SC to Examine Use of Money Bills in Legislation | 17 Jul 2024

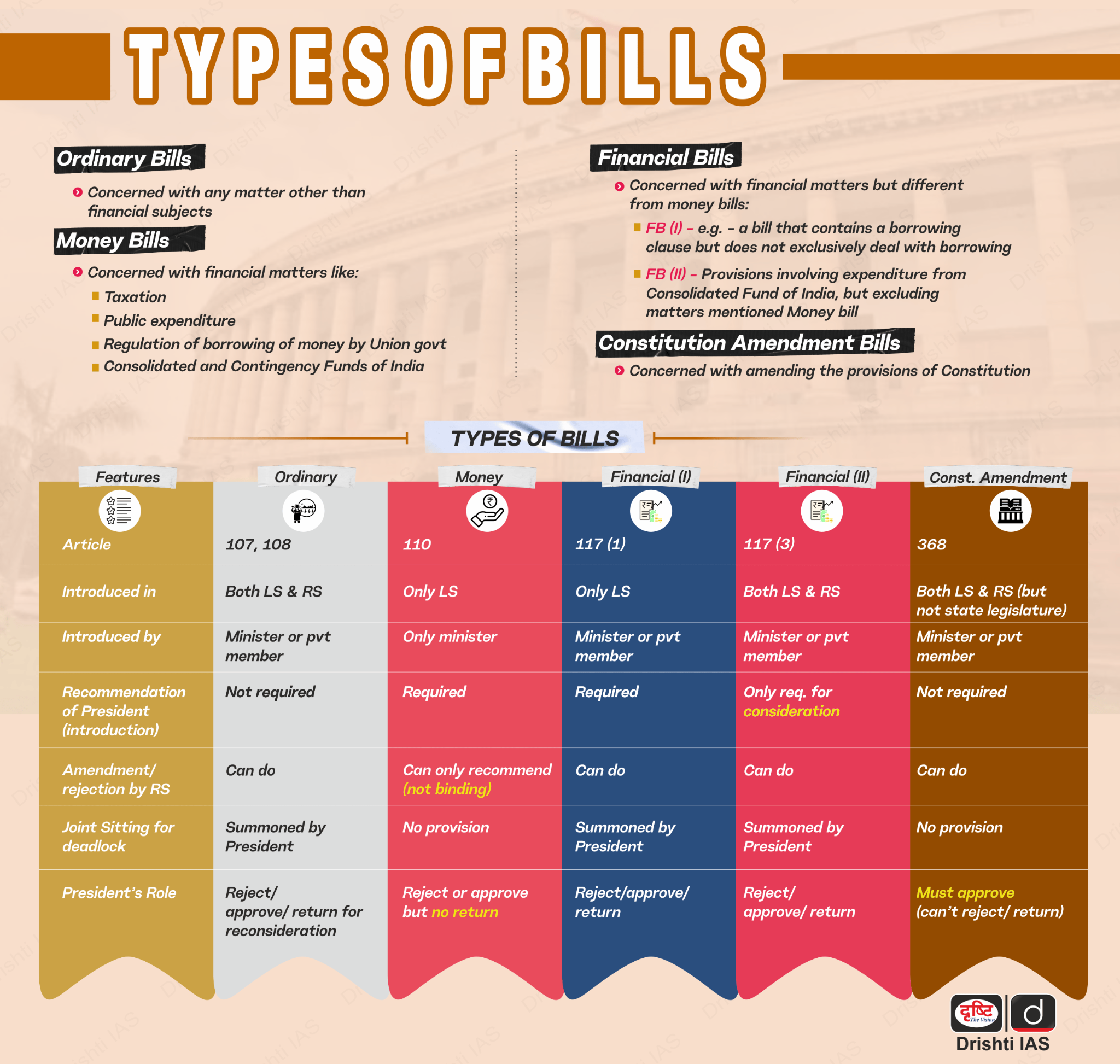

For Prelims: Chief Justice of India, Money Bill, Parliament, Rajya Sabha, Article 110, Judicial review, Supreme Court, Consolidated Fund

For Mains: Indian Constitution, Features, Amendments, Significant Provisions, Judicial Review

Why in News?

Recently, Chief Justice of India (CJI) has agreed to list petitions challenging the government's use of the Money Bill route to pass contentious amendments in the Parliament.

- This issue is crucial as it concerns the circumvention of the Rajya Sabha and potential violations of Article 110 of the Constitution.

What are the Concerns Regarding the Money Bill?

- Circumventing the Rajya Sabha: One of the primary concerns is that passing contentious amendments as a Money Bill allows the government to circumvent the Rajya Sabha, undermining the bicameral nature of Parliament.

- The classification of a bill as a money bill limits the Rajya Sabha to only recommending changes, without the power to amend or reject the bill.

- The Rajya Sabha, as the Upper House, provides additional scrutiny to legislation. Bypassing it reduces the opportunity for comprehensive debate and oversight.

- Violation of Article 110: It specifies what constitutes a Money Bill. There are concerns that certain amendments labelled as Money Bills do not strictly adhere to these provisions.

- Speaker's Certification: The Speaker of the Lok Sabha has the authority to certify a bill as a money bill under Article 110 of the Constitution, a decision that is not subject to judicial review.

- This raises concerns about the potential misuse of this power, allowing for circumvention of legislative processes.

- Specific Cases Highlighting Concerns:

-

Aadhaar Act: The Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016 was classified as a Money Bill under Article 110(1), which led to widespread controversy.

-

In 2018, the Supreme Court upheld the constitutionality of the Aadhaar law, with the majority ruling that the Act's main aim was to provide subsidies and benefits, which involves expenditure from the Consolidated Fund, and therefore qualified it to be passed as a Money Bill.

-

However, Justice D.Y. Chandrachud (who was not the CJI at the time) dissented, observing that the use of the Money Bill route in this case was an "abuse of the constitutional process".

-

-

Finance Act, 2017: The Finance Act, 2017 included amendments to a number of Acts, including empowering the government to notify rules regarding the service conditions of members of Tribunals.

-

A host of petitioners argued that the Finance Act, 2017 must be struck down in its entirety as it contained provisions that had no connection with the subjects listed in Article 110.

-

In 2019, in the case Rojer Mathew vs South Indian Bank Ltd, a five-judge Bench referred the Money Bill aspect to a larger seven-judge Bench.

-

-

Prevention of Money Laundering Act (PMLA) Amendments: Amendments to the PMLA, passed as Money Bills from 2015 onwards, gave the Enforcement Directorate extensive powers, including arrest and raids.

- Although the Supreme Court upheld the legality of these amendments, it left the question of whether they should have been passed as Money Bills to the seven-judge Bench.

- The broad powers granted through these amendments raised concerns about potential misuse and the bypassing of legislative scrutiny.

-

Developments Following the 2019 Ruling

- The seven-judge Bench (mentioned earlier) has yet to address key questions about what constitutes a valid Money Bill, impacting subsequent legislation.

- The court has avoided resolving the Money Bill question in cases related to the Enforcement Directorate's powers and electoral laws, awaiting the larger Bench’s decision.

What are the Potential Consequences of Misclassifying Money Bills?

- Legal Challenges: Misclassifying bills as money bills can lead to prolonged legal battles, adding uncertainty to the legislative process.

-

Legislative Precedents: If upheld by the judiciary, the use of money bills inappropriately could set a precedent for future governments to bypass the Rajya Sabha.

-

Public Trust: Controversies surrounding money bills can erode public trust in the legislative process and the integrity of parliamentary procedures.

-

Broader Implications for Indian Democracy:

- The ongoing debates and judicial reviews surrounding money bills underscore the importance of maintaining a balance of power between the Lok Sabha and the Rajya Sabha.

- Ensuring that the passage of significant legislation involves adequate scrutiny and debate is crucial for legislative transparency and accountability.

- Upholding the constitutional provisions and preventing their misuse is essential for the integrity of India's democratic processes.

What is a Money Bill?

- About: Article 110 of the Constitution of India outlines the definition of a Money Bill, stating that a bill is considered a Money Bill if it contains only provisions dealing with specific financial matters. These include:

-

Taxation Matters: Imposition, abolition, remission, alteration, or regulation of any tax.

-

Borrowing Regulation: Regulation of the borrowing of money by the Union government.

-

Custody of Funds: Management of the Consolidated Fund of India(revenue received by the government through taxes and expenses incurred in the form of borrowings and loans) or the contingency fund(money to meet unforeseen expenditure).

-

Appropriation of Funds: Appropriation of money out of the Consolidated Fund.

-

Expenditure Declaration: Declaration of any expenditure charged on the Consolidated Fund.

-

Receipt of Money: Receipt of money related to the Consolidated Fund or public accounts.

-

Other Matters: Any matters incidental to the above provisions.

-

-

Speaker's Certification: The decision on whether a bill is a Money Bill rests with the Speaker of the Lok Sabha. This decision is final and cannot be questioned in any court or by either House of Parliament, nor can it be contested by the President.

- Upon certification, the Speaker endorses the bill as a Money Bill when it is transmitted to the Rajya Sabha for recommendations.

- Legislative Procedure: Money Bills can only be introduced in the Lok Sabha and must be recommended by the President. They are treated as government bills and can only be introduced by a minister.

- After passing in the Lok Sabha, the bill is sent to the Rajya Sabha, which has limited powers: It cannot reject or amend a Money Bill, it can only make recommendations and must return the bill within 14 days, regardless of whether it makes recommendations or not.

- The Lok Sabha can accept or reject the Rajya Sabha's recommendations. If the Lok Sabha accepts any recommendations, the bill is deemed passed in the modified form; if it rejects them, it passes in its original form.

- Presidential Assent: Once a Money Bill is presented to the President, he can either give assent or withhold it but cannot return it for reconsideration.

- Generally, the President gives assent to Money Bills as they are introduced with his prior permission.

Note: A bill cannot be classified as a Money Bill simply because it involves Imposition of fines or pecuniary penalties, demand or payment of fees for licences or services, and taxation by local authorities for local purposes.

|

Drishti Mains Question: Q. Evaluate the concerns associated with the government's use of the Money Bill route to pass contentious amendments. How do these provisions ensure or undermine legislative accountability? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q1. Regarding the Money Bill, which of the following statements is not correct? (2018)

(a) A bill shall be deemed to be a Money Bill if it contains only provisions relating to the imposition, abolition, remission, alteration or regulation of any tax.

(b) A Money Bill has provisions for the custody of the Consolidated Fund of India or the Contingency Fund of India.

(c) A Money Bill is concerned with the appropriation of money out of the Contingency Fund of India.

(d) A Money Bill deals with the regulation of borrowing of money or giving of any guarantee by the Government of India.

Ans: (c)

Q2. What will follow if a Money Bill is substantially amended by the Rajya Sabha? (2013)

(a) The Lok Sabha may still proceed with the Bill, accepting or not accepting the recommendations of the Rajya Sabha.

(b) The Lok Sabha cannot consider the Bill further.

(c) The Lok Sabha may send the Bill to the Rajya Sabha for reconsideration.

(d) The President may call a joint sitting for passing the Bill.

Ans: (a)