Indian Economy

Need to Boost Labour Income and Consumption Expenditure

- 08 Feb 2022

- 7 min read

For Prelims: Important macroeconomic indicators of the Indian economy, Government Budgeting.

For Mains: Fiscal Consolidation Approach in the Budget 2022.

Why in News?

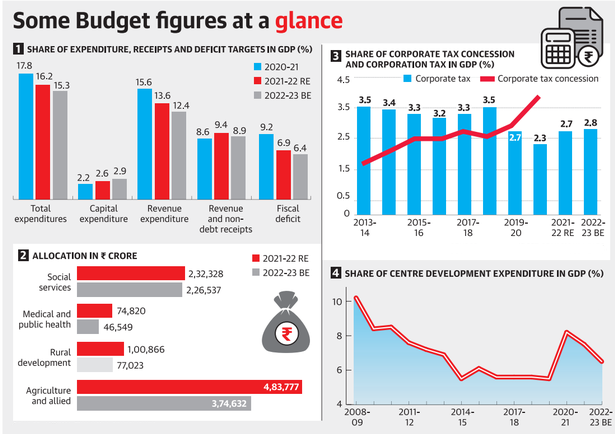

The Union Budget 2022-23 has projected a fiscal deficit of 6.4% of nominal GDP, a narrowing from the 6.9% assumed in the revised estimates for the current fiscal year ending on 31st March, 2022.

- In simple words, a fiscal deficit is a shortfall in a government's income compared with its spending.

- Nominal GDP is GDP (Gross Domestic Product) evaluated at current market prices. It includes all of the changes in market prices that have occurred during the current year due to inflation or deflation.

What was the Economic Context to this year’s Budget Formulation?

- Reduction in Labour Income and Consumption Expenditure:

- Though every economic crisis involves sharp reduction in output growth rate, the specificity of the present crisis in India lies in the sharper reduction in labour income as compared to profits.

- The consequent reduction in income share of labour was associated with a sharp fall in consumption-GDP ratio as well as absolute value of consumption expenditure during the pandemic.

- The four components of Gross Domestic Product (GDP) are personal consumption, business investment, government spending, and net exports.

- The consequent reduction in income share of labour was associated with a sharp fall in consumption-GDP ratio as well as absolute value of consumption expenditure during the pandemic.

- Though every economic crisis involves sharp reduction in output growth rate, the specificity of the present crisis in India lies in the sharper reduction in labour income as compared to profits.

- Structural Challenge:

- It is pertaining to addressing the structural constraints of the Indian economy that restricted growth even during the pre-pandemic period.

What are the Key Shortcomings in the Budget-22 in this Regard?

- Revenue Expenditure:

- The share of revenue and non-debt receipts in GDP has remained more or less unchanged, the objective of fiscal consolidation has been sought to be achieved primarily by reducing the expenditure-GDP ratio.

- Fiscal consolidation refers to the ways and means of narrowing the fiscal deficit.

- Hence, the brunt of this expenditure compression fell on revenue expenditure.

- Expenditure on the payment of wages and salaries, subsidies or interest payments would be typically classified as revenue expenditure.

- The share of revenue and non-debt receipts in GDP has remained more or less unchanged, the objective of fiscal consolidation has been sought to be achieved primarily by reducing the expenditure-GDP ratio.

- Effect on Income and Livelihood of Labour:

- Since the bulk of the revenue expenditure comprises food subsidies and current expenses in social and economic services, reduction in the allocation for revenue expenditure has been associated with fall in several key expenditure that affect the income and livelihood of labour.

- For example, allocation for both agriculture and allied activities and rural development registered a sharp decline in nominal absolute terms in 2022-23 as compared to 2021-22.

- Similarly, in the midst of the ongoing pandemic, total nominal expenditure on medical and public health registered a sharp fall in 2022-23 as compared to 2021-22. Such expenditure compression has been associated with the overall fall in the allocation for total social sector expenditure.

- Since the bulk of the revenue expenditure comprises food subsidies and current expenses in social and economic services, reduction in the allocation for revenue expenditure has been associated with fall in several key expenditure that affect the income and livelihood of labour.

- Low Corporate Tax Ratio:

- Despite sharp increase in profits during the pandemic, the corporate tax-GDP ratio has continued to remain below the 2018-19 level due to tax concessions. Despite the objective of fiscal consolidation, the corporate tax ratio continues to remain low and restrict revenue receipts.

What are the Implications for Development Spending?

- The objective of fiscal consolidation along with the inability to increase revenue receipts has posed a constraint on development expenditure.

- Developmental expenditure refers to the expenditure of the government which helps in economic development by increasing production and real income of the country.

- With non-development expenditure comprising of interest payments, administrative expenditure and various other components which are typically rigid downward, the brunt of expenditure compression has fallen on development expenditure.

- The reduction in the allocation for development expenditure ratio for 2022-23 reflects reduction in the allocation for food subsidies, national rural employment guarantee program, expenditure in agriculture, rural development and social sector.

What is the Concern from a Macroeconomic Perspective?

- Impact on the Recovery of Labour Income and Consumption Expenditure:

- Reduction in the allocation for development expenditure would have adverse impact on labour income and consumption expenditure.

- The positive impact of higher capital expenditure on the recovery process would be largely curtailed by the adverse impact of more than proportionate fall in revenue expenditure.

- Reduction in the allocation for development expenditure would have adverse impact on labour income and consumption expenditure.

- Dependent on External Factor for Economic Revival:

- Given the fiscal consolidation strategy of the Government, the prospect and extent of economic revival at the present remains heavily dependent on external demand.

- Despite the brief recovery in exports in the last few quarters, the possibility of sustained economic recovery relying exclusively on the export channel appears to be bleak at the present as different countries have already started pursuing fiscal consolidation at the dictate of the IMF (International Monetary Fund).

Way Forward

- In an economy where growth is largely consumption-driven, it is important that income reaches the hands of the lower and the middle-income groups. This extra money in the hands of the lower and middle incomes groups will reach into the consumption channel, spurring consumption-driven growth.

- India’s policy response needs to be ‘Keynesian’ — greater wealth taxation to channel resources towards social goals. This needs to be complemented by economic empowerment at the grassroots level by revitalising social security schemes targeted at income generation for lower income groups.

-min.jpg)