Indian Economy

Privatisation of Banks

- 17 Dec 2021

- 10 min read

For Prelims: Baking in India and related laws, Functions of RBI, Asset Reconstruction Company (Bad Bank)

For Mains: Privatisation of banks, its significance and related issues, Impact of Nationalisation of banks in pre liberalisation Era

Why in News

Recently, the government has decided to have a relook at some key aspects of Banking Laws (Amendment) Bill 2021 - which aims to Privatise Two Public Sector Banks (PSBs) - during the Winter session of Parliament.

- In the last session, the government passed a bill that will allow the privatisation of state-owned general insurance companies, through the General Insurance Business (Nationalisation) Amendment Bill, 2021.

Banking Laws (Amendment Bill 2021)

- The Bill aims to amend banking companies acquisition and transfer laws of 1970 and 1980 and the Banking Regulation Act, 1949 to achieve privatisation of two PSBs to meet disinvestment targets as stated by the finance minister in the Union Budget 2021-22.

- These laws had led to the nationalisation of banks, so relevant provisions of these laws have to be changed to pave the way for the privatisation.

- This move will bring down the minimum government holding in the PSBs from 51% to 26%.

Key Points

- About:

- Privatisation:

- The transfer of ownership, property or business from the government to the private sector is termed privatisation. The government ceases to be the owner of the entity or business.

- Privatisation is considered to bring more efficiency and objectivity to the company, something that a government company is not concerned about.

- India went for privatisation in the historic reforms budget of 1991, also known as 'New Economic Policy or LPG policy'.

- Nationalisation:

- Nationalisation is the process of taking privately-controlled companies, industries, or assets and putting them under the control of the government.

- It often happens in developing countries and can reflect a nation's desire to control assets or to assert its dominance over foreign-owned industries.

- Privatisation:

- Background:

- The government decided to nationalise the 14 largest private banks in 1969. The idea was to align the banking sector with the socialistic approach of the then government.

- State Bank of India (SBI) had been nationalised in 1955 itself, and the insurance sector in 1956.

- Various governments in the last 20 years were for and against privatisation of Public Sector Undertaking (PSU) banks. In 2015, the government had suggested privatisation but the then Reserve Bank of India (RBI) Governor did not favour the idea.

- The current steps of privatisation, along with setting up an Asset Reconstruction Company (Bad Bank) entirely owned by banks, underline an approach of finding market-led solutions to challenges in the financial sector.

- The government decided to nationalise the 14 largest private banks in 1969. The idea was to align the banking sector with the socialistic approach of the then government.

- Reasons for Privatisation:

- Degrading Financial Position of Public Sector Banks:

- Years of capital injections and governance reforms have not been able to improve the financial position of public sector banks significantly.

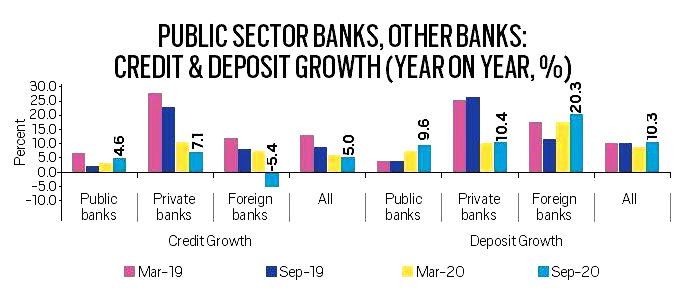

- Many of them have higher levels of stressed assets than private banks, and also lag the latter on profitability, market capitalization and dividend payment record.

- Part of a Long-Term Project:

- Privatisation of two public sector banks will set the ball rolling for a long-term project that envisages only a handful of state-owned banks, with the rest either consolidated with strong banks or privatised.

- The initial plan of the government was to privatise four. Depending on the success with the first two, the government is likely to go for divestment in another two or three banks in the next financial year.

- This will free up the government, the majority owner, from continuing to provide equity support to the banks year after year.

- Through a series of moves over the last few years, the government is now left with 12 state-owned banks, from 28 earlier.

- Privatisation of two public sector banks will set the ball rolling for a long-term project that envisages only a handful of state-owned banks, with the rest either consolidated with strong banks or privatised.

- Strengthening Banks:

- The government is trying to strengthen the strong banks and also minimise their numbers through privatisation to reduce its burden of support.

- Recommendations of Different Committees:

- Many committees had proposed bringing down the government stake in public banks below 51%:

- The Narasimham Committee proposed 33%.

- The P J Nayak Committee suggested below 50%.

- An RBI Working Group recently suggested the entry of business houses into the banking sector.

- Many committees had proposed bringing down the government stake in public banks below 51%:

- Creation of Big Banks:

- One of the objectives of privatisation is also to create big banks. Unless privatised PSBs are merged with existing large private banks, they cannot ultimately attain the kind of scale and size to develop higher risk appetite and lending capacity.

- Hence, privatisation is a multifaceted task considering all angles to tackle multiple challenges and exploring new ideas but it can pave the way for developing a more sustainable and strong banking system benefitting all stakeholders.

- Degrading Financial Position of Public Sector Banks:

- Issues:

- Rewarding Crony Capitalism:

- The privatisation of the PSBs is tantamount to selling the banks to private corporates, many of whom have defaulted on loans from the PSBs, and will only reward crony capitalism.

- Job Losses:

- The privatisation will also result in job losses, branch closures and financial exclusion.

- The privatisation will shrink employment opportunities for Scheduled Castes, Scheduled Tribes and Other Backward Classes (OBC) since the private sector does not follow reservation policies for the weaker sections.

- Financial Exclusion of Weaker Sections:

- The private sector banks concentrate on the more affluent sections of the population and the metropolitan/urban areas, leading to financial exclusion of weaker sections of the society, particularly in the rural areas.

- Public sector banks were taking banking to the rural areas and ensuring financial inclusion. He feared reversal of these gains may take place if PSBs are privatised.

- Bailout operation:

- Bank unions have termed the privatisation process a “bailout operation” for corporate defaulters.

- Private sector is responsible for the huge bad loans. In fact, they should be punished for this crime. But the government is rewarding them by handing over the banks to the private sector.

- Governance Issues:

- Industrial Credit and Investment Corporation of India (ICICI) Bank MD and CEO was sacked for allegedly extending dubious loans.

- Yes Bank CEO was not given extension by the RBI and now faces investigations by various agencies.

- Lakshmi Vilas Bank faced operational issues and was recently merged with DBS Bank of Singapore.

- Rewarding Crony Capitalism:

Banking Regulation Act, 1949

- It regulates banking firms in India. It was passed as the Banking Companies Act 1949. and was changed to the Banking Regulation Act,1949 from 1st March 1966.

- This act empowers the Reserve Bank of India (RBI) to.

- Issue licence to commercial banks, Regulate shareholders' shareholding and voting rights, Supervises the appointment of boards and management, Regulates the operations of banks, giving instructions for audit, Control moratorium, merger, and liquidation, Issues instructions to the banks in the interests of public welfare & banking policy, Impose a penalty on banks if required.

- In 2020, the government passed an ordinance to change the Banking Regulation Act, 1949, making all the co-operatives come under the supervision of the Reserve Bank, so that the interests of the depositors can be protected properly.

Way Forward

- There is an urgent and imperative need to bring in a suitable statutory framework to consider wilful defaults on bank loans a “criminal offence”.

- There is a need to follow prudential norms for lending and effective resolution of Non- Performing Assets.

- The governance and management of PSBs has to improve. The way to do this was outlined by the PJ Nayak committee, which recommended distancing between the government and top public sector appointments (everything the Banks Board Bureau was supposed to do but could not).

- Rather than blind privatisation, PSBs can be made into a corporation like Life Insurance Corporation (LIC). While maintaining government ownership, this will give more autonomy to PSBs.