Indian Economy

Budget 2021 Highlights: Health and Wellbeing

Why in News

Recently, the Minister of Finance presented the Union Budget 2021-22. This was the first ever digital Union Budget.

- It is based on six pillars - health and well-being, physical and financial capital and infrastructure, inclusive development for aspirational India, reinvigorating human capital, innovation and R&D, and 'Minimum Government, Maximum Governance'.

- This section deals with the proposals for the Health and Wellbeing Sector.

Budget and Constitutional Provisions

- According to Article 112 of the Indian Constitution, the Union Budget of a year is referred to as the Annual Financial Statement (AFS).

- It is a statement of the estimated receipts and expenditure of the Government in a Financial Year (which begins on 1st April of the current year and ends on 31st March of the following year).

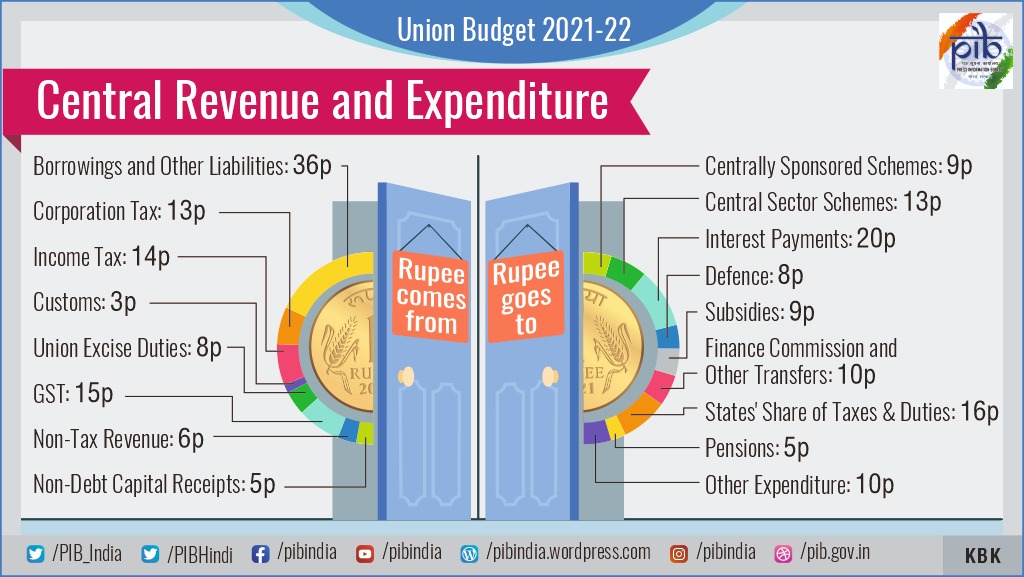

- Overall, the Budget contains:

- Estimates of revenue and capital receipts,

- Ways and means to raise the revenue,

- Estimates of expenditure,

- Details of the actual receipts and expenditure of the closing financial year and the reasons for any deficit or surplus in that year, and

- The economic and financial policy of the coming year, i.e., taxation proposals, prospects of revenue, spending programme and introduction of new schemes/projects.

- In Parliament, the Budget goes through six stages:

- Presentation of Budget.

- General discussion.

- Scrutiny by Departmental Committees.

- Voting on Demands for Grants.

- Passing an Appropriation Bill.

- Passing of Finance Bill.

- The Budget Division of the Department of Economic Affairs in the Ministry of Finance is the nodal body responsible for preparing the Budget.

- The first Budget of Independent India was presented in 1947.

Key Points

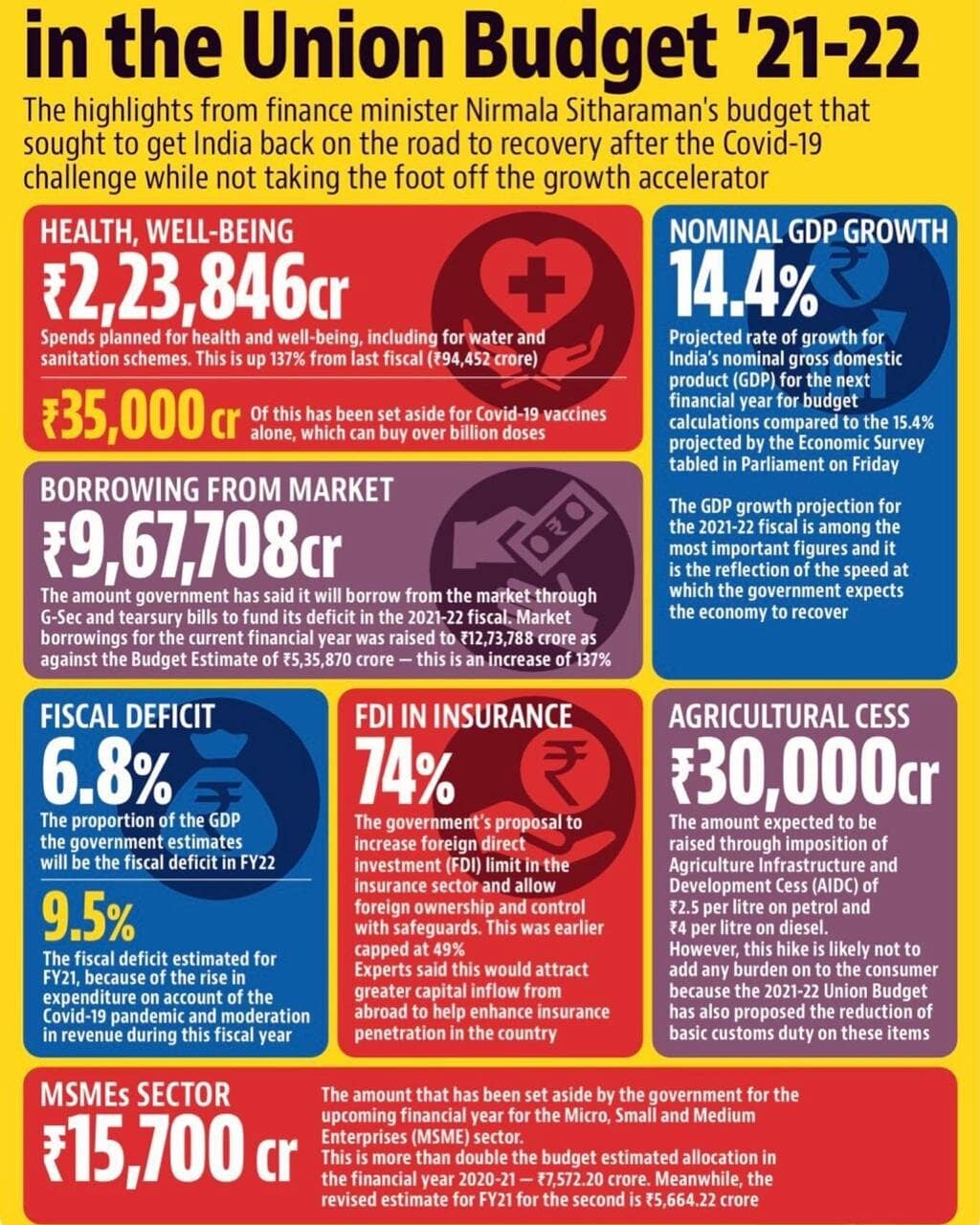

- Budget Outlay: Outlay for Health and Wellbeing in 2021-22 as against 2020-21 is an increase of 137%.

- Major Steps: Steps being taken for improving health and wellbeing:

- Vaccines:

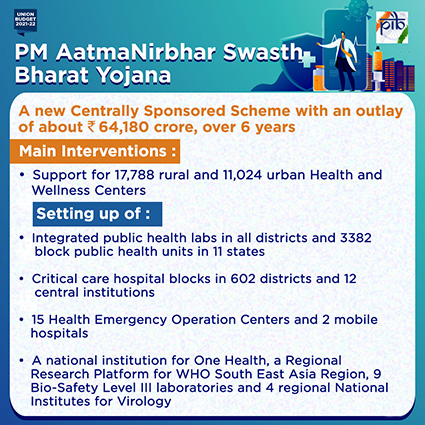

- Rs. 35,000 crore for Covid-19 vaccine in Budget Expenditure (BE) 2021-22.

- The Made-in-India Pneumococcal Vaccine to be rolled out across the country.

- Health Systems:

- PM AatmaNirbhar Swasth Bharat Yojana – a new centrally sponsored scheme to be launched, in addition to National Health Mission (NHM).

- Nutrition:

- Mission Poshan 2.0 to be launched to improve nutritional outcomes across 112 aspirational districts.

- Universal Coverage of Water Supply:

- Jal Jeevan Mission (Urban) - to be launched - to bring safe water to 2.86 crore households through tap connection.

- Swachch Bharat, Swasth Bharat:

- Strengthening of Urban Swachh Bharat Mission 2.0.

- Clean Air:

- Rs. 2,217 crore to tackle air pollution, for 42 urban centers with a million plus population.

- Scrapping Policy:

- Voluntary vehicle scrapping policy to phase out old and unfit vehicles.

- Vaccines:

Indian Economy

Budget 2021 Highlights: Infrastructure

Why in News

Recently, the Minister of Finance presented the Union Budget 2021-22. This was the first digital budget.

- This section deals with proposals related to Infrastructure.

Key Points

- Production Linked Incentive scheme (PLI):

- Rs. 1.97 lakh crore in next 5 years for PLI schemes in 13 Sectors to create and nurture manufacturing global champions for an AatmaNirbhar Bharat.

- Textiles:

- Mega Investment Textiles Parks (MITRA) scheme to be introduced.

- Infrastructure:

- National Infrastructure Pipeline (NIP) expanded to 7,400 projects.

- Measures in three thrust areas to increase funding for NIP:

- Creation of institutional structures:

- Set up and capitalise a Development Financial Institution (DFI).

- Big thrust on monetizing assets.

- Enhancing the share of capital expenditure.

- Creation of institutional structures:

- Roads and Highways Infrastructure:

- Rs. 1,18,101 lakh crore, highest ever outlay, for Ministry of Road Transport and Highways.

- New Economic corridors and Expressways being planned.

- Advanced Traffic management system in all new 4 and 6-lane highways.

- Railway Infrastructure:

- National Rail Plan for India (2030) to create a “future ready‟ Railway system by 2030.

- 100% electrification of Broad-Gauge routes to be completed by December, 2023.

- Western Dedicated Freight Corridor (DFC) and Eastern DFC to be commissioned by June 2022.

- Measures for passenger convenience and safety:

- Aesthetically designed Vista Dome Linke Hofmann Busch (LHB) coach on tourist routes for better travel.

- High density network and highly utilized network routes to have an indigenously developed automatic train protection system, eliminating train collision due to human error.

- Urban Infrastructure:

- Expansion of metro rail network and augmentation of city bus service.

- ‘MetroLite’ and ‘MetroNeo’ technologies will be used to provide metro rail systems at much lesser cost with similar experience.

- Power Infrastructure:

- A comprehensive National Hydrogen Energy Mission 2021-22 to be launched.

- Rs. 3,05,984 crore over 5 years for a revamped, reforms-based and result-linked new power distribution sector scheme.

- Ports, Shipping, Waterways:

- Rs. 2,000 crore worth 7 projects to be offered in Public Private Partnership (PPP)-mode in Financial Year (FY) 2021-22 for operation of major ports.

- Petroleum & Natural Gas:

- Extension of Ujjwala Scheme to cover 1 crore more beneficiaries.

- A new gas pipeline project in Jammu & Kashmir.

- An independent Gas Transport System Operator to be set up for facilitation and coordination of booking of common carrier capacity in all-natural gas pipelines on a non-discriminatory open access basis.

Indian Economy

Budget 2021 Highlights: Physical and Financial Capital

Why in News

Recently, the Minister of Finance presented the Union Budget 2021-22. This was the first digital budget.

- This section deals with proposals related to Physical and Financial Capital.

Key Points

- Financial Capital:

- A single Securities Markets Code to be evolved.

- To develop an investor charter as a right of all financial investors.

- A new permanent institutional framework to help in development of the Bond market.

- Setting up a system of Regulated Gold Exchanges.

- Securities and Exchange Board of India (SEBI) to be notified as a regulator and Warehousing Development and Regulatory Authority to be strengthened.

- Stressed Asset Resolution:

- Asset Reconstruction Company Limited and Asset Management Company (Bad Bank) to be set up.

- Increasing Foreign Direct Investment (FDI) in Insurance Sector:

- To increase the permissible FDI limit from 49% to 74% and allow foreign ownership and control with safeguards.

- Deposit Insurance:

- Amendments to the Deposit Insurance and Credit Guarantee Corporation Act, 1961, to help depositors get easy and time-bound access to their deposits to the extent of the deposit insurance cover.

- Deposit insurance increased from Rs. 1 lakh to Rs. 5 lakh for bank depositors.

- Minimum loan size eligible for debt recovery under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002 proposed to be reduced from Rs. 50 lakh to Rs. 20 lakh for NBFCs with minimum asset size of Rs. 100 crore.

- Amendments to the Deposit Insurance and Credit Guarantee Corporation Act, 1961, to help depositors get easy and time-bound access to their deposits to the extent of the deposit insurance cover.

- For Companies and Firms:

- To decriminalize the Limited Liability Partnership (LLP) Act, 2008.

- Easing Compliance requirement of Small companies by revising their definition under Companies Act, 2013.

- Promoting start-ups and innovators by incentivizing the incorporation of One Person Companies (OPCs).

- To ensure faster resolution of cases by:

- Strengthening National Company Law Appellate Tribunal (NCLAT) framework.

- Implementation of e-Courts system.

- Introduction of alternate methods of debt resolution and special framework for Micro, Small and Medium Enterprises (MSMEs).

- Disinvestment and Strategic Sale:

- New policy for Strategic Disinvestment approved; Central Public Sector Enterprises (CPSEs) except in four strategic areas to be privatized.

- Initial Public Offering (IPO) of Life Insurance Corporation (LIC) in 2021-22.

- Special Purpose Vehicle in the form of a company to monetize idle land.

- Introducing a revised mechanism for ensuring timely closure of sick or loss making CPSEs.

- Government Financial Reforms:

- Treasury Single Account (TSA) System for Autonomous Bodies to be extended for universal application.

- Separate Administrative Structure to streamline the Ease of Doing Business for Cooperatives.

Indian Economy

Budget 2021 Highlights: Inclusive Development for Aspirational India and Reinvigorating Human Capital

Why in News

Recently, the Finance Minister presented the Union Budget 2021-22. This was the first digital budget.

- This section deals with the theme ‘Inclusive Development for Aspirational India and Reinvigorating Human Capital’.

Key Points

- Inclusive Development for Aspirational India:

- Agriculture:

- Ensured Minimum Support Price (MSP) at minimum 1.5 times the cost of production across all commodities.

- SWAMITVA Scheme to be extended to all States/UTs.

- Operation Green Scheme to be extended to 22 perishable products, to boost value addition in agriculture and allied products.

- 1,000 more mandis to be integrated with the National Agricultural Market (e-NAM) to bring transparency and competitiveness.

- APMCs (agricultural produce market committee) to get access to the Agriculture Infrastructure Funds for augmenting infrastructure facilities.

- Fisheries:

- 5 major fishing harbours – Kochi, Chennai, Visakhapatnam, Paradip, and Petuaghat to be developed as hubs of economic activity.

- Multipurpose Seaweed Park in Tamil Nadu to promote seaweed cultivation.

- Migrant Workers and Labourers:

- One Nation One Ration Card scheme for beneficiaries to claim rations anywhere in the country - migrant workers to benefit the most.

- Portal to collect information on unorganized labour force, migrant workers especially, to help formulate schemes for them.

- Implementation of 4 labour codes underway:

- Social security benefits for gig and platform workers too.

- Minimum wages and coverage under the Employees State Insurance Corporation applicable for all categories of workers.

- Women workers allowed in all categories, including night-shifts with adequate protection.

- Compliance burden on employers reduced with single registration and licensing, and online returns.

- Financial Inclusion:

- Under Stand Up India Scheme for Scheduled Castes (SC), Scheduled Tribes (ST) and women,

- Margin money requirement reduced to 15%.

- To also include loans for allied agricultural activities.

- Under Stand Up India Scheme for Scheduled Castes (SC), Scheduled Tribes (ST) and women,

- Agriculture:

- Reinvigorating Human Capital:

- School Education:

- 15,000 schools to be strengthened by implementing all National Education Policy (NEP) components. Shall act as exemplar schools in their regions for mentoring others.

- 100 new Sainik Schools to be set up in partnership with NGOs/private schools/states.

- Higher Education:

- Legislation to be introduced to set up the Higher Education Commission of India as an umbrella body with 4 separate vehicles for standard-setting, accreditation, regulation, and funding.

- Creation of formal umbrella structure to cover all Government colleges, universities, research institutions in a city for greater synergy.

- Central University to come up in Leh for accessibility of higher education in Ladakh.

- Scheduled Castes and Scheduled Tribes Welfare:

- 750 Eklavya model residential schools in tribal areas.

- Revamped Post Matric Scholarship Scheme for welfare of SCs.

- Skilling:

- Proposed amendment to Apprenticeship Act to enhance opportunities for youth.

- Rs. 3000 crore for realignment of existing National Apprenticeship Training Scheme (NATS) towards post-education apprenticeship, training of graduates and diploma holders in Engineering.

- Initiatives for partnership with other countries in skilling to be taken forward, similar to partnership:

- With UAE to benchmark skill qualifications, assessment, certification, and deployment of certified workforce.

- With Japan for a collaborative Technical Intern Training Programme (TITP) to transfer skills, technique and knowledge.

- Innovation and Research & Development:

- National Language Translation Mission (NTLM) to make governance-and-policy related knowledge available in major Indian languages.

- PSLV-CS51 to be launched by New Space India Limited (NSIL) carrying Brazil’s Amazonia Satellite and some Indian satellites.

- As part of the Gaganyaan mission activities:

- 4 Indian astronauts being trained on Generic Space Flight aspects, in Russia.

- First unmanned launch is slated for December 2021.

- Rs. 4,000 crore over five years for Deep Ocean Mission survey exploration and conservation of deep sea biodiversity.

- School Education:

Indian Economy

Budget 2021 Highlights: Minimum Government, Maximum Governance and Fiscal Position

Why in News

Recently, the Minister of Finance presented the Union Budget 2021-22. This was the first digital budget.

- This section deals with the theme ‘Minimum Government, Maximum Governance’ and Fiscal Position of the government.

Key Points

- Minimum Government, Maximum Governance:

- National Commission for Allied Healthcare Professionals already introduced to ensure transparent and efficient regulation of the 56 allied healthcare professions.

- The National Nursing and Midwifery Commission Bill introduced for the same in the nursing profession.

- Proposed Conciliation Mechanism with mandate for quick resolution of contractual disputes with Central Public Sector Enterprises (CPSEs).

- Rs. 3,768 crore allocated for first digital census in the history of India.

- Rs. 300 crore grant to the Government of Goa for the diamond jubilee celebrations of the state’s liberation from Portuguese.

- Rs. 1,000 crore for the welfare of Tea workers especially women and their children in Assam and West Bengal through a special scheme.

- Fiscal Position:

- Fiscal deficit stands at 9.5% of the Gross Domestic Product (GDP), and is estimated to be 6.8% in 2021-22.

- Plan to continue on the path of fiscal consolidation, achieving a fiscal deficit level below 4.5% of GDP by 2025-2026 with a fairly steady decline over the period.

- Amendment to Fiscal Responsibility and Budget Management (FRBM) Act proposed to achieve targeted Fiscal Deficit levels.

- The Contingency Fund of India is to be augmented from Rs. 500 crore to Rs. 30,000 crore through Finance Bill.

- Recommendations of Fifteenth Finance Commission:

- The final report covering 2021-26 was submitted to the President, retaining vertical shares of states at 41%.

- Funds to UTs of Jammu and Kashmir and Ladakh would be provided by the Centre.

- On the Commission’s recommendation, Rs. 1,18,452 crore have been provided as Revenue Deficit Grant to 17 states in 2021-22, as against Rs. 74,340 crore to 14 states in 2020-21.

- Tax Proposals:

- No exemption on interest, if Provident Fund PF contribution is more than Rs. 2.5 lakh.

- Exemption from filing tax returns for senior citizens over 75 years of age and having only pension and interest income; tax to be deducted by paying the bank.

- Income Tax settlement commission abolished.

- Higher Tax Collection at Source rate for non-filers.

- Reducing time to file belated returns.

- Agriculture Infrastructure and Development Cess (AIDC) on a small number of items.

- Dispute Resolution Committee to be set up for taxpayers with taxable income up to Rs. 50 lakh and disputed income up to Rs. 10 lakh.

- National Faceless Income Tax Appellate Tribunal Centre to be established.

Governance

15th Finance Commission Recommendations: Resource Allocation

Why in News

Recently, the government accepted the 15th Finance Commission’s recommendation to maintain the States’ share in the divisible pool of taxes to 41% for the five-year period starting 2021-22.

- The Commission’s Report was tabled in the Parliament.

15th Finance Commission

- The Finance Commission (FC) is a constitutional body, that determines the method and formula for distributing the tax proceeds between the Centre and states, and among the states as per the constitutional arrangement and present requirements.

- Under Article 280 of the Constitution, the President of India is required to constitute a Finance Commission at an interval of five years or earlier.

- The 15th Finance Commission was constituted by the President of India in November 2017, under the chairmanship of NK Singh. Its recommendations will cover a period of five years from the year 2021-22 to 2025-26.

Key Points

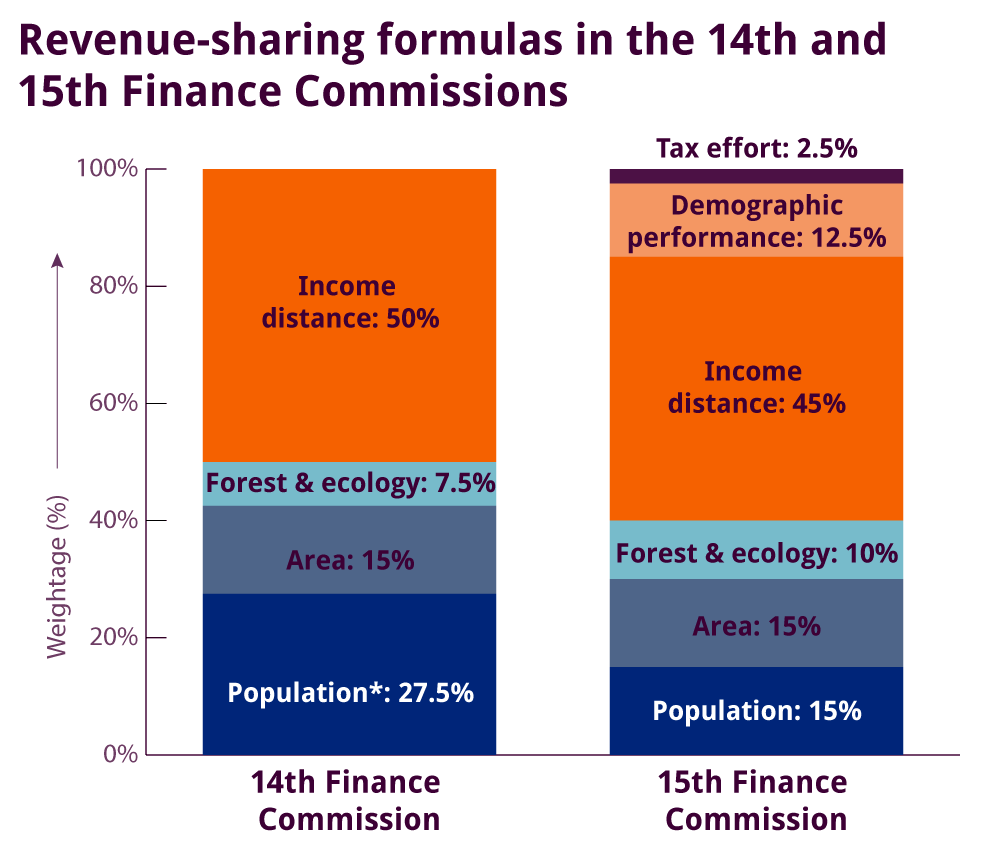

- Vertical Devolution (Devolution of Taxes of the Union to States):

- It has recommended maintaining the vertical devolution at 41% - the same as in its interim report for 2020-21.

- It is at the same level of 42% of the divisible pool as recommended by the 14th Finance Commission.

- It has made the required adjustment of about 1% due to the changed status of the erstwhile State of Jammu and Kashmir into the new Union Territories of Ladakh and Jammu and Kashmir.

- It has recommended maintaining the vertical devolution at 41% - the same as in its interim report for 2020-21.

- Horizontal Devolution (Allocation Between the States):

- For horizontal devolution, it has suggested 12.5% weightage to demographic performance, 45% to income, 15% each to population and area, 10% to forest and ecology and 2.5% to tax and fiscal efforts.

- Revenue Deficit Grants to States:

- Revenue deficit grants emanate from the requirement to meet the fiscal needs of the States on their revenue accounts that remain to be met, even after considering their own tax and non-tax resources and tax devolution to them.

- Revenue Deficit is defined as the difference between revenue or current expenditure and revenue receipts, that includes tax and non-tax.

- It has recommended post-devolution revenue deficit grants amounting to about Rs. 3 trillion over the five-year period ending FY26.

- The number of states qualifying for the revenue deficit grants decreases from 17 in FY22, the first year of the award period to 6 in FY26, the last year.

- Performance Based Incentives and Grants to States:

- These grants revolve around four main themes.

- The first is the social sector, where it has focused on health and education.

- Second is the rural economy, where it has focused on agriculture and the maintenance of rural roads.

- The rural economy plays a significant role in the country as it encompasses two-thirds of the country's population, 70% of the total workforce and 46% of national income.

- Third, governance and administrative reforms under which it has recommended grants for judiciary, statistics and aspirational districts and blocks.

- Fourth, it has developed a performance-based incentive system for the power sector, which is not linked to grants but provides an important, additional borrowing window for States.

- Fiscal Space for Centre:

- Total 15th Finance Commission transfers (devolution + grants) constitutes about 34% of estimated Gross Revenue Receipts to the Union, leaving adequate fiscal space to meet its resource requirements and spending obligations on national development priorities.

- Grants to Local Governments:

- Along with grants for municipal services and local government bodies, it includes performance-based grants for incubation of new cities and health grants to local governments.

- In grants for Urban local bodies, basic grants are proposed only for cities/towns having a population of less than a million. For Million-Plus cities, 100% of the grants are performance-linked through the Million-Plus Cities Challenge Fund (MCF).

- MCF amount is linked to the performance of these cities in improving their air quality and meeting the service level benchmarks for urban drinking water supply, sanitation and solid waste management.

Criticism

- Performance based incentives disincentivizes independent decision-making. Any conditions on the state's ability to borrow will have an adverse effect on the spending by the state, particularly on development thus, undermines cooperative fiscal federalism.

- It does not hold the Union government accountable for its own fiscal prudence and dilutes the joint responsibility that the Union and States have.

Horizontal Devolution Criteria

- Population:

- The population of a State represents the needs of the State to undertake expenditure for providing services to its residents.

- It is also a simple and transparent indicator that has a significant equalising impact.

- Area:

- The larger the area, greater is the expenditure requirement for providing comparable services.

- Forest and Ecology:

- By taking into account the share of dense forest of each state in the aggregate dense forest of all the states, the share on this criteria is determined.

- Income Distance:

- Income distance is the distance of the Gross State Domestic Product (GSDP) of a particular state from the state with the highest GSDP.

- To maintain inter state equity, the states with lower per capita income would be given a higher share.

- Demographic Performance:

- It rewards efforts made by states in controlling their population.

- This criterion has been computed by using the reciprocal of the total fertility ratio of each state, scaled by 1971 population data.

- This has been done to assuage the fears of southern States about losing some share in tax transfers due to the reliance on the 2011 Census data instead of the 1971 census, which could penalise States that did better on managing demographics.

- States with a lower fertility ratio will be scored higher on this criterion.

- The Total Fertility Ratio in a specific year is defined as the total number of children that would be born to each woman if she/they were to pass through the childbearing years bearing children according to a current schedule of age-specific fertility rates.

- Tax Effort:

- This criterion has been used to reward states with higher tax collection efficiency.

- It has been computed as the ratio of the average per capita own tax revenue and the average per capita state GDP during the three-year period between 2016-17 and 2018-19.

Governance

15th Finance Commission Recommendations: Different Sectors

Why in News

Recently, the 15th Finance Commission’s Report was tabled in the Parliament. The Report included recommendations for different sectors - Health, Defence and Internal Security and Disaster Risk Management, etc.

Key Points

- Health:

- Health spending by States should be increased to more than 8% of their budget by 2022.

- Given the inter-State disparity in the availability of medical doctors, it is essential to constitute an All India Medical and Health Service as is envisaged under Section 2A of the All-India Services Act, 1951.

- 15th FC also allocated funds for overhauling of medical services at all the levels and training of the allied healthcare workforce.

- Defence and Internal Security:

- The Union Government may constitute in the Public Account of India, a dedicated non-lapsable fund, Modernisation Fund for Defence and Internal Security (MFDIS).

- Disaster Risk Management:

- Formation of Mitigation Funds at both the national and State levels, in line with the provisions of the Disaster Management Act, 2005.

- The Fund should be used for those local level and community-based interventions which reduce risks and promote environment-friendly settlements and livelihood practices.

- Funding Priority Areas: 15th FC has also earmarked allocations for certain priority areas, such as :

- Funds for the National Disaster Response Force for expansion and modernisation of fire services and resettlement of displaced people affected by erosion.

- Funds for National Disaster Mitigation Fund (NDMF) for catalytic assistance to twelve most drought-prone states, managing seismic and landslide risks in ten hill States, reducing the risk of urban flooding in seven most populous cities and mitigation measures to prevent erosion.

- Formation of Mitigation Funds at both the national and State levels, in line with the provisions of the Disaster Management Act, 2005.

Governance

15th Finance Commission Recommendations: Fiscal Consolidation

Why in News

Recently, the 15th Finance Commission’s Report was tabled in the Parliament. It provided range for the fiscal deficit and debt path of both the Union and States.

Key Points

- Fiscal Deficit:

- Target for Centre: It recommended that the Centre brings down its fiscal deficit to 4% of Gross Domestic Product GDP by 2025-26 against 6.8% in FY22.

- Target for States: For states, it recommended fiscal deficit at 4% of Gross State Domestic Product (GSDP) in 2021-22, 3.5% in the following year and 3% for the next three years.

- Borrowing Ceilings for States:

- Because of Article 293 of the Constitution, State Governments operate under borrowing limits and, hence, budget constraints, approved by the Union Government.

- The normal limit for net borrowing may be fixed at 4% of Gross State Domestic Product (GSDP) in 2021-22, 3.5% in 2022-23 and be maintained at 3% of GSDP from 2023-24 to 2025-26.

- An additional borrowing of 0.5% of GSDP to be allowed to the States in case they meet the criteria for power sector reforms.

- Better Monitoring of Centrally Sponsored Scheme (CSS):

- A threshold amount of annual appropriation should be fixed below which the funding for a CSS may be stopped.

- Below the stipulated threshold, the administration department should justify the need for the continuation of the scheme.

- As the life cycle of ongoing schemes has been made co-terminus with the cycle of Finance Commissions, third-party evaluation of all CSSs should be completed within a stipulated time frame.

- A threshold amount of annual appropriation should be fixed below which the funding for a CSS may be stopped.

- New FRBM Framework:

- The Fiscal Responsibility and Budget Management Act (FRBM Act, 2003) needs a major restructuring and recommended that the time-table for defining and achieving debt sustainability may be examined by a High-powered Inter-governmental Group.

- This High-powered Group can craft the new FRBM framework and oversee its implementation.

- State Governments may explore formation of independent public debt management cells which will chart their borrowing programme efficiently.

- The Fiscal Responsibility and Budget Management Act (FRBM Act, 2003) needs a major restructuring and recommended that the time-table for defining and achieving debt sustainability may be examined by a High-powered Inter-governmental Group.