Rapid Fire

SEBI Introduced Specialised Investment Funds (SIFs)

- 20 Dec 2024

- 2 min read

SEBI has introduced a new asset class called Specialised Investment Fund (SIF). It is designed for informed investors willing to take on riskier investments.

Specialised Investment Fund (SIF):

- SIF bridges the gap between mutual funds (MFs) and portfolio management services (PMS).

-

It requires a minimum investment of Rs 10 lakh, with lower thresholds for accredited investors. SIFs will offer open-ended, close-ended, and interval investment strategies.

- Asset Class:

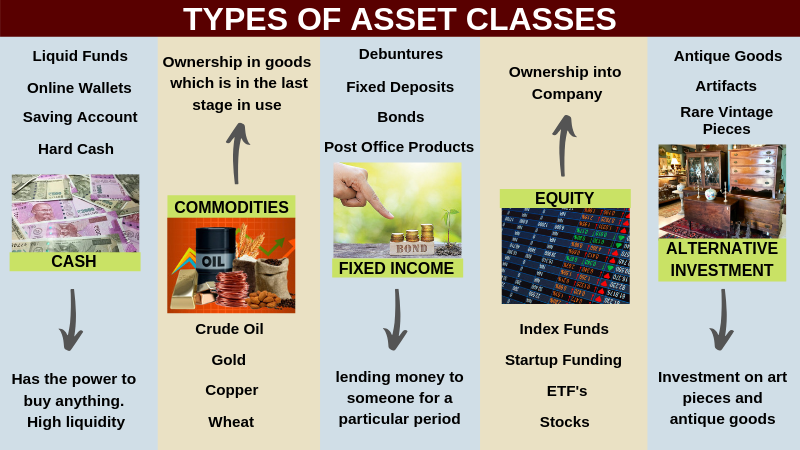

- It is a group of investments that share similar characteristics and are governed by the same regulations.

- Example: Equities (stocks), fixed income (bonds), cash and cash equivalents, real estate, commodities, and currencies.

- MFs: These are investment vehicles that pool money from multiple investors to purchase securities such as bonds, stocks, or a combination of both.

- PMS: It provides personalized investment management, where a dedicated portfolio manager tailors strategies to an investor’s specific needs, risk tolerance, and financial goals.

- Unlike MFs, PMS offers customized portfolios, with professional management based on in-depth research.

- It typically targets high-net-worth individuals and involves higher fees.

- SEBI also introduced Mutual Fund Lite regulations (a simplified regulatory system) to facilitate the passively managed funds schemes such as exchange traded funds (ETFs) and index funds by encouraging more players to enter the mutual fund market by reducing compliance burdens and easing entry barriers.

Read More: Amendment to Mutual Fund Rules