RBI’s Surveys & Indian Economy | 11 Aug 2022

For Prelims: RBI, RBI Survey, Monetary Policy

For Mains: Monetary Policy Review, Roles of RBI, Significance of Survey

Why in News?

Recently, the RBI unveiled its latest monetary policy review and seven surveys, ranging from consumer confidence to GDP growth expectations, that help it ascertain how the economy is doing.

- Widening Trade Deficit & Falling Rupee are also areas of major concern for Indian Economy.

Which Surveys were Unveiled by RBI?

- Consumer Confidence Survey (CCS):

- About:

- The CCS asks people across 19 cities about their current perceptions (in comparison with a year ago) and one-year ahead expectations on the general economic situation, employment scenario, overall price situation and own income and spending.

- Indices:

- The Current Situation Index (CSI)

- CSI has been recovering since falling to a historic low in July 2021.

- The Future Expectations Index (FEI)

- The FEI is in the positive bracket but even now it stays below the pre-pandemic levels.

- An index below the 100 mark implies people are pessimistic and a value higher than 100 conveys optimism.

- The Current Situation Index (CSI)

- About:

- Inflation Expectations Survey (IES):

- About:

- It tracks people’s expectations of inflation.

- Findings:

- Households’ inflation perception for the current period has moderated by 80 bps to 9.3%.

- About:

- OBICUS Survey:

- About:

- OBICUS stands for “Order Books, Inventories and Capacity Utilisation Survey”

- It covered 765 manufacturing companies in an attempt to provide a snapshot of demand conditions in India’s manufacturing sector from January 2022 to March 2022.

- Capacity Utilisation (CU):

- A low level of CU implies that manufacturing firms can meet the existing demand without needing to boost production.

- It has negative implications for job creation and the chances for private sector investments in the economy.

- A low level of CU implies that manufacturing firms can meet the existing demand without needing to boost production.

- Findings:

- The CU is well above the pre-pandemic level, suggesting India’s aggregate demand is recovering steadily.

- About:

- Industrial Outlook Survey (IOS):

- This survey tries to track the sentiments of the businessmen and businesswomen.

- The survey encapsulates qualitative assessment of the business climate by Indian manufacturing companies.

- Services and Infrastructure Outlook Survey (SIOS):

- This survey does a qualitative assessment of how Indian companies in the services and infrastructure sectors view the current situation and the future prospects.

- The companies in the services space are far more optimistic than the companies in the infrastructure sector.

- Bank Lending Survey (BLS):

- It captures the mood (qualitative assessment and expectations) of major scheduled commercial banks (SCBs) on credit parameters (loan demand and terms & conditions of loans) for major economic sectors.

- Survey of Professional Forecasters (SPF):

- It is a survey of 42 professional forecasters (outside the RBI) on key macroeconomic indicators such as GDP growth rate and inflation rate in the current year and the next financial year.

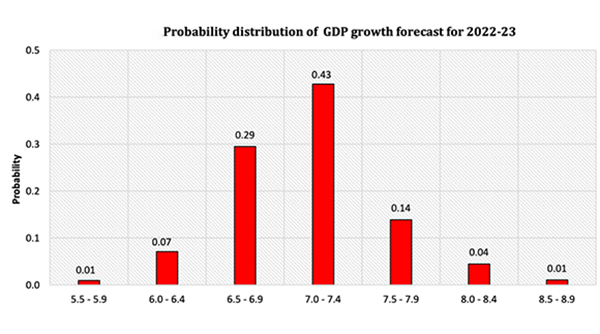

- GDP Expectations:

- India’s real GDP is expected to grow by 7.1% in 2022-23, projections revised down by 10 basis points from the last survey round and it is expected to grow by 6.3% in 2023-24.

- Findings:

- The highest probability is that GDP growth will range between 7%-7.4%, the second most probable outcome is that the growth rate will decelerate to 6.5%-6.9% range.

What is the Current State of Trade Deficit & Indian Rupee?

- Trade Deficit:

- About:

- The trade data details what goods (only goods, and not services) India imported and exported in July 2022. It presents this in value terms (in Indian rupees or US dollars).

- Findings:

- The Trade Deficit in the first four months of FY 2022-23 is already more than 50% of FY 2021-22 full year deficit.

- On a Year-on-Year (YoY) basis, exports dipped, while imports recorded a sharp rise in July 2022 on the back of higher commodity prices.

- The $20 billion YoY rise in imports was led by petroleum products and coal, negating the relief offered by a fall in gold imports.

- The Trade Deficit in the first four months of FY 2022-23 is already more than 50% of FY 2021-22 full year deficit.

- About:

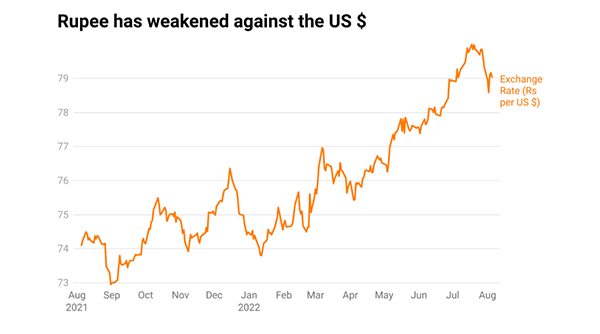

- Indian Rupee:

- Indian Rupee, in comparison to US Dollar, has fallen from Rs 74.2 in August 2021 to Rs 80 in July 2022.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. Consider the following statements:

- The Governor of the Reserve Bank of India (RBI) is appointed by the Central Government.

- Certain provisions in the Constitution of India give the Central Government the right to issue directions to the RBI in public interest.

- The Governor of the RBI draws his power from the RBI Act.

Which of the above statements are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Exp:

- The Reserve Bank of India was established on April 1, 1935 in accordance with the provisions of the Reserve Bank of India Act, 1934.

- Though originally privately owned, since nationalisation in 1949, the Reserve Bank is fully owned by the Government of India.

- The RBI’s affairs are governed by a central board of directors. The board is appointed by the Government of India in line with the Reserve Bank of India Act. Hence, statement 1 is correct.

- The directors are appointed/nominated for a period of four years.

- If in the opinion of the Central Government, the Bank fails to carry out any of the obligations imposed on it by or under the Act, the Central Government may declare the Central Board to be superseded, and thereafter the general superintendence and direction of the affairs of the Bank shall be entrusted to such agency as the Central Government may determine.

- The Central Government may from time to time give such directions to the Bank as it may, after consultation with the Governor of the Bank, consider it necessary in the public interest. Hence, statement 2 is not correct.

- The Governor of RBI draws his powers from Section 7(3) of the RBI Act. He can exercise all powers and do all things that may be exercised and done by the RBI. Hence, statement 3 is correct.

- Therefore, option (c) is the correct answer.