Important Facts For Prelims

RBI Surplus Transfer to Government

- 23 May 2024

- 5 min read

Why in News?

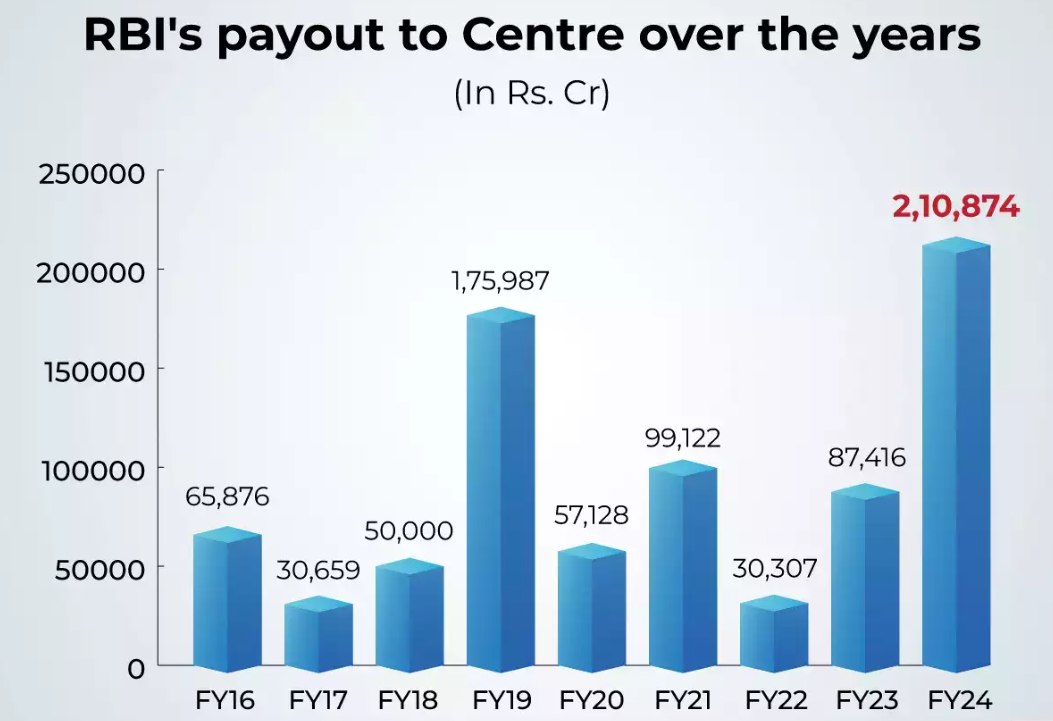

The Reserve Bank of India (RBI) has approved a significant surplus transfer of Rs 2.11 lakh crore to the Central Government for the accounting year 2023-24.

- This transfer marks a substantial increase from the previous year's dividend, showcasing a notable rise in surplus income.

How does the RBI Determine the Allocation of Dividends?

- The surplus calculation was based on the Economic Capital Framework (ECF) recommended by the Bimal Jalan committee, which advised the RBI to maintain a Contingent Risk Buffer (CRB) between 5.5% and 6.5% of its balance sheet.

- This risk provisioning is made primarily from retained earnings and only then is the surplus income transferred to the government as dividends.

- This range includes provisions for monetary and financial stability risks as well as credit and operational risks.

- RBI transfers its surplus, which is the excess of income over expenditure, to the government as per Section 47 of the Reserve Bank of India Act, 1934.

- Reasons for the Increase in RBI's Surplus: As of March 2024, the RBI had USD 646 billion in foreign exchange reserves, with USD 409 billion parked in top-rated sovereign securities.

- The RBI’s gross dollar sales were lower in FY24 (USD 153bn) compared to FY23 (USD 213 bn).

- Despite lower dollar sales in FY24 compared to FY23, the RBI's management of foreign currency assets ensured continued high revenue.

- Income from Liquidity Adjustment Facility (LAF) operations also contributed to the overall surplus.

- The RBI’s gross dollar sales were lower in FY24 (USD 153bn) compared to FY23 (USD 213 bn).

| Reserve Bank of India's Sources of Income | |

| Source of Income |

|

| Expenditure |

|

| Surplus |

|

Bimal Jalan Committee Recommendations

- Formation:

- The RBI in 2018 constituted a six-member committee, chaired by former governor Dr Bimal Jalan, to review the current economic capital framework (ECF), after the Ministry of Finance asked the central bank to follow global practices.

- Recommendations:

- The panel proposed a clear separation of RBI's economic capital into two parts: Realised equity and Revaluation balances.

- Revaluation reserves include unrealised gains/losses in foreign currencies, gold, securities, and a contingency fund.

- Realised equity, or CRB, is funded by retained earnings to cover risks and losses.

- The committee suggested that the RBI should maintain a CRB within the range of 6.5% to 5.5% of the RBI's balance sheet.

- This would provide an adequate buffer against market risks, credit risks, and operational risks.

- The committee recommended that the RBI should transfer its surplus funds to the government only after maintaining the CRB within the suggested range.

- This would ensure that the RBI's financial resilience is not compromised while supporting the government's fiscal needs.

- The panel also suggested that the RBI’s ECF should be reviewed every five years.

- The panel proposed a clear separation of RBI's economic capital into two parts: Realised equity and Revaluation balances.

Note:

- The RBI Board's technical Committee, led by Y H Malegam in 2013, recommended a higher transfer of reserves and surplus to the government, which typically averages around 0.5% of the Gross Domestic Product (GDP) with a few exceptions.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Which of the following statements is/are correct regarding the Monetary Policy Committee (MPC)? (2017)

- It decides the RBI’s benchmark interest rates.

- It is a 12-member body including the Governor of RBI and is reconstituted every year.

- It functions under the chairmanship of the Union Finance Minister.

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 2 and 3 only

Ans: A

Q. If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do? (2020)

- Cut and optimize the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: B

-min.jpg)