Indian Economy

Strengthening of Rupee

- 11 May 2024

- 10 min read

For Prelims: Depreciation of Indian Rupee, REER, NEER, Currency depreciation, inflation, Depreciation Vs Devaluation, Appreciation Vs Depreciation

For Mains: Impact of Depreciation of Indian Rupee on economy, Factors affecting strengthening and weakening of Indian Rupee

Why in News?

The Indian Rupee depreciated by around 27.6% against the US dollar in the last 10 years.

- The currency has gained real value when considering its exchange rate against major global currencies.

How is the Decadal Journey of the Indian Rupee?

- The rupee fell from Rs 44.37 to Rs 60.34 (26.5%) from 2004 to 2014 against the US dollar.

- The rupee has further depreciated from Rs 60.34 to Rs 83.38 (27.6%) against the US dollar in the last between 2014 to 2024.

- Appreciation and depreciation of currency refer to changes in the value of a currency relative to other currencies in the foreign exchange market.

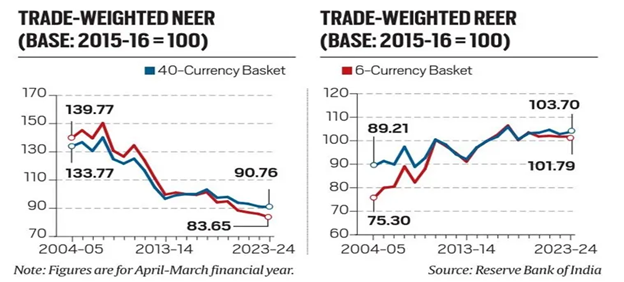

- Between 2004 and 2024, rupee declined by 32.2% (from 133.77 to 90.76) as per 40-currency basket NEER and 40.2%, (from 139.77 to 83.65) as per 6-currency basket NEER and during the same period.

- The rupee’s average exchange rate against the US dollar dropped by 45.7%, from Rs 44.9 to Rs 82.8.

- Therefore, between 2004 and 2024, the rupee has undergone a smaller depreciation against the currencies of India's major trading partners compared to its depreciation solely against the US dollar.

- Also rupee’s trade-weighted REER for both 40-currency and 6-currency basket has increased in the last 20 years indicating that Rupee strengthened between 2004-05 and 2023-24.

- Rupee has strengthened in real terms over time, while ruling at 100 or above most of the time in the last 10 years.

What is an Exchange Rate?

- About:

- An exchange rate is the rate at which one currency can be exchanged for another currency. It represents the value of one currency in terms of another currency.

- Exchange rates are typically expressed as the amount of one currency needed to purchase one unit of another currency.

- Types:

- Fixed Exchange Rate: Governments or central banks set the value of their currency in relation to other currencies and maintain that value by buying or selling their own currency in foreign exchange markets.

- Floating Exchange Rate: Value of a currency is determined by the forex market based on supply and demand. Most major currencies operate under this system.

- Managed Float: A mix of fixed and floating exchange rates where governments intervene occasionally to stabilise their currency's value.

- Factors Affecting Exchange Rates:

- Interest Rates: Higher interest rates in a country tend to attract foreign investment, increasing demand for that country's currency and strengthening its exchange rate.

- Inflation: If inflation is higher in a country compared to its trading partners, its currency weakens as its purchasing power decreases.

- Economic Growth: A strong and growing economy fosters confidence in a country's currency, leading to a stronger exchange rate.

- Political Stability: Political instability can deter foreign investment and weaken a country's currency.

- Supply and Demand: The fundamental principle of supply and demand plays a major role. If more people want to buy a particular currency (higher demand), its exchange rate strengthens.

What is Effective Exchange Rate (EER)?

- About:

- The Effective Exchange Rate (EER) of a currency is a weighted average of its exchange rates against other currencies, adjusted for inflation and trade competitiveness.

- The currency weights are derived from the share of the individual countries to India’s total foreign trade.

- Effect on Strength of a Currency:

- Strength or Weakness of a Currency depends on the Exchange rate of that currency with the currency of all trading Partners.

- For India, The strength or weakness of the Rupee is, hence, a function of its exchange rate with not just the US dollar, but also with other global currencies.

- In this case, it would be against a basket of currencies of the country’s most important trading partners, termed as the rupee’s “Effective Exchange Rate” or EER.

- Types of Effective Exchange Rate(EER):

- Nominal Effective Exchange Rate (NEER): NEER is a simple average of bilateral exchange rates between the domestic currency and the currencies of major trading partners, weighted by the respective trade shares.

- NEER measures the overall strength or weakness of a currency relative to a basket of other currencies without adjusting for inflation.

- The NEER indices are with reference to a base value of 100 and base rear as 2015-16.

- The Reserve Bank of India has constructed NEER indices of the rupee against a 2 different baskets of Currencies:

- 6 Currency Basket: It is a trade-weighted average rate at which the rupee is exchangeable with a basic currency basket, comprising the US dollar, the euro, the Chinese yuan, the British pound, the Japanese yen and the Hong Kong dollar.

- 40 currencies Basket: It covers a bigger basket of 40 currencies of countries that account for about 88% of India’s annual trade flows.

- Nominal Effective Exchange Rate (NEER): NEER is a simple average of bilateral exchange rates between the domestic currency and the currencies of major trading partners, weighted by the respective trade shares.

- Real Effective Exchange Rate (REER):

- REER adjusts NEER for differences in inflation rates between the domestic economy and its trading partners. It reflects changes in the relative price levels of goods and services.

- REER provides a more accurate measure of a currency's trade competitiveness by accounting for changes in price levels.

- REER is calculated by dividing NEER by a price deflator (such as Consumer Price Index) for the domestic economy and multiplying by 100.

What are the Implications of Currency Depreciation on the Indian Economy?

- Positive Impacts:

- Boosts Exports: Indian exports become cheaper for foreign buyers, potentially increasing demand and boosting export earnings.

- Inward Remittances: A weaker rupee will enable workers abroad to send more rupees back home when they convert their foreign currency earnings.

- This can increase disposable income in India.

- Negative Impacts:

- Higher Import Costs: Imported goods, including essential items like oil and machinery, become more expensive.

- This can lead to inflationary pressures, where the general price level of goods and services rises, impacting the common man's purchasing power.

- Costlier Foreign Debt: If India has borrowed money in foreign currencies, a weaker rupee means it has to pay back more rupees to settle the debt.

- This can strain the government's finances.

- Discourages Foreign Investment: A depreciating rupee can be seen as a sign of economic instability, potentially discouraging foreign investors from investing in India.

- Higher Import Costs: Imported goods, including essential items like oil and machinery, become more expensive.

Devaluation and Depreciation of Currency

|

Feature |

Devaluation |

Depreciation |

|

Cause |

Government Action |

Market Forces (Demand and Supply) |

|

Exchange Rate System |

Fixed |

Floating |

|

Intentionality |

Deliberate Action to Weaken Currency for economic gain |

Natural Decline in Value |

|

Control |

Government Control Exchange Rate |

Market Determines Exchange Rate |

|

Drishti Mains Question: Analyse the relationship between inflation and exchange rates in the Indian economy. Discuss the challenges posed by this relationship and suggest policy measures to manage them. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q1. Which one of the following is not the most likely measure the Government/RBI takes to stop the slide of the Indian rupee? (2019)

(a) Curbing imports of non-essential goods and promoting exports

(b) Encouraging Indian borrowers to issue rupee-denominated Masala Bonds

(c) Easing conditions relating to external commercial borrowing

(d) Following an expansionary monetary policy

Ans: (d)

Q2. Consider the following statements:

- The effect of devaluation of a currency is that it necessarily

- improves the competitiveness of the domestic exports in the foreign markets

- increases the foreign value of domestic currency

- improves the trade balance

Which of the above statements is/are correct?

(a) 1 only

(b) 1 and 2

(c) 3 only

(d) 2 and 3

Ans: (a)

Mains

Q. How would the recent phenomena of protectionism and currency manipulations in world trade affect macroeconomic stability of India? (2018)