Mutual Credit Guarantee Scheme for MSMEs | 03 Feb 2025

Why in News?

The Government of India has approved the introduction of the Mutual Credit Guarantee Scheme for MSMEs (MCGS- MSME).

What is MCGS- MSME?

- About: It is an initiative designed to facilitate access to credit for MSMEs by offering a guarantee for loans extended to them by reducing the risk perceived by lenders.

- Key Features:

- Target Borrowers: MSMEs with valid Udyam Registration Number.

- Loan Limit: Up to Rs 100 crore for purchase of equipment/machinery.

- Loan Guarantee: National Credit Guarantee Trustee Company Ltd (NCGTC) provides 60% guarantee coverage to Member Lending Institutions (MLIs).

- Project Costs: 75% of the project cost should be for equipment/machinery.

- Scheme Duration: Applicable for 4 years or until Rs. 7 lakh crore cumulative guarantee is issued, whichever is earlier.

- Significance:

- Boost to Manufacturing: Enhances credit availability for MSMEs, which contribute 17% to India’s GDP.

- Support for Make in India: Aligns with the vision to increase the manufacturing sector's share to 25% of GDP.

- Credit Access: Facilitates collateral-free loans for MSMEs to expand.

- Employment Growth: Creates significant job opportunities in the manufacturing sector, employing over 27 million.

Note: MLIs include all Scheduled Commercial Banks (SCBs), Non-Banking Financial Companies (NBFCs) and All India Financial institutions (AIFIs), who register with NCGTC under the Scheme.

What is National Credit Guarantee Trustee Company Ltd (NCGTC)?

- About: NCGTC is a common trustee company to manage and operate various credit guarantee trust funds to help borrowers access finance by sharing lending risks with lenders.

- It provides loan guarantees to lenders (like banks and financial institutions) , encouraging credit extension to underserved sectors like MSMEs, startups, and vulnerable groups.

- Establishment: It was established in March 2014, under the Indian Companies Act, 1956, with a paid-up capital of Rs 10 crore.

- It is a private limited company that is fully owned by the Government of India and operates under the Department of Financial Services, Ministry of Finance.

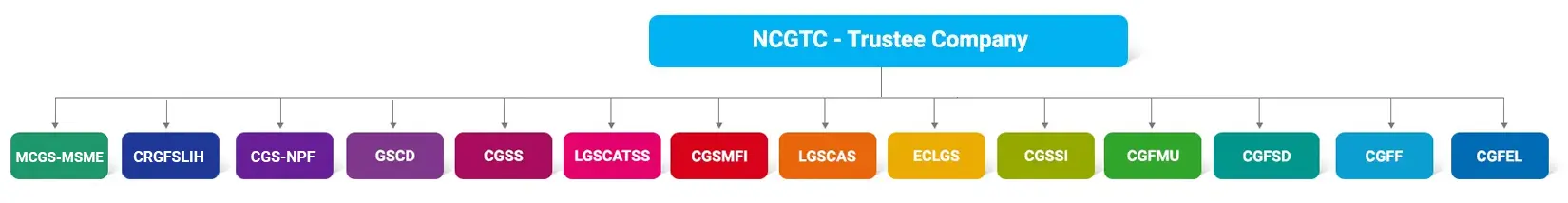

- Coverage: NCGTC currently manages 14 dedicated credit guarantee trust schemes including MCGS-MSME, Credit Guarantee Fund for Micro Units (CGFMU), Emergency Credit Line Guarantee Scheme (ECLGS) among others.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. What is/are the recent policy initiative(s)of Government of India to promote the growth of manufacturing sector? (2012)

- Setting up of National Investment and Manufacturing Zones

- Providing the benefit of ‘single window clearance’

- Establishing the Technology Acquisition and Development Fund

Select the correct answer using the codes given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)