Indian Economy

Economic Survey 2022

For Prelims: Economic Data, Important Economic Terms, Economic Survey, Asian Development Bank, World Bank, IMF, Various Government Schemes.

For Mains: Growth & Development,Monetary Policy, Planning, Capital Market, Fiscal Policy, Banking Sector & NBFCs, Inclusive Growth, Economic Survey, Related Concerns, Suggestions.

Why in News?

Recently, the Economic Survey 2021-22 was tabled in Parliament by the Finance Minister soon after the President's address to both Houses of Parliament.

- The central theme of this year’s Economic Survey is the “Agile approach”.

- This year's survey uses various examples to highlight the use of satellite and geospatial data to reflect the infrastructural growth in the country.

What is the Economic Survey?

- The Economic Survey of India is an annual document released by the Ministry of Finance.

- It contains the most authoritative and updated source of data on India’s economy.

- It is a report that the government presents on the state of the economy in the past one year, the key challenges it anticipates, and their possible solutions.

- It is prepared by the Economics Division of the Department of Economic Affairs (DEA) under the guidance of the Chief Economic Advisor.

- It is usually presented a day before the Union Budget is presented in the Parliament.

- The first Economic Survey in India was presented in the year 1950-51. Up to 1964, it was presented along with the Union Budget. From 1964 onwards, it has been delinked from the Budget.

What are the Key Points of the Economic Survey 2021-22?

- State of the Economy (GDP Growth):

- The Indian economy is estimated to grow by 9.2% in real terms in 2021-22 (as per first advance estimates) subsequent to a contraction of 7.3% in 2020-21.

- The Gross Domestic Product (GDP) projected to grow by 8-8.5% in real terms in 2022-23.

- Projection comparable with World Bank and Asian Development Bank’s latest forecasts of real GDP growth of 8.7% and 7.5% respectively for 2022-23.

- According to the International Monetary Fund’s latest World Economic Outlook projections, India’s real GDP is projected to grow at 9% in 2021-22 and 2022-23 and at 7.1% in 2023-2024, which would make India the fastest growing major economy in the world for all 3 years.

- Combination of high Foreign Exchange Reserves, sustained Foreign Direct Investment, and rising export earnings will provide an adequate buffer against possible global liquidity tapering in 2022-23.

- Tapering is the theoretical reversal of quantitative easing (QE) policies, which are implemented by a central bank and intended to stimulate economic growth.

- Fiscal Developments:

.png)

- Sustained revenue collection and a targeted expenditure policy has contained the Fiscal Deficit for April to November, 2021 at 46.2% of Budget Estimates.

- The revenue receipts from the Central Government (April to November, 2021) have gone up by 67.2% YoY(Year on Year) as against an expected growth of 9.6% in the 2021-22 Budget Estimates.

- Gross Tax Revenue registers a growth of over 50% during April to November, 2021 in YoY terms.

- This performance is strong compared to pre-pandemic levels of 2019-2020 also.

- Tax Revenue forms part of the Receipt Budget, which in turn is a part of the Annual Financial Statement of the Union Budget.

- During April-November 2021, Capex (Capital Expenditure) has grown by 13.5% (YoY) with focus on infrastructure-intensive sectors.

- With the enhanced borrowings on account of Covid-19, the Central Government debt has gone up from 49.1% of GDP in 2019-20 to 59.3% of GDP in 2020-21, but is expected to follow a declining trajectory with the recovery of the economy.

- Buoyant tax revenues and government policies have created “headroom for taking up additional fiscal policy interventions”.

- Stressing the need to continue the focus on capital expenditure, it has indicated that the government is on course to achieve the fiscal deficit target of 6.8% of GDP for the current year (2021-22).

- External Sectors:

- India’s merchandise exports and imports rebounded strongly and surpassed pre-Covid levels during the current financial year.

- There was significant pickup in net services with both receipts and payments crossing the pre-pandemic levels, despite weak tourism revenues.

- Net capital flows were higher at USD 65.6 billion in the first half of 2021-22, on account of continued inflow of foreign investment, revival in net external commercial borrowings, higher banking capital and additional Special Drawing Rights (SDR) allocation.

.png)

- As of end-November 2021, India was the fourth largest forex reserves holder in the world after China, Japan and Switzerland.

- Monetary Management and Financial Intermediation:

- The liquidity in the system remained in surplus.

- Repo rate was maintained at 4% in 2021-22.

- Reserve Bank of India undertook various measures such as G-Sec Acquisition Programme and Special Long-Term Repo Operations to provide further liquidity.

- The economic shock of the pandemic has been weathered well by the commercial banking system:

- Bank credit growth accelerated gradually in 2021-22 from 5.3% in April 2021 to 9.2% as on 31st December 2021.

- The Gross Non-Performing Advances ratio of Scheduled Commercial Banks (SCBs) declined from 11.2% at the end of 2017-18 to 6.9% at the end of September, 2021.

- Net Non-Performing Advances ratio declined from 6% to 2.2% during the same period.

- Capital to risk-weighted asset ratio of SCBs continued to increase from 13% in 2013-14 to 16.54% at the end of September 2021.

- The Return on Assets and Return on Equity for Public Sector Banks continued to be positive for the period ending September 2021.

- Exceptional year for the capital markets:

- Rs. 89,066 crore was raised via 75 Initial Public Offering (IPO) issues in April-November 2021, which is much higher than in any year in the last decade.

- The liquidity in the system remained in surplus.

- Prices and Inflation:

- The average headline Consumer Price Index (CPI) -Combined inflation moderated to 5.2% in 2021-22 (April-December) from 6.6% in the corresponding period of 2020-21.

- The decline in retail inflation (CPI) was led by easing food inflation. Food inflation averaged at a low of 2.9% in 2021-22 (April to December) as against 9.1% in the corresponding period last year.

- Effective supply-side management kept prices of most essential commodities under control during the year. Proactive measures were taken to contain the price rise in pulses and edible oils.

- Reduction in central excise and subsequent cuts in Value Added Tax by most States helped ease petrol and diesel prices.

- Wholesale inflation based on Wholesale Price Index (WPI) rose to 12.5% during 2021-22 (April to December). This has been attributed to:

- Low base in the previous year,

- Pick-up in economic activity,

- Sharp increase in international prices of crude oil and other imported inputs, and

- High freight costs.

- Divergence between CPI-C and WPI Inflation: The divergence peaked to 9.6% points in May 2020. However in 2021 there was a reversal in divergence with retail inflation falling below wholesale inflation by 8.0% points in December 2021. This divergence can be explained by factors such as:

- Variations due to base effect,

- Difference in scope and coverage of the two indices,

- Price collections,

- Items covered,

- Difference in commodity weights, and

- WPI being more sensitive to cost-push inflation led by imported inputs.

- With the gradual waning of base effect in WPI, the divergence in CPI-C and WPI is also expected to narrow down.

- Sustainable Development and Climate Change:

- India’s overall score on the NITI Aayog Sustainable Development Goals (SDG) India Index and Dashboard improved to 66 in 2020-21 from 60 in 2019-20 and 57 in 2018-19.

- India has the tenth largest forest area in the world. In 2020, India ranked third globally in increasing its forest area during 2010 to 2020.

- In 2020, the forests covered 24% of India’s total geographical area, accounting for 2% of the world’s total forest area.

- In August 2021, the Plastic Waste Management Amendment Rules, 2021, was notified which is aimed at phasing out single use plastic by 2022.

- Draft regulation on Extended Producer Responsibility for plastic packaging was notified.

- The Compliance status of Grossly Polluting Industries (GPIs) located in the Ganga main stem and its tributaries improved from 39% in 2017 to 81% in 2020.

- The Prime Minister, as a part of the national statement delivered at the 26th Conference of Parties (COP 26) in Glasgow in November 2021, announced ambitious targets to be achieved by 2030 to enable further reduction in emissions.

- The need to start the one-word movement ‘LIFE’ (Lifestyle for Environment) urging mindful and deliberate utilisation instead of mindless and destructive consumption was underlined.

- Agriculture and Food Management:

.png)

- The Agriculture sector experienced buoyant growth in the past two years, accounting for a sizable 18.8% (2021-22) in Gross Value Added (GVA) of the country registering a growth of 3.6% in 2020-21 and 3.9% in 2021-22.

- Minimum Support Price (MSP) policy is being used to promote crop diversification.

- Net receipts from crop production have increased by 22.6% in the latest Situation Assessment Survey (SAS) compared to the SAS Report of 2014.

- Allied sectors including animal husbandry, dairying and fisheries are steadily emerging to be high growth sectors and major drivers of overall growth in the agriculture sector.

- The Livestock sector has grown at a CAGR of 8.15% over the last five years ending 2019-20.

- Government facilitates food processing through various measures of infrastructure development, subsidised transportation and support for formalisation of micro food enterprises.

- India runs one of the largest food management programmes in the world.

- Government has further extended the coverage of the food security network through schemes like PM Gareeb Kalyan Yojana (PMGKY).

- Industry and Infrastructure:

- The Index of Industrial Production (IIP) grew at 17.4% during April-November 2021 as compared to (-)15.3% in April-November 2020.

- Capital expenditure for the Indian railways has increased to Rs. 155,181 crores in 2020-21 from an average annual of Rs. 45,980 crores during 2009-14 and it has been budgeted to further increase to Rs. 215,058 crores in 2021-22 – a five times increase in comparison to the 2014 level.

- Extent of road construction per day increased substantially in 2020-21 to 36.5 Kms per day from 28 Kms per day in 2019-20 – a rise of 30.4%.

- Net profit to sales ratio of large corporations reached an all-time high of 10.6% in July-September quarter of 2021-22 despite the pandemic (RBI Study).

- Introduction of Production Linked Incentive (PLI) scheme, major boost provided to infrastructure-both physical as well as digital, along with measures to reduce transaction costs and improve ease of doing business, would support the pace of recovery.

- Services:

- Gross Value Added:

- GVA of services crossed pre-pandemic level in July-September quarter of 2021-22; however, GVA of contact intensive sectors like trade, transport, etc. still remain below pre-pandemic level.

- Overall service Sector GVA is expected to grow by 8.2% in 2021-22.

- Foreign Direct Invest:

- During the first half of 2021-22, the service sector received over USD 16.7 billion Foreign Direct Invest – accounting for almost 54% of total FDI inflows into India.

- Reforms:

- Major government reforms include, removing telecom regulations in IT-BPO sector and opening up of the space sector to private players.

- Exports:

- Services exports surpassed pre-pandemic level in January-March quarter of 2020-21 and grew by 21.6% in the first half of 2021-22 - strengthened by global demand for software and IT services exports.

- Start-Ups:

- India has become the 3rd largest start-up ecosystem in the world after the US and China. Number of new recognized start-ups increased to over 14000 in 2021-22 from 733 in 2016-17.

- 44 Indian start-ups have achieved unicorn status in 2021 taking the overall tally of unicorns to 83, most of which are in the services sector.

- Gross Value Added:

- Social Infrastructure and Employment:

- Employment:

- With revival of the economy, employment indicators bounced back to pre-pandemic levels during the last quarter of 2020-21.

- As per the quarterly Periodic Labour Force Survey (PFLS) data up to March 2021, employment in urban sector affected by pandemic has recovered almost to the pre-pandemic level.

- According to Employees Provident Fund Organisation (EPFO) data, formalisation of jobs continued during the second Covid wave; adverse impact of Covid on formalisation of jobs much lower than during the first Covid wave.

- Social Infrastructure:

- Expenditure on social services (health, education and others) by Centre and States as a proportion of GDP increased from 6.2% in 2014-15 to 8.6% in 2021-22 (BE)

- As per the National Family Health Survey-5:

- Total Fertility Rate (TFR) came down to 2 in 2019-21 from 2.2 in 2015-16.

- Infant Mortality Rate (IMR), under-five mortality rate and institutional births have improved in 2019-21 over year 2015-16.

- Under Jal Jeevan Mission (JJM), 83 districts have become ‘Har Ghar Jal’ districts.

- Increased allotment of funds to Mahatma Gandhi National Rural Employment Guarantee Scheme (MNREGS) to provide buffer for unorganised labour in rural areas during the pandemic.

- In addition to the National Health Mission, Union Budget 2021-22, announced Ayushman Bharat Health Infrastructure Mission, a new Centrally Sponsored Scheme to develop capacities of primary, secondary and tertiary Health Care Systems, strengthen existing national institutions, and create new institutions to cater to detection and cure of new and emerging diseases.

- India is among the few countries producing Covid vaccines. The country started with two made in India Covid vaccines. In line with India’s vision of Atmanirbhar Bharat, India’s first domestic Covid -19 vaccine, Whole Virion Inactivated Coronavirus Vaccine (COVAXIN), was developed and manufactured by Bharat Biotech International Limited in collaboration with National Institute of Virology of Indian Council of Medical Research (ICMR).

- The progress of vaccination should be seen not just as a health response indicator, but also as a buffer against economic disruptions caused by repeated pandemic waves.

- Employment:

Indian Economy

Economic Survey 2022: Concerns & Suggestions

For Prelims: Economic Survey and its data.

For Mains: Economic Survey, Concerns Highlighted, Suggestions.

Why in News?

Recently, the Economic Survey 2021-22 was tabled in Parliament by the Finance Minister soon after the President's address to both Houses of Parliament.

What are the Key Challenges highlighted by Economic Survey 2022?

- Increased Inflation:

- The Survey notes that supply chain disruptions and slow economic growth have contributed to an increase in inflation. The withdrawal of stimulus in developed economies in the upcoming fiscal (2022-23) is likely to affect capital flows into the country.

- The surge in energy, food, non-food commodities, and input prices, supply constraints, disruption of global supply chains, and rising freight costs across the globe stoked global inflation during the year (2021-22).

- Stimulus spending in developed economies and pent up demand during the pandemic could lead to “imported inflation” (Inflation due to increases in the prices of import) in India.

- Volatility in Capital:

- The economic survey noted that major economies had begun the process of withdrawing liquidity that was extended during the pandemic in the form of stimulus checks and relaxed monetary policy to stimulate an economic recovery. Higher inflation has led to a winding down of pandemic related stimulus.

- The likely withdrawal of liquidity by major central banks over the next year may also make global capital flows more volatile,” the survey said, noting that this may adversely affect capital flows, putting pressure on India’s exchange rate and slow economic growth.

- India’s large and rising imports are also likely to put pressure on India’s exchange rate if capital flows to India decrease as a result of a withdrawal of stimulus in developed countries.

- Employment:

- A lack of jobs also continues to be among the primary concerns for the Indian economy with unemployment levels and labour force participation rates remaining worse than pre-pandemic levels.

- According to data from the PLFS, while the unemployment rate and labour force participation rate have improved somewhat from the start of the pandemic, they have still not recovered to pre-pandemic levels.

What are the Major Suggestions?

- The Survey calls for emphasis on developing a supply-side strategy to deal with the long-term unpredictability of the post-Covid world, emanating mainly from factors such as changes in consumer behaviour, technological developments, geopolitics, climate change, and their potentially unpredictable interactions.

- It calls for a “diversified mix of sources of energy of which fossil fuels are an important part”, but simultaneously calls for focus on building storage for intermittent electricity generation from solar PV and wind farms to ensure on-demand energy supply.

- It asks the government to focus on the pace of the shift from conventional fossil fuel-based sources, and encourage R&D to ensure an effortless switch to renewable sources of energy.

- It also has called for a standardised framework for Cross-Border insolvency as the Insolvency & Bankruptcy Code (IBC) at present does not have a standard instrument to restructure the firms involving cross border jurisdictions leading to several issues.

- It proposes use of the Agile approach to policy making with 80 high-frequency indicators in an environment of “extreme uncertainty”.

- The approach, used in project management and technology development, assesses outcomes in short iterations while constantly making incremental adjustments. The suggestion is based on the availability of a “wealth of real-time data” to take feedback-based decisions.

Indian Economy

Reverse Repo Normalisation

For Prelims: RBI, Repo Rate, Reverse Repo Rate, Reverse Repo Normalisation, Monetary Policy Normalisation

For Mains: Monetary Policy, Growth & Development, RBI and its Monetary Policy Tools.

Why in News?

In a recent report, State Bank of India has stated that it believes the stage is set for a Reverse Repo Normalisation in India.

- The Repurchase agreement (Repo) and the Reverse repo agreement are two key tools used by the Reserve Bank of India (RBI) to control the money supply.

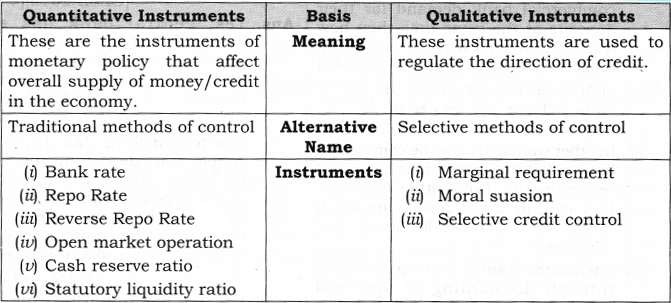

- The tools used by the Central bank to control money supply can be quantitative or qualitative.

What are Repo and Reverse Repo Rates?

- About:

- Repo rate is the rate at which the central bank of a country (RBI in case of India) lends money to commercial banks in the event of any shortfall of funds. Here, the central bank purchases the security.

- The reverse repo is the interest rate that the RBI pays to the commercial banks when they park their excess “liquidity” (money) with the RBI. The reverse repo, thus, is the exact opposite of the repo rate.

- Significance:

- Under normal circumstances, that is when the economy is growing at a healthy pace, the repo rate becomes the benchmark interest rate in the economy.

- That’s because it is the lowest rate of interest at which funds can be borrowed. As such, the repo rate forms the floor interest rate for all other interest rates in the economy - be it the rate for a car loan or a home loan or the interest earned on fixed deposit etc.

- When the RBI pumps more and more liquidity into the market but there are no takers of fresh loans — either because the banks are unwilling to lend or because there is no genuine demand for new loans in the economy.

- In such a scenario, the action shifts from repo rate to reverse repo rate because banks are no longer interested in borrowing money from the RBI.

- Rather they are more interested in parking their excess liquidity with the RBI. And that is how the reverse repo becomes the actual benchmark interest rate in the economy.

What is Reverse Repo Normalisation?

- About:

- It means the reverse repo rates will go up i.e. raising the reverse repo rate in one or two stages.

- In the face of rising inflation, several central banks across the world have either increased interest rates or signalled that they would do so soon.

- In India, too, it is expected that the RBI will raise the repo rate. But before that, it is expected that the RBI will raise the reverse repo rate and reduce the gap between the two rates.

- Significance:

- The process of normalisation is mainly aimed at curbing inflation.

- However, it will not only reduce excess liquidity but also result in higher interest rates across the board in the Indian economy.

- Thus reducing the demand for money among consumers (since it would make more sense to just keep the money in the bank) and making it costlier for businesses to borrow fresh loans.

What is Monetary Policy Normalisation?

- The RBI keeps changing the total amount of money in the economy to ensure smooth functioning. As such, when the RBI wants to boost economic activity it adopts a so-called “loose monetary policy”.

- There are two parts to such a policy:

- Injecting Liquidity in the Economy: It does so by buying government bonds from the market. As the RBI buys these bonds, it pays back money to the bondholders, thus injecting more money into the economy.

- Lowering Interest Rate: Two, the RBI also lowers the interest rate it charges banks when it lends money to them; this rate is called the repo rate.

- By lowering the interest rate at which it lends money to commercial banks, the RBI hopes that the commercial banks (and the rest of the banking system), in turn, will feel incentivised to lower interest rates.

- Lower interest rates and more liquidity, together, are expected to boost both consumption and production in the economy.

- For a consumer, it would now pay less to keep the money in the bank — thus it incentivises current consumption. For firms and entrepreneurs, it would make more sense to borrow money to start a new enterprise because interest rates are lower.

- The reverse of a loose monetary policy is a “tight monetary policy” and it involves the RBI raising interest rates and sucking liquidity out of the economy by selling bonds (and taking money out of the system).

- When any central bank finds that a loose monetary policy has started becoming counterproductive (for example, when it leads to a higher inflation rate), the central bank “normalises the policy” by tightening the monetary policy stance.

Social Justice

Expanding Scope of NCW

For Prelims: Legal Framework for Welfare of Women, Background & Mandate of National Commission for Women (NCW).

For Mains: Evolving needs of women in the country, Background & Mandate of National Commission for Women (NCW).

Why in News?

Recently, the 30th Foundation Day (31st January) of the National Commission for Women (NCW) was celebrated.

- According to the Prime Minister, given the evolving needs of women in the country, the scope of NCW must be broadened.

What is the need to expand the scope of the NCW?

- Development of New India:

- The Atmanirbhar Bharat (self-reliant India) campaign has shown the link between the ability of women with the development of the country.

- This change is visible as about 70% beneficiaries of Pradhan Mantri MUDRA Yojana are women.

- The country has seen a threefold increase in the number of women self-help groups in the last 6-7 years.

- Similarly, in more than 60 thousand startups that have emerged after 2016, 45% have at least one woman director.

- The Atmanirbhar Bharat (self-reliant India) campaign has shown the link between the ability of women with the development of the country.

- Old Thinking in Society:

- Industries from textile to dairy have progressed due to women’s skills and power.

- India's economy relies on Micro, Small and Medium Enterprises and there is a need to promote women entrepreneurs in the country.

- However, people with old thinking are of the view that the women’s roles are restricted to domestic work.

- Industries from textile to dairy have progressed due to women’s skills and power.

- Increasing Crime Against Women:

- In 2021, the NCW had informed that there was a rise of 46% in complaints of crimes against women in the first eight months of 2021 over the corresponding period of preceding year.

- Crimes that women were subjected to: Domestic violence, Harassment of married women or dowry harassment, Sexual harasment at workplace, Rape and attempt to rape, Cyber crimes.

What is the Background & Mandate of NCW?

- Background:

- The Committee on the Status of Women in India (CSWI) recommended nearly five decades ago, the setting up of a NCW to fulfil the surveillance functions to facilitate redressal of grievances and to accelerate the socio-economic development of women.

- Successive Committees/Commissions/Plans including the National Perspective Plan for Women (1988-2000) recommended the constitution of an apex body for women.

- Under the National Commission for Women Act, 1990, the NCW was set up as a statutory body in January 1992.

- The First Commission was constituted on 31st January 1992 with Mrs. Jayanti Patnaik as the Chairperson.

- The commission consists of a chairperson, a member secretary and five other members. The chairperson of the NCW is nominated by the Central Government.

- Mandate and Functions:

- Its mission is to strive towards enabling women to achieve equality and equal participation in all spheres of life by securing her due rights and entitlements through suitable policy formulation, legislative measures, etc.

- Its functions are to:

- Review the constitutional and legal safeguards for women.

- Recommend remedial legislative measures.

- Facilitate redressal of grievances.

- Advise the Government on all policy matters affecting women.

- It has received a large number of complaints and acted suo-moto in several cases to provide speedy justice.

- It took up the issue of child marriage, sponsored legal awareness programmes, Parivarik Mahila Lok Adalats and reviewed laws such as:

- Dowry Prohibition Act, 1961,

- Pre-Conception and Pre-Natal Diagnostic Techniques Act 1994,

- Indian Penal Code 1860.

What is the major Legal Framework for Welfare of Women?

- Constitutional Safeguards:

- Fundamental Rights:

- It guarantees all Indians the right to equality (Article 14), no discrimination by the State on the basis of gender (Article 15(1)) and special provisions to be made by the State in favour of women (Article 15(3)).

- Fundamental Duties:

- It ensures that practices derogatory to the dignity of women are prohibited under Article 51 (A).

- Fundamental Rights:

- Legislative Framework:

- Women Empowerment Schemes:

- Beti Bachao Beti Padhao Scheme

- One Stop Centre Scheme

- UJJAWALA: A Comprehensive Scheme for Prevention of trafficking and Rescue, Rehabilitation and Re-integration of Victims of Trafficking and Commercial Sexual Exploitation

- SWADHAR Greh (A Scheme for Women in Difficult Circumstances)

- NARI SHAKTI PURASKAR

- Mahila police Volunteers

- Mahila Shakti Kendras (MSK)

- NIRBHAYA.

Way Forward

- Amending NCW Act: Women's role is continuously expanding in today’s India and the expansion of the role of the NCW is the need of the hour.

- Further, the State Commissions must also widen their ambit.

- Increasing Minimum Age for Marriage: The age of marriage of daughters is being attempted to be raised to 21 years so that marriage at an early age does not hinder the education and career of daughters.

- Addressing Voilence Against Women: Violence against women continues to be an obstacle to achieving equality, development, peace as well as to the fulfillment of women and girls’ human rights.

- All in all, the promise of the Sustainable Development Goals (SDGs) - to leave no one behind - cannot be fulfilled without putting an end to violence against women and girls.

- Holistic Effort: Crime against women cannot be resolved in the court of law alone. A holistic approach & changing the entire ecosystem is what is required.

- All the stakeholders need to get their act together, including Law makers, police officers, forensic dept, prosecutors, judiciary, medical & health dept, NGOs, rehabilitation centres.

Social Justice

World Neglected Tropical Diseases Day

For Prelims: About NTDs, World Health Organisation.

For Mains: Indian efforts in combating Neglected Tropical Diseases.

Why in News?

Neglected tropical disease day is observed every year on 30th January. It was declared in the 74th World Health Assembly (2021).

- The proposal to recognise the day was floated by the United Arab Emirates. It was adopted unanimously by the delegates.

- The World Health Assembly is the decision-making body of the World Health Organization (WHO).

What are Neglected Tropical Diseases (NTDs)?

- NTDs are a group of infections that are most common among marginalized communities in the developing regions of Africa, Asia and the Americas.

- They are caused by a variety of pathogens such as viruses, bacteria, protozoa and parasitic worms.

- NTDs are especially common in tropical areas where people do not have access to clean water or safe ways to dispose of human waste.

- These diseases generally receive less funding for research and treatment than malaises like tuberculosis, HIV-AIDS and malaria.

- Examples of NTDs are: snakebite envenomation, scabies, yaws, trachoma, Leishmaniasis and Chagas disease etc.

Why is World NTD Day observed on 30th January?

- World NTD Day commemorates the simultaneous launch of the first NTD road map (2012-2020) and the London Declaration on NTDs on 30th January 2012.

- London Declaration on NTDs:

- It was adopted on 30th January, 2012 to recognise the global burden of NTDs.

- Officials from the World Health Organization (WHO), the World Bank, the Bill and Melinda Gates Foundation, representatives from leading global pharmaceutical companies as well as representatives of several national governments met at London’s Royal College of physicians to pledge to end the diseases.

- WHO’s New Roadmap for 2021–2030:

- From measuring process to measuring impact.

- From disease-specific planning and programming to collaborative work across sectors.

- From externally driven agendas reliant to programmes that are country-owned and country-financed.

What is the impact of NTDs?

- Global Scenario:

- NTDs affect more than a billion people globally.

- They are preventable and treatable. However, these diseases - and their intricate interrelationships with poverty and ecological systems - continue to cause devastating health, social and economic consequences.

- There are 20 NTDs that impact over 1.7 billion people worldwide.

- India carries the largest burden of at least 11 of these diseases, with parasitic illnesses like kala-azar and lymphatic filariasis affecting millions of people throughout the country – often the poorest and most vulnerable.

- NTDs affect more than a billion people globally.

- Indian Scenario:

- 2021 witnessed improved case surveillance, case detection and case prevalence rates with respect to Kala-Azar.

- 35% fewer cases of the disease were reported in 2021, as compared to 2020 and all reported cases were treated.

- India is at the cusp of eliminating Kala-Azar, with 99% Kala-Azar endemic blocks having achieved the elimination target.

What are the Indian Initiatives to Eliminate NTDs?

- The Accelerated Plan for Elimination of Lymphatic Filariasis (APELF) was launched in 2018, as part of intensifying efforts towards the elimination of NTDs.

- A WHO-supported regional alliance established by the governments of India, Bangladesh, and Nepal in 2005 to expedite early diagnosis and treatment of the most vulnerable populations and improve disease surveillance and control of sandfly populations (Kala-azar).

- India has already eliminated several other NTDs, including guinea worm, trachoma, and yaws.

- Preventive methods like Mass Drug Administration (MDA) rounds are periodically deployed in endemic areas during which anti-filarial medicines are provided free-of-cost to at-risk communities.

- Vector-control measures like Indoor Residual Spraying rounds are undertaken in endemic areas to prevent sandfly breeding.

- The government also supports morbidity management and disability prevention for those affected by lymphoedema and hydrocele.

- State and central governments have also introduced wage compensation schemes for those suffering from Kala-Azar and its sequela (a condition which is the consequence of a previous disease or injury) known as Post-Kala Azar Dermal Leishmaniasis.

Way Forward

- India is poised to emerge as a global leader in the battle against NTDs, but success in this decade will demand bolder action. As India stands firm on its commitment to eliminate NTDs, multi-stakeholder and cross-sectoral partnerships and collaboration will continue to play a central role in sustaining the momentum gained.

- An integrated approach to improving access to quality healthcare, water, sanitation, hygiene, addressing climate change and ensuring gender equality, mental health and well-being must lie at the core of eliminating these diverse NTDs.

Important Facts For Prelims

Bomb Cyclone

For Prelims: Bomb cyclone, Hurricanes, cyclones, typhoons.

For Mains: Cyclones and its formation, Important Geophysical phenomena.

Why in News?

Recently, ‘Bomb cyclone’ hits eastern US, which triggers transport chaos, outages.

What is a Bomb Cyclone?

- About:

- A bomb cyclone is a large, intense midlatitude storm that has low pressure at its center, weather fronts and an array of associated weather, from blizzards to severe thunderstorms to heavy precipitation.

- Bomb cyclones put forecasters on high alert, because they can produce significant harmful impacts.

- Reasons for the Formation:

- This can happen when a cold air mass collides with a warm air mass, such as air over warm ocean waters. The formation of this rapidly strengthening weather system is a process called bombogenesis.

- It occurs when a midlatitude cyclone rapidly intensifies, dropping at least 24 millibars over 24 hours.

- A millibar measures atmospheric pressure.

How does a Bomb Cyclone differ from a Hurricane?

- Hurricanes tend to form in tropical areas and are powered by warm seas. For this reason, they’re most common in summer or early fall, when seawater is warmest.

- Bomb cyclones generally occur during colder months because cyclones occur due to cold and warm air meeting. During the summer, there’s generally not much cold air across the atmosphere; this means a bomb cyclone is much less likely to occur.

- Hurricanes form in tropical waters, while bomb cyclones form over the northwestern Atlantic, northwestern Pacific and sometimes the Mediterranean Sea.

Important Facts For Prelims

SeHAT Initiative

Why in News?

The Ministry of Defence (MoD) has launched services for home delivery of medicines for veterans and serving military personnel services under an online medical consultation platform named Services e-Health Assistance and Teleconsultation (SeHAT).

What is SeHAT Initiative?

- It is the tri-services teleconsultation service of the MoD designed for all entitled personnel and their families.

- As part of the Government’s commitment to Digital India and e-Governance, the Defence Minister launched SeHAT in May 2021.

- It aims to provide healthcare services to patients in their homes.

- SeHAT Stay Home OPD is based on the lines of eSanjeevani a similar free OPD service run by the MoHFW (Ministry of Health and Family Welfare) for all citizens.

- SeHATOPD is a patient to doctor system where the patient can consult a doctor remotely through the internet.