RBI’s Framework for Reclassification of FPI to FDI | 13 Nov 2024

Why in News?

Recently, the Reserve Bank of India (RBI) introduced a framework to allow foreign portfolio investors to convert their investments to foreign direct investment (FDI).

What are the Key Highlights of the Framework?

- Threshold Crossing: Any foreign portfolio investor investing above 10% of the total paid-up equity has the option of divesting their holdings or reclassifying such holdings as FDI.

- FDI is the investment through capital instruments by a person resident outside India.

- In an unlisted Indian company or

- In 10% or more of the paid-up equity capital of a listed Indian company (Below 10% is considered Foreign portfolio investment (FPI)).

- FDI is the investment through capital instruments by a person resident outside India.

- Timely Conversion: The reclassification must be completed within five trading days from the transaction that results in breaching the 10% limit.

- Compliance Requirements: FPIs must adhere to reporting obligations under the Foreign Exchange Management (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019 (FEM (NDI) Rules, 2019).

- FEM (NDI) Rules, 2019 mandates that investments by non-residents in India must follow entry routes, sectoral caps, or investment limits unless specified otherwise.

- Sector Restrictions: Reclassification is not permitted in sectors where FDI is restricted E.g., Gambling and betting, Real Estate Business, Nidhi company (Mutual Benefit Funds Company) etc.

- Complementary Measures: It complements a similar update from the Securities and Exchange Board of India (SEBI) which mandates that once an FPI exceeds the 10% equity threshold, it may opt to convert the holdings to FDI.

Note

In order to curb opportunistic takeovers/acquisitions of Indian companies due to the Covid-19 pandemic, Government amended the FDI policy 2017 vide Press Note 3 (2020).

- It required entities from countries sharing a land border with India, or whose beneficial owner is from such countries, can only invest in India through the Government route.

- For the purpose of Press Note 3, India recognises Pakistan, Afghanistan, Nepal, Bhutan, China (including Hong Kong), Bangladesh and Myanmar as countries sharing land border with India (Bordering Countries).

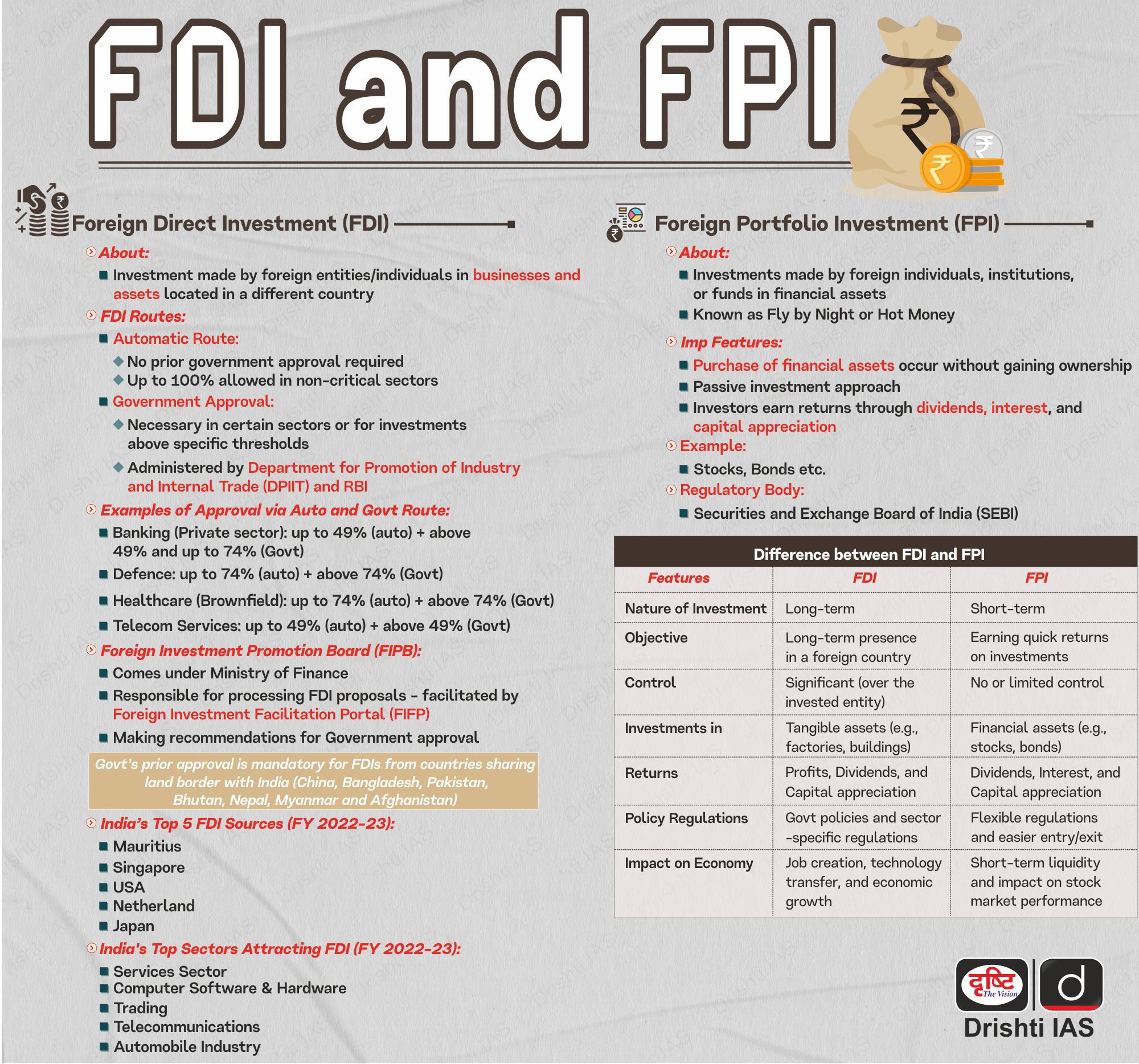

What is the Difference Between FDI and FPI?

| Parameter | FDI (Foreign Direct Investment) | FPI (Foreign Portfolio Investment) |

| Nature of Investment | Direct investment and business ownership in India by a foreigner. | Indirect investment in financial assets like stocks and bonds. |

| Investor Role | Active role | Passive role |

| Control and Influence | High degree of control over management and business operations. | No significant control over day-to-day operations of the company. |

| Asset Type | Physical assets of the foreign company. | Financial assets like stocks, bonds, and Exchange-Traded Fund (ETF). |

| Investment Approach & Time Frame | Long-term approach. It can take years to progress from planning to implementation. | Shorter term than FDIs. It is focused on market-linked gains. |

| Motive | Securing market access or strategic interests in a foreign country for long-term gains. | Short-term returns and market-linked gains. |

| Risk Factor | Generally more stable, but affected by the host country's policies, political environment, and regulations. | Generally more volatile due to fluctuations in asset prices. |

| Entry and Exit | Entry and exit are difficult. | Entry and exit are easy due to liquidity and wide trading of assets. |

UPSC Civil Services Examination, Previous Year Question

Q. Consider the following: (2021)

- Foreign currency convertible bonds

- Foreign institutional investment with certain conditions

- Global depository receipts

- Non-resident external deposits

Which of the above can be included in Foreign Direct Investments?

(a) 1, 2 and 3

(b) 3 only

(c) 2 and 4

(d) 1 and 4

Ans: (a)

Q. With reference to Foreign Direct Investment in India, which one of the following is considered its major characteristic? (2020)

(a) It is the investment through capital instruments essentially in a listed company.

(b) It is a largely non-debt creating capital flow.

(c) It is the investment which involves debt-servicing.

(d) It is the investment made by foreign institutional investors in the Government securities.

Ans: (b)