Inter-State Variations in Central Tax Distribution | 18 Mar 2023

For Prelims: 15th Finance Commission, Central Tax Distribution, Horizontal equity, Article 280 of the Constitution.

For Mains: Taxes Distribution Among States, Recommendations of 15th Finance Commission.

Why in News?

Critics argue that the 15th Finance Commission formula is skewed in favour of some states, resulting in wide inter-state variations.

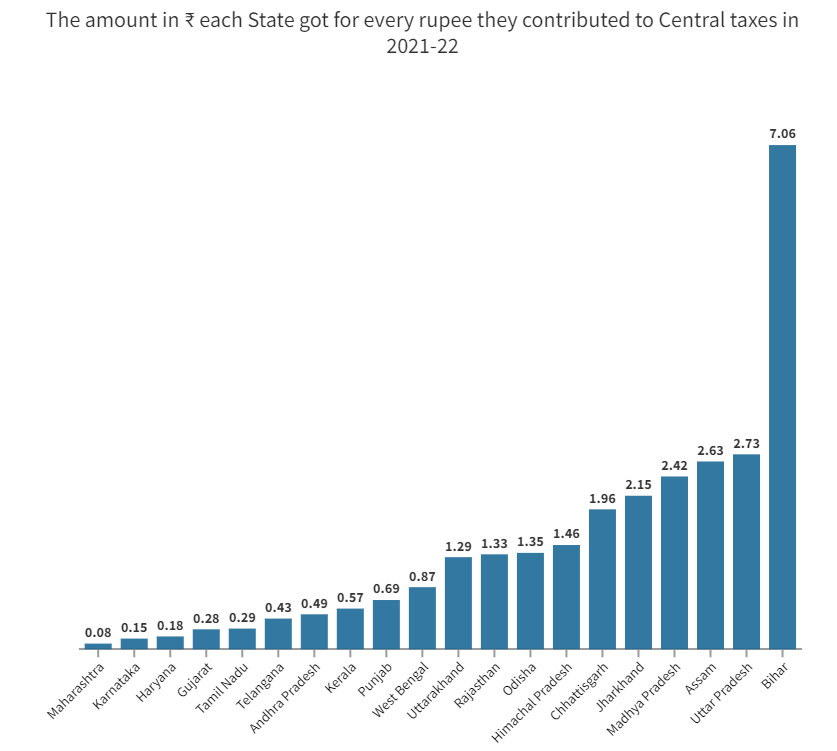

- Tamil Nadu gets back only 29 paise for every one rupee it gives to the Centre, while Uttar Pradesh gets ₹2.73 and Bihar gets back ₹7.06.

How Taxes are Distributed Among States?

- About:

- The Centre collects taxes from states and distributes it among them based on the Finance Commission's (XVFC) formula.

- XVFC Formula:

- The XVFC formula is based on each state's needs (population, area and forest and ecology), equity (per capita income difference), and performance (own tax revenue and lower fertility rate).

- Weightage:

- Needs are given 40% weightage, equity 45%, and performance 15%.

- The XVFC introduced the fertility rate component to reward states that have reduced fertility levels, but this has a lower weightage than equity and needs.

- Arguments:

- Critics argue that this formula favours some northern states, as the population is given higher weightage.

- The southern states' share has consistently declined in successive Finance Commissions.

- Some argue that transfers enable a state to provide comparable levels of services and ensure horizontal equity.

- However, others contend that the formula should not adversely impact a state's efficiency and progress.

- Critics argue that this formula favours some northern states, as the population is given higher weightage.

What is the 15th Finance Commission?

- About:

- The Finance Commission (FC) is a constitutional body that determines the method and formula for distributing the tax proceeds between the Centre and states, and among the states as per the constitutional arrangement and present requirements.

- Constitutionality:

- Under Article 280 of the Constitution, the President of India is required to constitute a Finance Commission at an interval of five years or earlier.

- 15th Finance Commission

- The 15th Finance Commission was constituted by the President of India in November 2017, under the chairmanship of NK Singh.

- Its recommendations will cover a period of five years from the year 2021-22 to 2025-26.

- The government accepted the 15th Finance Commission’s recommendation to maintain the States’ share in the divisible pool of taxes to 41% for the five-year period starting 2021-22.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. How have the recommendations of the 14th Finance Commission of India enabled the States to improve their fiscal position? (2021)