Indian Economy

FPI Disclosure Norms

- 31 Jan 2024

- 11 min read

For Prelims: Securities and Exchange Board of India (SEBI), Foreign portfolio investors (FPIs), Assets Under Management (AUM).

For Mains: FPI Disclosure Norms, Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Why in News?

Recently, the Securities and Exchange Board of India (SEBI) has extended more months to provide additional disclosures by the Foreign portfolio investors (FPIs).

- In May 2023, SEBI estimated that FPI Assets Under Management (AUM) of around Rs 2.6 lakh crore may potentially be identified as High-Risk FPIs requiring additional disclosures based on data as of 31st March 2023.

- High-risk FPI that own more than 50% or more of their equity (AUM) in a single corporate entity.

What are SEBI’s FPI Disclosure Norms?

- Requirement for Additional Disclosures:

- FPIs holding more than 50% of their Indian equity Assets Under Management (AUM) in a single Indian corporate group or holding over Rs 25,000 crore of equity AUM in the Indian markets are required to provide additional details.

- Timeline for Compliance:

- Existing FPIs that are in breach of the investment limits as of October 2023, are required to bring down their exposure within 90 calendar days unless they fall under any exempted categories.

- If FPIs do not meet the January-end deadline for disclosing data about their investors, they will reportedly get an additional seven months to liquidate their holdings.

- Liquidation of holding refers to the act of exiting a securities position, usually by selling the position for cash. For example, an investor can decide to sell some or all of the shares held for cash in their portfolio.

- Exempted Categories:

- Certain categories of FPIs are exempted from making additional disclosures.

- These include Sovereign Wealth Funds (SWFs), listed companies on certain global exchanges, public retail funds, and other regulated pooled investment vehicles with diversified global holdings.

- Certain categories of FPIs are exempted from making additional disclosures.

Why has SEBI Asked FPIs to Provide Additional Disclosures?

- Risk of Market Disruption: SEBI is concerned that FPIs with concentrated equity portfolios in a single investee company or corporate group may pose a risk to the orderly functioning of Indian securities markets.

- There is a worry that such entities, especially those with significant holdings, could potentially disrupt the market by misusing the FPI route.

- Potential Regulatory Circumvention: The regulator is wary of the possibility that promoters of investee companies or other investors acting in concert might use the FPI route to circumvent regulatory requirements.

- This includes avoiding disclosures mandated by the Substantial Acquisition of Shares and Takeovers Regulations, 2011 (SAST Regulations) or failing to meet the Minimum Public Shareholding (MPS) requirements in the listed company.

- Alignment with Regulatory Objectives: SEBI aims to ensure the integrity, transparency, and stability of the Indian securities markets.

- By obtaining detailed information from FPIs, the regulator seeks to align FPI activities with regulatory objectives, preventing misuse and maintaining market integrity.

- PN3 Exclusion: While Press Note 3 (PN3) issued by the Union government in April 2020 does not specifically apply to FPI investments, SEBI is still concerned about the potential misuse of the FPI route.

- SEBI believes that obtaining additional disclosures from FPIs is necessary to address these concerns and protect the interests of the Indian securities markets.

What is Press Note 3?

- During the Covid-19 pandemic, the Union government amended the Foreign Direct Investment (FDI) policy through a Press Note 3 (2020).

- The amendments were said to have been made to check opportunistic takeovers/acquisitions of stressed Indian companies at a cheaper valuation.

- The new regulations required an entity of a country, sharing a land border with India or where the beneficial owner of an investment into India is situated or is a citizen of any such country, to invest only under the Government route.

- There are two routes of Investment for foreign investors, the Government Route and the Automatic Route.

- The government route refers to obtaining official approval from regulatory bodies for foreign investments, whereas the Automatic Route allows investments without prior approval, common in sectors where foreign participation is encouraged.

- Also, in the event of the transfer of ownership of any existing or future FDI in an entity in India, directly or indirectly, resulting in the beneficial ownership falling within the restriction/purview of the said policy amendment, such subsequent change in beneficial ownership will also require government approval.

- Press Note 3 (2020) was enforced through Foreign Exchange Management (Non-Debt Instruments) Amendment Rules 2020.

- Press Note 3 is still enforceable as of January 2024.

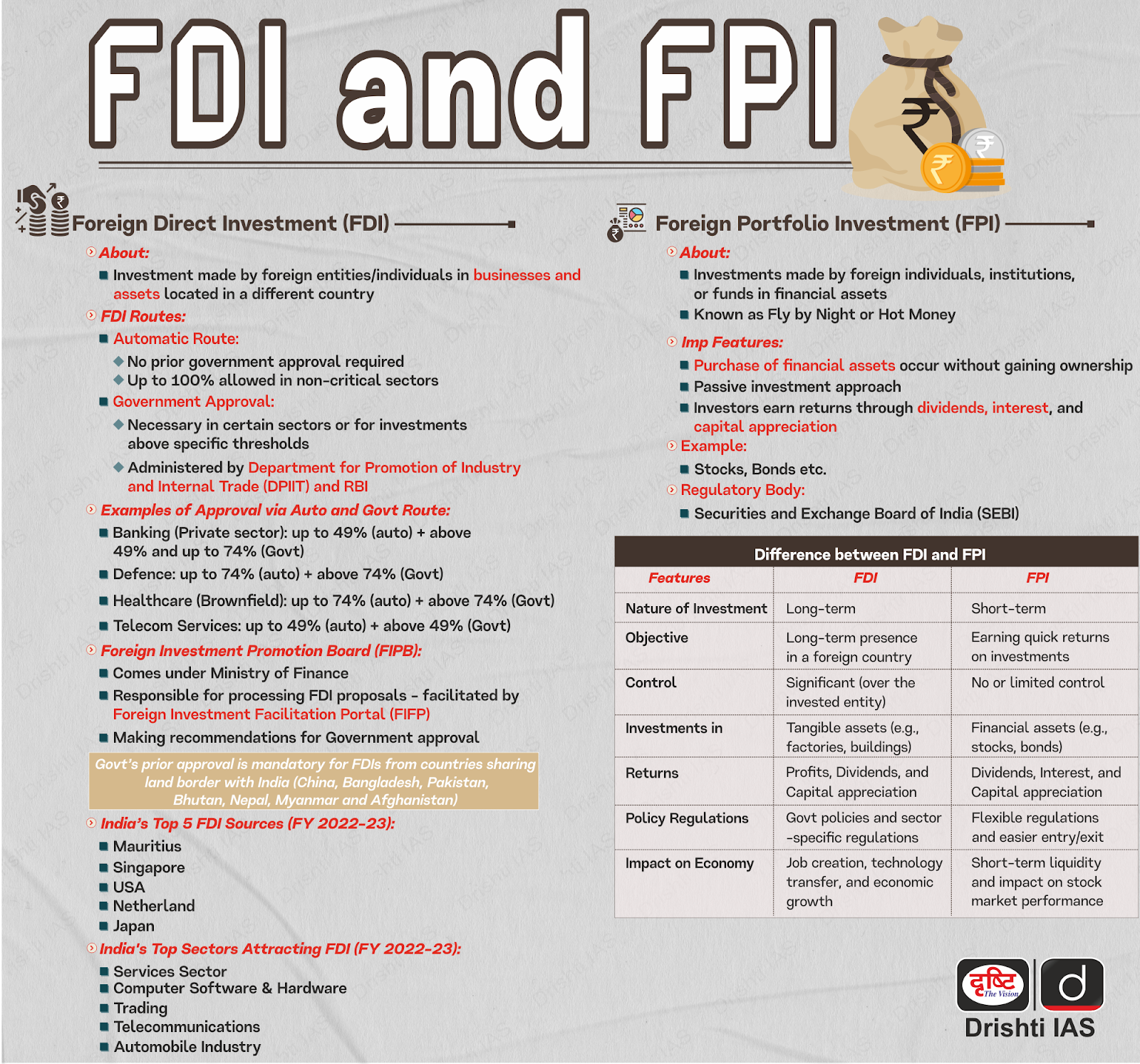

What are Foreign Portfolio Investors?

- Foreign portfolio investment (FPI) consists of securities and other financial assets passively held by foreign investors. It does not provide the investor with direct ownership of financial assets and is relatively liquid depending on the volatility of the market.

- Examples of FPIs include stocks, bonds, mutual funds, exchange-traded funds, American Depositary Receipts (ADRs), and Global Depositary Receipts (GDRs).

- FPI is part of a country’s capital account and is shown on its Balance of Payments (BOP).

- The BOP measures the amount of money flowing from one country to other countries over one monetary year.

- The Securities and Exchange Board of India (SEBI) brought new FPI Regulations, 2019, replacing the erstwhile FPI Regulations of 2014.

- FPI is often referred to as “hot money” because of its tendency to flee at the first signs of trouble in an economy. FPI is more liquid, volatile and therefore riskier than FDI.

What are the Advantages and Concerns Related to FPI?

- Advantages:

- FPI brings key advantages to India, including increased liquidity, higher stock market valuations and global market integration.

- The influx of foreign capital contributes to economic growth and competitiveness, particularly in technology-oriented sectors.

- Concerns:

- FPI entails risks, with market volatility influenced by global economic factors potentially causing instability and currency fluctuations.

- The intricate nature of FPI structures presents challenges in determining beneficial owners, raising concerns about potential fund misuse and tax evasion.

- Regulatory risks, shifts in global economic conditions, and reliance on foreign investment trends contribute to additional challenges in the FPI landscape.

UPSC Civil Services Examination, Previous Year Questions (PYQ)

Q. Which one of the following groups of items is included in India’s foreign-exchange reserves? (2013)

(a) Foreign-currency assets, Special Drawing Rights (SDRs) and loans from foreign countries

(b) Foreign-currency assets, gold holdings of the RBI and SDRs

(c) Foreign-currency assets, loans from the World Bank and SDRs

(d) Foreign-currency assets, gold holdings of the RBI and loans from the World Bank.

Ans: (b)

Q. With reference to Foreign Direct Investment in India, which one of the following is considered its major characteristic? (2020)

(a) It is the investment through capital instruments essentially in a listed company.

(b) It is a largely non-debt creating capital flow.

(c) It is the investment which involves debt-servicing.

(d) It is the investment made by foreign institutional investors in the Government securities.

Ans: (b)

- Foreign Direct Investment (FDI) is the investment through capital instruments by a person resident outside India in:

- An unlisted Indian company; or

- 10% or more of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company.

- Thus, FDI can be in a listed or unlisted company.

- The capital invested in India via FDI is non debt creating and not allowed to serve debt.

- An investment is called Foreign Portfolio Investment, if the investment made by a person (or institutional investors) resident outside India in capital instruments is:

- less than 10% of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company, or

- less than 10% of the paid up value of each series of capital instruments of a listed Indian company.

- Therefore, option (b) is the correct answer.

Mains:

Q.1 Justify the need for FDI for the development of the Indian economy. Why is there a gap between MoUs signed and actual FDIs? Suggest remedial steps to be taken for increasing actual FDIs in India. (2016)

Q.2 Foreign Direct Investment in the defence sector is now set to be liberalised. What influence is this expected to have on Indian defence and economy in the short and long run? (2014)