Indian Economy

Strengthening Regulatory Bodies

- 03 Feb 2025

- 11 min read

For Prelims: Securities and Exchange Board of India (SEBI), Banking, Insurance, Capital Markets, FSSAI, TRAI, RBI, CCI, IRDAI, PFRDA, National Pension System (NPS), PNGRB, Consolidated Fund of India, Parliament’s Standing Committee, Bonds, Derivatives, Securities Appellate Tribunal (SAT), National Institute of Securities Markets.

For Mains: Regulatory bodies, Concerns associated with them and way forward.

Why in News?

Some experts called for studying the impact of regulatory bodies like Securities and Exchange Board of India (SEBI) so that it can be factored into decision-making.

- They argued that regulatory bodies should clearly explain their decisions to ensure stakeholders feel satisfied, not just in reality but also in perception.

What are Regulatory Bodies?

- About: Regulatory bodies are organizations established to monitor and regulate specific sectors of the economy, ensuring fair practices and protecting public interests.

- Since 1991 (after LPG reforms), numerous authorities have been formed to prevent monopolies and regulate crucial sectors like banking, insurance, and capital markets.

- Most regulatory bodies are quasi-judicial in nature.

- Types: There are primarily two types of regulatory bodies i.e., Statutory regulatory bodies (e.g., SEBI) and Self-regulatory bodies (e.g., Bar Council of India).

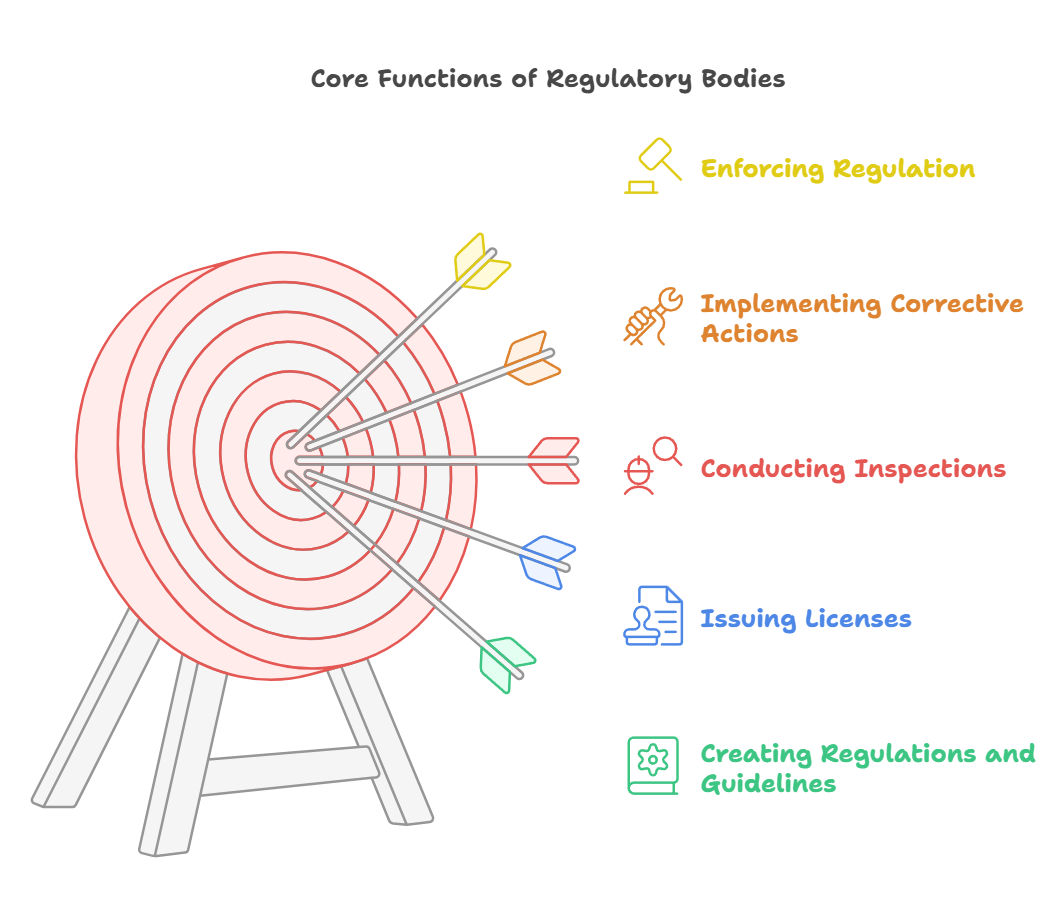

- Functions:

- Need:

- Protecting Consumer Interests: Enforcing standards and ensuring fair practices (e.g., FSSAI for food safety, TRAI for telecom pricing).

- Setting health and safety standards (e.g., CPCB for environment)

- Market Stability: Preventing fraud and promoting competition (e.g., SEBI for financial markets, CCI for fair competition).

- Economic Growth: Supporting sectoral growth (e.g., RBI for financial health, IRDAI for insurance), and attracting investments.

- Legal Compliance: Upholding laws and transparency (e.g., CVC, ED for legal compliance).

- Ethical Standards: Regulating professional ethics (e.g., Bar Council of India for legal professionals).

- Protecting Consumer Interests: Enforcing standards and ensuring fair practices (e.g., FSSAI for food safety, TRAI for telecom pricing).

- Examples: There are more than 30 regulatory bodies. Some of the authorities are as under:

- Reserve Bank of India (RBI): Oversees credit supply, banking operations, and ensures financial stability.

- SEBI: Regulates the securities market, ensures fair practices, and protects investors.

- Insurance Regulatory and Development Authority of India (IRDAI): IRDAI regulates the insurance sector, ensuring fairness and consumer protection.

- Ministry of Corporate Affairs (MCA): Regulates corporate governance and safeguards stakeholders’ interests.

- Pension Fund Regulatory and Development Authority (PFRDA): PFRDA oversees the National Pension System (NPS) and pension industry development.

- Petroleum and Natural Gas Regulatory Board (PNGRB): PNGRB was set up under PNGRB Act, 2006 that set technical and safety standards for petroleum, petroleum products, natural gas, and related infrastructure projects.

- Central Electricity Regulatory Commission: It regulates tariffs for Central Government-owned electricity generating companies, and oversees their inter-State transmission.

- Issues:

- Lack of Independence: Indian regulators, like TRAI, face interference from ministries, compromising their autonomy and objectivity.

- Absence of Financial Autonomy: They depend on ministry approval for budgets, and surplus funds are returned to the Consolidated Fund of India, limiting financial independence.

- Ineffective Appointment Processes: Top officials are often filled by retired civil servants lacking regulatory expertise, affecting credibility and efficiency.

- Lack of Parliamentary Accountability: Regulators lack sufficient oversight from Parliament, weakening public accountability and transparency in their decisions.

- E.g., SEBI is not directly accountable to Parliament’s Standing Committee on Finance.

- Inadequate Stakeholder Engagement: Indian regulators often fail to engage with stakeholders, resulting in decisions that don't fully address public or industry needs.

- E.g., SEBI’s unclear communication of regulatory decisions create uncertainty among market participants.

- Fragmented Regulatory Framework: Different financial segments (insurance, bonds, derivatives) are overseen by separate regulators that hinders market efficiency.

- E.g., Separate regulators for insurance and bonds hinder credit default swaps (insurance against loan default) and corporate debt market growth.

Steps to Reform Regulatory Bodies

- 12th Report of the 2nd ARC Suggested:

- Simplify, streamline, and make regulatory procedures transparent, citizen-friendly, and less discretionary to reduce corruption.

- Strengthen internal supervision and independent assessments of regulatory agencies.

- Promote self-regulation in sectors like taxation and public health to ease enforcement.

- 13th Report of the 2nd ARC Recommended:

- Ministries should create a ‘Management Statement’ outlining regulators' objectives and roles.

- Ensure uniformity in the appointment, tenure, and removal of regulatory authorities for consistency and independence.

- Strengthen parliamentary oversight of regulators through Standing Committees for accountability.

SEBI

- About: SEBI is a Statutory Body (a Non-Constitutional body) established under the SEBI Act, 1992.

- It was constituted as a non-statutory body on 12th April 1988 through a resolution of the Government of India

- Prior to SEBI, the Controller of Capital Issues, governed under the Capital Issues (Control) Act, 1947, was the regulatory authority for capital markets.

- Purpose: SEBI’s main functions are to protect the interests of investors in securities and to promote and regulate the securities market in India.

- Structure: SEBI’s board includes a Chairman, and other whole-time, and part-time members.

- The Securities Appellate Tribunal (SAT) handles appeals against SEBI’s decisions, with powers similar to those of a civil court.

- Key Responsibilities: It enables issuers to raise finance, ensures safety and accurate information for investors, and promotes a competitive market for intermediaries.

Way Forward

- Accountability: Regulatory bodies should be accountable to Parliament's Standing Committee, providing a mechanism for scrutiny, transparency, and public confidence.

- The annual expenditure of the regulator must be audited by the CAG and its report should be laid before Parliament.

- Regular reviews with input from experts, academics, and analysts would assess their actions and effectiveness.

- Independent Assessments: Collaborate with research institutions like the National Institute of Securities Markets (public trust established by SEBI in 2006) and major academic institutions such as the Indian Institutes of Management (IIMs) for rigorous research, market monitoring, and informed decision-making.

- Interdisciplinary Collaboration: Regulatory bodies like SEBI, RBI, IRDAI, and others should create cohesive regulatory frameworks that enhance market stability and prevent conflicting regulations that stifle innovation.

- Building Research Capacity: They should build a deeper pool of expertise by forming an advisory council of specialists in economics, finance, and law for better decision-making and interventions.

- Leveraging International Best Practices: Regulatory bodies can look to successful case studies such as the UK’s Regulatory Policy Committee, Australia’s Productivity Commission, that encourage regulatory coherence, and enhanced market efficiency.

- Brazil's telecom regulator is independent, with council members chosen by the president and approved by the Parliament.

- Independent Umbrella Body: Former CJI NV Ramana emphasized the need for an independent umbrella body to bring agencies like the CBI, SFIO, and ED under one roof, created under a statute with defined powers, functions, and jurisdictions.

- A similar body is needed for regulation of these regulatory bodies.

|

Drishti Mains Question: Discuss the challenges faced by Indian regulatory bodies and suggest measures to enhance their accountability, transparency, and effectiveness in decision-making. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Consider the following statements: (2019)

- Petroleum and Natural Gas Regulatory Board (PNGRB) is the first regulatory body set up by the Government of India.

- One of the tasks of PNGRB is to ensure competitive markets for gas.

- Appeals against the decisions of PNGRB go before the Appellate Tribunals for Electricity.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Q. In India, which of the following is regulated by the Forward Markets Commission? (2010)

(a) Currency Futures Trading

(b) Commodities Futures Trading

(c) Equity Futures Trading

(d) Both Commodities Futures and Financial Futures Trading

Ans: (b)

Mains

Q. What is a quasi judicial body? Explain with the help of concrete examples. (2016)

Q. The product diversification of financial institutions and insurance companies,resulting in overlapping of products and services strengthens the case for the merger of the two regulatory agencies, namely SEBI and IRDA. Justify (2013)