MSMEs and Covid-19 | 06 May 2020

Why in News

The Covid-19 pandemic has left its impact on all sectors of the economy including the Medium, Small and Micro Enterprises (MSMEs) sector.

- Earlier the government had declared the relief package namely, the PM Garib Kalyan Yojana for the poor to help them fight the battle against Coronavirus (Covid-19), the second package is expected to primarily focus on the MSME sector.

MSMEs in India

- Definition of MSMEs:

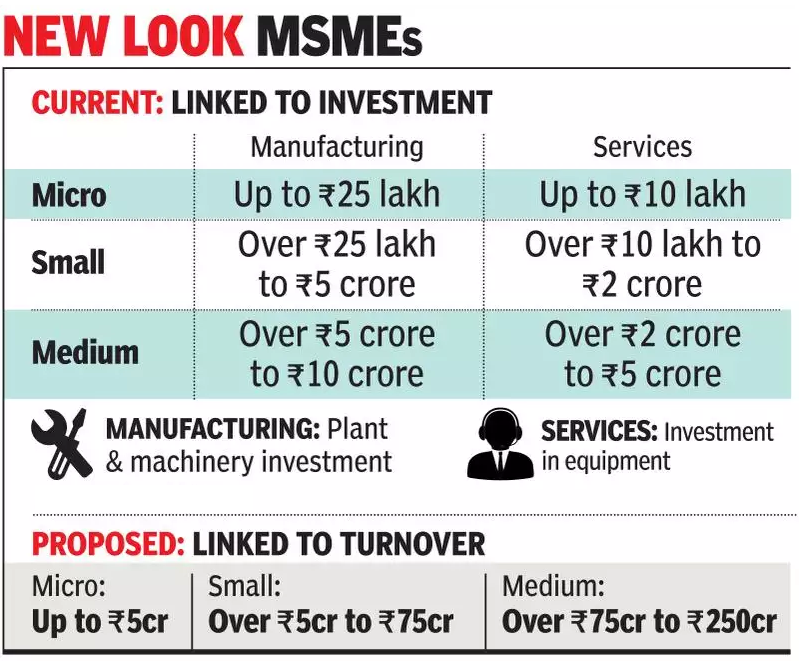

- In February 2018, the Union Cabinet decided the criterion of an annual turnover (in line with the imposition of GST) for defining MSMEs.

- Formally, MSMEs were defined in terms of investment in plant and machinery/equipment. But this criterion for the definition was criticized because credible and precise details of investments were not easily available by authorities.

- According to the proposed definition (which is yet to be formally accepted), the categorisation would be:

- Micro Enterprise : An annual turnover less than Rs 5 crores.

- Small Enterprise : An annual turnover between Rs 5 crores and Rs 75 crores.

- Medium Enterprise: An annual turnover less than Rs 250 crores.

- In February 2018, the Union Cabinet decided the criterion of an annual turnover (in line with the imposition of GST) for defining MSMEs.

- Statistical Data about MSMEs in India:

- Total Number of MSMEs: According to the Annual Report of the Department of MSMEs (2018-19), there are 6.34 crore MSMEs in the country.

- Rural-Urban Distribution: Around 51% of these are situated in rural India and 49% of them are situated in urban India.

- Employment: Both rural and urban MSMEs together employ over 11 crore people but 55% of the employment happens in the urban MSMEs.

- Category-wise Distribution: 99.5% of all MSMEs fall in the micro category. While micro enterprises are equally distributed over rural and urban India, small and medium ones are predominantly in urban India.

- Social Distribution of MSMEs: About 66 % of all MSMEs are owned by people belonging to the Scheduled Castes (12.5%), the Scheduled Tribes (4.1%) and Other Backward Classes (49.7%).

- Gender Ratio in MSMEs: The gender ratio among employees is largely consistent across the board at roughly 80% male and 20% female.

- Geographical Distribution: Seven Indian states account for 50 % of all MSMEs. These are Uttar Pradesh (14%), West Bengal (14%), Tamil Nadu (8%), Maharashtra (8%), Karnataka (6%), Bihar (5%) and Andhra Pradesh (5%).

Problems Faced by MSMEs in India

- Too Small to get Registered:

- Being out of the formal network, these MSMEs do not have to maintain accounts, pay taxes or adhere to regulatory norms etc., which brings down their costs. But in a time of crisis, it also constrains a government’s ability to help them.

- Lack of Financing:

- Most of the MSME funding comes from informal sources and it explains why the Reserve Bank of India’s efforts to push more liquidity towards the MSMEs have had a limited impact. Also, the government has launched schemes in this regard.

- Further, banks dither from extending loans to MSMEs due to the high ratio of bad loans.

- According to a 2018 report by the International Finance Corporation (part of the World Bank), the formal banking system supplies less than one-third (or about Rs 11 lakh crore) of the MSME credit need that it can potentially fund.

- Delays in Payments to MSMEs:

- It is one of the biggest reasons for financial turmoil in the MSME sector.

- MSMEs face delays in payment from their buyers which also includes the government. It also faces delays in GST refunds.

Problem Aggravated due to Covid-19

- Declining Revenues: MSMEs are already struggling — in terms of declining revenues and capacity utilisation — in the lead-up to the Covid-19 crisis.

- Unavailability of Cash: The total lockdown has raised an issue of the existence of MSMEs primarily due to unavailability of cash which subsequently will result in the job losses.

- Lack of Labour Availability: The return of migrant labourers will create an issue of lack of labour availability.

- Loan Against Collateral : Loans to MSMEs are mostly given against property (as collateral) but in times of crisis, property values fall and that inhibits the extension of new loans.

- Steps Taken: To ease the firms’ financial distress during this period, the Reserve bank of India has announced several measures such as a moratorium on term loans, and easier working capital financing. Some public sector banks have also opened up emergency credit lines for businesses.

Way Forward

- The government can provide tax relief (GST and corporate tax), give swifter refunds, and provide liquidity to rural India (may be through PM-Kisan) to boost demand for MSME products.

- A credit guarantee by the government can help as it assures the bank that its loan will be repaid by the government in case the MSME falters. If such defaults happen, credit guarantees are shown as a departmental expense in the Budget.