International Relations

OPEC+ Plans Production Cuts

- 04 Sep 2024

- 11 min read

For Prelims: Organization of the Petroleum Exporting Countries, OPEC+, Renewable energy

For Mains: Challenges Related to India’s Energy Sector, Initiatives Shaping India’s Energy Transition

Why in News?

The recent announcement of Organization of the Petroleum Exporting Countries (OPEC)+ countries to cut oil production has raised concerns regarding global oil markets and India's energy security.

- With India's fuel consumption which is around 4.8 million barrels per day in 2024 is expected to reach 6.6 million barrels per day by 2028, these cuts may push Indian refiners to source more crude from the Americas, highlighting shifts in global oil trade.

What is the Organization of the Petroleum Exporting Countries (OPEC)?

- About:

- The Organization of the Petroleum Exporting Countries (OPEC) is a permanent, intergovernmental organisation, established at the Baghdad Conference in 1960, by Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela.

- Its headquarters is located in Vienna, Austria.

- Objective:

- OPEC aims to coordinate and unify petroleum policies among its member countries to ensure fair and stable prices for producers, provide an efficient and regular supply of petroleum to consumers, and deliver a fair return on investment for those involved in the industry.

- Members:

- Currently, the Organization has a total of 12 Member Countries: Algeria, Congo, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, United Arab Emirates and Venezuela.

- Qatar terminated its membership on 1 January 2019. Angola withdrew its membership effective 1 January 2024.

- OPEC nations produce about 30% of the world's crude oil.

- Saudi Arabia is the biggest single oil supplier within the group, producing more than 10 million barrels a day.

- OPEC reports that its member countries represent approximately 49% of global crude oil exports and possess about 80% of the world's proven oil reserves.

- Currently, the Organization has a total of 12 Member Countries: Algeria, Congo, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, United Arab Emirates and Venezuela.

- OPEC+:

- In 2016, in reaction to declining oil prices caused by a surge in US shale oil production, OPEC formed an alliance with 10 additional oil-producing nations, leading to the establishment of OPEC+.

- OPEC+ now includes the 12 OPEC member countries along with Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan, and Sudan.

- OPEC+ countries produce about 40% of all the world's crude oil.

- In 2016, in reaction to declining oil prices caused by a surge in US shale oil production, OPEC formed an alliance with 10 additional oil-producing nations, leading to the establishment of OPEC+.

Why is OPEC+ Planning to Cut Oil Production?

- Market Stabilisation: OPEC+ aims to stabilise and boost oil prices by cutting production, addressing fluctuating demand and oversupply.

- This strategy is intended to enhance revenue for oil-producing countries amid economic uncertainties and geopolitical tensions.

- Response to Non-OPEC Supply Increases: The International Energy Agency (IEA) forecasts a significant increase in non-OPEC+ crude supply, particularly from the US, Canada, Brazil, and Guyana.

- This influx challenges OPEC’s market share, prompting the group to implement cuts to maintain price stability.

- Respond to Geopolitical Tensions: Rising geopolitical tensions, such as conflicts in the Middle East and disruptions in shipping routes, ongoing sanctions on Russian crude exports have impacted oil supply and prices.

- OPEC+ aims to address these challenges through coordinated output cuts.

- Long-term Strategy: OPEC+ aims to ensure sustainable production levels and prevent market crashes, which can occur when supply exceeds demand. By controlling output, they are attempting to create a more predictable and stable market environment.

What are the Implications of OPEC+ Oil Production Cuts?

- Global Oil Prices:

- A reduction in OPEC+ output is likely to lead to higher oil prices globally. This can result in increased costs for importing countries, impacting inflation rates and economic growth.

- Implications for India:

- Shift in Supply Dynamics: With OPEC+ reducing production, India may increase crude oil imports from non-OPEC+ countries like the US, Canada, Brazil, and Guyana. This shift could diversify India's import sources, reducing reliance on West Asian crude oil.

- This diversification strategy is crucial as West Asian imports have already declined from 2.6 mb/d in 2022 to 2 mb/d in 2023.

- Potential for Price Volatility: For India, diversifying the range of suppliers can enhance energy security, but increased reliance on non-OPEC sources may expose India to price fluctuations in these markets, potentially leading to higher import bills and impacting the trade balance.

- India is the world’s third-largest consumer of crude oil (after the US and China) with a high import dependency level of over 85%.

- Economic Growth: Higher oil prices can strain the Indian economy, particularly sectors reliant on oil. This could lead to increased transportation costs and inflation, affecting overall economic stability.

- Shift in Supply Dynamics: With OPEC+ reducing production, India may increase crude oil imports from non-OPEC+ countries like the US, Canada, Brazil, and Guyana. This shift could diversify India's import sources, reducing reliance on West Asian crude oil.

What are the Projected Trends in India's Liquid Fuels Consumption and Capacity Expansion?

- Growing Fuel Consumption: India's consumption of liquid fuels is expected to grow significantly, with projections indicating an increase from 5.3 mb/d in 2023 to 6.6 mb/d by 2028, a rise of 26% over five years.

- This growth is attributed to various economic factors, including population growth, GDP growth, and rising GDP per capita.

- The EIA estimates that annual growth in liquid fuels consumption will average between 4% and 5% until 2037.

- Capacity Expansion: India has expanded its refining capacity by 1.3 mb/d between 2011 and 2023 and plans further expansions to meet rising domestic fuel demand.

- By 2028, 11 new crude oil capacity projects are expected, including the 1.2 mb/d Ratnagiri mega project.

What are the Major Challenges in India's Energy Sector?

- Energy Security and Import Dependency and Geopolitics: India relies on imports for over 75% of its oil needs which is projected to exceed 90% by 2040. This growing dependency on volatile international markets poses significant risks.

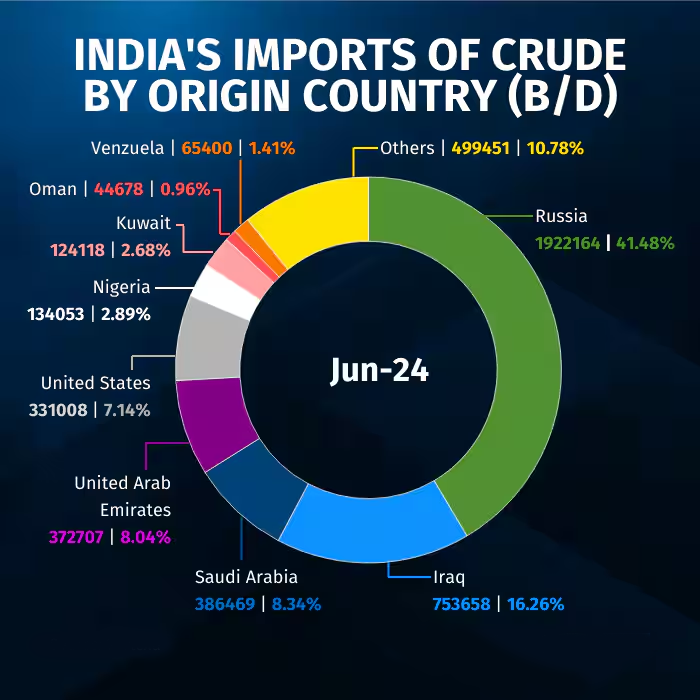

- Increasing dependence on imported oil has placed India's energy security under severe strain, and geopolitical disruptions such as Russia-Ukraine war and US, UK and EU sanctions over Russia have exacerbated the problem. Russian crude accounted for nearly 36% of India’s oil imports in FY24.

- India's energy transition to renewable energy faces challenges, including its dependency on China for renewable technologies and related raw materials.

- Domestic Production Decline: India's crude oil production has declined since 2011-12 due to insufficient investment in exploration and ageing oil fields.

- It declined from 32.2 million tonnes in 2019-20 to 29.2 million tonnes in 2022-23, according to government data.

- Infrastructure Bottlenecks: Limited pipeline infrastructure and storage facilities hinder the efficient transport and distribution of crude oil in India.

- It also includes issues such as land acquisition bottleneck, disinvestment, demand surge, lack of management skills, delay in regulatory clearances, climate change, under-investment bottleneck, etc.

- Rising Import Bill: India's economy is susceptible to global oil price fluctuations, resulting in rising import bills that threaten fiscal stability.

- India's net oil import bill is projected to reach USD 101-104 billion in FY25, up from USD 96.1 billion in FY24 which could negatively impact the economy by widening the current account deficit (CAD) and potentially causing higher inflation and fiscal deficits if not properly managed.

Way Forward

- Strengthening Bilateral Relations: India should focus on strengthening bilateral relations with oil-producing nations in the Americas to secure stable and favourable supply agreements.

- Investment in Domestic Refinery Capacity: Continued investment in refining capacity is essential. With plans for up to 11 new projects by 2028, India must prioritise these developments to enhance self-sufficiency and meet growing demand.

- Strategic Reserves: Building strategic petroleum reserves can provide a buffer against supply disruptions and price shocks, ensuring energy security during volatile market conditions.

- Diversification of Energy Sources: In addition to crude oil, India should explore alternative energy sources, including renewables, to reduce overall dependence on fossil fuels and enhance energy resilience.

- Monitoring Global Trends: Keeping a close watch on global oil market trends and OPEC+ decisions will allow India to adapt its energy strategy proactively, ensuring sustainable growth and stability in the energy sector.

|

Drishti Mains Question: What is OPEC? Analyse how changes in global oil supply dynamics, particularly from non-OPEC+ countries, may influence India's energy security and economic growth in the coming years. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Other than Venezuela, which one among the following from South America is a member of OPEC? (2009)

(a) Argentina

(b) Bolivia

(c) Ecuador

(d) Brazil

Ans: (c)

Mains

Q. “Access to affordable, reliable, sustainable and modern energy is the sine qua non to achieve Sustainable Development Goals (SDGs)”.Comment on the progress made in India in this regard. (2018)