Indian Economy

Rising NPAs due to Unrated Loans

- 07 Nov 2019

- 3 min read

Why in News

- According to data from the Reserve Bank of India (RBI), Non-Performing Assets (NPAs) for unrated loans has increased to 24 % (2018) from about 6 % (2015).

- Unrated Loans are loans that are not rated by credit rating agencies.

- High levels of NPAs in unrated loans indicate more economical risk for the banks as unrated loans are not secured through ratings.

Key Points

- Unrated borrowers account for about 60% of the total number and 40% of the total exposure of large borrowers.

- The central bank requires banks to report individual exposure of more than Rs 5 crore with the Central Repository of Information on Large Credits (CRILC), to capture data on large borrowers.

- The borrowers having an aggregate fund-based working capital of Rs 150 crore and above are termed as large borrowers.

How Unrated Loans and Related NPAs can be Reduced?

- By regularising credit ratings for loan exposure, RBI has raised risk-weighted Assets on unrated loans.

- Higher risk-weighted assets on unrated loans reduce the capacity of banks to lend such loans, thereby encouraging them to get such loans rated.

- The risk-weighted assets are used to determine the minimum amount of capital that must be held by banks to reduce the risk of insolvency.

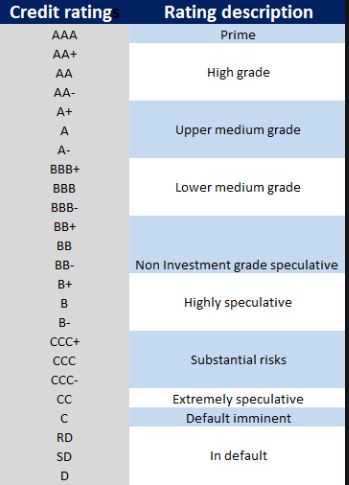

- Banks also need to consider rated exposures as some of the private sector banks experienced significant stress in their exposures to the credit rating of BB category (and below it) rated loan accounts.

- However, the RBI’s Financial Stability Report projected the gross NPA ratio of all banks to come down from 9.3% in March 2019 to 9.0 %by March 2020.

- The recoveries pick up pace due to the resolution of some cases under the Insolvency and Bankruptcy Code and banks write off their bad loans.

Central Repository of Information on Large Credits (CRILC)

- It has been constituted by RBI in 2014 to collect, store, and publish data on all borrower’s credit exposures

- Banks will have to provide credit information to CRILC about their borrowers with an aggregate fund-based and non-fund based exposure of and over Rs.5 Crores (Rs.50 million).

- It also helps financial institutions and banks to assess their non-performing assets (NPAs) and also share this information with other institutions.