Indian Economy

Issue of Petrol and Diesel Pricing in India

- 29 Apr 2022

- 7 min read

For Prelims: VAT, Excise Duty , crude oil prices

For Mains: Issue of Petrol and Diesel Pricing in India, Effect of Policies & Politics of Countries on India's Interests

Why in News?

Recently, the Prime Minister urged several Opposition-ruled states to cut taxes on petrol and diesel in order to reduce the economic burden on citizens and work as a team in this time of global crisis following the spirit of cooperative federalism”.

- Maharashtra, West Bengal, Telangana, Andhra Pradesh, Tamil Nadu, Kerala, and Jharkhand have not reduced Value-added tax (VAT) on Petrol and Diesel.

- VAT is consumption tax which is added to a product at every point of the supply chain where value is added to it.

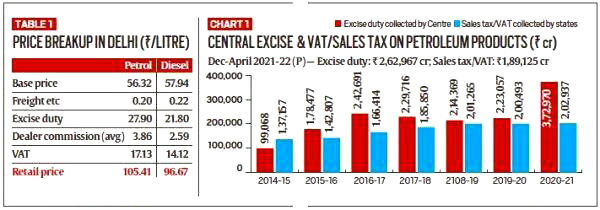

What are the Components of Retail Prices of Fuel?

- Retail prices of petrol and diesel are made up of mainly 3 components:

- Base price (reflecting cost of international oil)

- Central Excise Duty

- State Tax (VAT)

- Central and state taxes form a major chunk of the price of petrol and diesel in India.

- Excise duty is constant for all over India, state taxes (sales tax and value added tax) vary depending upon the rates levied by different state governments.

- These taxes make fuel even more costly for consumers.

- In November 2021, the Centre had reduced excise duties on both petrol and diesel to bring some relief to end-use customers.

- Exercise duty was reduced by Rs 5 per liter on petrol and Rs 10 per liter on diesel.

- Fuel prices remained constant after the Centre's exercise duty reduction.

- However, a recent surge in global crude oil prices owing to the war between Russia and Ukraine led to corresponding hikes in the price of petrol and diesel in India too.

- The price reduction varied across states due to differences in VAT rates.

- States with higher VAT witnessed slightly higher reduction in pump prices.

- Retail rates of petrol and diesel are governed by international prices as India depends on imports for meeting 85% of its oil needs.

What are the Government Earnings from Fuel Prices?

- Exercise duty and VAT on fuel constitute an important source of revenue for both the Centre and the states.

- As per the Budgets 2020-21, Excise duty on fuel makes up about 18.4% of the Centre’s gross tax revenues.

- Petroleum and alcohol, on average, account for 25-35% of states’ own tax revenue.

- Of the revenue receipts of states, central tax transfers comprise 25-29%, and own tax revenues 45-50%.

- Petroleum and alcohol, on average, account for 25-35% of states’ own tax revenue.

- During April-December 2021, taxes on crude oil and petroleum products had yielded Rs 3.10 lakh crore to the central exchequer, including Rs 2.63 lakh crore as excise duty, and Rs 11,661 crore as cess on crude oil.

- For the same period, Rs 2.07 lakh crore accrued to the state’s exchequer, of which Rs 1.89 lakh crore was through VAT.

What are the Constraints of States in Lowering Fuel Taxes?

- Major Source of Revenue:

- Petroleum and liquor account for roughly a third of states’ own tax revenue, making it difficult for states to forgo a part of it.

- Impact of Pandemic:

- The economic downturn and the pandemic had led to higher spending needs and reduced revenues.

- States’ consolidated fiscal deficit had jumped from 2.6% of Gross Domestic Product (GDP) in FY20 to 4.7% in FY21.

- The economic downturn and the pandemic had led to higher spending needs and reduced revenues.

What are the Options to Cool Inflation?

- As India is heavily dependent on imports for crude, there is no way of cooling energy price inflation other than by lowering taxes on the finished product or by re-introducing subsidies.

- Subsidies enable state-owned fuel retailers to sell at a lower price, while private refiners who do not get subsidy from the government are forced to incur losses.

- Given that higher fuel prices are getting transmitted to prices of other items as transportation becomes costlier, it is believed that monetary tightening would be the right solution.

Way Forward

- India has been experimenting with diversifying its source of oil and gas imports, creating strategic oil reserves, blending ethanol with auto fuel and an ambitious electric mobility plan.

- However, these measures are yet to achieve a critical mass to have a positive impact on energy prices in the face of a massive surge in global prices of crude oil, gas, petrol, and diesel.

- The easiest way that the government can stop fuel prices from rising is by cutting taxes on them, and by taking less dividends from oil Public sector undertakings.

- The government should restrict the export of fuel and other Petro-products.

- This will force refineries to sell their output in the domestic market, removing one reason for giving them assured trade-parity prices.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. In the context of global oil prices, “Brent crude oil” is frequently referred to in the news. What does this term imply? (2011)

- It is a major classification of crude oil.

- It is sourced from North Sea.

- It does not contain sulphur.

Which of the statements given above is/are correct?

(a) 2 only

(b) 1 and 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Exp:

- Brent crude oil is one of the major classifications of crude oil done on the basis of geographical location of the source.