Important Facts For Prelims

RBI Surplus Transfer

- 23 May 2023

- 4 min read

Why in News?

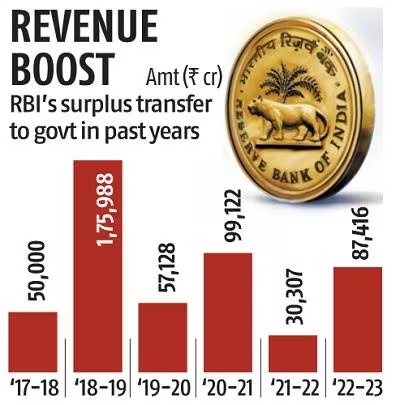

The Reserve Bank of India (RBI) has approved a significant transfer of surplus funds to the Union Government, providing a major boost to the fiscal position.

- The surplus transfer for the accounting year 2022-23 amounts to Rs 87,416 crore, a 188% increase compared to the previous year.

What Factors Contributed and Implications to the Surge in Surplus Transfer?

- Factors Contributed:

- Higher dividends from public sector banks and oil marketing companies.

- Increased earnings on investments, valuation changes on dollar holdings, revaluation of forex assets and adjustments in reserves as per the Bimal Jalan Committee recommendations and currency printing fees.

- Rupee depreciation against the dollar impacting the surplus transfer.

- Higher rates on the surplus distribution framework contributing to increased payouts.

- Higher earnings on the sale of foreign exchange and investments in US treasuries.

- Implications due to Surplus Transfer:

- Fiscal relief for the government, particularly in managing fiscal numbers amid uncertainties in the divestment program.

- Helps compensate for potential shortfalls in tax buoyancy and other revenue sources.

- When a tax is buoyant, its revenue increases without increasing the tax rate.

- Provides a fiscal buffer to support the budget targets.

- Surplus Transfer Impact on Disinvestment program:

- Assists in offsetting potential losses due to lower disinvestment, telecom pay-outs, or tax revenues.

- Enhances the government's ability to manage fiscal deficits with relative ease.

- Implications for Liquidity and Monetary Policy:

- Frictional liquidity is expected to ease in the near term due to dividend inflows and seasonal moderation in currency demand.

- Tight liquidity conditions may persist in the future, requiring the RBI to conduct open market operations worth Rs 1.5 lakh crore in the second half of FY24.

How does RBI Generate Surplus?

- RBI's Income:

- Interest on holdings of domestic and foreign securities.

- Fees and commissions from its services.

- Profits from foreign exchange transactions.

- Returns from subsidiaries and associates.

- Expenditure of RBI:

- Printing of currency notes.

- Payment of interest on deposits and borrowings.

- Salaries and pensions of staff.

- Operational expenses of offices and branches.

- Provisions for contingencies and depreciation.

- Surplus:

- The difference between RBI's income and expenditure is Surplus.

- RBI transfers the surplus to the government after making provisions for reserves and retained earnings.

- RBI transfers the surplus, in accordance with Section 47 (Allocation of Surplus Profits) of the Reserve Bank of India Act, 1934.

- A technical Committee of the RBI Board headed by Y H Malegam (2013), which reviewed the adequacy of reserves and surplus distribution policy, recommended a higher transfer to the government.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q1. If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do (2020)

- Cut and optimize the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Q2. With reference to Indian economy, consider the following: (2015)

- Bank rate

- Open market operations

- Public debt

- Public revenue

Which of the above is/are component/ components of Monetary Policy?

(a) 1 only

(b) 2, 3 and 4

(c) 1 and 2

(d) 1, 3 and 4

Ans: (c)