Indian Polity

SC Allows States to Regulate Industrial Alcohol

- 26 Oct 2024

- 10 min read

For Prelims: Supreme Court, Important Judgements, Constitutional Bench, Centre-State Relations, Industrial Alcohol, 7th Schedule, Excise Duty, GST

For Mains: Federalism in India, Important Supreme Court Judgements, Cooperative Federalism, Challenges to the Federalism, Financial Relations between Centre and States

Why in News?

Recently, the Supreme Court's nine-judge Constitution bench held in a 8:1 ruling that states have the authority to regulate industrial alcohol, reversing a 1990 decision (Synthetics & Chemicals Ltd v. State of Uttar Pradesh Case, 1989) that favored central government control.

What is the Constitutional Bench of the Supreme Court?

- About:

- A Constitution Bench consists of five or more judges in the Supreme Court, convened only for specific legal matters. These benches are not a routine phenomenon.

- Circumstances for Formation:

- Article 145(3): The minimum number of judges required for deciding cases involving substantial constitutional questions or references under Article 143 is five.

- Conflicting Judgments: When conflicting decisions arise from different three-judge benches, a larger bench (Constitution Bench) is formed to resolve the issue.

Industrial Alcohol

- About: Industrial alcohol is essentially impure alcohol that is used as an industrial solvent.

- Mixing chemicals such as benzene, pyridine, gasoline, etc. in ethanol (a process called denaturation) turns it into industrial alcohol, significantly lowering its prices and making it unfit for human consumption.

- Applications: Used in pharmaceuticals, perfumes, cosmetics, and cleaning liquids.

- Sometimes it is also used to make illicit liquor, cheap and dangerous intoxicants whose consumption poses severe risks, including blindness and death.

What has the SC Bench Ruled on Industrial Alcohol?

- Expanding the Definition: The majority Bench has overturned the 1990 ruling in Synthetics & Chemicals vs State of Uttar Pradesh, which limited the definition of "intoxicating liquor" to potable alcohol and barred states from taxing industrial alcohol.

- Majority Opinion: The Bench clarified that "intoxicating liquor" includes more than just alcoholic beverages or potable alcohol. All types of alcohol that can negatively impact public health are covered by this definition.

- The court emphasised that substances like alcohol, opium, and drugs can be misused and ruled that Parliament cannot override state powers over intoxicating liquors, stating that "intoxicating" can also mean "poisonous," allowing for broader classification.

- Dissenting Opinion: Justice B.V. Nagarathna expressed disagreement with the majority ruling regarding the regulation of industrial alcohol arguing that merely because there can be a potential misuse of “industrial alcohol”, Entry 8 – List II cannot be stretched to include such “industrial alcohol”.

- Permitting states to regulate industrial alcohol could result in misinterpretations of the legislative intent behind alcohol regulation.

Centre vs States’ Arguments on Industrial Alcohol Regulation

- Central Government's Argument:

- Classifies industrial alcohol as an "industry" under Entry 52 of the Union List, allowing the Centre to regulate industries deemed in public interest.

- Asserts that trade, commerce, supply, and distribution of industrial alcohol fall under Entry 33(a) of the Concurrent List, permitting central oversight.

- The Centre contends that industrial alcohol falls under the jurisdiction of the Industries (Development and Regulation) Act, 1961, asserting it “occupied the field” for regulation. Thus, states cannot impose their regulations on this subject.

- States' Argument:

- Argue for regulation under Entry 8 of the State List, asserting the right to tax intoxicating liquors, which includes industrial alcohol.

- States emphasize the necessity of maintaining authority to combat illegal consumption and generate crucial revenue, especially after the implementation of GST.

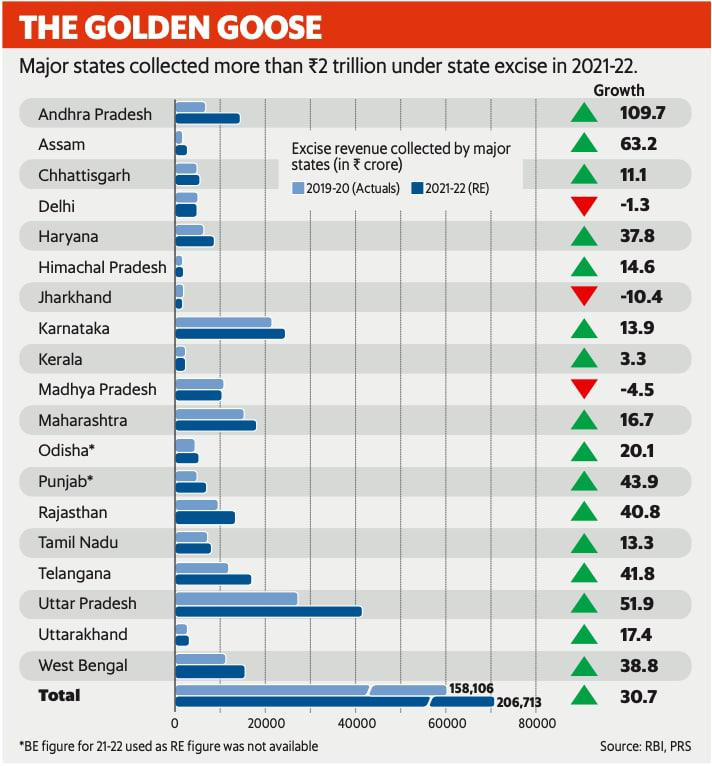

Importance of Taxing Alcohol for States

- Revenue Generation: Taxing alcohol is a vital source of revenue for states. For example, in 2023, Karnataka raised the Additional Excise Duty (AED) on Indian Made Liquor (IML) by 20%.

- Financial Dependency: States like Maharashtra and Kerala derive a significant portion of their revenue from alcohol taxes, contributing around 30-40% of their total excise revenue.

- Public Services Funding: Alcohol taxes are used to fund essential public services, including healthcare and education.

Industries (Development and Regulation) Act, 1951

- The Industries (Development and Regulation) Act, 1951 provides the legal and conceptual framework for industrial development and regulation in India.

- The act's main goals are to:

- Control and direct the growth of the nation's industries,

- Promote fair resource distribution,

- Avoid economic power concentration,

- Guarantee balanced and controlled industrial expansion.

- The act gives the central government the power to:

- Regulate the production, supply, and distribution of certain industries

- Impose restrictions on the establishment of new industries

- Grant licences to the industries to operate

- Create and run industries when it thinks it's in the best interests of the general public

- Take measures to stop the concentration of economic power in a small number of hands

What are the Other Similar Cases?

- Ch Tika Ramji v State of UP Case, 1956:

- The SC upheld Uttar Pradesh's legislation regulating the sugarcane industry against a challenge claiming exclusive central jurisdiction under Section 18-G of the Industries (Development and Regulation) Act, 1951 (IDRA).

- The ruling affirmed states' authority to legislate in industries even in the presence of central laws, setting a crucial precedent for federal governance.

- The SC upheld Uttar Pradesh's legislation regulating the sugarcane industry against a challenge claiming exclusive central jurisdiction under Section 18-G of the Industries (Development and Regulation) Act, 1951 (IDRA).

- Synthetics & Chemicals Ltd v. State of Uttar Pradesh Case, 1989:

- A 7-judge Constitution Bench held that states’ powers, as per Entry 8 of the State List, were limited to regulating “intoxicating liquors” which are different from industrial alcohol.

- Essentially, the SC said that only the Centre can impose levies or taxes on industrial alcohol, which is not meant for human consumption.

- The SC failed to consider its own prior Constitution Bench decision in Ch Tika Ramji v State of UP Case, 1956.

- A 7-judge Constitution Bench held that states’ powers, as per Entry 8 of the State List, were limited to regulating “intoxicating liquors” which are different from industrial alcohol.

What will be the Impact of this Ruling?

- Pending Litigations: The ruling will significantly influence ongoing litigations concerning protective taxes or special fees imposed by state governments, as prior judgments had stayed such levies.

- State Regulatory Power: States now possess authority over the regulation and taxation of industrial alcohol, which is expected to lead to varied tax regimes across states.

- Revenue Generation: States can leverage this ruling to enhance revenue streams, especially crucial post-GST, as they were previously restricted from taxing industrial alcohol.

- Industry Perspective: Industry bodies view the ruling positively, suggesting it clarifies regulatory controls and taxation for the Indian Made Foreign Liquor (IMFL) sector, reducing ambiguity for manufacturers.

- Operational Costs: Potentially, states may increase taxes on industrial alcohol, impacting operational costs for industries reliant on it, which could lead to pricing disparities.

Conclusion

- The Supreme Court's recent ruling grants states the authority to regulate industrial alcohol, allowing them to levy taxes and enhance local control over production and distribution.

- This decision strengthens states' fiscal autonomy post-GST, enables stricter regulation to prevent illegal consumption, and emphasises states’ legislative rights in managing local public health impacts.

|

Drishti Mains Question Discuss the implications of the Supreme Court's ruling on industrial alcohol regulation for state revenue generation and public health management in India. |