Indian Economy

Report on Currency and Finance (RCF) 2023-24

- 30 Jul 2024

- 15 min read

For Prelims: Digital India program, Unified Payments Interface (UPI), Payment and Settlement Systems Act, 2007, Reserve Bank of India (RBI).

For Mains: Impact of Digital Technology on Different Sectors in India, Positive and Negative Impacts of Digitization on Indian Economy

Why in News?

As per the 'Report on Currency and Finance (RCF) for the year 2023-24' released by the Reserve Bank of India (RBI), India's digital economy is set to constitute 20% of the country's GDP by 2026, doubling its current contribution of 10%.

- This significant growth projection underscores the transformative potential of digitalization in finance and its far-reaching impact on India's economy.

What is the Report on Currency and Finance?

- About:

- It is an annual publication of the RBI.

- The report covers various aspects of the Indian economy and financial system.

- Theme:

- The theme of the "Report is "India’s Digital Revolution."

- It focuses on the transformative impact of digitalization across various sectors in India, particularly in the financial sector.

- The theme of the "Report is "India’s Digital Revolution."

- Dimensions:

- It highlights how digital technologies are reshaping economic growth, financial inclusion, public infrastructure, and the regulatory landscape, while also addressing the associated opportunities and challenges.

What are the Key Highlights from the Report on Currency and Finance 2023-24?

- Expansion of Financial Services: The evolution and adoption of technological advancements have led to massive improvement in deepening of digital financial services.

- The potential for expanding financial inclusion in India by application of digital technologies is high in view of existing conditions.

- First, the progress of financial inclusion in India is evident in the Reserve Bank’s Financial Inclusion Index and narrowing account access gap between income groups.

- Second, in rural India, 46% of the population consists of wireless phone subscribers and 54% are active internet users.

- Third, given that more than half of FinTech consumers are from semi-urban and rural India and more than a third of digital payment users are from rural areas there is potential for furthering digital penetration and closing the rural-urban gap.

- Over two lakh gram panchayats have been connected through BharatNet in the last decade, enabling provision of services like e-health, e-education and e-governance in rural areas.

- The potential for expanding financial inclusion in India by application of digital technologies is high in view of existing conditions.

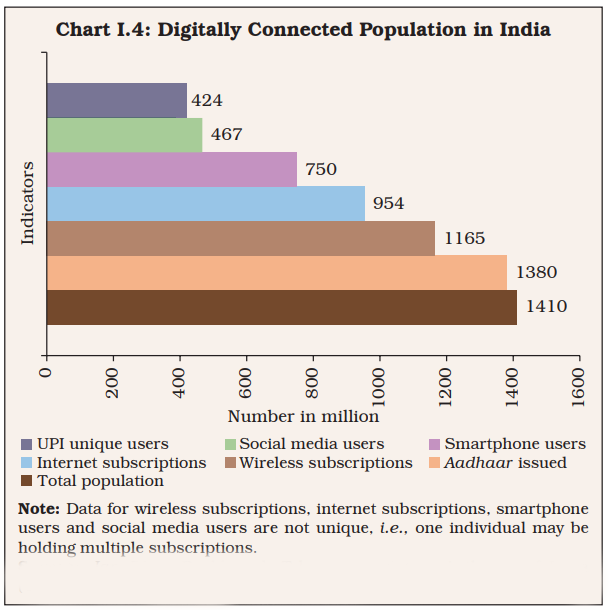

- Mobile Penetration: Although internet penetration in India was at 55% in 2023, the internet user base has grown by 199 million in the recent three years.

- India’s cost per gigabyte (GB) of data consumed is the lowest globally at an average of Rs. 13.32 per GB.

- India also has one of the highest mobile data consumption in the world, with an average per-user per-month consumption of 24.1 GB in 2023.

- There are about 750 million smartphone users, which is expected to reach about one billion by 2026.

- India is expected to be the second largest smartphone manufacturer in the next five years.

- Digital Economy: The digital economy currently accounts for 10% of India's GDP.

- By 2026, this figure is expected to double, contributing to 20% of GDP, driven by rapid advancements in digital infrastructure and financial technology.

- Digitization is strengthening banking infrastructure and public finance systems, optimizing direct benefit transfers and tax collections.

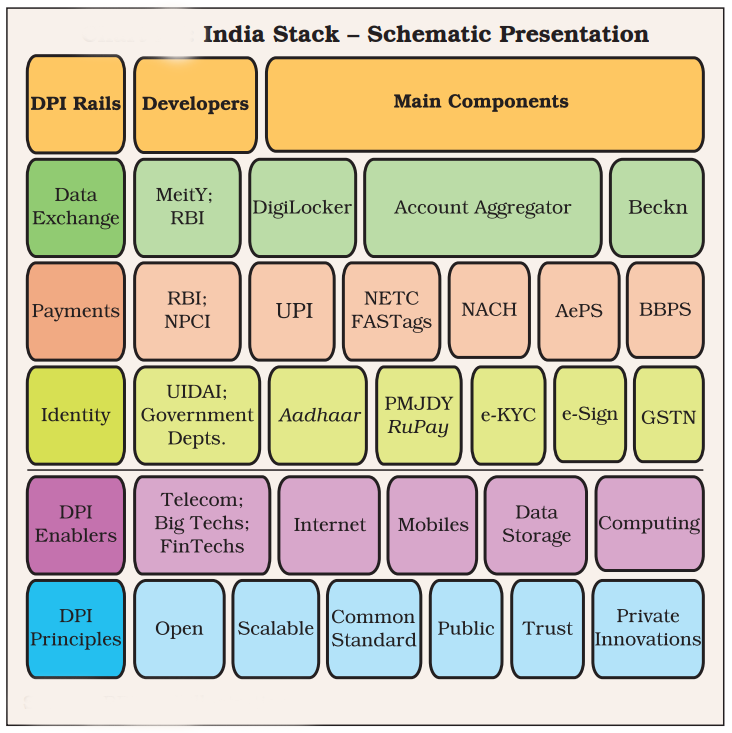

- India Stack: Key components such as Aadhaar, Unified Payments Interface (UPI), and DigiLocker have revolutionised service delivery. UPI has seen a tenfold increase in transactions over four years.

- Aadhaar: The world's largest biometric-based identification system, covering 1.38 billion ID holders.

- UPI: A real-time, low-cost transaction platform contributing significantly to financial inclusion.

- DigiLocker: Cloud-based storage providing secure document access.

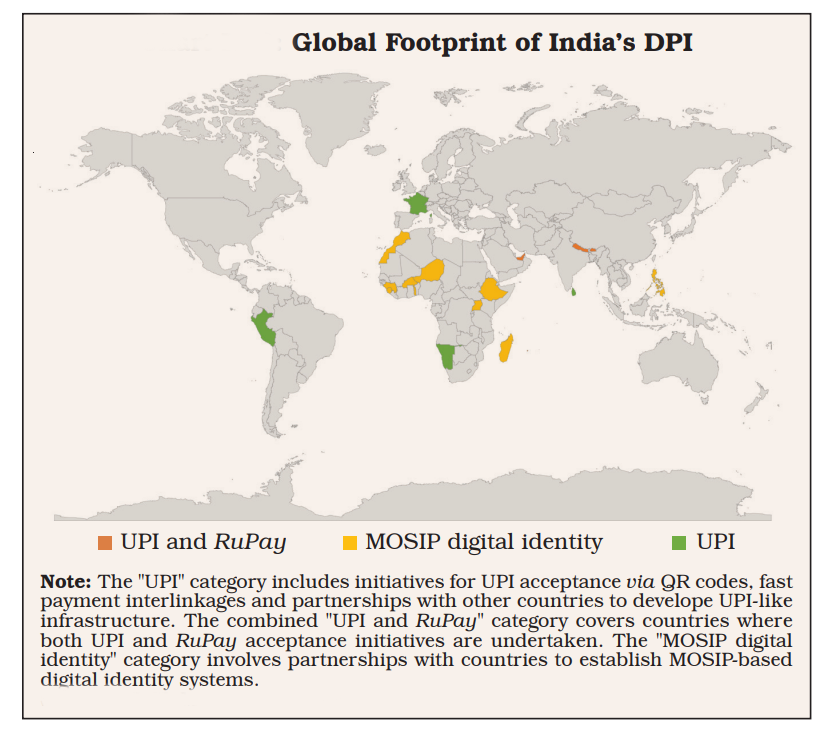

- Internationalisation of Digital Public Infrastructure: India’s DPI is going global by:

- Collaborating with other nations to develop digital identity solutions under the Modular Open Source Identity Platform (MOSIP) programme.

- Interlinkage of the UPI with fast payment systems of other nations like Singapore’s PayNow, the United Arab Emirates’ (UAE) Instant Pay Platform (IPP) and Nepal’s National Payments Interface (NPI) for cost-effective and fast remittances.

- Partnering with other central banks and foreign payment service providers to broaden UPI and RuPay acceptance beyond geographical borders, such as in countries like Bhutan, Mauritius, Singapore and the UAE.

- Sharing the Beckn protocol with nations to provide their public and private services through open, lightweight and decentralised specifications.

- Beckn Protocol enables the creation of open, peer-to-peer decentralized networks for pan-sector economic transactions.

- Vibrant Initiatives: The Open Credit Enablement Network, Open Network for Digital Commerce, and the Public Tech Platform for Frictionless Credit are driving the digital lending ecosystem.

- Fintech companies are partnering with banks and non-banking financial companies (NBFCs) to offer digital credit solutions and enhance financial inclusion.

Evolution of Digital Revolution in India

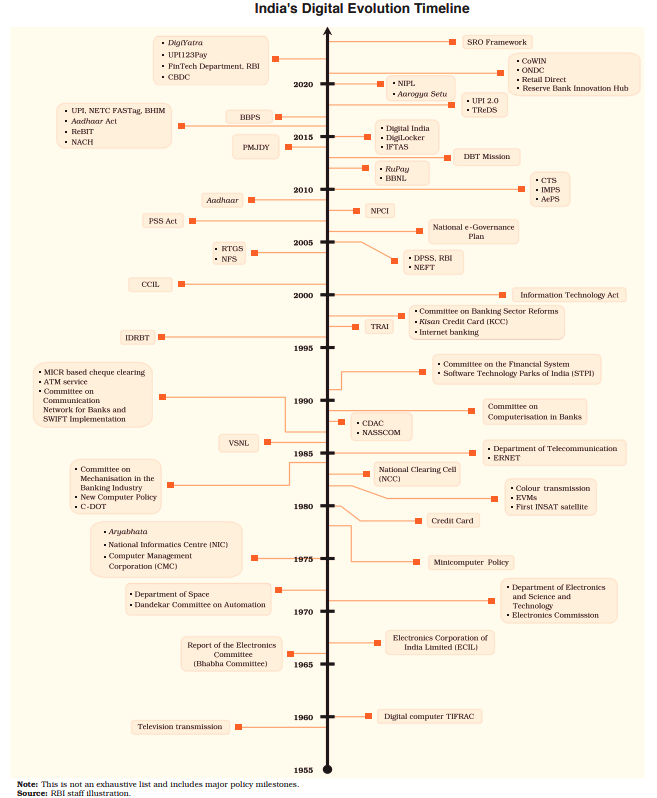

- India’s digital revolution is a blend of government-led initiatives and enabling regulatory frameworks of financial market regulators (Reserve Bank of India and the Securities and Exchange Board of India (SEBI)). This journey traverses four phases since independence.

| Phase | Period | Description |

| Digital Awakening | 1950s-1980s | Early computers were introduced in banks. ATMs and credit cards were also introduced during this period. |

| Liberalisation & InfoTech Boom | 1990s | The internet became more widely available in the 1990s. This led to the dematerialization of stocks, which means that stocks were no longer represented by physical certificates. Internet banking also began to be offered by banks during this time. |

| Building Legal Framework | 2000-2016 | Laws were passed to regulate digital transactions. Digital payment systems, such as UPI, were launched during this period. |

| Digital Innovation | 2017 onwards | India has become a leader in digital payments. New features, such as offline payments, have been introduced. |

What are the Challenges Posed by Digitalisation?

- Impact on Financial Markets: Digitalisation has led to the introduction of complex financial products and services, significantly impacting market structure and financial stability.

- The emergence of digital players with unreliable funding models increases system vulnerabilities and poses challenges to financial stability.

- This hyper-diversification of financial services may result in a "barbell" financial structure, where a few dominant multi-product players coexist with numerous niche service providers.

- Fear of Monopolisation: In India's digital payment ecosystem, the proliferation of Unified Payments Interface (UPI) applications has expanded customer choices and increased transaction volumes. However, a significant share of transactions is dominated by a few applications, as indicated by the Herfindahl-Hirschman Index (HHI) (a common measure of market concentration of an industry used to determine market competitiveness).

- To address concentration risks, the National Payments Corporation of India (NPCI) has capped the market share of a single third-party application provider to 30% by December 2024.

- Cyber Security Challenges: Cybersecurity is a major concern due to the diverse nature of cyber threats targeting digital financial infrastructure.

- In India, security incidents handled by the Indian Computer Emergency Response Team (CERT-In) have skyrocketed from 53,117 in 2017 to over 1.32 million between January and October 2023.

- The majority of these incidents involve unauthorized network scanning, probing, and exploitation of vulnerable services.

- In India, the average cost of a data breach in 2023 was USD 2.18 million, which is less than the global average but still represents a significant increase.

- Consumer Protection Issues: Digitalisation has also led to "dark patterns," where consumers are tricked into making decisions against their interests. Additionally, extensive use of customer data by companies raises concerns about data protection and privacy, potentially compromising customer trust.

- Reshaping Labour Markets: Digital technologies are transforming workforce composition, job quality, skill requirements, and labour policies. The implementation of AI in financial services shifts roles towards higher-skilled tasks, automating routine functions and aiding decision-making.

- Between 2013 and 2019, support roles in the financial sector declined, while the number of professionals and technicians increased.

- In India, private sector banks reported high turnover rates in 2022-23, leading to significant risks such as loss of institutional knowledge and higher recruitment costs.

What Steps Have Been Taken to Deal With the Challenges?

- Financial and Digital Inclusion: India has established Digital Banking Units (DBUs) and improved UPI with offline and conversational payments in local languages.

- The Payment Infrastructure Development Fund (PIDF) has been launched to broaden payment infrastructure, and digitalisation of agricultural finance is underway.

- Customer Protection: To address regulatory and customer protection challenges in the digital lending ecosystem, the RBI issued the Guidelines on Digital Lending, focusing on loan servicing, disclosures, grievance redressal, credit assessment standards, and data privacy.

- The Reserve Bank-Integrated Ombudsman Scheme (RB-IOS) has improved grievance redress mechanisms, and public awareness campaigns like ‘RBI Kehta Hai’ and the e-BAAT programme educate the public on digital payment products and fraud prevention.

- Data Protection: The RBI has implemented data localisation for payments data and guidelines preventing digital lending applications from accessing private information without explicit user consent. Card-on-file tokenisation (CoFT) through card-issuing banks has been enabled to enhance the security of digital payments.

- Cyber Security: To promote the security of digital transactions, measures such as two-factor authentication, increased customer control over card usage, faster turnaround times for transaction failures, and augmented supervisory oversight have been implemented.

- The RBI has issued comprehensive guidelines for IT and Cyber Risk management.

- FinTech Regulation: The RBI has launched the Regulatory Sandbox scheme, the Reserve Bank Innovation Hub, and FinTech Hackathons to encourage FinTech innovations.

- Digital Technologies in Regulation and Supervision: Digital tools are being leveraged to enhance supervisory and monitoring frameworks. The DAKSH system help digitalise supervisory processes.

- Integrated Compliance Management and Tracking System (ICMTS) and Centralised Information Management System (CIMS) are also being implemented to enhance data management and analytics capabilities.

|

Drishti Mains Question: Discuss the major challenges associated with the digitalisation of the Indian economy. How can these challenges be effectively addressed to ensure inclusive and sustainable growth? |

UPSC Civil Services Examination Previous Year Questions (PYQs)

Prelims:

Q. Consider the following statements: (2021)

- The Governor of the Reserve Bank of India (RBI) is appointed by the Central Government.

- Certain provisions in the Constitution of India give the Central Government the right to issue directions to the RBI in public interest.

- The Governor of the RBI draws his power from the RBI Act.

Which of the above statements are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Mains:

Q. Implementation of Information and Communication Technology (ICT) based Projects/Programmes usually suffers in terms of certain vital factors. Identify these factors, and suggest measures for their effective implementation. (2019)