India's Carbon Market: A Green Leap Forward | 12 Nov 2024

This editorial is based on “Giving shape to India’s carbon credit mechanism” which was published in The Hindu on 12/11/2024. The article brings into picture the key role of carbon finance and credit frameworks at COP-29, focusing on India's efforts to develop its domestic carbon market. It highlights two major challenges: ensuring the integrity of carbon credits to avoid greenwashing and aligning with international standards, especially under Article 6 of the Paris Agreement.

For Prelims: COP-29, Nationally Determined Contribution, Carbon Market, Paris Agreement, Greenwashing, Greenhouse gas, International Solar Alliance, EU-ETS, Performance Achieve Trade (PAT) scheme, Energy Conservation Amendment Act 2022, Smart Cities Mission.

For Mains: Opportunities for India in Developing a Domestic Carbon Market, Major Issues Related to Development of Carbon Market in India.

As COP-29 unfolds in Baku, Azerbaijan, carbon finance and credit frameworks have emerged as critical points of discussion between developed and developing nations. India, having updated its Nationally Determined Contributions in 2023, is poised to develop its domestic carbon market. However, global experiences highlight two crucial challenges: maintaining the integrity of carbon credits to prevent greenwashing, and ensuring alignment with international standards, particularly Article 6 of the Paris Agreement.

What are Carbon Credits?

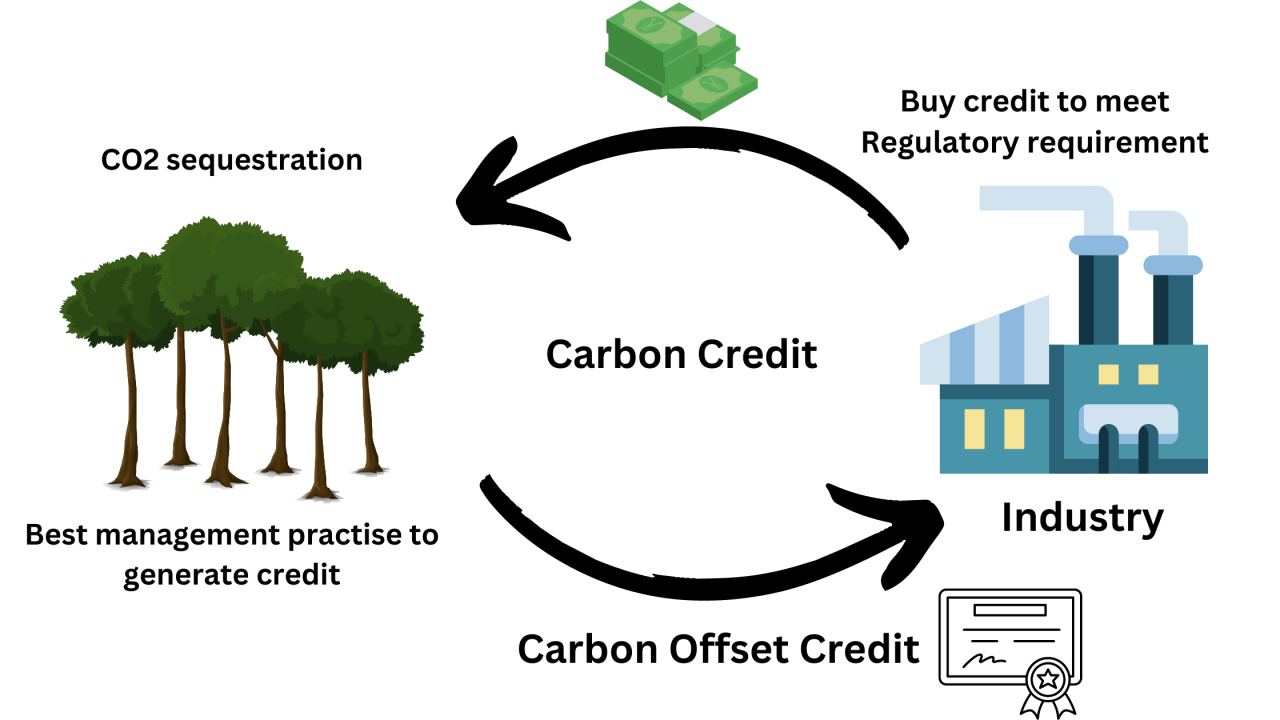

- About: Carbon credits are tradable certificates representing a claim to avoided greenhouse gas (GHG) emissions or enhanced removals from the atmosphere.

- They allow entities to transfer these claims to buyers, who can "retire" them to meet climate targets.

- Certification and Units: Credits are certified by governments or independent bodies and typically represent one metric ton of CO₂ avoided or removed.

- Carbon credits, rather than "offsets," are the preferred term for compliance and voluntary reporting.

- To compare GHG effects, emissions are standardized in CO₂-equivalents (CO₂e) using 100-year Global Warming Potentials (GWPs).

- Alternative Uses: Carbon credits are also used without offsetting claims, contributing solely to climate mitigation.

- This requires high-quality credits that meet stringent criteria.

What are the Opportunities for India in Developing a Domestic Carbon Market?

- Economic Value Creation & Market Size: India is a significant exporter of carbon credits and has issued 278 million credits in the voluntary carbon markets between 2010 and 2022, accounting for 17% of the global supply.

- Beyond trading, the market creates opportunities for carbon credit verification agencies, green finance institutions, and environmental consulting firms, potentially creating 200,000+ new jobs.

- The multiplier effect could contribute significantly to India's goal of becoming a $5 trillion economy while driving sustainable growth.

- International Climate Leadership: As the world's third-largest emitter yet leader in renewable energy adoption, India can leverage its carbon market to shape global climate finance architecture.

- Recent leadership in initiatives like International Solar Alliance demonstrates India's capacity to lead climate action.

- The carbon market could strengthen India's position in climate negotiations, particularly in developing-country coalitions, while creating opportunities for South-South cooperation and technology transfer.

- Industrial Competitiveness & Innovation: Carbon pricing could drive industrial modernization and innovation across sectors.

- Industries can leverage carbon markets to fund efficiency improvements, similar to how EU-ETS helped reduce industrial emissions by 41% since 2005.

- This presents opportunities for developing indigenous clean technologies, particularly in hard-to-abate sectors like cement and steel.

- Recent success stories like JSW Steel's carbon reduction initiatives show potential for the Indian industry to lead in low-carbon solutions.

- Digital Infrastructure & Technology Integration: India's robust digital infrastructure presents unique opportunities for creating transparent, efficient carbon markets.

- The success of digital public goods like UPI and COWIN provides a template for building sophisticated carbon trading platforms.

- Integration of blockchain, IoT, and AI could revolutionize carbon credit verification and trading, reducing costs and increasing transparency.

- This could position India as a leader in digital solutions for climate action.

- Green Investment Catalyst: A well-designed carbon market could attract significant international green finance.

- ESG investments now account for nearly 18% of foreign financing in emerging markets (excluding China).

- India's carbon market could provide a structured avenue for channeling this capital into sustainable projects, particularly in renewable energy, energy efficiency, and forest conservation. The market mechanism could also support India's green bonds and sustainable finance initiatives.

- Rural Development & Agricultural Transformation: Carbon markets present unique opportunities for rural India through agricultural and forestry carbon credits.

- Recent pilot projects in states like Maharashtra show farmers earning additional income through carbon farming practices.

- They are making up to ₹65,000 per acre annually from forest harvest and carbon revenue, compared to just ₹10,000 from paddy cultivation.

- The structured market could incentivize sustainable agriculture, agroforestry, and rural renewable energy projects, potentially benefiting farmers while supporting food security and climate resilience.

- Recent pilot projects in states like Maharashtra show farmers earning additional income through carbon farming practices.

- Sector Transformation Opportunities: Different sectors present unique opportunities: Energy sector can accelerate renewable transition, manufacturing can fund efficiency improvements, real estate can drive green building adoption, and transport sector can accelerate electric mobility.

- Recent success of the Performance Achieve Trade (PAT) scheme, covering 13 energy-intensive sectors, demonstrates industry readiness for market mechanisms.

- This sectoral approach could create specialized carbon credit categories and trading mechanisms.

- Knowledge Economy Development: Building a carbon market creates opportunities for developing expertise in carbon accounting, verification, trading, and climate finance.

- This could position India as a knowledge hub for emerging carbon markets globally.

- Recent initiatives like the Climate University Network (connecting 100+ universities) show potential for building specialized skills and research capacity.

- The market could drive innovation in environmental education and professional development.

- Urban Sustainability Integration: Carbon markets could accelerate sustainable urban development through projects in waste management, urban forestry, and clean transport.

- Cities like Indore, which generates revenue from waste carbon credits, demonstrate the potential.

- The market mechanism could support India's Smart Cities Mission, incentivizing low-carbon infrastructure and creating new revenue streams for urban local bodies to fund climate initiatives.

What are the Major Issues Related to Development of Carbon Market in India?

- Market Design & Pricing Complexity: India faces significant challenges in designing an efficient market structure that balances environmental goals with economic realities.

- Setting appropriate caps, allocating allowances, and ensuring market liquidity while preventing price volatility requires complex policy decisions.

- The diversity of India's industrial landscape, with varying technological capabilities and emission intensities, makes uniform pricing mechanisms particularly challenging.

- This is further complicated by the need to protect strategic sectors while maintaining market effectiveness.

- Measurement, Reporting & Verification Infrastructure: Current gaps in emissions data collection and verification systems pose significant challenges.

- The challenge is magnified by India's diverse industrial base, with many small and medium enterprises lacking technical capacity for accurate emissions monitoring. Establishing credible baseline emissions data across sectors remains a fundamental challenge.

- Regulatory Framework & Institutional Capacity: Despite the Energy Conservation Amendment Act 2022, significant regulatory gaps remain.

- Recent implementation delays in the Green Credit Programme highlight institutional capacity constraints.

- The need for coordination among multiple agencies ( Bureau of Energy Efficiency, Ministry of Environment, Forest and Climate Change, CERC) creates operational complexities.

- Current regulatory frameworks may need substantial enhancement to handle complex carbon market operations.

- Industry Readiness & Compliance Costs: Many Indian industries, particularly MSMEs generate around 110 million tonnes of CO2 equivalent annually, face significant challenges in market participation.

- The cost of compliance, including monitoring equipment, verification processes, and trading infrastructure, could be prohibitive for smaller players.

- Technical capacity gaps in carbon accounting and trading strategies could disadvantage certain sectors and regions, potentially creating market distortions.

- International Market Integration Issues: Aligning domestic carbon markets with international standards while protecting national interests presents complex challenges.

- Article 6 negotiations at COP29 highlight ongoing debates about corresponding adjustments and credit quality.

- India must navigate between maintaining sovereignty over its carbon assets and ensuring international market compatibility.

- The risk of carbon leakage through international trade and competitiveness concerns requires careful policy design.

- Double Counting & Additionality Concerns: Ensuring credit integrity and preventing double counting remains a significant challenge.

- Recent criticism of forestry credits under voluntary schemes, where up to 30% faced additionality questions, highlights verification challenges.

- The overlap between various schemes (PAT, Renewable Energy Certificate, proposed carbon market) creates risks of multiple counting.

- Establishing clear ownership rights and tracking mechanisms for carbon credits across different programs requires sophisticated systems and protocols.

- Regional & Sectoral Disparities: Significant variations in industrial development and technical capacity across states create equity concerns.

- States with higher industrial concentration (Gujarat, Maharashtra and Rajasthan) may dominate market dynamics.

- The risk of market benefits concentrating in developed regions while imposing disproportionate costs on less developed areas requires careful consideration.

- Technology & Infrastructure Gaps: Current technological infrastructure may be inadequate for sophisticated carbon market operations.

- Cybersecurity breaches in international carbon registries highlight technology risks.

- In January 2011, hackers stole nearly 1.2 million credits from the Czech carbon registry after issuing a bomb threat to its headquarters.

- Developing secure, transparent trading platforms, reliable monitoring systems, and verification technologies requires significant investment.

- The digital divide across regions and industries could create operational challenges and market access issues.

- Cybersecurity breaches in international carbon registries highlight technology risks.

- Market Manipulation & Speculation Risks: Experience from other markets shows vulnerability to price manipulation and excessive speculation.

- An investigation found that over 90% of rainforest carbon offsets by Verra, widely used by companies like Disney and Shell, may be "phantom credits" with little real impact on emissions.

- Furthermore, greenwashing—where companies claim carbon neutrality using questionable offsets—poses a risk to market credibility and consumer trust, further complicating the integrity of carbon markets.

What Measures can India Adopt to Accelerate the Development of Carbon Market?

- Phased Implementation Strategy: Adopt a tiered approach starting with high-emission sectors (power, cement, steel) where monitoring capabilities already exist under PAT scheme.

- Gradually expand to medium-emission sectors while building capacity in smaller industries.

- This approach, similar to China's successful Emissions Trading System rollout, allows market maturity while building institutional capacity.

- Integrated Digital Infrastructure: Develop a unified carbon registry platform integrating blockchain technology for transparent tracking and trading.

- Mandate standardized digital reporting formats and create APIs for seamless data integration across different systems.

- Implement real-time monitoring and verification systems using IoT sensors and automated data validation. This digital backbone would reduce transaction costs and enhance market transparency.

- Capacity Building Ecosystem: Establish a dedicated Carbon Market Skill Development Program targeting industry professionals, auditors, and regulators.

- Create standardized certification programs for carbon market professionals and verification agencies. Build industry-specific guidance and tools for emissions calculation and reporting.

- Dynamic Price Management System: Implement a price collar mechanism with floor and ceiling prices to prevent extreme volatility while ensuring meaningful carbon pricing.

- Create a market stability reserve similar to EU-ETS to manage supply-demand balance.

- Develop sector-specific allowance allocation methods considering technological capabilities and international competitiveness.

- Sectoral Integration Framework: Create sector-specific emission intensity benchmarks and reduction pathways aligned with India's NDCs.

- Develop mechanisms to link existing schemes (PAT, REC) with the carbon market to prevent double counting.

- Establish clear protocols for project-based credits from sectors not covered under cap-and-trade.

- Design specific provisions for hard-to-abate sectors including alternative compliance mechanisms. Create industry clusters for collective participation and knowledge sharing.

- International Alignment: Develop carbon market infrastructure aligned with Article 6 requirements from the start.

- Create clear frameworks for international credit transfers and corresponding adjustments.

- Establish bilateral partnerships for market linking and capacity building.

- Regional Development Framework: Create state-level carbon market cells for localized support and monitoring.

- Develop regional carbon market development plans considering local industrial profiles.

- Establish mechanisms for revenue sharing with states to incentivize participation.

Conclusion:

India's carbon market holds immense potential for sustainable development. By addressing challenges like market design, data integrity, and regulatory frameworks, India can create a robust and efficient market. This will drive emissions reductions, attract green investments, and position India as a global leader in climate action.

|

Drishti Mains Question: Discuss the role of carbon trading as a tool for climate mitigation. Analyse its potential with a focus on impact on developing countries. |

UPSC Civil Services Examination Previous Year Question:

Prelims

Q.1 Which one of the following statements best the term ‘Social Cost of Carbon’? (2020)

It is a measure, in monetary value, of the -

(a) long-term damage done by a tonne of CO2 emissions in a given year.

(b) requirement of fossil fuels for a country to provide goods and services to its citizens, based on the burning of those fuels.

(c) efforts put in by a climate refugee to adapt to live in a new place.

(d) contribution of an individual person to the carbon footprint on the planet Earth.

Ans: (a)

Q2. Regarding “carbon credits”, which one of the following statements is not correct? (2011)

(a) The carbon credit system was ratified in conjunction with the Kyoto Protocol

(b) Carbon credits are awarded to countries or groups that have reduced greenhouse gases below their emission quota

(c) The goal of the carbon credit system is to limit the increase of carbon dioxide emission

(d) Carbon credits are traded at a price fixed from time to time by the United Nations Environment Programme.

Ans: (d)

Q.3 Consider the following statements: (2023)

Statement-I: Carbon markets are likely to be one of the most widespread tools in the fight against climate change.

Statement-II: Carbon markets transfer resources from the private sector to the State.

Which one of the following is correct in respect of the above statements?

(a) Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

(b Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

(c) Statement-I is correct but Statement-II is incorrect

(d) Statement-I is incorrect but Statement-II is correct

Ans: (b)

Mains

Q. Should the pursuit of carbon credits and clean development mechanisms set up under UNFCCC be maintained even though there has been a massive slide in the value of a carbon credit? Discuss with respect to India’s energy needs for economic growth. (2014)