Indian Economy

Need of Reforms in Tea Industry

- 19 Sep 2024

- 12 min read

For Prelims: Tea Industry, Extreme Weather Events, Pesticide, Dooars, Terai, Nilgiris, Tea Board of India, Landslides, E-Commerce Technologies, Palm Oil, Farmer Field Schools (FFSs).

For Mains: Challenges in tea industry, impact of climate change on tea production.

Why in News?

Recently, the tea industry has seen a rise in price of around 13% for the Assam and West Bengal teas due to a drop in tea production in 2024.

- Extreme weather events and climate change are being held responsible for causing production losses and reforms are needed for its sustainable development.

What is the Current State of the Tea Industry in India?

- Recent Trends:

- Drop in Tea Production: Tea production has dropped in West Bengal and Assam by around 21% and 11% respectively in 2024 which has led to a 13% increase in domestic prices.

- Loss of Premium Products: The lost crop primarily belongs to the first and second shower of monsoon, considered the best quality teas of the year, further affecting the industry’s profitability and cash flows.

- Export Market Decline: Export prices have fallen by 4% this year, which is a discouraging trend.

- Pending Subsidies from the Tea Board: The industry has been waiting for due subsidies from the Tea Board for developmental work carried out in recent years. The non-receipt of subsidies has added to the financial burden, especially during a year of reduced production.

- Other Facts Related to Tea Industry:

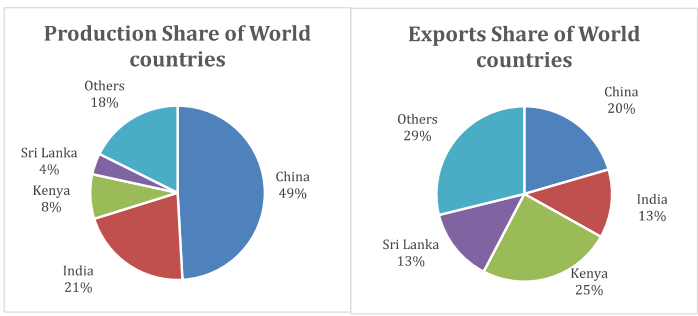

- Global Standing: India is the second-largest producer of tea globally after China. India ranks among the top 5 tea exporters globally, contributing approximately 10% of the total global tea exports.

- From April 2023-February 2024, the total value of tea exports from India stood at USD 752.85 million.

- Tea Consumption in India: India accounted for 19% of global tea consumption.

- India consumes approximately 81% of its total tea production domestically, in contrast to countries like Kenya and Sri Lanka which export the majority of their production.

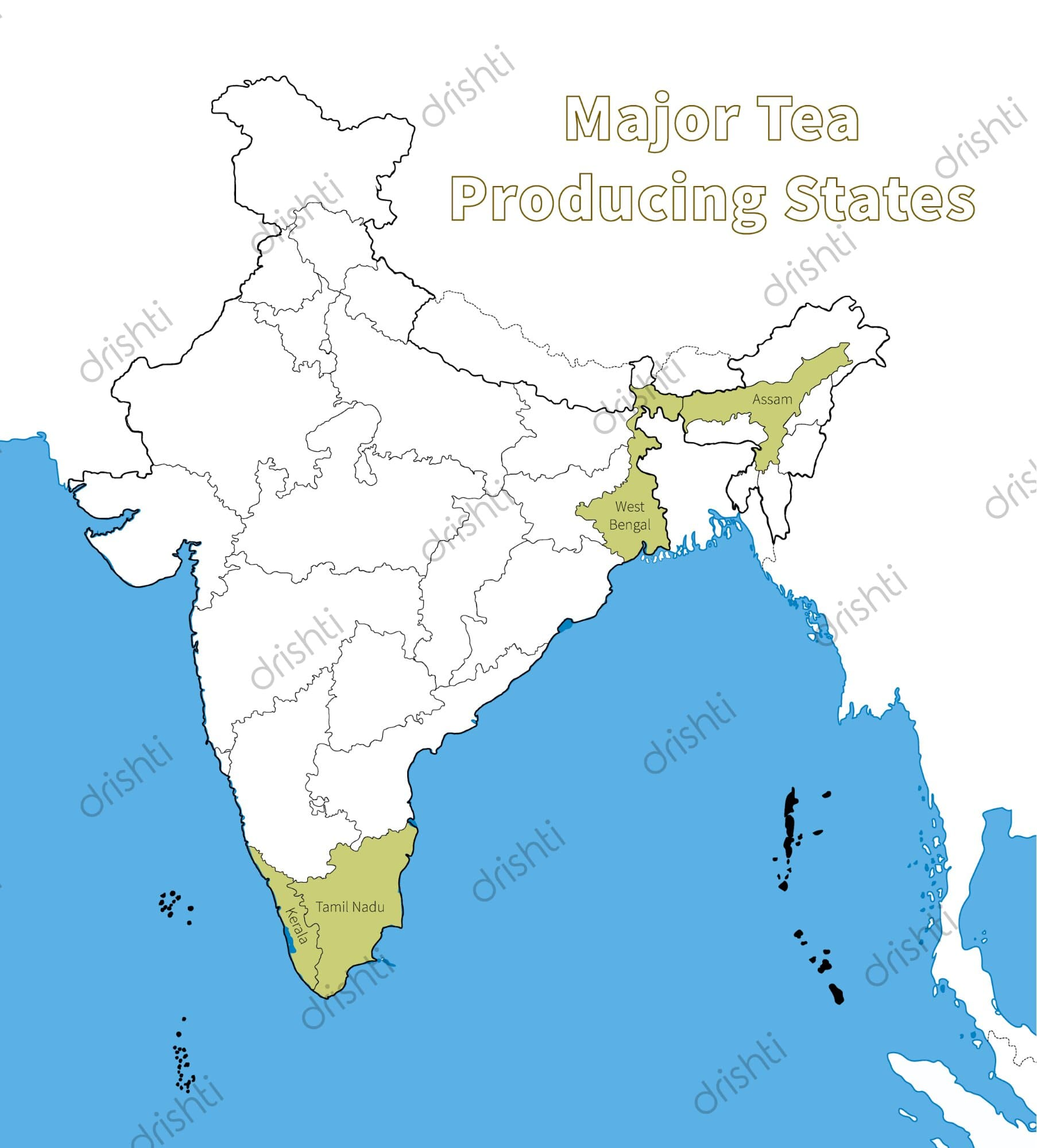

- Producer States: Major tea growing states are Assam, West Bengal, Tamil Nadu, and Kerala that account for 97% of India's total tea production.

- Major Export Types: Majority of the tea exported out of India is black tea which makes up about 96% of the total exports. Assam, Darjeeling, and Nilgiri tea are considered one of the finest in the world.

- Global Standing: India is the second-largest producer of tea globally after China. India ranks among the top 5 tea exporters globally, contributing approximately 10% of the total global tea exports.

What are the Key Challenges in the Tea Industry in India?

- Weather-Driven Decline: India’s tea production has been significantly impacted by extreme weather events, particularly excessive heat in May 2024 followed by flooding in Assam.

- In May 2024, Indian tea production dropped to 90.92 million kgs from 130.56 million kgs in May 2023, marking the lowest May output in more than 10 years.

- Expected Rise in Tea Prices: The average price of tea is expected to rise by up to 20% as a result of production disruptions.

- In July 2024, the price of tea represented a 47% increase since the start of 2024.

- Ban on Pesticides: The Indian government banned 20 pesticides that have contributed to higher tea prices due to costly alternatives to pesticides.

- However, after the pesticide ban, demand for Indian tea has risen again, particularly among Russia, Ukraine, Belarus, Azerbaijan, and Kazakhstan, which are key buyers of Indian tea.

- Although the ban on pesticides has increased demand, it has also led to production challenges, as tea growers scramble to find alternative pest management solutions.

- Stagnant Internal Consumption: With internal consumption nearly stagnant and the exports scenario depressed, excess tea continues to flood the market, further straining price realisation.

- Impact on Small Tea Growers (STGs): STGs, which operate on holdings of less than one hectare, account for over 55% of India’s total tea production and 65% of West Bengal’s tea output.

- Loss of production and decline in export price disproportionately impact them.

- Negative Ripple Effect: It would have a negative impact on the bought leaf factories (BLFs), as STGs provide raw material for these factories.

- BLFs are tea factories that buy tea leaves from other growers and process them into finished tea.

- Garden Closures in North Bengal: Approximately 13 to 14 tea gardens in the Dooars, Terai, and Darjeeling regions have closed down, affecting more than 11,000 workers.

- North Bengal produces approximately 400 million kg of tea annually from around 300 gardens.

Global Tea Statistics

- Global Production and Consumption: In 2022, the total global tea production was 6,478 million kg, while global tea consumption amounted to 6,209 million kg.

- Exports: Total tea exports from producing countries in 2022 amounted to 1,831 million kg.

- Major Producers: China, India, Kenya, and Sri Lanka are the leading tea producers and exporters. These countries account for 82% of global tea production and 73% of global tea exports.

Tea Board of India

- Establishment: It was established in 1953 and is headquartered in Kolkata. It has 17 offices across India.

- Statutory Body: It was set up under section 4 of the Tea Act, 1953.

- Regulatory Authority: It regulates various entities including tea producers, manufacturers, exporters, tea brokers, auction organisers, and warehouse keepers.

- Functions: It conducts market surveys, analyses, identifies, tracks consumer behaviour, and provides relevant and accurate information to importers and exporters.

How Climate Change Affects the Tea Industry Globally?

- Excessive Rainfall: While tea plants depend on rainwater, excessive rainfall can cause water logging, soil erosion and slope damage, reducing available plantation area.

- Drought Effects: Droughts can lead to dust accumulation on tea plants and block sunlight, impacting production in countries like India and China.

- Frost Damage: Frost is particularly harmful in places like Rwanda and China, where frozen leaves break under weight, leading to leaf loss.

- Melting of Glaciers: Permafrost regions may experience ground instability, increasing risks of rock avalanches and landslides.

- Rock avalanches and landslides may adversely impact tea plantations that requires hill slopes for its growth

- Impact on Tea Production and Quality: Global warming will make producing quality tea harder and more expensive.

- Both quality and quantity of tea will decline, leading to higher prices for consumers.

What Steps Need to be Taken to Make the Tea Industry More Viable?

- Minimum Benchmark Pricing: Regulated Tea Gardens (RTGs) and smallholder tea growers (STGs) should collaborate with the government to establish minimum benchmark prices for different grades of tea.

- The benchmark prices should be based on a cost-plus model to ensure that production costs are covered and to promote sector growth and export potential.

- E-Commerce Integration: Utilise e-commerce technologies and mobile applications to facilitate direct-to-consumer sales to increase profit margin.

- Focus on Premium Teas: The industry should shift focus towards improving quality which will fetch more income to the growers rather than just increasing quantity.

- Demand for premium teas is likely to increase as the income of consumers rises.

- Palm Oil as a Complementary Crop: STGs and RTGs should explore diversifying into palm oil production as tea estates in northeastern India are suitable for this crop.

- Palm oil cultivation requires less intensive labour, minimal water, and has high returns.

- Learning from Other Countries: Equipping farmers with knowledge to produce high-quality tea sustainably is critical.

- Kenya Tea Development Agency (KTDA) has introduced the Farmer Field Schools (FFSs) model that offers hands-on learning on increasing productivity and quality through planting, fine-plucking, preparing for certification, etc.

- Full Auction System: Full auction system should be introduced for ensuring 100% of bought leaf tea is sold through a public auction system.

- Currently, only 40% of tea leaves are auctioned, affecting price realisation.

- Expanding Export Destinations: The ready-to-drink (RTD) tea market in the Asia Pacific region is forecast to reach USD 6.67 billion by 2028, growing at an annual rate of 5.73%.

- India is well-positioned to capitalise on this market.

- Need of Research and Development (R&D): R&D is vital for enhancing tea quality, developing climate-resilient varieties, and finding eco-friendly solutions, such as organic pesticides, to address challenges occurring due to climate change.

|

Drishti Mains Question: Q.Discuss the major challenges facing the tea industry in India. How can policy interventions and technological advancements help address these challenges? |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. With reference to the "Tea Board" in India, consider the following statements: (2022)

- The Tea Board is a statutory body.

- It is a regulatory body attached to the Ministry of Agriculture and Farmers Welfare.

- The Tea Board's Head Office is situated in Bengaluru.

- The Board has overseas offices at Dubai and Moscow.

Which of the statements given above are correct?

(a) 1 and 3

(b) 2 and 4

(c) 3 and 4

(d) 1 and 4

Ans: (d)

Mains

Q. Whereas The British planters had developed tea gardens all along the Shivaliks and LesserHimalayasfrom Assam to Himachal Pradesh, in effect they did not succeed beyond the Darjeeling area. Explain. (2014)

-min.jpg)