Agriculture

Legalising MSP in India: Challenges and Way Forward

- 02 Jul 2024

- 20 min read

This editorial is based on ‘’Legal guarantee for MSP is a must’’ which was published in The Business Line on 01/07/2024. The article critically examines recent MSP hikes for Kharif crops, emphasizing farmers' discontent over inadequate compensation amid rising input costs.

For Prelims: Minimum Support Prices (MSPs), Kharif crops, MS Swaminathan committee, Welfare Schemes Related to Farmers in India, Fair and Remunerative Price (FRP)

For Mains: Challenges Related to Farming and Legalising the MSP in India, How Legalising MSP Could Secure India's Agricultural Future

MSP is not against the principles of free markets; instead, it helps to minimise extreme market fluctuations and volatility.

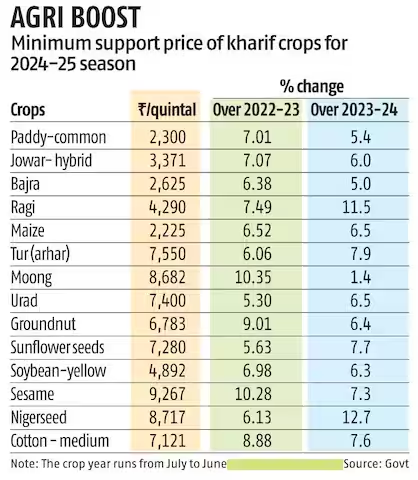

The recent increase in Minimum Support Prices (MSPs) for 14 Kharif crops has left protesting farmers and those aiming to double farmers’ incomes disappointed. The announced price hikes are being criticised for not considering the inflation in various farm inputs that farmers have been facing. As a result, the nominal increase in MSP fails to provide fair compensation, as it does not proportionally reflect the rise in input costs.

For instance, the hike in paddy MSP from ₹2,183 per quintal to ₹2,300, a mere difference of ₹117, represents an insignificant increase of about 5%. This seems unfair to millions of paddy growers, whose input costs have surged by over 20% in 2023.

As recommended by the government’s expert committee report in 2017, the MSP announcement seems to be more of a routine seasonal price revision rather than a step towards doubling farmers’ income.

Progress toward doubling farmers’ income lacks effective measurement, and the government has been hesitant to legalise MSP due to concerns that it might lead to inflation and reduce the competitiveness of agricultural exports.

Note

- In February 2024, farmers from Punjab, Haryana, and Uttar Pradesh were marching towards Delhi in the 'Delhi Chalo' protest, demanding legal guarantees for the MSP.

- In 2020, farmers protested against three farm laws passed by the government, at Delhi borders, leading to their repeal in 2021.

- These laws were -- The Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Act, The Farmers (Empowerment and Protection) Agreement of Price Assurance and Farm Services Act, and The Essential Commodities (Amendment) Act.

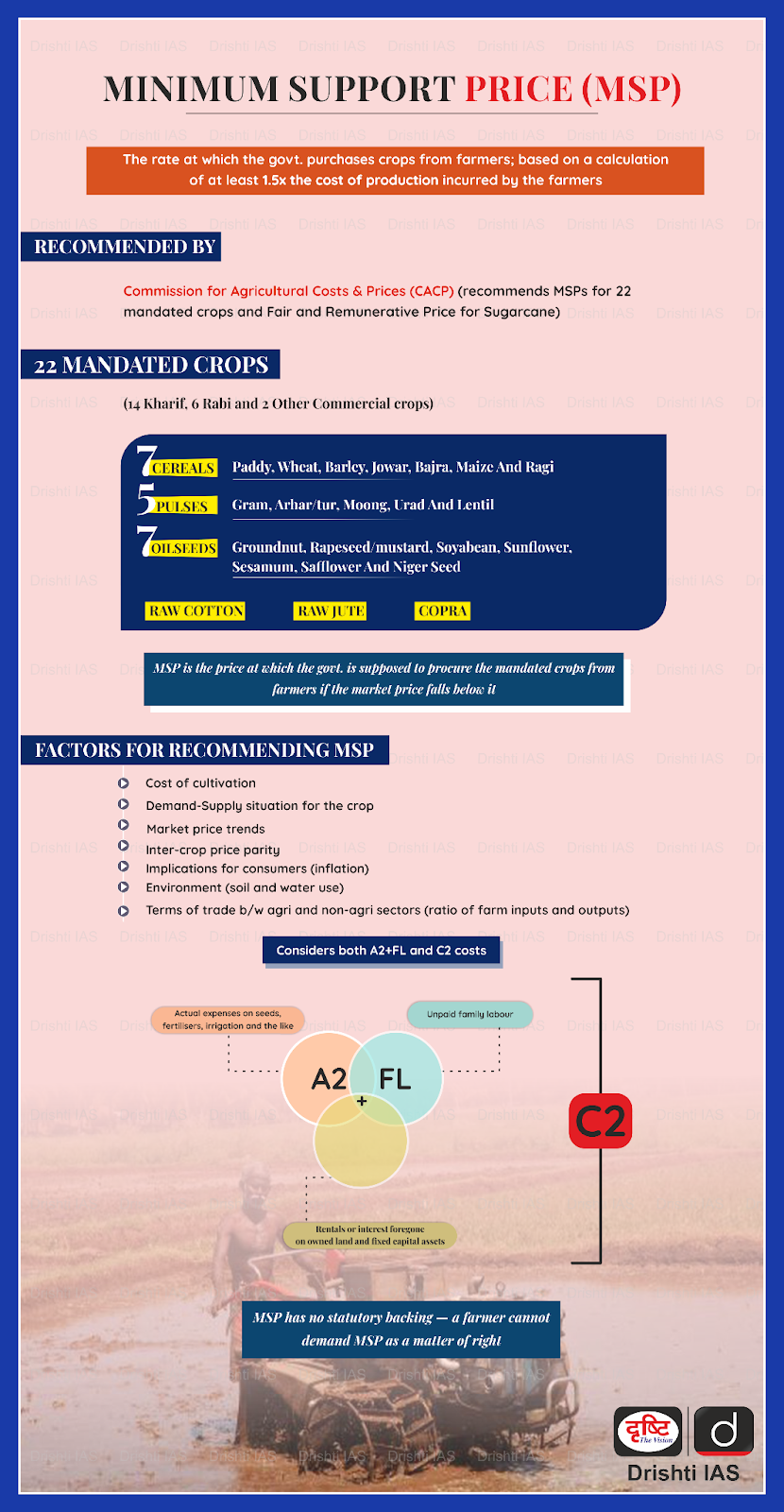

What is the Minimum Support Price (MSP)?

- About:

- The MSP regime was established in 1965 by setting up the Agricultural Prices Commission (APC) as a form of market intervention to enhance national food security and protect farmers from significant decline in market prices.

- MSP Calculation:

- The Commission for Agricultural Costs & Prices (CACP) calculates three types of production costs for every crop, both at the state and all-India average levels.

- A2: Covers all paid-out costs directly incurred by the farmer in cash and kind on seeds, fertilisers, pesticides, hired labour, leased-in land, fuel, irrigation, etc.

- A2+FL: Includes an estimated value of unpaid family labour with A2.

- C2: A comprehensive cost, which is A2+FL cost plus imputed rental value of owned land plus interest on fixed capital, rent paid for leased-in land.

- The government maintains that the MSP was fixed at a level of at least 1.5 times the all-India weighted average Cost of Production (CoP), but it calculates this cost as 1.5 times the A2+FL cost.

- The Commission for Agricultural Costs & Prices (CACP) calculates three types of production costs for every crop, both at the state and all-India average levels.

How can Legalising MSP help Indian Agriculture?

- Income Security for Farmers: By providing a legally guaranteed MSP, farmers would have a safety net against price fluctuations, ensuring they receive a minimum price for their crops.

- This could help stabilize their income, reduce the risk of financial distress, and potentially lower the debt burden on farmers.

- The average monthly income of agricultural households is around ₹10,695, which is often insufficient for a dignified life.

- Additionally, on average, 30 farmers die by suicide each day.

- This could help stabilize their income, reduce the risk of financial distress, and potentially lower the debt burden on farmers.

- Boost to Rural Economy: Improved price realization from both government procurement and private sector transactions could enhance the purchasing power of rural communities, stimulating economic activity in these areas.

- Extending FRP Model and Direct Compensation: Currently, private mills are mandated to procure sugarcane at or above the Fair and Remunerative Price (FRP) set by the Cabinet Committee on Economic Affairs (CCEA).

- This model could be extended to other MSP-covered crops. Furthermore, farmers should receive direct compensation if they are forced to sell below MSP, reimbursing them for the price difference.

- Legal Mandate for Private Crop Purchases: Private players should be legally mandated to purchase crops at or above MSP, with rigorous monitoring systems in place and penalties for any violations. This would ensure that farmers are not solely reliant on government procurement agencies for crop purchases.

- Encouragement for Investment: With assured returns, farmers might be more inclined to invest in better farming techniques, equipment, and inputs, potentially leading to increased productivity and agricultural growth.

- Corporate-Centric Approach: When there is a conflict between consumer prices and farmer compensation, governments tend to favor the interests of profit-making corporations involved in agri-produce processing.

- These corporations already benefit from legalised Maximum Retail Prices (MRP) on their products.

- This corporate-centric approach, along with intermediaries claiming a significant portion of the margin between farm and end-consumer prices, has negatively impacted farmers.

Fair and Remunerative Price (FRP)

- FRP is the price declared by the government, which mills are legally bound to pay to farmers for the cane procured from them.

- Mills have the option of signing an agreement with farmers, which would allow them to pay the FRP in installments.

- The payment of FRP across the country is governed by the Sugarcane Control Order, 1966, issued under the Essential Commodities Act (ECA), 1955 which mandates payment within 14 days of the date of delivery of the cane.

- It has been determined on the recommendation of the Commission for Agricultural Costs and Prices (CACP) and announced by the Cabinet Committee on Economic Affairs (CCEA).

- CACP is an attached office of the Ministry of Agriculture and Farmers Welfare. It is an advisory body whose recommendations are not binding on the Government.

- CCEA is chaired by the Prime Minister of India.

- The FRP is based on the Rangarajan Committee report on reorganising the sugarcane industry.

What are the Challenges Related to Farming and Legalising the MSP in India?

- Budgetary Concerns: There is a growing argument against legalising MSP, claiming that creating legal provisions is practically impossible. The combined value of all crops covered under MSP may exceed ₹11-lakh crore, while India’s total budgeted expenditure in 2023-24 was around ₹45-lakh crore.

- Thus, it appears unrealistic for the government to allocate such a large portion of the budget solely for purchasing crops from farmers. Moreover, farmers retain around 25% of their produce for personal and livestock use, further complicating the feasibility of legalising MSP.

- Complexity in Implementation: Creating legal provisions for MSP is deemed challenging due to the vast array of crops and the diverse agricultural landscape in India. Ensuring compliance and fair implementation across the country poses logistical and administrative challenges.

- Market Demand Mismatch in Agriculture:

- Lack of effective mechanisms for farmers to anticipate market demand and adjust their planting accordingly. Farmers often face price volatility and uncertainty because their planting decisions are not aligned with actual market demand. This disconnect leads to situations where high production levels result in oversupply and subsequent price drops, impacting farmer incomes negatively.

- In the 2016 kharif season, for example, the government pushed farmers to reduce cotton and plant more pulses. Those who continued growing cotton made good money but the majority who went in for pulses faced excess supply and are dealing with a steep fall in prices.

- Impact on Market Dynamics: Critics argue that MSP, if not implemented carefully, could distort market dynamics and inhibit the efficiency of agricultural markets. This includes concerns about disincentivising private investment and innovation in agriculture.

- For example, MSP has led to a decline in the cultivation of crops other than wheat and rice because the government predominantly procures these two crops in large quantities for Public Distribution System (PDS) distribution.

- Lack of effective mechanisms for farmers to anticipate market demand and adjust their planting accordingly. Farmers often face price volatility and uncertainty because their planting decisions are not aligned with actual market demand. This disconnect leads to situations where high production levels result in oversupply and subsequent price drops, impacting farmer incomes negatively.

- Limitations of APMC Law: The Agricultural Produce Market Committee (APMC) Act prohibits farmers from selling their produce in any mandi other than their designated one. This makes farmers vulnerable to middlemen and vested interests. They are exposed to global prices but are not provided with access to cost-efficient technologies and information systems. This places them at a disadvantage with farmers from other countries.

- Just 15% of the APMC markets have cold storage facilities. Weighing facilities are available in only 49% of the markets.

- As of March 2017, there were 6,630 APMCs in India, which means each APMC serves an average geographical area of 496 square kilometers. This exceeds the recommended area of 80 square kilometers per APMC (as per the National Farmers' Commission 2006).

Welfare Schemes Related to Farmers in India

Way Forward

- Recommendations of Swaminathan Commission: The commission report recommends that the government should ensure a MSP that is at least 50% higher than the weighted average cost of production. This recommendation, also referred to as the 'C2+50% formula,' includes the imputed cost of capital and the rent on the land (termed 'C2') to guarantee farmers a 50% return.

- It is suggested that the government implement a legal guarantee for this MSP based on the C2+50% formula.

- Recommendations of Ashok Dalwai Committee Recommendations: The report suggests adhering to the Model Agricultural Land Leasing Act, 2016, proposed by the Haque Committee (Haque Committee, 2016).

- In developing countries like India, tenancy reforms aimed to abolish informal and exploitative contracts to protect poor tenants from eviction and regulate rent. The Dalwai report, based on "market-led agrarian reform," assumes equal bargaining power between lessors and lessees.

- Comprehensive Policy Framework: A holistic national agriculture policy, embodied with an effective and efficient procurement policy of every grain as well as vegetables and fruits on FRP, is needed.

- The FIVE ‘Cs’ — Conservation of water and soil, Climate change resistance, Cultivation, Consumption, and Commercial viability are crucial for the livelihoods of farmers across the country.

- Need to Amend APMC Act: States should amend their APMC Acts to align with the Model Act and promptly notify the necessary rules. To maximise the benefits of these reforms for small and marginal farmers, states should also promote the formation of Self Help Groups, Farmers/Commodity Interest Groups, and similar organizations.

- Balancing Market Forces and Government Support: Recognise that while some agricultural segments, such as horticultural crops, can thrive through market forces, others require government support through mechanisms like MSP.

- Consider the growth of horticultural crops, which have doubled the growth rate of rice and wheat in the last decade, as evidence that demand-driven factors can significantly enhance farmers' income and growth.

- Assured Price to Farmers (APF): Implement an APF system that includes both an MSP component and a profit margin. Set the MSP equal to the cost C2 to ensure a net return for farmers, with an additional margin determined annually by an expert body like the CACP. This margin should remain variable, unlike the consistently rising MSP.

- Categorisation and Implementation of MSP Crops: For effective MSP implementation, crops should be categorised into those of all-India importance and regional importance.

- The central government should handle the Assured Price to Farmers (APF) for all-India crops, while states, with shared funding from the central government, should manage the APF for regionally important crops.

- Establishment of Commodity-based Farmers' Organisations: To provide global demand-supply projections, guide planting decisions, and moderate acreages to avoid price crashes. Additionally, there's a need for non-partisan platforms where farmers can engage with policymakers, economists, and scientists objectively, prioritizing scientific approaches over political or special interest agendas.

- In other countries, such organisations advise farmers on global projections of demand and supply for specific crops and help in moderating acreages in line with projected demand.

- Comprehensive Cost Inclusion in MSP: The MSP should be revised to include all production costs such as labour costs, expenses, fertilizers, irrigation, and interest on working capital and land rent. This should also encompass the imputed value of family labour.

- By including these comprehensive costs in the MSP calculation, the aim is to provide farmers with a price that not only covers their basic production expenses but also ensures a reasonable profit margin.

- Use of Evolving Technologies: Karnataka has united all mandis in the state on an electronic platform and this has reportedly improved farmers’ selling prices by 38%. This system enhances price transparency and market access, benefiting farmers economically. Adopting this model across the country could similarly boost farmers' incomes nationwide.

Conclusion

The agricultural sector has faced numerous challenges over the years, and there is a pressing need for a legal guarantee for MSP to address this crisis. Despite the agreement reached with protesting farmers, the Central Government has not taken concrete action in the past two years. The government should have promptly addressed the demand for a legal guarantee for MSP and other issues to transform the country’s focus from food security to nutrition security.

|

Drishti Mains Question Q. Discuss the challenges and potential solutions regarding the Minimum Support Price (MSP) in India's agricultural sector, emphasizing the implications for farmers' incomes and national food security. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. Consider the following statements: (2020)

- In the case of all cereals, pulses, and oil seeds, the procurement at Minimum Support price (MSP) is unlimited in any State/UT of India.

- In the case of cereals and pulses, the MSP is fixed in any State/UT at a level to which the market price will never rise.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)

Q. Consider the following statements: (2023)

- The Government of India provides Minimum Support Price for niger (Guizotia abyssinica) seeds.

- Niger is cultivated as a Kharif crop.

- Some tribal people in India use niger seed oil for cooking.

How many of the above statements are correct?

(a) Only one

(b) Only two

(c) All three

(d) None

Ans: (c)

Mains

Q. What do you mean by Minimum Support Price (MSP)? How will MSP rescue the farmers from the low income trap? (2018)