Food Inflation | 09 Aug 2022

For Prelims: Inflation, Food Inflation, Food Price Index, CPI, MSP

For Mains: Food Inflation and issues, Growth & Development

Why in News?

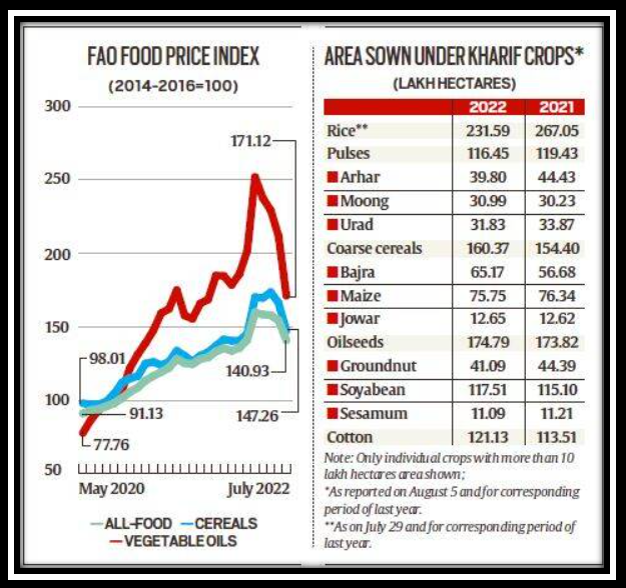

The UN Food and Agriculture Organization’s Food Price Index (FFPI) averaged 140.9 points in July 2022, 8.6% down from its previous month’s level and marking the steepest monthly drop since October 2008.

- It is expected that Food Inflation may ease faster than expected.

What do we know about the Food Price Index (FFPI)?

- About:

- It is a measure of the monthly change in international prices of a basket of food commodities.

- It consists of the average of five commodity group price indices weighted by the average export shares of each of the groups over 2014-2016 (Base Year).

- It was introduced in 1996 as a public good to help in monitoring developments in the global agricultural commodity markets.

- Trends in FFPI:

- FFPI hit an all-time-high of 159.7 points in March 2022, the month that followed the Russian invasion of Ukraine in February 2022.

- The latest index reading (July 2022) is the lowest since the 135.6 points of January 2022, before the still-ongoing war.

- Between March 2022 and July 2022, the FFPI has cumulatively declined by 11.8%.

What are the Reasons for Fall in FFPI?

- Global:

- Black Sea Trade Route:

- The UN-backed agreement for unblocking of the Black Sea trade route provides for unobstructed shipments of Russian food and fertilisers.

- Russia alone is expected to export 40 million tonnes (mt) in 2022-23 (July-June), up from last year’s 33 mt.

- Lift of Ban on Palm Oil:

- Indonesia, since late-May 2022, has lifted its ban on palm oil exports.

- Soyabean Crops:

- The US, Brazil, Argentina and Paraguay are set to harvest bumper soyabean crops.

- Pandemic Effect:

- The supply disruption caused by Covid-19 pandemic is also easing with the movement of migrants and increase in production of food crops.

- Black Sea Trade Route:

- Domestic:

- Rainfall:

- Cumulative rainfall during the current monsoon season from June 2022 to August 2022 has been 5.7% above the historical long-term average for this period.

- Almost all agriculturally-significant areas – barring Uttar Pradesh, Bihar, Jharkhand and West Bengal – have received good rains so far.

- Above average rainfall across the South Peninsula, Central and Northwest India has boosted acreages under most crops this kharif (monsoon) season.

- Cumulative rainfall during the current monsoon season from June 2022 to August 2022 has been 5.7% above the historical long-term average for this period.

- Rainfall:

What are the Causes of Recent Food Inflation?

- Weather:

- It included droughts in Ukraine (2020-21) and South America (2021-22), which especially impacted sunflower and soyabean supplies, and the March-April 2022 heat wave that devastated India’s wheat crop.

- Covid-19 Pandemic:

- The pandemic’s supply-side impact was felt the most in Malaysia’s oil palm plantations, where harvesting of fresh fruit bunches is done mainly by migrant labourers from Indonesia and Bangladesh.

- As Covid-19 resulted in many of them flying back and no new work permits being issued, output from the world’s second largest palm oil producer and exporter fell.

- The pandemic’s supply-side impact was felt the most in Malaysia’s oil palm plantations, where harvesting of fresh fruit bunches is done mainly by migrant labourers from Indonesia and Bangladesh.

- Russo-Ukrainian War:

- It led to supply disruptions from the two countries that, in 2019-20 (a non-war, non-drought year), accounted for 28.5% of the world’s wheat, 18.8% of corn, 34.4% of barley and 78.1% of sunflower oil exports.

- Export Controls:

- Controls were first imposed by Russia in December 2020, prompted by domestic food inflation fears arising from record hot temperatures.

- Shortage concerns at home triggered similar actions in palm oil by Indonesia (the world’s No. 1 producer-cum-exporter) and in wheat by India during March-May 2022.

- Controls were first imposed by Russia in December 2020, prompted by domestic food inflation fears arising from record hot temperatures.

How Global Prices of Food Affect Domestic Prices?

- The transmission of the global inflation to domestic food prices basically depends on how much of a country’s consumption/production is imported/exported.

- Such transmission is evident in edible oils and cotton, where up to 2/3rd of India’s consumption and 1/5th of its production are imported and exported, respectively.

- In the case of wheat, the heat wave from mid-March 2022 severely impacting yields, both public stocks and overall domestic availability are under pressure, even as open market prices have risen to export parity levels.

- Centre has decided to slash wheat allocations and offer more rice under its flagship free-grains scheme.

- Sugar is one commodity where retail prices haven’t gone up much, despite record exports by mills.

- The reason for it is production is also hitting a historic high.

Way Forward

- There should be consistency in import policy as that sends appropriate market signals in advance.

- Intervening through import tariffs is better than quotas which leads to greater welfare loss. This also calls for more accurate crop forecasts using satellite, remote sensing and GIS techniques to indicate shortfall/surplus in a crop year much in advance.

- Moreover, a decade old Consumer Price Index (CPI) base year of 2011-12 that gives nearly half of the weight to food items needs to be revised and updated to reflect the change in food habits and lifestyle of the population.

- With the rising middle-class, spending on non-food items has increased and this needs to be better reflected in the CPI, thereby enabling RBI to better target the non-volatile segment (core inflation).

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Consider the following statements: (2020)

- The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI).

- The WPI does not capture changes in the prices of services, which CPI does.

- Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (a)

Explanation:

- Wholesale Price Index (WPI) is a measure of the average change in the prices of goods in the wholesale market or at the wholesale level. It is published by the Office of Economic Adviser, Ministry of Commerce and Industry.

- Consumer Price Index (CPI) is the measure of changes in the price level of a basket of consumer goods and services bought by households. There are four types of CPI based on items basket:

- CPI for Industrial Workers (IW)

- CPI for Agricultural Labourer (AL)

- CPI for Rural Labourer (RL)

- CPI (Rural/Urban/Combined)

- Of these, the first three are compiled by the Labour Bureau in the Ministry of Labour and Employment. Fourth is compiled by the Central Statistical Organisation (CSO) in the Ministry of Statistics and Programme Implementation.

- Weightage of items in CPI is based on average household expenditure taken from consumer expenditure surveys. The weightage of food in CPI is far higher (approx. 46%) than in WPI (approx. 24%). A significant proportion of WPI items basket represents manufacturing inputs and intermediate goods like minerals, basic metals, machinery etc. Hence, statement 1 is correct.

- Moreover, WPI does not capture changes in the prices of services, which CPI does. Hence, statement 2 is correct.

- WPI is used as a key measure of inflation in some economies. However, the RBI no longer uses it for policy purposes, including setting repo rates. In April 2014, the RBI adopted the CPI or retail inflation as a key measure of inflation to set the monetary and credit policy. Hence, statement 3 is not correct.

- Therefore, option (a) is the correct answer.

Mains

Q. There is also a point of view that Agricultural Produce Market Committees (APMCs) set up under the State Acts have not only impeded the development of agriculture but also have been the cause of food inflation in India. Critically examine. (2014)