Indian Economy

Need of Reforms in Diamond Sector

- 23 Sep 2024

- 10 min read

For Prelims: Diamond, Rough Diamonds, Gross Domestic Product (GDP), Employment, Foreign Direct Investment (FDI), Reserve Bank of India (RBI), Inflation, Lab-Grown Diamonds, Interest Rate, Corporate Tax, Special Notified Zones (SNZs), India-UAE Comprehensive Economic Partnership Agreement (CEPA).

For Mains: Importance of Gems and Jewellery Industry for India, Associated challenges and way forward.

Why in News?

According to the think tank Global Trade Research Initiative (GTRI), India's diamond sector is experiencing a major downturn, marked by significant declines in imports and exports over the past three years.

- It has led to defaults, factory closures, and widespread job losses for which reforms in the diamond sector are needed.

What is the Current State of Crisis in India's Diamond Industry?

- Sharp Decline in Diamond Imports and Exports: Rough diamond imports fell by 24.5%, from USD 18.5 billion in FY 2021-22 to USD 14 billion in FY 2023-24.

- Exports of cut and polished diamonds dropped by 34.6%, from USD 24.4 billion in FY 2022 to USD 13.1 billion in FY 2024.

- High Inventory of Unprocessed Rough Diamonds: The gap between net imports of rough diamonds and net exports of cut and polished diamonds has widened significantly, from USD 1.6 billion in FY 2022 to USD 4.4 billion in FY 2024.

- Rough Diamonds refer to diamonds which are still in their natural state after being removed from the earth and before being shaped and polished.

- Increased Returns of Unsold Diamonds: The percentage of unsold diamonds returned to India rose from 35% to 45.6% during the period from FY 2022 to FY 2024.

- Impact on Employment and Factory Closures: The industry, which provides direct employment to 1.3 million workers, has been hit hard leading to joblessness and suicides.

What is the Importance of Gems and Jewellery Industry for India?

- Contribution to India’s Economy: As of January 2022, the gold and diamond trade accounted for approximately 7% of India’s Gross Domestic Product (GDP), showcasing its significant role in the national economy.

- Employment: The gems and jewellery sector employs around 5 million people, making it a crucial industry for job creation in India.

- The Indian diamond industry comprises over 7,000 companies, mainly small and medium enterprises (SMEs), concentrated in Surat in Gujarat, and Mumbai in Maharashtra.

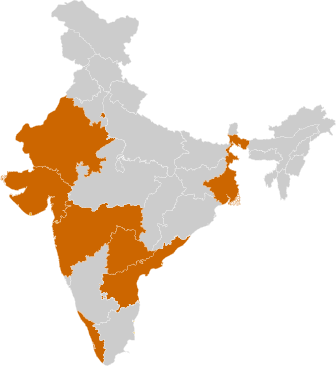

- Surat, Mumbai, Jaipur, Thrichor, Nellore, Delhi, Hyderabad and Kolkata are the major hubs for gems and jewellery in India.

- Surat alone employs about 800,000 workers in diamond cutting and polishing.

- FDI Policy: The Government has allowed 100% Foreign Direct Investment (FDI) in the gems and jewellery sector under the automatic route.

- Between April 2000 and March 2024, cumulative FDI inflows into India’s diamond and gold ornaments sector totaled USD 1,276.52 million.

- Growth and Export Performance: In FY2021, the size of India’s gems and jewellery market stood at USD 78.50 billion.

- In FY24, India's gems and jewellery exports were at USD 22.27 billion, reflecting the sector's resilience despite global challenges.

What are the Reasons for the Crisis in India's Diamond Industry?

- Economic Uncertainty: Demand for polished diamonds has dropped sharply in key markets like the US, China, and Europe due to economic uncertainty, inflation, and geopolitical tensions, leading to reduced consumer spending on luxury goods, including diamonds.

- Russia-Ukraine Conflict: The Russia-Ukraine conflict has also disrupted the global diamond supply chain, with sanctions on Russia, a major rough diamond producer.

- It further complicated trade and slowed down the global diamond trade.

- Fluctuations in Prices: Fluctuations in global diamond prices have caused uncertainty, with buyers hesitant to purchase rough diamonds in anticipation of further price drops.

- Preferences to Lab-Grown Diamonds: Consumer preferences are shifting toward lab-grown diamonds, which are more affordable, ethical, and sustainable. It is also impacting the demand for natural diamonds.

- Lab grown diamonds are man made diamonds that are chemically and optically identical to natural mined diamonds.

- Rising Operational Costs: Rising operational costs (high labour, energy, and materials cost) and reduced profit margins in the global diamond trade, have made it difficult for many polishing units to remain viable.

- It has led to shop closures and layoffs, especially in Surat.

- Tighter Credit Conditions: The diamond industry is heavily dependent on financing, but tighter credit conditions like higher interest rates and reduced lending from banks have made it difficult for companies to purchase rough diamonds, stalling production further.

- Regulatory Issues: India’s high corporate tax regime on foreign suppliers of rough diamonds has led to more rough diamonds being re-exported from UAE, rather than India thus weakening India’s Special Notified Zones (SNZs) in Mumbai and Surat.

- UAE imports rough diamonds from Botswana, Angola, South Africa, Russia and re-exports these to India.

- As a result, UAE’s share in India’s rough diamond imports has surged, from 36.3% in FY 2020 to 64.5% in the first quarter of FY 2024, while Belgium’s share fell from 37.9% to 17.6% during the same period.

- UAE enjoys zero tariff on cut and polished diamonds exported to India under the India-UAE Comprehensive Economic Partnership Agreement (CEPA).

- Complex Customs Procedures: A significant portion of cut and polished diamonds exported from India are being returned due to quality issues, overstocking by buyers etc.

- Handling these returns is costly and time-consuming due to complex customs procedures, putting further strain on exporters.

What can be Done to Address the Crisis in India's Diamond Industry?

- Extend Export Credit Terms: The Reserve Bank of India (RBI) could extend the export credit period for cut and polished diamond exporters from 6 to 12 months, as buyers demand longer credit terms.

- The export credit period refers to the duration for which credit is extended to exporters to finance their export operations.

- Exempt Foreign Diamond Sellers from Corporate Tax: GTRI suggests exempting foreign sellers of rough diamonds from corporate tax in India, as the current tax structure pushes sellers to re-routing it through the UAE.

- Regulate the Lab-Grown Diamond Industry: The rising demand for lab-grown diamonds requires regulation to ensure a fair and sustainable market for natural diamonds.

- Reconsider Zero Tariff Import from Dubai: The zero tariff on cut and polished diamonds imported from UAE under the India-UAE trade pact needs to be reconsidered to protect the domestic diamond industry.

- Shift towards Organised Players: Large retailers and organised players can offer a wider variety of designs and products and help in expanding India’s gems market both domestically and internationally.

|

Drishti Mains Question: Examine the importance of the Gems and Jewellery Industry for India’s economy. Also, analyse the key challenges it is facing in recent times. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q.Which one of the following foreign travellers elaborately discussed about diamonds and diamond mines of India? (2018)

(a) Francois Bernier

(b) Jean-Baptiste Tavernier

(c) Jean de Thevenot

(d) Abbe Barthelemy Carre

Ans: (b)