Science & Technology

Electronics: Powering India’s Participation in Global Value Chains

- 31 Dec 2024

- 17 min read

For Prelims: NITI Aayog, Electronics sector, Economic growth, Industrialization, Production-Linked Incentive (PLI) scheme, India Semiconductor Mission, Global Value Chains (GVCs), R&D investment, IoT devices, Electric vehicles, Industrial clusters, Make in India

For Mains: India’s Participation in Global Value Chains, Investment Under PLI Schemes

Why in News?

The NITI Aayog has released a comprehensive report titled "Powering India's Participation in Global Value Chains (GVCs)," with a focus on the electronics sector.

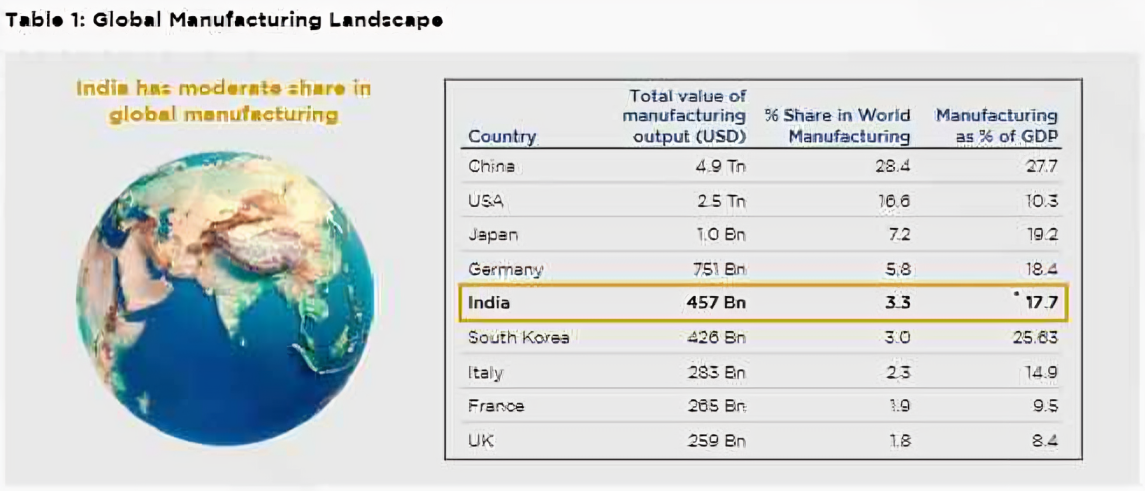

- This initiative comes at a crucial time as India seeks to bolster its share in the global manufacturing landscape, which currently stands at a modest 3.3% of global output.

What are the Key Observations of the Report?

- About:

- GVCs are international production sharing, where the full range of activities (i.e., design, production, marketing, distribution, and support to the final consumer, etc.) are divided among multiple firms and workers across geographic spaces, to bring a product from conception to end-use and beyond.

- Role of GVCs:

- GVCs enable firms to integrate into global markets by specializing in specific production tasks.

- Countries can participate in parts of the production process, not entire value chains, maximizing efficiency and specialization.

- GVC participation accelerates industrialization, economic growth, and exports.

- It fosters job creation, income generation, knowledge transfer, and ecosystem development.

- Example - iPhone:

- Components come from multiple countries (e.g., USA for design, China for rare earth minerals, Japan/Korea for LCD panels, Europe for gyroscopes).

- Final assembly occurs in countries like India, China, and Vietnam.

- Theoretical Evolution: The concept of global value chains has evolved significantly over time, mirroring the changing landscape of international trade theory.

- David Ricardo's theory: Specialization based on cost advantage benefits to trade.

- Hecksher-Ohlin theory: Trade patterns depend on factor endowments like labor or capital.

- Paul Krugman’s new trade theory: Trade benefits arise from specialization, economies of scale, and industrial clusters.

- Global Manufacturing Landscape:

- Globally, manufacturing grew 2.5 times in 24 years, reaching USD 1619 trillion in 2022.

- China leads with 28.4% of global output, followed by the USA (16.6%) and Japan (7.2%). India contributes USD 457 billion, holding 3.3% of the global share, trailing behind major players.

- Significance of the Electronics Sector:

- Economic Contribution: The electronics sector significantly boosts India's Gross Domestic Product (GDP), contributing between 13-17.7%.

- Post-Covid Opportunities: Supply chain shifts and geopolitical factors favor India as a manufacturing hub.

- Rising Export Potential: Growth in mobile phone exports strengthens India's global positioning.

- Demographic Advantage: A young, aspirational population increases demand for advanced electronics.

- Innovation Driver: The sector leads in cutting-edge technology influencing multiple industries.

- Global Integration: Strengthening ties in global value chains offers further growth potential.

- Global Value Chains (GVCs) in Electronics Setor:

- Global Electronics Market: Valued at USD 4.3 trillion, it spans diverse segments, from smartphones to electric vehicles.

- Major Players: Countries like China, Taiwan, the USA, South Korea, Vietnam, Japan, Mexico, and Malaysia dominate, controlling over 90% of global electronics production.

- China leads with 60% of global production.

- Emerging centers include Vietnam, Malaysia, and India.

- Trade Dynamics: Global electronics trade is worth USD 3 trillion.

- China accounts for 30% of exports, followed by Taiwan (9%) and the USA (7%).

- India’s share remains under 1%, with USD 25 billion in annual exports.

- Finished Goods: Valued at USD 2.4 trillion, it is expected to grow to USD 3.5 trillion by 2030, driven by mobiles, auto electronics, and telecom electronics.

- Components Market: Valued at USD 1.8 trillion, dominated by electronic components and modules.

- Outlook:

- Market Growth: The global electronics finished goods market is projected to grow at a 5% Compound annual growth rate (CAGR), reaching USD 3.5 trillion by the Fiscal Year 2030, driven by rising consumption, premiumization, and new product categories.

- Supply Chain Shift: Geopolitical tensions, Covid-19 disruptions, and diminishing labor cost advantages in China are pushing producers to diversify supply chains to countries like Vietnam, Mexico, and Malaysia.

- India’s Potential: Favorable demographics, government schemes, and growing domestic capabilities position India to benefit from this shift.

- Strong competition from Vietnam, Mexico, and Malaysia makes it critical for India to act urgently to secure a 4-5% share in global electronics exports by 2030.

What is the State of India’s Electronics Manufacturing?

- Growth of the Electronics Sector in India:

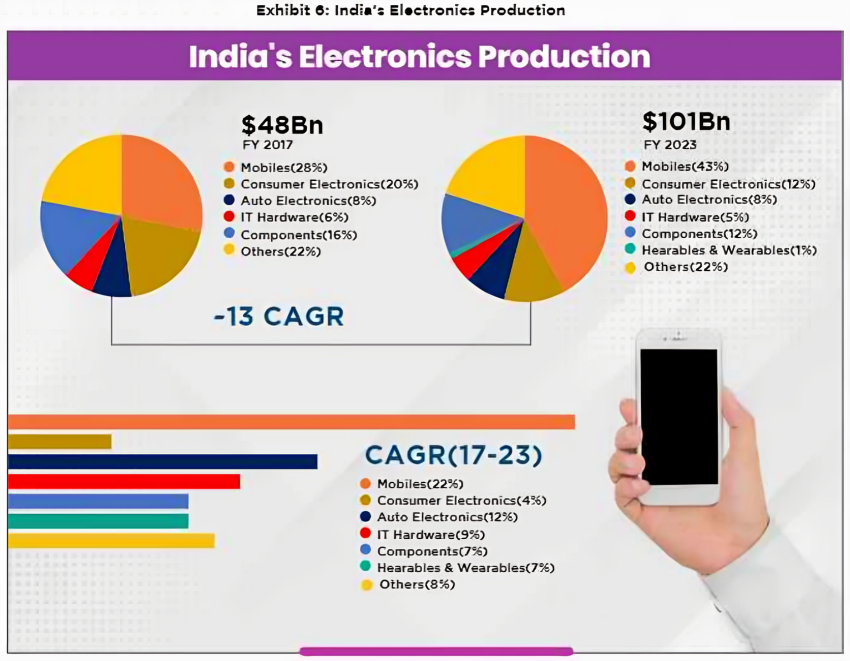

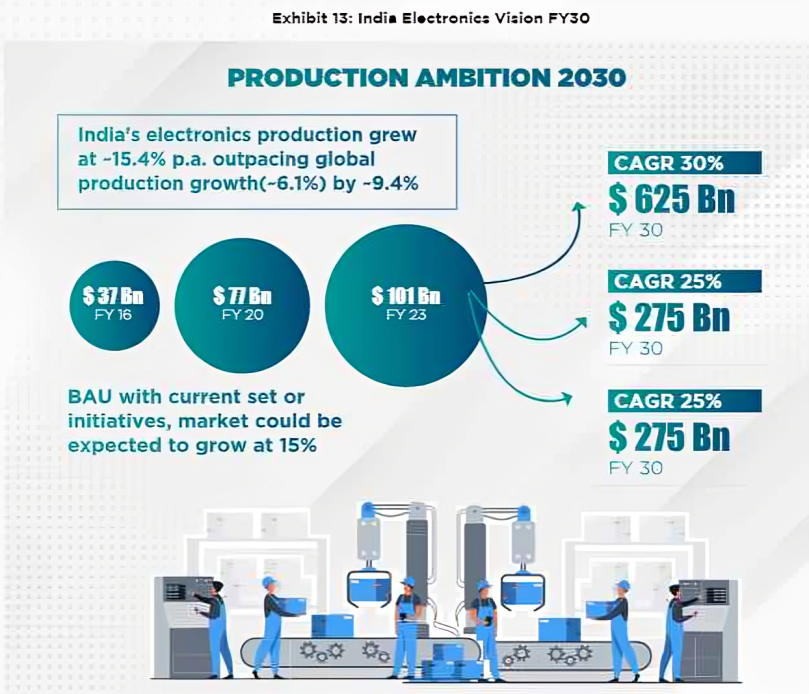

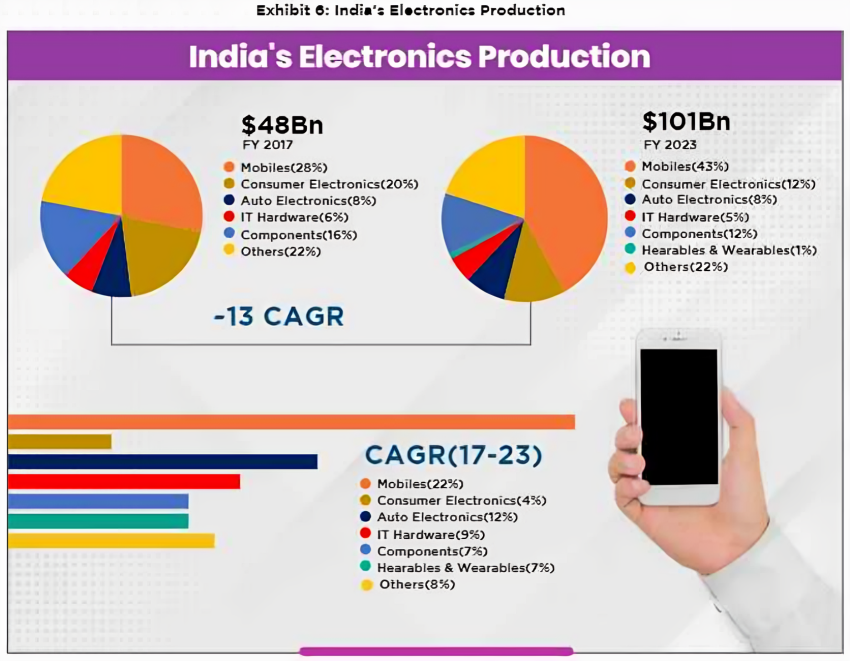

- Rapid Growth: India's electronics sector grew at a 13% Compound annual growth rate (CAGR), with production doubling from USD 48 billion in FY17 to USD 101 billion in FY23, driven mainly by mobile phones (43% of production).

- Mobile Manufacturing Milestone: India transitioned from importing 80% of smartphones to producing 99% domestically.

- Government Initiatives: Policies, like Make in India, Production Linked Incentive Scheme(PLI), and the India Semiconductor Mission, have boosted domestic manufacturing and foreign investments, particularly in mobile and auto electronics.

- Mixed Success: While PLI for large-scale electronics has attracted significant investments, schemes for IT hardware and telecom are yet to achieve a similar impact.

- Domestic Demand and Exports: Electronics demand is growing at 15% CAGR, reaching USD 155 billion in FY23, but India contributes only 4% of the global electronics market and less than 1% to global value chains.

- India's electronics production focuses mainly on final assembly, with limited progress in design and component manufacturing. To scale globally, India must pivot towards export-driven growth and strengthen its ecosystem.

- Manufacturing Landscape of India:

- India's manufacturing spans diverse industries, with the electronics sector emerging as a standout.

- Valued at USD 155 billion, domestic electronics production doubled between 2017 and 2022, growing at a 13% CAGR due to rising demand, technological advances, and supportive policies.

- Electronics exports rose from the 9th to 6th position among India's top export sectors, contributing USD 235 billion in FY23.

- This growth highlights India's global competitiveness, boosting foreign exchange and solidifying its position in the international electronics market.

- India’s Presence across the Electronics Value Chain:

- Electronics Value Chain Overview:

- Design Players/ Original Design Manufacturers (ODMs): Specialize in product design and prototypes.

- Component Makers: Includes Build-to-Print (Original Equipment Manufacturer (OEM) specs) and Build-to-Specification (co-create designs with ODMs).

- Assemblers/ Electronics Manufacturing Services (EMS): Contract manufacturers handling assembly, testing, and packaging.

- Brand Owners (OEMs): Focus on product innovation, marketing, and IP ownership.

- India’s Presence:

- Strong in assembling and OEMs (e.g., Foxconn, Dixon, Samsung).

- Limited in component manufacturing, with most high-tech parts imported.

- Minimal design capabilities across sectors.

- Segment Insights:

- Mobile Phones: Strong in assembly and sub-assembly (batteries, chargers), but high dependency on imports for camera modules and displays. Minimal design presence.

- Consumer Electronics: TVs, ACs, and refrigerators show moderate assembly localization but rely heavily on imported components like open cells.

- IT Hardware: Over 80% import dependency for laptops and servers. Weak assembly and design capabilities.

- Telecom Products: 40% imports from China for equipment; minimal local manufacturing and growing design initiatives.

- Automotive Electronics: 65% import-dependent for sub-assemblies; low-tech components like wire harnesses produced locally. Limited electronic design capabilities.

- Wearables & Hearables: Focused on assembly with negligible design and component manufacturing.

- Electronics Value Chain Overview:

What are the Policy Initiatives in Electronics Sector?

- To achieve USD 500 billion in electronics production and USD 200-225 billion in exports, India must focus on USD 350 billion from finished goods and USD 150 billion from components, supported by incentives, trade policies, tax reforms, infrastructure development, and a strong R&D and technology ecosystem.

- The policy initiatives and reforms have been broadly categorized into two major heads:

- Fiscal interventions for components manufacturing, R&D, and industrial infrastructure; and

- Non-fiscal interventions for overall electronics manufacturing.

|

Category |

Intervention |

Description |

|

Fiscal Interventions |

Fiscal Incentives |

|

|

|

Product/System Design Ecosystem |

|

|

|

Scale Up Industrial Infrastructure |

|

|

Non-Fiscal Interventions |

Tariffs Simplification and Tax Rationalization |

|

|

|

Soft Infrastructure/Skilling |

|

|

|

Tech Transfer and EoDB |

|

What are the Challenges in Building India’s Electronics Manufacturing Ecosystem?

- Relatively high import tariffs: India’s high and complex tariff structure, with an average Most Favored Nation (MFN) tariff of 7.5% (compared to China’s 4%, Malaysia’s 3.5%, and Mexico’s 2.7%), coupled with heavy reliance on imported components, inflates costs and undermines global competitiveness, especially in sub-assemblies and components.

- Lack of Robust Electronics Component Ecosystem: India's electronics component production grew at a slower CAGR of 7% (reaching USD 15 billion in FY23), dominated by low-complexity components, while high-complexity manufacturing remains undeveloped due to high capex requirements, unattractive incentives, and limited access to advanced technologies.

- High cost of capital: India's electronics manufacturing faces challenges due to high financing costs (9-13%) compared to 2-7% in countries like China and Vietnam, with existing support schemes falling short of industry needs.

- Tech-Transfer Challenges: Indian manufacturers face critical technology and skill gaps in advanced electronics manufacturing, compounded by delays in joint ventures and technology transfer due to restrictive investment policies and visa approvals, limiting access to expertise and innovations.

- Inadequate Talent and Skilling: India's electronics manufacturing sector faces significant skill gaps at all levels, driven by outdated training programs, insufficient practical exposure, and a lack of specialized institutes, resulting in higher training costs, low workforce readiness, and limited innovation capacity, which hinders industry growth and global competitiveness.

Way Forward

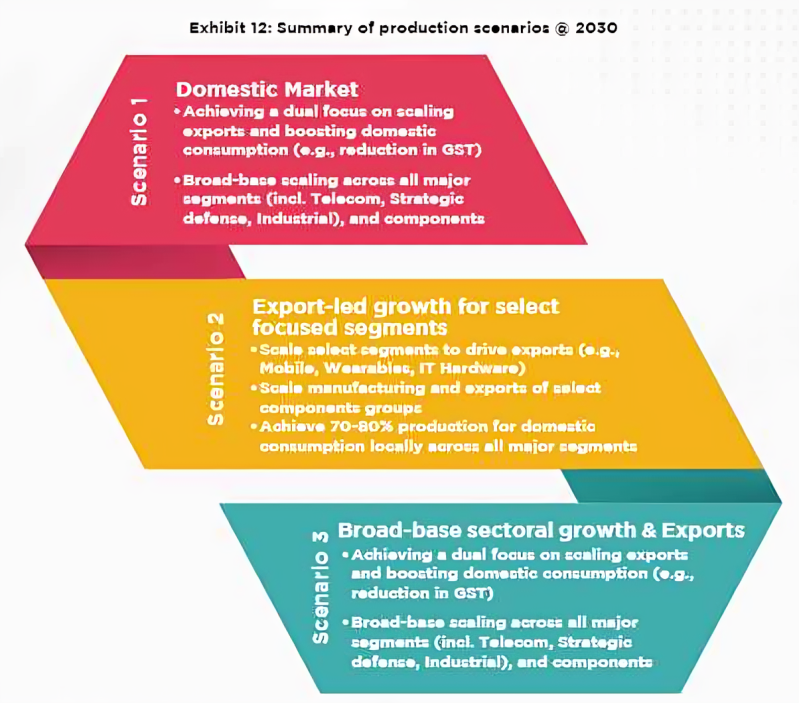

- Production Scenarios @ 2030: The NITI Aayog report highlights the three possible scenarios, out of which Scenario 2 is the preferred Vision for 2030.

- Vision @ 2030:

- Scenario 2 emphasizes focused scaling of select segments and components to efficiently allocate resources, optimize growth, and achieve targeted outcomes effectively.

- India's USD 500 billion electronics production target by 2030, with USD 350 billion from finished goods and USD 150 billion from components, aims to boost Domestic Value Addition to over 35%, secure 4-5% of global electronics exports, and create 5.5-6 million jobs, driving economic growth and stability.

- Achieving USD 350 Billion Production in Finished Goods:

- USD 500 Billion Electronics Production Target: India aims for USD 350 billion from finished goods by focusing on established segments, diversifying into new products, and moving up the value chain with sub-assemblies like camera modules and displays.

- Established Segments: Scale up assembly operations in high-demand areas like mobile devices and consumer electronics for both domestic and global markets.

- Emerging Products: Venture into dynamic categories such as laptops, telecom hardware, wearables, and IoT devices to broaden the electronics portfolio.

- Priority Segments: Focus on mobiles, IT hardware, and consumer electronics as mass-market drivers with significant growth potential, leveraging existing infrastructure and favorable policies.

- Auto Electronics Growth: Capitalize on the rapid growth in auto electronics driven by Electronic Vehicles adoption and global demand for sustainable transportation.

- 5G and Advanced Electronics: Leverage indigenous 5G capabilities to scale production and exports, tapping into global demand for telecom and strategic electronics.

- Achieving the USD 150 billion in Component Production:

- Value Chain Localization: India must shift focus from assembly to strengthening component manufacturing to enhance global competitiveness and increase domestic value addition.

- Targeted Component Growth: Electronic component production is targeted to grow from USD 15 billion to USD 150 billion by FY30, contributing to exports, job creation, and domestic value addition.

- Category A (High Capex, IP-Owned Components): Semiconductors like microprocessors and power electronics, supported by the USD 10 billion India Semiconductor Mission, aim to contribute USD 20 billion by 2030.

- Category B (Tech-Transfer Components): Components like SMT-grade passives, battery cells, and sensors require technology access and moderate capex, targeting USD 55-60 billion in production by 2030.

- Category C (Low Complexity, Scalable Components): Easily scalable items like connectors, and wire harnesses are expected to contribute USD 70-75 billion, supported by domestic players scaling up.

- Design Ecosystem Development: Localized designs will enable the sourcing of innovative components and integrate India further into global value chains.