Empowering India’s Gig Workforce | 15 Oct 2024

This editorial is based on “ Ensuring a proper social safety net for the gig worker” which was published in The Hindu on 15/10/2024. This article discusses the social security challenges encountered by gig workers in India and recommends labor law rationalization to improve their formalization and integration into the safety net.

For Prelims: Gig workers, Gig economy, NITI Aayog Report on India's Gig and Platform Economy (2022), e-Shram Portal, Pradhan Mantri Shram Yogi Maandhan (PMSYM)

For Mains: Opportunities for Gig Workers Evolving in India, Challenges Faced by Gig Workers in India, Steps to Empower the Gig Workers in India

In recent years, the gig economy has surged in India, transforming the landscape of employment and offering new opportunities for millions. However, this rapid growth has brought to light significant challenges, particularly regarding the social security of gig workers.

Recognizing the need for a robust safety net, the Union Ministry of Labour and Employment is drafting a national law to incorporate gig workers into social security schemes. Furthermore, the government is revising the definitions of gig workers to ensure they are more inclusive and reflective of contemporary employment realities.

Who Are Considered Gig Workers?

- Gig workers are individuals engaged in the gig economy, taking on temporary or flexible jobs instead of traditional full-time roles.

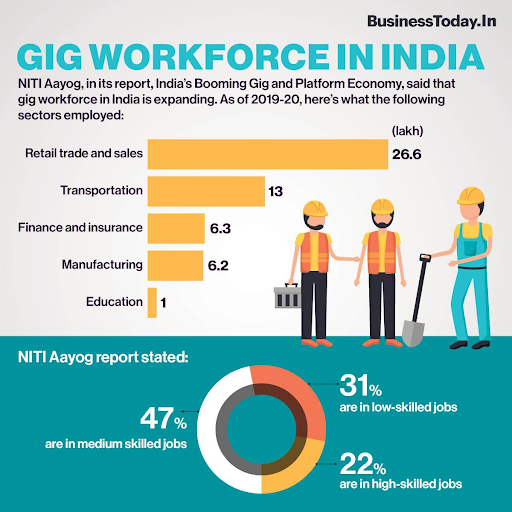

- The NITI Aayog Report 2022 classifies gig workers as individuals engaged in work outside the traditional employer-employee setup, with two distinct subsets – platform workers and non-platform workers.

- Platform workers utilize online algorithmic matching platforms like Amazon or Uber to connect with customers, while non-platform workers encompass those in sectors such as construction, day jobs, and other technology-independent temporary work.

- India has the fifth largest population of gig economy workers, and by 2030, this could improve to 3rd place.

How are the Opportunities for Gig Workers Evolving in India?

- Market Growth and Employment Potential :

- The gig economy is valued at approximately USD 20 billion in India, and it’s poised to grow by 17% annually until 2027.

- According to NITI Aayog's report titled “India’s Booming Gig and Platform Economy,” the gig workforce in India is projected to grow to 23.5 million (2.35 crore) workers by the year 2029-30.

- The gig workers are expected to form 6.7% of the non-agricultural workforce or 4.1% of the total livelihood in India by 2029-30.

- Diverse Opportunities Across Sectors :

- Companies like Uber, Ola, Zomato, and Swiggy are continually expanding their services, creating more gig jobs.

- In the fiscal year 2023, Zomato has gained more strength with 647 million orders to 58 million customers, with a total order value of Rs 263.1 billion across more than 800 cities in the country.

- Platforms like Upwork, Freelancer, and Fiverr are allowing professionals to offer their services globally.

- The Indian freelance workforce is expected to grow at a CAGR of around 17% from 2021 to 2025

- Companies like Uber, Ola, Zomato, and Swiggy are continually expanding their services, creating more gig jobs.

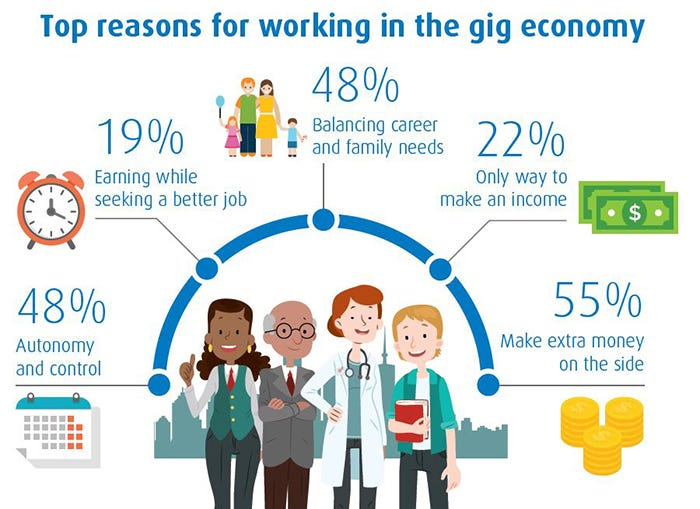

- Flexible Work Arrangements :

- The gig economy offers flexibility that traditional employment often lacks. Workers can choose their hours, select projects, and work from various locations.

- This adaptability is particularly attractive to younger generations, leading to a rise in gig employment among millennials and Gen Z, who prioritize work-life balance and autonomy.

- Technological Advancement and Emergence of a Start-up Culture:

- The rise of digital platforms and mobile applications has streamlined the gig process, making it easier for workers to find jobs and for companies to hire them

- India's start-up ecosystem is rapidly evolving, with many start-ups opting to hire contractual freelancers for non-core activities to reduce high fixed costs associated with full-time employees

What are the Major Challenges Faced by Gig Workers in India?

- Ambiguous Employment Relations in Gig Work:

- Gig workers are classified as informal workers, which places them outside the traditional employer-employee relationship.

- Employment relations in the gig economy are camouflaged, with gig workers being labeled as independent contractors.

- This categorization leads to gig workers missing out on institutional social security benefits enjoyed by formal workers.

- In 2023, Swiggy delivery workers staged significant strikes in various cities across India, highlighting their demands for better working conditions, fair wages, and improved benefits

- Institutional Social Security vs. Social Security Schemes:

- There are significant gaps between the entitlements provided under institutional social security and informal social security schemes.

- Gig workers are entitled to certain social security schemes but not full institutional protections like paid leave and maternity benefits.

- Absence of Minimum Wage and Occupational Safety:

- Gig workers are not protected under minimum wage laws or occupational safety regulations.

- Gig work often involves physically demanding tasks, such as delivery or ride-sharing, exposing workers to health and safety risks.

- They are excluded from the Industrial Relations Code 2020 and its dispute resolution mechanisms.

- Gig workers are not protected under minimum wage laws or occupational safety regulations.

- Precarious Employment and Income Insecurity:

- Gig workers can be easily disconnected from the platform, leading to a loss of income and livelihood.

- Moreover, their earnings are often unpredictable and fluctuate based on demand, making it difficult to plan financially.

- The Fairwork India Ratings 2024 report evaluates the working conditions of platform workers in India, highlighting that digital labor platform aggregators show a lack of commitment to ensuring local living wages and recognizing workers' collective rights.

- Exploitation and Unfair Treatment:

- The lack of legal protection and the power imbalance between workers and platforms create conditions ripe for exploitation.

- Workers may face unreasonable demands, such as the "oaths" imposed not to drink water or use the restroom unless they meet targets.

- Lack of Collective Bargaining Power:

- Gig workers are typically isolated and lack the ability to unionize or collectively bargain for better working conditions and remuneration.

- This power imbalance makes it difficult for them to advocate for their rights or negotiate better terms with the platforms they work for.

What are the Government Initiatives to Protect Gig Workers in India?

- Code on Social Security, 2020: This act recognizes gig workers as a separate category and envisages extension of social security benefits to them.

- However, the specific rules and implementation details are yet to be finalized by individual states.

- NITI Aayog Report on India's Gig and Platform Economy (2022): This report recommends promoting platform-led skilling initiatives and social security measures for gig workers. It also emphasizes the need for data collection and better enumeration of the gig workforce.

- e-Shram Portal: A national database for unorganized sector workers, including gig and platform workers.

- Pradhan Mantri Shram Yogi Maandhan (PMSYM): Pension scheme for workers in the unorganized sector, including gig workers.

- Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY): Life insurance scheme for unorganized workers

How can India Empower the Gig Workers?

- Defining Aggregators as Employers:

- To protect gig workers, the labor law should clearly define aggregators as employers and recognize the employment relationship.

- Aggregator companies may be required to contribute 1%-2% of their revenue to a social security fund.

- The UK Supreme Court’s 2021 ruling on Uber, where Uber drivers were recognized as workers, sets an important precedent.

- Registration of Gig Workers:

- Aggregators should be responsible for registering gig workers on the Labour Ministry’s e-Shram portal.

- Workers registered on e-Shram are eligible for life and accidental insurance, among other benefits.

- Registered gig workers must be given a minimum 14-day notice before termination, accompanied by valid reasons.

- Aggregators should be responsible for registering gig workers on the Labour Ministry’s e-Shram portal.

- Establishment of Tripartite Governance Structure:

- A tripartite governance structure involving the government, gig platforms, and worker representatives could be established.

- This would allow for effective dialogue, collective bargaining, and the formulation of industry-wide standards and guidelines for fair working conditions, grievance redressal mechanisms, and worker welfare measures.

- A welfare board should be created to manage the social security fund for gig workers.

- Fair Pay and Algorithmic Transparency:

- Platforms should be held accountable for ensuring fair pay structures and transparent algorithms that determine pay rates and task allocation.

- An automated system for ensuring transparency and resolving disputes should be implemented to safeguard workers' rights.

- Gig Worker Data Portability:

- Implementing data portability standards that allow gig workers to transfer their work history, ratings, and skill certifications across different platforms. This reduces dependence on a single platform and improves worker mobility.

- Data security and privacy concerns need to be addressed to ensure worker data is protected during transfers.

- Skill Development and Upskilling Initiatives:

- India needs to push efforts to provide gig workers with opportunities for skill development and upskilling according to the current market scenarios, enabling them to transition into higher-paying roles or pursue entrepreneurial ventures.

- This could include collaborations with vocational training institutes and government-backed programs.

Conclusion:

A balanced approach that promotes innovation and flexibility, while safeguarding basic protections and fair working conditions, is essential for creating an inclusive and secure environment for gig workers in the future. Collaboration between policymakers, businesses, and the workers themselves will be vital to building a fair and equitable system. This system must strike a balance between flexibility and security, ensuring that gig workers in India can thrive in the evolving economy while having their rights fully protected.

|

Drishti Mains Question : In light of the growing gig economy, what actions can India take to protect the rights and ensure fair wages for gig workers? |

UPSC Previous Year Questions

Prelims

Q.With reference to casual workers employed in India, consider the following statements: (2021)

- All casual workers are entitled for Employees Provident Fund coverage.

- All casual workers are entitled for regular working hours and overtime payment.

- The government can by a notification specify that an establishment or industry shall pay wages only through its bank account.

Which of the above statements are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: B

Mains

Q. Examine the role of ‘Gig Economy’ in the process of empowerment of women in India. (2021)