Trends in Remittances Inflow | 29 Jun 2024

For Prelims: World Bank, Remittances, Foreign exchange, Organisation for Economic Co-operation and Development, Gulf Cooperation Council, National Payments Corporation of India.

For Mains: Remittance Trends Across the Globe, Factors Affecting Remittance Flows to India, Measures to Boost Remittance Inflow.

Why in News?

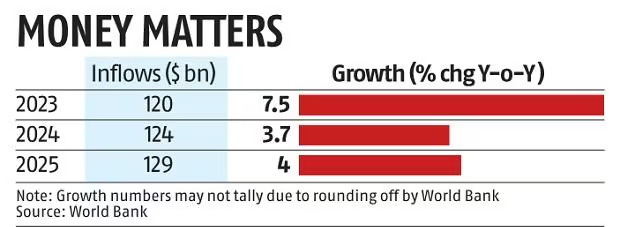

According to the latest report by the World Bank, the growth in remittances to India is likely to halve in 2024 compared to 2023.

- This slowdown is attributed to "reduced outflows from GCC (Gulf Cooperation Council) countries, amid declining oil prices and production cuts.

What are Remittances?

- About:

- Remittances are the funds or goods that migrants send back to their families in their home country to provide financial support.

- They are an important source of income and foreign exchange for many developing countries, especially those in South Asia.

- Remittances can help reduce poverty, improve living standards, support education and health care, and stimulate economic activity.

- India sent out 18.7 million emigrants in 2023.

- Remittances are the funds or goods that migrants send back to their families in their home country to provide financial support.

-

Growth of Remittances:

- Remittances Inflows in Countries:

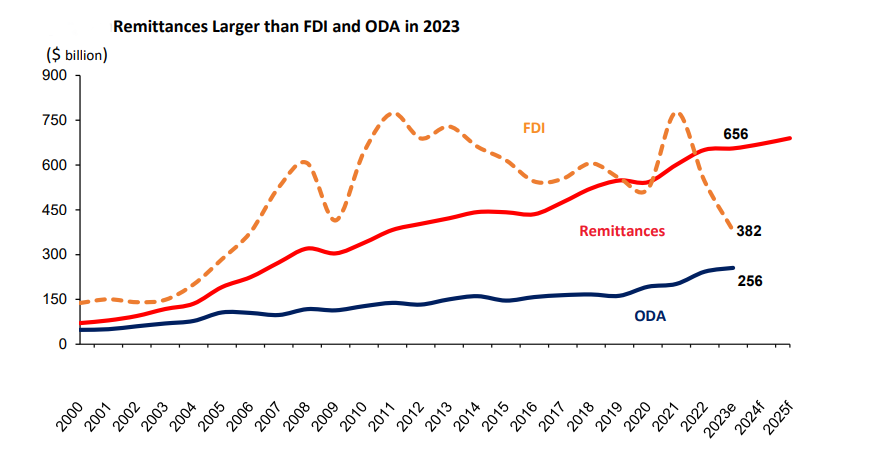

- In 2023, India topped in remittances inflow list, followed by Mexico (USD 66 billion), China (USD 50 billion), the Philippines (USD 39 billion), and Pakistan (USD 27 billion).

- India's foreign assets increased more than liabilities in 2023-24 according to RBI data.

Migration Trends

- In 2023, there were approximately 302.1 million international migrants globally, according to World Bank data.

- Economic migrants constituted an estimated 252 million of the total international migrants.

- Refugees and asylum seekers numbered around 50.3 million in 2023, according to the United Nations High Commissioner for Refugees (UNHCR).

What are the Factors Affecting Remittance Flows to India?

- Top Sources of Remittances for India:

- Around 36% of total remittance flows to India are sent by high-skilled Indian migrants residing in 3 high-income countries like the United States, the United Kingdom, and Singapore.

- The post-pandemic recovery led to a tight labour market in these regions, resulting in wage hikes that boosted remittances.

- Among the other high-income destinations for Indian migrants, such as the Gulf Cooperation Council (GCC) countries, UAE accounted for 18% of India's remittance flows, while Saudi Arabia, Kuwait, Oman, and Qatar collectively accounted for 11%.

- Around 36% of total remittance flows to India are sent by high-skilled Indian migrants residing in 3 high-income countries like the United States, the United Kingdom, and Singapore.

- Reason for Consistent Remittance Inflow:

-

Strong Economic Conditions:

- In developed economies like the US, UK, and Singapore, lower inflation and strong labour markets have benefited skilled Indian professionals, resulting in increased remittance inflows to India.

- High employment growth and a general decrease in inflation in Europe contributed to the increase in remittances worldwide.

- Diversified Migrant Pool:

-

India's migrant pool is no longer concentrated solely on high-income countries. A significant portion resides in the Gulf Cooperation Council (GCC), offering a buffer during economic downturns in either region.

- Favorable economic conditions in GCC, including high energy prices and curbed food price inflation have positively impacted employment and incomes for Indian migrants, especially those in less-skilled sectors.

- India and the United Arab Emirates (UAE) signed a pact in 2023 to establish a Local Currency Settlement System (LCSS) to promote the use of the Indian rupee (INR) and UAE Dirham (AED) for cross-border transactions further boosting remittance flows.

-

- Improved Remittance Channels:

- Initiatives like Unified Payment Interface (UPI) have enabled real-time fund transfers, allowing remittances to be sent and received instantly.

- The National Payments Corporation of India (NPCI) has allowed NRIs to use UPI in several countries including Singapore, Australia, Canada, Hong Kong, Oman, Qatar, USA, Saudi Arabia, United Arab Emirates, and the United Kingdom, Sri Lanka, Bhutan, Mauritius, France, Nepal.

-

How can Remittance Inflow in India be Increased?

- Boosting Financial Inclusion: World Bank data indicates only 80% of Indians have bank accounts. Expanding formal financial services, especially in rural areas can facilitate easier remittance transfers through a wider network of bank branches, ATMs, and digital platforms.

-

Reducing Remittance Costs: As per World Bank data, India has high remittance costs (5-6%).

- Introducing competition between remittance service providers and promoting digital channels can lower transaction costs, while government incentives for formal channels can boost adoption.

- Enhancing Remittance Infrastructure: Upgrading payment systems and leveraging new technologies like blockchain can streamline the remittance process.

-

The Reserve Bank of India's Centralized Payment System such as Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) is a step towards this goal.

-

-

Targeted Diaspora Engagement: Increased government engagement with the Indian diaspora through programs like Pravasi Bharatiya Divas and the Know India Programme can strengthen connections.

-

Offering attractive investment options and tax breaks, as suggested by the International Monetary Fund (IMF) data can incentivize higher remittance inflows.

-

-

Promoting Economic Stability:

- Implementing sound macroeconomic policies, improving the ease of doing business, and addressing corruption is crucial for diaspora confidence which can create a more attractive environment for remittance flows .

|

Drishti Mains Question: Analyze the factors influencing remittance inflows to India and discuss the policy measures that can be implemented to enhance their contribution to the Indian economy. |

UPSC Civil Services Examination, Previous Year Questions

Q1. Which of the following constitute Capital Account? (2013)

- Foreign Loans

- Foreign Direct Investment

- Private Remittances

- Portfolio Investment

Select the correct answer using the codes given below:

(a) 1, 2 and 3

(b) 1, 2 and 4

(c) 2, 3 and 4

(d) 1, 3 and 4

Ans: (b)

Q2. With reference to digital payments, consider the following statements: (2018)

- BHIM app allows the user to transfer money to anyone with a UPI-enabled bank account.

- While a chip-pin debit card has four factors of authentication, BHIM app has only two factors of authentication.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Q3. Which of the following is a most likely consequence of implementing the ‘Unified Payments Interface (UPI)’? (2017)

(a) Mobile wallets will not be necessary for online payments.

(b) Digital currency will totally replace the physical currency in about two decades.

(c) FDI inflows will drastically increase.

(d) Direct transfer of subsidies to poor people will become very effective.

Ans: (a)

Mains

Q. ‘Indian diaspora has a decisive role to play in the politics and economy of America and European Countries’. Comment with examples. (2020)