Important Government Schemes

Pradhan Mantri MUDRA Yojana (PMMY)

- 26 Dec 2024

- 7 min read

Key Points

|

What are the Key Features of PM MUDRA Yojana?

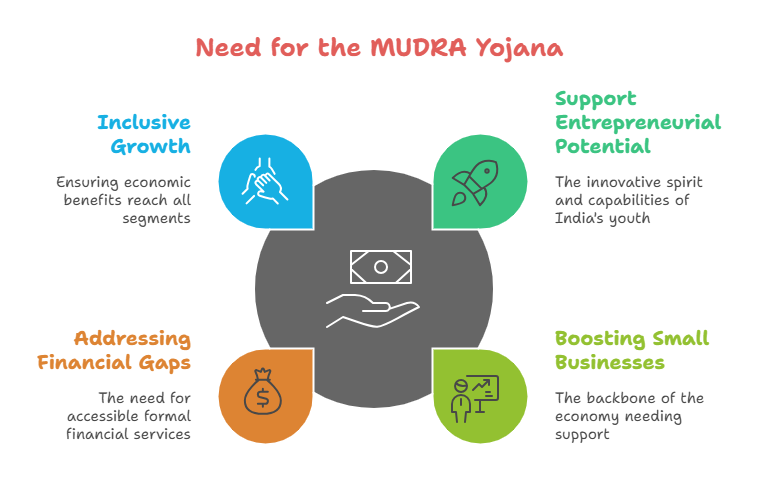

- About: The aim of PMMY is to facilitate easy collateral-free micro credit to non-corporate, non-farm small and micro entrepreneurs for income generating activities.

- MUDRA (Micro Units Development and Refinance Agency) was launched in 2015, to provide refinance support to financial institutions like banks, micro-finance institutions (MFIs), and non-banking financial companies (NBFCs).

- It provides refinance, credit guarantee, and development support to financial institutions, helping them extend financial services to micro-enterprises in manufacturing, trading, and services.

- MUDRA (Micro Units Development and Refinance Agency) was launched in 2015, to provide refinance support to financial institutions like banks, micro-finance institutions (MFIs), and non-banking financial companies (NBFCs).

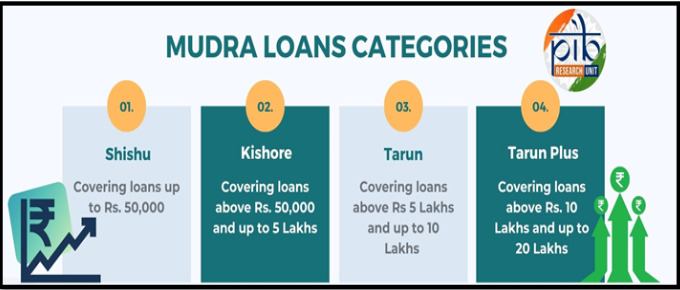

- Loan Limits Under Various Categories: The Pradhan Mantri MUDRA Yojana (PMMY) offers loans under four distinct categories, each catering to different stages of business growth. The loan limits for each category are as follows:

- Shishu Category:

- Loan Limit: Up to Rs 50,000

- This category is designed for businesses that are in the initial phase of their operations and need minimal capital to start or maintain their activities.

- Kishore Category:

- Loan Limit: Rs 50,000 to Rs 5 lakh

- The Kishore category supports businesses that are in the growth phase and require additional funding to expand their operations or increase their working capital.

- Tarun Category:

- Loan Limit: Rs 5 lakh to Rs 10 lakh

- The Tarun category caters to well-established businesses that require larger loans to scale up their operations, increase production capacity, and expand their market reach.

- Tarun Plus Category:

- Loan Limit: Rs.10 lakh to Rs. 20 lakhs (Raised Union Budget 2024-25)

- This newly introduced category provides additional financial support for businesses that have successfully repaid loans under the Tarun category and are looking to take their operations to the next level with higher funding needs.

- Shishu Category:

- Eligible Beneficiaries: Eligible borrowers include individuals, proprietary concerns, partnership firms, private and public limited companies, and other legal entities.

- Loan Disbursement: Loans under PMMY are disbursed by various Member Lending Institutions (MLIs), including banks (public and private sector), regional rural banks, small finance banks, MFIs, and NBFCs.

- Collateral-Free Loans: One of the significant features of PMMY is that it provides loans without the need for collateral.

- This makes it accessible to entrepreneurs who may not have assets to pledge, thereby reducing the barriers to obtaining finance.

- Credit Guarantee: The Credit Guarantee Fund for Micro Units (CGFMU) offers additional security by providing guarantee coverage for loans under PMMY.

- It ensures that financial institutions are protected from defaults, thus encouraging more lending to the microenterprise sector.

MUDRA Card

- Purpose: The MUDRA Card is an innovative financial product that provides a hassle-free credit facility to borrowers, enabling them to manage their working capital needs efficiently.

- Rupay Debit Card: This card functions as a RuPay debit card, allowing entrepreneurs to withdraw cash from ATMs, make payments using Point of Sale (POS) machines, and access funds directly for business-related expenses.

- Overdraft Facility: The MUDRA Card comes with an overdraft facility, meaning that borrowers can use it as a credit line and repay it as and when they have surplus cash, reducing the cost of credit by minimizing interest charges.

What Steps Have Been Taken to Improve Scheme Implementation?

- Online Application Platforms: The scheme has integrated online portals like PSBloansin59minutes and Udyamimitra, making it easier for entrepreneurs to apply for loans from the comfort of their homes or offices.

- Also, MUDRA MITRA is a mobile app that offers information on MUDRA schemes, guides loan seekers to bankers, and provides loan-related materials and application forms.

- Publicity Campaigns: Extensive public awareness campaigns are conducted nationwide to raise awareness about PMMY, ensuring that all eligible entrepreneurs are aware of the scheme and its benefits.

- Simplified Forms: The application process has been simplified by streamlining the forms, making them more accessible and less time-consuming for potential borrowers.

- Nodal Officers: MUDRA has designated MUDRA Nodal Officers in Public Sector Banks (PSBs) to oversee the scheme’s implementation, ensuring effective monitoring and support for applicants.

- Interest Subvention: A 2% interest subvention is provided for prompt repayment of Shishu loans under PMMY, applicable for a period of 12 months to all eligible borrowers.

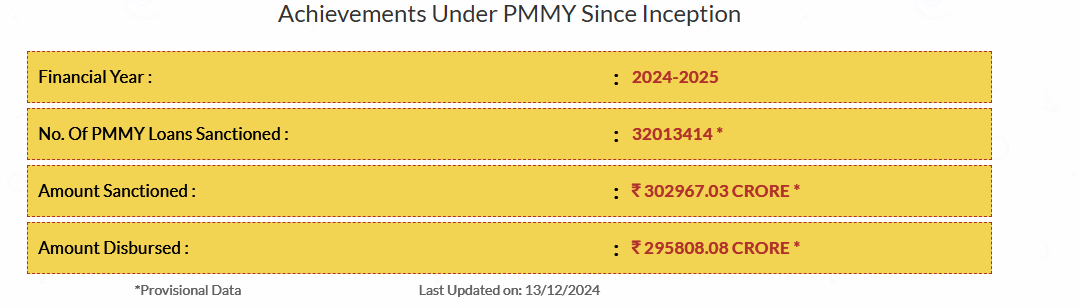

Achievements of PMMY

- Significant Financial Disbursement: As of 13th December 2024, 3.20 crore PMMY loans have been sanctioned, amounting to Rs 3,02,967.03 crore.

- Of this, Rs 2,95,808.08 crore has been disbursed, reflecting significant progress under the scheme.

- Empowerment of Marginalized Groups: Around 69% of MUDRA loan accounts are held by women, while 51% belong to SC/ST and OBC entrepreneurs, promoting gender equality and social equity.

- Boost to Self-Employment: The scheme has encouraged self-employment, particularly in rural and semi-urban areas, fostering small business development and job creation.

- Reduced Non-Performing Assets (NPAs): The NPA rate under the scheme dropped from 3.61% in FY21 to 2.1% in FY24, reflecting improved financial discipline among borrowers.

- Steady Increase in Lending Exposure: Total MUDRA loan exposure rose from ₹3.3 lakh crore in FY22 to over ₹5 lakh crore in FY24, demonstrating the scheme’s expanding reach.

- Focus on Rural Inclusion: The scheme has impacted rural entrepreneurs, though unequal regional distribution of credit highlights the need for targeted outreach.