate Tribunal

Nandini Das Wins British Academy Book Prize 2023

Nandini Das, an India-born author, won the British Academy Book Prize 2023 for Global Cultural Understanding, for her book 'Courting India: England, Mughal India, and the Origins of Empire.'

- The author has sought to present a new perspective on the origins of empire through the story of the arrival of the first English ambassador in India, Sir Thomas Roe, in the early 17th century.

- The British Academy Book Prize, previously named the Nayef Al-Rodhan Prize, was created in 2013 to honor outstanding non-fiction works that exhibit rigor, originality, and promote a deeper understanding of different world cultures and their interactions.

Read More: International Booker Prize, Nobel Prize in Literature

Manufacturing PMI Signals Eight-Month Low

In October 2023, the manufacturing sector's growth slowed down to its lowest pace since February. This decline was attributed to a decrease in new orders, which reached a one-year low, as indicated by the S&P Global India Manufacturing Purchasing Managers' Index (PMI).

- Producers facing higher costs due to increased prices for aluminum, chemicals, leather, paper, rubber, and steel reported slower input accumulation, the slowest in eight months, even though manufacturers continued to stock up on supplies.

- Business confidence dipped to a five-month low as concerns about inflation and demand tempered optimism, though firms still maintained a generally positive outlook on future prospects.

- Consumer goods were behind most of the slowdown, recording considerably softer increases in sales, production, exports, input inventories and buying levels.

Read More: Index of Industrial Production, India’s Manufacturing Sector