India's Concerns on EU's CBAM and Deforestation Norms | 11 Oct 2024

For Prelims: European Union, Carbon Border Adjustment Mechanism (CBAM), European Union Deforestation Regulation (EUDR), Carbon Price, EU Emissions Trading System (ETS), Trade Barrier, Green Steel, Carbon Leakage, Intellectual Property Rights, Trade Secrets, World Trade Organization, Non-Tariff Barrier (NTBs), India-EU FTA, Clean Technologies.

For Mains: European Union’s Carbon Border Adjustment Mechanism (CBAM), European Union Deforestation Regulation (EUDR) and Related Concerns.

Why in News?

Recently, India’s Finance minister termed the European Union’s Carbon Border Adjustment Mechanism (CBAM) and European Union Deforestation Regulation (EUDR) as unilateral, arbitrary and a trade-barrier aimed at hurting Indian industries.

What is the EU's Carbon Border Adjustment Mechanism (CBAM)?

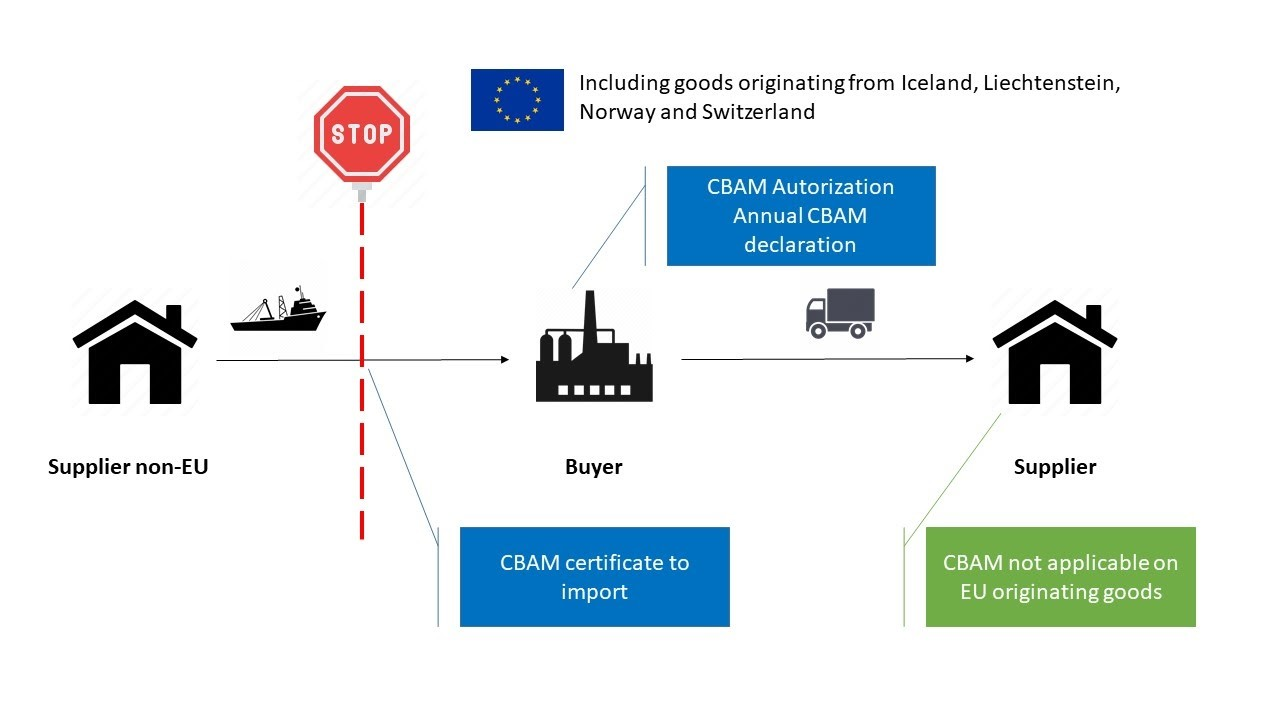

- About CBAM: It is the EU's tool to put a fair price on the carbon emitted during the production of carbon intensive goods that are entering the EU, and to encourage cleaner industrial production in non-EU countries.

- It ensures that the carbon price for imports matches the carbon price applied to EU-produced goods, maintaining fair competition.

- CBAM’s Functioning Framework:

- Registration and Certification: EU importers of goods covered by CBAM will need to register with national authorities and purchase CBAM certificates, reflecting the carbon emissions embedded in their imports.

- Annual Declaration: Importers will need to declare the emissions embedded in their imported goods and surrender the corresponding number of certificates annually.

- Payment of Carbon Price: Importers need to prove that a carbon price has already been paid during production in a non-EU country to get the amount deducted from the CBAM payment.

- Goods Covered by CBAM: Initially, CBAM applies to high-risk carbon leakage goods such as cement, iron and steel, aluminum, fertilisers, electricity and hydrogen.

- Over time, CBAM will capture more than 50% of emissions from sectors covered by the EU Emissions Trading System (ETS) e.g., oil refineries, shipping etc.

What is European Union Deforestation Regulation (EUDR)?

- About EUDR: Operators or traders placing specified commodities on the EU market or exporting them must prove their products do not come from recently deforested land or contribute to forest degradation.

- Objectives of the Regulation: The primary objectives include:

- Prevention of Deforestation: Ensuring listed products in the EU do not contribute to deforestation or forest degradation.

- Carbon Emission Reduction: Aiming for a reduction of at least 32 million metric tonnes of carbon emissions annually from these commodities.

- Combat Forest Degradation: Addressing deforestation and degradation caused by agricultural expansion related to these commodities.

- Commodities Covered: It focuses on commodities such as cattle, wood, cocoa, soy, palm oil, coffee, rubber, and related products (e.g., leather, chocolate, tires, furniture).

- It aims to enhance transparency and accountability within supply chains linked to these commodities.

What are Key Concerns Related to EU’s CBAM and EUDR?

- CABM as a Trade Barrier: CBAM could result in tariffs of up to 35% on imports of carbon-intensive goods like cement, aluminium, iron, and steel from India, acting as a unilateral trade barrier.

- This is a significant issue, as over a quarter of India’s exports of these materials in 2022 were directed to the EU.

- CBAM as a Tool of Protectionism: The EU imposes tariffs on carbon intensive steel imports while it continues to produce the same kind of steel domestically, using the proceeds from CBAM to fund its transition to green steel production.

- CBAM is intended to prevent carbon leakage, a phenomenon where EU-based firms shift their carbon-intensive production to countries with less stringent climate policies.

- Threat to Intellectual property rights (IPRs): CBAM requires exporters to provide up to 1,000 data points on production methods.

- Indian exporters fear that the detailed data collection could not only erode their competitive edge but also risk exposing sensitive trade secrets.

- A trade secret is any practice or process of a company that is generally not known outside of the company.

- Indian exporters fear that the detailed data collection could not only erode their competitive edge but also risk exposing sensitive trade secrets.

- Impact on India’s Trade Dynamics: The EU represents approximately 14% of India’s overall export mix, which includes significant exports of steel and aluminium.

- India’s status as the EU's third-largest trade partner and its projected economic growth trajectories imply that the size of Indian exports, including those in CBAM-affected sectors, will likely increase over time.

- Disproportionate Impact: The carbon intensity of Indian products tends to be higher than that of their European counterparts.

- Consequently, the carbon tariffs imposed through CBAM would be proportionately higher for Indian exports.

- Non-Compliance with WTO Norms: Indian government raised concerns about whether CBAM complies with World Trade Organization (WTO) norms.

- It creates uncertainty and additional challenges for countries like India despite meeting international commitments.

- EUDR as Non-Tariff Barrier: EUDR mandates that importers of commodities like cattle, soy, palm oil, coffee, and wood certify that their products do not come from recently deforested land or contribute to forest degradation.

- India views this regulation as another form of protectionism and a non-tariff barrier (NTBs).

- A non-tariff barrier is a trade restriction other than a tariff. NTBs include quotas, embargoes, sanctions, and levies.

- Barrier to Net-Zero Emissions Target: CBAM imposed by the EU will hinder India meeting net-zero carbon emission goal by 2070.

- Slowing FTA Negotiations: Sustainability measures like CBAM and the EUDR have become contentious issues in the ongoing India-EU FTA negotiations.

- Previous Tariff Barriers: EU's steel tariffs have caused India USD 4.41 billion in trade losses between 2018 and 2023.

- These steel tariffs were part of the EU’s safeguard measures, which were initially set to expire in June 2023 but have been extended.

- Potential for Global Policy Replication: The implementation of CBAM may prompt other countries to adopt similar regulations, potentially leading to additional tariffs or regulations in major markets.

- This trend could complicate India’s trading relationships and impact its balance of payments.

Way Forward

- Advocating for Fair Trade Practices: India must advocate for fair trade practices and actively engage in World Trade Organization (WTO) discussions to challenge the legality of CBAM and EUDR under international trade laws.

- Investing in Clean Technology: India should accelerate investments in clean technologies and sustainable production methods to lower the carbon intensity of its exports, align with international standards, and mitigate the impact of CBAM tariffs.

- Diversifying Export Markets: Exploring new markets in Asia, Africa, and Latin America can reduce the potential economic impact of CBAM and EUDR.

- Countering EU’s CBAM: India can counter such unilateral trade moves by imposing a similar counter-measures e.g., imposition of additional tariffs on products originating from EU countries.

- Also, India should focus on domestically producing such goods to make itself immune from such policy shocks of other countries.

- Monitoring Global Policy Trends: India should monitor global policies like CBAM to anticipate challenges in international trade and proactively develop strategies to address emerging barriers and protect its economic interests.

|

Drishti Mains Question: Discuss the potential challenges that India's industries might face due to the implementation of EU's Carbon Border Adjustment Mechanism (CBAM) and the European Union Deforestation Regulation (EUDR). |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Which of the following adopted a law on data protection and privacy for its citizens known as ‘General Data Protection Regulation’ in April, 2016 and started implementation of it from 25th May, 2018?(2019)

(a) Australia

(b) Canada

(c) The European Union

(d) The United States of America

Ans: (c)

Q.‘Broad-based Trade and Investment Agreement (BTIA)’ is sometimes seen in the news in the context of negotiations held between India and (2017)

(a) European Union

(b) Gulf Cooperation Council

(c) Organization for Economic Cooperation and Development

(d) Shanghai Cooperation Organization

Ans: (a)