Indian Economy

National Urban Cooperative Finance and Development Corporation Limited

- 14 Mar 2024

- 7 min read

For Prelims: National Urban Cooperative Finance and Development Corporation Limited, Urban cooperative banks, Multi-State Cooperative Societies Act, 2002, Banking Regulation Act, 1949, N. S. Vishwanathan Committee, Small Finance Banks.

For Mains: Major Issues Related to the UCBs, Issues Related to Banking Sector in India.

Why in News?

Recently, the Union Minister for Cooperation inaugurated the National Urban Cooperative Finance and Development Corporation Limited (NUCFDC), an umbrella organisation for urban cooperative banks (UCB).

- NUCFDC has received Reserve Bank of India (RBI)’s approval to function as a non-banking finance company and a self-regulatory organisation for the urban cooperative banking sector.

What are Urban Cooperative Banks?

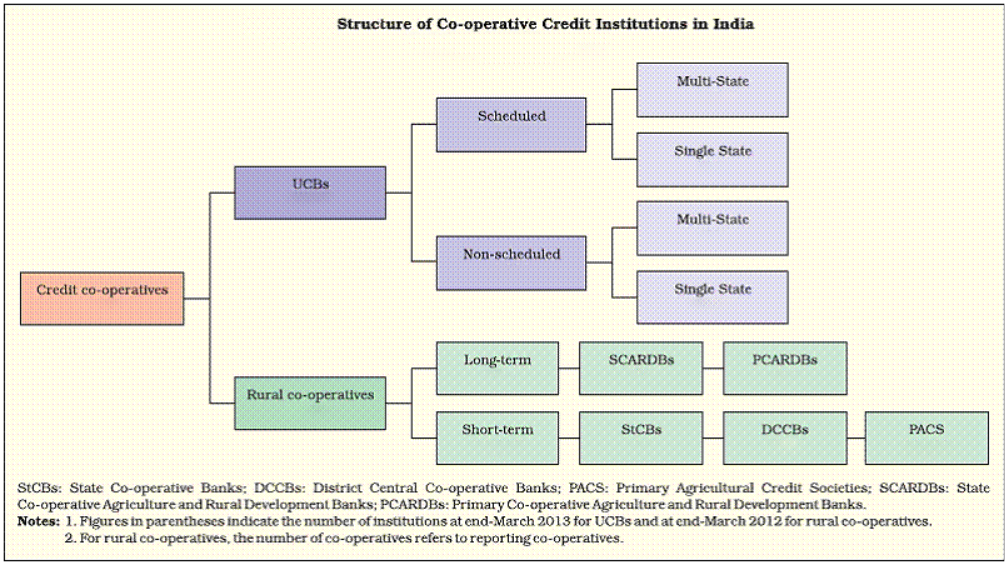

- About: Cooperative banks are financial institutions that are owned and operated by their members, who are also the bank's customers.

- In order to support the financial needs of a community such as a village or a specific community, people come together to pool resources and provide banking services such as loans.

- In India, they are registered under the Cooperative Societies Act of the State concerned or the Multi-State Cooperative Societies Act, 2002.

- Urban Co-operative Banks (UCBs) refers to primary cooperative banks located in urban and semi-urban areas.

- In order to support the financial needs of a community such as a village or a specific community, people come together to pool resources and provide banking services such as loans.

- History:

- The urban cooperative banking movement in India originated at the end of the 19th century, influenced by successful cooperative experiments in Britain and Germany.

- The "Anyonya Sahakari Mandali" in the princely State of Baroda is believed to be the earliest mutual aid society in India.

- Also, the first urban cooperative credit society was registered in Canjeevaram (Kanjivaram) in the erstwhile Madras province in October, 1904.

- The urban cooperative banking movement in India originated at the end of the 19th century, influenced by successful cooperative experiments in Britain and Germany.

- Regulator: The Reserve Bank regulates the banking functions of Urban Cooperative Banks under the provisions of Sections 22 and 23 of the Banking Regulation Act, 1949.

- Also, State Cooperative Banks, District Central Cooperative Banks and Urban Cooperative Banks, which are registered with Deposit Insurance and Credit Guarantee Corporation are insured.

- Four Tier Structure:

- In 2021 RBI appointed N. S. Vishwanathan committee that suggested a 4-tier structure for the UCBs.

- Tier 1 with all unit UCBs and salary earner’s UCBs (irrespective of deposit size) and all other UCBs having deposits up to Rs 100 crore.

- Tier 2 with UCBs of deposits between Rs 100 crore and Rs 1,000 crore,

- Tier 3 with UCBs of deposits between Rs 1,000 crore and Rs 10,000 crore, and

- Tier 4 with UCBs of deposits more than Rs 10,000 crore.

- In 2021 RBI appointed N. S. Vishwanathan committee that suggested a 4-tier structure for the UCBs.

- Minimum Capital and RWA: Tier 1 UCBs operating in a single district should have a minimum net worth of ₹2 crore. For all other UCBs the minimum net worth should be ₹5 crore.

- Tier 1 UCBs have to maintain a minimum capital to risk weighted assets ratio of 9% of Risk Weighted Assets (RWAs) on an ongoing basis.

- Tier 2 to 4 UCBs have to maintain a minimum capital to risk weighted assets of 12% of RWAs on an ongoing basis.

- UCBs with a minimum net worth of Rs.500 million and maintaining Capital to Risk (Weighted) Assets Ratio of 9% and above are eligible to apply for voluntary transition to Small Finance Banks.

- Current Status: Currently, there are 1,514 UCBs in India, accounting for 11% of the total credit to agriculture. The total deposit base of UCBs stands at ₹5.26 trillion.

Note

NABARD is entrusted with the responsibility for conduct of statutory inspections of State Cooperative Banks, District Central Cooperative Banks and Regional Rural Banks under the Banking Regulation Act, 1949.

- The regulatory powers continue to be vested with the Reserve Bank of India.

What are the Major Issues Related to the UCBs?

- High Non-performing Assets: Non-performing assets (NPAs) remain a significant concern for UCBs (2.10%). Poor credit appraisal practices, inadequate risk management frameworks, and exposure to vulnerable sectors contribute to high levels of NPAs, impacting profitability and stability.

- Limited Technology Adoption: Limited technological infrastructure and digital capabilities hinder UCBs' ability to offer modern banking services and compete with larger commercial banks.

- Inadequate investment in technology leads to inefficiencies, operational risks, and difficulties in meeting evolving customer expectations.

- Fraud and Mismanagement: Instances of fraud, embezzlement, and mismanagement have been reported in several UCBs (like Urban Co-operative Bank, Sitapur, Uttar Pradesh), eroding depositor confidence and tarnishing the sector's reputation.

- In the financial year 2022-23, RBI cancelled licences of 8 cooperative banks.

Way Forward

- Transparency and Accountability: UCBs need to embrace greater transparency in their operations and financial reporting to rebuild public trust. This includes regular audits and clear communication with members.

- Proactive Credit Risk Management: Implementing robust credit risk management practices to identify, assess, and monitor credit risks associated with lending activities.

- This involves conducting thorough credit assessments of borrowers, including comprehensive analysis of their financials, repayment capacity, and credit history.

- Additionally, establishing clear credit policies, risk grading systems, and early warning indicators can help UCBs detect potential NPAs at an early stage and take timely corrective actions to prevent defaults.

- Capacity Building: Investing in training and capacity building initiatives for UCB staff to enhance their skills, knowledge, and expertise in banking operations, risk management, and customer service. Urban Co-operative Banks: RBI - To The Point | Drishti IAS English

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. With reference to ‘Urban Cooperative Banks’ in India, consider the following statements:

- They are supervised and regulated by local boards set up by the State Governments.

- They can issue equity shares and preference shares.

- They were brought under the purview of the Banking Regulation Act, 1949 through an Amendment in 1966.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)