Lessons from NPA Crisis | 19 Dec 2019

This article is based on “Some key lessons from the NPA crisis” which was published in The Hindu Business Line on 18/12/2019. It highlights the reasons for rising Non-Performing Assets (NPAs) and the lessons that regulators need to learn from it.

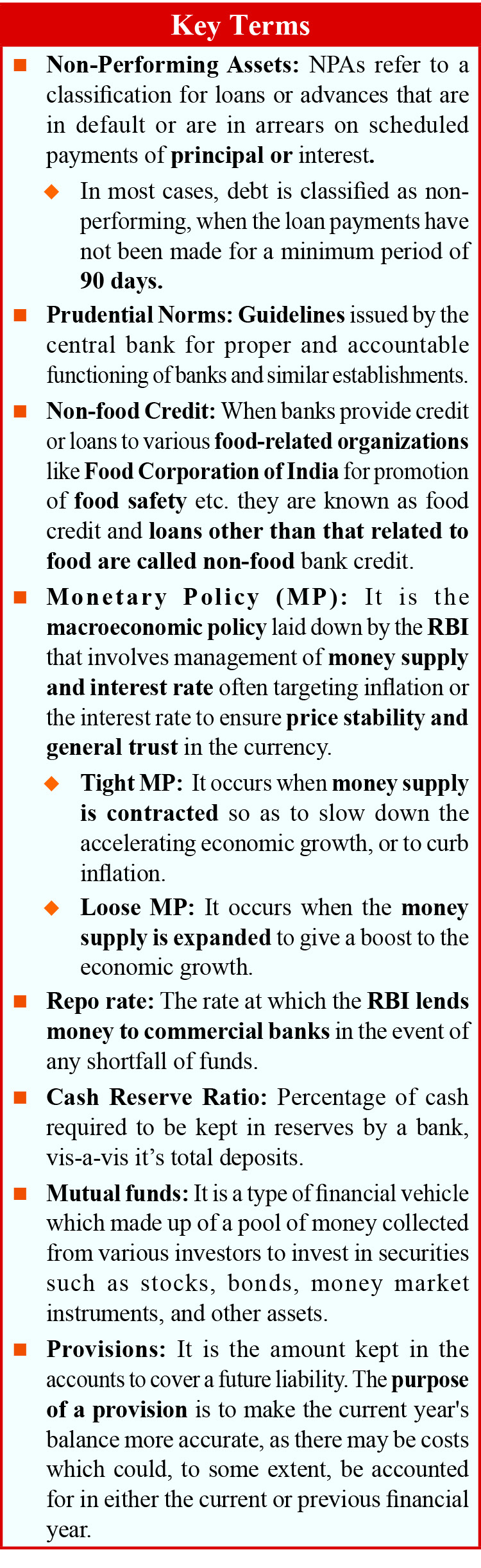

Despite the introduction of prudential norms and a stringent regulatory mechanism, the Indian banking system is still under continuous stress. According to the data from the Reserve Bank of India (RBI), Non-Performing Assets (NPAs) for unrated loans has increased to 24% (2018) from about 6% (2015).

Problem of Rising NPA Ratio

- Credit Boom: The problem of rising NPAs began since credit boom which the country witnessed during 2003-04.

- Between 2003-04 and 2007-08, the outstanding non-food credit or the commercial credit expanded by three times, which during 2007-08 and 2011-12 got doubled.

- It was a period during which the world as well as the Indian economy were booming. Indian firms borrowed furiously in order to avail the growth opportunities.

- Credit booms are generally succeeded by stress in the banking system which actually happened in India.

- The substantial flow of credit to infrastructure (power, roads, telecom), mining, aviation, iron and steel was important for growth but these were also subject to severe output fluctuations, which raised a huge burden on the banks. Also, large Chinese imports during that period affected the iron and steel industry.

- Monetary Policy: The Reserve Bank of India also followed a tightened monetary policy at that time.

- The Repo rate was increased from 6% (March 2004) to 9% (August 2008). Also, the Cash Reserve Ratio was raised from 4.75% to 9%.

- But even after tightening the norms, the credit expansion happened which ultimately led to rising NPAs.

- However, during 2008, the repo rate and CRR were lowered substantially in response to the global financial crisis. There was a mild reversal of this step as was marked by a slowdown in real growth (between 2009 and 2012).

- Role of NBFCs: In addition to that, the assets under management of mutual funds and credit extended by Non-Banking Financial Company (NBFCs) also expanded enormously during that period.

- Stalling Legislative & Judicial Procedure: Court judgments had an adverse impact on mining, power and steel sectors. There were problems in acquiring land and getting environmental clearances because of which several projects got stalled and consequently, the project costs soared.

- Regulatory Forbearance: Although there were some regulatory steps that were initiated like Asset Quality Review introduced in 2015 which tightened the situation to bring out greater transparency led to a doubling of the NPA ratio in one year. But, by that time, the banks were left with a huge problem with no immediate relief.

- Other reasons:

- With the onset of the global financial crisis in 2007-08 and the slowdown in growth after 2011-12, revenues fell well short of forecasts. As a result, financing costs rose as policy rates were tightened in India in response to the crisis.

- Further, the depreciation of the rupee meant higher outflows for companies that had borrowed in foreign currency.

- This combination of adverse factors made it difficult for companies to maintain and repay their loans to banks. Higher NPAs meant higher provisions on the part of banks which rose to a level where banks (especially PSBs) started making losses. Therefore, once NPAs happen, it is important to resolve them quickly, otherwise, the interest on dues causes them to rise relentlessly.

What needs to be done?

Reserve Bank of India

- Regulatory design needs to quantify financial and business cycles and take appropriate remedial measures in time in the backdrop of challenges faced by the RBI on account of external factors like the global financial crisis (2008-09).

- As international experience shows, increase in compliance cost does not automatically translate to better regulation. The regulatory regime needs to pinpoint parameters that need special attention for good governance.

- Also, as RBI has the responsibility to monitor macro-prudential indicators (such as overall credit growth). This has implications when the RBI tightens or loosens monetary policy.

- Therefore, RBI’s concerns must be communicated to the government/owners within time limits, and made public so that informed decisions can be timely taken.

- Notwithstanding several measures taken by the RBI, including the 2016 guidelines, the performance of the resolution process has been slow and needs to be reviewed. The Insolvency and Bankruptcy Code (IBC) is an important innovation but glitches need to be timely resolved.

- The recent RBI issued new set of norms for dealing with stressed assets/NPAs in the banking sector are a welcome step.

Government

- The government has the responsibility for overall management of the economy and being the owner of the banks, it may push the banks in certain directions. The government must ensure that banks run in the larger national interest but commercial decisions are best left to bank boards.

- The relationship between the government and the boards/CEO is still an unresolved question. Therefore, improvement in governance of the boards needs to be done.

- Banks’ Boards must be empowered to decide on capital raising plans from the market within a well-defined framework.

- Recapitalisation may be done in cash rather than through bonds or in some combination.

- The government and regulators need to promote specialised institutions for project finance (funding long-term infrastructure/industrial projects, and public services using a limited financial structure). The promotion of corporate debt markets both for performing loans as well as distressed loans needs special attention.

- Also, reliance on project appraisal by just one single institution has entailed losses to a number of small and medium banks. Hence, there is a need for institutionalized mechanism that can efficiently perform such function.

Banks

- Management: Banks need to take responsibility for the soundness of credit decisions. They need to identify and define their own risk taking capabilities rather than leaning on the big lenders’ appraisal.

- Banks need to significantly upgrade their appraisal and monitoring skills and invest in personnel training. Risk management needs to be improved at all levels.

- Audit: Assurance systems (internal & external audits and credit rating) need to be strengthened.

- Given the reported large scale siphoning (illegal transfer) of funds, round tripping of debt as equity through dozens of shell companies needs to be checked through forensic audits at annual reviews.

The need of the hour is a concentrated focus on the part of the government and efficient implementation of policies like Project ‘Sashakt’ so as to effectively tackle the problem of rising NPAs.

| Drishti Mains Question Discuss the various reasons behind the rise in NPAs (non-performing assets) in the Indian banking sector and suggest measures to tackle this rise. |