Paris Club | 06 Feb 2023

For Prelims: Paris Club, International Monetary Fund, Sri Lanka Economic Crisis, Organisation for Economic Co-operation and Development (OECD)

For Mains: India's Position on Bilateral Negotiation with Sri Lanka, India’s Neighborhood First Policy.

Why in News?

The Paris Club, an informal group of creditor nations, will provide financial assurances to the International Monetary Fund (IMF) on Sri Lanka’s debt.

- Sri Lanka needs assurance from the Paris Club and other creditors in order to receive a USD 2.9 billion bailout package from the IMF, following an economic crisis in 2022.

What is the Paris Club?

- About:

- The Paris Club is a group of mostly western creditor countries that grew from a 1956 meeting in which Argentina agreed to meet its public creditors in Paris.

- It describes itself as a forum where official creditors meet to solve payment difficulties faced by debtor countries.

- Their objective is to find sustainable debt-relief solutions for countries that are unable to repay their bilateral loans.

- The Paris Club is a group of mostly western creditor countries that grew from a 1956 meeting in which Argentina agreed to meet its public creditors in Paris.

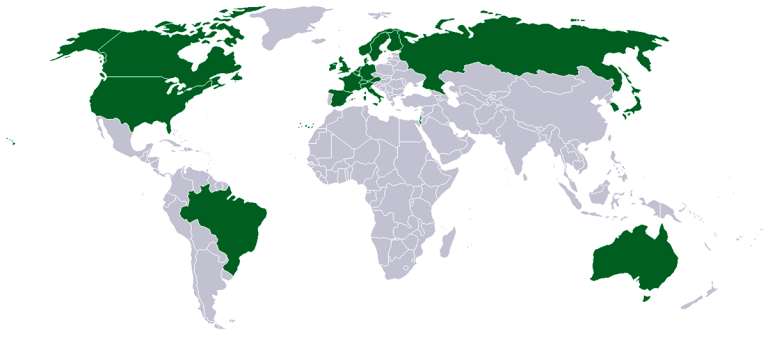

- Members:

- The members are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Israel, Japan, Netherlands, Norway, Russia, South Korea, Spain, Sweden, Switzerland, the United Kingdom and the United States.

- All 22 are members of the group called Organisation for Economic Co-operation and Development (OECD).

- Involved in Debt Agreements:

- According to its official website, Paris Club has reached 478 agreements with 102 different debtor countries.

- Since 1956, the debt treated in the framework of Paris Club agreements amounts to USD 614 billion.

- Recent Developments:

- The Paris group countries dominated bilateral lending in the last century, but their importance has receded over the last two decades or so with the emergence of China as the world’s biggest bilateral lender.

- In Sri Lanka’s case, for instance, India, China, and Japan are the largest bilateral creditors.

- Sri Lanka’s debt to China is 52% of its bilateral debt, 19.5% to Japan, and 12% to India.

What is India's Position on Bilateral Negotiation with Sri Lanka?

- India launched its own bilateral negotiations with Sri Lanka in January 2023.

- The Indian External Affairs Minister announced that India had written to the IMF providing the necessary financial assurances, adding that it hoped others would follow suit.

- The decision of financing assurance was also a reassertion of India’s belief in the principle of “neighborhood first”, and not leaving a partner to fend for themselves.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q1. "Rapid Financing Instrument" and "Rapid Credit Facility" are related to the provisions of lending by which one of the following? (2022)

(a) Asian Development Bank

(b) International Monetary Fund

(c) United Nations Environment Programme Finance Initiative

(d) World Bank

Ans: (b)

Exp:

- Rapid Financing Instrument (RFI) provides quick financial assistance, which is available to all member countries facing urgent balance of payments requirements. The RFI was created as part of a broader reform to make IMF financial support more flexible to meet the diverse needs of member states. The RFI replaces the IMF's previous emergency assistance policy and can be used in a wide variety of circumstances.

- The Rapid Credit Facility (RCF) provides immediate balance of payments (BoP) requirements to low-income countries (LICs) with no ex-post condition, where a full economic program is neither necessary nor feasible. RCF was set up as part of a comprehensive reform to make the fund's financial support more flexible and better suited to suit the diverse needs of LIC including times of crisis.

- There are three areas under the RCF: (i) a "regular window" for immediate BoP needs due to a wide range of sources such as household instability, emergencies and fragility (ii) for immediate BoP needs due to sudden, exogenous shocks. an “exogenous shock window” and (iii) a “large natural disaster window” for immediate BoP needs due to natural disasters where the damage is estimated to be equal to or greater than 20% of the member's GDP.

Q2. “Gold Tranche” (Reserve Tranche) refers to (2020)

(a) a loan system of the World Bank

(b) one of the operations of a Central Bank

(c) a credit system granted by WTO to its members

(d) a credit system granted by IMF to its members

Ans: (d)

Mains

Q1. In respect of India-Sri Lanka relations, discuss how domestic factors influence foreign policy. (2013)

Q2. ‘India is an age-old friend of Sri Lanka.’ Discuss India's role in the recent crisis in Sri Lanka in the light of the preceding statement. (2022)