Indian Economy

Unlocking India’s MSME Potential

- 06 Feb 2025

- 23 min read

This editorial is based on “New definition for MSMEs, increased credit guarantee” which was published in The Indian Express on 02/01/2025. The article brings into picture the expansion of MSME investment and turnover limits to boost growth and manufacturing. However, deeper policy interventions and structural reforms are needed to tackle persistent challenges.

For Prelims: Ministry of Micro, Small and Medium Enterprises, Manufacturing Sector, PM Vishwakarma scheme, Mudra Yojana expansion, Udyam portal, Government e-Marketplace, Production-Linked Incentive, PM Vishwakarma Scheme, RAMP scheme, Economic Survey 2024-25, Europe's Carbon Border Adjustment Mechanism, Digital MSME 2.0

For Mains: Role of MSMEs in India’s Economic Growth, Key Issues Hindering the Growth of MSME Sector.

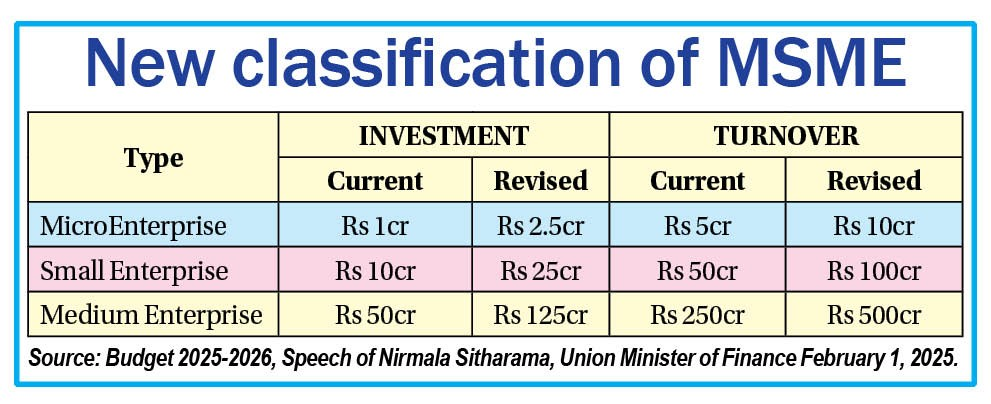

The government has recently announced plans to expand the Ministry of Micro, Small and Medium Enterprises (MSME) investment and turnover limits, allowing more businesses to benefit from the sector’s advantages. With over 1 crore MSMEs employing 7.5 crore people and contributing significantly to manufacturing and exports, they remain a key driver of growth. The revised classification aims to raise investment limits to Rs 2.5 crore for micro, Rs 25 crore for small, and Rs 125 crore for medium enterprises, with higher turnover thresholds. These reforms aim to boost MSME growth and strengthen India’s manufacturing potential. However, challenges remain, requiring deeper policy interventions and structural reforms for long-term resilience.

What is the Role of MSMEs in India’s Economic Growth?

- Employment Generation & Livelihood Support: MSMEs are the largest source of non-agricultural employment in India, especially for semi-skilled and unskilled workers, fostering inclusive growth in rural and urban areas.

- The rise of digitalization and fintech solutions has further enabled micro-enterprises to access financial markets and scale operations.

- Scheme like PM Vishwakarma scheme and Mudra Yojana expansion (₹5.41 lakh crore sanctioned in FY24) have further boosted self-employment.

- India has over 1 crore registered MSMEs, providing employment to nearly 7.5 crore people.

- Contribution to GDP & Industrial Growth: MSMEs significantly contribute to India's economic resilience by driving domestic production, industrial expansion, and localized supply chains.

- They support large industries by supplying raw materials and intermediates, making them a critical component of industrial clusters.

- With rising formalization through the Udyam portal (4 crore MSMEs registered as of March 2024), their role in structured economic growth is expanding.

- As of recent reports, the MSME contribution stands at around 30% of India's total GDP and 45% of manufacturing output.

- Boosting Exports & Foreign Exchange Earnings: MSMEs are pivotal in global trade, with their unique products catering to niche international markets, especially in textiles, leather, and engineering goods.

- Government e-Marketplace (GeM) and the Production-Linked Incentive (PLI) scheme have strengthened MSME participation in global supply chains.

- In 2023-24, MSME-related products accounted for 45.73% of India’s total exports, reinforcing their role in positioning the country as a global manufacturing hub.

- Driving Digital & Technological Transformation: With increased adoption of digital payments, automation, and AI-driven solutions, MSMEs are transitioning into tech-driven enterprises.

- Government initiatives such as ONDC (Open Network for Digital Commerce) and the ₹1 lakh crore interest-free innovation corpus (Budget 2024) encourage digital integration.

- 72% of MSME transactions are now digital, and RBI’s Public Tech Platform for Frictionless Credit is improving access to non-collateral loans.

- Initiatives like in aerospace (Boeing contract for Tamil Nadu MSME) and pharma (Aragen Life Sciences’ ₹2,000 crore investment in Hyderabad) are fostering a robust start-up ecosystem.

- Enhancing Women & Social Entrepreneurship: Women-led MSMEs are emerging as drivers of social change, improving gender equity and economic empowerment.

- Credit access through the Mudra Yojana has sanctioned ₹32.36 lakh crore for 51.41 crore loans, with 68% of the loans benefiting women, enabling more women entrepreneurs to scale businesses.

- Women-owned MSMEs now constitute 20.5% of Udyam registrations, reflecting their growing role in the economy.

- Strengthening Rural Economy & Agri-Based Enterprises: Rural MSMEs help reduce migration to cities by creating localized job opportunities and supporting agro-processing industries.

- The PM Vishwakarma Scheme (₹13,000 crore outlay) and Self-Reliant India (SRI) Fund (₹50,000 crore corpus) are enhancing rural industrialization.

- Also, under the Animal Husbandry Credit Guarantee Scheme (2023), livestock MSMEs now get collateral-free loans, boosting India’s dairy and meat processing industries.

- Facilitating Green & Sustainable Growth: MSMEs are at the forefront of India’s green industrial revolution by adopting clean energy solutions and circular economy models.

- The RAMP scheme ( with World Bank support) and Telangana MSME Policy (₹4,000 crore to boost MSMEs and entrepreneurship) emphasize sustainability.

What are the Key Issues Hindering the Growth of MSME Sector?

- Limited Access to Credit & Financial Constraints: MSMEs often struggle with inadequate financing due to stringent collateral requirements and risk-averse banking policies.

- The dependence on informal credit sources increases their operational costs and limits scalability.

- Despite government-backed schemes, disbursement delays and lack of awareness hinder effective utilization.

- As per CRISIL estimates, only 20% of the country's MSMEs have access to formal credit. The recent increase in CGTMSE guarantees has helped, but only 2.5 crore out of 6.3 crore MSMEs have availed formal credit, highlighting a major gap.

- Also, delayed payments from large corporations and government departments create severe cash flow issues, making survival difficult.

- A 2022 report estimated that delayed payments to MSMEs in India total around ₹10.7 lakh crore, or 6% of the country’s GVA.

- The dependence on informal credit sources increases their operational costs and limits scalability.

- Regulatory Burden & Compliance Complexity: MSMEs face cumbersome regulatory procedures, frequent policy changes, and high compliance costs, limiting ease of doing business.

- Multiple overlapping laws across labor, taxation, and environmental regulations create bureaucratic roadblocks.

- The Economic Survey 2024-25 calls for urgent deregulation to boost MSME growth, stressing that excessive regulatory burdens hinder business efficiency and innovation

- Lack of Skilled Workforce & Technological Gaps: Limited access to a skilled workforce and low technological adoption reduce productivity and competitiveness.

- Most MSMEs rely on outdated machinery and lack the financial capability to invest in automation and AI-driven solutions.

- Only 6% of MSMEs actively use e-commerce platforms for sales, highlighting limited digital adoption in the sector.

- According to a survey by the Ministry of MSMEs, only 45% of MSMEs have adopted some form of AI in their operations

- Infrastructure Bottlenecks: Poor road connectivity, inefficient rail freight systems, and high logistics costs hinder timely movement of goods, reducing MSME competitiveness.

- Frequent power outages and high industrial electricity costs affect production efficiency, especially in rural and semi-urban MSME clusters.

- Limited access to high-speed internet, lack of industrial parks, and inadequate common facility centers restrict MSMEs from leveraging technology and scaling operations.

- Also, most industrial clusters are concentrated in a few states, leaving MSMEs in other regions with poor infrastructure support, limiting their integration into national and global supply chains.

- Market Access & Global Competitiveness Challenges: MSMEs struggle with limited access to international markets due to inadequate branding, lack of export incentives, and stringent quality standards.

- High logistics costs and limited integration with global value chains (GVCs) further reduce competitiveness.

- The Economic Survey 2022-23 pointed out that logistics costs in India have been in the range of 14-18% of GDP against the global benchmark of 8%.

- High logistics costs and limited integration with global value chains (GVCs) further reduce competitiveness.

- Lack of Awareness & Utilization of Government Schemes: Despite multiple government schemes, many MSMEs fail to take advantage due to low awareness and bureaucratic hurdles.

- Complex application processes and lack of proper guidance deter small businesses from availing benefits.

- The situation is worse for first-time entrepreneurs and rural MSMEs who struggle with formal banking procedures.

- As of Nov 2024, ₹2.57 lakh crore was sanctioned under Mudra Yojana, but many eligible businesses remain outside the credit net.

- Complex application processes and lack of proper guidance deter small businesses from availing benefits.

- Environmental & Sustainability Compliance Pressure: With increasing global ESG (Environmental, Social, and Governance) standards, MSMEs face difficulties in meeting sustainability norms.

- A 2018 report by the Centre for Study estimated that Indian MSMEs produce around 110 million tonnes of CO₂ annually. This highlights their significant carbon footprint and environmental impact.

- High costs of adopting green technology and lack of incentives deter small enterprises from transitioning to eco-friendly practices.

- Many export-driven MSMEs risk losing international clients due to non-compliance with global carbon footprint norms.

- For instance, Europe's Carbon Border Adjustment Mechanism, which levies a carbon tax on certain exports into the EU, is expected to hurt India's steel industry.

- A 2018 report by the Centre for Study estimated that Indian MSMEs produce around 110 million tonnes of CO₂ annually. This highlights their significant carbon footprint and environmental impact.

- Lack of Formalization: A significant portion of MSMEs remains unregistered, leading to a lack of reliable data, weak policy implementation, and limited access to institutional support.

- Informal businesses struggle with financial inclusion, making it difficult for them to avail government benefits, structured credit, and insurance schemes.

- The absence of formal labor contracts results in poor enforcement of labor codes, leaving workers without essential social security benefits like ESI, PF, and health insurance.

What Measures can be Adopted to Revamp the MSME Sector in India?

- Strengthening Formal Credit Access & Reducing Financial Bottlenecks: Expand collateral-free lending via fintech and digital platforms. Integrate Mudra Yojana & CGTMSE for better risk coverage.

- Establish MSME Credit Monitoring Cell to track loan delays. Promote factoring services & invoice discounting to ease cash flow. Also, MSME finance companies can be established.

- Mandate strict payment timelines under the MSME Samadhan portal.

- Link TReDS & GeM procurement for faster invoice settlements. Encourage public sector units & large corporates to prioritize MSME payments.

- Streamlining Regulatory Framework & Reducing Compliance Burden: Implement single-window clearance for MSME approvals. Strengthen RAMP scheme to cut red tape and lower compliance costs. Establish self-declaration mechanisms for minor regulatory filings.

- Form state-level MSME facilitation councils for faster grievance redressal.

- Boosting Market Access & Global Competitiveness: Promote export-oriented MSMEs via Free Trade Agreements (FTAs) & global supply chains.

- Expand PLI schemes & cluster-based development to strengthen local industries.

- Improve e-commerce integration with ONDC & GeM for direct market reach.

- Provide subsidized branding & certification support for international markets.

- Expand PLI schemes & cluster-based development to strengthen local industries.

- Enhancing Digital & Technological Adoption: Facilitate AI, IoT, & automation adoption through MSME tech hubs. Integrate Udyam & ONDC platforms for seamless digital onboarding.

- Launch Digital MSME 2.0 to improve cybersecurity, cloud access, and e-commerce participation.

- Expand Skill India & PM Vishwakarma Scheme to create sector-specific training programs.

- Establish MSME Apprenticeship Hubs in industrial clusters.

- Reducing Raw Material Costs & Supply Chain Constraints: Develop MSME-focused raw material banks to ensure stable pricing.

- Encourage domestic manufacturing of key inputs under the Atma Nirbhar Bharat initiative.

- Strengthen warehousing & logistics parks for better inventory management. Implement cluster-based procurement models to reduce costs.

- Promote bulk buying cooperatives for MSMEs to access cheaper raw materials.

- Strengthening Rural & Agri-Based MSMEs: Expand PM Vishwakarma Scheme & SFURTI clusters for artisan-based enterprises.

- Provide targeted financial incentives for rural industries in agro-processing and handicrafts.

- Strengthen cooperative-based business models to scale rural MSMEs. Promote cold storage & rural supply chain networks for agri-MSMEs.

- Develop MSME-friendly agricultural export hubs to link small farmers with global markets.

- Promoting Green MSMEs & Sustainable Growth: Expand Green MSME certification programs for eco-friendly businesses.

- Provide low-interest green finance for renewable energy adoption.

- Establish circular economy incentives to reduce waste and boost recycling enterprises. Promote ESG-linked credit programs for sustainable business practices.

- Strengthening Women & Social Entrepreneurship in MSMEs: Provide higher credit guarantee cover for women-led MSMEs under CGTMSE.

- Expand Mudra Yojana’s dedicated women entrepreneur fund. Link self-help groups (SHGs) with MSME clusters for financial inclusion.

- Encourage co-working spaces & mentorship programs for women entrepreneurs. Improve market access through GeM for women-owned enterprises.

- Expand Mudra Yojana’s dedicated women entrepreneur fund. Link self-help groups (SHGs) with MSME clusters for financial inclusion.

- Enhancing Disaster Resilience & Crisis Management: Develop an MSME Disaster Recovery Fund for economic shocks. Strengthen insurance schemes to cover pandemic-like disruptions.

- Implement flexible credit restructuring policies during downturns. Promote alternative credit sources like crowdfunding & peer-to-peer lending.

- Formalization of MSMEs & Strengthening Institutional Support: Implement mandatory Udyam registration with incentives like lower GST rates & priority lending benefits to encourage formalization.

- Link formal registration with access to government schemes, GeM procurement, and credit guarantee programs for better participation.

- 25% of annual procurement by Central Ministries/Departments/Public Sector Enterprises (CPSEs) has to be made from Micro & Small enterprises is a significant step in the right direction.

- Strengthen enforcement of labor codes while ensuring ease of compliance for small businesses. Integrate MSME databases with Aadhaar, GSTIN & banking systems to improve policy targeting and implementation.

- Link formal registration with access to government schemes, GeM procurement, and credit guarantee programs for better participation.

Key Recommendations of Standing Committee on Finance Report on MSME Credit (April 2022)

|

Conclusion:

The MSME sector is a vital pillar of India's economy, contributing significantly to employment, GDP, and exports. Strengthening formalization, promoting green practices, and enhancing market access can propel MSMEs to new heights. Targeted policy interventions and structural reforms will be crucial in unlocking the sector's full potential. Ultimately, a resilient MSME ecosystem is key to India's long-term economic development and global competitiveness.

|

Drishti Mains Question: Analyze the role of the MSME sector in driving India’s economic growth, with special reference to employment generation and exports. What are the key challenges faced by MSMEs, and how can government policies and reforms address them for long-term sustainability?" |

UPSC Civil Services Examination, Previous Year Question:(PYQ)

Prelims:

Q.1 What is/are the recent policy initiative(s)of Government of India to promote the growth of the manufacturing sector? (2012)

- Setting up of National Investment and Manufacturing Zones

- Providing the benefit of ‘single window clearance’

- Establishing the Technology Acquisition and Development Fund

Select the correct answer using the codes given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Q2. Which of the following can aid in furthering the Government’s objective of inclusive growth? (2011)

- Promoting Self-Help Groups

- Promoting Micro, Small and Medium Enterprises

- Implementing the Right to Education Act

Select the correct answer using the codes given below:

(a) 1 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (d)

Q3. Consider the following statements with reference to India : (2023)

- According to the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, the ‘medium enterprises’ are those with investments in plant and machinery between `15 crore and `25 crore.

- All bank loans to the Micro, Small and Medium Enterprises qualify under the priority sector.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)