Foreign Trade Policy 2023 | 03 Apr 2023

For Prelims: Major components of Foreign Trade Policy 2023, PM-MITRA

For Mains: Foreign Trade Policy 2023, Comparison with previous trade policies.

Why in News?

Recently, Union Minister of Commerce and Industry, Consumer Affairs, Food and Public Distribution and Textiles launched the Foreign Trade Policy (FTP) 2023 which comes into effect from April 1, 2023.

- FTP 2023 is a policy document which is based on continuity of time-tested schemes facilitating exports as well as a document which is nimble and responsive to the requirements of trade.

What are Details of FTP 2023?

- About:

- The policy is based on the principles of trust and partnership with exporters and aims at process re-engineering and automation to facilitate ease of doing business for exporters.

- The Key Approach is based on Four Pillars:

- Incentive to Remission,

- Export promotion through collaboration - Exporters, States, Districts, Indian Missions,

- Ease of doing business, reduction in transaction cost and e-initiatives, and

- Emerging Areas – E-Commerce Developing Districts as Export Hubs and streamlining Special Chemicals, Organisms, Materials, Equipment, and Technologies (SCOMET) policy.

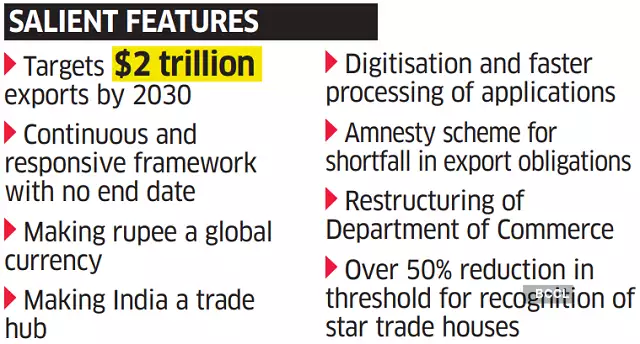

- Goals and Targets:

- The government aims to increase India’s overall exports to USD 2 trillion by 2030, with equal contributions from the merchandise and services sectors.

- The government also intends to encourage the use of the Indian currency in cross-border trade, aided by a new payment settlement framework introduced by the RBI in July 2022.

- This could be particularly advantageous in the case of countries with which India enjoys a trade surplus.

What are the Salient or Important features of FTP 2023?

- Process Re-Engineering and Automation:

- The policy emphasizes export promotion and development, moving away from an incentive regime to a regime which is facilitating, based on technology interface and principles of collaboration.

- Reduction in fee structures and IT-based schemes will make it easier for MSMEs and others to access export benefits.

- Duty exemption schemes for export production will now be implemented through Regional Offices in a rule-based IT system environment, eliminating the need for manual interface

- Towns of Export Excellence (TEE):

- Four new towns, namely Faridabad, Mirzapur, Moradabad, and Varanasi, have been designated as TEE in addition to the existing 39 towns.

- The TEEs will have priority access to export promotion funds under the MAI scheme and will be able to avail Common Service Provider (CSP) benefits for export fulfillment under the Export Promotion Capital Goods (EPCG) Scheme.

- Recognition of Exporters:

- Exporter firms recognized with 'status' based on export performance will now be partners in capacity-building initiatives on a best-endeavor basis.

- Similar to the 'each one teach one' initiative, 2-star and above status holders would be encouraged to provide trade-related training based on a model curriculum to interested individuals.

- Status recognition norms have been re-calibrated to enable more exporting firms to achieve 4 and 5-star ratings, leading to better branding opportunities in export markets.

- Promoting Export from the Districts:

- The FTP aims at building partnerships with State governments and taking forward the Districts as Export Hubs (DEH) initiative to promote exports at the district level and accelerate the development of grassroots trade ecosystem.

- Efforts to identify export worthy products & services and resolve concerns at the district level will be made through an institutional mechanism – State Export Promotion Committee and District Export Promotion Committee at the State and District level, respectively.

- District specific export action plans to be prepared for each district outlining the district specific strategy to promote export of identified products and services.

- Streamlining SCOMET Policy:

- India is placing more emphasis on the "export control" regime as its integration with export control regime countries strengthens.

- There is a wider outreach and understanding of SCOMET among stakeholders, and the policy regime is being made more robust to implement international treaties and agreements entered into by India.

- A robust export control system in India would provide access of dual-use High end goods and technologies to Indian exporters while facilitating exports of controlled items/technologies under SCOMET from India.

- Facilitating E-Commerce Exports:

- Various estimates suggest e-commerce export potential in the range of USD 200 to USD 300 billion by 2030.

- FTP 2023 outlines the intent and roadmap for establishing e-commerce hubs and related elements such as payment reconciliation, book-keeping, returns policy, and export entitlements.

- As a starting point, the consignment wise cap on E-Commerce exports through courier has been raised from ₹5Lakh to ₹10 Lakh in the FTP 2023.

- Depending on the feedback of exporters, this cap will be further revised or eventually removed.

- Facilitation under (EPCG) Scheme:

- The EPCG Scheme, which allows import of capital goods at zero Customs duty for export production, is being further rationalized. Some key changes being added are:

- Prime Minister Mega Integrated Textile Region and Apparel Parks (PM MITRA) scheme has been added as an additional scheme eligible to claim benefits under CSP(Common Service Provider) Scheme of EPCG.

- Dairy sector to be exempted from maintaining Average Export Obligation – to support the dairy sector to upgrade the technology.

- Battery Electric Vehicles (BEV) of all types, Vertical Farming equipment, Wastewater Treatment and Recycling, Rainwater harvesting system and Rainwater Filters, and Green Hydrogen are added to Green Technology products – will now be eligible for reduced Export Obligation requirement under EPCG Scheme

- The EPCG Scheme, which allows import of capital goods at zero Customs duty for export production, is being further rationalized. Some key changes being added are:

- Facilitation under Advance authorization Scheme:

- Advance authorisation Scheme accessed by DTA (Domestic tariff area) units provides duty-free import of raw materials for manufacturing export items and is placed at a similar footing to EOU and SEZ Scheme.

- Special Advance Authorisation Scheme extended to export of Apparel and Clothing sector on self-declaration basis to facilitate prompt execution of export orders.

- Benefits of Self-Ratification Scheme for fixation of Input-Output Norms extended to 2 star and above status holders in addition to Authorized Economic Operators at present.

- Amnesty Scheme:

- Under the amnesty scheme, an online portal will be launched for registration and a six-month window will be available to exporters to avail the scheme.

- It will cover all pending cases of default in export obligation of authorisations, these can be regularised on payment of all customs duties exempted in proportion to unfulfilled export obligation.

What About Previous Trade Policy?

- The previous foreign trade policy for 2015-2020 had targeted exports of USD 900 billion by 2020;

- This target was extended along with the policy for three years till March 2023.

- India is, however, likely to end 2022-23 with total exports of USD 760-770 billion as against USD 676 billion in 2021-22.