India's Garment Export Sector | 25 Jul 2024

For Prelims: Globalisation, Viscose Staple Fibre, Quality Control Orders, Production Linked Incentive (PLI) Scheme, Compound annual growth rate, Foreign Direct Investment (FDI), National Technical Textiles Mission,

For Mains: Textile Sector of India, Potential and Challenges, Related Government Policies and Initiatives

Why in News?

India’s garment export industry, a significant contributor to employment, has been facing a persistent decline. A recent report by the Global Trade Research Initiative (GTRI) , a research Group focused on Climate Change, technology and trade, sheds light on the reasons behind this downturn, pointing to self-inflicted barriers rather than external competition.

What are the Key Highlights of the GTRI Report?

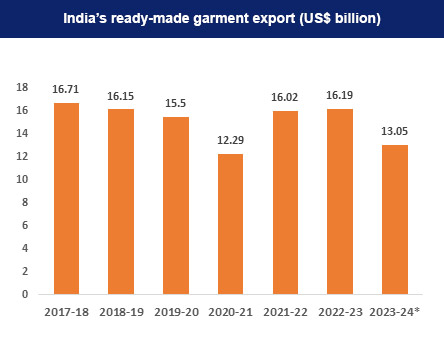

- Decline in Export Value: India's garment exports in 2023-24 were USD 14.5 billion, compared to USD 15 billion in 2013-14.

-

Vietnam and Bangladesh's garment exports grew significantly during the same period, reaching USD 33.4 billion and USD 43.8 billion, respectively.

-

Despite a decline, China still exported about USD 114 billion in garments.

- Globalisation has increased competition and shifted production to lower-cost labour countries, affecting India's market share.

-

- Trade Barriers: The sector faces substantial duties on importing essential raw materials, making production more expensive.

- Archaic customs and trade procedures add to the challenges, consuming time and resources that could be better utilised.

- The dominance of local suppliers for raw materials like Polyester Staple Fibre and Viscose Staple Fibre forces exporters to rely on more expensive domestic options.

- Recent Quality Control Orders (QCOs) for fabric imports have complicated the import process, pushing up costs for exporters.

- Exporters are forced to use pricier domestic supplies, making Indian garments less competitive globally. Exporters must meticulously account for every imported component, adding to the complexity and cost.

- Production Linked Incentive (PLI) Scheme: The PLI scheme launched in 2021 has not attracted sufficient investment and requires major modifications to be effective.

- Rising Imports: India's garment and textiles imports reached nearly USD 9.2 billion in 2023, with concerns that this could increase if export challenges remain unresolved.

- Synthetic Fabrics in Global Markets: Developed countries prefer clothing made from mixed synthetics, while only less than 40% of Indian exports consist of synthetic fabrics.

- Diversifying into synthetics can enable Indian manufacturers to operate year-round, meeting demands during autumn and winter as well.

- Indian exporters need to keep up with the fast-paced demands of the Fast Fashion Industry (FFI), which includes major players like Walmart, Zara, H&M, Gap, and online retailers like Amazon.

- Recommendations for Improving the Sector: Simplifying customs and trade procedures can reduce the time and cost burdens on exporters.

- Lowering duties on essential raw materials can help reduce production costs.

- Ensuring fair competition in the domestic market for raw materials can lower costs for exporters.

What are the Key Facts About India's Garment Industry?

- The garment industry in India is highly fragmented, with a large number of small-scale manufacturers and fabricators dominating the scene. There are around 27,000 domestic manufacturers, 48,000 fabricators, and 100 manufacturer-exporters. Most of the firms are either proprietorship or partnership-owned.

- The industry benefits from a large pool of skilled workers and consistent growth across different sectors, making it a key potential sector in India.

- The textiles and apparel industry in India is the 2nd largest employer in the country after agriculture, providing direct employment to 4.5 crore people and 10 crore people in allied industries.

- Key Producers and Products: India is one of the largest producers of cotton and jute in the world. India is also the 2nd largest producer of silk in the world and 95% of the world’s hand-woven fabric comes from India.

- Tamil Nadu is a major cotton textile centre, contributing over 25% to the country's export of cotton yarn and fabrics.

- Market Growth: Total textile exports are expected to reach USD 65 Bn by FY26 and is expected to grow at a 10% Compound annual growth rate (CAGR) from 2019-20 to reach USD 190 billion by 2025-26.

- Export Trends: India is a significant exporter of textiles and apparel, with a large manufacturing base. In 2022-23, textile and apparel exports accounted for 8.0% of India's total exports, with a 5% share in global trade. The government aims to achieve USD 250 billion in textiles production in exports by 2030.

- India's textile and apparel products, including handlooms and handicrafts, are exported to over 100 countries worldwide, with key export destinations including the USA, Bangladesh, the UK, UAE, and Germany.

- The USA is the largest importer, accounting for about one-fourth of India's total exports.

- India signed a Free Trade Agreement (FTA) with the UAE in May 2022 and is in the process of negotiating FTAs with the EU, Australia, the UK, Canada, Israel, and other countries/regions to boost textile and apparel exports.

- Additionally, India's Foreign Direct Investment (FDI) policy allows for 100% FDI in single-brand product retail trading and up to 51% FDI in multi-brand retail trading, attracting international retailers to source from India and driving interest from new export destinations.

- India's textile and apparel products, including handlooms and handicrafts, are exported to over 100 countries worldwide, with key export destinations including the USA, Bangladesh, the UK, UAE, and Germany.

- Government Initiatives:

-

Union Budget 2024-25:

- The budget allocation for the textiles sector has been increased by USD 974 crore to USD 4,417.09 crore in the Budget 2024.

- The Union Budget proposes to reduce customs duty on wet white, crust, and finished leather for making garments, footwear, and other leather products for exports from 10% to 0%.

- Additionally, the duty on real down-filling material from duck or goose for use in manufacturing garments for exports will be reduced to 10% from the current 30%.

- Apparel Export Promotion Council (AEPC): AEPC, sponsored by the Ministry of Textiles, was incorporated in 1978. It is a nodal agency to promote exports of readymade garments from India.

-

The primary objective of the council is to promote, advance, increase, and develop the export of all types of ready-made garments in India.

-

AEPC supports the apparel industry by providing research and inputs on FTA, Foreign Trade Policy (FTP), and bilateral agreements.

-

-

PM Mega Integrated Textile Region and Apparel (PM MITRA) parks

-

Rebate of State and Central Taxes and Levies on the Export of Garments and Made-ups (RoSCTL scheme)

-

Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme

-

What are the Strategies to Boost India's Garment Industry?

- Align Exports with Global Market Demand: Focus on manufacturing apparel products and sustainable fashion that are in high demand globally.

- Market-Specific Strategies:

- Identify top imported commodities by each country where India has a low share.

- Address compliance issues and conduct cost comparisons with competing countries. Implement targeted interventions at the micro level to minimise the supply-demand gap.

- Market-Specific Strategies:

- Enhance Brand Building: Enhance the perceived value of Indian garments through effective branding.

- Obtain certifications such as Global Organic Textile Standard (GOTS) to improve brand image and compliance with international quality standards.

- Meeting the apparel exports of USD 40 billion by the year 2030 as highlighted by the Commerce and Industry Ministry requires at least 1,200 additional manufacturing units by 2030, compared to the projected addition of only 200 units.

- Proper branding of Indian apparel products can increase Unit Value Realisation (UVR), making exports more competitive.

- Capacity Creation: Invest in scaling up and modernising these segments to match spinning capacity. Encourage major domestic players to reinvest profits in capacity creation.

- Invest in weaving, fabric processing, and garmenting to strengthen the value chain and achieve cost competitiveness.

- Diversify Markets and Products: Reduce dependence on traditional markets like the US, EU, and UK. Explore new markets such as Mauritius through FTA.

- Increase production of man-made fibre (MMF) garments to tap into their growing global demand.

- MMFs are mainly of two types: synthetic (made from crude oil) and cellulosic (made from wood pulp). The main varieties of synthetic staple fibres are polyester, acrylic, and polypropylene, while cellulosic fibres include viscose and modal.

- Increase production of man-made fibre (MMF) garments to tap into their growing global demand.

- Leverage E-commerce Opportunities: Global e-commerce exports are expected to grow from USD 800 billion to USD 2 trillion by 2030.

- India aims to achieve a merchandise export target of USD 1 trillion by 2030, with USD 200 billion coming from e-commerce. The country's high internet penetration and demand from the Indian diaspora are expected to fuel this growth.

- E-commerce is important for MSMEs as it can greatly increase apparel exports. To achieve this, regulatory compliances should be simplified, and separate customs codes created for e-commerce shipments.

- It is important to take a quick, bold, and targeted approach to harness e-commerce for export expansion.

|

Drishti Mains Question: Q. Evaluate the impact of globalization on India's garment industry. How has it influenced the sector’s competitive position in the global market? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Consider the following statements: (2020)

- The value of Indo-Sri Lanka trade has consistently increased in the last decade.

- “Textile and textile articles” constitute an important item of trade between India and Bangladesh.

- In the last five years, Nepal has been the largest trading partner of India in South Asia.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (b)

Mains

Q. Analyse the factors for highly decentralised cotton textile industry in India. (2013)